Académique Documents

Professionnel Documents

Culture Documents

Tax Penalties & Authorities in Bangladesh

Transféré par

Sajib DevDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Penalties & Authorities in Bangladesh

Transféré par

Sajib DevDroits d'auteur :

Formats disponibles

Penalty and Imposing Authorities A penalty is an additional amount imposed on the assesse for violation of tax law by the

respective authorities on the basis of tax law. The following authorities are entitled to impose penalty on the assesse within their power: Deputy commissioner of Taxes(DCT) Appellate joint commissioner of taxes Appellate tribunal

Conditions to Impose Penalty: No penalty can be imposed on the assesse without notice. Written notice need not to be served always. He should be allowed to defend his case. Offences and Penalties under Income Tax Ordinance: Number of Offences Penalty for not maintaining accounts in prescribed manner (Sec.123) : Amount of Penalties a) A sum not exceeding one and a half time the amount of tax payable by him. b) If the total income does not exceed minimum taxable limit, the amount of penalty may be a sum upto tk. 100. a) A sum of 10% of the income tax of last assessment or Tk. 1000 & Tk. 50 for per default

Vous aimerez peut-être aussi

- General Principles of Taxation and BIR PowersDocument12 pagesGeneral Principles of Taxation and BIR Powerswords of Ace.Pas encore d'évaluation

- Tax Allowable ExpensesDocument2 pagesTax Allowable Expensesdavidhor75% (4)

- GPG DB T ColumbiaDocument25 pagesGPG DB T ColumbiaIușan MihaelaPas encore d'évaluation

- Module 1 Bureau of Internal Revenue, Functions and PowersDocument8 pagesModule 1 Bureau of Internal Revenue, Functions and PowersSkyline PiscesPas encore d'évaluation

- Tax ReviewerDocument10 pagesTax ReviewerClaire ZafraPas encore d'évaluation

- Compromise ReportDocument11 pagesCompromise ReportAnonymous LZgIlI0YqTPas encore d'évaluation

- Obligations: 1. RegistrationDocument5 pagesObligations: 1. RegistrationPhilip AlamboPas encore d'évaluation

- 2016 Tax Bar ExaminationsDocument19 pages2016 Tax Bar Examinations涛 明 灵Pas encore d'évaluation

- Tax AdministrationDocument5 pagesTax AdministrationAbdullahi AbdikadirPas encore d'évaluation

- Law 7/2021 Tax Regulation HarmonyDocument8 pagesLaw 7/2021 Tax Regulation Harmonytina SibagariangPas encore d'évaluation

- Chapter 1 General Overview of The Tunisian Tax System: I-IntroductionDocument5 pagesChapter 1 General Overview of The Tunisian Tax System: I-IntroductionsaiyanPas encore d'évaluation

- 143 National Power Corporation v. City of CabanatuanDocument3 pages143 National Power Corporation v. City of CabanatuanclarkorjaloPas encore d'évaluation

- W3 Module 3 - Tax Administration Part IIDocument14 pagesW3 Module 3 - Tax Administration Part IIElmeerajh JudavarPas encore d'évaluation

- Tax Law G2 de LeonDocument16 pagesTax Law G2 de LeonBestie BushPas encore d'évaluation

- Q2 Questions and NotesDocument5 pagesQ2 Questions and NotesA FCPas encore d'évaluation

- Profiteering: Reduction of Tax Rate in New Tax Regime Benefit of Input Tax CreditDocument6 pagesProfiteering: Reduction of Tax Rate in New Tax Regime Benefit of Input Tax CreditDebaPas encore d'évaluation

- 7 TemaDocument28 pages7 TemaMarcos AntonioPas encore d'évaluation

- 2016 BAR EXAMINATIONS Suggested AnswersDocument11 pages2016 BAR EXAMINATIONS Suggested AnswersAudreyPas encore d'évaluation

- TAXATION LAW 1 REVIEWER: ASPECTS OF TAXATIONDocument85 pagesTAXATION LAW 1 REVIEWER: ASPECTS OF TAXATIONReyrhye RopaPas encore d'évaluation

- Introduction To TaxationDocument26 pagesIntroduction To TaxationHiyakishu SanPas encore d'évaluation

- STATUTORY PENALTIESDocument11 pagesSTATUTORY PENALTIESDianna MontefalcoPas encore d'évaluation

- Indonesian Tax Treatment For Foreign Drilling Companies FDCDocument4 pagesIndonesian Tax Treatment For Foreign Drilling Companies FDCJoko ArifiantoPas encore d'évaluation

- Taxation - Ramen NotesDocument8 pagesTaxation - Ramen NotesborgyambuloPas encore d'évaluation

- Budget Highlights 2013Document12 pagesBudget Highlights 2013Souma MukherjeePas encore d'évaluation

- The Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Document10 pagesThe Sigma Rho Fraternity: Commissioner of Internal Revenue v. St. Luke's (GR No. 195909)Daryl DumayasPas encore d'évaluation

- Tax Review Remedies of The GovernmentDocument120 pagesTax Review Remedies of The GovernmentJaline Aquino MozoPas encore d'évaluation

- Amnisty For Tax and Custom DutiesDocument12 pagesAmnisty For Tax and Custom DutieserishysiPas encore d'évaluation

- Examination Proper:: Tax Law Review Mid-Term ExaminationDocument9 pagesExamination Proper:: Tax Law Review Mid-Term ExaminationGRACEPas encore d'évaluation

- Transfer TaxDocument6 pagesTransfer TaxMark Rainer Yongis LozaresPas encore d'évaluation

- The Minimum Corporate Income Tax (MCIT) is imposed on gross income, not capital, and prevents tax avoidanceDocument4 pagesThe Minimum Corporate Income Tax (MCIT) is imposed on gross income, not capital, and prevents tax avoidanceCharmaine Ganancial SorianoPas encore d'évaluation

- Tax Law AnswersDocument63 pagesTax Law AnswersMiamor NatividadPas encore d'évaluation

- PLS Taxation QA FinalDocument24 pagesPLS Taxation QA FinalTAU MU OFFICIALPas encore d'évaluation

- Lesson 3 - TAX Its Characteristics and ClassificationDocument18 pagesLesson 3 - TAX Its Characteristics and ClassificationAbigail MangaoangPas encore d'évaluation

- Income Taxation Prelims-YsondandaDocument12 pagesIncome Taxation Prelims-YsondandaJenevy CornistaPas encore d'évaluation

- What Is Tax Evasion in IndiaDocument2 pagesWhat Is Tax Evasion in IndiahrammrpPas encore d'évaluation

- Tax TVDocument151 pagesTax TVAngel MariePas encore d'évaluation

- VAT Law With No DefinitionDocument3 pagesVAT Law With No DefinitionMohammad Shahjahan SiddiquiPas encore d'évaluation

- PWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionDocument5 pagesPWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionAnonymous FnM14a0Pas encore d'évaluation

- Morales Taxation Topic 10 Other Percentages TaxDocument14 pagesMorales Taxation Topic 10 Other Percentages TaxMary Joice Delos santosPas encore d'évaluation

- Principles of Taxation-3Document6 pagesPrinciples of Taxation-3Skyline PiscesPas encore d'évaluation

- Lesson 2 TaxationDocument25 pagesLesson 2 TaxationGracielle EspirituPas encore d'évaluation

- East African Taxation Law Imposition SummaryDocument14 pagesEast African Taxation Law Imposition SummaryEDWARD BIRYETEGAPas encore d'évaluation

- Chapter 1 TaxationDocument6 pagesChapter 1 TaxationCharlotte CañetePas encore d'évaluation

- BUSINESS LAW - Tax Law FSJES SOUISSI LPE-BADocument45 pagesBUSINESS LAW - Tax Law FSJES SOUISSI LPE-BAAMINEPas encore d'évaluation

- What Every Lawyer Should Know About Delinquent Tax Suits - MLL Rev 08-18-16Document11 pagesWhat Every Lawyer Should Know About Delinquent Tax Suits - MLL Rev 08-18-16r holleyPas encore d'évaluation

- Taxation: DifferenceDocument4 pagesTaxation: DifferenceZed AbantasPas encore d'évaluation

- Taxation II ReportDocument6 pagesTaxation II ReportKrishianne LabianoPas encore d'évaluation

- 1035 Withholding TaxDocument8 pages1035 Withholding TaxViren GandhiPas encore d'évaluation

- Faq - Mra TDSDocument11 pagesFaq - Mra TDSGamil PardhunPas encore d'évaluation

- Taxation Law Review QuestionsDocument5 pagesTaxation Law Review QuestionsRJ DAWATONPas encore d'évaluation

- Q.18.Write Down The Procedure of Making An Appeal To Commissioner Appeal and Appeal To Appellate TribunalDocument5 pagesQ.18.Write Down The Procedure of Making An Appeal To Commissioner Appeal and Appeal To Appellate Tribunalatia khanPas encore d'évaluation

- Company Tax (Cameroon) - Chapter 1Document5 pagesCompany Tax (Cameroon) - Chapter 1Tagem AlainPas encore d'évaluation

- Principles of CasesDocument27 pagesPrinciples of CasesEvin Megallon VillarubenPas encore d'évaluation

- Withholding Tax: Period of Payment of TaxDocument4 pagesWithholding Tax: Period of Payment of TaxlegendPas encore d'évaluation

- CY TaxAlerts 6 07 21EN NoexpDocument2 pagesCY TaxAlerts 6 07 21EN Noexph3493061Pas encore d'évaluation

- RCBC Estopped from Questioning Validity of WaiversDocument14 pagesRCBC Estopped from Questioning Validity of WaiversJepoy Nisperos ReyesPas encore d'évaluation

- Saving On Real Estate Related TaxationDocument40 pagesSaving On Real Estate Related TaxationLou SuyangPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- Digitalization of MoneyDocument31 pagesDigitalization of MoneySajib DevPas encore d'évaluation

- Role of Banks in Financial Inclusion in IndiaDocument13 pagesRole of Banks in Financial Inclusion in IndiaSajib Dev100% (1)

- FRB - FEDS Notes - Why Are Net Interest Margins of Large Banks So CompressedDocument7 pagesFRB - FEDS Notes - Why Are Net Interest Margins of Large Banks So CompressedSajib DevPas encore d'évaluation

- A Case Study On: Airinum Internationalization Strategy in IndiaDocument17 pagesA Case Study On: Airinum Internationalization Strategy in IndiaSajib DevPas encore d'évaluation

- Financial Decision Making For ManagersDocument3 pagesFinancial Decision Making For ManagersSajib DevPas encore d'évaluation

- Week 7 What Is GDPR The Summary Guide To GDPR Compliance in The UK-Sunnary-Sanjay Deb Sajib-Group 3Document1 pageWeek 7 What Is GDPR The Summary Guide To GDPR Compliance in The UK-Sunnary-Sanjay Deb Sajib-Group 3Sajib DevPas encore d'évaluation

- Research TopicDocument1 pageResearch TopicSajib DevPas encore d'évaluation

- Policy Paper BD BankDocument28 pagesPolicy Paper BD BankSharifa AminPas encore d'évaluation

- Paper 1: Management of Financial InstitutionsDocument7 pagesPaper 1: Management of Financial InstitutionsSajib DevPas encore d'évaluation

- BkashDocument3 pagesBkashSajib DevPas encore d'évaluation

- IT Related AbbreviationsDocument8 pagesIT Related AbbreviationsSajib DevPas encore d'évaluation

- Risk Factors Exist at Every Level of Organisational StructureDocument3 pagesRisk Factors Exist at Every Level of Organisational StructureSajib DevPas encore d'évaluation

- Do You Think That Such A SuddenDocument6 pagesDo You Think That Such A SuddenSajib DevPas encore d'évaluation

- Chapter 8 PDFDocument8 pagesChapter 8 PDFSajib DevPas encore d'évaluation

- Week 6 - Pradhan Mantri Jan Dhan Yozana-SummaryDocument1 pageWeek 6 - Pradhan Mantri Jan Dhan Yozana-SummarySajib DevPas encore d'évaluation

- ReferencesDocument2 pagesReferencesSajib DevPas encore d'évaluation

- AppendixDocument8 pagesAppendixSajib DevPas encore d'évaluation

- Reference NewDocument4 pagesReference NewSajib DevPas encore d'évaluation

- Chapter One SevenDocument24 pagesChapter One SevenSajib DevPas encore d'évaluation

- Intro to Hospitality Structure & PurposeDocument1 pageIntro to Hospitality Structure & PurposeSajib DevPas encore d'évaluation

- 6&9Document12 pages6&9Sajib DevPas encore d'évaluation

- EXECUTIVE SUMMARY+objective+methodologyDocument3 pagesEXECUTIVE SUMMARY+objective+methodologySajib DevPas encore d'évaluation

- Cross-National CGM Adoption and SNM MarketingDocument1 pageCross-National CGM Adoption and SNM MarketingSajib DevPas encore d'évaluation

- My Name Is TakluDocument1 pageMy Name Is TakluSajib DevPas encore d'évaluation

- Sajib AnswerDocument1 pageSajib AnswerSajib DevPas encore d'évaluation

- ReferencesDocument2 pagesReferencesSajib DevPas encore d'évaluation

- CV of A Imaginary PersonDocument1 pageCV of A Imaginary PersonSajib DevPas encore d'évaluation

- Remaking Financial Services Risk Management Five Years After The CrisisDocument16 pagesRemaking Financial Services Risk Management Five Years After The CrisisNitin NamdeoPas encore d'évaluation

- What Is Activity Based CostingDocument4 pagesWhat Is Activity Based CostingSajib DevPas encore d'évaluation

- Economic Value Adde1Document6 pagesEconomic Value Adde1Sajib DevPas encore d'évaluation

- Commission On Elections: May 10, 2010 National and Local ElectionsDocument7 pagesCommission On Elections: May 10, 2010 National and Local ElectionstagadagatPas encore d'évaluation

- President's Appointment of CHR Chairman Requires No ConfirmationDocument24 pagesPresident's Appointment of CHR Chairman Requires No ConfirmationMarton Emile DesalesPas encore d'évaluation

- MarxismDocument16 pagesMarxismKristle Jane VidadPas encore d'évaluation

- Greeces Elusive Quest For Security ProviDocument14 pagesGreeces Elusive Quest For Security ProviDImiskoPas encore d'évaluation

- Review Palestine Joan Peters Book From Time ImmemorialDocument120 pagesReview Palestine Joan Peters Book From Time ImmemorialZahid M. NaserPas encore d'évaluation

- Tijam v. Sibonghanoy G.R. No. L-21450 April 15, 1968 Estoppel by LachesDocument5 pagesTijam v. Sibonghanoy G.R. No. L-21450 April 15, 1968 Estoppel by LachesethPas encore d'évaluation

- The Code of Civil Procedure PDFDocument342 pagesThe Code of Civil Procedure PDFSabio ElvenPas encore d'évaluation

- NALA ChargesDocument4 pagesNALA ChargesRaghuPas encore d'évaluation

- International GCSE History Scheme of WorkDocument18 pagesInternational GCSE History Scheme of WorkAnwar EldalliPas encore d'évaluation

- United States v. John F. Grismore, 546 F.2d 844, 10th Cir. (1976)Document9 pagesUnited States v. John F. Grismore, 546 F.2d 844, 10th Cir. (1976)Scribd Government DocsPas encore d'évaluation

- Agustin vs. Intermediate Appellate Court 187 SCRA 218, July 05, 1990Document7 pagesAgustin vs. Intermediate Appellate Court 187 SCRA 218, July 05, 1990juan dela cruzPas encore d'évaluation

- Cebu South Memorial Garden Inc Vs Siao (Manzano)Document2 pagesCebu South Memorial Garden Inc Vs Siao (Manzano)Tenet ManzanoPas encore d'évaluation

- Rule 49 - Oral ArgumentDocument1 pageRule 49 - Oral ArgumentbubblingbrookPas encore d'évaluation

- Advert NLC Distributing Agency 2023Document1 pageAdvert NLC Distributing Agency 2023andywavesbeatsPas encore d'évaluation

- LEA ScorecardDocument6 pagesLEA ScorecardMichael EgotPas encore d'évaluation

- The Vices of ProstitutionDocument21 pagesThe Vices of Prostitutiongiselle anne martinezPas encore d'évaluation

- Case Digest Wages To Attorneys FeeDocument28 pagesCase Digest Wages To Attorneys FeeJefferson Maynard RiveraPas encore d'évaluation

- Models of Corporate Governance: Different Approaches ExplainedDocument25 pagesModels of Corporate Governance: Different Approaches Explainedvasu aggarwalPas encore d'évaluation

- Brgy. Resolution For AdolescentDocument4 pagesBrgy. Resolution For AdolescentGina Salvador - GonzalesPas encore d'évaluation

- Bohol Transport Secretary's CertificateDocument2 pagesBohol Transport Secretary's CertificaterbolandoPas encore d'évaluation

- Amistad Film AnalysisDocument4 pagesAmistad Film AnalysisMRose SerranoPas encore d'évaluation

- Notice of Non-Consent To Stop Smart Meter InstallationDocument2 pagesNotice of Non-Consent To Stop Smart Meter Installationstormrunner002Pas encore d'évaluation

- Aquino Vs Aure DigestDocument1 pageAquino Vs Aure Digestxyrakrezel100% (1)

- Resolution On Road and Brgy Hall Financial AssistanceDocument6 pagesResolution On Road and Brgy Hall Financial AssistanceEvelyn Agustin Blones100% (2)

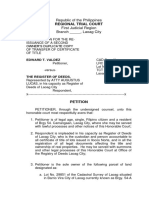

- Petition Lost TitleDocument3 pagesPetition Lost TitleEdward Tolentino ValdezPas encore d'évaluation

- Graphic Organizer - Marshall Court StudentDocument3 pagesGraphic Organizer - Marshall Court StudentDelilah100% (1)

- Group 2 - Written ReportDocument3 pagesGroup 2 - Written ReportAlexia Francis Jenica BasartePas encore d'évaluation

- Gov - Ph-Republic Act No 10592Document3 pagesGov - Ph-Republic Act No 10592Frans Emily Perez Salvador100% (2)

- PUBLIC INTERNATIONAL LAW fundamentalsDocument5 pagesPUBLIC INTERNATIONAL LAW fundamentalsMeku DigePas encore d'évaluation

- Cyber Militias and Political Hackers UseDocument7 pagesCyber Militias and Political Hackers UseSenait MebrahtuPas encore d'évaluation