Académique Documents

Professionnel Documents

Culture Documents

MH Cashflow 2006

Transféré par

shankarvittaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MH Cashflow 2006

Transféré par

shankarvittaDroits d'auteur :

Formats disponibles

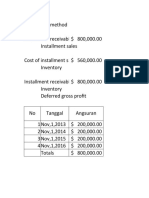

Sheet1

INTERNATIONAL PERIPHERAL PRODUCTS

PRO FORMA CASH FLOW STATEMENT, 2006

($1,000's)

CASH IN

Cash Balance

# of Units

Revenue

Spares Revenue

Equity

Debt

TOTAL CASH IN

January 2006

February

March

April

May

$7,898.37

750.00

3,000.00

$8,133.51

750.00

3,000.00

$8,368.65

750.00

3,750.00

$8,349.96

750.00

3,750.00

$9,260.10

750.00

3,750.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

$10,898.37 $11,133.51 $12,118.65 $12,099.96 $13,010.10

OWNERS' EQUITY & LIABILITIES

Equity

Management

Angel

Outside

$4,920.00

Debt

$4,920.00

$4,920.00

$4,920.00

$4,920.00

5,540.00

5,540.00

5,540.00

5,540.00

5,540.00

$0.00

119.79

26.67

55.40

3.00

1,500.00

$0.00

119.79

26.67

55.40

3.00

1,500.00

$0.00

119.79

26.67

55.40

3.00

1,500.00

$0.00

119.79

26.67

55.40

3.00

1,500.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

750.00

750.00

750.00

750.00

750.00

310.00

310.00

310.00

385.00

385.00

$2,851.85

CASH OUT

Capital Equipment

Salary

Factory Lease

Interest

Phones

Material

Spares Material

Direct Labor

Overhead

Insurance

Tooling

Selling

Spares Selling

Consultant

Taxes

Spares Taxes

Other

TOTAL CASH OUT

$2,764.86

$2,764.86

$3,768.69

$2,839.86

NET CASH FLOW

$8,133.51

$8,368.65

$8,349.96

$9,260.10 $10,158.25

1,003.83

Used by permission of the McGraw-Hill Companies.

Copyright The McGraw-Hill Companies. All rights reserved.

Sheet1

June

July

August

September

October

November

December

$10,158.25 $10,052.57 $10,950.72 $11,848.87 $11,743.19 $12,641.34 $13,539.49

750.00

750.00

750.00

750.00

750.00

750.00

750.00

3,750.00

3,750.00

3,750.00

3,750.00

3,750.00

3,750.00

3,750.00

1,951.11

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

$13,908.25 $13,802.57 $14,700.72 $15,598.87 $15,493.19 $16,391.34 $19,240.60

$4,920.00

$4,920.00

$4,920.00

$4,920.00

$4,920.00

$4,920.00

$4,920.00

5,540.00

5,540.00

5,540.00

5,540.00

5,540.00

5,540.00

5,540.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

750.00

750.00

750.00

750.00

750.00

750.00

$0.00

131.78

26.67

55.40

3.00

1,500.00

487.77

750.00

385.00

385.00

385.00

385.00

385.00

385.00

1,003.83

$3,855.68

1,003.83

$2,851.85

$2,851.85

$3,855.68

385.00

195.11

1,003.39

507.28

$2,851.85

$2,851.85

$5,045.40

$10,052.57 $10,950.72 $11,848.87 $11,743.19 $12,641.34 $13,539.49 $14,195.20

Used by permission of the McGraw-Hill Companies.

Copyright The McGraw-Hill Companies. All rights reserved.

Vous aimerez peut-être aussi

- Sure Cut SheersDocument7 pagesSure Cut SheersEdward Marcell Basia67% (3)

- Financial Comparison Template: Your Company, IncDocument1 pageFinancial Comparison Template: Your Company, IncKakkala RajiPas encore d'évaluation

- SCM Topic 1 Blades Solution 2022Document3 pagesSCM Topic 1 Blades Solution 2022Adi KurniawanPas encore d'évaluation

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiPas encore d'évaluation

- Case Study #2: Growing PainsDocument3 pagesCase Study #2: Growing PainsMissey Grace PuntalPas encore d'évaluation

- Task 7Document14 pagesTask 7Damaris MoralesPas encore d'évaluation

- Acctg 115 - CH 2 SolutionsDocument9 pagesAcctg 115 - CH 2 SolutionsRand_A100% (1)

- Cash PositionDocument1 pageCash PositionjadelcuevasPas encore d'évaluation

- For The Year Ended 31 Dec 2012: Pay Corporation and Subs Consolidation Workingpapers Pay SueDocument16 pagesFor The Year Ended 31 Dec 2012: Pay Corporation and Subs Consolidation Workingpapers Pay SuePutu Adi NugrahaPas encore d'évaluation

- Solutions To Chapter 15 Questions - Managing Current AssetsDocument5 pagesSolutions To Chapter 15 Questions - Managing Current AssetsSyeda MiznaPas encore d'évaluation

- Zed Rate of ReturnDocument3 pagesZed Rate of ReturnAtif MushtaqPas encore d'évaluation

- Starbucks Corporation (SBUX) Balance SheetDocument2 pagesStarbucks Corporation (SBUX) Balance Sheetstevan joePas encore d'évaluation

- Calculation of Net Increase and Decrease in Assets, Current Liabilities and Shareholders Fund'sDocument13 pagesCalculation of Net Increase and Decrease in Assets, Current Liabilities and Shareholders Fund'schatterjee rikPas encore d'évaluation

- Dynashears Inc - Avance PRLDocument33 pagesDynashears Inc - Avance PRLAdolfoShPas encore d'évaluation

- Akm 233Document6 pagesAkm 233wahdah ulin nafisahPas encore d'évaluation

- Financial Planning and Control: AFN, Leverage and Break Even Point Additional Fund NeededDocument6 pagesFinancial Planning and Control: AFN, Leverage and Break Even Point Additional Fund NeededCalistaPas encore d'évaluation

- Planilha de Cálculo Simples Nacional: Função ContábilDocument4 pagesPlanilha de Cálculo Simples Nacional: Função ContábilMIQUEIASPas encore d'évaluation

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatPas encore d'évaluation

- Case Study No. 3 PDFDocument6 pagesCase Study No. 3 PDFMuhammadZahirGulPas encore d'évaluation

- Annual Income Statemen1 Mcdonalds KFCDocument6 pagesAnnual Income Statemen1 Mcdonalds KFCAnwar Ul HaqPas encore d'évaluation

- ToyWorld Soln 1Document12 pagesToyWorld Soln 1Spark HsiaoPas encore d'évaluation

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzPas encore d'évaluation

- Mini Case Chapter 3 Final VersionDocument14 pagesMini Case Chapter 3 Final VersionAlberto MariñoPas encore d'évaluation

- FuncaoContabil Calculo Simples NacionalDocument4 pagesFuncaoContabil Calculo Simples Nacionalflavio oliveiraPas encore d'évaluation

- Five Year ProjectionsDocument1 pageFive Year Projectionss m tayyabPas encore d'évaluation

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyPas encore d'évaluation

- Financial Analysis of Amazom - Inc CompanyDocument9 pagesFinancial Analysis of Amazom - Inc Companyshepherd junior masasiPas encore d'évaluation

- Session 7 - Financial Statements and RatiosDocument23 pagesSession 7 - Financial Statements and Ratiosalanablues1Pas encore d'évaluation

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsTamar PkhakadzePas encore d'évaluation

- EF Case3Document4 pagesEF Case3Ge YangPas encore d'évaluation

- Bab-Mk Afn1Document6 pagesBab-Mk Afn1CalistaPas encore d'évaluation

- SWOT FrameworkDocument15 pagesSWOT Frameworksoul_hacker7Pas encore d'évaluation

- Elusive Cash BalanceDocument10 pagesElusive Cash Balancesalehaiman2019Pas encore d'évaluation

- Estado de Situacion Financiera: Cuenta Indus Corp (Dolares) Tasa de Cambio Indus Corp (Pesos)Document2 pagesEstado de Situacion Financiera: Cuenta Indus Corp (Dolares) Tasa de Cambio Indus Corp (Pesos)Seleny Hernandez BohorquezPas encore d'évaluation

- Financial Statement AND Ratio Analysis TablesDocument46 pagesFinancial Statement AND Ratio Analysis TablesRanjani KSPas encore d'évaluation

- 2016 IRA For Barangays - LagunaDocument51 pages2016 IRA For Barangays - LagunaDBM CALABARZON50% (2)

- 5 - Assign - Pad & Sad Co.Document2 pages5 - Assign - Pad & Sad Co.Pinky DaisiesPas encore d'évaluation

- Discounted Cash Flow AnalysisDocument2 pagesDiscounted Cash Flow AnalysisTommyPas encore d'évaluation

- Advanced Diploma of Leadership & Management: Part ADocument10 pagesAdvanced Diploma of Leadership & Management: Part AAngie Fer.Pas encore d'évaluation

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- 18 - Short-Term Finance and PlanningDocument19 pages18 - Short-Term Finance and Planninggabisan1087Pas encore d'évaluation

- Steve Wynn, Matthew Maddox Compensation, 2007-2016Document2 pagesSteve Wynn, Matthew Maddox Compensation, 2007-2016Las Vegas Review-JournalPas encore d'évaluation

- Cash Flow History 1 Year: Month Beginning Cash First Quarter Second Quarter ReceivablesDocument6 pagesCash Flow History 1 Year: Month Beginning Cash First Quarter Second Quarter ReceivablesasmaPas encore d'évaluation

- Livermore Valley Joint Unified School District: 45-Day Budget RevisionDocument2 pagesLivermore Valley Joint Unified School District: 45-Day Budget RevisionLivermoreParentsPas encore d'évaluation

- Case Study #1: Bigger Isn't Always Better!Document4 pagesCase Study #1: Bigger Isn't Always Better!Marilou GabayaPas encore d'évaluation

- Sample Company Balance Sheet: AnaltemplateDocument1 pageSample Company Balance Sheet: AnaltemplateNaoman ChPas encore d'évaluation

- Financial Statement Analysis: I Ntegrated CaseDocument13 pagesFinancial Statement Analysis: I Ntegrated Casehtet sanPas encore d'évaluation

- Toy World - Working FileDocument30 pagesToy World - Working Filepiyush aroraPas encore d'évaluation

- Chapter XIIIDocument3 pagesChapter XIIIRhea AlianzaPas encore d'évaluation

- Financial PlanDocument86 pagesFinancial PlanVõ Thị Ngọc HuyềnPas encore d'évaluation

- BreadDocument1 pageBreadElliot RichardPas encore d'évaluation

- BreadDocument1 pageBreadElliot RichardPas encore d'évaluation

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarPas encore d'évaluation

- Egger's Roast CoffeeDocument21 pagesEgger's Roast CoffeeemedinillaPas encore d'évaluation

- Harris SeafoodsDocument2 pagesHarris SeafoodsNadia IqbalPas encore d'évaluation

- Copy of Broiler FinancialsDocument5 pagesCopy of Broiler Financialskevior2Pas encore d'évaluation

- Treasury Analysis Worksheet1Document3 pagesTreasury Analysis Worksheet1Baljeet SinghPas encore d'évaluation

- Convenience Store Revenues World Summary: Market Values & Financials by CountryD'EverandConvenience Store Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryD'EverandSporting Goods Store Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation