Académique Documents

Professionnel Documents

Culture Documents

Manila Standard Today - Business Daily Stock Review (October 19, 2012)

Transféré par

Manila Standard TodayDescription originale:

Titre original

Copyright

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Manila Standard Today - Business Daily Stock Review (October 19, 2012)

Transféré par

Manila Standard TodayDroits d'auteur :

extrastory2000@gmail.com • business@mst.

ph ManilaStandardToday

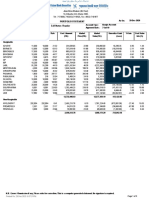

Business SATURDAY OCTOBER 20, 2012 B3

MST BUSINESS DAILY STOCKS REVIEW

M

FRIDAY, OCTOBER 19, 2012

52 Weeks Previous % Net Foreign

High Low STOCKS Close High Low Close Change Volume Trade/Buying

FINANCIAL

70.50 46.00 Banco de Oro Unibank Inc. 65.00 65.00 63.10 63.10 (2.92) 755,310 (13,202,240.50)

77.45 50.00 Bank of PI 82.10 84.35 82.30 82.95 1.04 806,040 49,475,878.50

595.00 370.00 China Bank 53.45 53.50 53.45 53.50 0.09 91,770 271,626.00

28.50 27.80 Citystate Savings 28.00 25.00 25.00 25.00 (10.71) 1,000

23.90 13.80 COL Financial 19.00 19.40 18.80 19.00 0.00 79,700 380,000.00

20.70 18.50 Eastwest Bank 23.15 23.35 23.05 23.10 (0.22) 1,365,600 4,437,855.00

22.00 7.95 Filipino Fund Inc. 10.24 10.26 10.24 10.24 0.00 600

0.95 0.62 First Abacus 0.72 0.73 0.72 0.72 0.00 30,000

89.00 50.00 First Metro Inv. 86.55 86.55 86.50 86.50 (0.06) 8,000

3.26 1.91 I-Remit Inc. 2.80 2.80 2.60 2.78 (0.71) 256,000

650.00 420.00 Manulife Fin. Corp. 500.00 490.00 490.00 490.00 (2.00) 200

39.20 3.00 Maybank ATR KE 23.00 25.00 25.00 25.00 8.70 1,500

102.50 60.00 Metrobank 92.25 93.00 92.05 92.80 0.60 1,005,420 (14,414,510.00)

3.06 1.30 Natl Reinsurance Corp. 1.94 1.90 1.90 1.90 (2.06) 6,000

94.50 56.00 Phil Bank of Comm 74.00 74.00 74.00 74.00 0.00 220

77.80 41.00 Phil. National Bank 73.30 73.20 72.70 72.70 (0.82) 92,920 2,932,212.50

95.00 69.00 Phil. Savings Bank 85.70 85.00 85.00 85.00 (0.82) 300

500.00 210.00 PSE Inc. 366.40 369.00 367.00 369.00 0.71 10,330

45.50 29.45 RCBC `A’ 45.70 45.90 45.60 45.90 0.44 74,300.00 2,911,300.00

155.20 77.00 Security Bank 166.90 167.30 166.70 166.90 0.00 511,020 63,954,659.00

1100.00 879.00 Sun Life Financial 975.00 990.00 980.00 990.00 1.54 510

140.00 58.00 Union Bank 107.50 107.60 107.00 107.00 (0.47) 732,590 35,513,300.00

2.06 1.43 Vantage Equities 2.16 2.31 2.19 2.28 5.56 1,323,000 (159,900.00)

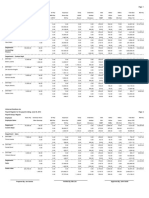

INDUSTRIAL

35.50 26.50 Aboitiz Power Corp. 33.60 33.90 33.45 33.45 (0.45) 465,900 (1,232,000.00)

13.58 8.00 Agrinurture Inc. 8.17 8.60 8.17 8.17 0.00 127,300

23.95 11.98 Alaska Milk Corp. 16.32 16.32 13.90 13.90 (14.83) 31,000

1.70 0.97 Alliance Tuna Intl Inc. 1.75 1.87 1.70 1.84 5.14 23,364,000 (3,987,450.00)

48.00 25.00 Alphaland Corp. 27.40 27.95 27.95 27.95 2.01 200 5,590.00

1.62 1.08 Alsons Cons. 1.40 1.41 1.40 1.41 0.71 544,000

Asiabest Group 20.00 20.80 20.00 20.50 2.50 26,600

2.96 2.12 Calapan Venture 3.80 4.04 3.90 3.95 3.95 124,000

2.75 2.30 Chemrez Technologies Inc. 2.85 2.88 2.86 2.88 1.05 314,000 379,340.00

9.74 7.41 Cirtek Holdings (Chips) 11.92 11.94 11.90 11.90 (0.17) 2,500

6.41 4.83 Energy Devt. Corp. (EDC) 6.27 6.30 6.21 6.25 (0.32) 15,829,200 (10,223,735.00)

7.77 2.80 EEI 8.68 9.05 8.65 9.00 3.69 3,802,400 8,490,113.00

3.80 1.00 Euro-Med Lab. 1.85 1.90 1.85 1.90 2.70 28,000

19.40 12.50 First Gen Corp. 20.90 21.05 20.80 20.80 (0.48) 2,055,000 7,816,330.00

79.30 51.50 First Holdings ‘A’ 80.90 81.00 80.00 80.00 (1.11) 1,130,260 (65,940,741.00)

27.00 17.50 Ginebra San Miguel Inc. 18.00 18.00 18.00 18.00 0.00 6,100

0.02 0.0110 Greenergy 0.0210 0.0210 0.0200 0.0200 (4.76) 100,480,000 515,000.00

13.10 7.80 Holcim Philippines Inc. 13.40 13.46 13.20 13.20 (1.49) 11,400

6.00 3.80 Integ. Micro-Electronics 4.00 4.00 3.96 3.98 (0.50) 26,000 (11,880.00)

2.35 0.61 Ionics Inc 0.660 0.670 0.650 0.650 (1.52) 107,000 3,250.00

120.00 80.00 Jollibee Foods Corp. 105.00 105.90 104.50 105.00 0.00 246,960 3,347,572.00

Lafarge Rep 9.48 9.60 9.48 9.60 1.27 161,700 794,564.00

8.40 1.04 LMG Chemicals 2.07 2.13 2.07 2.10 1.45 299,000

3.20 1.32 Manchester Intl. “A” 2.52 2.52 2.52 2.52 0.00 12,000

27.45 18.10 Manila Water Co. Inc. 28.40 29.30 28.50 28.75 1.23 5,804,800 (91,626,875.00)

18.10 8.12 Megawide 16.600 16.700 16.520 16.700 0.60 843,900 13,886,166.00

280.60 215.00 Mla. Elect. Co `A’ 284.40 290.00 284.40 285.00 0.21 177,030 2,850,954.00

12.20 7.50 Pancake House Inc. 8.10 8.10 7.55 8.10 0.00 5,000

3.65 1.96 Pepsi-Cola Products Phil. 4.70 4.76 4.68 4.76 1.28 5,538,000 (9,920,620.00)

16.00 9.70 Petron Corporation 10.96 11.00 10.84 11.00 0.36 823,500

14.94 8.05 Phoenix Petroleum Phils. 8.15 8.09 8.05 8.08 (0.86) 210,800

4.42 1.01 RFM Corporation 3.99 3.99 3.95 3.97 (0.50) 3,857,000 11,010.00

2.49 1.10 Roxas and Co. 2.40 2.40 2.40 2.40 0.00 23,000

3.90 2.01 Roxas Holdings 2.70 2.75 2.72 2.75 1.85 28,000

34.60 26.50 San Miguel Brewery Inc. 34.10 34.10 34.00 34.10 0.00 88,000

129.20 110.20 San Miguel Corp `A’ 110.00 110.00 109.60 110.00 0.00 312,310 (1,723,784.00)

2.62 1.25 Seacem 2.50 2.54 2.48 2.50 0.00 5,728,000

2.44 1.73 Splash Corporation 1.79 1.82 1.77 1.82 1.68 43,000

0.196 0.112 Swift Foods, Inc. 0.167 0.175 0.163 0.168 0.60 7,620,000 126,800.00

14.66 3.30 Tanduay Holdings 11.88 11.94 11.88 11.88 0.00 737,500

2.88 1.99 TKC Steel Corp. 2.08 2.02 2.01 2.02 (2.88) 418,000 (58,290.00)

S

1.41 0.90 Trans-Asia Oil 1.27 1.29 1.26 1.28 0.79 2,297,000

69.20 37.00 Universal Robina 70.10 72.00 70.20 72.00 2.71 884,800 3,190,163.50

5.50 1.05 Victorias Milling 1.17 1.19 1.15 1.19 1.71 1,971,000 (41,940.00)

0.77 0.320 Vitarich Corp. 0.880 0.890 0.870 0.880 0.00 557,000 (404,800.00)

HOLDING FIRMS

1.18 0.65 Abacus Cons. `A’ 0.70 0.76 0.70 0.74 5.71 40,332,000 787,850.00

59.90 35.50 Aboitiz Equity 48.50 48.90 48.10 48.90 0.82 1,278,000 47,723,945.00

0.019 0.014 Alcorn Gold Res. 0.1410 0.1690 0.1250 0.1320 (6.38) 7,947,380,000 26,976,930.00

13.70 8.00 Alliance Global Inc. 15.04 15.42 15.00 15.14 0.66 14,202,600 (4,384,490.00)

2.60 1.80 Anglo Holdings A 2.02 2.03 2.00 2.03 0.50 463,000

5.02 3.00 Anscor `A’ 5.00 5.00 4.93 4.93 (1.40) 25,200

6.98 0.260 Asia Amalgamated A 5.05 5.18 5.10 5.11 1.19 868,800

2.98 1.49 ATN Holdings A 1.42 1.47 1.47 1.47 3.52 1,000

4.16 2.30 ATN Holdings B 1.57 1.57 1.41 1.57 0.00 156,000 11,280.00

485.20 272.00 Ayala Corp `A’ 426.80 430.00 425.00 427.80 0.23 441,870 65,147,214.00

64.80 30.50 DMCI Holdings 56.95 57.00 56.60 56.60 (0.61) 530,440 (8,468,141.50)

5.20 3.30 Filinvest Dev. Corp. 4.13 4.18 4.15 4.18 1.21 88,000

0.98 0.10 Forum Pacific 0.229 0.229 0.221 0.229 0.00 130,000

556.00 455.40 GT Capital 540.50 544.00 530.00 533.00 (1.39) 160,730 (2,668,110.00)

5.22 2.94 House of Inv. 5.95 6.10 5.85 6.00 0.84 588,800

36.20 19.00 JG Summit Holdings 33.60 33.60 32.90 32.90 (2.08) 2,370,800 (60,006,265.00)

4.19 2.27 Jolliville Holdings 7.20 7.20 6.81 7.20 0.00 46,900

6.21 4.00 Lopez Holdings Corp. 5.50 5.49 5.37 5.39 (2.00) 5,937,900 (13,479,209.00)

1.54 0.61 Lodestar Invt. Holdg.Corp. 1.25 1.31 1.24 1.28 2.40 8,394,000 124,460.00

0.91 0.300 Mabuhay Holdings `A’ 0.44 0.43 0.43 0.43 (1.15) 60,000

3.82 1.800 Marcventures Hldgs., Inc. 2.10 2.15 2.08 2.15 2.38 427,000 (69,300.00)

4.65 2.56 Metro Pacific Inv. Corp. 4.13 4.17 4.13 4.13 0.00 5,571,000 3,064,410.00

6.24 3.40 Minerales Industrias Corp. 4.98 4.98 4.98 4.98 0.00 100,000

9.66 1.22 MJCI Investments Inc. 5.68 6.65 6.00 6.64 16.90 234,700

0.0770 0.045 Pacifica `A’ 0.0480 0.0510 0.0500 0.0500 4.17 9,000,000

2.20 1.20 Prime Media Hldg 1.280 1.290 1.280 1.280 0.00 111,000

0.82 0.44 Prime Orion 0.510 0.510 0.500 0.510 0.00 310,000

4.10 1.56 Republic Glass ‘A’ 2.93 2.95 2.93 2.95 0.68 92,000 (164,880.00)

2.40 1.01 Seafront `A’ 1.50 1.84 1.56 1.56 4.00 281,000 11,130.00

0.490 0.285 Sinophil Corp. 0.325 0.325 0.320 0.320 (1.54) 770,000

760.00 450.00 SM Investments Inc. 817.00 850.00 804.00 824.00 0.86 356,310 32,790,890.00

2.71 1.08 Solid Group Inc. 1.96 1.98 1.95 1.96 0.00 172,000

1.57 1.14 South China Res. Inc. 1.16 1.17 1.15 1.17 0.86 21,000

0.420 0.101 Unioil Res. & Hldgs 0.2700 0.2750 0.2450 0.2700 0.00 720,000

0.620 0.082 Wellex Industries 0.3050 0.3100 0.2950 0.2950 (3.28) 2,090,000

0.980 0.380 Zeus Holdings 0.400 0.405 0.400 0.405 1.25 280,000

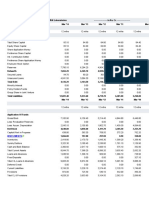

PROPERTY

3.34 1.70 A. Brown Co., Inc. 3.20 3.20 3.10 3.20 0.00 2,404,000 319,260.00

24.15 13.36 Ayala Land `B’ 23.45 23.45 23.20 23.20 (1.07) 8,956,800 (19,413,640.00)

5.62 3.08 Belle Corp. `A’ 5.18 5.18 5.13 5.16 (0.39) 2,082,600 (460,788.00)

9.00 2.26 Cebu Holdings 4.99 4.99 4.99 4.99 0.00 1,000

2.85 1.35 Century Property 1.48 1.48 1.45 1.46 (1.35) 1,904,000 1,000,600.00

2.91 1.20 City & Land Dev. 2.40 2.40 2.40 2.40 0.00 2,000

1.50 1.05 Cityland Dev. `A’ 1.08 1.08 1.08 1.08 0.00 51,000

1.11 0.67 Cyber Bay Corp. 0.84 0.85 0.82 0.85 1.19 476,000

0.94 0.54 Empire East Land 0.920 0.970 0.910 0.940 2.17 96,832,000 (12,664,570.00)

3.80 2.90 Eton Properties 3.70 3.75 3.70 3.70 0.00 128,000

0.310 0.10 Ever Gotesco 0.242 0.249 0.242 0.243 0.41 3,400,000 465,680.00

2.74 1.63 Global-Estate 1.85 1.88 1.83 1.85 0.00 16,598,000 4,156,930.00

1.44 0.98 Filinvest Land,Inc. 1.38 1.37 1.36 1.36 (1.45) 3,161,000 91,960.00

3.80 1.21 Highlands Prime 1.95 2.00 1.95 2.00 2.56 85,000

2.14 0.65 Interport `A’ 1.31 1.36 1.28 1.36 3.82 292,000

2.34 1.51 Megaworld Corp. 2.49 2.51 2.46 2.46 (1.20) 49,352,000 15,564,310.00

0.36 0.150 MRC Allied Ind. 0.1720 0.1720 0.1650 0.1710 (0.58) 9,970,000 333,280.00

0.990 0.089 Phil. Estates Corp. 0.6700 0.6900 0.6500 0.6700 0.00 14,554,000 408,650.00

0.67 0.41 Phil. Realty `A’ 0.470 0.470 0.470 0.470 0.00 1,070,000

4.33 2.10 Primex Corp. 3.00 3.47 3.47 3.47 15.67 2,000

19.94 10.00 Robinson’s Land `B’ 19.50 19.70 19.38 19.40 (0.51) 3,030,100 (25,959,838.00)

7.71 2.51 Rockwell 3.30 3.32 3.10 3.17 (3.94) 1,198,000 6,340.00

2.85 1.81 Shang Properties Inc. 2.85 2.89 2.82 2.89 1.40 93,000

8.95 6.00 SM Development `A’ 6.30 6.30 6.24 6.25 (0.79) 1,254,900 3,745,528.00

18.20 10.94 SM Prime Holdings 14.76 14.92 14.60 14.60 (1.08) 10,120,600 25,162,780.00

0.91 0.64 Sta. Lucia Land Inc. 0.69 0.69 0.67 0.68 (1.45) 218,000

4.55 1.80 Starmalls 3.69 3.70 3.44 3.68 (0.27) 282,000

0.64 0.45 Suntrust Home Dev. Inc. 0.530 0.510 0.510 0.510 (3.77) 43,000

4.66 2.60 Vista Land & Lifescapes 4.740 4.760 4.690 4.740 0.00 11,088,000 (21,118,890.00)

SERVICES

42.00 24.80 ABS-CBN 30.85 30.80 30.60 30.65 (0.65) 57,300

18.98 1.05 Acesite Hotel 1.31 1.34 1.31 1.32 0.76 373,000 19,800.00

T

0.78 0.45 APC Group, Inc. 0.610 0.620 0.610 0.620 1.64 923,000

10.92 7.30 Asian Terminals Inc. 8.90 9.20 9.20 9.20 3.37 2,000

102.80 4.45 Bloomberry 13.28 13.66 13.20 13.20 (0.60) 10,924,000 (69,888,400.00)

0.5300 0.1010 Boulevard Holdings 0.1440 0.1480 0.1440 0.1450 0.69 32,230,000 24,480.00

24.00 5.20 Calata Corp. 5.77 5.92 5.75 5.78 0.17 164,300 (36,146.00)

82.50 60.80 Cebu Air Inc. (5J) 57.00 57.00 56.75 56.95 (0.09) 224,810 (7,012,348.50)

10.60 8.20 Centro Esc. Univ. 10.30 10.50 10.50 10.50 1.94 100

9.70 5.44 DFNN Inc. 5.80 5.73 5.40 5.50 (5.17) 70,100 316,120.00

1750.00 800.00 FEUI 1000.00 1010.00 1010.00 1010.00 1.00 20

1270.00 831.00 Globe Telecom 1138.00 1162.00 1135.00 1157.00 1.67 95,770 51,532,330.00

11.00 6.18 GMA Network Inc. 8.33 8.33 8.29 8.30 (0.36) 194,400

77.00 43.40 I.C.T.S.I. 70.60 70.70 69.65 69.95 (0.92) 661,470 14,031,093.50

0.98 0.36 Information Capital Tech. 0.430 0.445 0.420 0.445 3.49 450,000 (30,700.00)

6.80 4.30 IPeople Inc. `A’ 7.30 7.90 7.30 7.30 0.00 17,600

4.70 1.75 IP Converge 2.60 2.69 2.48 2.56 (1.54) 266,000

34.50 0.036 IP E-Game Ventures Inc. 0.058 0.069 0.055 0.057 (1.72) 2,711,630,000 4,565,300.00

3.87 1.00 IPVG Corp. 1.02 1.05 1.02 1.02 0.00 4,318,000 (41,100.00)

0.0760 0.042 Island Info 0.0480 0.0480 0.0470 0.0480 0.00 2,200,000

5.1900 2.550 ISM Communications 2.8500 2.8500 2.7800 2.7800 (2.46) 83,000

10.30 5.90 Leisure & Resorts 9.00 9.02 8.87 9.00 0.00 932,900 505,589.00

3.70 2.60 Liberty Telecom 2.50 2.51 2.50 2.50 0.00 194,000

3.96 2.70 Macroasia Corp. 2.70 2.75 2.75 2.75 1.85 201,000

0.84 0.57 Manila Bulletin 0.70 0.68 0.68 0.68 (2.86) 7,000

4.08 1.21 Manila Jockey 2.84 3.06 2.82 3.03 6.69 3,409,000 2,181,340.00

9.60 6.50 Metro Pacific Tollways 7.00 5.63 5.63 5.63 (19.57) 1,600

22.95 13.80 Pacific Online Sys. Corp. 14.12 14.10 14.10 14.10 (0.14) 2,000

8.58 5.35 PAL Holdings Inc. 5.50 5.60 5.57 5.57 1.27 121,700

3.39 1.05 Paxys Inc. 2.75 2.75 2.73 2.73 (0.73) 268,000

10.00 5.00 Phil. Racing Club 9.20 9.50 9.50 9.50 3.26 1,000,000 (9,500,000.00)

71.00 18.00 Phil. Seven Corp. 73.00 73.00 72.50 73.00 0.00 70

17.88 12.10 Philweb.Com Inc. 17.02 17.00 16.88 17.00 (0.12) 388,700 2,967,106.00

2886.00 2096.00 PLDT Common 2678.00 2676.00 2664.00 2670.00 (0.30) 98,670 (58,036,230.00)

0.39 0.25 PremiereHorizon 0.315 0.315 0.315 0.315 0.00 60,000

30.15 10.68 Puregold 31.15 31.15 30.55 30.65 (1.61) 4,037,100 (47,647,720.00)

STI Holdings 1.63 1.65 1.62 1.65 1.23 22,000

0.79 0.34 Waterfront Phils. 0.435 0.445 0.440 0.440 1.15 110,000

Yehey 2.700 2.950 2.010 2.550 (5.56) 5,638,000 289,540.00

MINING & OIL

0.0083 0.0038 Abra Mining 0.0056 0.0058 0.0056 0.0057 1.79 384,000,000 (39,900.00)

6.20 3.01 Apex `A’ 4.76 4.82 4.76 4.78 0.42 271,000

6.22 3.00 Apex `B’ 5.00 5.00 4.90 4.90 (2.00) 200,600 997,990.00

20.80 14.50 Atlas Cons. `A’ 17.98 17.98 17.62 17.88 (0.56) 83,900 116,314.00

48.00 20.00 Atok-Big Wedge `A’ 26.35 26.00 24.00 26.00 (1.33) 5,500 34,400.00

0.345 0.170 Basic Energy Corp. 0.270 0.275 0.270 0.275 1.85 3,510,000

29.00 19.98 Benguet Corp `A’ 23.75 23.80 23.80 23.80 0.21 13,000

34.00 21.20 Benguet Corp `B’ 22.95 22.95 22.95 22.95 0.00 300 (6,885.00)

2.23 1.05 Century Peak Metals Hldgs 1.07 1.07 1.07 1.07 0.00 20,000

61.80 6.96 Dizon 19.98 20.00 19.78 19.90 (0.40) 30,000 (102,844.00)

1.21 0.50 Geograce Res. Phil. Inc. 0.58 0.59 0.58 0.59 1.72 2,230,000 53,100.00

1.81 1.0600 Lepanto `A’ 1.170 1.180 1.140 1.160 (0.85) 10,394,000

2.070 1.0900 Lepanto `B’ 1.240 1.220 1.200 1.220 (1.61) 6,045,000 196,380.00

0.085 0.042 Manila Mining `A’ 0.0570 0.0580 0.0560 0.0570 0.00 113,160,000

0.840 0.570 Manila Mining `B’ 0.0570 0.0570 0.0560 0.0570 0.00 151,390,000

36.50 15.04 Nickelasia 17.22 17.26 17.14 17.18 (0.23) 81,700 444,096.00

12.84 2.91 Nihao Mineral Resources 6.99 7.05 6.95 6.95 (0.57) 275,000

1.100 0.008 Omico 0.6300 0.6400 0.6400 0.6400 1.59 2,000

8.40 2.99 Oriental Peninsula Res. 4.390 4.450 4.340 4.350 (0.91) 192,000

0.032 0.014 Oriental Pet. `A’ 0.0190 0.0200 0.0190 0.0200 5.26 39,900,000

0.033 0.014 Oriental Pet. `B’ 0.0210 0.0200 0.0200 0.0200 (4.76) 10,000,000

7.05 5.10 Petroenergy Res. Corp. 5.97 5.93 5.92 5.93 (0.67) 56,200

28.25 18.40 Philex `A’ 15.46 15.54 15.36 15.54 0.52 2,487,700 (1,626,040.00)

48.00 3.00 PhilexPetroleum 25.50 26.00 25.25 26.00 1.96 160,800

0.062 0.017 Philodrill Corp. `A’ 0.045 0.046 0.045 0.045 0.00 304,700,000 112,500.00

257.80 161.10 Semirara Corp. 223.40 222.80 221.00 222.00 (0.63) 49,410 (6,403,952.00)

0.029 0.015 United Paragon 0.0180 0.0180 0.0170 0.0170 (5.56) 312,400,000 (340,000.00)

PREFERRED

50.00 23.05 ABS-CBN Holdings Corp. 30.00 30.00 29.70 29.70 (1.00) 84,100 (1,741,200.00)

109.80 101.50 First Phil. Hldgs.-Pref. 102.00 102.20 102.10 102.10 0.10 14,120 12,252.00

11.02 6.00 GMA Holdings Inc. 8.35 8.40 8.10 8.40 0.60 3,428,200 102,500.00

116.70 108.90 PCOR-Preferred 107.50 107.10 107.10 107.10 (0.37) 510

SMC Preferred A 74.95 75.00 74.90 75.00 0.07 2,030,200 (1,837,550.00)

80.00 74.50 SMC Preferred B 78.50 77.00 77.00 77.00 (1.91) 10

SMC Preferred C 75.00 75.25 75.05 75.25 0.33 50 3,002.00

1050.00 1000.00 SMPFC Preferred 1011.00 1011.00 1010.00 1011.00 0.00 2,605

6.00 0.87 Swift Pref 1.60 1.36 1.36 1.36 (15.00) 13,000

WARRANTS & BONDS

1.31 0.62 Megaworld Corp. Warrants 1.48 1.45 1.44 1.44 (2.70) 42,000

Vous aimerez peut-être aussi

- Daily Report 31.12Document59 pagesDaily Report 31.12Prabu DoraisamyPas encore d'évaluation

- Portfolio00710 01.12.10Document2 pagesPortfolio00710 01.12.10habibur.ibblPas encore d'évaluation

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamPas encore d'évaluation

- Daily Report 01 10 4Document87 pagesDaily Report 01 10 4Gihan PereraPas encore d'évaluation

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Document3 pagesStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaPas encore d'évaluation

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDocument3 pagesPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitPas encore d'évaluation

- First Capital Securities LTD.: Buy/Sale ConfirmationDocument2 pagesFirst Capital Securities LTD.: Buy/Sale ConfirmationEnamul HaquePas encore d'évaluation

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDocument3 pagesPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitPas encore d'évaluation

- BC XCDocument6 pagesBC XCKaren Sofía Villa RealPas encore d'évaluation

- Calculos Petro BS Abril 2021Document2 371 pagesCalculos Petro BS Abril 2021fidel ZambranoPas encore d'évaluation

- PortFolio 07283Document1 pagePortFolio 07283ashifa.rafinagorPas encore d'évaluation

- Compound Vs Simple Interest 8% Per Year For 40 YearsDocument4 pagesCompound Vs Simple Interest 8% Per Year For 40 YearsRanjit RPas encore d'évaluation

- Portfolio00710 - 05.05.11 - Loss - 0.98 LacDocument2 pagesPortfolio00710 - 05.05.11 - Loss - 0.98 Lachabibur.ibblPas encore d'évaluation

- Balance SheetDocument1 pageBalance SheetNajihahPas encore d'évaluation

- Kurva LorenzDocument12 pagesKurva Lorenzanwar deliPas encore d'évaluation

- AssignmentDocument10 pagesAssignmentczymonPas encore d'évaluation

- Friday November 26, 2010: Total Turnover (RS.)Document14 pagesFriday November 26, 2010: Total Turnover (RS.)Don Nuwan DanushkaPas encore d'évaluation

- Payroll RegisterDocument2 pagesPayroll RegisterqueensophiaPas encore d'évaluation

- GlobalCash Cumulative V2260J1020220625190901683449Document3 pagesGlobalCash Cumulative V2260J1020220625190901683449lalit JainPas encore d'évaluation

- S&P CNX Nifty: As On 02-JUL-2010 16:00:13 Hours ISTDocument4 pagesS&P CNX Nifty: As On 02-JUL-2010 16:00:13 Hours ISTkartikdhl7Pas encore d'évaluation

- Purchase Transaction Reconciliation of Listing For EnforcementDocument7 pagesPurchase Transaction Reconciliation of Listing For EnforcementMArk BarenoPas encore d'évaluation

- Cash Count Collection ReportDocument3 pagesCash Count Collection ReportReger PagiosPas encore d'évaluation

- A-Gastos Distribuidos % Venta MejoradoDocument6 pagesA-Gastos Distribuidos % Venta MejoradoArturo ValenciaPas encore d'évaluation

- Market Index SummaryDocument2 pagesMarket Index Summarysivam thuvarakanPas encore d'évaluation

- Maruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementDocument1 pageMaruti Suzuki India Balance Sheet - Maruti Suzuki India LTD Balance Sheet, Financial StatementPriyanka GodhaPas encore d'évaluation

- Cash Count SheetDocument12 pagesCash Count SheetJessel Ann MontecilloPas encore d'évaluation

- Bukidnon Cooperative Bank: Cash Count SheetDocument12 pagesBukidnon Cooperative Bank: Cash Count SheetKrystel Matondo100% (1)

- SPC 1Document5 pagesSPC 1SERGIO ALFONSO CULEBRO CORTESPas encore d'évaluation

- M & M Appliance Center ACC417Document48 pagesM & M Appliance Center ACC417Marie100% (1)

- Company Name Last Price % CHG 52 WK High 52 WK Low Market CapDocument1 pageCompany Name Last Price % CHG 52 WK High 52 WK Low Market CapCriese lavilePas encore d'évaluation

- Form 60 - May, 2021Document19 pagesForm 60 - May, 2021Hannah ManieboPas encore d'évaluation

- Unrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15Document2 pagesUnrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15ErUmangKoyaniPas encore d'évaluation

- Companies With Best Net SalesDocument3 pagesCompanies With Best Net Salesraju thakurPas encore d'évaluation

- Extracto Crédito PDFDocument1 pageExtracto Crédito PDFLuis FranPas encore d'évaluation

- Interes SimpleDocument7 pagesInteres SimpleNox34Pas encore d'évaluation

- Metodo Hill of Value Cueq Docencia 02-10-2020Document12 pagesMetodo Hill of Value Cueq Docencia 02-10-2020cristhianPas encore d'évaluation

- MSN BalacesheetsDocument16 pagesMSN BalacesheetsnawazPas encore d'évaluation

- Maruti Suzuki India LTD.: Balance Sheet (Standalone)Document5 pagesMaruti Suzuki India LTD.: Balance Sheet (Standalone)Denish VekariyaPas encore d'évaluation

- Closing Rate Summary From:: Flu No: Pageno: 1 125/2020 P.Kse100 Ind: C.Kse100 Ind: Net ChangeDocument12 pagesClosing Rate Summary From:: Flu No: Pageno: 1 125/2020 P.Kse100 Ind: C.Kse100 Ind: Net ChangeUmar Sarfraz KhanPas encore d'évaluation

- Cpayslip 2022 2023 100000000687181 IGSLDocument1 pageCpayslip 2022 2023 100000000687181 IGSLpranit9845Pas encore d'évaluation

- XA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Document6 pagesXA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Mit NguPas encore d'évaluation

- Clearing BalancingDocument5 pagesClearing BalancingIbrar HussainPas encore d'évaluation

- 2187-Shahid-22 06 23Document2 pages2187-Shahid-22 06 23Shahid MahmudPas encore d'évaluation

- Dokumen - Tips - Analisa Beton Ready Mix PDFDocument2 pagesDokumen - Tips - Analisa Beton Ready Mix PDFSunari SipilPas encore d'évaluation

- Espectro E030 2003 Peru - MCDocument9 pagesEspectro E030 2003 Peru - MCOscarQuirogaPas encore d'évaluation

- Nairobi Stock Exchange Daily Price List Nation Centre, (1St Floor), Kimathi Street P.O. BOX 43633, NAIROBI. TEL: 2831000 FAX: 224200 E-MAIL: Info@nse - Co.ke: Website: WWW - Nse.co - KeDocument12 pagesNairobi Stock Exchange Daily Price List Nation Centre, (1St Floor), Kimathi Street P.O. BOX 43633, NAIROBI. TEL: 2831000 FAX: 224200 E-MAIL: Info@nse - Co.ke: Website: WWW - Nse.co - Keekenokoriang9780Pas encore d'évaluation

- Hired Vehicle Rent - Resort JunagarhDocument1 pageHired Vehicle Rent - Resort JunagarhKshitij TarePas encore d'évaluation

- Ratio Tell A StoryDocument6 pagesRatio Tell A StoryHeru MuskitaPas encore d'évaluation

- Prepaid Top Up Vouchers v02Document1 pagePrepaid Top Up Vouchers v02Vikash Kumar mishraPas encore d'évaluation

- P13Document21 pagesP13Saeful AzizPas encore d'évaluation

- Perimeter FenceDocument13 pagesPerimeter FenceTaki TachibanaPas encore d'évaluation

- Carry RolloverDocument12 pagesCarry RolloverKoushik SenPas encore d'évaluation

- Financial Statement For Quiz 3 PDFDocument4 pagesFinancial Statement For Quiz 3 PDFJiaXinLimPas encore d'évaluation

- PPGE&C Payroll 22 110322dDocument1 pagePPGE&C Payroll 22 110322djadan tupuaPas encore d'évaluation

- Ping's Fund With MeDocument15 pagesPing's Fund With MeJessie LokePas encore d'évaluation

- Clasificacion Geomecanica DDH-P-06 RVDocument6 pagesClasificacion Geomecanica DDH-P-06 RVjuanPas encore d'évaluation

- C U A D R E C A J A: Soles Dolares Denom. Fajos Sueltos Soles Denom. Fajos Sueltos DólarDocument4 pagesC U A D R E C A J A: Soles Dolares Denom. Fajos Sueltos Soles Denom. Fajos Sueltos Dólarcerrodepasco arcangelPas encore d'évaluation

- M. Alfitrah Gilang Dianto - 213210363 - UAS - WELL TESTDocument5 pagesM. Alfitrah Gilang Dianto - 213210363 - UAS - WELL TESTM ALFITRAH GILANG DIANTOPas encore d'évaluation

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesD'EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesÉvaluation : 5 sur 5 étoiles5/5 (3)

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayPas encore d'évaluation

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 16, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Weekly Stocks Review (April 19, 2015)Document1 pageThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayPas encore d'évaluation

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayPas encore d'évaluation

- Bonus 6 - Mastering ASP - NET Core SecurityDocument147 pagesBonus 6 - Mastering ASP - NET Core SecurityDark Shadow100% (1)

- Rhea Huddleston For Supervisor - 17467 - DR2Document1 pageRhea Huddleston For Supervisor - 17467 - DR2Zach EdwardsPas encore d'évaluation

- Ansi MV Techtopics75 enDocument2 pagesAnsi MV Techtopics75 enjobpei2Pas encore d'évaluation

- Mid Semester Question Paper Programming in CDocument8 pagesMid Semester Question Paper Programming in CbakaPas encore d'évaluation

- Ultrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedDocument2 pagesUltrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedhaujesPas encore d'évaluation

- Biodiversity Management Bureau: Repucjuf The Philippines Department of Environment and Natural ResourcesDocument36 pagesBiodiversity Management Bureau: Repucjuf The Philippines Department of Environment and Natural ResourcesMarijenLeañoPas encore d'évaluation

- Food Safety and StandardsDocument8 pagesFood Safety and StandardsArifSheriffPas encore d'évaluation

- QUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsDocument2 pagesQUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsGonzalo Jr. Ruales86% (7)

- OS Lab ManualDocument37 pagesOS Lab ManualVenkatanagasudheer ThummapudiPas encore d'évaluation

- Amended Formal ComplaintDocument87 pagesAmended Formal ComplaintWXYZ-TV Channel 7 DetroitPas encore d'évaluation

- Ap Human Geography Unit 5Document4 pagesAp Human Geography Unit 5api-287341145Pas encore d'évaluation

- (L) Examples of Machine Shop Practice (1910)Document54 pages(L) Examples of Machine Shop Practice (1910)Ismael 8877100% (1)

- Arti ResearchDocument10 pagesArti Researcharti nongbetPas encore d'évaluation

- Sample Lesson Plan Baking Tools and EquipmentDocument3 pagesSample Lesson Plan Baking Tools and EquipmentJoenel PabloPas encore d'évaluation

- Booklet Course 8 Chapter 3Document19 pagesBooklet Course 8 Chapter 3Joaquin CarrilloPas encore d'évaluation

- Tactical Radio BasicsDocument46 pagesTactical Radio BasicsJeff Brissette100% (2)

- b1722Document1 pageb1722RaziKhanPas encore d'évaluation

- FIN323 Project 2021-2022Document6 pagesFIN323 Project 2021-2022saleem razaPas encore d'évaluation

- Vocabulary List Year 6 Unit 10Document2 pagesVocabulary List Year 6 Unit 10Nyat Heng NhkPas encore d'évaluation

- DTR For ReadingDocument2 pagesDTR For ReadingTimosa TeyobPas encore d'évaluation

- L11 Single Phase Half Controlled Bridge ConverterDocument19 pagesL11 Single Phase Half Controlled Bridge Converterapi-19951707Pas encore d'évaluation

- Revised Procedural Manual On Hazardous Waste Management (Revised DAO 04-36) I CONTENTS Chapter Page PDFDocument53 pagesRevised Procedural Manual On Hazardous Waste Management (Revised DAO 04-36) I CONTENTS Chapter Page PDFdennisPas encore d'évaluation

- Product Sold by APPLE AustraliaDocument1 pageProduct Sold by APPLE AustraliaImran KhanPas encore d'évaluation

- PDF of Proposed Museum ProjectDocument145 pagesPDF of Proposed Museum ProjectHarshita ParnamiPas encore d'évaluation

- Module 9 School AgeDocument16 pagesModule 9 School AgeMichelle FactoPas encore d'évaluation

- Harrod-Domar ModelDocument13 pagesHarrod-Domar ModelsupriyatnoyudiPas encore d'évaluation

- BS en 12285-1-2003 (2006)Document162 pagesBS en 12285-1-2003 (2006)dahzahPas encore d'évaluation

- Unclaimed Abandoned Vehicles Feb 2022Document66 pagesUnclaimed Abandoned Vehicles Feb 2022kumar himanshuPas encore d'évaluation

- Business Ethics Final Work Brief 2Document6 pagesBusiness Ethics Final Work Brief 2KALIZA TRESSY MEGHANPas encore d'évaluation

- A Branding Effort of Walt DisneyDocument17 pagesA Branding Effort of Walt DisneyKanishk GuptaPas encore d'évaluation