Académique Documents

Professionnel Documents

Culture Documents

Entrepreneurial Finance

Transféré par

O Lupita Díaz GarcíaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Entrepreneurial Finance

Transféré par

O Lupita Díaz GarcíaDroits d'auteur :

Formats disponibles

Actividad 5.

4 Problemas del captulo 4

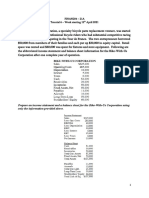

Problema 5. Cindy and Robert (Rob) Castillo founded the Castillo Products Company in 2006. The company manufactures components for personal decision assistant (PDA) products and for other hand-held electronic products. Year 2007 proved to be a test of the Castillo Products Companys ability to survive. However, sales increased rapidly in 2008 and the firm reported a net income after taxes of $75,000. Depreciation expenses were $40,000 in 2008. Following are the Castillo Products Companys balance sheets for 2007 and 2008.

CASTILLO PRODUCTS COMPANY 2007 2008 Cash 50,000 20,000 Accounts Receivables 200,000 280,000 Inventories 400,000 500,000 Total Current Assets 650,000 800,000 Gross Fixed Assets 450,000 540,000 Accumulated Depreciation (100,000) (140,000) Net Fixed Assets 350,000 400,000 Total Assets 1,000,000 1,200,000 Accounts Payable Accruals Bank Loan Total Current Liabilities Long-Term Debt Common Stock Paid-in-Capital Retained Earnings Total Liabilities & Equity a) b) c) d) 130,000 160,000 50,000 70,000 90,000 100,000 270,000 330,000 300,000 400,000 150,000 150,000 200,000 200,000 80,000 120,000 1,000,000 1,200,000

(30,000) 80,000 100,000 150,000 90,000 (40,000) 50,000 200,000 30,000 20,000 10,000 60,000 100,000 0 0 40,000 200,000

Calculate Castillos cash flow from operating activities for 2008. Calculate Castillos cash flow from investing activities for 2008. Calculate Castillos cash flow from financing activities for 2008. Prepare a formal statement of cash flows for 2008 and identify the major cash inflows and outflows that were generated by the Castillo Company. e) Use your calculation results from Parts A and B above to determine whether Castillo was building or burning cash during 2008 and indicate the dollar amount of the cash build or burn. f) If Castillo had a net cash burn from operating and investing activities in 2008 divide the amount of burn by 12 to calculate an average monthly burn amount. If the 2009 monthly cash burn continues at the 2008 rate, indicate how long in months it will be before the firm runs out of cash if there are no changes in financing activities.

Because Retained Earning increased by only 40,000 and Net Income was 75,000, Cash Dividends paid must have been 35,000. Parts A-D: Statement of Cash Flows Cash from Operating Activities: Net income Depreciation Increse in accounts receivable Increase in inventories Increase in accounts payable Increase in accrued liabilities a) Net from Operating Activities Cash from Investing Activities: Increase in gross fixed assets b) Net from Investing Activities Cash from Financing Activities: Increase in bank loan Increase in long-term debt Cash dividends paid c) Net from Financing Activities Total net cash increase (decrease) Cash at begining of period d) Total net cash increase (decrease) Part E: Operating activities (-15) + Investing activities (-90) = Part F: Monthly burn rate = Annual burn/12 Time to Out of Cash = Cash/Mthly Burn = 105,000 / 12 = = 20,000 / 87,50 = 8,750 per month 2.29 months (105,000) (annual net cash burn) 2008 75,000 40,000 (80,000) (100,000) 30,000 20,000 (15,000) dato dado

(90,000) (90,000)

10,000 100,000 (35,000) 75,000 (30,000) 50,000 20,000

entre Ingreso Neto y Ut. Retenidas.

Bibliografa Leach, J. C., & Melicher, R. W. (2009). Introduction and Overview. In Entrepreneurial finance . Mason, OH: SouthWestern Cengage Learning.

Vous aimerez peut-être aussi

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonPas encore d'évaluation

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingPas encore d'évaluation

- FINAN204-21A - Tutorial 6 Week 7Document10 pagesFINAN204-21A - Tutorial 6 Week 7Danae YangPas encore d'évaluation

- FINAN204-21A - Tutorial 1 Week 1Document12 pagesFINAN204-21A - Tutorial 1 Week 1Danae YangPas encore d'évaluation

- Organizing and Financing A New Venture: 1. Describe The Major Differences Between A Proprietorship and A PartnershipDocument21 pagesOrganizing and Financing A New Venture: 1. Describe The Major Differences Between A Proprietorship and A Partnershipmahnoor javaid100% (1)

- Accounting Chapter 10 Solutions GuideDocument56 pagesAccounting Chapter 10 Solutions GuidemeaningbehindclosedPas encore d'évaluation

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- Completed Chapter 6 Problem Working Papers For Artero Corporation Fall 2014Document5 pagesCompleted Chapter 6 Problem Working Papers For Artero Corporation Fall 2014ZachLoving75% (4)

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3mahnoor javaidPas encore d'évaluation

- Chapter 16Document11 pagesChapter 16Aarti J50% (2)

- Chap 10 SolutionsDocument10 pagesChap 10 SolutionsMiftahudin Miftahudin100% (1)

- Chapter 13Document75 pagesChapter 13Anonymous rh4M7A100% (2)

- Investment Analysis - Chapter 3Document34 pagesInvestment Analysis - Chapter 3Linh MaiPas encore d'évaluation

- Practice ProblemsDocument12 pagesPractice ProblemsJonathan BohbotPas encore d'évaluation

- Financial AccountingDocument22 pagesFinancial AccountingHoàng Minh Nguyễn100% (2)

- FM11 CH 02 Mini CaseDocument9 pagesFM11 CH 02 Mini CaseTimeka CarterPas encore d'évaluation

- FIM Anthony CH End Solution PDFDocument287 pagesFIM Anthony CH End Solution PDFMosarraf Rased50% (6)

- Problem Set #1 Solution: Part 1 (Cost of Capital)Document4 pagesProblem Set #1 Solution: Part 1 (Cost of Capital)Shirley YeungPas encore d'évaluation

- Chapter 11 ExerciseDocument5 pagesChapter 11 ExerciseJoe DicksonPas encore d'évaluation

- Chapter 7 SolutionsDocument4 pagesChapter 7 Solutionshassan.murad33% (3)

- Tut Lec 5 - Chap 80Document6 pagesTut Lec 5 - Chap 80Bella SeahPas encore d'évaluation

- SolutionsToPracticeProblems Working Capital ManagementDocument2 pagesSolutionsToPracticeProblems Working Capital ManagementPrima Facie100% (1)

- Bracelet Delights Is A New Company That Manufactures Custom JewelryDocument1 pageBracelet Delights Is A New Company That Manufactures Custom JewelryAmit PandeyPas encore d'évaluation

- Dividend Discount Model - Commercial Bank Valuation (FIG)Document2 pagesDividend Discount Model - Commercial Bank Valuation (FIG)Sanjay RathiPas encore d'évaluation

- Soal Teori:: Petunjuk: Kerjakan SOAL TEORI Dan SOAL PRAKTIKA Pada Kolom Jawaban Yang Tersedia !!Document6 pagesSoal Teori:: Petunjuk: Kerjakan SOAL TEORI Dan SOAL PRAKTIKA Pada Kolom Jawaban Yang Tersedia !!irma purnama ningrumPas encore d'évaluation

- Mini CaseDocument9 pagesMini CaseJOBIN VARGHESEPas encore d'évaluation

- Tugas FM-High Rock IndustryDocument5 pagesTugas FM-High Rock IndustryAnggit Tut PinilihPas encore d'évaluation

- CH 09Document21 pagesCH 09Ahmed Al EkamPas encore d'évaluation

- Hull-OfOD8e-Homework Answers Chapter 03Document3 pagesHull-OfOD8e-Homework Answers Chapter 03Alo Sin100% (1)

- Investments Analysis and Management 12th Edition Charles P Jones Test BankDocument10 pagesInvestments Analysis and Management 12th Edition Charles P Jones Test BankMohmed GodaPas encore d'évaluation

- ICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPDocument28 pagesICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPHankhnilPas encore d'évaluation

- Leach TB Chap01 Ed3Document9 pagesLeach TB Chap01 Ed3bia070386Pas encore d'évaluation

- All HOMEWORK ANSWER KEYDocument6 pagesAll HOMEWORK ANSWER KEYhy_saingheng_7602609Pas encore d'évaluation

- Problem Set #4Document2 pagesProblem Set #4Oxky Setiawan WibisonoPas encore d'évaluation

- Chapter 18Document17 pagesChapter 18queen hassaneenPas encore d'évaluation

- Accounting For Business Combinations: Learning ObjectivesDocument41 pagesAccounting For Business Combinations: Learning Objectivesmohammad.mamdooh94720% (1)

- Week 1 ICA - 2019 - Time Value of MoneyDocument2 pagesWeek 1 ICA - 2019 - Time Value of MoneyMira0% (1)

- Koehl's Doll ShopDocument3 pagesKoehl's Doll Shopmobinil1Pas encore d'évaluation

- Chapter 4-FinanceDocument14 pagesChapter 4-Financesjenkins66Pas encore d'évaluation

- Sample Test Bank Valuation Measuring and Managing The Value of Companies 6th Edition McKinseyDocument7 pagesSample Test Bank Valuation Measuring and Managing The Value of Companies 6th Edition McKinseySandra Navarrete100% (1)

- Evaluating Risk and Return - Chapter 8Document2 pagesEvaluating Risk and Return - Chapter 8ikycazmaj100% (1)

- Chapter Five Decision Making and Relevant Information Information and The Decision ProcessDocument10 pagesChapter Five Decision Making and Relevant Information Information and The Decision ProcesskirosPas encore d'évaluation

- Chapter 13 MK 2Document5 pagesChapter 13 MK 2Novelda100% (1)

- Mcdonald'S Corporation'S British Pound Exposure: 1 CaseDocument4 pagesMcdonald'S Corporation'S British Pound Exposure: 1 CaseJoel Christian Mascariña100% (1)

- Goliath Transfer Pricing Case ArticleDocument13 pagesGoliath Transfer Pricing Case ArticleFridRachmanPas encore d'évaluation

- Rais12 SM ch13Document32 pagesRais12 SM ch13Edwin MayPas encore d'évaluation

- FIN 4610 HW 3Document19 pagesFIN 4610 HW 3Michelle Lam50% (2)

- Assignment 5 FinanceDocument3 pagesAssignment 5 FinanceAhmedPas encore d'évaluation

- Question and Answer - 37Document31 pagesQuestion and Answer - 37acc-expert0% (1)

- Acc501-Data Bank 2018Document21 pagesAcc501-Data Bank 2018Fun NPas encore d'évaluation

- LÀM LẠI ĐỀ MIDTERMDocument15 pagesLÀM LẠI ĐỀ MIDTERMGiang HoàngPas encore d'évaluation

- CH 01Document5 pagesCH 01deelol99Pas encore d'évaluation

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDocument4 pagesB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemPas encore d'évaluation

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)Document10 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)marygraceomacPas encore d'évaluation

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Enterpreneurship Finance Exercises 4-6Document6 pagesEnterpreneurship Finance Exercises 4-6Trang TranPas encore d'évaluation

- FFS & CFSDocument15 pagesFFS & CFSNishaTripathiPas encore d'évaluation

- MCD2010 - T8 SolutionsDocument9 pagesMCD2010 - T8 SolutionsJasonPas encore d'évaluation

- Practical Accounting - Part 1Document17 pagesPractical Accounting - Part 1Kenneth Bryan Tegerero Tegio100% (1)

- Activity 1Document2 pagesActivity 1Cristine Joy BenitezPas encore d'évaluation

- GTE Financial Capacity Matrix (S) - Title & Name (2021)Document4 pagesGTE Financial Capacity Matrix (S) - Title & Name (2021)Anupriya RoyPas encore d'évaluation

- Letter TextsDocument6 pagesLetter TextsanjarPas encore d'évaluation

- Lloyds Bank Ltd. V BundyDocument15 pagesLloyds Bank Ltd. V BundyNicole YauPas encore d'évaluation

- FIN 331 2010 Spring Test 2 A Updated 5-14-2010Document8 pagesFIN 331 2010 Spring Test 2 A Updated 5-14-2010lthomas09Pas encore d'évaluation

- 35 Common Banking Terms Rates - Asked in Bank PO Interview (With Meaning Definitions)Document5 pages35 Common Banking Terms Rates - Asked in Bank PO Interview (With Meaning Definitions)Kalpesh BhagnePas encore d'évaluation

- Engineering Economics FormularsDocument9 pagesEngineering Economics FormularsFe Ca Jr.Pas encore d'évaluation

- A Guide To Operations and Record KeepingDocument38 pagesA Guide To Operations and Record KeepingOwenPas encore d'évaluation

- Faith Based Millionaire Mindset SlidesDocument44 pagesFaith Based Millionaire Mindset SlidesShakes SMPas encore d'évaluation

- Govt Filing 3 Fannie MaeDocument73 pagesGovt Filing 3 Fannie MaeValueWalkPas encore d'évaluation

- Property Return Form 2016Document4 pagesProperty Return Form 2016Saurav ChandanPas encore d'évaluation

- UdaanDocument39 pagesUdaanAnkit ButtoliaPas encore d'évaluation

- New Age of Banking-1 PDFDocument9 pagesNew Age of Banking-1 PDFsomprakash giriPas encore d'évaluation

- Questions On RibaDocument4 pagesQuestions On RibaSyed NazhefPas encore d'évaluation

- Interview: Dr. A. Gary ShillingDocument4 pagesInterview: Dr. A. Gary ShillingYogita RaiPas encore d'évaluation

- Fs App BibleDocument28 pagesFs App Bibleroy064Pas encore d'évaluation

- David MccormickDocument20 pagesDavid MccormickAnonymous vRG3cFNjAPas encore d'évaluation

- 6812 - 2017 - Ex3 - 8-1-17 - Payments + AnswersDocument4 pages6812 - 2017 - Ex3 - 8-1-17 - Payments + Answersრაქსშ საჰაPas encore d'évaluation

- Corporate Restructuring StrategyDocument35 pagesCorporate Restructuring StrategyJay PatelPas encore d'évaluation

- 21tai Tong Chuache V Ins Comm DigestDocument2 pages21tai Tong Chuache V Ins Comm DigestXing Keet LuPas encore d'évaluation

- Revision Grid BTEC Business Unit 3 Learning Aim ADocument3 pagesRevision Grid BTEC Business Unit 3 Learning Aim AChrisPas encore d'évaluation

- Cash and Cash EquivalentDocument7 pagesCash and Cash EquivalentAlex VillanuevaPas encore d'évaluation

- Compilation Credit Trans FinalsDocument27 pagesCompilation Credit Trans FinalsJoVic2020100% (1)

- Case Study - 6: TITLE: Corporate Failure (Money Laundering)Document7 pagesCase Study - 6: TITLE: Corporate Failure (Money Laundering)KanakaMaha LakshmiPas encore d'évaluation

- Welfare Schemes Tap 220218 PDFDocument5 pagesWelfare Schemes Tap 220218 PDFDinesh KumarPas encore d'évaluation

- 853 Title Smart Document 02-04-19Document5 pages853 Title Smart Document 02-04-19Kirsten Johnston EllesPas encore d'évaluation

- L1a - Financial AccountingDocument42 pagesL1a - Financial AccountingandyPas encore d'évaluation

- Sss vs. Moonwalk Development & Housing CorporationDocument15 pagesSss vs. Moonwalk Development & Housing CorporationAngelo Raphael B. DelmundoPas encore d'évaluation

- Bank ValuationDocument9 pagesBank ValuationHarshil SinghalPas encore d'évaluation

- A cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFDocument4 pagesA cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFkartik naikPas encore d'évaluation