Académique Documents

Professionnel Documents

Culture Documents

Insurance Law-Claims and Settlements

Transféré par

David FongCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Insurance Law-Claims and Settlements

Transféré par

David FongDroits d'auteur :

Formats disponibles

11.

Claims and Settlements

Notice of risk

Duty to notify

Hadenfayre Ltd. v. British National Insurance Society Ltd. [1984] 2 Lloyd's Rep. 393. Lloyd J.: When there was no term to require an insured to notify an insurer of a loss, a term requiring notice to be given within a reasonable time would be implied. In 1983, developers acquired three disused woollen mills but later decided to sell the sites to demolition contractors, for 275,000 payable in 154 weekly instalments of 3,000. Contigency insurance covering purchasers default was arranged by insurance brokers and the slip stated the weekly instalment as 6,000. Purchaser defaulted in June and on October 7. Insurers were informed that the insured had accepted a slower rate of payment. Insurers: Insured failed to give notice of loss within a reasonable time. This was rejected. What is a reasonable time? Default took place in June, informed in October Insurer claimed should have informed immediately. Rejected

Time limit where there is nothing specified There is a difference where it is specified (Cassel case) and where it is not (Verelst/Stork) Verelst's Administratix v. Motor Union Insurance Co. [1925] 2 K.B. 137. Roche J.: In a policy requiring notice of loss to be given as soon as possible, surrounding circumstances, including an insureds representatives knowledge of the existence of the policy could be taken into account. Policy: Notice of loss to be given as soon as possible. A Miss Verelst was insured against the risks of accidents while travelling in a private motor car. Insured was killed in a motor accident in India on January 14, 1923. News of her death reached her personal representative in England within a month but she knew of the policy only in January 1924. Insurers: Notice had to be given as soon as the representative knew of the accident and not when she became aware of the policy

Stork Technology Services Asia Pte. Ltd. v. First Capital Insurance Ltd. [2006] 3 S.L.R. 652 Lai Siu Chiu J.: When an insured was required to give immediate notice of claim, it meant that he must notify the insurer within a reasonable time and without any unjustifiable delay. Plaintiff fabricated a standby slip joint for a third party. It was insured against public liability including product liability claims. Plaintiff received a letter dated July 18, 2002 from third party solicitors giving notice of a catastrophic failure of the standby slip joint. On September 18, 2002, the plaintiff notified the insurers of the third partys solicitors letter.

Nature of a term regarding notice (where a time is specified) Cassel v. Lancashire & Yorkshire Accident Insurance Co. (1885) 1 T.L.R. 495. Pollock B.: When a policy fixed a time for giving notice, surrounding circumstances could not be taken into account to explain a delay in giving the notice. Policy: Notice in writing to be given within 14 days of an accident. Insured was covered under an accident policy. Insured met with an accident in July 1883, while paddling a canoe. Injury did not manifest itself until March of the following year, whereupon, the insured notified the insurers. Insurers: Notice was not given within 14 days of the accident.

Stoneham v. Ocean, Railway & General Accident Insurance Co. (1877) 19 Q.B.D. 237. Mathew J.: If a duty to notify an insurer was not made a condition precedent, the insurer could not avoid liability for its breach. The insurers remedy was limited to a claim for damages. Policy: In case of fatal accident notice thereof must be given to the company at the head office in London within the like time of seven days. Policy: this policy shall be subject to the conditions indorsed hereon which shall be considered as incorporated herein. Insured drown in an accident in Jersey and it was not possible to notify the insurers within 7 days. Insurers: The duty to notify the insurers was a condition precedent because it stated that notice must be given.

Adamson v. Liverpool & London & Globe Insurance Co. (1953) 2 Lloyd's Rep. 355. Lord Goddard C.J.: When the time for giving notice was fixed by a policy, failure to give notice within the time stated constituted an effective bar to recovery. Insurers were not liable for any loss not notified within 14 days of its occurrence. Insured had a "cash in transit" policy subject to a limit of 25 for any one loss. Over a period of 2 years, an employee systematically embezzled funds meant for the purchase of National Insurance stamps. The loss, amounting to 2,300 was discovered after the employee absconded. Insurers: Except for the thefts which took place two weeks preceding their discovery they were not liable as no notice was given within 14 days of the thefts.

McAlpine v. BAI *1998+ 2 Lloyds Rep. 694. Colman J.: If an insureds duty to notify an insurer was not made a condition precedent, the insurer could not avoid liability but was entitled to damages. The insurer was obliged to show the extent of the prejudice suffered before damages would be awarded. Main contractors policy: Insured shall, as soon as possible, give notice thereof to the Company, in writing A workman fell from a scaffold while cementing a new bridge over the A3 Brighton By-Pass.

He was employed by a sub-contractor. The scaffold, erected by another sub-contractor, was unsafe. In the Court of Appeal, Waller L.J.: That a loss notification term even though not labelled as a condition precedent could allow an insurer to disclaimed liability if it was an innominate term where the consequences of a breach might be so serious that it would entitle the insurer to reject the claim, even though not so serious as to amount to a repudiation of the entire contract.

Aspen Insurance UK Ltd. v. Pectel Ltd. [2009] 2 All E.R. (Comm.) 873 Teare J.: When a term requiring an insured to notify an insurer of a potential claim was a made a condition precedent, the insurer came under no liability unless the term had been complied with by the insured. Policy: Give immediate written notice with full particulars of any occurrence which may give rise to indemnity under this insurance. Insured, was a specialist contractor in the removal of asbestos from major underground facilities. A fire broke out in a section of the tunnels on March 29, 2004. Insurer notified on March 22, 2007.

Friends Provident Life and Pensions Ltd. v. Sirius International Insurance [2005] 2 All E.R. (Comm.) 145 English Court of Appeal: There was no basis for a new doctrine of partial repudiatory breach, and if a term was not stipulated as a condition precedent, then even in the event of a serious breach having serious consequences, the insurers could not repudiate liability.

Ronson International Ltd. v. Patrick [2005] 2 All E.R. (Comm.) 453 Judge Richard Seymour Q.C.: A loss notification term would not allow an insurer to repudiate liability unless it was made a condition precedent. There was no basis for creating an innominate term to allow the insurer to repudiate liability when there was serious breach.

Duty to Co-operate

Hiddle v. National Fire & Marine Insurance Co. [1896] A.C. 372. Privy Council: When a policy required an insured to give a detailed account of a loss, the insurer was not liable if the insured failed to provide the necessary details of the loss. Policy: Insured: "shall within fifteen days after such fire deliver to the same an account in detail of such loss. The contents of a shop was insured against the risk of fire. The stocks were destroyed in a fire. Cash-book and customers' ledgers, kept in a safe, were not damaged by the fire but stock-book and stock-sheets were destroyed Insured itemised the losses stating the value of each item claimed. Insurers: The insured failed to give a detailed account of their losses.

Welch v. Royal Exchange Assurance [1939] 1 K.B. 294. English Court of Appeal: A term requiring an insured to provide information about his claim had to be strictly complied if it was made a condition precedent. Insured acted stupidly and obstinately, but not dishonestly. Policy: Insured to give such proofs and information with respect to the claim as may reasonably be required. A motor tyre and accessory manufacturer insured his stock-in-trade for 25,714. The stocks were damaged by fire and the insured claimed 41,383. Insurer asked to inspect certain bank accounts kept by the insureds mother. Insured: That he had no power to compel his mother to disclose the accounts. Insurers: First, the claim was fraudulent. Secondly, the insured failed to supply the information about his mother's bank accounts.

Shinedean Ltd. v. Alldown Demolition (London) Ltd. [2006] 2 All E.R. (Comm.) 982 English Court of Appeal: When a claim co-operation provision was made a condition precedent, the insurer could avoid liability for a breach without showing prejudice. Policy: Insured to provide all necessary information and assistance. Alldown, demolition contractors notified their insurers about the partial collapse of a wall on April 25, 2002. There were, however, delays in providing the insurers with additional information on the claim.

Compliance with Duty to Give Notice

Brook v. Trafalgar Insurance Co. (1946) 79 Ll.L. Rep. 365. English Court of Appeal: An insurance agent did not have the authority to waive a term requiring an insured to give written notice to an insurer. Policy:Notice of any accident must be given in writing to the company at its head office immediately. if within seven days after such accident or loss has occurred, the company has not been notified as above set forth, then all benefit under this policy shall be forfeited. Insured car was destroyed by fire on December 17, 1943. Insured visited his agent the next day to tell him about the loss. Agent gave insured a claim form which he completed on January 3. Insurers: No notice in writing was given to insurers at their head office within 7 days of the accident ASK: Insureds should not go to agents They are not presumed to have authority. ASK: If the agent relays the information to the insurer, can the insurers failure to act on it amount to a waiver?

Herbert v. Railway Passengers Assurance Co. [1938] 1 All E.R. 650. Insured felt unwell as he made his way to watch a football match. He got his friend to drive the motor cycle but it was involved in an accident and the plaintiff was injured.

Plaintiff successfully sued the insured. Insurers contended that no notice of the proceedings leading to the judgment was given to them. Plaintiff: The insured had in a casual conversation with the insurance agent mentioned that an action was being brought against him and this constituted a sufficient notice. Porter J.: Notice under section 10(2) of the English Road Traffic Act 1934 that legal proceedings were being brought against a policyholder must be a formal notice. What was said to an agent in the course of a friendly casual conversation did not constitute a proper notice.

Form of notice

Must writing be handwriting? Oral? Sms? Can receipt be proved? Sent and read recipt?

J. Pereira Fernandes SA v. Mehta [2006] 2 All E.R. 891. Email possibly can, but is not considered to have a signature.

SM Integrated Transware Pte. Ltd. v. Schenker Singapore (Pte.) Ltd. [2005] 2 S.L.R. 651. Email correspondence can be in writing for s6(d) of the CLA

Kim Eng Securities Pte. Ltd. v. Tan Suan Khee [2007] 3 S.L.R. 195.

Waiver

Remember the case of Brooks v Trafalgar Barrett Bros. (Taxis) Ltd. v. Davies; Lickiss & Milestone Motor Policies at Lloyds (Third Parties) [1966] 1 W.L.R. 1334. Lord Denning M.R.: When an insurer was in possession of all relevant information pertaining to a loss, it was futile to require the insured to give the same information to the insurer. A motor cyclist was involved in an accident with a taxicab. He did not inform his insurers but they learnt of it from the taxicab owners' solicitor. Insured received a summons but did not inform the insurers. The police informed the insurers about the prosecution. The insurers wrote:It would be appreciated if you would let us know why you have not notified us of these proceedings. Insured pleaded guilty in a letter to the court and was fined 5. Insurers: Insured did not send them the notice of prosecution and the summons. ASK: where has this been followed? Seems to be embraced in Signapore and Malaysia But in the UK?

Allen v. Robles [1969] 1 W.L.R. 1193.

English Court of Appeal: An insurer who delayed rejecting a claim after discovering an insureds breach of contract would not be precluded from disclaiming liability unless the delay prejudiced the insured. Insured's car crashed into the plaintiffs house causing personal injury and damaging the house. The accident occurred on April 9, 1967. Insured notified insurers on July 4, 1967, when he was charged with dangerous driving. He submitted a set of claim forms to the insurers on August 10. The insurers wrote to say that they reserved their legal position under the terms of the policy. On November 29, insurers indicated that they would only deal with the plaintiffs claim for personal injuries. Insured: The insurers were precluded by the delay from denying liability

Nasser Diab v. Regent Insurance Co. Ltd. [2007] 1 W.L.R. 797. Privy Council: An insurers repudiation of liability on a ground unconnected with an insureds duty to notify the insurer of a loss did not relieve the insured of his obligation to notify the insurer. Insured operated a business dealing in general business electronic, general clothing textiles, materials, shoes, watches, some electronics. Premises were damaged by fire on 2627 April 1997. Insurers orally indicated that arson was suspected. Insureds solicitors wrote to insurers on June 2, 1997, claiming payment under the policy. Insurers: The insured did not notify the insurers within 15 days of the loss.

Kosmar Villa Holidays Plc. v. Trustees of Syndicate 1243 [2008] 1 All E.R. (Comm.) 769. Mr Evans sued Kosmar and Kosmar claimed under its public liability insurance. For some reason, however, it did not notify insurers until 4th September 2003, over a year after the event. On 17th September 2003, insurers emailed Kosmar with tactical advice on the gathering of evidence. On 19th September, they wrote to Mr Evans' solicitors (copied to Kosmar) asking them to note their interest and saying they were making enquiries of the insured which might take some time. Three days later, they wrote again regarding access to the swimming pool, stating "we are the liability insurers of the above-named tour operator." This letter, too, was copied to Kosmar. On 30th September, insurers emailed Kosmar reserving their position. This was followed by a solicitors' letter on 21st October denying liability for the claim because Kosmar had breached a condition precedent in the policy that required the insured to give written notice "immediately after the occurrence of any injury or damage" Kosmar argued that insurers had waived their right to rely on the breach by their conduct before and after the claim. The High Court judge held that the previous course of dealing did not amount to a waiver, but agreed that the correspondence did. Insurers, knowing there had been a late notification and that they could rely on the breach of condition to deny the claim, had by their conduct made an unequivocal

representation that they did not intend to rely on that right. Kosmar was entitled to an indemnity Held: Appeal allowed Insurers had not waived their right and so were not liable to pay the claim. Quite simply, the correspondence did not amount to the sort of unequivocal representation that is needed to establish a waiver. Insurers' letters did not say they were waiving the requirement for immediate notice or that they were accepting liability under the policy. They were still waiting for responses from the insured to their enquiries.

Establishing loss

Burden of Proof - If an insured asserts that he has suffered a loss and this is refuted by an insurer, who bears the burden of proof? Rules of Evidence - How does the ordinary rules of evidence operate in a situation involving an insured and his insurer? - Can the burden be revered? By express term An example: If we allege that by reason of any of these exclusions, any loss, damage, injury, or liability is not covered by the Policy, the burden of proving the contrary shall be on you. Regina Fur Co. Ltd. v. Bossom *1958+ 2 Lloyds Rep. 42 READ English Court of Appeal: The onus for proving a loss rested solely with an insured. Plaintiff fur traders policy: As bailees against all risks of loss or damage from whatsoever cause arising. Insured premises were burgled. Insurers: Claim was fraudulent and the insured had not shown the alleged loss. Insured: Since the insurers were alleging fraud, the onus was on the insurers to show that the loss did not come within the purview of the policy.

Penguin Boat International Ltd. v. Royal & Sun Alliance Insurance (Singapore) Ltd. [2008] 4 S.L.R. 21. Kan Ting Chiu J.: When there was no agreement that a loss was covered by an insurance policy, the burden was on the insured to show that the loss was so covered. Policy: all sums which the insured shall become liable to pay by reason of the legal liability of the insured as shiprepairers. The insured supplied at a yacht owners request, a cradle made by the insureds subcontractor. During the voyage to Vancouver, the ship carrying the yacht met a severe storm and the cradle broke and the yacht was lost.

Chua Ek Leng v. Tokio Marine Insurans (Malaysia) Bhd. [2010] 7 C.L.J. 730. Ravinthran Paramaguru J.C.: The burden of proof rested with an insured to bring his claim within the ambit of the policy. Policy covered risks of burglary, housebreaking or theft.

Exclusion: mutiny, strike riot and civil commotion, military or popular rising, insurrection, rebellion, revolutionary, military or usurped power, and delay, seizure, confiscation or detention by Government Authorities. Insured claimed that the excavators were brought across the Malaysian border into Indonesia by the criminal act of unknown persons alleged to be Indonesian (TNI) soldiers.

Duty of good faith in making claims

Where is an insureds duty to act in good faith when he makes an insurance claim to be found? What if there is bad faith? From either insurer and insured? Is an insureds duty to act in good faith when he makes a claim similar to the duty he has to exercise during the formation of the contract? How would the upcoming changes under the Consumer Insurance (Disclosure and Representations) Bill affect an insureds duty of good faith in the UK? Ask: Does bad faith/fraud on part of co-insured affect insureds rights?

Manifest Shipping Co. Ltd. v. Uni-Polaris Insurance Co. Ltd. [2003] 1 A.C. 469. House of Lords: An insureds duty of good faith after the contracts formation was limited to not making a fraudulent claim. Once litigation started, the duty came to an end. Star Sea became a constructive total loss after it caught fire. Vessel was equipped with a CO2 fire fighting system but the master was not familiar with it and unaware that a cut in the suction pipe was not repaired. Owing to the masters incompetence and the defective fire fighting equipment, a fire was not effectively put out. Insurers: Vessel was unseaworthy. Owners did not act in good faith in respect of certain exchange of statements before the trial regarding fires on board other vessels. ASK: So what duty remains during trial? Is there any duty outside of civil procedure duties?

Agapitos v. Agnew [2003] Q.B. 556. English Court of Appeal: An insureds common law duty of good faith came to an end after litigation started. Policy: Wtd no hot work. Aegeon, a passenger ferry was insured under a hull and machinery port risks while undergoing general and cosmetic maintenance in Greece. On February 19, 1996, the vessel was destroyed by fire. Insurers relied on sworn statements taken from two workmen after the fire showing that substantial hot works were carried out from February 1, 1996 ASK: What would the sworn statements of the workmen show? What impact would the statements have if the court allowed the insurer to rely on the statements?

K/S Merc-Scandia XXXXII v. Certain Lloyd's Underwriters subscribing to Lloyd's Policy No 25T 105487, The Mercandian Continent *2001+ 2 Lloyds Rep. 563

English Court of Appeal: Breach of an insureds post-contractual duty of good faith would not entitle an insurer to avoid liability unless it materially affected the insurers liability. Shipowners put their vessel in Port of Spain, Trinidad for repairs. Shortly after redelivery, vessels engine exploded causing severe damage to the vessel. Repairers failed to tighten the engine bolts in the No. 2 cylinder. Insured tendered a forged document to solicitors thinking it might assist over the issue of jurisdiction. The forgery was discovered by the solicitors and the underwriters disclaimed liability.

Inflated claims

Is it possible to infer that an insured is acting in bad faith when he puts in an inflated claim? Would an insureds claim be fatally affected if the insured made a honest mistake in submitting an exaggerated claim?

Britton v. Royal Insurance Co. (1886) 4 F. & F. 905. Willes J. : A person who made a fraudulent claim would not be permitted to recover at all since the contract of insurance was one of perfect good faith on both sides, and it was most important that such good faith should be maintained. A tailor insured his furniture and effects for 50, trade fixtures for 50 and stock-in-trade for 450. Premises were damaged by fire and insured stated that his loss was above 700. Evidence showed that insured had 3 fires within a space of 2 or 3 years and that he had changed his name from Benjamin Britton to John Britton. Insurers: Insured made a false and fraudulent claim by representing that his loss was 550. This was accepted. Also argued that Insured deliberately set fire to his own premises. This was rejected.

Norton v. Royal Life Assurance Co. (1885) 1 T.L.R. 460. English Court of Appeal: Even though an inflated claim might be evidence of fraud, an insured was entitled to show that he had no intention to defraud the insurer. A grocer, insured his premises, stock-in-trade and furniture for 450. After a fire, the insured put in a claim for 274 of which 196 was for stock-in-trade. During negotiations, insured reduced the claim to 187, out of which 87 was for goods and 100 for damages. Insurers refused to pay contending that the claim was fraudulent and the insured sued for 150. Insured:That he made out the claim from recollection and had reduced the amount not intending to induce the company to pay the full amount.

Chapman v. Pole, P.O. (1870) 22 L.T. 306 Cockburn C.J.: When a claim was grossly excessive, not only in point of value, but also as to the quantity and character of the property insured it was not easy to conceive of such gross exaggeration as being honest.

Contents of a house was insured for 500. Insured suffered a loss by fire and he put in a claim for 418. Insurers: Claim was fraudulent because the value as well as the quantity of goods destroyed were grossly exaggerated.

Ewer v. National Employers' Mutual General Insurance [1937] 2 All E.R. 139. MacKinnon J.: An insured who put forward a higher claim as a bargaining figure but had no intention to defraud the insurer would not be precluded from claiming against the insurer. Goods were insured under a fire insurance policy. The goods were damaged by fire. Insured listed the cost price of items destroyed in the fire without giving allowance for the fact that they were no longer new. Insurers: Claim was fraudulent because insured put in an exaggerated claim. ASK: How do you show this?

Central Bank of India v. Guardian Ass. Co. (1936) 54 Ll.L. Rep. 247. Privy Council: The evidence as to the height of the debris in the godowns within a very short time of the discovery of the fire pointed to the untruth of the statements as to the contents of the godowns given by the witnesses. Owner of a flour mill insured goods under a fire insurance policy. Goods were pledged to the Central Bank of India. The goods, consisting of wheat, wheat products and gunny sacks were kept in godowns. Fire destroyed the goods. Insured claimed that the godowns were full and the goods were stacked right up to the ceilings. Insurers: Claim was exaggerated and fraudulent.

Teh Say Cheng v. North British and Mercantile Insurance Co. Ltd. (1921) F.M.S.L.R. 248. Whitley J.C.: An insureds dire financial straits made it unlikely that he would have the means to keep the stocks he claimed were lost in the fire. A wine merchant insured his shop and stock-in-trade for $73,000 and his furniture and effects for $2,000. A fire destroyed everything in the insured premises. Insured claimed $63,503 for stock-in-trade and $3,500 for furniture. When the policy was effected, the insured had several judgments entered against him and part of his stocks were later attached by judgment creditors. Insurers: Claims were so excessive as to be fraudulent.

Asean Security Paper Mills Sdn. Bhd. v. CGU Insurance Bhd. [2007] 2 C.L.J. 1. Malaysian Federal Court: The standard of proof resting on an insurer alleging arson was proof beyond reasonable doubt. Insurers alleged that the loss was caused by arson even though the chemists who examined the site after the fire found no traces of chemicals or hydrocarbon and they entertained the possibility that it could have been due to spontaneous combustion owing the presence of special chemicals in the security paper stored at the warehouse. ASK: Is the standard the same in Singapore?

Direct Line Insurance Plc. v. Fox [2009] 1 All E.R. (Comm.) 1017 Judge Richard Seymour Q.C.: When an insurer agreed to settle an insureds claim, the settlement discharged or modified the contract in relation to which the claim was said to have arisen. The new agreement was not one to which the doctrine of utmost good faith to guard against fraudulent claims would be applicable. Policy: If any claim or part of a claim is made fraudulently or falsely, the policy shall become void and all benefit under this policy will be forfeited. Insurers entered into a written agreement to settle a claim for 46,524.50 in full settlement of all claims. Insured later submitted forged invoices to claim the balance of 4,112.4350 from the insurers but later withdrew the invoices.

Settlements

Holmes v. Payne [1930] 2 K.B. 301. Roche J.: In the absence of any misrepresentation, fraud or mistake, an insurer was bound by a settlement. A pearl necklace was insured against "all loss wheresoever which the assured may sustain by the loss of or damage to the property herein specified". Insured could not find her necklace and she informed the underwriters representative that she had lost the necklace. Insurer settled with the insured. The necklace was later found when it fell out of an evening cloak. Insurers: Loss meant a permanent deprivation of the insured property and they had made a factual mistake regarding the loss of the property.

Projection Pte. Ltd. v. The Tai Ping Insurance Co. Ltd. [2001] 2 S.L.R. 399. Singapore Court of Appeal: A settlement agreed to by an insurer was binding on the insurer. Projection Pte. Ltd. (PPL) were the main contractors for a sports and recreation centre at Jurong East Street 31. PPL, the Sports Council and PPLs sub-contractors were named as the assured under a Contractors All Risks policy. A retaining wall at the building site collapsed, damaging a third partys canal. PPL notified the insurers of its claim. Loss adjusters worked out a claim of $679,066.09. PPL signed the discharge voucher alone and added the following statement: This full and final settlement shall be limited to the aforesaid incident only.

Payment by mistake

Ask: Is there any defence to resist restitution for payment by mistake? Change of position?

Magee v. Pennine [1969] H.L.C. 507.

English Court of Appeal: An insurer who agreed to settle a claim was entitled to set aside the settlement if it turned out that the insured had no valid claim against the insurer. Insured, who could not drive, acquired a car for his son of 18 to drive. A garage proprietor who sold the car to the insured filled in the proposal form for him. Insured stated that he was the holder of a provisional driving licence and that he and his elder son of 35 would drive the car in addition to his younger son. Car was used exclusively by the younger son. It skidded into a shop window and became a complete wreck. Insured claimed 600. Insurers offered 385 and insured accepted. Insurers: There were material non-disclosure and misrepresentation.

Kelly v. Solari (1841) 9 M. & W. 54. House of Lords: An insurer who paid while labouring under a mistake induced by his own forgetfulness was not barred from recovering the payment. Recovery would be barred if the insurer acted in reckless disregard for the true facts. Defendants husband was insured under a life insurance policy. The policy lapsed just before the insured died owing to the non-payment of premiums. Insurers knew that the policy had lapsed. When the defendant applied for payment, the insurers paid having forgotten that the policy had lapsed. Insurers: Payment was made under a mistake of fact. HL agreed

Kleinwort Benson Ltd. v. Lincoln City Council [1999] 2 A.C. 349. MCST No. 473 v. De Beers Jewellery Pte. Ltd. [2002] 2 S.L.R. 1. Statoil ASA v. Louis Dreyfus Energy Services LP; The Harriette N [2009] 1 All E.R. (Comm.) 1035 Scottish Equitable v Derby English Court of Appeal: Before a recipient of a mistaken payment could to rely on the defence of change of position, the detriment suffered must be causally linked to the mistaken payment. In 1995, insured checked the value of his policy. Insurer provided a print-out showing a value of 201,938, failing to take into account an earlier withdrawal leaving only 50,000 in the account. Insured took a lump sum payment of 51,333 and placed another 150,604 with another insurer. When the insurer discovered the mistake, they sought to recover the payment save for a sum of approximately 9,600 the insured had used to make modest improvements to his lifestyle.

Reference to arbitration

Can be made a condition precedent to liability

Is this fair and just? More costs? How about possible bias? See the cases for what grounds you can apply to set this aside.

Scott v. Avery (1856) H.L.C. 810. House of Lords: An arbitration clause did not oust the courts jurisdiction. Arbitration would allow any dispute that arose to be speedily and economically determined so that public policy would require that effect should be given to the contract. Insured commenced legal proceedings against an insurer under a policy providing: *T+hat no member ... shall be entitled to maintain any action at law, or suit in equity, on his policy, until the matters in dispute shall have been referred to, and decided by, arbitrators Insurers applied for a stay of proceedings on the ground that the dispute had not been referred to arbitration. Plaintiff: Agreement was contrary to public policy as tending to oust the jurisdiction of the courts.

Clough v. Country Line Stock Insurance Co. (1916) 85 L.J.K.B. 1185. Avory J.: When a dispute involved difficult questions of law, the Court would exercise its discretion to allow the action to proceed to trial without referring the matter to arbitration. Several horses were insured under a policy providing that: any differences between the parties should be referred to arbitration. Each party shall pay his or their own costs of the reference, and a moiety of the costs of the award Insurers disclaimed liability alleging that there was a misrepresentation as to the age of one of the horses. Insurers applied for the dispute to be referred to arbitration. Insured: The clause was unfair. . Alternatively, there were difficult questions of law in the dispute.

Jureidini v. National British & Irish Millers Insurance [1951] A.C. 499. House of Lords: An insurer who asserted that he was not bound by a policy owing to an insureds fraudulent conduct could not later seek to rely on an arbitration provision in the policy. Plaintiffs, hardware merchants in Costa Rica, insured their stock-in-trade against the risk of fire. Policy provided that any differences was to be referred to arbitration. Policy further provided in clause 12 that "if the claim be in any respect fraudulent" or "if the loss or damage be occasioned by the wilful act, or with the connivance of the insured" all benefits under the policy shall be forfeited. Insurers: First, the plaintiffs' claim was fraudulent. . Secondly, the plaintiffs set fire to the insured premises or connived at their being set on fire. ASK: What is the Courts basis? Many different grounds. Policy? Law? But the policy says the benefits under the policy shall be forfeited. Does not say that the policy ceases to exist!

Would he succeed if he can prove fraud? See Super Chem for a decision clearing up the case. Toller v. Law Accident Insurance Society [1936] 2 All E.R. 952. English Court of Appeal: An insurer who disputed the existence of a valid contract, could not rely on an arbitration provision in the contract. Plaintiff submitted a proposal for a motor insurance policy on August 15, 1935. No premiums were paid until October 29, 1935, when a policy was issued. Before the issue of the policy, various cover notes were issued, the last of which expired on October 2. On that day, the car was involved in an accident damaging a taxicab and injuring a pedestrian. Insurers denied the existence of a contract but they asked for a stay of proceedings to have the matter arbitrated. Plaintiff: Insurers could not rely on arbitration clause as they had declared there there was no policy in existence.

Woodall v. Peal Assurance Co. Ltd. [1919] 1 K.B. 593. English Court of Appeal: When an insurer relied on a term in a policy to avoid liability, he was also entitled to rely on an arbitration provision in the policy. Insured took out a personal accident policy stating his occupation as that of a haulier and contractor. The assured was killed in an accident. Insurers disclaimed liability on the ground that the insured had wrongly described his occupation and the truth of the statement was made the basis of the contract. Insurers applied for a stay of the proceedings under the arbitration clause. Insurers: They were not denying the existence of the policy but relying on a term in the policy to avoid liability.

Smith v. Peal Assurance Co. [1939] 1 All E.R. 95. English Court of Appeal: Poverty or financial hardship was not a sufficient ground for the Court to exercise its discretion to order a stay of arbitration proceedings. Plaintiff was a passenger in a car when it was involved in an accident. He suffered personal injuries. Plaintiff was awarded a sum of 2,160 for the drivers negligence. Driver was insolvent so the plaintiff issued a writ against his insurers. Insurers applied for the matter to be referred to arbitration. Plaintiff: He would be put to financial hardship if the matter was referred to arbitration as he would not be entitled to legal aid.

Harbour Assurance Co. (U.K.) Ltd. v. Kansa General International Insurance Co. Ltd. [1993] 3 W.L.R. 42. Hoffman L.J.: There will obviously be cases in which a claim that no contract came into existence necessarily entails a denial that there was any agreement to arbitrate. Cases of non est factum or denial that there was a concluded agreement, or mistake as to the

identity of the other contracting party suggest themselves as examples. But there is no reason why every case of initial invalidity should have this consequence. Note: Not about insurance

Soleimany v. Soleimany [1998] 3 W.L.R. 811. English Court of Appeal: An arbitration award founded upon an illegal contract would not be enforced by the English courts on grounds of public policy. Plaintiff discovered that he could make substantial profits from the export and sale of Persian carpets even though it contravened Iranian revenue laws and export controls. He found a way to smuggle the carpets out of Iran by arranging with diplomats to take them out using their diplomatic immunity. The carpets where later sold by the plaintiffs father in England and elsewhere. A dispute arose between the parties over the division of the profits. The parties agreed for the matter to be arbitrated before the Beth Din (Court of Chief Rabbi) applying Jewish law.

Super Chem Products Ltd. v. American Life and General Insurance Co. Ltd. [2004] 1 All E.R. (Comm.) 713. Privy Council: Precluding an insurer who asserted that an insured was acting fraudulently from relying on an arbitration provision was not consistent with the principles of contract law. Insured manufacturered detergents, shampoos, disinfectants, adhesives in Trinidad and were insured for stock and consequential losses. Policy: If the claim be in any respect fraudulent, ... all benefit under this Policy shall be forfeited. Fire destroyed large parts of the insureds factory, stock and equipment, and offices. Insurers: Fire was caused by arson or with the insureds connivance or complicity

Tay Eng Chuan v. Ace Insurance Ltd. [2008] 4 S.L.R. 95. Singapore Court of Appeal: When a reference to arbitration was not made a condition precedent to an insureds right to sue the insurers, the insured was not precluded from bringing an action against the insurers even though the dispute was not referred to arbitration. Insurers paid the insured $300,000 for the loss of the lens in his left eye but refused further payment when the insured claimed for the loss of sight of his eye. Insurers: Insured failed to refer the dispute to arbitration and was precluded from suing on the claim.

Vous aimerez peut-être aussi

- Insurance Law-Intentional, Negligent and Illegal ConductDocument9 pagesInsurance Law-Intentional, Negligent and Illegal ConductDavid Fong100% (1)

- Insurance Law - Increase in RiskDocument6 pagesInsurance Law - Increase in RiskDavid FongPas encore d'évaluation

- Queen's Bench Division Insurance CaseDocument28 pagesQueen's Bench Division Insurance CasePancakesM80% (5)

- Insurance Law-SubrogationDocument10 pagesInsurance Law-SubrogationDavid Fong100% (4)

- Understanding Subrogation RightsDocument20 pagesUnderstanding Subrogation RightsSrijan AcharyaPas encore d'évaluation

- Insurance Law - CausationDocument28 pagesInsurance Law - CausationRosary BeadesPas encore d'évaluation

- Insurance Law-ConstructionDocument10 pagesInsurance Law-ConstructionDavid FongPas encore d'évaluation

- Insurance Law-ClaimsDocument8 pagesInsurance Law-ClaimsDavid FongPas encore d'évaluation

- Insurance Law-IntermediariesDocument12 pagesInsurance Law-IntermediariesDavid FongPas encore d'évaluation

- Insurance Law-DisclosureDocument34 pagesInsurance Law-DisclosureDavid Fong100% (1)

- Insurance Law-IntroDocument4 pagesInsurance Law-IntroDavid FongPas encore d'évaluation

- Insurance Law-WarrantiesDocument21 pagesInsurance Law-WarrantiesDavid FongPas encore d'évaluation

- Fire Insurance CaseDocument38 pagesFire Insurance Caseisha04tyagi100% (1)

- Insurance Law-Insurance ContractDocument14 pagesInsurance Law-Insurance ContractDavid Fong100% (4)

- Insurable Interest LectureDocument20 pagesInsurable Interest LectureTiffany NkhomaPas encore d'évaluation

- Insurance Law NotesDocument15 pagesInsurance Law NotesGumisiriza BrintonPas encore d'évaluation

- Insurable interest requirements and exceptionsDocument18 pagesInsurable interest requirements and exceptionsDavid Fong100% (1)

- Insurance Law-ContributionDocument5 pagesInsurance Law-ContributionDavid FongPas encore d'évaluation

- Unit 4 Duty of Disclosure Materiality of Facts and MisrepresentationDocument19 pagesUnit 4 Duty of Disclosure Materiality of Facts and MisrepresentationIsrael KalabaPas encore d'évaluation

- Utmost Good Faith Principle & Cause ProximaDocument4 pagesUtmost Good Faith Principle & Cause ProximaTONG SHU ZHEN100% (1)

- Ziale Lpqe - Commercial Transactions Notes On Commercial CreditDocument5 pagesZiale Lpqe - Commercial Transactions Notes On Commercial CreditMoses Bwalya MweenePas encore d'évaluation

- Insurance Contract Law NotesDocument10 pagesInsurance Contract Law NotesTay Min Si100% (2)

- Civil Law - Conveyancing - Mortgage - dispute over computation of compound interestDocument667 pagesCivil Law - Conveyancing - Mortgage - dispute over computation of compound interestSimushi SimushiPas encore d'évaluation

- Ziale Lecture Notes On PartnershipDocument13 pagesZiale Lecture Notes On PartnershipLeonard TemboPas encore d'évaluation

- Commercial Law Assignment 2Document7 pagesCommercial Law Assignment 2Francis BandaPas encore d'évaluation

- DEFAMATIONDocument8 pagesDEFAMATIONflirtz2010100% (1)

- Cases in The Law of EvidenceDocument528 pagesCases in The Law of EvidenceNahmy83% (6)

- Republic of ZambiaDocument4 pagesRepublic of ZambiaBwaima-Twaima Lushimba ChileyaPas encore d'évaluation

- Fothergill V Monarch Airlines LTDDocument6 pagesFothergill V Monarch Airlines LTDAishwariyaaAngelinaStephenPas encore d'évaluation

- ZIALE EXPECTATIONS STRATEGIESDocument4 pagesZIALE EXPECTATIONS STRATEGIESRichard MutachilaPas encore d'évaluation

- MALIKO IP ASSignmentDocument11 pagesMALIKO IP ASSignmentMaliko Mudenda100% (1)

- Elements of The Law of Contract: DR Graham Melling March 2014Document70 pagesElements of The Law of Contract: DR Graham Melling March 2014kks8070Pas encore d'évaluation

- Negligence: Blyth V Birmingham WaterworksDocument17 pagesNegligence: Blyth V Birmingham WaterworksTee Khai ChenPas encore d'évaluation

- Commercial Securities Lecture NotesDocument36 pagesCommercial Securities Lecture NotesElizabeth Chilufya100% (1)

- Fitzroy v. CaveDocument2 pagesFitzroy v. CavecrlstinaaaPas encore d'évaluation

- Law Notes Vitiating FactorsDocument28 pagesLaw Notes Vitiating FactorsadelePas encore d'évaluation

- Insurance Notes ExplainedDocument58 pagesInsurance Notes Explainedpauline1988Pas encore d'évaluation

- Family and Succession LawDocument5 pagesFamily and Succession LawLaurance NamukambaPas encore d'évaluation

- Find Insurance Complaint HelpDocument10 pagesFind Insurance Complaint HelpbeingviswaPas encore d'évaluation

- Uol Contract Main ExamDocument5 pagesUol Contract Main ExamSaadat Bin SiddiquePas encore d'évaluation

- Fuji Finance v Aetna Life Insurance Co LtdDocument21 pagesFuji Finance v Aetna Life Insurance Co LtdKirk-patrick TaylorPas encore d'évaluation

- CGLDocument19 pagesCGLArindam ChakrabortyPas encore d'évaluation

- Delict Second SemesterDocument100 pagesDelict Second SemesterfirdousPas encore d'évaluation

- Lesson 2 - 2022 Nov ZIALEDocument26 pagesLesson 2 - 2022 Nov ZIALEtalk2marvin70Pas encore d'évaluation

- Witness Competence and Compellability in English LawDocument6 pagesWitness Competence and Compellability in English LawNahmy100% (2)

- Company Law Exam Questions on Formation, Authority and RecoveryDocument6 pagesCompany Law Exam Questions on Formation, Authority and Recoverymweene88100% (1)

- Notes On Bringing Land Under The RTADocument4 pagesNotes On Bringing Land Under The RTAReal TrekstarPas encore d'évaluation

- (CONTRACT) Case Summaries & StatutesDocument5 pages(CONTRACT) Case Summaries & StatutesJanice OoiPas encore d'évaluation

- Bank of Nova Scotia Vs Hellenic Mutual War Risks AUKHL910043COM137144Document18 pagesBank of Nova Scotia Vs Hellenic Mutual War Risks AUKHL910043COM137144Samaksh KhannaPas encore d'évaluation

- BLAW Chapter 8 Notes - Negligence and Strict LiabilityDocument5 pagesBLAW Chapter 8 Notes - Negligence and Strict Liabilitypik-yeePas encore d'évaluation

- GRAND EDDY KNOWLES V OHAN TRANSPORT LIMITEDDocument5 pagesGRAND EDDY KNOWLES V OHAN TRANSPORT LIMITEDSimushi SimushiPas encore d'évaluation

- Insurance Law KenyaDocument6 pagesInsurance Law KenyaSenelwa Anaya100% (6)

- Mozambican Man Sues TV Station for Negligence After Distressing BroadcastDocument8 pagesMozambican Man Sues TV Station for Negligence After Distressing BroadcastLaurance NamukambaPas encore d'évaluation

- Liswaniso V Mopani (2004)Document8 pagesLiswaniso V Mopani (2004)Adrian NjavwaPas encore d'évaluation

- THE RISK (Cl.8) : BY Dr. Y. Papa Rao Course TeacherDocument10 pagesTHE RISK (Cl.8) : BY Dr. Y. Papa Rao Course TeacherVarnika TayaPas encore d'évaluation

- IC-74 Liability InsuranceDocument334 pagesIC-74 Liability Insurancemani_588Pas encore d'évaluation

- Contracts of indemnity and insurable interestDocument8 pagesContracts of indemnity and insurable interestkuldeep Roy SinghPas encore d'évaluation

- Insurance Law IndemnityDocument8 pagesInsurance Law Indemnitykuldeep Roy SinghPas encore d'évaluation

- Insurance Law-IndemnityDocument7 pagesInsurance Law-IndemnityDavid FongPas encore d'évaluation

- Topic: Concealment Material Concealment: Incontestability Clause (1994)Document3 pagesTopic: Concealment Material Concealment: Incontestability Clause (1994)alyPas encore d'évaluation

- Insurance Law-AssignmentDocument7 pagesInsurance Law-AssignmentDavid FongPas encore d'évaluation

- Insurance Law-ContributionDocument5 pagesInsurance Law-ContributionDavid FongPas encore d'évaluation

- Insurance Law-ConstructionDocument10 pagesInsurance Law-ConstructionDavid FongPas encore d'évaluation

- Insurance Law-IndemnityDocument7 pagesInsurance Law-IndemnityDavid FongPas encore d'évaluation

- Insurance Law-IntermediariesDocument12 pagesInsurance Law-IntermediariesDavid FongPas encore d'évaluation

- Insurance Law-ClaimsDocument8 pagesInsurance Law-ClaimsDavid FongPas encore d'évaluation

- Insurance Law-WarrantiesDocument21 pagesInsurance Law-WarrantiesDavid FongPas encore d'évaluation

- Insurance Law-DisclosureDocument34 pagesInsurance Law-DisclosureDavid Fong100% (1)

- Insurable interest requirements and exceptionsDocument18 pagesInsurable interest requirements and exceptionsDavid Fong100% (1)

- Insurance Law-IntroDocument4 pagesInsurance Law-IntroDavid FongPas encore d'évaluation

- Insurance Law-Insurance ContractDocument14 pagesInsurance Law-Insurance ContractDavid Fong100% (4)

- MEP Civil Clearance 15-July-2017Document4 pagesMEP Civil Clearance 15-July-2017Mario R. KallabPas encore d'évaluation

- Dyesebel 3Document7 pagesDyesebel 3Leachez Bbdear BarbaPas encore d'évaluation

- Problem IsDocument5 pagesProblem IsSharra Vesta Llana ValeraPas encore d'évaluation

- 5 6271466930146640792Document1 225 pages5 6271466930146640792Supratik SarkarPas encore d'évaluation

- Literary Alexandria PDFDocument50 pagesLiterary Alexandria PDFMariaFrankPas encore d'évaluation

- Practice 4Document5 pagesPractice 4Nguyễn Tuấn ĐịnhPas encore d'évaluation

- CASES IN LOCAL and REAL PROPERTY TAXATIONDocument3 pagesCASES IN LOCAL and REAL PROPERTY TAXATIONTreblif AdarojemPas encore d'évaluation

- Understanding Plane and Solid FiguresDocument9 pagesUnderstanding Plane and Solid FiguresCoronia Mermaly Lamsen100% (2)

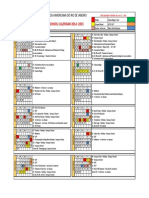

- CalendarDocument1 pageCalendarapi-277854872Pas encore d'évaluation

- Peta in Business MathDocument2 pagesPeta in Business MathAshLeo FloridaPas encore d'évaluation

- Networking and TESOL career goalsDocument2 pagesNetworking and TESOL career goalsSadiki FltaPas encore d'évaluation

- Universiti Kuala Lumpur Intra Management System: Unikl-ImsDocument16 pagesUniversiti Kuala Lumpur Intra Management System: Unikl-ImsAfnanFadlanBinAzmiPas encore d'évaluation

- Ex For Speech About The ObesityDocument3 pagesEx For Speech About The ObesityJenniferjenniferlalalaPas encore d'évaluation

- National University's Guide to Negligence PrinciplesDocument35 pagesNational University's Guide to Negligence PrinciplesSebin JamesPas encore d'évaluation

- Case DigestsDocument31 pagesCase DigestsChristopher Jan DotimasPas encore d'évaluation

- Magsaysay v. NLRCDocument17 pagesMagsaysay v. NLRCJohn BernalPas encore d'évaluation

- Shareholding Agreement PFLDocument3 pagesShareholding Agreement PFLHitesh SainiPas encore d'évaluation

- E-Waste & Electronic Recycling: Who Will Pay?: Congressional BriefingDocument14 pagesE-Waste & Electronic Recycling: Who Will Pay?: Congressional BriefingSrivatsan SeetharamanPas encore d'évaluation

- CH8 OligopolyModelsDocument37 pagesCH8 OligopolyModelsJeffrey LaoPas encore d'évaluation

- Philippines-Expanded Social Assistance ProjectDocument2 pagesPhilippines-Expanded Social Assistance ProjectCarlos O. TulaliPas encore d'évaluation

- Marketing PlanDocument18 pagesMarketing PlanPatricia Mae ObiasPas encore d'évaluation

- BE1 - 1. Skripta (Kolokvij)Document5 pagesBE1 - 1. Skripta (Kolokvij)PaulaPas encore d'évaluation

- PMLS Professional Organization ActivityDocument4 pagesPMLS Professional Organization ActivityHershei Vonne Baccay100% (1)

- SOP For Master of Business Administration: Eng. Thahar Ali SyedDocument1 pageSOP For Master of Business Administration: Eng. Thahar Ali Syedthahar ali syedPas encore d'évaluation

- Spider Man: No Way Home First Official Poster Is Out NowDocument3 pagesSpider Man: No Way Home First Official Poster Is Out NowzlatanblogPas encore d'évaluation

- House Bill 667Document10 pagesHouse Bill 667daggerpressPas encore d'évaluation

- Indirect Questions BusinessDocument4 pagesIndirect Questions Businessesabea2345100% (1)

- Coursebook Chapter 15 AnswersDocument3 pagesCoursebook Chapter 15 AnswersAhmed Zeeshan80% (10)

- Assignment World Group6 SectionBDocument3 pagesAssignment World Group6 SectionBWanderer InneverlandPas encore d'évaluation

- The Problem and It'S BackgroundDocument9 pagesThe Problem and It'S BackgroundGisbert Martin LayaPas encore d'évaluation