Académique Documents

Professionnel Documents

Culture Documents

Ahtn Description of Commodities Quantity Value: 34039911000 Compressor Oil 4.00 Drums 9,074.00 AUD

Transféré par

Che AlsimDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ahtn Description of Commodities Quantity Value: 34039911000 Compressor Oil 4.00 Drums 9,074.00 AUD

Transféré par

Che AlsimDroits d'auteur :

Formats disponibles

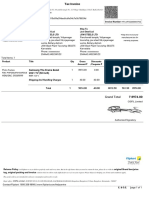

APPLICATION FOR AUTHORITY TO RELEASE IMPORTED GOODS Bureau of Internal Revenue BIR National Office Agham Road, Diliman,

Quezon City

Date: Jul-06-2011 OIC Chief Large Tax Assistance Division II Bureau of Internal Revenue *Required Entries/Selection *IMPORTER/OWNER NAME DRILLCORP PHILIPPINES INC *IMPORTER/OWNER'S TIN 006322916000

*IMPORTER/OWNER ADDRESS NO. 16 SOUTH INDUSTRIAL ESTATE BANCAL CARMONA CAVITE Bancal Carmona, Cavite Broker Advance Global Transport /Filemon Aguillon *BL NO / AIRWAY BILL NO. AUFREAS6705128 *COUNTRY OF ORIGIN Australia *ESTIMATED DATE OF ARRIVAL July 31, 2011 Broker TIN 109895775000 CARRIER Broker Address Canlalay Binan Laguna VOYAGE NO. BUNGA PELANGI DUA 138

*PORT OF ENTRY Manila South Harbour (PoM) PURPOSE OF IMPORTATION OWN USE IN COMPRESSOR MACHINE-REPAIRS AND MAINTENANCE

*FINAL DESTINATION 16 SOUTH COAST INDUSTRIAL ESTATE BANCAL CARMONA CAVITE (specify complete address) COMMODITY DETAILS

*AHTN 34039911000 *Description of Commodities COMPRESSOR OIL 4.00 Drums *Quantity 9,074.00 AUD *Value

1. *Detailed description of how the commodity will be used by taxpayer (as machinery, raw materials, goods for sale, etc.) AS RAW MATERIALS IN MAINTAINANCE AND REPAIRS OF COMPANY'S COMPRESSOR MACHINES. 2. Legal basis for exemption from payment of VAT / excise tax(es) (state specific section(s) or articles of the pertinent law)

I hereby declare under oath that the above information are true and correct in witness whereof, and I hereby assume the full responsibility to any legal consequence that may arise from any misinterpretation on my/our part if the imported article(s), upon inspection, prove to be different or are not the same as manifested or, if any of the documents submitted in support of this application described the article(s) in a manner that will conceal their true nature for the purpose of avoiding payment of the appropriate taxes. I hereby affix my signature. ________________________________________________, Philippines, ___________________________, 20___________________.

CHERYL ALSIM (Importer or his duly authorized representative) ACCOUNTANT (Title / Position)

DOC NO PAGE NO BOOK NO SERIES NO Notar i zati on SUBSCRIBED an d SWORN to m e th i s ______ day of ________ 20___ i n __________ affi an t exh i bi ted to m e h i s/h er Com m u n i ty Tax Cer ti fi cate N. ________ i ssu ed at ______ on ___________

BIR070611325283

Vous aimerez peut-être aussi

- Esclatran Transport Services: 32 Rizal St. Benedicto Jaro, Iloilo CityDocument5 pagesEsclatran Transport Services: 32 Rizal St. Benedicto Jaro, Iloilo CityRheneir Mora50% (8)

- Sample Investment ContractDocument5 pagesSample Investment ContractGinny PañoPas encore d'évaluation

- Annex C Sworn Application For Tax Clearance - Engr. SamDocument1 pageAnnex C Sworn Application For Tax Clearance - Engr. SamMarycris Balanay-Caoile100% (1)

- Republic Act No. 7641, Retirement Pay Law - Implementing Rules. GuidelinesDocument11 pagesRepublic Act No. 7641, Retirement Pay Law - Implementing Rules. GuidelinesAllan Bacaron100% (1)

- Chapter 5 - (PART 2) Strategy FormulationDocument22 pagesChapter 5 - (PART 2) Strategy FormulationAila Marie PastorPas encore d'évaluation

- BHJR46/575/18 EGLV235801195441 Evergreen Shipping: Sheng Long Bio-Tech International Co LTDDocument2 pagesBHJR46/575/18 EGLV235801195441 Evergreen Shipping: Sheng Long Bio-Tech International Co LTDmitch galaxPas encore d'évaluation

- ANNEX A Application For NRI CorpDocument1 pageANNEX A Application For NRI CorpKristinePas encore d'évaluation

- BIR Form 1604EDocument2 pagesBIR Form 1604Ecld_tiger100% (2)

- Bureau of Internal Revenue Form 1604e 2016Document2 pagesBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesPas encore d'évaluation

- 1604 e 99Document4 pages1604 e 99ILubo AkPas encore d'évaluation

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArlenePas encore d'évaluation

- Erd 4 F 003Document3 pagesErd 4 F 003GCLT Logistics and Transport and Trucking ServicesPas encore d'évaluation

- Motion To ReleaseDocument4 pagesMotion To ReleaseMai peePas encore d'évaluation

- Rmo01 04Document8 pagesRmo01 04Eric SavinaPas encore d'évaluation

- Bureau of Customs vs. The Honorable Agnes VST Devanadera, Et AlDocument32 pagesBureau of Customs vs. The Honorable Agnes VST Devanadera, Et AlElise Marie BertosPas encore d'évaluation

- JOB ORDER AGREEMENT ClerkDocument4 pagesJOB ORDER AGREEMENT ClerkReinagin MulatoPas encore d'évaluation

- Velera vs. Office of The Ombudsman, 547 SCRA 43Document14 pagesVelera vs. Office of The Ombudsman, 547 SCRA 43Machida AbrahamPas encore d'évaluation

- Tax Digests For Years 2011 - 2012Document102 pagesTax Digests For Years 2011 - 2012Naomi Corpuz100% (3)

- Republic of The Philippines) City Of) S.S. Undertaking As Non-Regular ImporterDocument1 pageRepublic of The Philippines) City Of) S.S. Undertaking As Non-Regular ImporterjuvyPas encore d'évaluation

- BIR Form No. 0901-T (Transport and Shipping)Document2 pagesBIR Form No. 0901-T (Transport and Shipping)ChristianNicolasBetantosPas encore d'évaluation

- Kenmed Trading Alltop Trading CorpDocument1 pageKenmed Trading Alltop Trading CorpJeffrey MedinaPas encore d'évaluation

- CTA Crim. Case No. O-454Document48 pagesCTA Crim. Case No. O-454Rieland CuevasPas encore d'évaluation

- Affidavit of Loss Certificate of Registration With UndertakingDocument2 pagesAffidavit of Loss Certificate of Registration With UndertakingFreitzPas encore d'évaluation

- Republic of The Philippines: East-Westbound Terminals & Public MarketDocument4 pagesRepublic of The Philippines: East-Westbound Terminals & Public MarketEastwest BoundPas encore d'évaluation

- Omnibus Sworn Statement-DBPDocument3 pagesOmnibus Sworn Statement-DBPRodel AysonPas encore d'évaluation

- Tax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior YearsDocument2 pagesTax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior YearsAngela ArlenePas encore d'évaluation

- Sedc Atlapac 28-01-2019Document1 pageSedc Atlapac 28-01-2019esmeraldaPas encore d'évaluation

- Tax Cases 2Document146 pagesTax Cases 2Sylver JanPas encore d'évaluation

- Schedule A FormDocument3 pagesSchedule A FormNaim AzazeePas encore d'évaluation

- G.R. No. 203867 - Shell vs. Commissioner Morales - Freedom of Speech - Sub JudiceDocument21 pagesG.R. No. 203867 - Shell vs. Commissioner Morales - Freedom of Speech - Sub JudiceSANDRA MAE BONRUSTROPas encore d'évaluation

- Affidavit of Undertaking - OnsemiDocument1 pageAffidavit of Undertaking - Onsemilleiryc7Pas encore d'évaluation

- Dennis Floria (Memo of Agreement)Document2 pagesDennis Floria (Memo of Agreement)Adrian Paul MacatoPas encore d'évaluation

- Alicemarie Stotler Financial Disclosure Report For 2010Document6 pagesAlicemarie Stotler Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- Combined Declaration of Use and Incontestability Under Sections 8 & 15Document7 pagesCombined Declaration of Use and Incontestability Under Sections 8 & 15LadyJane2000Pas encore d'évaluation

- DTI Application FormDocument2 pagesDTI Application FormClarisse30Pas encore d'évaluation

- Cta 2D CV 08331 D 2013nov28 AssDocument27 pagesCta 2D CV 08331 D 2013nov28 AssBobby Olavides SebastianPas encore d'évaluation

- Commissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestDocument2 pagesCommissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestAbilene Joy Dela CruzPas encore d'évaluation

- f510024 Importer PermitDocument3 pagesf510024 Importer PermitAnonymous UUUcrNPas encore d'évaluation

- BIS - No-Dollar Importation of Used Motor Vehicle (Balikbayan) EO 156-LpvDocument3 pagesBIS - No-Dollar Importation of Used Motor Vehicle (Balikbayan) EO 156-Lpvlito77Pas encore d'évaluation

- Special Power of AttorneyDocument6 pagesSpecial Power of AttorneySally SiaotongPas encore d'évaluation

- Omnibus 2021Document2 pagesOmnibus 2021Mike Francis F GubuanPas encore d'évaluation

- Michael Flores Documents 0001Document7 pagesMichael Flores Documents 0001taddy_guillermoPas encore d'évaluation

- 18517Document38 pages18517alicewilliams83nPas encore d'évaluation

- Application Form Corp 2020Document3 pagesApplication Form Corp 2020nikkosbreadshopPas encore d'évaluation

- Fajardo vs. Office of The OmbudsmanDocument2 pagesFajardo vs. Office of The Ombudsmanmisslee misseunPas encore d'évaluation

- Written Export AuthorizationDocument1 pageWritten Export AuthorizationAnonymous IRDAHBPas encore d'évaluation

- BSP-Information Sheet CorporationDocument1 pageBSP-Information Sheet CorporationadobopinikpikanPas encore d'évaluation

- 1904 January 2018 ENCS FinalDocument3 pages1904 January 2018 ENCS FinalFatima LunaPas encore d'évaluation

- Anti Dumping LawDocument15 pagesAnti Dumping LawDaria Asacta TolentinoPas encore d'évaluation

- Sworn Statement Bid DocumentsDocument2 pagesSworn Statement Bid Documentsivo mandantesPas encore d'évaluation

- Omnibus BidDocument2 pagesOmnibus BidZikki RemollenoPas encore d'évaluation

- 15-8046 - Permits PDFDocument36 pages15-8046 - Permits PDFRecordTrac - City of OaklandPas encore d'évaluation

- Polylite Industrial Corporation: Hospital Road, Putol Magdalo Cavite 4104 PhilippinesDocument1 pagePolylite Industrial Corporation: Hospital Road, Putol Magdalo Cavite 4104 PhilippinesAnonymous nbaIC9Pas encore d'évaluation

- Omnibus Sworn Statement FFJJ CONSTRUCTIONDocument2 pagesOmnibus Sworn Statement FFJJ CONSTRUCTIONJerpaks NawamuhPas encore d'évaluation

- PPA OminibusDocument1 pagePPA OminibusEmperor of Asia PacificPas encore d'évaluation

- BIR Revenue Memorandum Order 10-2014Document17 pagesBIR Revenue Memorandum Order 10-2014PortCalls100% (4)

- Omnibus Sworn StatementDocument2 pagesOmnibus Sworn StatementBenjie paranPas encore d'évaluation

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaD'EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaPas encore d'évaluation

- The immigration offices and statistics from 1857 to 1903D'EverandThe immigration offices and statistics from 1857 to 1903Pas encore d'évaluation

- OCP - Supplier's Performance EvaluationDocument4 pagesOCP - Supplier's Performance EvaluationChe Alsim100% (1)

- Discussion... Philippine Legal System.... 12.07.13Document6 pagesDiscussion... Philippine Legal System.... 12.07.13Che AlsimPas encore d'évaluation

- Double Tax Philippines eDocument32 pagesDouble Tax Philippines eChe AlsimPas encore d'évaluation

- Is Retirement Pay TaxableDocument2 pagesIs Retirement Pay TaxableChe AlsimPas encore d'évaluation

- Is Retirement Pay TaxableDocument2 pagesIs Retirement Pay TaxableChe AlsimPas encore d'évaluation

- Dole Do 18-02 2002Document7 pagesDole Do 18-02 2002thecityforeverPas encore d'évaluation

- Foreign Investment Negative Lists or EO 584 PDFDocument1 pageForeign Investment Negative Lists or EO 584 PDFNoel RemolacioPas encore d'évaluation

- Foreign Investment Negative Lists or EO 584 PDFDocument1 pageForeign Investment Negative Lists or EO 584 PDFNoel RemolacioPas encore d'évaluation

- 65716RR No 12-2012 PDFDocument2 pages65716RR No 12-2012 PDFGale Calaycay LaenoPas encore d'évaluation

- Citizen's Charter: Metro Cotabato Water DistrictDocument44 pagesCitizen's Charter: Metro Cotabato Water DistrictMaddie SyPas encore d'évaluation

- FTKF BDocument2 pagesFTKF BPads PrietoPas encore d'évaluation

- Pass Book - RWPDocument29 pagesPass Book - RWPpunjab food authority RawalpindiPas encore d'évaluation

- Tor Ic Adri - 2Document7 pagesTor Ic Adri - 2herri susantoPas encore d'évaluation

- Electrical SOQ EVDocument16 pagesElectrical SOQ EVjaiPas encore d'évaluation

- DOCSDocument10 pagesDOCSSWATIPas encore d'évaluation

- Catalog CV Cipta Abadi 2022Document61 pagesCatalog CV Cipta Abadi 2022EMPAT ANUGERAH SYUKUR ,PTPas encore d'évaluation

- International Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Test BankDocument18 pagesInternational Business Opportunities and Challenges in A Flattening World Version 3 0 3rd Carpenter Test BankAna Lyons100% (34)

- TECHNOR CaseDocument4 pagesTECHNOR CaseДенис ЗаславскийPas encore d'évaluation

- 5 B 96474 F 4 B 08 eDocument59 pages5 B 96474 F 4 B 08 eSABAPas encore d'évaluation

- Advanced Research Methods - Class 4Document19 pagesAdvanced Research Methods - Class 4Kito JabariPas encore d'évaluation

- Samsung The Frame Bezel 2021 TV (50 Inch) : Grand Total 8974.00Document1 pageSamsung The Frame Bezel 2021 TV (50 Inch) : Grand Total 8974.00Anil ChanduriPas encore d'évaluation

- PostsocialismDocument7 pagesPostsocialismPavel NedelcuPas encore d'évaluation

- Marketing StrategyDocument15 pagesMarketing StrategyDimbag Gold WilliyantoPas encore d'évaluation

- Straight Line Graphs 5A: y y X X y y X XDocument3 pagesStraight Line Graphs 5A: y y X X y y X XboobooPas encore d'évaluation

- Process Costing TEST BANK PDFDocument7 pagesProcess Costing TEST BANK PDFJohn Brian D. Soriano100% (1)

- Packaging Market in Poland: Economic Information Department Polish Information and Foreign Investment AgencyDocument6 pagesPackaging Market in Poland: Economic Information Department Polish Information and Foreign Investment AgencyMera SamirPas encore d'évaluation

- DA PLANT Agust 2021Document8 pagesDA PLANT Agust 2021Awalin sakhi zailani AwalinPas encore d'évaluation

- Customer Inquiry ReportDocument4 pagesCustomer Inquiry ReportDian LelaPas encore d'évaluation

- Stocks and Their ValuationDocument31 pagesStocks and Their ValuationShao BajamundePas encore d'évaluation

- ZaykaDocument15 pagesZaykaAndrea AmprinoPas encore d'évaluation

- 12th Economics Model Unit Test - 02Document5 pages12th Economics Model Unit Test - 02Raaja YoganPas encore d'évaluation

- Shop Layout Management IM 1 PDFDocument125 pagesShop Layout Management IM 1 PDFMark DelacruzPas encore d'évaluation

- Akmen 5 QuizDocument5 pagesAkmen 5 QuizNabilah AdediaPas encore d'évaluation

- DK Automation ComplaintDocument48 pagesDK Automation ComplaintDhruv PandeyPas encore d'évaluation

- Methodology StatementDocument3 pagesMethodology StatementMichael Tauna KekeiPas encore d'évaluation

- Gold Is Money - Sennholz, HDocument214 pagesGold Is Money - Sennholz, HBozhidar Malamov PetrovPas encore d'évaluation

- Grade Xi Economics Project - GuidelinesDocument3 pagesGrade Xi Economics Project - GuidelinesAayush TetePas encore d'évaluation

- MAC (Misdirected Directive Case Analysis)Document3 pagesMAC (Misdirected Directive Case Analysis)Prasad GowdPas encore d'évaluation