Académique Documents

Professionnel Documents

Culture Documents

Total Number of Rooms 50.63

Transféré par

hanuman24Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Total Number of Rooms 50.63

Transféré par

hanuman24Droits d'auteur :

Formats disponibles

Skyview

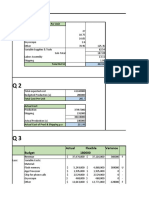

Manor 1. On average, how many rooms must be rented each night in season for the hotel to breakeven? About 51 rooms must be rented each night during the peak season for the hotel to breakeven. Break-even number of rooms each night total sales Fixed costs Variable costs per room: Contribution margin CM Ratio Break-even in dollars Break-even ($/day) Break-even rev from dbl/day Number of doubles /day Break even rev from sgl/day Number of singles/day total number of rooms rooms East Wing West Wing Total Rooms available Avg Occupancy winter Winter days Manager annual salary Manager wife/day Desk clerk/day Maid/day Maids peak Payroll Taxes/Fringe Benefits Depreciation Property Taxes Insurance (Just Winter) Repairs and Maintenance (Just winter) # Rooms Rented in Winter at 80% Occupancy Cleaning Supplies/room Miscellaneous Fixed Miscellaneous variable Linen (just winter) Linen /double room Linen/single room Rooms rented telephones/room/month telephones: basic charge/month Telephones (just winter) Electricity/ available room (just winter) Interest on Mortgage Rooms Double rate 50 30 80 120 $ 15,000 20 24 15 4 20% $ 30,000 $ 4,000 $ 3,000 $ 17,204 7680 $ 0.25 $ 3,657 $ 3,657 $ 13,920 $ 1.51 $ 0.76 fixed variable variable variable fixed fixed partially variable partially variable dbl rate sgle rate 20 15 25 20 Single Rev 160800 $ 77,973 $ 60,437 $ 100,363 62% $ 124,927.10 $ 1,041.06 $ 832.85 $ 38 $ 208.21 12 50.63

3 variable 50 fixed 1160 $ 65 variable $ 21,716 fixed Dbl Rev single rate

East Wing West Wing Total rooms available Average Occupancy Rate Average Rate Avg Revenue/Day

50 30 80 80%

20 25 80% 21.75

640 480 1120

15 20 20% 16.875

120 96

216

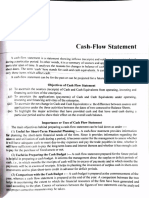

2. The hotel is full on weekends in the ski season. If all room rates were raised $5 on weekend nights, but occupancy fell to 72 rooms instead of 80, what is the revised profit before taxes for the year, per Exhibit 1? If room rates were raised by $5 on weekend nights and occupancy fell, the revised profit before taxes would be $24,982. Manager Manager's Wife Desk Clerk Maids Payroll Taxes Depreciation Property Taxes Insurance (Just winter) Repairs (just winter) Cleaning Supplies Utilities Linen Service Interest Misc. Expenses Total Expenses Profit before Taxes Income Taxes Net Profit Weekend nights in winter Weekday nights in winter Weekend occupancy at regular rates weekday occupancy at regular rates Average Occupancy Average rate weekday average rate weekend Weekend total rooms Weekday total rooms 35 85 90% 69% 80% $ 20.78 $ 25.88 2520 4692 Revenue Expenses $ 162,681.30 Salaries $ 15,000 $ 2,400 $ 2,880 $ 7,200 $ 27,480 $ 5,496 $ 30,000 $ 4,000 $ 3,000 $ 17,204 $ 1,850 $ 6,360 $ 13,412 $ 21,716 $ 7,181 x x x x $ 137,699 $ 24,982 $ 11,992 $ 12,991

Weekday revenue weekend revenue Total Revenue Winter days Manager annual salary Manager wife/day Desk clerk/day Maid/day Maids peak Payroll Taxes/Fringe Benefits Depreciation Property Taxes Insurance (Just Winter) Repairs and Maintenance (Just winter) # Rooms Rented in Winter at 80% Occupancy Cleaning Supplies/room Miscellaneous Fixed Miscellaneous variable Linen (just winter) Linen /double room Linen/single room Rooms rented telephones/room/month telephones: basic charge/month Telephones (just winter) Electricity/ available room (just winter) Interest on Mortgage

$ 97,476.30 $ 65,205.00 $ 162,681.30 120 $ 15,000 fixed 20 variable 24 variable 15 variable 4 20% $ 30,000 fixed $ 4,000 fixed $ 3,000 partially variable $ 17,204 partially variable 7680 $ 0.25 $ 3,657 $ 3,657 $ 13,920 $ 1.51 $ 0.76 7212 3 variable 50 fixed 1160 $ 65 variable $ 21,716 fixed

3. What is the proposed incremental contribution margin per occupied room/day during the off-season? Here we are trying to determine how much incremental contribution to the profit per occupied room/day during the off-season. Contribution margin is determined as follows: Sales COGS variable operating expenses. The average revenue per occupied room/day is $14. 4. For each alternative in the case, list the annual expenses that are incremental to that decision alternative but are not related to the room/days occupied?

5. For each decision alternative calculate the occupancy rate necessary to break even on the incremental annual expenses. 6. What alternative do you recommend? Why? I recommend opening the west wing year round as only a 2% occupancy rate would justify doing this. I would hold off on building the pool as it is a major capital expenditure and makes it much riskier that it will breakeven on the investment. Moreover, it is not entirely clear what effect the pool will have on the occupancy rate. Therefore, since it is very likely the hotel can maintain 2% occupancy rates during the off-season, and likely much more than that, this is the best and most profitable choice. 7. Evaluate the profitability of the Hotel as an investment for its owners. Does this affect your answer to question 6? The profit margin of the hotel (profit as a percent of sales) is $11k/160k = 7%. However, if they decide to open the hotel for the summer they would need to reach 24% occupancy in order to reach the same absolute profits of about $11k and their profit margin would drop to 6%. The only way they can maintain profit margins of 7 to 7.5% would be to get occupancy during the off-season of 30%, which is definitely not a sure thing. One option would be to try opening the hotel for the off-season for one-year and testing what occupancy rates they can expect. If they are lower than they need, they could always decide not to open the hotel during the off-season in the future. This option does not exist for the pool options. Once they decide to build a pool they will have incurred a major capital expenditure and will likely need to support this investment over time in order to please their clientele who might have gotten used to having a pool. Therefore, while the business is quite profitable as is, I would still choose to open the hotel in the summer months.

Vous aimerez peut-être aussi

- Skyview Manor SolutionDocument5 pagesSkyview Manor Solutionsindhuja2160% (5)

- ACCT233 Tutorial 5 QuestionsDocument3 pagesACCT233 Tutorial 5 QuestionsDominic RobinsonPas encore d'évaluation

- Boulevard Sandwiches, Inc. (A) : FAPC Assignment Group 7Document7 pagesBoulevard Sandwiches, Inc. (A) : FAPC Assignment Group 7Akshay100% (1)

- UnitRon Case SolutionDocument5 pagesUnitRon Case SolutionsaPas encore d'évaluation

- Case Study 1 Anadam MFG Instructions and NotesDocument1 pageCase Study 1 Anadam MFG Instructions and NotesSaifuddin Mohammed Tarek0% (1)

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyDocument5 pagesTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- GUNA FIBRES Case Study QuestionsDocument2 pagesGUNA FIBRES Case Study QuestionsRahul Kumar0% (1)

- Grand River University Water Buffalos AbcDocument6 pagesGrand River University Water Buffalos Abcfisa kiahsPas encore d'évaluation

- Butler Lumber Case Study SolutionDocument8 pagesButler Lumber Case Study SolutionBagus Be WePas encore d'évaluation

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniPas encore d'évaluation

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanPas encore d'évaluation

- Allied Office ProductDocument26 pagesAllied Office ProductAnanda Agustin Fitriana100% (1)

- Kreative Kasuals Woeking NotesDocument3 pagesKreative Kasuals Woeking NotesAashima GroverPas encore d'évaluation

- Case Analysis Toy WorldDocument11 pagesCase Analysis Toy WorldNiketa Jaiswal100% (1)

- Blaine SolutionDocument4 pagesBlaine Solutionchintan MehtaPas encore d'évaluation

- Gas Traders CaseDocument9 pagesGas Traders CaseRajesh PathakPas encore d'évaluation

- Marion BoatsDocument6 pagesMarion BoatssubratajuPas encore d'évaluation

- Blackhealth Manufacturing Company-RevisitedDocument8 pagesBlackhealth Manufacturing Company-RevisitedRahul Sharma100% (1)

- Alberta Gauge Company CaseDocument2 pagesAlberta Gauge Company Casenidhu291Pas encore d'évaluation

- 1701Document6 pages1701Dolly BringasPas encore d'évaluation

- W7 - Soal Case 6 - Skyview Manor (Recovered)Document2 pagesW7 - Soal Case 6 - Skyview Manor (Recovered)Suci NurlaeliPas encore d'évaluation

- Tijuana Bronze MachiningDocument19 pagesTijuana Bronze MachiningHari Haran43% (7)

- Sol Wellington Chemicals DivisionDocument3 pagesSol Wellington Chemicals DivisionRahul Goyal100% (1)

- Case 18-1 Huron Automotive Company StudyDocument4 pagesCase 18-1 Huron Automotive Company StudyEmpress CarrotPas encore d'évaluation

- Coma - BlackHeath Manufacturing Company - Revisited (Has Errors)Document44 pagesComa - BlackHeath Manufacturing Company - Revisited (Has Errors)Nitin Gavishter100% (1)

- Phuket Beach Case SolutionDocument8 pagesPhuket Beach Case SolutionGmitPas encore d'évaluation

- China LodgingsDocument2 pagesChina LodgingsMaryam ZafarPas encore d'évaluation

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisPas encore d'évaluation

- Skyview ManorDocument12 pagesSkyview ManorSteffi Dcosta100% (1)

- Skyview ManorDocument8 pagesSkyview ManorPhuong Bogrand100% (2)

- Skyview ManorDocument15 pagesSkyview ManorDevina PutriPas encore d'évaluation

- Skyview ManorDocument4 pagesSkyview ManorDwi Handoyo MiharjoPas encore d'évaluation

- UnitronDocument9 pagesUnitronIvan Naufal PriadyPas encore d'évaluation

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- Section E - Group 1 - RegionFly CaseDocument6 pagesSection E - Group 1 - RegionFly CaseAshish VijayaratnaPas encore d'évaluation

- Skyview Manor CaseDocument3 pagesSkyview Manor CaseNisa SasyaPas encore d'évaluation

- Allied Office ProductsDocument5 pagesAllied Office ProductsAdeel Jalil100% (1)

- Modern Pharma SolnDocument3 pagesModern Pharma SolnSakshiPas encore d'évaluation

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- Guna Fibre Financial AnalysisDocument5 pagesGuna Fibre Financial AnalysissumeetkantkaulPas encore d'évaluation

- Case 11-2 SolutionDocument2 pagesCase 11-2 SolutionArjun PratapPas encore d'évaluation

- Mgt. Acctg, - Case Study - Baldwin BicycleDocument14 pagesMgt. Acctg, - Case Study - Baldwin BicycleCristina Fernandez SanchezPas encore d'évaluation

- Unitron CorporationDocument7 pagesUnitron CorporationERika PratiwiPas encore d'évaluation

- GBA 645 Case7 Real Estate and Capital Structure DecisionsDocument6 pagesGBA 645 Case7 Real Estate and Capital Structure DecisionssimplyabeerPas encore d'évaluation

- Selligram Case Answer KeyDocument3 pagesSelligram Case Answer Keysharkss521Pas encore d'évaluation

- Case of Joneja Bright Steels: The Cash Discount DecisionDocument10 pagesCase of Joneja Bright Steels: The Cash Discount DecisionRHEAPas encore d'évaluation

- WCM QuestionsDocument5 pagesWCM QuestionsBhavin BaxiPas encore d'évaluation

- SUBJECT: Analyses and Recommendations For The Different Cost AccountingDocument4 pagesSUBJECT: Analyses and Recommendations For The Different Cost AccountinglddPas encore d'évaluation

- Bridgeton HWDocument3 pagesBridgeton HWravPas encore d'évaluation

- Allied Office ProductsDocument10 pagesAllied Office Productsdian ratnasari100% (7)

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbPas encore d'évaluation

- Pinetree MotelMP 26 Case - N - Group 4Document5 pagesPinetree MotelMP 26 Case - N - Group 4harleeniitrPas encore d'évaluation

- Lipman Bottle CompanyDocument20 pagesLipman Bottle CompanySaswata BanerjeePas encore d'évaluation

- Group 2 - Danshui Plant Case Study - SolutionDocument6 pagesGroup 2 - Danshui Plant Case Study - SolutionArindam MandalPas encore d'évaluation

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Pas encore d'évaluation

- E 06 H 1 MortgageDocument6 pagesE 06 H 1 MortgageMintPas encore d'évaluation

- Excel To Business Analys ExamDocument15 pagesExcel To Business Analys Examrhea23aPas encore d'évaluation

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654Pas encore d'évaluation

- Case 2 - Lady M-2Document11 pagesCase 2 - Lady M-2Joanne LinPas encore d'évaluation

- Lesson 3Document29 pagesLesson 3Anh MinhPas encore d'évaluation

- Cwip Theory AccountingDocument33 pagesCwip Theory AccountingRebeccaNandaPas encore d'évaluation

- Cash and Accrual Single Entry PDFDocument8 pagesCash and Accrual Single Entry PDFJoyce Anne GarduquePas encore d'évaluation

- B. Cash Flow StatementDocument6 pagesB. Cash Flow Statementrahul jambagiPas encore d'évaluation

- Mathematics - 120 Questions With Answer Key - LET EXAM - Questions & AnswersDocument19 pagesMathematics - 120 Questions With Answer Key - LET EXAM - Questions & AnswersAsiyah B. Balindong100% (2)

- FY 2017 CEKA Wilmar+Cahaya+Indonesia+Tbk (CEKA)Document87 pagesFY 2017 CEKA Wilmar+Cahaya+Indonesia+Tbk (CEKA)Ririn Sentia AyuPas encore d'évaluation

- Soce2023bskeforms Form1Document1 pageSoce2023bskeforms Form1Alexander Ibabao Villanueva100% (2)

- Le Merien Da Nang Resort & Spa ProjectDocument37 pagesLe Merien Da Nang Resort & Spa ProjectLê HuyPas encore d'évaluation

- Federal Income Tax CourseDocument1 027 pagesFederal Income Tax Courserskamath16114644100% (1)

- Cash Flow Statements TheoryDocument16 pagesCash Flow Statements Theorysk9693092588Pas encore d'évaluation

- Answer 2Document4 pagesAnswer 2asdfPas encore d'évaluation

- Keac 210Document65 pagesKeac 210vichmegaPas encore d'évaluation

- Chandu Softech Computer and Mobile ServiceDocument8 pagesChandu Softech Computer and Mobile ServiceVinay KalagarlaPas encore d'évaluation

- 1652426740-447 & 8168 HCL Comnet Systems & Services LTDDocument7 pages1652426740-447 & 8168 HCL Comnet Systems & Services LTDArulnidhi Ramanathan SeshanPas encore d'évaluation

- Fabm1 & 2 - ReviewDocument77 pagesFabm1 & 2 - ReviewBernice Jayne MondingPas encore d'évaluation

- Churro Iloco Business PlanDocument10 pagesChurro Iloco Business PlanJom Rigonan73% (11)

- CHARITABLETRUST 3rdsepDocument146 pagesCHARITABLETRUST 3rdsepAnkit DamaniPas encore d'évaluation

- ICAEW Vietnam Accounting Course Notes Print Version 2021Document298 pagesICAEW Vietnam Accounting Course Notes Print Version 2021LisaPas encore d'évaluation

- Research ProjectDocument68 pagesResearch ProjectRj BîmålkümãrPas encore d'évaluation

- Budgeting CTRLDocument9 pagesBudgeting CTRLJoseph PamaongPas encore d'évaluation

- Islamic Accounting FrameworkDocument18 pagesIslamic Accounting FrameworkNurul Faezah Mat JalilPas encore d'évaluation

- Chapter 1-Fundamentals of Financial AccountingDocument20 pagesChapter 1-Fundamentals of Financial AccountingAudrey ReyesPas encore d'évaluation

- Comprehensive ExamsDocument28 pagesComprehensive ExamsKang JoonPas encore d'évaluation

- Cooperative Chart of AccountsDocument37 pagesCooperative Chart of AccountsGianena MariePas encore d'évaluation

- 1-5032-FRONTSHEET 1-Assignment 1Document23 pages1-5032-FRONTSHEET 1-Assignment 1Nguyễn Minh BảoPas encore d'évaluation

- Pcoa 008 - Intermediate Accounting Ii Learning OutcomesDocument19 pagesPcoa 008 - Intermediate Accounting Ii Learning OutcomesNicole LucasPas encore d'évaluation

- Budget Preparation Forms and Instructions (Updates)Document41 pagesBudget Preparation Forms and Instructions (Updates)mgallegoPas encore d'évaluation

- Administer Financial Accounts (ModuleDocument11 pagesAdminister Financial Accounts (ModuleFelekePhiliphosPas encore d'évaluation

- My Tax Espresso Newsletter Apr2023Document18 pagesMy Tax Espresso Newsletter Apr2023Claudine TanPas encore d'évaluation

- Overtime FormDocument1 pageOvertime FormMarco Ruiz CastronuevoPas encore d'évaluation