Académique Documents

Professionnel Documents

Culture Documents

Self Assessment Payment Letter

Transféré par

Sardarified Charanpreet SinghCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Self Assessment Payment Letter

Transféré par

Sardarified Charanpreet SinghDroits d'auteur :

Formats disponibles

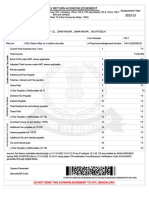

Date: 24th October 2012

From: Name of the Assessee Address of the Assessee PAN: of the Assessee To: The ITO, Address. Sir, Ref: Your letter for Unpaid SA Tax for A.Y. 20XX-XX. Communication Reference No.: No.ABC/PQRS/S.A.Tax/NP/20XX-XX/123 dated 24th October 2012. Sub: Payment of Self Assessment Tax for AY 20XX-XX. With reference to the above I may state as under: I am in receipt of your above referred letter of communication, whereby I am required to pay self assessment tax amount of Rs. XX,XXX as per the return filed for AY 20XX-XX. In this regard I wish to state that I have paid an amount of RsXX,XXX on(Date of payment ) towards the self assessment tax liability for A.Y20XX-XX. The detail of enclosed challan is tabulated hereunder: Assessment Year 20XX-XX Particulars Self Assessment Tax Challan Amount (Rs.) XX,XXX Bank Detail ABCD Bank BSR Code XXXXXX Challan Sr. No. XXXXX

Kindly take the above on your records and oblige. Thanking you, Yours faithfully,

Name of the Assessee PAN: of the Assessee Enclosed please find; 1) Copy of S. A. Tax paid challan for AY 20XX-XX.

Vous aimerez peut-être aussi

- Ing Vysya Bank Limited: Statement of AccountDocument4 pagesIng Vysya Bank Limited: Statement of Accountanoop_mishra1986Pas encore d'évaluation

- Application For Export Bills For CollectionDocument2 pagesApplication For Export Bills For CollectionsrinivasPas encore d'évaluation

- Cover LetterDocument3 pagesCover Letterapi-358201396Pas encore d'évaluation

- NatWest Current Account Application Form Non UK EU ResDocument17 pagesNatWest Current Account Application Form Non UK EU ResL mPas encore d'évaluation

- Bank Payment Declaration For MT103 SwiftDocument1 pageBank Payment Declaration For MT103 SwiftSumantriPas encore d'évaluation

- UTI - New Editable Transaction Application Form For Purchase Redemption and SwitchDocument2 pagesUTI - New Editable Transaction Application Form For Purchase Redemption and SwitchAnilmohan Sreedharan0% (1)

- Account Transcript - NICH - 103569728089Document2 pagesAccount Transcript - NICH - 103569728089Ashley Marie NicholsPas encore d'évaluation

- Bank Statement Template 1Document1 pageBank Statement Template 1Frank GallagherPas encore d'évaluation

- U.S. Customs Form: CBP Form 226 - Record of Vessel Foreign Repair or Equipment PurchaseDocument2 pagesU.S. Customs Form: CBP Form 226 - Record of Vessel Foreign Repair or Equipment PurchaseCustoms FormsPas encore d'évaluation

- 2 Sample SBLC 2023Document2 pages2 Sample SBLC 2023SANG HOANG THANH100% (1)

- Remittance Advice - Emily Bano AriquezDocument1 pageRemittance Advice - Emily Bano AriquezEdmil Jhon AriquezPas encore d'évaluation

- XXXXXX XXXXXX: Sender: Sbltgb2Lxxx Suisse Credit Capital Limited London GB ReceiverDocument1 pageXXXXXX XXXXXX: Sender: Sbltgb2Lxxx Suisse Credit Capital Limited London GB ReceiverSanto XingPas encore d'évaluation

- Bank Islam IBDocument1 pageBank Islam IBMuhammad Khairul HafiziPas encore d'évaluation

- GCash Bills Pay ReceiptDocument2 pagesGCash Bills Pay ReceiptDonnaPas encore d'évaluation

- BANK Sign Verfication FormatDocument1 pageBANK Sign Verfication FormatAbhishek KumarPas encore d'évaluation

- Bank Guarantee (FormatDocument2 pagesBank Guarantee (Formatmsadhanani3922Pas encore d'évaluation

- InternationalPaymentFM 20161122 0106Document1 pageInternationalPaymentFM 20161122 0106Nathalia SilvaPas encore d'évaluation

- Westpac Pacific Internet Banking - Fiji - Make Immediate Payment ReceiptDocument1 pageWestpac Pacific Internet Banking - Fiji - Make Immediate Payment ReceiptViliamePas encore d'évaluation

- Payment GuidelinesDocument1 pagePayment GuidelinesJavier AbarcaPas encore d'évaluation

- HST Business enDocument6 pagesHST Business enSPas encore d'évaluation

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDocument1 pageThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoPas encore d'évaluation

- Bank Guarantee Format Icc 458Document3 pagesBank Guarantee Format Icc 458Priors Mortgages & Finance LtdPas encore d'évaluation

- Ncnd+ifmpa - en - Blanco Luis D 2Document12 pagesNcnd+ifmpa - en - Blanco Luis D 2Charles CroesPas encore d'évaluation

- BankdetailsDocument5 pagesBankdetailsAnupam DasPas encore d'évaluation

- Sample Bank LetterDocument1 pageSample Bank LetterspkeenanPas encore d'évaluation

- First PRSMTDocument49 pagesFirst PRSMTnandk98Pas encore d'évaluation

- Barclays Bank United Kingdom Re Confirmation of Payment FundDocument2 pagesBarclays Bank United Kingdom Re Confirmation of Payment FundromizahPas encore d'évaluation

- Form A PDFDocument2 pagesForm A PDFSundar SethPas encore d'évaluation

- Banker Verification LetterDocument1 pageBanker Verification LetterVharry Watson100% (1)

- CBZ Bank Limited. - Account Statement: Transaction Date Value Date Reference Description Debit Credit BalanceDocument1 pageCBZ Bank Limited. - Account Statement: Transaction Date Value Date Reference Description Debit Credit BalanceMusiiwa FariraiPas encore d'évaluation

- 1 PDFDocument3 pages1 PDFSugiThanikaPas encore d'évaluation

- Oceanic Bank - Letter From John Aboh - CEODocument1 pageOceanic Bank - Letter From John Aboh - CEOOceanic Bank International PLCPas encore d'évaluation

- KRA Tax Compliance CertificateDocument1 pageKRA Tax Compliance Certificateyasmin contractingcoltdPas encore d'évaluation

- AmanDocument7 pagesAmanGaba StudioPas encore d'évaluation

- HB o BR Wire-App0914Document2 pagesHB o BR Wire-App0914Anonymous HH3c17osPas encore d'évaluation

- Refund Request Form: Important Information - Please ReadDocument1 pageRefund Request Form: Important Information - Please ReadShuCiNgPas encore d'évaluation

- Lol - 2019 09 06 Financial OpportunitiesDocument3 pagesLol - 2019 09 06 Financial OpportunitiesOildeals Ng100% (1)

- Alpha NewsDocument3 pagesAlpha Newscrichert30Pas encore d'évaluation

- U.S. Customs Form: CBP Form 301 - Customs BondDocument2 pagesU.S. Customs Form: CBP Form 301 - Customs BondCustoms Forms100% (1)

- 3232 Void Corrected: Form W-2GDocument8 pages3232 Void Corrected: Form W-2GMichael HenryPas encore d'évaluation

- ReceiptDocument1 pageReceiptASHIQ HUSSAINPas encore d'évaluation

- Federal Deposit Insurance Corporation: Certificate of AssuranceDocument1 pageFederal Deposit Insurance Corporation: Certificate of AssurancebravokPas encore d'évaluation

- Standard Charted Gambia LTD: VED CT ., 2019Document1 pageStandard Charted Gambia LTD: VED CT ., 2019Hector SchiavonePas encore d'évaluation

- Annexure - 1 Bank Attestation of Account Details & Account-Holder's SignatureDocument1 pageAnnexure - 1 Bank Attestation of Account Details & Account-Holder's SignatureGyan Swaroop TripathiPas encore d'évaluation

- 2012 Ontario Tax FormDocument2 pages2012 Ontario Tax FormHassan MhPas encore d'évaluation

- Movers and Packers Bill ReceiptDocument12 pagesMovers and Packers Bill ReceiptGaurav ChoudharyPas encore d'évaluation

- Instrument of Transfer For Non Listed Securities PDFDocument3 pagesInstrument of Transfer For Non Listed Securities PDFphilippos1979Pas encore d'évaluation

- 2019 11 SNS BANK + SNS REAAL OfferDocument5 pages2019 11 SNS BANK + SNS REAAL OfferSouthey CapitalPas encore d'évaluation

- StatementEmail4321450000359043 - 26 Jun 201614 40 59 PDFDocument2 pagesStatementEmail4321450000359043 - 26 Jun 201614 40 59 PDFfghjjkkkkkPas encore d'évaluation

- PF Withdrawal Application (Sample Copy)Document5 pagesPF Withdrawal Application (Sample Copy)Ravi Kant Thakur80% (5)

- 103FTP2022-01027 4Document10 pages103FTP2022-01027 4Desart Bano100% (1)

- COR Letter To Etrade 2Document1 pageCOR Letter To Etrade 2janiceshellPas encore d'évaluation

- IPB-SA PB Account-10011620045 Confirmation of Credit Card Purchase 2932571033Document1 pageIPB-SA PB Account-10011620045 Confirmation of Credit Card Purchase 2932571033tony roxPas encore d'évaluation

- KYC Test CasesDocument18 pagesKYC Test CasesrekhaPas encore d'évaluation

- Bip S ReceiptDocument1 pageBip S ReceiptScotty CraigPas encore d'évaluation

- I Was Not 30,60,90,120 Days LateDocument1 pageI Was Not 30,60,90,120 Days LateElcana MathieuPas encore d'évaluation

- Iinquiry Deletion BureauDocument1 pageIinquiry Deletion Bureauemmanuelhood642Pas encore d'évaluation

- Understanding Your CIBIL CIRDocument3 pagesUnderstanding Your CIBIL CIRVijayprakash LodhaPas encore d'évaluation

- VFS Refund RequestDocument2 pagesVFS Refund RequestMildred Gabriela Gálvez RodasPas encore d'évaluation

- Reason I Didn-T Pay LateDocument1 pageReason I Didn-T Pay LateJayden MaedaPas encore d'évaluation

- Cameron Fisher Excel Budget ProjectDocument2 pagesCameron Fisher Excel Budget Projectapi-340519862Pas encore d'évaluation

- International - Payment - Methods - USW (2) (1) - 1Document2 pagesInternational - Payment - Methods - USW (2) (1) - 1its shawxPas encore d'évaluation

- Questions and Answers On Significant SupDocument2 pagesQuestions and Answers On Significant SupSorayah M. Sharief-TabaoPas encore d'évaluation

- Taxable IncomeDocument18 pagesTaxable Incomerav danoPas encore d'évaluation

- Statement For Aug 18, 2023Document1 pageStatement For Aug 18, 2023Hawa KabiaPas encore d'évaluation

- Urmila JiDocument11 pagesUrmila JiMahendra KumarPas encore d'évaluation

- SUA Form DanelDocument2 pagesSUA Form DanelDanel SanchezPas encore d'évaluation

- DK SFR Fak Fos 0005272232 05297528 815645287 20151031Document5 pagesDK SFR Fak Fos 0005272232 05297528 815645287 20151031Anonymous lqamnugdWPas encore d'évaluation

- IDFCFIRSTBankstatement 10124475903Document14 pagesIDFCFIRSTBankstatement 10124475903RAJ KUMHAREPas encore d'évaluation

- Invoice DHL No. JKTR002114131Document3 pagesInvoice DHL No. JKTR002114131Tri Wahyuni100% (2)

- Solved The Revenues and Expenses of Sentinel Travel Service For TheDocument1 pageSolved The Revenues and Expenses of Sentinel Travel Service For TheAnbu jaromiaPas encore d'évaluation

- Invoice To: Despatch ToDocument1 pageInvoice To: Despatch ToAYUSH PRADHANPas encore d'évaluation

- 2nd BillDocument1 page2nd BillParag KhandelwalPas encore d'évaluation

- Shahzad Haider: Declaration Acknowledgement SlipDocument2 pagesShahzad Haider: Declaration Acknowledgement SlipShehzad HaiderPas encore d'évaluation

- Invoice No. 8032017603: Bayer Cropscience Inc. 3rd Flr. Bayer House PO Box 4600 4028 Calamba Laguna PhilippinesDocument2 pagesInvoice No. 8032017603: Bayer Cropscience Inc. 3rd Flr. Bayer House PO Box 4600 4028 Calamba Laguna PhilippinesGlezilda LoberianoPas encore d'évaluation

- Your Final Bill.: Account Balance Your Payment Is Due NowDocument3 pagesYour Final Bill.: Account Balance Your Payment Is Due NowJaktron71% (7)

- Itr 22-23 PDFDocument1 pageItr 22-23 PDFPixel computerPas encore d'évaluation

- Seahorse Shipping CorporationDocument1 pageSeahorse Shipping CorporationBảo AnPas encore d'évaluation

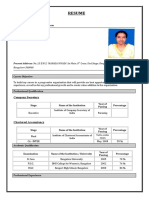

- Manasa Resume - 1Document3 pagesManasa Resume - 1ManasaPas encore d'évaluation

- Your Adv Plus Banking: Account SummaryDocument4 pagesYour Adv Plus Banking: Account SummaryAPas encore d'évaluation

- Bank Recon SeatworkDocument4 pagesBank Recon SeatworkMary Lyn DatuinPas encore d'évaluation

- Deductions On Gross IncomeDocument6 pagesDeductions On Gross IncomeJamaica DavidPas encore d'évaluation

- Inbound 7593446463458303621Document2 pagesInbound 7593446463458303621Brajmohan SoniPas encore d'évaluation

- Yes Bank2Document8 pagesYes Bank2Hafidz MozillaPas encore d'évaluation

- Tangerine-eStatement Jul19 PDFDocument2 pagesTangerine-eStatement Jul19 PDFRudyard Martin Cardozo33% (6)

- Auditing Practice Problem 6Document2 pagesAuditing Practice Problem 6Jessa Gay Cartagena TorresPas encore d'évaluation

- Postemployment Benefits: Employee's Employee Employee Obligation DecemberDocument25 pagesPostemployment Benefits: Employee's Employee Employee Obligation DecemberGabriel PanganPas encore d'évaluation

- Income Statement Horizontal Analysis TemplateDocument2 pagesIncome Statement Horizontal Analysis TemplateSope DalleyPas encore d'évaluation

- Purchase Request: Denr - Penro AlabelDocument11 pagesPurchase Request: Denr - Penro AlabelMaika J. PudaderaPas encore d'évaluation

- Chapter 3 PayrollDocument12 pagesChapter 3 Payrollawlachew100% (2)