Académique Documents

Professionnel Documents

Culture Documents

Exp Return On Plan Assets Actual Return On Plan Assets: The Funded Status of The Plan Is: Underfunded

Transféré par

AJ SuttonTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Exp Return On Plan Assets Actual Return On Plan Assets: The Funded Status of The Plan Is: Underfunded

Transféré par

AJ SuttonDroits d'auteur :

Formats disponibles

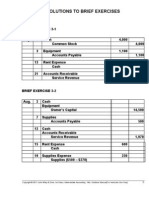

3/17/2013 13:23 AJ VERSION Contributions made to plan Discount rate = $ 300 Exp Return on plan assets= Actual Return

on Plan Assets Informal Records 8% ($ in 000s) Balance, Jan. 1, 2007 Service Cost Interest Cost Expected return on assets Adjust for: (Loss) or Gain on assets Amortization of: Prior service cost Net loss or gain Gain (Loss) on PBO Prior service cost Cash funding Retiree benefits Balance, Dec. 31, 2007 237 (1,941) 300 (237) 1,575 (50) PBO Plan Assets (1,845) 1,400 (135) (148)

98

14

14 Retiree Benefits Paid = $ 237 Service cost $ 135 8% Avg Remaining Service Period (Yrs) = 13 7% Expected future pay levels to go up & impact plan by $ 50 * Formal Records * OCI-Prior Pension * Service OCI - Net (Liability)/ * Cost Loss (Gain) Pension Expense Cash Asset * 220 210 (445) * * 135 (135) * * 148 (148) * * (98) 98 * * * (14) 14 * * (17) 17 * * * (14) 14 * * 50 (50) * * * * * * * (300) 300 0 (366)

Pension expense Plan assets Amortization of net loss - OCI Amortization of prior service cost - OCI PBO (to record pension expense) Plan assets OCI - Net Gain (to record net gain on assets) Loss - OCI PBO (to record loss on PBO) Plan assets Cash (to record cash contribution to plan assets) PBO Plan assets (to record retiree benefits) THE FUNDED STATUS OF THE PLAN IS:

216 98 14 17 283

14 14

(50) (50)

300 300

237 237

UNDERFUNDED

203

232

216

(300)

Complete the spreadsheet, using good cell referencing so I can change your assumptions and get a new, good spreadsheet. Show all entries needed for the year. Report the funded status of the plan at year-end in good form. You must use at least one "if/then" statement in Excel (if you're really adventurous, you could use a "double if/then")

Vous aimerez peut-être aussi

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- E19-13 Opsco Corp.: To Net Income (Service Costs & Interest Costs)Document1 pageE19-13 Opsco Corp.: To Net Income (Service Costs & Interest Costs)Jedd GardnerPas encore d'évaluation

- Financial Accounting: A: How To Study AccountingDocument29 pagesFinancial Accounting: A: How To Study Accountingrishi_positive1195Pas encore d'évaluation

- Exam2 Acct414 F07Document16 pagesExam2 Acct414 F07ElvinPas encore d'évaluation

- Self Study Solutions Chapter 3Document27 pagesSelf Study Solutions Chapter 3flowerkmPas encore d'évaluation

- Be Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItDocument6 pagesBe Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItSalman KhalidPas encore d'évaluation

- Week3 Homework AC557Document2 pagesWeek3 Homework AC557seniorr001100% (1)

- Ac557 W3 HW HBDocument2 pagesAc557 W3 HW HBHasan Barakat100% (2)

- Chapter 19 SolutionsDocument34 pagesChapter 19 SolutionsRachel Rajanayagam100% (1)

- Chapter 20Document9 pagesChapter 20ezanswersPas encore d'évaluation

- Retirement Seatwork New Answer Key - With Asset CeilingDocument25 pagesRetirement Seatwork New Answer Key - With Asset CeilingsweetEmie031Pas encore d'évaluation

- Farview Foundation 2008 990Document38 pagesFarview Foundation 2008 990TheSceneOfTheCrimePas encore d'évaluation

- Farview Foundation 2010 990Document36 pagesFarview Foundation 2010 990TheSceneOfTheCrimePas encore d'évaluation

- Chapter 18Document30 pagesChapter 18Joana MariePas encore d'évaluation

- Engineering Economics Exercises - SolutionsDocument4 pagesEngineering Economics Exercises - SolutionsMehmet ZirekPas encore d'évaluation

- Olive Branch Foundation 2007 990Document25 pagesOlive Branch Foundation 2007 990TheSceneOfTheCrimePas encore d'évaluation

- Assignment Questions - Suggested Answers (E4-8, E4-19, P4-2, P4-7) E4-8Document6 pagesAssignment Questions - Suggested Answers (E4-8, E4-19, P4-2, P4-7) E4-8Ivy KwokPas encore d'évaluation

- Pensions: RCJ Chapter 14Document35 pagesPensions: RCJ Chapter 14Mini GroverPas encore d'évaluation

- FINA2207 Solutions To Practice QuestionsDocument22 pagesFINA2207 Solutions To Practice Questionszdoug1Pas encore d'évaluation

- AFM Solution 2010Document6 pagesAFM Solution 2010Ashish AgarwalPas encore d'évaluation

- 4801-Article Text-19217-1-10-20110701Document8 pages4801-Article Text-19217-1-10-20110701David BriggsPas encore d'évaluation

- Postemployment BenefitsDocument2 pagesPostemployment Benefitsbuenaflorgladys11Pas encore d'évaluation

- 2010-07-11 045532 Kunede 4Document6 pages2010-07-11 045532 Kunede 4Aarti JPas encore d'évaluation

- Financial LeverageDocument63 pagesFinancial LeverageShubham GoelPas encore d'évaluation

- Assgnmnt 12 BDocument11 pagesAssgnmnt 12 BCharis Adit67% (3)

- Lifeline Humanitarian Organization of Chicago - 2011 Form 990Document24 pagesLifeline Humanitarian Organization of Chicago - 2011 Form 990trb216Pas encore d'évaluation

- SBR Share Based PaymentDocument5 pagesSBR Share Based PaymentAkshay SadhuPas encore d'évaluation

- Provident Fund Contribution Calculator (A) (B) (C) (D)Document1 pageProvident Fund Contribution Calculator (A) (B) (C) (D)Shilpa ShivannaPas encore d'évaluation

- 0452 w07 Ms 3 PDFDocument9 pages0452 w07 Ms 3 PDFHassan PansariPas encore d'évaluation

- The Nathan Cummings Foundation 2008 990Document89 pagesThe Nathan Cummings Foundation 2008 990TheSceneOfTheCrimePas encore d'évaluation

- Chapter 6Document23 pagesChapter 6Ali NawazPas encore d'évaluation

- Farview Foundation 2006 990Document30 pagesFarview Foundation 2006 990TheSceneOfTheCrimePas encore d'évaluation

- Chapter 3 SolutionsDocument100 pagesChapter 3 SolutionssevtenPas encore d'évaluation

- Donors Capital Fund541934032 2007 048EED01SearchableDocument28 pagesDonors Capital Fund541934032 2007 048EED01Searchablecmf8926Pas encore d'évaluation

- DT 2007 990Document34 pagesDT 2007 990shimeralumPas encore d'évaluation

- CH 4 4-35 SpreadsheetDocument34 pagesCH 4 4-35 Spreadsheetcherishwisdom_997598Pas encore d'évaluation

- 9-Trialtest (Sage UBS Payroll SSG 2011 Edition)Document154 pages9-Trialtest (Sage UBS Payroll SSG 2011 Edition)bezeePas encore d'évaluation

- Answers - V2Chapter 6 2012Document6 pagesAnswers - V2Chapter 6 2012Rhei BarbaPas encore d'évaluation

- Threshold Foundation 2007 990Document28 pagesThreshold Foundation 2007 990TheSceneOfTheCrimePas encore d'évaluation

- Return of Organization Exempt From Income TaxDocument11 pagesReturn of Organization Exempt From Income TaxEnvironmental Working GroupPas encore d'évaluation

- Acc 3606 Cheatsheet FinalDocument2 pagesAcc 3606 Cheatsheet FinaldarciechoyPas encore d'évaluation

- Exercises: 1) Acme Borrowed $100,000 From A Local Bank, Which Charges Them An Interest Rate of 7% PerDocument4 pagesExercises: 1) Acme Borrowed $100,000 From A Local Bank, Which Charges Them An Interest Rate of 7% PerIslam MomtazPas encore d'évaluation

- TP StatDocument7 pagesTP Statமணிகண்டன் பிரியாPas encore d'évaluation

- Practical Task 3 PROBLEM SOLUTIONDocument7 pagesPractical Task 3 PROBLEM SOLUTIONTanya PribylevaPas encore d'évaluation

- Accounting For PensionsDocument15 pagesAccounting For PensionsOnwuchekwa Chidi CalebPas encore d'évaluation

- Chapter 3 Payroll Accounting SystemDocument17 pagesChapter 3 Payroll Accounting SystemNasiibuPas encore d'évaluation

- Form 990-EZ: Short Form Return of Organization Exempt From Income TaxDocument8 pagesForm 990-EZ: Short Form Return of Organization Exempt From Income TaxJakara MovementPas encore d'évaluation

- Accounting For Postemployment Benefits SummaryDocument3 pagesAccounting For Postemployment Benefits Summarylooter198Pas encore d'évaluation

- Analysis of Financial StatementDocument9 pagesAnalysis of Financial StatementSums Zubair MoushumPas encore d'évaluation

- The Barbara Streisand Foundation 2006 990Document31 pagesThe Barbara Streisand Foundation 2006 990TheSceneOfTheCrimePas encore d'évaluation

- Comport MacoDocument4 pagesComport MacoTHIAM Serigne MbayePas encore d'évaluation

- Financial Projection TemplateDocument88 pagesFinancial Projection TemplateChuks NwaGodPas encore d'évaluation

- Solutions To Exam Financial Statement Analysis June 23, 2011Document8 pagesSolutions To Exam Financial Statement Analysis June 23, 2011BuketPas encore d'évaluation

- 401 (K) Savings Calculator: 401 (K) Plan Assumptions Summary of ResultsDocument9 pages401 (K) Savings Calculator: 401 (K) Plan Assumptions Summary of Resultsmurali.5482Pas encore d'évaluation

- Financial Plan TemplateDocument23 pagesFinancial Plan TemplateKosong ZerozirizarazoroPas encore d'évaluation

- FA2 Spring 2011 Suggested SolutionDocument6 pagesFA2 Spring 2011 Suggested Solutionaqsa_22inPas encore d'évaluation

- BMS SSF 2009-10Document46 pagesBMS SSF 2009-10Nitin GoriPas encore d'évaluation

- Handbook of Capital Recovery (CR) Factors: European EditionD'EverandHandbook of Capital Recovery (CR) Factors: European EditionPas encore d'évaluation

- Data Interpretation Guide For All Competitive and Admission ExamsD'EverandData Interpretation Guide For All Competitive and Admission ExamsÉvaluation : 2.5 sur 5 étoiles2.5/5 (6)