Académique Documents

Professionnel Documents

Culture Documents

Analysis of Operating Leverage of Banks: Presented By: Rohit Luthra

Transféré par

Satyajeet Suman0 évaluation0% ont trouvé ce document utile (0 vote)

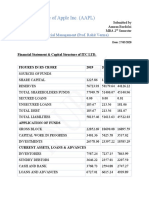

28 vues3 pagesThis document analyzes the operating leverage of several major banks in India. It presents data on the total revenue, variable operating costs, contribution, fixed operating costs, and degree of operating leverage (DOL) for ICICI Bank, Axis Bank, ING VYASYA Bank, and HDFC Bank. The analysis finds that ICICI Bank has the highest DOL of 9.76, indicating higher potential risk, while ING VYASYA Bank has the lowest DOL of 1.63, but also less impact on earnings before interest and taxes. The average industry DOL is 3.85.

Description originale:

leverage analysis

Titre original

leverage analysis of banks

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document analyzes the operating leverage of several major banks in India. It presents data on the total revenue, variable operating costs, contribution, fixed operating costs, and degree of operating leverage (DOL) for ICICI Bank, Axis Bank, ING VYASYA Bank, and HDFC Bank. The analysis finds that ICICI Bank has the highest DOL of 9.76, indicating higher potential risk, while ING VYASYA Bank has the lowest DOL of 1.63, but also less impact on earnings before interest and taxes. The average industry DOL is 3.85.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

28 vues3 pagesAnalysis of Operating Leverage of Banks: Presented By: Rohit Luthra

Transféré par

Satyajeet SumanThis document analyzes the operating leverage of several major banks in India. It presents data on the total revenue, variable operating costs, contribution, fixed operating costs, and degree of operating leverage (DOL) for ICICI Bank, Axis Bank, ING VYASYA Bank, and HDFC Bank. The analysis finds that ICICI Bank has the highest DOL of 9.76, indicating higher potential risk, while ING VYASYA Bank has the lowest DOL of 1.63, but also less impact on earnings before interest and taxes. The average industry DOL is 3.85.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

ANALYSIS OF OPERATING LEVERAGE OF BANKS

Presented by: Rohit Luthra

TOTAL REVENUE OF ICICI BANK

67035.96

DEGREE OF LEVERAGE OF DIFFERENT BANKS

28312.37 6773.35 VARIAB LE OPERATI NG COST VARIABL E OPERATI NG COST

TOTAL 27414.87 REVENU E OF AXIS BANK

TOTAL REVENU E OF ING VYASYA BANK

4526.5 7

TOTAL REVENUE OF HDFC

3261 9.76

- VARIABLE OPERATING COST

720.96

VARIABLE OPERATIN G COST

8520 .67

CONTRIBUTI ON

- FIXED OPERATING COST EBIT

38723.59

CONTRI BUTION

20641.52

CONTRIB 3805.6 UTION 1

- FIXED OPERATI NG COST EBIT 1471.6 1

CONTRIBU 2409 TION 9.09

- FIXED OPERATIN G COST EBIT 1300 5.62

34755.44

- FIXED 9538 OPERATI NG COST EBIT 11103.52

3968.15

2334

1109 3.47 2.17

DOL=

9.76

DOL

1.86

DOL

1.63

DOL

In the above table we can found out that the average of industry leverage is 3.85, while the DOL of ICICI Bank is 9.76, which is far more than industry leverage,so potential risk is more , while most safe bank is ING VYASYA, but its effect on EBIT IS also very less.

Vous aimerez peut-être aussi

- Outlet SelectionDocument23 pagesOutlet SelectionSatyajeet SumanPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Analysis of Operating Leverage of Banks: Presented By: Rohit LuthraDocument3 pagesAnalysis of Operating Leverage of Banks: Presented By: Rohit LuthraSatyajeet SumanPas encore d'évaluation

- HDFC Bank AnnualReport 2012 13Document180 pagesHDFC Bank AnnualReport 2012 13Rohan BahriPas encore d'évaluation

- DR Umesh SolankiDocument29 pagesDR Umesh Solankivivek guptaPas encore d'évaluation

- Annual Report 2013 Axis BankDocument211 pagesAnnual Report 2013 Axis BankRahul PagariaPas encore d'évaluation

- Axis 2013Document212 pagesAxis 2013Abhishek AroraPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- wealthAR 2016 2017Document160 pageswealthAR 2016 2017sharkl123Pas encore d'évaluation

- ICICI Financial AnalysisDocument13 pagesICICI Financial AnalysisAkhil MahajanPas encore d'évaluation

- PVR Inox - Accounts 1Document13 pagesPVR Inox - Accounts 1Prithwish RoyPas encore d'évaluation

- HDFC Bank Ratio AnalysisDocument14 pagesHDFC Bank Ratio Analysissunnykumar.m2325Pas encore d'évaluation

- Jai Sri Gurudev - : Department of Mba Accounting For Managers (20mba13)Document4 pagesJai Sri Gurudev - : Department of Mba Accounting For Managers (20mba13)Meghana SushmaPas encore d'évaluation

- Sbi Annual Report 2012 13Document190 pagesSbi Annual Report 2012 13udit_mca_blyPas encore d'évaluation

- UntitledDocument376 pagesUntitledpoobalanipbPas encore d'évaluation

- Financial Statement Analysis of HDFC BankDocument58 pagesFinancial Statement Analysis of HDFC BankArup SarkarPas encore d'évaluation

- Financial ManagementDocument13 pagesFinancial Managementruchi sharmaPas encore d'évaluation

- JETIR2002031Document5 pagesJETIR2002031adilsk1019Pas encore d'évaluation

- Tata MotorsDocument10 pagesTata MotorsGourav BainsPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Daily Equity Report 6 February 2015Document4 pagesDaily Equity Report 6 February 2015NehaSharmaPas encore d'évaluation

- Analysis of Earnings and Dividend LevelDocument6 pagesAnalysis of Earnings and Dividend Leveldeveshr25Pas encore d'évaluation

- ARL Annual 2017Document97 pagesARL Annual 2017rehan naeemPas encore d'évaluation

- Ambika Cotton Mills LimitedDocument69 pagesAmbika Cotton Mills LimitedTotmolPas encore d'évaluation

- Infy Bs 3Document6 pagesInfy Bs 3Rohith kumarPas encore d'évaluation

- KILAnnualReport2020 2021Document224 pagesKILAnnualReport2020 2021rkumar_81Pas encore d'évaluation

- A Study Using Dummy Variables On Public Sector BankDocument5 pagesA Study Using Dummy Variables On Public Sector BankrajneeshkarloopiaPas encore d'évaluation

- Asthmapreventionapendix QnsDocument120 pagesAsthmapreventionapendix Qnsnav33nPas encore d'évaluation

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiPas encore d'évaluation

- Analysis Report PsoDocument3 pagesAnalysis Report PsoMuhammad Waqas HafeezPas encore d'évaluation

- Annual Report 2016-2017Document104 pagesAnnual Report 2016-2017UDayPas encore d'évaluation

- Punjab National Bank Project ReportDocument40 pagesPunjab National Bank Project ReportVarun100% (40)

- DPIH - 4Q Results FYE2022 - 20220531Document24 pagesDPIH - 4Q Results FYE2022 - 20220531家星Pas encore d'évaluation

- Ma Term Paper 20192mba0328Document8 pagesMa Term Paper 20192mba0328Dileepkumar K DiliPas encore d'évaluation

- LCPL Annual Report 2016Document57 pagesLCPL Annual Report 2016nasiralisauPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Annual Report 2010Document281 pagesAnnual Report 2010gogiadhirajPas encore d'évaluation

- ITC Financial AnalysisDocument21 pagesITC Financial AnalysisDeepak ChandekarPas encore d'évaluation

- Annual Report Summit Bank Pakistan 2015Document239 pagesAnnual Report Summit Bank Pakistan 2015HammadPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- ACCM CA1pdfDocument15 pagesACCM CA1pdfTabrej AnsariPas encore d'évaluation

- Assignment of Fundamentals of Financial ManagementDocument10 pagesAssignment of Fundamentals of Financial ManagementShashwat ShuklaPas encore d'évaluation

- Irctc: An Assignment ReportDocument12 pagesIrctc: An Assignment ReportAshwani RaiPas encore d'évaluation

- Financial Statement Analysis ofDocument14 pagesFinancial Statement Analysis ofvizakanPas encore d'évaluation

- Bv-Cia 1.2 526 - 646 - 674Document20 pagesBv-Cia 1.2 526 - 646 - 674Pevin KumarPas encore d'évaluation

- Etisalat Group Financial Statements FY2018 EnglishDocument73 pagesEtisalat Group Financial Statements FY2018 Englishahsin aleemPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- NDDB AR 2016-17 Eng 0 Part40Document2 pagesNDDB AR 2016-17 Eng 0 Part40siva kumarPas encore d'évaluation

- HUL Post Mid TermDocument13 pagesHUL Post Mid TermSweta SinghPas encore d'évaluation

- Capital Structure Analysis of ITC LTDDocument4 pagesCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- AccntDocument29 pagesAccntMegha SinghPas encore d'évaluation

- Annual Report 2007Document168 pagesAnnual Report 2007anithaasriiPas encore d'évaluation

- KIRTIMAAN SINGH 21214416 - CIA 3 (Market-Based Project) Due Date - 02.11.2022Document14 pagesKIRTIMAAN SINGH 21214416 - CIA 3 (Market-Based Project) Due Date - 02.11.2022Rohit GoyalPas encore d'évaluation

- HDFC Annual Report 2015 16Document220 pagesHDFC Annual Report 2015 16Billy Sam VarghesePas encore d'évaluation

- Presentation On Financial ManagementDocument2 pagesPresentation On Financial Managementruchi sharmaPas encore d'évaluation

- Accm507 Ca2 Nishtha ChhabraDocument12 pagesAccm507 Ca2 Nishtha ChhabraNishtha ChhabraPas encore d'évaluation

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document7 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachD'EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachÉvaluation : 3 sur 5 étoiles3/5 (3)

- Fast-Track Tax Reform: Lessons from the MaldivesD'EverandFast-Track Tax Reform: Lessons from the MaldivesPas encore d'évaluation

- Working Capital Financing by PVT BankDocument105 pagesWorking Capital Financing by PVT BankSatyajeet SumanPas encore d'évaluation

- Models CBDocument57 pagesModels CBSatyajeet SumanPas encore d'évaluation

- Legal Environment of AdvertisingDocument38 pagesLegal Environment of AdvertisingSatyajeet SumanPas encore d'évaluation

- Consumer MotivationDocument51 pagesConsumer MotivationSatyajeet SumanPas encore d'évaluation

- On Memorandum of AssociationDocument17 pagesOn Memorandum of AssociationSatyajeet Suman100% (1)

- Case On at and T - Spss AnalysisDocument16 pagesCase On at and T - Spss AnalysisSatyajeet SumanPas encore d'évaluation

- Vardhman Textiles PDFDocument39 pagesVardhman Textiles PDFSatyajeet SumanPas encore d'évaluation

- Definition of DemandandDocument3 pagesDefinition of DemandandSatyajeet SumanPas encore d'évaluation

- Presentation 10Document10 pagesPresentation 10Satyajeet SumanPas encore d'évaluation

- Information Processing: Submitted By:-Agrim Verma Mba - A Submitted To: - Ms. Prabhjot KaurDocument51 pagesInformation Processing: Submitted By:-Agrim Verma Mba - A Submitted To: - Ms. Prabhjot KaurSatyajeet SumanPas encore d'évaluation

- Consumer BehaviourDocument27 pagesConsumer BehaviourSatyajeet SumanPas encore d'évaluation

- An Environmental Scanning Report On Cement IndustryDocument20 pagesAn Environmental Scanning Report On Cement IndustrySatyajeet SumanPas encore d'évaluation

- An Environmental Scanning Report On Cement IndustryDocument20 pagesAn Environmental Scanning Report On Cement IndustrySatyajeet SumanPas encore d'évaluation

- Authority & Responsibility in An OrganizationDocument22 pagesAuthority & Responsibility in An OrganizationSatyajeet SumanPas encore d'évaluation

- Presentation 10Document10 pagesPresentation 10Satyajeet SumanPas encore d'évaluation

- An Environmental Scanning Report On Cement IndustryDocument20 pagesAn Environmental Scanning Report On Cement IndustrySatyajeet SumanPas encore d'évaluation

- Performance AppraisalDocument50 pagesPerformance AppraisalSatyajeet SumanPas encore d'évaluation

- An Environmental Scanning Report On Cement IndustryDocument20 pagesAn Environmental Scanning Report On Cement IndustrySatyajeet SumanPas encore d'évaluation

- Report On CSRDocument27 pagesReport On CSRSatyajeet SumanPas encore d'évaluation

- (Vi) Meetings of A CompanyDocument28 pages(Vi) Meetings of A CompanySatyajeet SumanPas encore d'évaluation

- Purva KansalDocument2 pagesPurva KansalSatyajeet SumanPas encore d'évaluation

- chDDA SIRDocument21 pageschDDA SIRSatyajeet SumanPas encore d'évaluation

- (Vi) Meetings of A CompanyDocument28 pages(Vi) Meetings of A CompanySatyajeet SumanPas encore d'évaluation

- FinalDocument12 pagesFinalSatyajeet SumanPas encore d'évaluation

- Performance AppraisalDocument50 pagesPerformance AppraisalSatyajeet SumanPas encore d'évaluation