Académique Documents

Professionnel Documents

Culture Documents

Smart Tracking Error Jan 13

Transféré par

api-226289126Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Smart Tracking Error Jan 13

Transféré par

api-226289126Droits d'auteur :

Formats disponibles

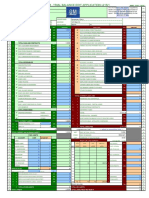

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

EXPENSE PERFORMANCE ANALYSIS REPORT

To discuss any of this report,

please contact your representative:

Michael Stillman

International Research & Asset Management, Inc.

mstillman@intlresearch.com

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

PERFORMANCE COMPARISON - Current Vs. Category Index

Investment Allocation

Current Portfolio

Fund

Type

% of

Assets

MV

0.05%

$643

AllianceBern Discovery Value K

LV

1.13%

$14,480

American Century Equity Income R

Value

Fund Name

3 Yr Total

% Return

Category Index

3 Yr Total $

Return

5 Yr Total

% Return

5 Yr Total $

Return

14.79%

$973

7.28%

$914

Russell Mid Cap Value TR USD

17.21%

11.57%

$20,110

4.49%

$18,036

Russell 1000 Value TR USD

14.30%

Index Name

3 Yr Total

% Return

3 Yr Total $

Return

+ / - Current

Fund 3 Yr

5 Yr Total

% Return

5 Yr Total $

Return

+ / - Current

Fund 5 Yr

$1,035

$63

6.27%

$871

($42)

$21,623

$1,513

2.70%

$16,543

($1,493)

GI

7.18%

$91,983

American Century Government Bond A

4.00%

$103,468

4.52%

$114,737

Barclays US Government TR USD

4.71%

$105,602

$2,134

4.57%

$115,012

$275

TG

0.05%

$613

American Century LIVESTRONG 2025 R

9.88%

$813

3.95%

$744

Morningstar Lifetime Moderate 2025

11.82%

$857

$44

4.70%

$771

$27

TI

0.02%

$200

American Century LIVESTRONG 2035 R

10.91%

$273

3.62%

$239

Morningstar Lifetime Moderate 2035

12.49%

$285

$12

4.32%

$247

$8

TK

0.74%

$9,533

American Century LIVESTRONG 2045 R

11.69%

$13,282

3.51%

$11,328

Morningstar Lifetime Moderate 2045

12.49%

$13,570

$287

4.25%

$11,738

$411

LG

0.70%

$9,029

American Century Ultra R

13.11%

$13,066

3.83%

$10,896

Russell 1000 Growth TR USD

14.61%

$13,593

$527

5.70%

$11,913

$1,017

LG

3.96%

$50,682

American Funds AMCAP R3

12.79%

$72,722

4.75%

$63,918

Russell 1000 Growth TR USD

14.61%

$76,299

$3,577

5.70%

$66,870

$2,951

MA

0.03%

$437

American Funds American Balanced R3

11.59%

$607

4.76%

$551

Morningstar Moderately Aggr Target

Risk

11.37%

$604

($4)

4.51%

$545

($7)

HY

5.04%

$64,524

American Funds American Hi Inc Tr R3

10.09%

$86,092

7.97%

$94,675

BofAML US High Yield Master II TR

USD

11.55%

$89,563

$3,471

10.62%

$106,878

$12,203

CI

0.22%

$2,787

American Funds Bond Fund of Amer R3

5.40%

$3,263

3.42%

$3,297

Barclays US Government/Credit 5-10

Yr TR USD

8.05%

$3,516

$252

7.06%

$3,920

$623

IB

2.97%

$37,984

American Funds Capital World Bond R3

4.94%

$43,896

4.37%

$47,041

Citigroup WGBI NonUSD USD

3.55%

$42,175

($1,721)

4.11%

$46,458

($583)

FB

2.75%

$35,257

American Funds EuroPacific Gr R3

7.04%

$43,240

0.61%

$36,346

MSCI ACWI Ex USA NR USD

7.03%

$43,228

($12)

-0.10%

$35,081

($1,264)

LG

0.12%

$1,578

American Funds Growth Fund of Amer

R3

11.74%

$2,202

2.90%

$1,820

Russell 1000 Growth TR USD

14.61%

$2,376

$174

5.70%

$2,082

$262

LB

0.00%

$0

American Funds Invmt Co of Amer R3

10.55%

$0

2.40%

$0

Russell 1000 TR USD

14.48%

$0

$0

4.28%

$0

$0

WS

3.79%

$48,596

American Funds SMALLCAP World R3

11.80%

$67,909

2.85%

$55,927

MSCI World NR USD

10.26%

$65,141

($2,768)

1.41%

$52,120

($3,807)

American Funds Washington Mutual R3

13.24%

$46

3.14%

$37

Russell 1000 Value TR USD

14.30%

$48

$1

2.70%

$37

($1)

Russell 2000 TR USD

15.98%

$21,957

6.31%

$19,111

12.48%

$38,051

($4,010)

6.88%

$37,293

($2,105)

LV

0.00%

$32

SB

1.10%

$14,074

Dreyfus Small Cap A

ST

2.09%

$26,739

Dreyfus Technology Growth A

16.30%

$42,061

8.06%

$39,398

Morningstar Technology Sector Index

TR USD

FB

2.21%

$28,357

Fidelity Advisor Diversified Intl T

7.46%

$35,189

-1.75%

$25,961

MSCI ACWI Ex USA NR USD

7.03%

$34,768

($421)

-0.10%

$28,215

$2,254

TE

1.75%

$22,436

Fidelity Advisor Freedom 2020 T

9.13%

$29,159

2.66%

$25,583

Morningstar Lifetime Moderate 2020

11.20%

$30,850

$1,691

5.01%

$28,648

$3,065

TI

0.83%

$10,615

Fidelity Advisor Freedom 2035 T

10.29%

$14,241

1.93%

$11,680

Morningstar Lifetime Moderate 2035

12.49%

$15,110

$869

4.32%

$13,115

$1,435

TJ

15.17%

$194,353

Fidelity Advisor Freedom 2040 T

10.36%

$261,232

1.74%

$211,861

Morningstar Lifetime Moderate 2040

12.53%

$276,947

$15,715

4.28%

$239,660

$27,800

SR

10.61%

$135,946

Fidelity Advisor Real Estate T

21.32%

$242,753

6.53%

$186,520

Dow Jones US Select REIT TR USD

21.62%

$244,558

$1,805

5.89%

$180,984

($5,536)

MU

4.48%

$57,385

Fidelity Advisor Strategic Income T

7.83%

$71,948

8.08%

$84,630

Barclays US Universal TR USD

5.98%

$68,308

($3,640)

5.78%

$76,000

($8,630)

MB

0.28%

$3,604

Fidelity Advisor Value Strategies T

15.72%

$5,585

4.84%

$4,565

S&P MidCap 400 TR

17.57%

$5,857

$272

7.99%

$5,293

$728

SP

9.44%

$120,905

Franklin Gold and Precious Metals A

0.37%

$122,252

-0.49%

$117,972

MSCI World/Metals&Mining PR USD

-1.63%

$115,089

($7,163)

-6.86%

$84,747

($33,224)

LG

1.55%

$19,913

Franklin Growth Opportunities R

12.76%

$28,550

5.56%

$26,100

Russell 1000 Growth TR USD

14.61%

$29,978

$1,428

5.70%

$26,273

$174

CA

1.91%

$24,521

Franklin Income R

10.75%

$33,310

5.12%

$31,475

Morningstar Moderately Cons Target

Risk

8.24%

$31,096

($2,214)

4.97%

$31,251

($224)

ES

2.30%

$29,422

Invesco European Growth R

11.27%

$40,533

1.68%

$31,978

MSCI Europe NR USD

7.38%

$36,429

($4,104)

-1.09%

$27,853

($4,125)

FG

0.17%

$2,146

Invesco International Growth R

8.83%

$2,766

1.59%

$2,322

MSCI EAFE Growth NR USD

8.00%

$2,703

($63)

-0.30%

$2,114

($208)

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 2

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

PERFORMANCE COMPARISON - Current Vs. Category Index

SB

1.52%

$19,491

Invesco Small Cap Equity R

16.70%

$30,978

6.60%

$26,830

Russell 2000 TR USD

15.98%

$30,408

($570)

6.31%

$26,467

($363)

LV

1.74%

$22,247

Invesco Value Opp R

11.52%

$30,855

1.60%

$24,085

Russell 1000 Value TR USD

14.30%

$33,221

$2,366

2.70%

$25,417

$1,332

SG

1.55%

$19,867

Lord Abbett Developing Growth A

18.18%

$32,792

7.12%

$28,021

Russell 2000 Growth TR USD

17.02%

$31,836

($956)

6.85%

$27,670

($351)

LB

1.40%

$17,973

Nuveen Equity Index R3

13.18%

$26,057

3.21%

$21,049

Russell 1000 TR USD

14.48%

$26,966

$908

4.28%

$22,163

$1,114

MB

0.53%

$6,773

Nuveen Mid Cap Index R3

16.64%

$10,748

7.23%

$9,602

S&P MidCap 400 TR

17.57%

$11,007

$259

7.99%

$9,947

$345

MV

2.90%

$37,112

Nuveen Mid Cap Value R3

10.95%

$50,687

2.21%

$41,398

Russell Mid Cap Value TR USD

17.21%

$59,760

$9,073

6.27%

$50,300

$8,902

SB

1.70%

$21,755

Nuveen Small Cap Value R3

16.51%

$34,407

5.91%

$28,990

Russell 2000 TR USD

15.98%

$33,940

($467)

6.31%

$29,541

$552

LB

0.14%

$1,793

Pioneer R

9.34%

$2,344

1.52%

$1,933

Russell 1000 TR USD

14.48%

$2,690

$346

4.28%

$2,211

$278

MG

0.14%

$1,763

Prudential Jennison Mid Cap Growth R

15.80%

$2,738

7.49%

$2,530

Russell Mid Cap Growth TR USD

16.76%

$2,806

$69

6.22%

$2,384

($146)

EM

5.65%

$72,368

Templeton Developing Markets R

7.41%

$89,677

1.87%

$79,392

MSCI EM NR USD

7.17%

$89,077

($600)

2.04%

$80,057

$665

SV

0.08%

$1,039

Victory Small Company Opportunity R

14.34%

$1,553

8.06%

$1,531

Russell 2000 Value TR USD

14.88%

$1,575

$22

5.63%

$1,366

($165)

10.21%

$1,714,375

3.61%

$1,525,911

10.70%

$1,754,498

$18,166

3.57%

$1,549,169

$4,147

TOTALS

100.00%

Weighted Return

$1,280,955

Weighted Return

Current

Category

Cat Advtg

Weighted Return

Projected Growth After 3 Years

$1,714,375

$1,754,498

$18,166

10.21% vs 10.70%

Projected Growth After 5 Years

$1,525,911

$1,549,169

$4,147

3.61% vs 3.57%

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 3

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

PERFORMANCE COMPARISON - Current Vs. Proposed Funds

Investment Allocation

Current Portfolio

Fund

Type

% of

Assets

MV

0.05%

$643

AllianceBern Discovery Value K

LV

1.13%

$14,480

American Century Equity Income R

Value

Fund Name

3 Yr Total

% Return

Proposed Portfolio

3 Yr Total $

Return

5 Yr Total

% Return

5 Yr Total $

Return

14.79%

$973

7.28%

$914

XXXXXXXXXX

17.87%

11.57%

$20,110

4.49%

$18,036

XXXXXXXXXX

16.25%

Fund Name

3 Yr Total

% Return

3 Yr Total $

Return

+ / - Current

Fund 3 Yr

5 Yr Total

% Return

5 Yr Total $

Return

+ / - Current

Fund 5 Yr

$1,053

$80

7.43%

$920

$6

$22,748

$2,638

5.28%

$18,728

$692

GI

7.18%

$91,983

American Century Government Bond A

4.00%

$103,468

4.52%

$114,737

XXXXXXXXXX

5.08%

$106,725

$3,257

5.58%

$120,675

$5,937

TG

0.05%

$613

American Century LIVESTRONG 2025 R

9.88%

$813

3.95%

$744

XXXXXXXXXX

10.46%

$826

$13

4.47%

$763

$19

TI

0.02%

$200

American Century LIVESTRONG 2035 R

10.91%

$273

3.62%

$239

XXXXXXXXXX

11.47%

$277

$4

4.14%

$245

$6

TK

0.74%

$9,533

American Century LIVESTRONG 2045 R

11.69%

$13,282

3.51%

$11,328

XXXXXXXXXX

12.28%

$13,494

$212

4.04%

$11,621

$293

LG

0.70%

$9,029

American Century Ultra R

13.11%

$13,066

3.83%

$10,896

XXXXXXXXXX

18.45%

$15,005

$1,939

8.97%

$13,873

$2,977

LG

3.96%

$50,682

American Funds AMCAP R3

12.79%

$72,722

4.75%

$63,918

XXXXXXXXXX

18.45%

$84,228

$11,507

8.97%

$77,873

$13,955

MA

0.03%

$437

American Funds American Balanced R3

11.59%

$607

4.76%

$551

XXXXXXXXXX

11.25%

$602

($6)

5.52%

$572

$20

HY

5.04%

$64,524

American Funds American Hi Inc Tr R3

10.09%

$86,092

7.97%

$94,675

XXXXXXXXXX

13.08%

$93,299

$7,207

10.65%

$107,023

$12,348

CI

0.22%

$2,787

American Funds Bond Fund of Amer R3

5.40%

$3,263

3.42%

$3,297

XXXXXXXXXX

6.93%

$3,407

$144

7.47%

$3,996

$698

IB

2.97%

$37,984

American Funds Capital World Bond R3

4.94%

$43,896

4.37%

$47,041

XXXXXXXXXX

8.74%

$48,839

$4,943

9.60%

$60,069

$13,028

FB

2.75%

$35,257

American Funds EuroPacific Gr R3

7.04%

$43,240

0.61%

$36,346

XXXXXXXXXX

11.84%

$49,322

$6,082

5.15%

$45,320

$8,975

LG

0.12%

$1,578

American Funds Growth Fund of Amer

R3

11.74%

$2,202

2.90%

$1,820

XXXXXXXXXX

18.45%

$2,622

$421

8.97%

$2,425

$604

LB

0.00%

$0

American Funds Invmt Co of Amer R3

10.55%

$0

2.40%

$0

XXXXXXXXXX

22.51%

$0

$0

10.69%

$0

$0

WS

3.79%

$48,596

American Funds SMALLCAP World R3

11.80%

$67,909

2.85%

$55,927

XXXXXXXXXX

10.87%

$66,228

($1,681)

4.54%

$60,675

$4,748

American Funds Washington Mutual R3

13.24%

$46

3.14%

$37

XXXXXXXXXX

16.25%

$50

$4

5.28%

$41

$4

XXXXXXXXXX

22.45%

$25,840

13.26%

$26,230

LV

0.00%

$32

SB

1.10%

$14,074

Dreyfus Small Cap A

ST

2.09%

$26,739

Dreyfus Technology Growth A

16.30%

$42,061

8.06%

$39,398

XXXXXXXXXX

16.18%

$41,931

($130)

11.45%

$45,978

$6,580

FB

2.21%

$28,357

Fidelity Advisor Diversified Intl T

7.46%

$35,189

-1.75%

$25,961

XXXXXXXXXX

11.84%

$39,669

$4,481

5.15%

$36,451

$10,490

TE

1.75%

$22,436

Fidelity Advisor Freedom 2020 T

9.13%

$29,159

2.66%

$25,583

XXXXXXXXXX

10.32%

$30,124

$964

4.26%

$27,640

$2,057

TI

0.83%

$10,615

Fidelity Advisor Freedom 2035 T

10.29%

$14,241

1.93%

$11,680

XXXXXXXXXX

11.72%

$14,802

$561

3.69%

$12,723

$1,044

TJ

15.17%

$194,353

Fidelity Advisor Freedom 2040 T

10.36%

$261,232

1.74%

$211,861

XXXXXXXXXX

11.85%

$271,956

$10,724

3.81%

$234,308

$22,448

SR

10.61%

$135,946

Fidelity Advisor Real Estate T

21.32%

$242,753

6.53%

$186,520

XXXXXXXXXX

33.76%

$325,346

$82,593

12.60%

$246,070

$59,550

MU

4.48%

$57,385

Fidelity Advisor Strategic Income T

7.83%

$71,948

8.08%

$84,630

XXXXXXXXXX

10.48%

$77,384

$5,436

9.01%

$88,334

$3,704

MB

0.28%

$3,604

Fidelity Advisor Value Strategies T

15.72%

$5,585

4.84%

$4,565

XXXXXXXXXX

17.53%

$5,851

$266

7.74%

$5,232

$667

SP

9.44%

$120,905

Franklin Gold and Precious Metals A

0.37%

$122,252

-0.49%

$117,972

XXXXXXXXXX

5.22%

$140,844

$18,592

2.94%

$139,754

$21,782

LG

1.55%

$19,913

Franklin Growth Opportunities R

12.76%

$28,550

5.56%

$26,100

XXXXXXXXXX

18.45%

$33,093

$4,544

8.97%

$30,596

$4,497

CA

1.91%

$24,521

Franklin Income R

10.75%

$33,310

5.12%

$31,475

XXXXXXXXXX

10.81%

$33,364

$54

7.48%

$35,170

$3,695

ES

2.30%

$29,422

Invesco European Growth R

11.27%

$40,533

1.68%

$31,978

XXXXXXXXXX

11.84%

$41,159

$626

2.15%

$32,724

$746

FG

0.17%

$2,146

Invesco International Growth R

8.83%

$2,766

1.59%

$2,322

XXXXXXXXXX

12.89%

$3,087

$321

1.42%

$2,303

($19)

SB

1.52%

$19,491

Invesco Small Cap Equity R

16.70%

$30,978

6.60%

$26,830

XXXXXXXXXX

22.45%

$35,786

$4,808

13.26%

$36,326

$9,496

LV

1.74%

$22,247

Invesco Value Opp R

11.52%

$30,855

1.60%

$24,085

XXXXXXXXXX

16.25%

$34,950

$4,095

5.28%

$28,774

$4,689

SG

1.55%

$19,867

Lord Abbett Developing Growth A

18.18%

$32,792

7.12%

$28,021

XXXXXXXXXX

19.41%

$33,826

$1,035

9.12%

$30,736

$2,715

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 4

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

PERFORMANCE COMPARISON - Current Vs. Proposed Funds

LB

1.40%

$17,973

Nuveen Equity Index R3

13.18%

$26,057

3.21%

$21,049

XXXXXXXXXX

22.51%

$33,047

$6,990

10.69%

$29,865

MB

0.53%

$6,773

Nuveen Mid Cap Index R3

16.64%

$10,748

7.23%

$9,602

XXXXXXXXXX

17.53%

$10,996

$248

7.74%

$9,833

$231

MV

2.90%

$37,112

Nuveen Mid Cap Value R3

10.95%

$50,687

2.21%

$41,398

XXXXXXXXXX

17.87%

$60,775

$10,088

7.43%

$53,106

$11,708

SB

1.70%

$21,755

Nuveen Small Cap Value R3

16.51%

$34,407

5.91%

$28,990

XXXXXXXXXX

22.45%

$39,943

$5,535

13.26%

$40,545

$11,556

LB

0.14%

$1,793

Pioneer R

9.34%

$2,344

1.52%

$1,933

XXXXXXXXXX

22.51%

$3,297

$953

10.69%

$2,979

$1,046

MG

0.14%

$1,763

Prudential Jennison Mid Cap Growth R

15.80%

$2,738

7.49%

$2,530

XXXXXXXXXX

16.38%

$2,779

$41

7.91%

$2,580

$50

EM

5.65%

$72,368

Templeton Developing Markets R

7.41%

$89,677

1.87%

$79,392

XXXXXXXXXX

11.85%

$101,264

$11,587

SV

0.08%

$1,039

Victory Small Company Opportunity R

14.34%

$1,553

8.06%

$1,531

XXXXXXXXXX

13.79%

$1,531

($22)

9.76%

$1,655

$124

14.49%

$1,951,372

$211,156

6.74%

$1,724,733

$251,983

TOTALS

100.00%

Weighted Return

$1,280,955

$8,816

Weighted Return

10.21%

$1,714,375

3.61%

$1,525,911

Current

Proposed

Prop Advtg

Weighted Return

Projected Growth After 3 Years

$1,714,375

$1,951,372

$211,156

10.21% vs 14.49%

Projected Growth After 5 Years

$1,525,911

$1,724,733

$251,983

3.61% vs 6.74%

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 5

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

BENCHMARKING SERVICES RENDERED - Plans by Asset Size

Your Plan of $1,280,955 in assets is Benchmarked against 406 Plans within an Asset range of $1 to $2.5 million

Revenue

Captured

Advisor Services

Deducted

from

Assets

% Cost

$ Cost

% Cost

Conver

Total

Cost Identifier

Top 95(%)

Bottom 5(%)

Mean(%)

Median(%)

ERISA 3(21) Functional Fiduciary

Yes

No

0.00%

$0

0.00%

0.00%

Fiduciary Fee

0.89%

0.24%

0.55%

0.50%

Registered Rep - Suitability Std

Yes

Yes

0.55%

$0

0.00%

0.55%

Commissions

0.75%

0.23%

0.38%

0.40%

Investment Manager Search

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

Investment Menu Design

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.07%

0.02%

0.04%

0.02%

Investment Policy Statement

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.07%

0.02%

0.03%

0.02%

Investment Monitoring & Reporting

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.10%

0.03%

0.06%

0.05%

Fiduciary Education - Committee

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.07%

0.02%

0.04%

0.02%

Expense Analysis

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.07%

0.02%

0.03%

0.02%

Expense Benchmarking

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.08%

0.02%

0.04%

0.03%

Investment Benchmarking

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.05%

0.02%

0.04%

0.04%

Participant Level Advice

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.04%

0.04%

0.04%

0.04%

Attend Plan Committee Meeting

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.10%

0.04%

0.08%

0.10%

Vendor Search/RFP or RFI

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

Evaluate/Design Communication Materials

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.06%

0.04%

0.04%

0.04%

Fiduciary Governance System

Yes

No

0.00%

$0

0.00%

0.00%

Included in Fiduciary

Fee

0.04%

0.04%

0.04%

0.04%

0.98%

0.23%

0.53%

0.50%

CATEGORY BENCHMARK

0.55%

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 6

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

SERVICE CATEGORY BENCHMARKING SUMMARY - Comparison

Your Plan of 91 participants is Benchmarked against 372 Plans within a participant count range of 51 to 100

Current Plan

SERVICE CATEGORIES

Top 95th Percentile

Bottom 5th Percentile

Mean

Median

Total %

$ Per Head

$ Per Head

$ Per Head

$ Per Head

$ Per Head

0.55%

$77.42

0.79%

$111.41

0.11%

$15.77

0.30%

$42.41

0.40%

$56.31

0.40%

$56.31

0.55%

$77.42

0.79%

$111.41

0.11%

$15.77

0.30%

$42.41

0.40%

$56.31

0.40%

$56.31

Advisor Services

Current

Proposed

WEIGHTED AVERAGE EXPENSE

CURRENT

PROPOSED

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 7

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

SERVICE CATEGORY BENCHMARKING SUMMARY - Comparison

Your Plan of $1,280,955 in assets is Benchmarked against 406 Plans within an asset range of $1 to $2.5 million

Current Plan

SERVICE CATEGORIES

Top 95th Percentile

Bottom 5th Percentile

Mean

Median

Total %

Total $

Total $

Total $

Total $

Total $

0.55%

$7,045

0.98%

$12,601

0.23%

$2,946

0.53%

$6,807

0.50%

$6,405

0.40%

$5,124

0.55%

$7,045

0.98%

$12,601

0.23%

$2,946

0.53%

$6,807

0.50%

$6,405

0.40%

$5,124

Advisor Services

Current

Proposed

WEIGHTED AVERAGE EXPENSE

CURRENT

PROPOSED

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 8

Expense Performance Analysis Report

Prepared for: Smart Company

Plan Name: Smart Company 401(k) Plan

For Month Ending: January 31, 2013

DISCLOSURES

Past performance does not guarantee future results. The value of an investment will vary so that an

investor's shares, when redeemed, may be worth less than their original value.

Hyphens appear in data columns to indicate that data is not available.

Separate Account data is a delayed import and will be available approximately 45 days after month end.

Therefore, some of the Separate Account data may be empty or outdated until it is available.

Peer groups are comprised of all of the funds that match an investment's category as classified by

Morningstar. Morningstar Category identifies funds based on their actual investment styles as measured by

their underlying portfolio holdings over a three-year period.

Although the information contained within this report has been obtained from sources believed to be

reliable, no third-party associated with the development of this software or the importation of data

guarantees the information contained herein is accurate, adequate, or complete. In addition, there are no

warranties, conditions, guaranties or representations, whether express or implied, in law or in fact, oral or in

writing as to the information contained herein by any third-party. Each third-party their employees,

affiliates, contractors, agents, or any other information provider expressly disclaim any condition of quality

and any implied warranty of title, non-infringement, merchantability or fitness for a particular purpose and

under no circumstances will they be liable for any indirect, incidental, special or consequential damages or

for any errors in the information contained in this report or for any actions taken in reliance thereon,

including lost profits, regardless of whether such damages could have been foreseen or prevented.

Information contained herein is subject to change without notice.

2012 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to

Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to

be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any

damages or losses arising from any use of this information. Past performance is no guarantee of future

results.

*** This investment does not have the performance history for the time frame selected. Therefore, the rate

of return calculation and the accumulative value ignores this investment and its comparative.

Category Benchmarking Total compares the Current and Proposed total to all plans within the plan

participant or asset range to which it is compared regardless of which services lines are included. However,

each service line within the Category only reflects the information applicable to that service line. As a

result, if you add up the service lines reflected it will not equal the Category Benchmarking Total.

Prepared By: Michael Stillman, International Research & Asset Management, Inc.

PT ID: 17886

Powered by PlanTools

TM

| 2002-2013

Page 9

Vous aimerez peut-être aussi

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceD'EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissancePas encore d'évaluation

- Portfolio Report PDFDocument7 pagesPortfolio Report PDFAnonymous kjeBVVlobPas encore d'évaluation

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementD'EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementPas encore d'évaluation

- Bukit Sembawang EstatesDocument7 pagesBukit Sembawang EstatesNicholas AngPas encore d'évaluation

- Fin439 Final Luv Aal UpdatedDocument91 pagesFin439 Final Luv Aal Updatedapi-323273427Pas encore d'évaluation

- Simfund MF OverviewDocument26 pagesSimfund MF OverviewRama ChandranPas encore d'évaluation

- Singapore Company Focus: HOLD S$3.70Document9 pagesSingapore Company Focus: HOLD S$3.70LuiYuKwangPas encore d'évaluation

- 2013-5-22 First Resources CIMBDocument27 pages2013-5-22 First Resources CIMBphuawlPas encore d'évaluation

- BGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEDocument5 pagesBGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEmittlePas encore d'évaluation

- A Fuller OFC: K-REIT AsiaDocument5 pagesA Fuller OFC: K-REIT Asiacentaurus553587Pas encore d'évaluation

- Putnam Alternating Market LeadershipDocument2 pagesPutnam Alternating Market LeadershipPutnam InvestmentsPas encore d'évaluation

- Update 28 August 2023Document18 pagesUpdate 28 August 2023ivanPas encore d'évaluation

- Action Notes: Trican Well Service LTDDocument4 pagesAction Notes: Trican Well Service LTDkanith0Pas encore d'évaluation

- Larsen & Toubro 4QF16 Result Review 26-05-16 PDFDocument8 pagesLarsen & Toubro 4QF16 Result Review 26-05-16 PDFrajpersonalPas encore d'évaluation

- 2015Q1 Google Earnings SlidesDocument15 pages2015Q1 Google Earnings SlidesToni HercegPas encore d'évaluation

- Wyndham - V2 AlejandraDocument22 pagesWyndham - V2 AlejandraDheeraj ChinthalapellyPas encore d'évaluation

- BRS Market Report: Week II: 11Document7 pagesBRS Market Report: Week II: 11Sudheera IndrajithPas encore d'évaluation

- Bmo 8.1.13 PDFDocument7 pagesBmo 8.1.13 PDFChad Thayer VPas encore d'évaluation

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngPas encore d'évaluation

- Weekly S-Reit TrackerDocument4 pagesWeekly S-Reit TrackerChan Weng HongPas encore d'évaluation

- Daily Trade Journal - 05.03.2014Document6 pagesDaily Trade Journal - 05.03.2014Randora LkPas encore d'évaluation

- Nike Inc Nyse Nke FinancialsDocument10 pagesNike Inc Nyse Nke FinancialsvipinPas encore d'évaluation

- FY14 HPQ Salient Points 20141125Document2 pagesFY14 HPQ Salient Points 20141125Amit RakeshPas encore d'évaluation

- Ishares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummaryDocument3 pagesIshares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummarywanwizPas encore d'évaluation

- KKR Investor UpdateDocument8 pagesKKR Investor Updatepucci23Pas encore d'évaluation

- SPCapitalIQEquityResearch ConchoResourcesInc Feb 28 2016Document11 pagesSPCapitalIQEquityResearch ConchoResourcesInc Feb 28 2016VeryclearwaterPas encore d'évaluation

- JP MorganDocument10 pagesJP MorganNatalie Laurent SiaPas encore d'évaluation

- Bluechips Stepped Center Stage Amidst Rallying of IndicesDocument6 pagesBluechips Stepped Center Stage Amidst Rallying of IndicesRandora LkPas encore d'évaluation

- Icici Bank: Wholesale Pain, Retail DelightDocument12 pagesIcici Bank: Wholesale Pain, Retail DelightumaganPas encore d'évaluation

- TD Ameritrade Commission-Free EtfsDocument6 pagesTD Ameritrade Commission-Free EtfsVaro LiouPas encore d'évaluation

- Wing Tai Holdings: 2QFY11 Results ReviewDocument4 pagesWing Tai Holdings: 2QFY11 Results ReviewRaymond LuiPas encore d'évaluation

- ZagroDocument2 pagesZagropamela_medici_1Pas encore d'évaluation

- TD Ameritrade Commission-Free EtfsDocument6 pagesTD Ameritrade Commission-Free EtfsSteve SantucciPas encore d'évaluation

- Results Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYDocument9 pagesResults Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYÁngel Josue Aguilar VillaverdePas encore d'évaluation

- CRISIL Event UpdateDocument4 pagesCRISIL Event UpdateAdarsh Sreenivasan LathikaPas encore d'évaluation

- Index Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Document6 pagesIndex Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Randora LkPas encore d'évaluation

- Model Portfolio: DBS Group Research - EquityDocument12 pagesModel Portfolio: DBS Group Research - EquityFunk33qPas encore d'évaluation

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlPas encore d'évaluation

- Capital Research (PVT) LTD.: Fundamental Analysis DivisionDocument8 pagesCapital Research (PVT) LTD.: Fundamental Analysis DivisionupkumaraPas encore d'évaluation

- Markit News: Biggest Credit Movers: Markit Itraxx and CDXDocument5 pagesMarkit News: Biggest Credit Movers: Markit Itraxx and CDXaapokinPas encore d'évaluation

- Ishares Core S&P 500 Etf: Historical Price Performance Quote SummaryDocument3 pagesIshares Core S&P 500 Etf: Historical Price Performance Quote SummarywanwizPas encore d'évaluation

- Daily Trade Journal - 15.10.2013Document6 pagesDaily Trade Journal - 15.10.2013Randora LkPas encore d'évaluation

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDocument6 pagesUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkPas encore d'évaluation

- Thomson Reuters M&a Review (2015)Document24 pagesThomson Reuters M&a Review (2015)Carlos MartinsPas encore d'évaluation

- Citi Report CIBCDocument23 pagesCiti Report CIBCinchoateherePas encore d'évaluation

- PNB Analyst Presentation March16Document29 pagesPNB Analyst Presentation March16tamirisaarPas encore d'évaluation

- Still A Long Way To Go: Otto MarineDocument6 pagesStill A Long Way To Go: Otto MarineckyeakPas encore d'évaluation

- Sears Vs Walmart - v01Document37 pagesSears Vs Walmart - v01chansjoy100% (1)

- Aci Reuters BuyDocument6 pagesAci Reuters BuysinnlosPas encore d'évaluation

- United Engineers - CIMBDocument7 pagesUnited Engineers - CIMBTheng RogerPas encore d'évaluation

- Nestle IndiaDocument38 pagesNestle Indiarranjan27Pas encore d'évaluation

- Sony Music MRP Phase II Review (2014)Document84 pagesSony Music MRP Phase II Review (2014)Stephanie SchneiderPas encore d'évaluation

- BRS Market Report: Week III: 14Document7 pagesBRS Market Report: Week III: 14Sudheera IndrajithPas encore d'évaluation

- Key Performance Indicators - 26 04 2013Document8 pagesKey Performance Indicators - 26 04 2013Randora LkPas encore d'évaluation

- Tillerson AssetsDocument38 pagesTillerson AssetsZerohedgePas encore d'évaluation

- RCS Investments: Global Macro Fund Aggressive February 2014 FactsheetDocument2 pagesRCS Investments: Global Macro Fund Aggressive February 2014 FactsheetRCS_CFAPas encore d'évaluation

- Flagship One Pager - All ReturnsDocument6 pagesFlagship One Pager - All ReturnsridnaniPas encore d'évaluation

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalPas encore d'évaluation

- Wyeth - Q4FY12 Result Update - Centrum 22052012Document4 pagesWyeth - Q4FY12 Result Update - Centrum 22052012SwamiPas encore d'évaluation

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlPas encore d'évaluation

- Game Theory (2) - Mechanism Design With TransfersDocument60 pagesGame Theory (2) - Mechanism Design With Transfersjm15yPas encore d'évaluation

- AMT4SAP - Junio26 - Red - v3 PDFDocument30 pagesAMT4SAP - Junio26 - Red - v3 PDFCarlos Eugenio Lovera VelasquezPas encore d'évaluation

- Ch. 4: Financial Forecasting, Planning, and BudgetingDocument41 pagesCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8Pas encore d'évaluation

- Bbob Current AffairsDocument28 pagesBbob Current AffairsGangwar AnkitPas encore d'évaluation

- Project ProposalDocument7 pagesProject Proposalrehmaniaaa100% (3)

- Porter 5 Force FinalDocument35 pagesPorter 5 Force FinalAbinash BiswalPas encore d'évaluation

- Pipistrel Alpha Trainer e Learning 2020Document185 pagesPipistrel Alpha Trainer e Learning 2020Kostas RossidisPas encore d'évaluation

- Paul Buchanan - Traffic in Towns and Transport in CitiesDocument20 pagesPaul Buchanan - Traffic in Towns and Transport in CitiesRaffaelePas encore d'évaluation

- $Ffhvvwr6Dih:Dwhu: Charting The Progress of PopulationsDocument5 pages$Ffhvvwr6Dih:Dwhu: Charting The Progress of PopulationskatoPas encore d'évaluation

- 16 PDFDocument11 pages16 PDFVijay KumarPas encore d'évaluation

- Company Profile ManmulDocument3 pagesCompany Profile ManmulAston Rahul Pinto50% (2)

- Principles of Effective Governance ECOSOCDocument3 pagesPrinciples of Effective Governance ECOSOCIsabella RamiaPas encore d'évaluation

- Final Paper (Assignment of Globalization Problems) - TFR 1.1KDocument1 pageFinal Paper (Assignment of Globalization Problems) - TFR 1.1KJayboy SARTORIOPas encore d'évaluation

- Synopsis Self-Sustainable CommunityDocument3 pagesSynopsis Self-Sustainable Communityankitankit yadavPas encore d'évaluation

- PERRUCI Millennials and Globalization 2012 PDFDocument6 pagesPERRUCI Millennials and Globalization 2012 PDFgomiuxPas encore d'évaluation

- Bank Guarantee BrochureDocument46 pagesBank Guarantee BrochureVictoria Adhitya0% (1)

- Business StudiesDocument2 pagesBusiness StudiesSonal JhaPas encore d'évaluation

- ICSB Mexico MSMEs Outlook Ricardo D. Alvarez v.2.Document4 pagesICSB Mexico MSMEs Outlook Ricardo D. Alvarez v.2.Ricardo ALvarezPas encore d'évaluation

- Gender Wise Classification of RespondentsDocument34 pagesGender Wise Classification of Respondentspavith ranPas encore d'évaluation

- GM OEM Financials Dgi9ja-2Document1 pageGM OEM Financials Dgi9ja-2Dananjaya GokhalePas encore d'évaluation

- Ballina TT A4 LFDocument3 pagesBallina TT A4 LFdyani davisonPas encore d'évaluation

- 1 Priciples of Engineering EconomyDocument32 pages1 Priciples of Engineering EconomyMaricar AlgabrePas encore d'évaluation

- Lista de Tablas GPDocument196 pagesLista de Tablas GPNatalia MoragaPas encore d'évaluation

- EVALUATION OF BANK OF MAHARASTRA-DevanshuDocument7 pagesEVALUATION OF BANK OF MAHARASTRA-DevanshuDevanshu sharma100% (2)

- Syllabus DUDocument67 pagesSyllabus DUMohit GoyalPas encore d'évaluation

- Herbert HooverDocument4 pagesHerbert HooverZuñiga Salazar Hamlet EnocPas encore d'évaluation

- Chap 013Document141 pagesChap 013theluckless77750% (2)

- Hegels Theory of The Modern State XYZDocument10 pagesHegels Theory of The Modern State XYZMaría CastroPas encore d'évaluation

- Panay Electric vs. NLRCDocument1 pagePanay Electric vs. NLRCsamme1010Pas encore d'évaluation

- Entry Mode StrategyDocument12 pagesEntry Mode StrategyMetiya RatimartPas encore d'évaluation