Académique Documents

Professionnel Documents

Culture Documents

Robertson Tool Company Operating and Financial Data 1998-2002

Transféré par

dineshjn2000Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Robertson Tool Company Operating and Financial Data 1998-2002

Transféré par

dineshjn2000Droits d'auteur :

Formats disponibles

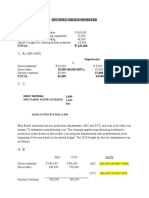

Exhibit 1 Condensed Operating and Stockholder Information, Robertson Tool Company

(millions of dollars except per-share data)

1998

1999

2000

2001

2002

$ 48.5

$ 49.1

$ 53.7

$ 54.8

$ 55.3

32.6

33.1

35.9

37.2

37.9

10.7

11.1

11.5

11.9

12.3

2.0

2.3

2.4

2.3

2.1

Operations

Sales

Cost of Goods

Selling, General and

Administrative Costs

Depreciation Expense

Interest Expense

Income Before Taxes

.4

.7

.8

.8

.8

2.8

1.9

3.1

2.6

2.2

1.1

.8

1.2

1.0

.9

$1.7

$1.1

$1.9

$1.6

$1.3

Cost of Goods

67%

67%

67%

68%

69%

Sell, Genl, Admin.

22%

23%

21%

22%

22%

Operating Income

6.6%

5.3%

7.3%

6.2%

5.4%

$ 2.91

$ 1.88

$ 3.25

$ 2.74

$ 2.23

1.60

1.60

1.60

1.60

1.60

Taxes

Net Income

Percentage of Sales

Stockholder Information

Earnings Per Share

Dividends Per Share

Book Value Per Share

49.40

49.68

51.33

52.47

53.10

Market Price

33-46

35-48

29-41

25-33

23-32

Price/Earnings Ratio

11-16

10-26

9-13

9-12

10-14

Shares Outstanding

584,000

584,000

584,000

584,000

584,000

Exhibit 2 Balance Sheet at December 31, 2002, Robertson Tool Company

(millions of dollars)

Assets

Liabilities and Net Worth

$ 1

Cash

Accounts Receivable

Inventories

Current Assets

Net Plant and Equipment

Total Assets

Other

18

1

Other

Accounts Payable

Current Liabilities

$ 2

2

4

Long-term Debt

12

Net Worth

31

28

19

$ 47

Collection Period (days)

53

Days of Inventory (days)

173

Sales/Total Assets

1.18

Total

$ 47

Debt as % Capital

28%

Total Assets/Net Worth

1.52

Exhibit 3 Condensed Operating and Stockholder Information, NDP Corporation

(millions of dollars except per-share data)

1998

1999

2000

2001

2002

Sales

$ 45

$ 97

$ 99

$ 98

$ 100

Net Income

1.97

3.20

3.20

1.13

2.98

$ 25

$ 46

$ 49

$ 41

$ 46

11

15

10

13

Net Working Capital

19

35

34

31

33

Long-term Debt

10

18

16

15

17

Shareholders Equity

21

36

40

41

41

$ .78

$ .61

$ .59

$ .21

$ .54

0.20

0

7.45

Operations

Financial Position

Current Assets

Current Liabilities

Stockholders Information

Earnings Per Share

Dividends Per Share

Book Value Per Share

8.31

6.86

7.37

7.38

Market Price

6-17

10-18

7-18

4-10

5-8

Price/Earnings Ratio

8-22

16-30

12-31

19-48

9-15

Shares Outstanding

2,525,600

5,245,900

5,430,100

5,510,000

5,501,000

Exhibit 4 ProFormas for Robertson Tool (millions of dollars)

Actual

2002

Forecasts

2003

2004

2005

2006

2007 to Infinity

$ 55.3

$ 58.6

$ 62.1

$ 65.9

$ 69.8

$ 69.8

Cost of Goods

37.9

39.8

41.6

43.5

45.4

45.4

Gross Profit

17.4

18.8

20.5

22.4

24.4

24.4

Sell & Admin

12.3

12.3

12.4

12.5

13.3

13.3

Depreciation

2.1

2.3

2.5

2.7

2.9

2.9

EBIT

3.0

4.2

5.6

7.2

8.2

8.2

Tax @ 40%

1.2

1.7

2.2

2.9

3.3

3.3

EBIAT

$ 1.8

$ 2.5

$ 3.4

$ 4.3

$ 4.9

$ 4.9

CoGS % Sales

69%

68%

67%

66%

65%

65%

Sell & Admin % Sales

22%

21%

20%

19%

19%

19%

$ 19.0

$ 20.7

$ 21.7

$ 22.6

$ 23.5

(4.0)

(3.5)

(3.6)

(3.8)

(2.9)

2.3

2.5

2.7

2.9

2.9

$ 20.7

$ 21.7

$ 22.6

$ 23.5

$ 23.5

Sales

Net Plant & Equip @

Beginning of Year

Capital Expenditures

Depreciation Expense

Net Plant & Equip @

End of Year

Exhibit 5 Five-Year Forecast of Monmouth, Inc. Earnings, Excluding Robertson Tool

(millions of dollars except per-share data)

Net Income

Shares Outstanding (mil)

Earnings Per Share

2003

2004

2005

2006

2007

$ 11.0

$ 11.9

$ 12.8

$ 13.8

$ 15.0

4.21

4.21

4.21

4.21

4.21

$ 2.61

$ 2.83

$ 3.04

$ 3.27

$ 3.56

Exhibit 6 Selected Financial Information on Quasi-Comparable Firms, 2002

Actuant Corp.

Collection Period (days)

Briggs &

Stratton

Idex Corp.

Lincoln Electric

Snap On Inc.

Stanley Works

Robertson Tool

Co.

55

77

47

61

96

77

53

Inventory % Sales

12%

18%

13%

17%

18%

16%

33%

Operating Margin % Sales

17%

13%

20%

15%

10%

15%

5%

Return on Capital

21%

9%

10%

12%

11%

14%

4%

3.8

3.2

7.1

11.5

7.8

9.3

3.5

balance sheet values

98%

52%

30%

27%

29%

40%

28%

market values

29%

37%

20%

17%

19%

24%

37%

BB-

BB+

BBB

A+

$ 712

$ 1,443

$ 1,191

$ 1,145

$ 1,861

$ 3,014

$ 29

55

119

98

90

129

234

1.80

EBIAT Multiple

12.8

12.1

12.2

12.7

14.4

12.9

16.1

Share Price

$ 42

$ 42

$ 29

$ 22

$ 26

$ 27

$ 30

Earnings Per Share

2.80

3.20

2.00

1.78

1.80

2.32

2.32

Price/Earnings

15.0

13.1

14.5

12.4

14.4

11.6

13.5

Equity Beta

1.00

1.00

1.00

.75

1.05

.95

Asset Beta

.71

.63

.80

.63

.85

.73

Times Interest Earned

Debt % Capital

Bond Rating

Value of Firm ($ mil)

EBIAT ($ mil)

Exhibit 7 Information on United States Capital Markets

I. Interest Rates in May 2003

30-Year U.S.

Treasury Bonds

U.S. Corporate Bonds Rated

A

BBB

AA

4.10%

4.52%

5.07%

BB

6.07%

II. Estimated Market Risk Premium = 5.5% over 30-Year U.S. Treasury Bonds

III. Median Values of Key Ratios by Standard & Poors Rating Category

AAA

AA

A

BBB

BB

Times Interest Earned (X)

EBITDA / Interest (X)

Pre-tax Return on Capital (%)

Debt as % Capital (%)

Number of companies

5.9

7.6

15.1

43.7

213

3.4

4.6

12.5

51.9

297

1.5

2.3

8.8

74.9

345

27.3

31.0

25.2

12.6

6

18.0

21.4

25.4

36.1

15

10.4

12.8

19.7

38.4

118

IV. Debt and Times Interest Earned Ratios for Selected Industries

AAA

AA

A

Food Processing

Debt % Capital

Times Interest Earned

Electrical Equipment

Debt % Capital

Times Interest Earned

Electric Utilities

Debt % Capital

Times Interest Earned

BBB

BB

44%

7.9

51%

6.7

54%

4.3

53%

2.9

36%

7.3

48%

3.2

72%

1.6

46%

4.0

54%

3.4

57%

2.7

73%

2.0

7.96%

Vous aimerez peut-être aussi

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataAjax0% (1)

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataVishal VermaPas encore d'évaluation

- Monmouth Case SolutionDocument16 pagesMonmouth Case SolutionAjaxPas encore d'évaluation

- MonmouthDocument16 pagesMonmouthjamn1979100% (1)

- Monmouth Group4Document18 pagesMonmouth Group4Jake Rolly0% (1)

- Air Thread ConnectionsDocument31 pagesAir Thread ConnectionsJasdeep SinghPas encore d'évaluation

- This Study Resource Was: Gain Control of Robertson Tool in May 2003?Document4 pagesThis Study Resource Was: Gain Control of Robertson Tool in May 2003?Pedro José ZapataPas encore d'évaluation

- XLS EngDocument26 pagesXLS EngcellgadizPas encore d'évaluation

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyPas encore d'évaluation

- DCF Value of cost synergies from Pillsbury acquisitionDocument8 pagesDCF Value of cost synergies from Pillsbury acquisitionteenabansalPas encore d'évaluation

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoPas encore d'évaluation

- Radent Case QuestionsDocument2 pagesRadent Case QuestionsmahiePas encore d'évaluation

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenPas encore d'évaluation

- Sampa VideoDocument24 pagesSampa VideodoiPas encore d'évaluation

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Caso Nextel DataDocument42 pagesCaso Nextel Dataelena ubillasPas encore d'évaluation

- Clarkson Lumber Analysis - TylerDocument9 pagesClarkson Lumber Analysis - TylerTyler TreadwayPas encore d'évaluation

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionGourav DadhichPas encore d'évaluation

- Tire City 1997 Pro FormaDocument6 pagesTire City 1997 Pro FormaXRiloXPas encore d'évaluation

- Monmouth Case QuestionsDocument1 pageMonmouth Case Questionssakshi gulatiPas encore d'évaluation

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaPas encore d'évaluation

- Debt Policy at Ust Inc Case AnalysisDocument23 pagesDebt Policy at Ust Inc Case AnalysisLouie Ram50% (2)

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rPas encore d'évaluation

- California Pizza Chicken Share Repurchase AnalysisDocument13 pagesCalifornia Pizza Chicken Share Repurchase AnalysisBerni RahmanPas encore d'évaluation

- Bed Bath Beyond (BBBY) Stock ReportDocument14 pagesBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDocument2 pagesM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현Pas encore d'évaluation

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoPas encore d'évaluation

- Blaine Kitchenware financial analysis and capital structure optimizationDocument11 pagesBlaine Kitchenware financial analysis and capital structure optimizationBala GPas encore d'évaluation

- Wells Fargo CaseDocument58 pagesWells Fargo CaseMeenaPas encore d'évaluation

- Burton SensorsDocument2 pagesBurton SensorsSankalp MishraPas encore d'évaluation

- 10 BrazosDocument20 pages10 BrazosAlexander Jason LumantaoPas encore d'évaluation

- Group BDocument10 pagesGroup BHitin KumarPas encore d'évaluation

- Final Sheet DCF - With SynergiesDocument4 pagesFinal Sheet DCF - With SynergiesAngsuman BhanjdeoPas encore d'évaluation

- Robertson Tool Company Financial AnalysisDocument25 pagesRobertson Tool Company Financial AnalysisPerci LunarejoPas encore d'évaluation

- Dollarama LBO Analysis: Is it a Good Candidate for Private Equity AcquisitionDocument2 pagesDollarama LBO Analysis: Is it a Good Candidate for Private Equity AcquisitionKenton ParrottPas encore d'évaluation

- AIRTHREAD ACQUISITION Revenue Projections and Operating AssumptionsDocument7 pagesAIRTHREAD ACQUISITION Revenue Projections and Operating AssumptionsAlex Wilson0% (1)

- BurtonsDocument6 pagesBurtonsKritika GoelPas encore d'évaluation

- Jones Electrical SlidesDocument6 pagesJones Electrical SlidesRohit AwadePas encore d'évaluation

- Hill Country Snack Foods CompanyDocument14 pagesHill Country Snack Foods CompanyVeni GuptaPas encore d'évaluation

- Finance Simulation - Capital BudgetingDocument1 pageFinance Simulation - Capital BudgetingKarthi KeyanPas encore d'évaluation

- Tire RatiosDocument7 pagesTire Ratiospp pp100% (1)

- General Mills' acquisition of Pillsbury from DiageoDocument4 pagesGeneral Mills' acquisition of Pillsbury from DiageoDigraj Mahanta100% (1)

- ACC to Acquire AirThread for $7.5 BillionDocument16 pagesACC to Acquire AirThread for $7.5 Billionbtlala0% (1)

- Monmouth Case - Strategic Fit, DCF, Synergies, RisksDocument1 pageMonmouth Case - Strategic Fit, DCF, Synergies, RisksthoroftedalPas encore d'évaluation

- Group-13 Case 12Document80 pagesGroup-13 Case 12Abu HorayraPas encore d'évaluation

- Pacific Grove Spice Company CalculationsDocument12 pagesPacific Grove Spice Company CalculationsJuan Jose Acero CaballeroPas encore d'évaluation

- Obscurity: Undesirability: P/E: Screening CriteriaDocument21 pagesObscurity: Undesirability: P/E: Screening Criteria/jncjdncjdnPas encore d'évaluation

- Ocean Carriers FinalDocument5 pagesOcean Carriers FinalsaaaruuuPas encore d'évaluation

- Air Thread Connection: Group FacdDocument11 pagesAir Thread Connection: Group FacdAnandPas encore d'évaluation

- Target CorporationDocument20 pagesTarget CorporationAditiPatilPas encore d'évaluation

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Pas encore d'évaluation

- Calculating The NPV of The AcquisitionDocument23 pagesCalculating The NPV of The Acquisitionkooldude1989100% (1)

- This Study Resource WasDocument9 pagesThis Study Resource WasVishalPas encore d'évaluation

- Gemini Electronics: US LCD TV Giant's Growth & Financial AnalysisDocument1 pageGemini Electronics: US LCD TV Giant's Growth & Financial AnalysisSreeda PerikamanaPas encore d'évaluation

- Seagate NewDocument22 pagesSeagate NewKaran VasheePas encore d'évaluation

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANPas encore d'évaluation

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005Pas encore d'évaluation

- Monmouth Case SolutionDocument19 pagesMonmouth Case SolutionAkshat Nayer40% (10)

- Millions of Dollars Except Per-Share DataDocument23 pagesMillions of Dollars Except Per-Share DataPedro José ZapataPas encore d'évaluation

- Millions of Dollars Except Per-Share DataDocument7 pagesMillions of Dollars Except Per-Share DataalejandroPas encore d'évaluation

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument12 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionthisisfordesignPas encore d'évaluation

- Vouching and Verification Techniques for Auditing Financial RecordsDocument19 pagesVouching and Verification Techniques for Auditing Financial RecordsHimanshu UtekarPas encore d'évaluation

- Moon Shopping Mall Cash & Carry AnalysisDocument6 pagesMoon Shopping Mall Cash & Carry Analysissara khanPas encore d'évaluation

- Harshit Management ProjectDocument2 pagesHarshit Management ProjectHarshit GuptaPas encore d'évaluation

- CH 1 MarketingDocument68 pagesCH 1 Marketinganwar muhammedPas encore d'évaluation

- PWC Guide To Fair Value MeasurementDocument206 pagesPWC Guide To Fair Value MeasurementFahad Dehbar, ACCA100% (2)

- ClassificationDocument2 pagesClassificationKate ParanaPas encore d'évaluation

- Capacity Utilisation: Learning ObjectiveDocument14 pagesCapacity Utilisation: Learning Objectivesk001Pas encore d'évaluation

- Cambridge IGCSE: Accounting 0452/13Document12 pagesCambridge IGCSE: Accounting 0452/13Khaled AhmedPas encore d'évaluation

- Do It Yourself - AnswersDocument60 pagesDo It Yourself - AnswersSafaetplayzPas encore d'évaluation

- Jindi ShikhaDocument11 pagesJindi ShikhaShikha TickooPas encore d'évaluation

- GAAP/IFRS Accounting DifferencesDocument7 pagesGAAP/IFRS Accounting DifferencesAlexander BoshraPas encore d'évaluation

- LenovoDocument5 pagesLenovoamin233Pas encore d'évaluation

- Valuation-Methods and ParametersDocument15 pagesValuation-Methods and ParametersPranav Chaudhari100% (2)

- Digital Marketing Boosts Small Business ProfitsDocument13 pagesDigital Marketing Boosts Small Business ProfitsMJ Gomba AdriaticoPas encore d'évaluation

- Factors Affecting Customers Using Modern Retail Stores in BangkokDocument5 pagesFactors Affecting Customers Using Modern Retail Stores in BangkokRahul GheewalaPas encore d'évaluation

- FAC1601-partnerships - LiquidationDocument12 pagesFAC1601-partnerships - Liquidationtommy tazvityaPas encore d'évaluation

- Dell's Supply Chain Strategy DissertationDocument4 pagesDell's Supply Chain Strategy DissertationAman Singh Kailley50% (2)

- Seminar Assignments Multiple Choice Questions Why Do Cities Exist PDFDocument4 pagesSeminar Assignments Multiple Choice Questions Why Do Cities Exist PDFminlwintheinPas encore d'évaluation

- Calculating Stock Returns, Risk Premiums, and Inflation AdjustmentsDocument0 pageCalculating Stock Returns, Risk Premiums, and Inflation AdjustmentsJas Chy100% (1)

- APM Question Pack FinalDocument96 pagesAPM Question Pack FinalDexter DexPas encore d'évaluation

- Christine Smith Resume SummaryDocument1 pageChristine Smith Resume Summarypianix0000Pas encore d'évaluation

- Racquetball RacketDocument2 pagesRacquetball RacketVenkatesh Nenavath0% (1)

- Shemaroo Entertainment LTDDocument16 pagesShemaroo Entertainment LTDsheetalsamantPas encore d'évaluation

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGPas encore d'évaluation

- Nykaa DetailedDocument34 pagesNykaa Detailedsahil malhotra67% (9)

- Spring 2021 - ECO401 - 2 - BC200409477Document2 pagesSpring 2021 - ECO401 - 2 - BC200409477Noman AliPas encore d'évaluation

- CMA December 2009 Exam QuestionsDocument52 pagesCMA December 2009 Exam QuestionsAshiq HossainPas encore d'évaluation

- David J StiansenDocument2 pagesDavid J StiansengaryPas encore d'évaluation

- Accounting Basics for Non-AccountantsDocument129 pagesAccounting Basics for Non-Accountantsdesikan_r100% (7)