Académique Documents

Professionnel Documents

Culture Documents

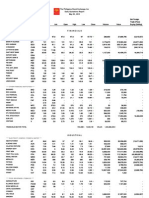

The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2013

Transféré par

srichardequipTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2013

Transféré par

srichardequipDroits d'auteur :

Formats disponibles

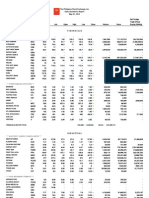

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

FINANCIALS

**** BANKS ****

ASIATRUST

BANK PH ISLANDS

ASIA

BPI

107.4

111.8

107.5

BDO UNIBANK

BDO

90.95

91

CHINABANK

CHIB

64.6

65.1

93

93

65.5

65.5

CITYSTATE BANK

CSB

EW

34.4

18

34.45

34.8

METROBANK

EIBA

EIBB

MBT

117.8

117.9

PB BANK

PBB

PBCOM

PBC

PNB

36.3

103.2

PSBANK

PTC

PSB

RCBC

RCB

SECURITY BANK

SECB

UNION BANK

UBP

EAST WEST BANK

EXPORT BANK

EXPORT BANK B

PHIL NATL BANK

PHILTRUST

107.5

111.8

107.5

1,922,640

207,785,754

(152,701,450)

90.8

91

6,346,310

578,850,019.5

(383,990,206)

64.6

64.6

294,930

19,184,260.5

(1,828,011)

34.8

34.45

34.45

1,471,300

50,733,045

7,075,655

117

117.8

115.5

117.8

1,175,900

137,793,879

(6,593,994)

36.35

36.95

37

36.3

36.35

367,800

13,419,595

25,480

104

101.8

104

100.8

104

719,530

73,822,981

(37,633,167)

70

120

126

125

127

125

126

220

27,640

69.45

69.5

68

69.45

65.95

69.45

2,286,000

157,148,429.5

43,899,846.5

182

183

183.6

183.6

182

183

271,970

49,728,885

14,800,956

126

127

125.5

126

63,200

7,955,300

590,320

**** OTHER FINANCIAL INSTITUTION ****

BANKARD

BKD

1.21

1.22

1.25

1.26

1.21

1.21

2,084,000

2,556,300

BDO LEASING

BLFI

COL

FFI

1.98

19.42

13.04

2.03

19.7

13.3

19.98

13.2

20

14.8

19.5

13.02

19.7

13.3

106,600

15,000

2,110,926

199,750

294,600

-

FAF

I

MFC

MAKE

0.82

2.75

550

27.8

0.88

2.85

555

28

28.15

28.15

27.8

27.8

97,900

2,736,840

PHIL STOCK EXCH

MED

NRCP

PSE

1.95

486

1.96

489.8

1.95

499.8

1.96

500

1.95

475

1.96

486

451,000

107,010

883,900

52,794,246

19,750

SUN LIFE

SLF

1,045

1,068

1,055

1,055

1,035

1,045

475

496,275

VANTAGE

2.55

2.57

2.57

2.57

2.55

2.55

208,000

532,100

VOLUME :

17,989,785

(44,287,580)

COL FINANCIAL

FILIPINO FUND

FIRST ABACUS

IREMIT

MANULIFE

MAYBANK ATR KE

MEDCO HLDG

NTL REINSURANCE

FINANCIALS SECTOR TOTAL

VALUE :

1,358,760,125.5

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

AP

38.05

38.1

38.7

38.7

37.55

38.05

2,072,600

78,757,045

ALSONS CONS

ACR

1.34

1.36

1.36

1.36

1.34

1.34

817,000

1,103,790

CALAPAN VENTURE

H2O

4.7

4.72

4.29

4.7

4.29

4.7

341,000

1,536,870

4,610

ENERGY DEVT

EDC

6.41

6.45

6.5

6.52

6.41

6.41

22,237,100

143,199,325

(24,545,566)

FIRST GEN

FGEN

23.15

23.9

23.65

24.2

22.8

23.9

3,611,900

83,751,200

(51,724,930)

FIRST PHIL HLDG

FPH

108.5

109.5

108.6

110

107.9

109.5

494,910

54,057,003

(20,203,460)

MANILA WATER

MWC

37

37.05

37.2

37.2

36.8

37.05

6,356,300

235,380,090

(121,069,215)

MERALCO

MER

320.8

322

320.4

322

315

322

534,060

170,184,878

(7,476,720)

PETRON

PCOR

14.24

14.28

14.36

14.4

14.12

14.28

8,799,900

125,006,086

(1,896,928)

PHOENIX

PNX

9.52

9.57

9.7

9.7

9.52

9.52

1,214,200

11,609,463

(8,615,823)

SALCON POWER

TRANS ASIA

SPC

TA

4.72

2.4

4.95

2.41

2.42

2.43

2.35

2.4

13,826,000

33,064,580

(1,627,360)

VIVANT

VVT

9.01

9.8

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

7.07

7.1

7.2

7.25

7.07

95,700

674,471

ALLIANCE SELECT

DNL INDUS

FOOD

BMM

CAT

CBC

DNL

2.13

50.6

13.52

6.95

2.14

63

15.88

6.96

2.14

6.72

2.2

6.96

2.14

6.65

2.14

6.96

11,769,000

11,923,500

25,486,420

81,783,181

(7,982,840)

(8,891,201)

GINEBRA

GSMI

15.52

16.9

15.9

16.98

15.9

16.9

8,900

143,792

(48,000)

JOLLIBEE

JFC

124

124.5

123

125

123

124.3

583,790

72,563,821

(4,117,384)

LIBERTY FLOUR

LT GROUP

LFM

LTG

49

14.96

53

15

15.14

15.14

15

15

1,436,000

21,592,112

3,728,060

PANCAKE

PCKH

7.85

7.9

8.09

7.9

8.09

4,100

32,409

PEPSI COLA

PIP

6.31

6.32

6.45

6.45

6.28

6.32

2,996,700

18,934,722

(815,028)

PUREFOODS

PF

RFM

295

4.81

298

4.85

298

4.85

298

4.85

297

4.8

298

4.8

4,220

257,000

1,255,030

1,236,020

981,500

870,500

SAN MIGUEL CORP

RCI

ROX

SMB

SMC

2.26

3

114.8

2.44

3.05

115

3

115

3

115.6

3

113.8

3

115

48,000

1,042,180

144,000

119,463,734

(4,280,493)

SWIFT FOODS

SFI

0.136

0.141

0.136

0.136

0.136

0.136

1,050,000

142,800

136,000

BOGO MEDELLIN

CNTRL AZUCARERA

COSMOS

RFM CORP

ROXAS AND CO

ROXAS HLDG

SAN MIGUEL BREW

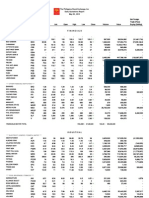

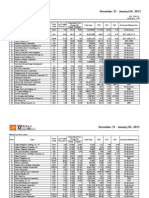

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

UNIV ROBINA

URC

102.3

103.3

97.8

103.5

97.8

102.3

6,159,210

619,045,314

249,061,504

VICTORIAS

VMC

VITA

1.49

0.95

1.5

0.96

1.51

0.96

1.51

0.96

1.49

0.94

1.5

0.95

1,709,000

802,000

2,561,020

758,280

(95,050)

VITARICH

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

CONCRETE A

CA

CONCRETE B

21.85

22.35

22.75

22.75

21.55

22.35

1,200

26,470

50

65

65

65

65

65

10

650

15

12.74

6.01

12.86

12.98

11

12.9

12.94

13

12.98

13

12.72

12.82

12.98

12.9

342,500

-

4,441,296

-

4,101,030

-

HOLCIM

CAB

EEI

FED

HLCM

35,600

461,888

45,500

LAFARGE REP

LRI

10.68

10.7

10.98

10.98

10.7

10.7

1,119,900

12,075,412

612,270

MARIWASA

MEGAWIDE

MMI

MWIDE

5.55

17.66

5.99

17.7

17.7

17.7

17.5

17.7

292,500

5,168,080

PHINMA

PHN

13.58

13.7

13.94

13.94

13.58

13.58

14,200

194,780

PNCC

PNC

CMT

SRDC

T

VUL

1.2

1.61

1.55

1.68

1.57

1.56

1.57

1.55

1.55

531,000

826,480

(31,200)

CIP

COAT

73.1

2.81

100

2.92

2.83

2.85

2.8

2.8

184,000

516,900

162,400

EURO

LMG

1.72

2.32

1.8

2.39

2.45

2.49

2.32

2.39

LMG CHEMICALS

31,000

74,750

34,340

MABUHAY VINYL

MVC

1.75

2.09

1.86

1.86

1.75

1.75

37,000

66,710

MANCHESTER A

MIH

MIHB

MAH

MAHB

PPC

15

14.98

-

15.3

15

-

15

15.5

-

16.3

16

-

15

14.6

-

15

15

-

246,900

84,400

-

3,780,218

1,279,446

-

EEI CORP

FED CHEMICALS

SEACEM

SUPERCITY

TKC STEEL

VULCAN INDL

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

EUROMED

MANCHESTER B

METROALLIANCE A

METROALLIANCE B

PRYCE CORP

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CHIPS

GREENERGY

INTEGRATED MICR

GREEN

IMI

IONICS

ION

PANASONIC

PMPC

23

23.1

23.6

23.6

22.15

23

43,300

990,275

0.019

4.01

0.02

4.12

0.02

4.01

0.02

4.01

0.019

4

0.019

4.01

21,000,000

30,000

399,100

120,290

0.66

0.67

0.68

0.68

0.66

0.66

593,000

397,840

5.35

21

1.74

23

1.76

1.73

1.77

1.73

1.76

46,000

80,610

**** OTHER INDUSTRIALS ****

ALPHALAND

SPLASH CORP

ALPHA

FYN

FYNB

PCP

SPH

STENIEL

STN

FILSYN A

FILSYN B

PICOP RES

INDUSTRIALS SECTOR TOTAL

VOLUME :

136,682,555

VALUE :

2,829,385,675

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS CONS

ABA

0.66

0.67

0.66

0.67

0.66

0.67

1,195,000

790,720

(135,340)

ABOITIZ EQUITY

AEV

57.2

57.4

58.45

58.45

57

57.2

1,352,200

77,486,330

(15,462,522.5)

ALCORN GOLD

APM

0.164

0.165

0.165

0.166

0.164

0.164

55,660,000

9,153,920

ALLIANCE GLOBAL

AGI

21.6

21.65

22

22

20.7

21.65

11,608,900

247,392,135

(74,881,320)

ANGLO PHIL HLDG

ANSCOR

APO

ANS

2.32

6.99

2.4

7.08

6.95

6.97

26,400

183,948

16,728

ASIA AMLGMATED

AAA

4.49

4.87

4.47

4.96

4.47

4.9

16,000

76,190

ATN HLDG A

ATN HLDG B

ATN

ATNB

0.91

0.95

0.99

0.98

0.98

0.98

0.98

0.98

200,000

196,000

AYALA CORP

AC

550

552

560

561

550

550

1,670,200

922,556,540

(72,992,455)

BHI HLDG

BH

DMC

432

53.8

645

53.95

54.2

54.5

53.9

53.95

1,368,500

73,892,220.5

8,584,865

FC

FDC

5.78

5.8

5.8

5.81

5.78

5.78

154,600

895,490

2.92

2.75

0.217

759

3.03

3.4

0.238

760

761

761

756

760

194,900

148,012,765

(122,994,575)

HI

JGS

7.77

40.6

7.78

41.95

7.77

40

7.8

41.95

7.77

39.75

7.77

41.95

4,304,300

1,742,500

33,444,484

70,731,020

27,839,910

(2,529,475)

JOH

KPH

KPHB

5.74

4.9

4.8

6.5

5.05

5.59

5.05

5.59

5.05

5.59

5.05

5.59

5.05

5.59

120,000

200

606,000

1,118

LIHC

LPZ

0.89

7.27

0.91

7.31

0.9

7.35

0.91

7.35

0.89

7.24

0.91

7.31

1,191,000

852,500

1,061,930

6,214,101

(1,268,719)

DMCI HLDG

FIL ESTATE CORP

FILINVEST DEV

FJ PRINCE A

FJ PRINCE B

FORUM PACIFIC

GT CAPITAL

HOUSE OF INV

JG SUMMIT

JOLLIVILLE HLDG

KEPPEL HLDG A

KEPPEL HLDG B

LODESTAR

LOPEZ HLDG

FJP

FJPB

FPI

GTCAP

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

MABUHAY HLDG

MHC

0.62

0.63

0.6

0.63

0.6

0.62

430,000

267,060

MARCVENTURES

METRO PAC INV

MARC

MPI

1.75

5.31

1.78

5.32

1.75

5.31

1.75

5.35

1.74

5.2

1.75

5.31

637,000

21,122,500

1,109,890

111,692,850

44,736,536

MINERALES IND

MIC

6.55

6.69

6.74

6.74

6.74

6.74

2,000

13,480

MJC INVESTMENTS

MJIC

5.73

5.98

5.72

5.72

5.72

5.72

13,000

74,360

PACIFICA

PA

0.048

0.049

0.048

0.051

0.048

0.049

2,060,000

100,010

(510)

PRIME MEDIA

PRIM

1.86

1.91

1.95

2.01

1.81

1.91

443,000

830,810

PRIME ORION

POPI

REG

SPM

0.68

2.75

2.06

0.69

2.8

2.15

0.69

2.75

2.08

0.69

2.75

2.08

0.68

2.75

2.07

0.69

2.75

2.07

982,000

310,000

29,000

668,070

852,500

60,160

690

-

SM INVESTMENTS

SINO

SM

0.315

1,075

0.325

1,079

1,093

1,095

1,075

1,075

589,240

636,329,800

(69,809,775)

SOLID GROUP

SGI

2.16

2.17

2.08

2.17

2.07

2.16

573,000

1,227,450

SOUTH CHINA

SOC

SGP

UNI

1.1

366

0.27

1.14

450

0.275

0.255

0.27

0.255

0.27

250,000

66,750

WIN

ZHI

0.255

0.475

0.27

0.485

0.27

0.5

0.28

0.52

0.25

0.475

0.27

0.475

4,120,000

1,065,200

410,000

198,350

VOLUME :

113,627,940

REPUBLIC GLASS

SEAFRONT RES

SINOPHIL

SYNERGY GRID

UNIOIL HLDG

WELLEX INDUS

ZEUS HLDG

HOLDING FIRMS SECTOR TOTAL

VALUE :

2,347,251,651.5

PROPERTY

**** PROPERTY ****

A BROWN

ARTHALAND CORP

BRN

ALHI

ARA

ALCO

AYALA LAND

ALI

31

31.05

31.2

31.2

30.5

31

17,660,300

545,440,885

(133,042,090)

BELLE CORP

BEL

5.9

5.94

6.1

6.3

5.87

5.9

19,366,000

116,666,444

(15,825,387)

CEBU HLDG

CHI

4.68

4.72

4.66

4.72

4.65

4.68

15,277,000

71,497,080

69,779,280

CEBU PROP A

CPV

CPVB

CPG

4.7

4.81

2.14

5.1

5.1

2.15

2.16

2.16

2.12

2.14

10,922,000

23,358,600

1,221,710

LAND

CDC

CEI

CYBR

2.32

1.13

0.068

0.76

2.44

1.14

0.07

0.77

0.76

0.77

0.76

0.76

832,000

636,130

EVER GOTESCO

ELI

EVER

1.08

0.31

1.09

0.32

1.08

0.32

1.09

0.32

1.07

0.315

1.08

0.315

59,231,000

590,000

63,984,380

185,900

26,934,540

-

FILINVEST LAND

FLI

1.95

1.96

1.97

1.97

1.94

1.95

9,005,000

17,581,120

(530,280)

GLOBAL ESTATE

GERI

GO

GOB

HP

IRC

2.12

2.01

1.27

2.15

2.33

1.29

2.13

1.3

2.15

1.32

2.1

1.27

2.15

1.27

13,854,000

3,403,000

29,343,460

4,418,620

15,760,830

-

MEGAWORLD

KEP

MC

MCB

MEG

3.01

3.79

3.5

3.8

3.78

3.84

3.73

3.8

78,973,000

299,319,580

(95,004,630)

MRC ALLIED

MRC

0.115

0.116

0.115

0.117

0.115

0.116

1,670,000

193,580

PHIL ESTATES

PHES

0.58

0.59

0.6

0.6

0.57

0.59

225,000

129,900

PHIL REALTY

RLT

0.53

0.54

0.54

0.54

0.53

0.53

1,884,000

1,000,670

PHIL TOBACCO

ROBINSONS LAND

TFC

PMT

PRMX

RLC

18.1

2.71

25.2

25

3.1

25.25

24.5

25.25

24.4

25.25

2,832,400

70,836,070

(11,714,670)

ROCKWELL

ROCK

3.14

3.15

3.27

3.27

3.15

3.15

5,176,000

16,507,350

511,790

SAN MIGUEL PROP

SM DEVT

SMP

SHNG

SMDC

3.4

8.09

3.45

8.1

3.4

8.29

3.45

8.5

3.4

8.09

3.45

8.1

8,000

4,189,900

27,250

34,344,873

3,114,266

SM PRIME HLDG

SMPH

18.8

18.82

18.92

18.92

18.7

18.8

13,456,700

253,018,996

(96,790,434)

STA LUCIA LAND

SLI

1.09

1.1

1.1

1.14

1.04

1.09

16,213,000

17,617,700

(40)

STARMALLS

STR

3.86

4.06

4.06

4.06

4.06

4.06

1,000

4,060

SUNTRUST HOME

SUN

0.6

0.62

0.61

0.61

0.6

0.6

66,000

39,900

UNIWIDE HLDG

UW

VLL

5.38

5.39

5.35

5.4

5.29

5.39

71,930,800

384,805,111

297,326,673

ANCHOR LAND

ARANETA PROP

CEBU PROP B

CENTURY PROP

CITY AND LAND

CITYLAND DEVT

CROWN EQUITIES

CYBER BAY

EMPIRE EAST

GOTESCO LAND A

GOTESCO LAND B

HIGHLANDS PRIME

IRC PROP

KEPPEL PROP

MARSTEEL A

MARSTEEL B

PRIMETOWN PROP

PRIMEX CORP

SHANG PROP

VISTA LAND

2.86

18

1.82

0.208

2.9

20.25

1.85

0.21

20

1.85

0.21

20

1.86

0.21

20

1.75

0.208

PROPERTY SECTOR TOTAL

VOLUME :

20

1.85

0.208

17,800

2,945,000

230,000

356,000

5,300,600

48,040

20,000

-

350,344,900

VALUE :

1,957,687,519

SERVICES

**** MEDIA ****

ABS CBN

GMA NETWORK

ABS

GMA7

38.5

9.88

39

9.9

39.2

9.94

39.2

9.94

38.3

9.7

39

9.9

76,100

560,700

2,966,540

5,545,123

MANILA BULLETIN

MB

0.82

0.86

0.82

0.89

0.81

0.82

745,000

613,740

MLA BRDCASTING

MBC

3.6

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

**** TELCOMMUNICATION ****

GLOBE TELECOM

GLO

1,194

1,200

1,198

1,202

1,190

1,200

42,355

50,766,750

18,109,440

LIBERTY TELECOM

PLDT

LIB

TEL

2.29

2,860

2.4

2,870

2,920

2,920

2,842

2,860

209,810

599,096,200

(272,625,810)

PTT CORP

PTT

4.42

5.1

4.33

4.5

5.99

39

4.48

4.51

4.25

4.51

4.48

4.49

4.25

4.5

4.33

1,315,000

335,000

5,905,020

1,448,790

(8,800)

**** INFORMATION TECHNOLOGY ****

DFNN INC

IP CONVERGE

DFNN

IMP

IMPB

CLOUD

IPVG CORP

IP

0.63

0.65

0.64

0.67

0.64

0.65

873,000

574,770

ISLAND INFO

IS

0.054

0.055

0.057

0.057

0.055

0.055

2,680,000

148,060

4,560

ISM COMM

PHILWEB

ISM

NXT

WEB

2.11

14.34

2.15

14.52

2.11

14.56

2.11

14.56

2.11

14.52

2.11

14.52

74,000

99,200

156,140

1,442,006

(103,390)

307,964

TOUCH SOLUTIONS

TSI

19.88

19.92

19.22

20.3

19.22

19.88

196,300

3,901,619

TRANSPACIFIC BR

TBGI

1.88

2.2

1.99

1.99

1.99

1.99

1,000

1,990

YEHEY CORP

YEHEY

1.29

1.3

1.31

1.31

1.3

1.3

199,000

259,710

1.7

13.1

1.8

14.1

1.7

13.3

1.7

13.3

1.7

13.1

1.7

13.1

2,000

3,600

3,400

47,440

IMPERIAL A

IMPERIAL B

NEXTSTAGE

**** TRANSPORTATION SERVICES ****

2GO GROUP

ASIAN TERMINALS

2GO

ATI

CEBU AIR

CEB

68

68.3

68.1

68.25

67.5

68.25

337,870

22,971,873

6,650,578

INTL CONTAINER

ICT

87.3

87.35

86.3

87.8

86

87.3

1,958,400

170,203,521

(25,650,218)

LORENZO SHIPPNG

LSC

MAC

PAL

1.41

2.42

-

1.63

2.52

-

2.52

-

2.52

-

2.52

-

2.52

-

4,000

-

10,080

-

ACE

BHI

1.28

0.125

1.33

0.126

1.33

0.127

1.33

0.128

1.28

0.126

1.33

0.126

28,000

32,020,000

35,990

4,048,130

(170,100)

GPH

WPI

26.5

0.395

45

0.4

0.405

0.405

0.4

0.4

380,000

152,100

CENTRO ESCOLAR

CEU

10.24

11

11

11

10.22

10.98

12,000

125,610

FAR EASTERN U

FEU

IPO

1,177

11

1,215

12

10.5

11

10.5

11

221,200

2,430,700

2,378,200

BCOR

BLOOM

24.9

14.74

25.1

14.76

24.9

15.08

24.9

15.26

24.9

14.72

24.9

14.74

300

21,615,500

7,470

325,045,850

(165,552,886)

LEISURE AND RES

EG

LR

0.023

8.46

0.025

8.48

0.024

8.75

0.025

8.8

0.023

8.45

0.025

8.48

494,400,000

287,800

11,868,300

2,452,667

139,200

-

MANILA JOCKEY

MJC

2.55

2.56

2.55

2.56

2.55

2.56

265,000

677,400

PACIFIC ONLINE

LOTO

15.1

15.6

14.82

15.1

14.82

15.1

21,900

329,262

PHIL RACING

PRC

10.36

10.68

10.5

10.5

10.5

10.5

8,400

88,200

PRMIERE HORIZON

PHA

0.33

0.34

CALATA CORP

CAL

3.38

3.4

3.37

3.43

3.36

3.4

253,000

858,400

PHIL SEVEN CORP

SEVN

PGOLD

91

39.35

92.95

39.4

91

39.6

91.05

39.65

91

39.15

91

39.4

12,150

1,957,400

1,105,665

77,044,800

(250,250)

(35,278,455)

0.8

2.8

0.81

2.9

0.81

2.89

0.81

2.89

0.81

2.85

0.81

2.85

762,000

37,000

617,220

105,630

PORT

ICTV

PAX

10

0.42

2.79

20

0.44

2.8

2.79

2.8

2.78

2.8

341,000

950,480

PHC

STI

0.98

0.99

0.99

0.99

0.97

0.98

3,800,000

3,717,900

9,700

MACROASIA

PAL HLDG

**** HOTEL & LEISURE ****

ACESITE HOTEL

BOULEVARD HLDG

GRAND PLAZA

WATERFRONT

**** EDUCATION ****

IPEOPLE

**** CASINOS & GAMING ****

BERJAYA

BLOOMBERRY

IP EGAME

**** RETAIL ****

PUREGOLD

**** OTHER SERVICES ****

APC GROUP

EASYCALL

GLOBALPORT

ICTV INC

PAXYS

PHILCOMSAT

STI HLDG

APC

ECP

SERVICES SECTOR TOTAL

VOLUME :

566,576,985

VALUE :

1,311,493,732

MINING & OIL

**** MINING ****

ABRA MINING

AR

0.0048

0.005

0.0048

0.005

0.0048

0.005

133,000,000

639,800

APEX MINING A

APX

4.25

4.26

4.27

4.27

4.26

4.26

19,000

80,970

APEX MINING B

APXB

4.28

4.3

4.3

4.3

4.3

4.3

50,000

215,000

ATLAS MINING

AT

22.5

22.8

22.75

22.8

22.3

22.8

1,376,200

31,140,245

2,551,620

ATOK

AB

BC

BCB

17.5

18

17.4

19

18.52

18.8

19

18.2

-

19

18.2

-

19

18

-

19

18

-

10,000

102,000

-

190,000

1,856,200

-

(190,000)

-

BENGUET A

BENGUET B

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

CENTURY PEAK

CPM

0.94

0.95

0.93

0.93

0.93

0.93

385,000

358,050

COAL ASIA HLDG

DIZON MINES

COAL

DIZ

1

11.34

1.01

11.6

1.01

11.88

1.01

11.88

0.99

11.2

1

11.6

2,786,000

105,500

2,784,150

1,210,780

(220,600)

5,680

GEOGRACE

GEO

0.52

0.53

0.54

0.54

0.52

0.53

2,714,000

1,419,350

LEPANTO A

LC

1.1

1.11

1.1

1.1

1.08

1.1

7,197,000

7,865,110

LEPANTO B

LCB

1.17

1.18

1.2

1.2

1.18

1.18

3,714,000

4,430,340

(174,700)

MANILA MINING A

MA

0.058

0.059

0.06

0.06

0.059

0.059

235,800,000

13,912,450

MANILA MINING B

NICKEL ASIA

MAB

NIKL

0.059

25.5

0.06

25.55

0.059

24

0.06

25.5

0.059

23.9

0.06

25.5

103,170,000

4,209,200

6,187,280

105,631,680

(60,000)

2,882,790

NIHAO

NI

3.56

3.57

3.6

3.6

3.54

3.57

474,000

1,690,240

108,000

OMICO CORP

ORNTL PENINSULA

OM

ORE

0.57

3.39

0.58

3.45

3.48

3.48

3.37

3.45

16,000

54,310

PHILEX

PX

17.88

17.9

18

18

17.5

17.9

3,814,900

67,571,344

11,201,318

SEMIRARA MINING

SCC

240.2

241

240.6

241

238

241

156,500

37,592,860

14,052,772

UNITED PARAGON

UPM

0.016

0.017

0.016

0.016

0.016

0.016

7,500,000

120,000

BSC

OPM

OPMB

PERC

0.28

0.02

0.021

7

0.285

0.021

0.022

7.05

0.28

0.02

0.021

6.9

0.285

0.02

0.021

7.08

0.28

0.02

0.021

6.9

0.28

0.02

0.021

7

730,000

18,000,000

48,700,000

371,000

204,450

360,000

1,022,700

2,600,810

413,700

224,000

OV

PEC

PECB

PXP

0.042

30.4

0.043

31

0.042

31

0.043

31

0.042

30.05

0.043

31

62,100,000

193,100

2,653,700

5,919,085

71,400

(533,575)

VOLUME :

636,693,400

32,800

**** OIL ****

BASIC PETROLEUM

ORIENTAL A

ORIENTAL B

PETROENERGY

PHILODRILL

PNOC A

PNOC B

PX PETROLEUM

MINING AND OIL SECTOR TOTAL

VALUE :

297,710,904

PREFERRED

ABC PREF

FGEN PREF G

ABC

PBCP

ACPA

ACPR

DMCP

FGENF

FGENG

FPH PREF

FPHP

101

101.3

101

101

100.9

101

6,350

640,815

358,195

PCOR PREF

PPREF

108.2

109

109

109

108.2

108.2

73,810

7,998,859

PF PREF

PFP

SFIP

SMCP1

SMC2A

SMC2B

1,035

1.3

-

1,040

1.45

-

1,035

75

76.5

1,040

75

76.5

1,035

75

76.5

1,035

75

76.5

3,005

11,653,410

66,000

3,110,700

874,005,750

5,049,000

(346,520,250)

-

ABS HLDG PDR

SMC2C

BCP

ABSP

12.26

40.5

41.45

79

41

79

41.45

79

40.1

79

41.45

52,900

307,000

4,179,100

12,427,355

(6,535,385)

GMA HLDG PDR

GMAP

9.8

9.95

9.65

9.99

9.65

9.95

135,000

1,341,831

(121,584)

GLO PREF A

GLOPA

TLHH

PBC PREF

AC PREF A

AC PREF B

DMC PREF

FGEN PREF F

SFI PREF

SMC PREF 1

SMC PREF 2A

SMC PREF 2B

SMC PREF 2C

BC PREF A

TEL PREF HH

525

101.6

109.2

528

107.5

109.5

109.2

109.4

109.2

PREFERRED TOTAL

109.4

VOLUME :

12,297,775

300

VALUE :

908,786,210

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

IRC WARRANT

MEG WARRANT

MEG WARRANT 2

PLDT USD

IRW

MEGW1

0.05

2.7

2.75

2.66

2.75

2.65

2.75

386,000

1,025,220

MEGW2

DTEL

2.61

-

2.85

-

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

VOLUME :

386,000

VALUE :

1,025,220

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

RPL

9.1

10

9.88

9.88

9.88

9.88

100

988

MAKATI FINANCE

MFIN

2.51

4.65

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

100

1,821,915,665

VALUE :

VALUE :

988

10,102,290,595

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

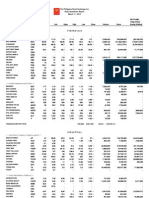

NO. OF ADVANCES:

53

NO. OF DECLINES:

98

NO. OF UNCHANGED:

46

NO. OF TRADED ISSUES: 197

NO. OF TRADES:

28305

BLOCK SALES

SECURITY

PRICE

TEL

2,965.4795

JFC

123.6777

URC

97.3041

JGS

39.8968

AT

22.7

VLL

5.35

VLL

5.35

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

VALUE

112,365 333,216,104.0175

245,000

30,301,036.5

345,000

33,569,914.5

2,408,400

96,087,453.12

2,000,000

45,400,000

22,400,000

119,840,000

4,666,000

24,963,100

150,446

186,171.09

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

221,015,763

3,862,998,546.92

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,809.25

9,930.77

5,943.63

2,767.35

1,978.19

21,512.19

6,753.29

4,214.07

1,809.38

9,973.46

5,948.1

2,769.3

1,978.55

21,514.91

6,753.77

4,214.07

1,775.86

9,862.97

5,853.74

2,728.63

1,944.28

21,195.04

6,647.82

4,159.51

1,782.41

9,972.01

5,894.68

2,750.13

1,954.26

21,506.61

6,694.71

4,183.3

-1.52

0.01

-1.09

-0.48

-2.04

-0.06

-1.21

-0.73

-27.5

1.34

-64.89

-13.31

-40.65

-13.87

-81.85

-30.77

17,989,911

137,284,355

116,039,095

377,423,614

566,736,224

638,769,577

1,358,775,489.3

2,893,300,465.75

2,443,356,499.68

2,102,528,252.2

1,644,757,193.22

343,135,486.09

100

988

1,854,242,876

Php

10,785,854,374.2375

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

Php 5,787,843,845.06

Php 7,198,274,876.58

Companies Under Suspension by the Exchange as of 03/14/2013

ACPR

- AC PREF B

ASIA

- ASIATRUST

CBC

- COSMOS

CMT

- SEACEM

EIBA

- EXPORT BANK

EIBB

- EXPORT BANK B

FC

- FIL ESTATE CORP

FYN

- FILSYN A

FYNB

- FILSYN B

GO

- GOTESCO LAND A

GOB

- GOTESCO LAND B

MAH

- METROALLIANCE A

MAHB

- METROALLIANCE B

MC

- MARSTEEL A

MCB

- MARSTEEL B

NXT

- NEXTSTAGE

PAL

- PAL HLDG

PBC

- PBCOM

PBCP

- PBC PREF

PEC

- PNOC A

PECB

- PNOC B

PHC

- PHILCOMSAT

PNC

- PNCC

SMB

- SAN MIGUEL BREW

SMP

- SAN MIGUEL PROP

MED

- MEDCO HLDG

PCP

- PICOP RES

PMT

- PRIMETOWN PROP

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2013

Name

PPC

PTT

STN

UW

ABC

TLHH

SMCP1

Symbol

-

Bid

PRYCE CORP

PTT CORP

STENIEL

UNIWIDE HLDG

ABC PREF

TEL PREF HH

- SMC PREF 1

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

Vous aimerez peut-être aussi

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesD'EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesPas encore d'évaluation

- Network by Paddy Chayefsky PDFDocument120 pagesNetwork by Paddy Chayefsky PDFannaknightley111Pas encore d'évaluation

- People As Media & People in MediaDocument14 pagesPeople As Media & People in MediaCath SalayPas encore d'évaluation

- Star Trek Chronology ProjectDocument17 pagesStar Trek Chronology ProjectVinícius Lemos50% (2)

- Screwvala, Ronnie - Dream With Your Eyes Open - An Entrepreneurial JourneyDocument192 pagesScrewvala, Ronnie - Dream With Your Eyes Open - An Entrepreneurial JourneyPrakhar JainPas encore d'évaluation

- Mass MarketingDocument21 pagesMass MarketingZahoor SoomroPas encore d'évaluation

- AdvertisingDocument49 pagesAdvertising03215076411saghirPas encore d'évaluation

- NETFLIXDocument13 pagesNETFLIXganesh chandraPas encore d'évaluation

- Torts and Damages Updated SyllabusDocument11 pagesTorts and Damages Updated SyllabusAngelica MariePas encore d'évaluation

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceD'EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissancePas encore d'évaluation

- Millionaire Traders: How Everyday People Are Beating Wall Street at Its Own GameD'EverandMillionaire Traders: How Everyday People Are Beating Wall Street at Its Own GameÉvaluation : 4 sur 5 étoiles4/5 (3)

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 06, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 08, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 22, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 09, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 29, 2013Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 29, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Paul JonesPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipPas encore d'évaluation

- Stockquotes 02062015Document8 pagesStockquotes 02062015srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipPas encore d'évaluation

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipPas encore d'évaluation

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipPas encore d'évaluation

- ECCODocument3 pagesECCOsrichardequipPas encore d'évaluation

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipPas encore d'évaluation

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipPas encore d'évaluation

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipPas encore d'évaluation

- October 2015: Sun Mon Tue Wed Thu Fri SatDocument1 pageOctober 2015: Sun Mon Tue Wed Thu Fri SatjPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipPas encore d'évaluation

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipPas encore d'évaluation

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipPas encore d'évaluation

- Stockquotes 04022013Document7 pagesStockquotes 04022013srichardequipPas encore d'évaluation

- Table 1 Marriage 2011Document1 pageTable 1 Marriage 2011srichardequipPas encore d'évaluation

- Chapter 07 SMDocument25 pagesChapter 07 SMTehniat HamzaPas encore d'évaluation

- 2GIG DBELL1 345 Install GuideDocument2 pages2GIG DBELL1 345 Install GuideAlarm Grid Home Security and Alarm MonitoringPas encore d'évaluation

- AP Media KitDocument16 pagesAP Media KitHannahPas encore d'évaluation

- C V - D G: Urriculum Itae Amian ILLDocument5 pagesC V - D G: Urriculum Itae Amian ILLDamian GillPas encore d'évaluation

- Statement of Account: Date IDR USD RemarkDocument8 pagesStatement of Account: Date IDR USD RemarkRickyFernandoPas encore d'évaluation

- Chordu Piano Chords Musikalisai Puisi Doa Karya Chairil Anwar MTSN 3 Kuningan 9 1 Chordsheet Id GNRYhk17VLcDocument2 pagesChordu Piano Chords Musikalisai Puisi Doa Karya Chairil Anwar MTSN 3 Kuningan 9 1 Chordsheet Id GNRYhk17VLcRatih Zata YumniPas encore d'évaluation

- The Importance of MediaDocument6 pagesThe Importance of Mediaelenapokea100% (1)

- At&tDocument4 pagesAt&tGeovanni GarciaPas encore d'évaluation

- Simulcast HistoriaDocument20 pagesSimulcast HistoriaRicardo Jose Sarmiento MejiasPas encore d'évaluation

- Radio and TV BroadcastingDocument13 pagesRadio and TV BroadcastingLean MiñonPas encore d'évaluation

- Ministry of Information and Communication TechnologyDocument27 pagesMinistry of Information and Communication TechnologyBeta TesterPas encore d'évaluation

- Broadcast News ProductionDocument7 pagesBroadcast News ProductionKidula JafferPas encore d'évaluation

- The Simpson Quotes 1Document23 pagesThe Simpson Quotes 1Soeghy AliePas encore d'évaluation

- Evervue USA Inc.'s Mirrorvue, A Vanishing Mirror TVDocument2 pagesEvervue USA Inc.'s Mirrorvue, A Vanishing Mirror TVPR.comPas encore d'évaluation

- Oct 14 - Bankole Sodipo - IP EnvironmentDocument9 pagesOct 14 - Bankole Sodipo - IP EnvironmentCFCNigeriaPas encore d'évaluation

- David Allen Rivera - Nowhere Man - The Complete Story of The Show That Was ErasedDocument315 pagesDavid Allen Rivera - Nowhere Man - The Complete Story of The Show That Was ErasedBig VeePas encore d'évaluation

- 1.samsung Electronics Success by Design PDFDocument20 pages1.samsung Electronics Success by Design PDFbalaganesh78100% (1)

- 2212business StudiesDocument12 pages2212business Studiesswetha sathyanath100% (1)

- Herzer RICO Shari RedstoneDocument65 pagesHerzer RICO Shari RedstonegmaddausPas encore d'évaluation

- A Project On VideoconDocument58 pagesA Project On VideoconKiran morePas encore d'évaluation

- Procesador de Puertos HDMI SiI9287 - DBDocument8 pagesProcesador de Puertos HDMI SiI9287 - DBAntonio ChavezPas encore d'évaluation

- Radio AdvertisingDocument127 pagesRadio AdvertisingGd_775% (4)