Académique Documents

Professionnel Documents

Culture Documents

Department of Labor: 2000-5500-Schedule-P-mp

Transféré par

USA_DepartmentOfLaborDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Department of Labor: 2000-5500-Schedule-P-mp

Transféré par

USA_DepartmentOfLaborDroits d'auteur :

Formats disponibles

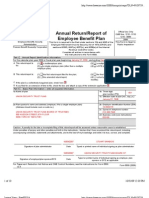

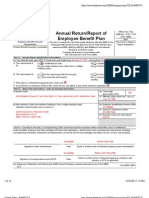

SCHEDULE P Annual Return of Fiduciary Official Use Only

(FORM 5500) of Employee Benefit Trust OMB No. 1210-0110

This schedule may be filed to satisfy the requirements under section 6033(a) for an

annual information return from every section 401(a) organization exempt from tax

under section 501(a).

2000

Filing this form will start the running of the statute of limitations under section

6501(a) for any trust described in section 401(a) that is exempt from tax under This Form is Open to

section 501(a). Public Inspection.

έ File as an attachment to Form 5500 or 5500-EZ.

Department of the Treasury

Internal Revenue Service

For trust calendar year 2000 or fiscal year beginning , and ending ,

1a Name of trustee or custodian

b Number, street, and room or suite no. (If a P.O. box, see the instructions for Form 5500 or 5500-EZ.)

c City or town, state, and ZIP code

2a Name of trust

b Trust's employer identification number

3 Name of plan if different from name of trust

4 Have you furnished the participating employee benefit plan(s) with the trust financial information required

to be reported by the plan(s)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

5 Enter the plan sponsor's employer identification number as shown on Form 5500

or 5500-EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . έ

Under penalties of perjury, I declare that I have examined this schedule, and to the best of my knowledge and belief it is true, correct, and

complete.

Signature of fiduciary έ Date έ

For Paperwork Reduction Act Notice and OMB Control Numbers, v3.2 Schedule P (Form 5500) 2000

see the instructions for Form 5500 or 5500-EZ.

2 6 0 0 0 0 0 1 0 9

Vous aimerez peut-être aussi

- US Internal Revenue Service: f5500sp - 1999Document1 pageUS Internal Revenue Service: f5500sp - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sp - 2000Document1 pageUS Internal Revenue Service: f5500sp - 2000IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sp - 1991Document1 pageUS Internal Revenue Service: f5500sp - 1991IRSPas encore d'évaluation

- US Internal Revenue Service: I5500sp - 2003Document1 pageUS Internal Revenue Service: I5500sp - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: I5500sp - 2004Document1 pageUS Internal Revenue Service: I5500sp - 2004IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sb - 2003Document7 pagesUS Internal Revenue Service: f5500sb - 2003IRSPas encore d'évaluation

- Carpenters Vacation Fund 2006Document14 pagesCarpenters Vacation Fund 2006Latisha WalkerPas encore d'évaluation

- Carpenters Welfare Fund 2006Document16 pagesCarpenters Welfare Fund 2006Latisha WalkerPas encore d'évaluation

- Carpenters Welfare Fund 2007Document18 pagesCarpenters Welfare Fund 2007Latisha WalkerPas encore d'évaluation

- Carpenters Annuity Fund 2006Document20 pagesCarpenters Annuity Fund 2006Latisha WalkerPas encore d'évaluation

- Carpenters Vacation Fund 2007Document8 pagesCarpenters Vacation Fund 2007Latisha WalkerPas encore d'évaluation

- Retirement & Pension Plan For NYCDCC Employees 2006Document13 pagesRetirement & Pension Plan For NYCDCC Employees 2006Latisha WalkerPas encore d'évaluation

- 2006 Form 5500 Carpenter Pension PlanDocument22 pages2006 Form 5500 Carpenter Pension PlanLatisha WalkerPas encore d'évaluation

- Carpenters Annuity Fund 2007Document19 pagesCarpenters Annuity Fund 2007Latisha WalkerPas encore d'évaluation

- Instructions For Schedule A (Form 990 or 990-EZ)Document10 pagesInstructions For Schedule A (Form 990 or 990-EZ)IRSPas encore d'évaluation

- Instructions For Form 990-EZ: Department of The TreasuryDocument16 pagesInstructions For Form 990-EZ: Department of The TreasuryIRSPas encore d'évaluation

- 2007 Form 5500 Carpenter Pension PlanDocument21 pages2007 Form 5500 Carpenter Pension PlanLatisha WalkerPas encore d'évaluation

- Kaiser Supplemental Savings and Retirement Plan Annual Report Form 5500Document37 pagesKaiser Supplemental Savings and Retirement Plan Annual Report Form 5500James LindonPas encore d'évaluation

- Union Security Trust Fund 2006Document10 pagesUnion Security Trust Fund 2006Latisha WalkerPas encore d'évaluation

- US Internal Revenue Service: f5500sb - 1999Document8 pagesUS Internal Revenue Service: f5500sb - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 2003Document2 pagesUS Internal Revenue Service: f5500sr - 2003IRSPas encore d'évaluation

- Union Security Trust Fund 2007Document10 pagesUnion Security Trust Fund 2007Latisha WalkerPas encore d'évaluation

- Retirement & Pension Plan For NYCDCC Employees 2007Document13 pagesRetirement & Pension Plan For NYCDCC Employees 2007Latisha WalkerPas encore d'évaluation

- Short Form Return of Organization Exempt From Income TaxDocument16 pagesShort Form Return of Organization Exempt From Income TaxHalosPas encore d'évaluation

- Retirement Plan of Trustees 2006Document13 pagesRetirement Plan of Trustees 2006Latisha WalkerPas encore d'évaluation

- Retirement Plan of Trustees 2007Document14 pagesRetirement Plan of Trustees 2007Latisha WalkerPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 2001Document2 pagesUS Internal Revenue Service: f5500sr - 2001IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sf - 1997Document1 pageUS Internal Revenue Service: f5500sf - 1997IRSPas encore d'évaluation

- Military Family Advisory Network Tax Return 2015-12-31Document17 pagesMilitary Family Advisory Network Tax Return 2015-12-31Military Family Advisory NetworkPas encore d'évaluation

- US Internal Revenue Service: I990sa - 1998Document8 pagesUS Internal Revenue Service: I990sa - 1998IRSPas encore d'évaluation

- US Internal Revenue Service: f5500 - 2001Document4 pagesUS Internal Revenue Service: f5500 - 2001IRSPas encore d'évaluation

- Resolve 990 Federal Financial Disclosure - 2009Document13 pagesResolve 990 Federal Financial Disclosure - 2009ResolvePas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument4 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDocument8 pagesInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSPas encore d'évaluation

- US Internal Revenue Service: F5500se - 1999Document3 pagesUS Internal Revenue Service: F5500se - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: f5500 - 2002Document6 pagesUS Internal Revenue Service: f5500 - 2002IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 2000Document2 pagesUS Internal Revenue Service: f5500sr - 2000IRSPas encore d'évaluation

- Change To 2003 Instructions For Form 1099-R and 5498-Guide To Distribution Codes (Box 7)Document16 pagesChange To 2003 Instructions For Form 1099-R and 5498-Guide To Distribution Codes (Box 7)IRSPas encore d'évaluation

- J1 WCIJ Form990 Tax Return 2009Document14 pagesJ1 WCIJ Form990 Tax Return 2009jlabinternPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument7 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- Instructions For Schedule A (Form 990) : Internal Revenue ServiceDocument8 pagesInstructions For Schedule A (Form 990) : Internal Revenue ServiceIRSPas encore d'évaluation

- US Internal Revenue Service: f5500sr - 1999Document2 pagesUS Internal Revenue Service: f5500sr - 1999IRSPas encore d'évaluation

- US Internal Revenue Service: I1099r 06Document15 pagesUS Internal Revenue Service: I1099r 06IRSPas encore d'évaluation

- Return of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustDocument15 pagesReturn of Private Foundation or Section 49 A7 @) (11 Nonexempt Charitable TrustalavifoundationPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument8 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- US Internal Revenue Service: I1040sf - 2004Document6 pagesUS Internal Revenue Service: I1040sf - 2004IRSPas encore d'évaluation

- US Internal Revenue Service: I5500sb - 2005Document9 pagesUS Internal Revenue Service: I5500sb - 2005IRSPas encore d'évaluation

- Part IV. Items of General Interest: Elimination of Schedule P of Form 5500 Series Announcement 2007-63Document1 pagePart IV. Items of General Interest: Elimination of Schedule P of Form 5500 Series Announcement 2007-63IRSPas encore d'évaluation

- Exempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )Document16 pagesExempt Organization Business Income Tax Return 990-T: (And Proxy Tax Under Section 6033 (E) )greenwellPas encore d'évaluation

- l111l l11l I L, 111I: Lil LilDocument26 pagesl111l l11l I L, 111I: Lil Lilcmf8926Pas encore d'évaluation

- US Internal Revenue Service: I1040sf - 2003Document6 pagesUS Internal Revenue Service: I1040sf - 2003IRSPas encore d'évaluation

- US Internal Revenue Service: I5500sb - 2004Document9 pagesUS Internal Revenue Service: I5500sb - 2004IRSPas encore d'évaluation

- US Internal Revenue Service: f5500sb - 1994Document3 pagesUS Internal Revenue Service: f5500sb - 1994IRSPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument4 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- Belastingaangifte Bill & Melinda Gates FoundationDocument98 pagesBelastingaangifte Bill & Melinda Gates FoundationDe MorgenPas encore d'évaluation

- US Internal Revenue Service: rr-03-88Document3 pagesUS Internal Revenue Service: rr-03-88IRSPas encore d'évaluation

- Application For Determination of Employee Stock Ownership PlanDocument2 pagesApplication For Determination of Employee Stock Ownership PlanIRSPas encore d'évaluation

- 990 SBH 2016 Public Disclosure PDFDocument55 pages990 SBH 2016 Public Disclosure PDFAl FalackPas encore d'évaluation

- Attention:: WWW - Efast.dol - GovDocument5 pagesAttention:: WWW - Efast.dol - GovIRSPas encore d'évaluation

- Instructions ITR5 AY2021 22Document196 pagesInstructions ITR5 AY2021 22Partha Pratim BiswasPas encore d'évaluation

- Department of Labor: Generalprovision 6 28 07Document6 pagesDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Dst-Aces-Cps-V20040617Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040617USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Dst-Aces-Cps-V20040123Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040123USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Stop1sticker6Document1 pageDepartment of Labor: Stop1sticker6USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: ForkliftstickerDocument1 pageDepartment of Labor: ForkliftstickerUSA_DepartmentOfLaborPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: Aces CPDocument36 pagesDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- Department of Labor: Stop2stickerDocument1 pageDepartment of Labor: Stop2stickerUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: YouthworkerDocument1 pageDepartment of Labor: YouthworkerUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Stop2sticker6Document1 pageDepartment of Labor: Stop2sticker6USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Stop1stickerDocument1 pageDepartment of Labor: Stop1stickerUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: 20040422 YouthrulesDocument1 pageDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: YouthRulesBrochureDocument12 pagesDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Forkliftsticker6Document1 pageDepartment of Labor: Forkliftsticker6USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 8x11 2Document1 pageDepartment of Labor: JYMP 8x11 2USA_DepartmentOfLaborPas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: BookmarkDocument2 pagesDepartment of Labor: BookmarkUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Final ReportDocument37 pagesDepartment of Labor: Final ReportUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Niosh Letter FinalDocument3 pagesDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: ln61003Document2 pagesDepartment of Labor: ln61003USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: Niosh Recs To Dol 050302Document198 pagesDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: LindseyDocument1 pageDepartment of Labor: LindseyUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 8x11 3Document1 pageDepartment of Labor: JYMP 8x11 3USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: KonstaDocument1 pageDepartment of Labor: KonstaUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 11x17 3Document1 pageDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: YouthConstructDocument1 pageDepartment of Labor: YouthConstructUSA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 11x17 2Document1 pageDepartment of Labor: JYMP 11x17 2USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 8x11 1Document1 pageDepartment of Labor: JYMP 8x11 1USA_DepartmentOfLaborPas encore d'évaluation

- Department of Labor: JYMP 11x17 1Document1 pageDepartment of Labor: JYMP 11x17 1USA_DepartmentOfLaborPas encore d'évaluation