Académique Documents

Professionnel Documents

Culture Documents

Betawacc

Transféré par

amro_bary0 évaluation0% ont trouvé ce document utile (0 vote)

61 vues1 pageTitre original

betawacc

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

XLS, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

61 vues1 pageBetawacc

Transféré par

amro_baryDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

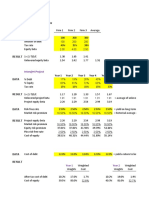

ESTIMATING THE WEIGHTED AVERAGE COST OF CAPITAL

Input cells are in yellow.

Comparable Companies

Firm 1 Firm 2 Firm 3 Average

DATA Amount of equity 200 200 300

Amount of debt 100 200 200

Tax rate 40% 35% 38%

Equity beta 1.10 1.25 0.90

RESULT 1+ (1-T)D/E 1.30 1.65 1.41

Unlevered equity beta 0.85 0.76 0.64 0.75

Project or Acquisition

DATA % Debt 40%

% Equity 60%

Tax rate 40%

RESULT 1+ (1-T)D/E 1.40

Unlevered project beta 0.75 = average of unlevered equity betas of comparable firms

Project equity beta 1.05

DATA Risk-free rate 6.00% = yield on long-term Treasury bonds

Market risk premium 7.40% = historical average excess return of S&P 500

RESULT Project equity beta 1.05

Market risk premium 7.40%

Equity risk premium 7.74%

Plus risk-free rate 6.00%

Cost of equity 13.74%

Note: The estimate of the market risk premium is the arithmetic average from 1927-1997, based on

the Ibbotson Associates "Stocks, Bonds, Bills and Inflation" data.

DATA Cost of debt 9.0%

RESULT Weighted

Weights Cost

After-tax cost of debt 5.4% 40.0% 2.2%

Cost of equity 13.7% 60.0% 8.2%

Weighted average cost of capital 10.4%

Vous aimerez peut-être aussi

- Estimating WACC using comparable companiesDocument1 pageEstimating WACC using comparable companiesgraskoskirPas encore d'évaluation

- BetawaccDocument1 pageBetawaccNabarun BhattacharyaPas encore d'évaluation

- Estimating WACC using comparable companiesDocument1 pageEstimating WACC using comparable companiesmspanskiPas encore d'évaluation

- BetawaccDocument1 pageBetawaccwelcome2junglePas encore d'évaluation

- BetawaccDocument1 pageBetawaccRajesh KatyalPas encore d'évaluation

- BetawaccDocument1 pageBetawaccMuhammad Ahsan MukhtarPas encore d'évaluation

- BetawaccDocument1 pageBetawaccOmar GhaniPas encore d'évaluation

- betawaccDocument1 pagebetawaccSachin KulkarniPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesShubham SharmaPas encore d'évaluation

- betawaccDocument1 pagebetawaccDj (Dj)Pas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesSaadatPas encore d'évaluation

- PrivatecompanywaccDocument1 pagePrivatecompanywacckunaltiwari81Pas encore d'évaluation

- Food Distribution LBO Deleverage AnalysisDocument12 pagesFood Distribution LBO Deleverage AnalysismartinsiklPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesMd Rakibul HasanPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesAndhika Artha PrayudhaPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesMd Rakibul HasanPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesNabilPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesTalha ImtiazPas encore d'évaluation

- SFGSDFDocument1 pageSFGSDFCamille CaramanzanaPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesvinayakgundaPas encore d'évaluation

- Calculate WACC for Project Using Comparable Firm BetasDocument1 pageCalculate WACC for Project Using Comparable Firm BetasEdi SaputraPas encore d'évaluation

- Campus Deli Case 4Document15 pagesCampus Deli Case 4Ash RamirezPas encore d'évaluation

- WACC CalculatorDocument11 pagesWACC CalculatorshountyPas encore d'évaluation

- Comparable Companies: Inter@rt ProjectDocument9 pagesComparable Companies: Inter@rt ProjectVincenzo AlterioPas encore d'évaluation

- RiskpracDocument4 pagesRiskpracveda20Pas encore d'évaluation

- PvtdiscrateDocument4 pagesPvtdiscrateapi-3763138Pas encore d'évaluation

- w6 - Cost of Capital - Capital StructureDocument3 pagesw6 - Cost of Capital - Capital StructureMooqyPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesAbhinav SharmaPas encore d'évaluation

- BetawaccDocument1 pageBetawaccAndera PararinoPas encore d'évaluation

- Copia de BetawaccDocument1 pageCopia de BetawaccDamaris ChavezPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesAlberto FloresPas encore d'évaluation

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesDwinanda SeptiadhiPas encore d'évaluation

- Valuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsDocument89 pagesValuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsJames MitchellPas encore d'évaluation

- CF Assignment 2 Group 9Document35 pagesCF Assignment 2 Group 9rishabh tyagiPas encore d'évaluation

- Capital Structure and Leverage (D. Bañas)Document6 pagesCapital Structure and Leverage (D. Bañas)DAISYBELLE S. BAÑASPas encore d'évaluation

- 2 CorpDocument40 pages2 CorpMR MARWANE OFFICIELPas encore d'évaluation

- DF1 601 Individual AssignmentDocument5 pagesDF1 601 Individual AssignmentIan KipropPas encore d'évaluation

- Optimal Capital Structure Lecture NotesDocument8 pagesOptimal Capital Structure Lecture NotesMohamed HamedPas encore d'évaluation

- Capital Structure: Debt To Total Capitalization Equity To Total CapitalizationDocument2 pagesCapital Structure: Debt To Total Capitalization Equity To Total CapitalizationAcxel Andres AltuvePas encore d'évaluation

- DCF Valuation TemplateDocument15 pagesDCF Valuation TemplateDEV DUTT VASHIST 22111116Pas encore d'évaluation

- WACC Calculation Comparable Companies Unlevered Beta Capital StructureDocument1 pageWACC Calculation Comparable Companies Unlevered Beta Capital StructureIkramPas encore d'évaluation

- Shapiro CHAPTER 6 SolutionsDocument10 pagesShapiro CHAPTER 6 SolutionsjzdoogPas encore d'évaluation

- A B19049 Assignment 3Document9 pagesA B19049 Assignment 3Shrey BhalaPas encore d'évaluation

- Cost of Capital Wacc UpdatedDocument46 pagesCost of Capital Wacc UpdatedDEBAPRIYA SARKARPas encore d'évaluation

- Ueht3 2021 - Finc3015 - Trần Hữu Phước - 20448989.Document8 pagesUeht3 2021 - Finc3015 - Trần Hữu Phước - 20448989.phuoc.tran23006297Pas encore d'évaluation

- ABC Company, Inc. Recapitalization AnalysisDocument10 pagesABC Company, Inc. Recapitalization AnalysisMarcPas encore d'évaluation

- Corporate Finance Cost of Capital: Dr. Avinash Ghalke, CFADocument20 pagesCorporate Finance Cost of Capital: Dr. Avinash Ghalke, CFAmansi agrawalPas encore d'évaluation

- CH 4 - in ClassDocument3 pagesCH 4 - in ClassJOSEPH MICHAEL MCGUINNESSPas encore d'évaluation

- P07A - Cost of CapitalDocument3 pagesP07A - Cost of CapitalL1588AshishPas encore d'évaluation

- Weighted Average Cost of Capital CalculationDocument9 pagesWeighted Average Cost of Capital CalculationinoocentkillerPas encore d'évaluation

- Case 5Document26 pagesCase 5ibrahim ahmedPas encore d'évaluation

- Tutorial - 1: Corporate Finance (Sec E & F)Document16 pagesTutorial - 1: Corporate Finance (Sec E & F)Vivekananda RPas encore d'évaluation

- Firm's Capital Structure and Leverage AnalysisDocument9 pagesFirm's Capital Structure and Leverage AnalysisMariel GarraPas encore d'évaluation

- Start File DCF ExerciseDocument13 pagesStart File DCF ExerciseshashankPas encore d'évaluation

- Equity Valuation Project: GroupDocument20 pagesEquity Valuation Project: Groupsushilgoyal86100% (1)

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaPas encore d'évaluation

- Easy Northern Forest Products 90 Copy of 0 324 53131 1 Case 90DIRDocument5 pagesEasy Northern Forest Products 90 Copy of 0 324 53131 1 Case 90DIRPhạm Hà DươngPas encore d'évaluation

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersD'EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersPas encore d'évaluation

- Fcfe Stable Growth ModelDocument5 pagesFcfe Stable Growth Modelapi-3763138Pas encore d'évaluation

- Cfroi HoltDocument7 pagesCfroi Holtamro_baryPas encore d'évaluation

- Microsoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)Document5 pagesMicrosoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)amro_baryPas encore d'évaluation

- Fcfe 3 STDocument16 pagesFcfe 3 STapi-3763138Pas encore d'évaluation

- Cash Flow MatrixDocument5 pagesCash Flow Matrixamro_baryPas encore d'évaluation

- Risk AnalysisDocument2 pagesRisk AnalysisGlenn JareckiPas encore d'évaluation

- Estimating TemplateDocument53 pagesEstimating Templateamro_bary67% (3)

- Two Stage FCFE Discount ModelDocument21 pagesTwo Stage FCFE Discount Modelamro_baryPas encore d'évaluation

- Cash GapDocument4 pagesCash Gapamro_baryPas encore d'évaluation

- Equity Analysis of A Project: Capital Budgeting WorksheetDocument8 pagesEquity Analysis of A Project: Capital Budgeting WorksheetanuradhaPas encore d'évaluation

- Capital StructureDocument2 pagesCapital StructureAmitMittalPas encore d'évaluation

- JumpdiffDocument16 pagesJumpdiffamro_baryPas encore d'évaluation

- Collateral Damage: A Source of Systematic Credit RiskDocument15 pagesCollateral Damage: A Source of Systematic Credit Riskamro_baryPas encore d'évaluation

- MfinanceDocument32 pagesMfinanceamro_baryPas encore d'évaluation