Académique Documents

Professionnel Documents

Culture Documents

Symptoms

Transféré par

Imran MobinDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Symptoms

Transféré par

Imran MobinDroits d'auteur :

Formats disponibles

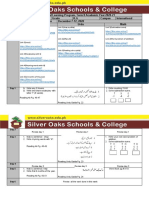

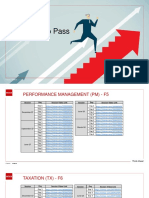

KAPLAN EXAM TIPS FOR ACCA P6 P6 ADVANCED TAXATION Corporation tax Loan relationship rules Group relief tax

ax planning; consortium relief, company losses Capital allowances with AIA Expansion overseas: branch vs. subsidiary CFCs Double tax relief: WHT and ULT Research and development Takeovers: pre acquisition trading and capital losses Close companies Capital gains tax Reliefs: incorporation relief, Entrepreneurs' relief, gift relief Capital gains groups Share takeovers or reorganisations Inheritance tax Estate computations Business property relief Planning Income tax Overseas aspects for employees Sole trader/partnerships cessation, with planning, possibly losses Benefits: car, loan, accommodation, share schemes VAT Land and buildings, including capital goods scheme VAT groups Partial exemption Overseas aspects Scenarios Lease vs. buy assets: net cost Incorporation: all aspects (IT, NICs, CGT, VAT, stamp duty) Badges of trade: IT vs. CGT Employee vs. partner CGT vs. IHT for lifetime gifts

Ethics! P6 IHT with the death estate including BPR, APR and valuation rules. Transfer of unused nil rate band between spouses. Changing the will after a person is dead. Instalment option for paying IHT. A big company question regarding a company selling its trade and assets. Controlled foreign companies and transfer pricing. Sole trader starting to trade with opening year rules, choice of accounting date, capital allowances and maybe trading losses at the beginning of the trading cycle. Maybe Rules for personal service companies Incorporation of a business including incorporation relief and the election to transfer plant and machinery at TWDV. Self assessment for individuals, consequences of filing the tax return late and paying the balancing payment late. Ethics and deliberate tax defaulters

F7 Q1:CSFP or CIS with associates and contingent or deferred consideration; or CSFP plus CIS without Assoc. Q2:Redrafting published accounts; or normal Published, both with 15 marks on standards. Q3:Interpretation and/or cash flow, with 5 marks on standards. Q4:Mixed standards and concepts, eg financial instruments, non-current assets, contracts, deferred tax, discontinued operati Q5:Mixed standards, eg substance, EPS, leasing, accounting policy changes, intangibles

x, discontinued operations.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Math Grade 5 Ex 2 - 3 (A) - Ex 2 - 3 (B) Recording CommDocument10 pagesMath Grade 5 Ex 2 - 3 (A) - Ex 2 - 3 (B) Recording CommImran MobinPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Black ScholesDocument41 pagesBlack ScholesImran MobinPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- OVLP Term II Grade K - G Cycle 2 (Week 3) (December 7 12. 2020) International CampusesDocument4 pagesOVLP Term II Grade K - G Cycle 2 (Week 3) (December 7 12. 2020) International CampusesImran MobinPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- R27.P1.T4.Hull Ch19 Greek Letters v5Document40 pagesR27.P1.T4.Hull Ch19 Greek Letters v5Imran MobinPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- P1.T4.Valuation & Risk Models Chapter 16. Option Sensitivity Measures: The "Greeks" Bionic Turtle FRM Study NotesDocument24 pagesP1.T4.Valuation & Risk Models Chapter 16. Option Sensitivity Measures: The "Greeks" Bionic Turtle FRM Study NotesImran MobinPas encore d'évaluation

- FRM I 2016 - VaR Quiz 6 - NewDocument8 pagesFRM I 2016 - VaR Quiz 6 - NewImran MobinPas encore d'évaluation

- TVM - Practice QuestionsDocument66 pagesTVM - Practice QuestionsImran MobinPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- FRM I 2016 - VaR Quiz 2 - NewDocument9 pagesFRM I 2016 - VaR Quiz 2 - NewImran MobinPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- FRM I 2016 - VaR Quiz 3 - NewDocument9 pagesFRM I 2016 - VaR Quiz 3 - NewImran MobinPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- FRM I 2016 - VaR Quiz 4 - NewDocument9 pagesFRM I 2016 - VaR Quiz 4 - NewImran MobinPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- FRM I 2016 - VaR Quiz 7 - NewDocument8 pagesFRM I 2016 - VaR Quiz 7 - NewImran MobinPas encore d'évaluation

- FRM I 2016 - VaR Quiz 1 - NewDocument8 pagesFRM I 2016 - VaR Quiz 1 - NewImran MobinPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Day Plan P7 LRDocument2 pagesDay Plan P7 LRImran MobinPas encore d'évaluation

- SBLDocument3 pagesSBLImran MobinPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- MM-Quantitative Analysis V1Document11 pagesMM-Quantitative Analysis V1Imran MobinPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- © Edupristine For Quantitative Analysis-I (2016)Document56 pages© Edupristine For Quantitative Analysis-I (2016)Imran MobinPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- MM Foundation of Risk Management V1Document12 pagesMM Foundation of Risk Management V1Imran MobinPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- ExP ACCA SBR 19 v101Document48 pagesExP ACCA SBR 19 v101Imran Mobin100% (4)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- MM Financial Market and Products V1Document23 pagesMM Financial Market and Products V1Imran MobinPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Prepare To Pass VideosDocument13 pagesPrepare To Pass VideosImran Mobin100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- FTN's of Government Departments As EmployersDocument19 pagesFTN's of Government Departments As Employersabidsajjad50% (2)

- P7 Standards FBDocument142 pagesP7 Standards FBImran MobinPas encore d'évaluation

- Ias 23Document2 pagesIas 23Imran MobinPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)