Académique Documents

Professionnel Documents

Culture Documents

Mba3 Sapm De09

Transféré par

sogatTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mba3 Sapm De09

Transféré par

sogatDroits d'auteur :

Formats disponibles

Roll No. ................:..... Total No.

of Questions : 071

,^y1,*1/\/ all*uJfeth

4,7A^.t (Wul

No' of Pages: 02

MBA (sem. -r3,a14tnlJ

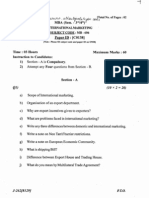

SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT SUBJECTCODE : MB - 921(2K8 Batch) PaperID : [C01571

[Note : Please lill subject code and paper ID on OMRI

Time : 03 Hours Maximum Marks : 60 Instructionto Candidates: - A is Compulsory. 1) Section - B. 2) AttemptanyFour questions from Section -A Section QI) a) b) c) d) e) 0 g) h) i) j) What is a firm? What areliquidity ratios? Whatis DOW theory? What is a bearish market? Whatis meant by options? Whatis badlatransaction? What areFIIs? Whatis dollarcostaveraging? What is bar charting? Whatarevolumeindicators?

P,TO.

(10x2:20)

J-884[8129]

-B Section (4x10=40) opportunitycan be How an investment opportunity? Q2) What is investment identified? Give its classification. Q3) What is an industry? Q4) What is the theoryof randomwalk? How is it differentfrom fundamental analysis? Q5) What is portfolio risk?How is it determined? in a free Whatis the role of derivatives of derivatives? Q6) What is the concept market? between futuresandoptions? Differentiate Q7) What is meantby options?

++++

J-884

Vous aimerez peut-être aussi

- Mba3 Im Dec09Document2 pagesMba3 Im Dec09karawat23Pas encore d'évaluation

- MBA (Sem. - 1") Managerial Economics Sub - Iect Code: Mb-1O5 Paper ID: (CO105)Document2 pagesMBA (Sem. - 1") Managerial Economics Sub - Iect Code: Mb-1O5 Paper ID: (CO105)Surbhi SofatPas encore d'évaluation

- Paper ID (MB105) : T"j'i ) Ti. 9q S q-1&r. 4 Gor - ComDocument2 pagesPaper ID (MB105) : T"j'i ) Ti. 9q S q-1&r. 4 Gor - ComSurbhi SofatPas encore d'évaluation

- Paper ID: (C0110) : Financialmanagement Subject Code: MB - 205Document2 pagesPaper ID: (C0110) : Financialmanagement Subject Code: MB - 205suchjazzPas encore d'évaluation

- Paper ID (MB, 6221: MBA (Sem. - 3'ul4'n7Document2 pagesPaper ID (MB, 6221: MBA (Sem. - 3'ul4'n7Surbhi SofatPas encore d'évaluation

- Mba 512Document2 pagesMba 512api-3782519Pas encore d'évaluation

- Mba1 Me Dec07Document2 pagesMba1 Me Dec07Surbhi SofatPas encore d'évaluation

- Mba4 WCM May09Document2 pagesMba4 WCM May09Archana BhattacharjeePas encore d'évaluation

- CB 1Document2 pagesCB 1Avadhesh ChundawatPas encore d'évaluation

- Mba S'Ol+'F Seme - Ster-21 25: Rollno...... Total No. of Questions:7Document4 pagesMba S'Ol+'F Seme - Ster-21 25: Rollno...... Total No. of Questions:7Surbhi SofatPas encore d'évaluation

- Mba 506Document2 pagesMba 506api-3782519Pas encore d'évaluation

- Mba3 Od Dec09Document2 pagesMba3 Od Dec09ashish kanwarPas encore d'évaluation

- Mba1 Afm Dec09Document2 pagesMba1 Afm Dec09kamalsodhi24Pas encore d'évaluation

- Mba4 SM May09Document2 pagesMba4 SM May09ashish kanwarPas encore d'évaluation

- Roll No. Total No. of Questions: 071 (Total No. of Pages: 02 TZ T LR) Alltuhoo&A1Au - LervtDocument2 pagesRoll No. Total No. of Questions: 071 (Total No. of Pages: 02 TZ T LR) Alltuhoo&A1Au - Lervtashish kanwarPas encore d'évaluation

- Financial ServicesDocument2 pagesFinancial Servicesannugautam1902Pas encore d'évaluation

- Bba 702Document2 pagesBba 702api-3782519Pas encore d'évaluation

- Paper ID: 1, (0316l: Roll No. Total No. of Questions: 091Document2 pagesPaper ID: 1, (0316l: Roll No. Total No. of Questions: 091adeepadeepPas encore d'évaluation

- Bba 5 Sem Dec 2019Document17 pagesBba 5 Sem Dec 2019Tanmay SinghPas encore d'évaluation

- BBM IbDocument92 pagesBBM Ibಮಂಜುನಾಥ ರಥPas encore d'évaluation

- Me 1Document2 pagesMe 1vijay_kankanePas encore d'évaluation

- Bba 5th Sem Dec 2018Document13 pagesBba 5th Sem Dec 20188bhgp7bkjsPas encore d'évaluation

- Finance MbaDocument2 pagesFinance MbaShAdab KhAnPas encore d'évaluation

- Paper ID (B0205) : MBA/PGDBM (105) (S05) (O) (Sem. - 1) Managerial EconomicsDocument2 pagesPaper ID (B0205) : MBA/PGDBM (105) (S05) (O) (Sem. - 1) Managerial EconomicsDeep NarayanPas encore d'évaluation

- Paper Id: (A04801: Rotl No. Total No" of Questions: 091 Ttotal No. of Pages: 02 4,,1R, 1Vt 6Ll+Avtdt4,7'Tu CCR"'Document2 pagesPaper Id: (A04801: Rotl No. Total No" of Questions: 091 Ttotal No. of Pages: 02 4,,1R, 1Vt 6Ll+Avtdt4,7'Tu CCR"'ravinder_sandhu_1Pas encore d'évaluation

- QI) e o X 2 - 2 0) : Roll No. Total No. of Questions: 091 (Total No. of Pages: 02Document2 pagesQI) e o X 2 - 2 0) : Roll No. Total No. of Questions: 091 (Total No. of Pages: 02ravinder_sandhu_1Pas encore d'évaluation

- Roll No. Total No. of Questions: 071 (Total No. of Pages: 02 MBA (Sem. - 3rd/4th)Document2 pagesRoll No. Total No. of Questions: 071 (Total No. of Pages: 02 MBA (Sem. - 3rd/4th)neha21021990Pas encore d'évaluation

- Paper ID: (C01691: Organisational Be Havtour Subject Code: MB - 102 (2K9)Document2 pagesPaper ID: (C01691: Organisational Be Havtour Subject Code: MB - 102 (2K9)Surbhi SofatPas encore d'évaluation

- Paper (B0101) : Marks: 75Document16 pagesPaper (B0101) : Marks: 75edudivyaPas encore d'évaluation

- Mba2 FM May08Document2 pagesMba2 FM May08ambystarPas encore d'évaluation

- (A Division of Achievers Academy) Sub: - Ib DATE: - 11/03/15 Time: - 2 Hrs MARKS: 75Document2 pages(A Division of Achievers Academy) Sub: - Ib DATE: - 11/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniPas encore d'évaluation

- PM 4Document2 pagesPM 4balajieducationsocietyPas encore d'évaluation

- (WWW - Entrance-Exam - Net) - PTU B. Pharma 7th Sem.-Pharmaceutical Industrial Management Sample Paper 3 PDFDocument2 pages(WWW - Entrance-Exam - Net) - PTU B. Pharma 7th Sem.-Pharmaceutical Industrial Management Sample Paper 3 PDFRahim KhanPas encore d'évaluation

- Mba4 Mbfi May08Document2 pagesMba4 Mbfi May08Jagjeet SinghPas encore d'évaluation

- Paper ID (A04581: B.Tech. (Sem. - 4'h)Document2 pagesPaper ID (A04581: B.Tech. (Sem. - 4'h)Vijay SamyalPas encore d'évaluation

- BCA (Sem.Y3'a V: Total No. of Questions: 071Document2 pagesBCA (Sem.Y3'a V: Total No. of Questions: 071Jazz VirakPas encore d'évaluation

- CS de 23 - 1556081005Document2 pagesCS de 23 - 1556081005Mohit AngariaPas encore d'évaluation

- Cs 3Document2 pagesCs 3Bhaskar ChutiaPas encore d'évaluation

- Mba 105Document2 pagesMba 105api-3782519Pas encore d'évaluation

- (A Division of Achievers Academy) Sub: - Ib DATE: - 31/03/15 Time: - 2 Hrs MARKS: 75Document1 page(A Division of Achievers Academy) Sub: - Ib DATE: - 31/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniPas encore d'évaluation

- Pape-R ID: (C0101) : F R L 6 8 6 F TsselDocument2 pagesPape-R ID: (C0101) : F R L 6 8 6 F TsselSurbhi SofatPas encore d'évaluation

- BCA (Serfi.-1.t) U: Roll No. Total No. of Questions: 071 (Total No. of Pages: 02 ('t3+ 3ze Al I Su/7 - Eet-R 4ycc, @taDocument2 pagesBCA (Serfi.-1.t) U: Roll No. Total No. of Questions: 071 (Total No. of Pages: 02 ('t3+ 3ze Al I Su/7 - Eet-R 4ycc, @taBasant SinghPas encore d'évaluation

- Sa 1 0707Document20 pagesSa 1 0707api-3749988Pas encore d'évaluation

- Mba 546Document2 pagesMba 546api-3782519Pas encore d'évaluation

- Mba 516Document2 pagesMba 516api-3782519Pas encore d'évaluation

- Paper ID (C022ll: Roll No. Total No. of Questions: 071 (Total No. of Pages: 02Document2 pagesPaper ID (C022ll: Roll No. Total No. of Questions: 071 (Total No. of Pages: 02Surbhi SofatPas encore d'évaluation

- PTU DDE BBA Finance International Finance Exam - Paper2Document3 pagesPTU DDE BBA Finance International Finance Exam - Paper2Gaurav SehgalPas encore d'évaluation

- KKKKDocument2 pagesKKKKGURJARPas encore d'évaluation

- Mba 517Document2 pagesMba 517api-3782519Pas encore d'évaluation

- MBA/M-l7: Analysis ManagementDocument2 pagesMBA/M-l7: Analysis ManagementGURJARPas encore d'évaluation

- Mba4 CBPM May09Document2 pagesMba4 CBPM May09ombhattPas encore d'évaluation

- Bba 801Document2 pagesBba 801api-3782519Pas encore d'évaluation

- (4870) - 3015 M.B.A. International Business Mgt. Spl. 306 (IB) - Export Documentation and Procedure (2013 Pattern) (Semester - III)Document1 page(4870) - 3015 M.B.A. International Business Mgt. Spl. 306 (IB) - Export Documentation and Procedure (2013 Pattern) (Semester - III)Jiya LelePas encore d'évaluation

- Common Mba PapersDocument5 pagesCommon Mba PapersedudivyaPas encore d'évaluation

- Electrical EngineeringDocument2 pagesElectrical EngineeringDivyam RajPas encore d'évaluation

- Mca 103Document2 pagesMca 103kola0123Pas encore d'évaluation

- Master of Arts (ECONOMICS) (MEC) Term-End Examination December, 2021Document4 pagesMaster of Arts (ECONOMICS) (MEC) Term-End Examination December, 2021rahul ranjan pratap singhPas encore d'évaluation

- Mb-627 (Theory) Id Co143Document2 pagesMb-627 (Theory) Id Co143sukhwinderPas encore d'évaluation

- M Com Ist Sem Dec 2018Document14 pagesM Com Ist Sem Dec 2018pritishPas encore d'évaluation

- Khaman Dhokla Recipe CardDocument2 pagesKhaman Dhokla Recipe CardSurbhi SofatPas encore d'évaluation

- Current Chief Ministers in IndiaDocument1 pageCurrent Chief Ministers in IndiaSurbhi SofatPas encore d'évaluation

- Account Share CapitalDocument13 pagesAccount Share CapitalSurbhi SofatPas encore d'évaluation

- International: Labour OrganizationDocument37 pagesInternational: Labour OrganizationSurbhi SofatPas encore d'évaluation

- International Labour OrganisationDocument12 pagesInternational Labour OrganisationSurbhi SofatPas encore d'évaluation

- Paper ID: (C01691: Organisational Be Havtour Subject Code: MB - 102 (2K9)Document2 pagesPaper ID: (C01691: Organisational Be Havtour Subject Code: MB - 102 (2K9)Surbhi SofatPas encore d'évaluation

- Pape-R ID: (C0101) : F R L 6 8 6 F TsselDocument2 pagesPape-R ID: (C0101) : F R L 6 8 6 F TsselSurbhi SofatPas encore d'évaluation

- Businmss Laws - Ii Siibtect Code: BB - 4M " Paper ID I lc022llDocument2 pagesBusinmss Laws - Ii Siibtect Code: BB - 4M " Paper ID I lc022llSurbhi SofatPas encore d'évaluation

- Issues in Consultant Client Relationship1Document25 pagesIssues in Consultant Client Relationship1Surbhi SofatPas encore d'évaluation

- Papcr Id: Lc022Ll: 'Fotal No. of Questions: 071 L0Tlw'Ll'I ('Ibtnl No. of I'Agcs: 02Document2 pagesPapcr Id: Lc022Ll: 'Fotal No. of Questions: 071 L0Tlw'Ll'I ('Ibtnl No. of I'Agcs: 02Surbhi SofatPas encore d'évaluation

- GsdeDocument6 pagesGsdeSurbhi Sofat0% (1)

- 04 - Issues of Collective BargainingDocument3 pages04 - Issues of Collective BargainingSurbhi SofatPas encore d'évaluation