Académique Documents

Professionnel Documents

Culture Documents

Tax Assignment 1

Transféré par

Nin JaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Assignment 1

Transféré par

Nin JaDroits d'auteur :

Formats disponibles

General Principle o Concepts, Basis, Purpose o Principles of sound tax system o Scope of taxation o Limitations Inherent Pascual vs Sec

c of Public Works and Highways, GR L-10405, Dec. 29, 1960 Constitutional Ormoc Sugar Central vs City Treasurer 22 SCRA 603 Herrera vs QC 3 SCRA 186 Abra vs Hernando 162 SCRA 106 Abra Valley vs Aquino 162 SCRA 106 Philippine Lung Center vs QC 433 SCRA 119 o Aspects of taxation o Classification of taxes o Interpretation and construction of tax statutes o Tax doctrines Prospectivity Imprescriptibility Double Taxation Commissioner vs Johnson 309 SCRA 87 Power to destroy Forms of escape from taxation Badges of fraud Doctrine of Equitable Recoupment Doctrine of Set-off Republic vs Mambulao 4 SCRA 622 Domingo vs Galitos 8 SCRA 443 Francia vs IAC 162 SCRA 753 Caltex vs COA 208 SCRA 726 Phitex vs Commissioner 294 SCRA 687 Taxpayer suit Power to compromise o Taxation vs Eminent Domain vs Police Power o Taxes: Definition, characteristics, nature, distinguished from other forms of exactions, kinds o Income tax system Global Schedular Semi Schedular or semi global o Features of Philippine income tax law o Criteria for imposition o When is income taxable o Tests in determining whether income is earned for tax purposes.

Vous aimerez peut-être aussi

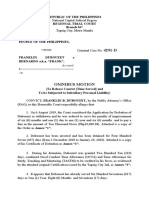

- Omnibus Motion - Time Served & Subsidiary Franklin DubouzetDocument4 pagesOmnibus Motion - Time Served & Subsidiary Franklin DubouzetNin JaPas encore d'évaluation

- Affidavit of GUARDIANSHIPDocument1 pageAffidavit of GUARDIANSHIPNin JaPas encore d'évaluation

- Affidavit of Loss CaramiasDocument1 pageAffidavit of Loss CaramiasNin JaPas encore d'évaluation

- Affidavit Change of GradeDocument4 pagesAffidavit Change of GradeNin JaPas encore d'évaluation

- Case DigestDocument2 pagesCase DigestNin JaPas encore d'évaluation

- Affidavit of Being SingleDocument1 pageAffidavit of Being SingleNin JaPas encore d'évaluation

- Philippine Citizenship AffidavitDocument1 pagePhilippine Citizenship AffidavitNin Ja100% (1)

- Affidavit: Republic of The Philippines) Taguig City) S.S. X - XDocument2 pagesAffidavit: Republic of The Philippines) Taguig City) S.S. X - XNin JaPas encore d'évaluation

- Affidavit of Cohabitation DocumentsDocument5 pagesAffidavit of Cohabitation DocumentsNin JaPas encore d'évaluation

- Affidavit of Being SingleDocument2 pagesAffidavit of Being SingleNin JaPas encore d'évaluation

- Comm. Rev. CasesDocument6 pagesComm. Rev. CasesNin Ja100% (1)

- Evidence Case DigestDocument3 pagesEvidence Case DigestNin JaPas encore d'évaluation

- BIR Rulings On Estate TaxDocument11 pagesBIR Rulings On Estate TaxNin JaPas encore d'évaluation

- Part 1 Disqualification of WitnessDocument3 pagesPart 1 Disqualification of WitnessNin JaPas encore d'évaluation

- RULE 132 Sec 1-7 DigestDocument13 pagesRULE 132 Sec 1-7 DigestNin Ja100% (1)

- Sherman ShaferDocument2 pagesSherman ShaferNin JaPas encore d'évaluation

- Part 1 RULE 131Document3 pagesPart 1 RULE 131Nin JaPas encore d'évaluation

- Conflict IIDocument11 pagesConflict IINin JaPas encore d'évaluation

- Chavez vs. PeaDocument1 pageChavez vs. Peavennyse_5131994Pas encore d'évaluation

- Reviewer in Legal Profession and CounsellingDocument8 pagesReviewer in Legal Profession and CounsellingLeo ConsolacionPas encore d'évaluation

- Conflict IIDocument11 pagesConflict IINin JaPas encore d'évaluation

- RA 10142 Financial Rehabilitation and Insolvency ActDocument25 pagesRA 10142 Financial Rehabilitation and Insolvency ActCharles DumasiPas encore d'évaluation

- Probation Law Digested CasesDocument15 pagesProbation Law Digested CasesNin Ja100% (27)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)