Académique Documents

Professionnel Documents

Culture Documents

1040 Form Filing Status and Dependents

Transféré par

AU SharmaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

1040 Form Filing Status and Dependents

Transféré par

AU SharmaDroits d'auteur :

Formats disponibles

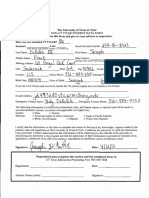

1040

Form

Department of the TreasuryInternal Revenue Service

U.S. Individual Income Tax Return

Last name

(99)

2012

, 2012, ending

OMB No. 1545-0074 , 20

IRS Use OnlyDo not write or staple in this space.

For the year Jan. 1Dec. 31, 2012, or other tax year beginning Your first name and initial

See separate instructions.

Your social security number

Walter

If a joint return, spouses first name and initial

Bunge

Last name Apt. no.

7 0 0 0 1 0 0 0 2

Spouses social security number

Rebecca

Home address (number and street). If you have a P.O. box, see instructions. City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Foreign country name Foreign province/state/county

Bunge

2 2 2 4 3 7 6 9 0

883 Scrub Brush Street

Las Vegas, NV - 89125

52B

Make sure the SSN(s) above and on line 6c are correct.

Presidential Election Campaign

Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking Foreign postal code a box below will not change your tax or refund. You Spouse

Filing Status

Check only one box.

1 2 3 6a b c

Single Married filing jointly (even if only one had income) Married filing separately. Enter spouses SSN above and full name here. Spouse . Dependents: . . . . . . . . . . . .

Head of household (with qualifying person). (See instructions.) If the qualifying person is a child but not your dependent, enter this childs name here.

5 . . .

Qualifying widow(er) with dependent child

Exemptions

Yourself. If someone can claim you as a dependent, do not check box 6a . . . . .

(2) Dependents social security number (3) Dependents relationship to you

. .

. .

. .

. .

(1) First name

Last name

(4) if child under age 17 qualifying for child tax credit (see instructions)

Boxes checked on 6a and 6b No. of children on 6c who: lived with you

did not live with you due to divorce or separation (see instructions) Dependents on 6c not entered above

2 0

0 0

2

If more than four dependents, see instructions and check here d Total number of exemptions claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 8a 9a 10 11 12 13 14 15b 16b 17 18 19 20b 21 22

Add numbers on lines above

Income

Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld.

7 8a b 9a b 10 11 12 13 14 15a 16a 17 18 19 20a 21 22 23 24 25 26 27 28 29 30 31a 32 33 34 35 36 37

Wages, salaries, tips, etc. Attach Form(s) W-2 . Taxable interest. Attach Schedule B if required . Tax-exempt interest. Do not include on line 8a . Ordinary dividends. Attach Schedule B if required

. . 8b . .

50000 0 0

0 0

0 . .

Qualified dividends . . . . . . . . . . . 9b Taxable refunds, credits, or offsets of state and local income taxes Alimony received . . . . . . . . . . . . . . .

0 . . . .

. .

If you did not get a W-2, see instructions. Enclose, but do not attach, any payment. Also, please use Form 1040-V.

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . Capital gain or (loss). Attach Schedule D if required. If not required, check here Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . .

0 0 0 0 0 (2480) 0 0

0 0 47520

IRA distributions . 15a b Taxable amount . . . 0 Pensions and annuities 16a b Taxable amount . . . 0 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F . Unemployment compensation . . . . Social security benefits 20a . . . . . . . . . . . . . . . . . . . . b Taxable amount . . . . . . . . .

0 Other income. List type and amount Combine the amounts in the far right column for lines 7 through 21. This is your total income

Educator expenses . . . . . . . . . . 23 24 25 26 27 28 29 30 31a 32 33 34 . . . . . . . .

0 0 0 5194 0 0 0 0 0 0 0

Adjusted Gross Income

Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ Health savings account deduction. Attach Form 8889 . Moving expenses. Attach Form 3903 . . . . . . Deductible part of self-employment tax. Attach Schedule SE . Self-employed SEP, SIMPLE, and qualified plans . . Self-employed health insurance deduction Penalty on early withdrawal of savings . . Alimony paid b Recipients SSN IRA deduction . . . . . . . Student loan interest deduction . . Tuition and fees. Attach Form 8917 . . . . . . . . . . . . . . . . . . . . . . . . . . .

Domestic production activities deduction. Attach Form 8903 35 Add lines 23 through 35 . . . . . . . . . . . . . Subtract line 36 from line 22. This is your adjusted gross income

0 0 . . .

36 37

Form

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 11320B

1040

5194 42326

(2012)

Form 1040 (2012)

Page 2

Tax and Credits

Standard Deduction for People who check any box on line 39a or 39b or who can be claimed as a dependent, see instructions. All others: Single or Married filing separately, $5,950 Married filing jointly or Qualifying widow(er), $11,900 Head of household, $8,700

38 39a b 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59a b 60 61

Amount from line 37 (adjusted gross income) Check if:

You were born before January 2, 1948, Spouse was born before January 2, 1948,

Blind. Blind.

38

42326

Total boxes checked 39a

0

39b . . . . 40 41 42 43 44 45 46

If your spouse itemizes on a separate return or you were a dual-status alien, check

here

Itemized deductions (from Schedule A) or your standard deduction (see left margin) Subtract line 40 from line 38 . . . . . . . . . . . . . . . . .

11900

30426 7600

Exemptions. Multiply $3,800 by the number on line 6d . . . . . . . . . . . . Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . . Form 4972 c 962 election Tax (see instructions). Check if any from: a Form(s) 8814 b Alternative minimum tax (see instructions). Attach Form 6251 . Add lines 44 and 45 . . . . . . . . . . . . . . Foreign tax credit. Attach Form 1116 if required . . . .

Credit for child and dependent care expenses. Attach Form 2441

22826

2554 0 2554

. . 47 48 49 50 51

. .

. .

. .

. .

. .

. .

0 0

Education credits from Form 8863, line 19 . . . . . Retirement savings contributions credit. Attach Form 8880 Child tax credit. Attach Schedule 8812, if required . . .

0

0 0

Residential energy credits. Attach Form 5695 . . . . 52 3800 b 8801 c Other credits from Form: a 53 Add lines 47 through 53. These are your total credits . . . . . Subtract line 54 from line 46. If line 54 is more than line 46, enter -0Self-employment tax. Attach Schedule SE . . . . Unreported social security and Medicare tax from Form:

Household employment taxes from Schedule H Other taxes. Enter code(s) from instructions . . .

. . .

. . . b

. .

. . .

. .

. .

0 0 . . .

. .

. . .

54 55 56 57 58 59a 59b

Other Taxes

. . . . a 4137

. . . . .

. . 8919

. . . .

. .

. . .

0 2554 0 0

0 0 0 0 2554

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required . . . . First-time homebuyer credit repayment. Attach Form 5405 if required

Add lines 55 through 60. This is your total tax

60 61

Payments

If you have a qualifying child, attach Schedule EIC.

62 63 64a b 65 66 67 68 69 70 71 72

Federal income tax withheld from Forms W-2 and 1099 . . 2012 estimated tax payments and amount applied from 2011 return Earned income credit (EIC) . . . . . . Nontaxable combat pay election 64b Additional child tax credit. Attach Schedule 8812 . . . .

0

. . . . .

. . . . .

62 63 64a 65 66 67 68

5000 0 0 0 0

. . . . . .

American opportunity credit from Form 8863, line 8 . Reserved . . . . . . . . . . . . . Amount paid with request for extension to file . .

Excess social security and tier 1 RRTA tax withheld

. . 69 Credit for federal tax on fuels. Attach Form 4136 . . 70 Credits from Form: a 2439 b Reserved c 8801 d 8885 71 Add lines 62, 63, 64a, and 65 through 71. These are your total payments . . .

0 0 0 0 .

Refund

73

If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you overpaid Amount of line 73 you want refunded to you. If Form 8888 is attached, check here . c Type: Routing number Checking Savings 1 2 3 4 5 6 7 8 9 Account number 1 2 3 4 5 6 7 8 9 1 0 1 1 1 2 1 3 0 Amount of line 73 you want applied to your 2013 estimated tax 75 Amount you owe. Subtract line 72 from line 61. For details on how to pay, see instructions

72 73 74a

5000 2446

2446

Direct deposit? See instructions.

74a b d 75 76

Amount You Owe

76

Third Party Designee

77 77 Estimated tax penalty (see instructions) . . . . . . . Do you want to allow another person to discuss this return with the IRS (see instructions)?

Designees name Phone no.

0

Yes. Complete below. No

Sign Here

Joint return? See instructions. Keep a copy for your records.

Personal identification number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature Spouses signature. If a joint return, both must sign.

Date Date

Your occupation

Daytime phone number

High School Teacher

Spouses occupation

123-456-7890

If the IRS sent you an Identity Protection PIN, enter it here (see inst.) PTIN Check if self-employed

Homemaker

Preparers signature Date

Paid Preparer Use Only

Print/Type preparers name

Firms name

Firm's EIN Phone no.

Firms address

Form 1040 (2012)

Vous aimerez peut-être aussi

- 21 - 1040 (Forecast)Document153 pages21 - 1040 (Forecast)cjPas encore d'évaluation

- Tax Checklist REV 2Document1 pageTax Checklist REV 2Rocka FellaPas encore d'évaluation

- TurboTax® Free Edition - Free Tax Filing, Free Taxes Online, Free Tax Return, Free EfileDocument25 pagesTurboTax® Free Edition - Free Tax Filing, Free Taxes Online, Free Tax Return, Free Efilerandy5burton940% (1)

- IRS NONEMPLOYEE COMPENSATION FORM f1099NEC Effective Jan 2020Document8 pagesIRS NONEMPLOYEE COMPENSATION FORM f1099NEC Effective Jan 2020JoniTay802Pas encore d'évaluation

- Notice to Employee tax and benefit detailsDocument1 pageNotice to Employee tax and benefit detailsMandy StokesPas encore d'évaluation

- Loan Checklist: Everything You Need for Your ApplicationDocument5 pagesLoan Checklist: Everything You Need for Your Applicationkhalid khayPas encore d'évaluation

- Form 1040 Tax ReturnDocument2 pagesForm 1040 Tax ReturnHamzah B ShakeelPas encore d'évaluation

- DuPont PDFDocument5 pagesDuPont PDFMadhur100% (1)

- 1040 Tax Form SummaryDocument2 pages1040 Tax Form SummaryKevin RowanPas encore d'évaluation

- Robinhood Securities LLC: Tax Information Account 161786165Document8 pagesRobinhood Securities LLC: Tax Information Account 161786165Matthew Stacy0% (1)

- Intuit LawsuitDocument25 pagesIntuit Lawsuitjonathan_skillingsPas encore d'évaluation

- House Report 85-481Document226 pagesHouse Report 85-481Tax HistoryPas encore d'évaluation

- Super Day Secrets - Your Technical Interview GuideDocument24 pagesSuper Day Secrets - Your Technical Interview GuideJithin RajanPas encore d'évaluation

- Instructions For Form 1120Document31 pagesInstructions For Form 1120A.F. GRANADAPas encore d'évaluation

- WWW - Irs.gov Pub Irs-PDF f4506tDocument2 pagesWWW - Irs.gov Pub Irs-PDF f4506tJennifer GonzalezPas encore d'évaluation

- U.S. Individual Income Tax Return: See Separate InstructionsDocument4 pagesU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Skip LarsonPas encore d'évaluation

- FTF1302745105156Document5 pagesFTF13027451051562sly4youPas encore d'évaluation

- US Internal Revenue Service: p1220Document140 pagesUS Internal Revenue Service: p1220IRSPas encore d'évaluation

- 1040 Tax Return SummaryDocument2 pages1040 Tax Return SummaryLinda100% (2)

- Miscellaneous Information: Copy B For RecipientDocument4 pagesMiscellaneous Information: Copy B For RecipientAubree Gates100% (1)

- Annual Return To Report Transactions With Foreign TrustsDocument6 pagesAnnual Return To Report Transactions With Foreign TrustsCarmita Keepitmovin FosterPas encore d'évaluation

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockPas encore d'évaluation

- NATH f1040Document2 pagesNATH f1040Spencer NathPas encore d'évaluation

- BNI 1120 ReturnDocument5 pagesBNI 1120 ReturndishaakariaPas encore d'évaluation

- CORRECTED (If Checked) : Mortgage Interest StatementDocument2 pagesCORRECTED (If Checked) : Mortgage Interest StatementScott DoePas encore d'évaluation

- Cicortflorina 8879Document2 pagesCicortflorina 8879Florin Cicort100% (3)

- SAP Cutover PlanDocument32 767 pagesSAP Cutover PlanMichelle FossPas encore d'évaluation

- Caps W 9Document4 pagesCaps W 9api-215255337Pas encore d'évaluation

- Georgia Individual Income Tax Guide 2019Document52 pagesGeorgia Individual Income Tax Guide 2019vinayak ShedgePas encore d'évaluation

- LIBRO 9 Derecho RomanoDocument30 pagesLIBRO 9 Derecho RomanoDomingo VasquezPas encore d'évaluation

- Please Review The Updated Information Below.: New Information For Form 1040-X FilersDocument3 pagesPlease Review The Updated Information Below.: New Information For Form 1040-X FilersAdam MasonPas encore d'évaluation

- Employee pay slip detailsDocument1 pageEmployee pay slip detailsAmar Rajput58% (12)

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and Certificationcade chevalierPas encore d'évaluation

- Zuckerman2015 Tax ReturnDocument3 pagesZuckerman2015 Tax ReturnAnonymous 2zbzrvPas encore d'évaluation

- Instructions for Trust Account SetupDocument10 pagesInstructions for Trust Account SetupVasishtha TeeluckdharryPas encore d'évaluation

- Afar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFDocument11 pagesAfar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFJamaica David50% (2)

- F 1040Document2 pagesF 1040Sue BosleyPas encore d'évaluation

- F 1099 MSCDocument8 pagesF 1099 MSCVenkatapavan SinagamPas encore d'évaluation

- FTF1327867575806Document3 pagesFTF1327867575806erzahler0% (1)

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- Form 4506-T (Rev. 11-2021)Document1 pageForm 4506-T (Rev. 11-2021)keyPas encore d'évaluation

- Non-UT Tyler Student Data FormDocument5 pagesNon-UT Tyler Student Data FormGeoffrey Ortiz100% (1)

- XXXX2681 2020 1099 02-04-2021Document14 pagesXXXX2681 2020 1099 02-04-2021Nicholas FusaroPas encore d'évaluation

- Lance Dean 2013 Tax Return - T13 - For - RecordsDocument57 pagesLance Dean 2013 Tax Return - T13 - For - Recordsjessica50% (4)

- Form W-8 Certificate of Foreign StatusDocument2 pagesForm W-8 Certificate of Foreign StatusSalaam Bey®Pas encore d'évaluation

- Profit Driven Digital MarketingDocument28 pagesProfit Driven Digital MarketingSike Thedeviant100% (8)

- Withholding Certificate For Pension or Annuity Payments: General InstructionsDocument6 pagesWithholding Certificate For Pension or Annuity Payments: General InstructionsАндрей КрайниковPas encore d'évaluation

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnYudo KunaPas encore d'évaluation

- Absorption and Variable CostingDocument2 pagesAbsorption and Variable CostingJenni Lorico67% (3)

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlPas encore d'évaluation

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarPas encore d'évaluation

- US Internal Revenue Service: f9325Document2 pagesUS Internal Revenue Service: f9325IRSPas encore d'évaluation

- Media Industry Draft v4Document32 pagesMedia Industry Draft v4maragar100% (1)

- Instruction and Information Sheet For SF 180, Request Pertaining To Military RecordsDocument3 pagesInstruction and Information Sheet For SF 180, Request Pertaining To Military RecordsAnthony Bonafide Dakush100% (1)

- Survey Master LLC Group focuses on larger projectsDocument8 pagesSurvey Master LLC Group focuses on larger projectsBalaji ArunPas encore d'évaluation

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerPas encore d'évaluation

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaPas encore d'évaluation

- Developing Management SkillsDocument37 pagesDeveloping Management SkillsAU Sharma100% (1)

- Applied EconomicsDocument144 pagesApplied EconomicsLucille Gacutan Aramburo71% (7)

- CIR vs Philam Life Prescription RefundDocument1 pageCIR vs Philam Life Prescription RefundRaquel Doquenia100% (1)

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyDocument3 pagesForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandPas encore d'évaluation

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваPas encore d'évaluation

- Instructions For Form 709: Pager/SgmlDocument12 pagesInstructions For Form 709: Pager/SgmlIRSPas encore d'évaluation

- 2009 Form 990-EZDocument4 pages2009 Form 990-EZCircuit MediaPas encore d'évaluation

- Individual Tax Returns - IRS 2009Document200 pagesIndividual Tax Returns - IRS 2009Steve EldridgePas encore d'évaluation

- W-9 FormDocument4 pagesW-9 FormLouiseDulcePas encore d'évaluation

- Sheila McCorriston WithdrawalDocument14 pagesSheila McCorriston WithdrawalAnonymous BmFjIMShq9100% (1)

- US Internal Revenue Service: F1040sei - 1992Document2 pagesUS Internal Revenue Service: F1040sei - 1992IRSPas encore d'évaluation

- Background Form PDFDocument1 pageBackground Form PDFMiloPas encore d'évaluation

- Estimated Tax for IndividualsDocument12 pagesEstimated Tax for IndividualsJob SchwartzPas encore d'évaluation

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-173610472Pas encore d'évaluation

- Weighted Average Inventory ValuationDocument3 pagesWeighted Average Inventory ValuationAU SharmaPas encore d'évaluation

- Excel Quick Reference 2007 PDFDocument0 pageExcel Quick Reference 2007 PDFRonald RestonPas encore d'évaluation

- 11 CH 01Document53 pages11 CH 01Zulaikha ZubirPas encore d'évaluation

- Job Costing PowerpointDocument28 pagesJob Costing PowerpointAU SharmaPas encore d'évaluation

- Job Costing PowerpointDocument28 pagesJob Costing PowerpointAU SharmaPas encore d'évaluation

- Cultural Immersion vs. Technology Driven Language LearningDocument14 pagesCultural Immersion vs. Technology Driven Language LearningAU SharmaPas encore d'évaluation

- Project AnalysisDocument24 pagesProject AnalysisAU SharmaPas encore d'évaluation

- Chapter 5 Time Value of MoneyDocument39 pagesChapter 5 Time Value of MoneyAU Sharma100% (2)

- TaxationDocument4 pagesTaxationAU Sharma0% (1)

- Google IncDocument2 pagesGoogle IncAU SharmaPas encore d'évaluation

- Corporate Social Responsibility Reality or An Eye WashDocument20 pagesCorporate Social Responsibility Reality or An Eye WashRoger Dsouza100% (2)

- Westchester Overtime Costs MillionsDocument2 pagesWestchester Overtime Costs MillionsGerald McKinstryPas encore d'évaluation

- Fund Flow StatementDocument8 pagesFund Flow StatementfastcablesPas encore d'évaluation

- Problem 8 25Document2 pagesProblem 8 25anon_590039258100% (1)

- Credit Analysis of RompetrolDocument13 pagesCredit Analysis of RompetrolLori CristeaPas encore d'évaluation

- IAS 20 Summary NotesDocument5 pagesIAS 20 Summary NotesShiza ArifPas encore d'évaluation

- Macroeconomic Variables PDFDocument19 pagesMacroeconomic Variables PDFmonaPas encore d'évaluation

- Life Always Begins With One Step Outside of Your Comfort Zone.Document21 pagesLife Always Begins With One Step Outside of Your Comfort Zone.Czarina PanganibanPas encore d'évaluation

- SwagruhaDocument11 pagesSwagruhaAditya MishraPas encore d'évaluation

- Graded Illustrations on Capital Budgeting TechniquesDocument57 pagesGraded Illustrations on Capital Budgeting TechniquesVishesh GuptaPas encore d'évaluation

- Lecture 8 - Offshore Captive Insurance PDFDocument11 pagesLecture 8 - Offshore Captive Insurance PDFRaveesh HurhangeePas encore d'évaluation

- Comprehensive Problem 1Document3 pagesComprehensive Problem 1Heaven WincletPas encore d'évaluation

- 11 Accounts Sample Paper 2Document15 pages11 Accounts Sample Paper 2Techy ParasPas encore d'évaluation

- WR SupplementDocument9 pagesWR Supplementtrb301Pas encore d'évaluation

- Introduction of the Bureau of Internal Revenue Department at the Universidad de ManilaDocument32 pagesIntroduction of the Bureau of Internal Revenue Department at the Universidad de ManilaDencio BrownPas encore d'évaluation

- Corse Cod: ACT328 Section: 1 Name: Shaheed AhmedDocument3 pagesCorse Cod: ACT328 Section: 1 Name: Shaheed AhmedSidad KurdistaniPas encore d'évaluation

- Quiz 1 - Limited CompaniesDocument2 pagesQuiz 1 - Limited CompaniesELIZABETH MARGARETHAPas encore d'évaluation

- Designit Denmark AsDocument21 pagesDesignit Denmark AsRithesh KPas encore d'évaluation

- Sample Case Studies-OperationsDocument2 pagesSample Case Studies-OperationsKiran Soni100% (1)