Académique Documents

Professionnel Documents

Culture Documents

98 1000 PDF

Transféré par

FUCKYOU2117Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

98 1000 PDF

Transféré par

FUCKYOU2117Droits d'auteur :

Formats disponibles

Int-Scorebd-Rank

7/1/98 6:30 PM

CMYK 03

49

Page 49

EDIT PASS

EDIT OK

INT-SCOREBD-RANK

BW

BW INTL

INT

COLOR OK

PE

DAD

???/!!!

XX

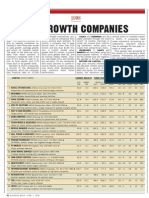

1998 Leaders

THE

BUSINESS WEEK

GLOBAL 1000

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

GENERAL ELECTRIC

MICROSOFT

ROYAL DUTCH/SHELL GROUP

COCA-COLA

EXXON

1

2

3

4

5

1

5

3

2

6

6

7

8

9

10

9

22

4

20

7

MERCK

PFIZER

NIPPON TELEGRAPH & TELEPHONE

WAL-MART STORES

INTEL

11

12

13

14

15

11

12

13

18

14

NOVARTIS

PROCTER & GAMBLE

INTERNATIONAL BUSINESS MACHINES

BRISTOL-MYERS SQUIBB

ROCHE HOLDING

16

17

18

19

20

26

19

8

56

17

AT&T

GLAXO WELLCOME

TOYOTA MOTOR

LUCENT TECHNOLOGIES

JOHNSON & JOHNSON

21

22

23

24

25

10

32

24

33

23

PHILIP MORRIS

BERKSHIRE HATHAWAY

DUPONT

UNILEVER

AMERICAN INTERNATIONAL GROUP

26

27

28

29

30

21

38

30

41

47

BRITISH PETROLEUM

NESTLE

LLOYDS TSB GROUP

ALLIANZ

CISCO SYSTEMS

31

32

33

34

35

28

25

51

31

78

WALT DISNEY

DEUTSCHE TELEKOM

NATIONSBANK

SBC COMMUNICATIONS

BELL ATLANTIC

36

37

38

39

40

68

36

34

16

45

TRAVELERS GROUP

ELI LILLY

CITICORP

HSBC HOLDINGS

BRITISH TELECOMMUNICATIONS

41

42

43

44

45

37

35

70

46

39

GILLETTE

HEWLETT-PACKARD

ING GROEP

BELLSOUTH

AMERICAN HOME PRODUCTS

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

FORD MOTOR

FANNIE MAE

SCHERING-PLOUGH

MOBIL

SMITHKLINE BEECHAM

U.S.

U.S.

Neth./Britain

U.S.

U.S.

271.64

208.98

195.68

193.53

172.50

46

47

48

49

50

U.S.

U.S.

U.S.

U.S.

Britain

62.92

61.84

61.35

60.95

60.89

U.S.

U.S.

Japan

U.S.

U.S.

139.85

133.03

130.91

123.47

121.16

51 27 PEPSICO

52 115 CREDIT SUISSE GROUP

53 55 CHASE MANHATTAN

54 79 HOME DEPOT

55 40 ABBOTT LABORATORIES

U.S.

Switzerland

U.S.

U.S.

U.S.

60.85

58.59

58.01

57.62

57.26

Switzerland

U.S.

U.S.

U.S.

Switzerland

116.17

112.47

110.79

106.99

98.90

56

57

58

59

60

U.S.

Italy

U.S.

France

Sweden

56.45

56.42

56.13

56.01

55.62

U.S.

Britain

Japan

U.S.

U.S.

98.87

96.07

94.34

93.07

92.87

61 180 SAP

62 118 FIRST UNION

63 177 DELL COMPUTER

64 98 WARNER-LAMBERT

65 44 CHEVRON

Germany

U.S.

U.S.

U.S.

U.S.

55.59

53.33

52.77

52.29

52.24

U.S.

U.S.

U.S.

Neth./Britain

U.S.

90.74

87.74

87.11

86.67

86.62

66 58 DAIMLER-BENZ

67 147 TELECOM ITALIA

68 15 BANK OF TOKYO-MITSUBISHI

69 53 GENERAL MOTORS

70 73 AMERICAN EXPRESS

Germany

Italy

Japan

U.S.

U.S.

52.11

51.30

48.08

48.04

47.33

Britain

Switzerland

Britain

Germany

U.S.

85.28

84.40

78.28

77.41

77.36

71 102 WORLDCOM

72 255 MORGAN STANLEY DEAN WITTER

73 66 AMERITECH

74 169 AEGON

75 63 BOEING

U.S.

U.S.

U.S.

Netherlands

U.S.

46.96

46.90

46.56

46.50

46.50

U.S.

Germany

U.S.

U.S.

U.S.

77.21

73.64

72.65

71.49

71.12

76 105 TIME WARNER

77 95 DEUTSCHE BANK

78 101 TELEFONICA

79 69 McDONALDS

80 135 TIM

U.S.

Germany

Spain

U.S.

Italy

45.97

45.92

45.85

45.11

44.94

U.S.

U.S.

U.S.

Britain

Britain

70.44

67.97

67.39

67.26

66.26

81

82

83

84

85

Switzerland

U.S.

Britain

Britain

U.S.

43.19

41.58

40.70

40.17

40.12

U.S.

U.S.

Netherlands

U.S.

U.S.

65.79

64.31

64.08

63.86

63.42

86 75 ALLSTATE

87 166 NOKIA

88 84 SCHLUMBERGER

89 104 MCI COMMUNICATIONS

90 88 ZENECA GROUP

U.S.

Finland

U.S.

U.S.

Britain

39.52

39.48

38.90

38.73

38.52

48

43

72

29

42

54

57

52

NR

71

92

83

85

NR

49

BANKAMERICA

ENI

GTE

FRANCE TELECOM

L.M. ERICSSON

UBS

COMPAQ COMPUTER

BARCLAYS BANK

DIAGEO

AMOCO

BUSINESS WEEK / JULY 13, 1998 49

TB

NY: Dowling, Comes, Power, Brady, Warner, Pearson

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Rank

7/1/98 6:30 PM

CMYK 03

50

Page 50

EDIT PASS

EDIT OK

INT-SCOREBD-RANK

BW

BW INTL

INT

COLOR OK

PE

DAD

???/!!!

XX

THE BUSINESS WEEK GLOBAL 1000

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

91 99 ELF AQUITAINE

92 230 MANNESMANN

93 NR HALIFAX

94 171 AXA-UAP

95 61 MINNESOTA MINING & MFG.

France

Germany

Britain

France

U.S.

38.12

38.04

37.96

37.78

37.47

156

157

158

159

160

65

124

125

156

213

SANWA BANK

MARKS & SPENCER

ATLANTIC RICHFIELD

ABBEY NATIONAL

BMW

Japan

Britain

U.S.

Britain

Germany

25.43

25.34

25.31

25.18

25.13

Germany

Germany

U.S.

U.S.

Germany

37.31

37.06

36.15

35.91

34.94

161

162

163

164

165

186

160

148

197

146

FIRST CHICAGO NBD

ENDESA

CAMPBELL SOUP

U S WEST

ALLIEDSIGNAL

U.S.

Spain

U.S.

U.S.

U.S.

25.11

24.95

24.75

24.61

24.17

U.S.

France

U.S.

Neth./Belgium

U.S.

24.16

23.51

23.30

23.04

23.03

U.S.

U.S.

U.S.

Japan

U.S.

23.00

22.98

22.80

22.71

22.57

96 153 MUENCHENER RUECK.

97 77 SIEMENS

98 188 BANC ONE

99 142 CHRYSLER

100 91 BAYER

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

101

102

103

104

105

199

172

74

109

217

ALCATEL

PHILIPS ELECTRONICS

SONY

ABN AMRO HOLDING

BANCO BILBAO VIZCAYA

France

Netherlands

Japan

Netherlands

Spain

34.92

34.76

34.38

34.18

34.03

166

167

168

169

170

174

110

221

220

100

SEARS, ROEBUCK

CARREFOUR

FLEET FINANCIAL GROUP

FORTIS

EASTMAN KODAK

106

107

108

109

110

141

143

248

164

113

NORTHERN TELECOM

XEROX

VODAFONE GROUP

SWISS RE

LOREAL

Canada

U.S.

Britain

Switzerland

France

33.80

33.77

33.75

33.75

33.57

171

172

173

174

175

81

209

271

137

280

ORACLE

BANK OF NEW YORK

CBS

TAKEDA CHEMICAL INDUSTRIES

MEDIAONE GROUP

Japan

U.S.

Japan

Italy

Sweden

33.19

33.17

33.08

33.06

32.85

176

177

178

179

180

198

150

301

219

170

PHARMACIA & UPJOHN

ANHEUSER-BUSCH

NATIONAL CITY

GENERAL ELECTRIC CO.

J.P. MORGAN

U.S.

U.S.

U.S.

Britain

U.S.

22.45

22.32

22.27

22.18

22.16

Germany

U.S.

U.S.

Britain

U.S.

32.69

32.29

31.68

31.59

31.25

181

182

183

184

185

67

191

168

234

175

HITACHI LTD.

LOCKHEED MARTIN

DOW CHEMICAL

NEWS CORP.

UNITED TECHNOLOGIES

Japan

U.S.

U.S.

Australia

U.S.

21.99

21.95

21.81

21.80

21.57

U.S.

Germany

U.S.

U.S.

U.S.

30.94

30.94

30.92

30.90

30.88

186

187

188

189

190

622

97

107

126

132

SUEZ LYONNAISE DES EAUX

SINGAPORE TELECOMMUNICATIONS

HONG KONG TELECOMMUNICATIONS

NOMURA SECURITIES

FUJITSU

France

Singapore

Hong Kong

Japan

Japan

21.54

21.50

21.44

21.39

21.36

Sweden/Switz.

France

Australia

U.S.

Canada

30.84

30.35

30.28

29.42

29.42

191

192

193

194

195

245

378

114

131

386

FIAT GROUP

GAP

COLUMBIA/HCA HEALTHCARE

REED ELSEVIER

DUKE ENERGY

Italy

U.S.

U.S.

Neth./Britain

U.S.

21.29

21.27

21.04

20.94

20.77

Japan

Japan

U.S.

U.S.

Hong Kong

20.70

20.67

20.62

20.34

20.25

Britain

U.S.

U.S.

France

U.S.

20.25

20.15

20.14

20.12

20.09

Britain

Australia

U.S.

France

U.S.

19.92

19.83

19.80

19.69

19.61

Japan

France

U.S.

U.S.

France

19.55

19.55

19.40

19.34

19.33

Britain

Japan

U.S.

Canada

Germany

19.30

18.99

18.91

18.88

18.82

111 89 HONDA MOTOR

112 106 MONSANTO

113 59 MATSUSHITA ELECTRIC INDUSTRIAL

114 229 ASSICURAZIONI GENERALI

115 103 ASTRA

116 94 VEBA

117 324 TYCO INTERNATIONAL

118 60 MOTOROLA

119 154 NATIONAL WESTMINSTER BANK

120 87 TEXACO

121

122

123

124

125

152

136

200

122

128

SPRINT

VOLKSWAGEN

MERRILL LYNCH

WELLS FARGO

FREDDIE MAC

126

127

128

129

130

111

133

NR

158

203

ABB ASEA BROWN BOVERI

TOTAL

TELSTRA

NORWEST

BCE (BELL CANADA ENTERPRISES)

131

132

133

134

135

50

130

205

316

246

SUMITOMO BANK

HOECHST

ZURICH INSURANCE GROUP

U.S. BANCORP

BANCO DE SANTANDER

Japan

Germany

Switzerland

U.S.

Spain

29.36

29.35

29.34

29.07

28.93

196

197

198

199

200

120

144

358

333

76

ITO-YOKADO

CANON

EMC

DAYTON HUDSON

HUTCHISON WHAMPOA

136

137

138

139

140

210

129

179

161

96

DRESDNER BANK

BASF

SWISS BANK CORP.

COMPUTER ASSOCIATES INTERNATIONAL

B.A.T. INDUSTRIES

Germany

Germany

Switzerland

U.S.

Britain

28.88

28.86

28.76

28.67

27.95

201

202

203

204

205

232

302

181

323

201

BG

CARNIVAL

CATERPILLAR

RHONE-POULENC

TEXAS INSTRUMENTS

141

142

143

144

145

165

93

243

216

117

SARA LEE

KIMBERLY-CLARK

AIRTOUCH COMMUNICATIONS

VIVENDI

EMERSON ELECTRIC

U.S.

U.S.

U.S.

France

U.S.

27.86

27.61

27.26

27.19

26.89

206

207

208

209

210

313

149

138

314

334

RENTOKIL INITIAL

NATIONAL AUSTRALIA BANK

HUGHES ELECTRONICS

GROUPE DANONE

VIACOM

146

147

148

149

150

140

82

211

196

212

RWE

SEVEN-ELEVEN JAPAN

KONINKLIJKE PTT NEDERLAND

MEDTRONIC

ASSOCIATES FIRST CAPITAL

Germany

Japan

Netherlands

U.S.

U.S.

26.72

26.69

26.42

26.12

25.92

211

212

213

214

215

62

346

218

239

376

DAI-ICHI KANGYO BANK

SOCIETE GENERALE

H. J. HEINZ

AUTOMATIC DATA PROCESSING

PINAULT-PRINTEMPS-REDOUTE

151

152

153

154

155

108

185

173

189

317

TOKYO ELECTRIC POWER

COLGATE-PALMOLIVE

PRUDENTIAL

CABLE & WIRELESS

BAYERISCHE VEREINSBANK

Japan

U.S.

Britain

Britain

Germany

25.87

25.76

25.74

25.60

25.45

216

217

218

219

220

253

163

259

254

286

TESCO

EAST JAPAN RAILWAY

GANNETT

ROYAL BANK OF CANADA

COMMERZBANK

50 BUSINESS WEEK / JULY 13, 1998

TB

NY: Dowling, Comes, Power, Brady, Warner

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Rank

7/1/98 6:30 PM

CMYK 03

51

Page 51

EDIT PASS

INT-SCOREBD-RANK

BW

BW INTL

INT

RANK

1998 1997

COLOR OK

MARKET VALUE

Billions of U.S. dollars

PE

DAD

???/!!!

XX

EDIT OK

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

221

222

223

224

225

190

379

238

151

303

BRIDGESTONE

CENDANT

SOUTHERN

LVMH MOET HENNESSY LOUIS VUITTON

RAYTHEON

Japan

U.S.

U.S.

France

U.S.

18.76

18.51

18.44

18.38

18.38

286

287

288

289

290

450

64

294

452

366

ROYAL BANK OF SCOTLAND GROUP

FUJI BANK

BASS

COCA-COLA ENTERPRISES

HOUSEHOLD INTERNATIONAL

226

227

228

229

230

507

413

261

689

339

WASHINGTON MUTUAL

BANQUE NATIONALE DE PARIS

J.C. PENNEY

AMERICA ONLINE

TELE-COMMUNICATIONS

U.S.

France

U.S.

U.S.

U.S.

18.23

18.21

18.11

18.01

17.92

291

292

293

294

295

305

325

127

NR

474

LAIR LIQUIDE

GREAT UNIVERSAL STORES

HANG SENG BANK

NORWICH UNION

BANK OF SCOTLAND

231

232

233

234

235

184

264

282

304

335

ELECTRONIC DATA SYSTEMS

KONINKLIJKE AHOLD

COMPAGNIE DE SAINT-GOBAIN

MELLON BANK

SAFEWAY

U.S.

Netherlands

France

U.S.

U.S.

17.89

17.61

17.60

17.55

17.51

296

297

298

299

300

237

262

351

396

390

236

237

238

239

240

90

292

159

258

119

BROKEN HILL PROPRIETARY

WALGREEN

FUJI PHOTO FILM

PNC BANK

RIO TINTO

Australia

U.S.

Japan

U.S.

Australia/Brit

17.50

17.48

17.42

17.37

17.33

301

302

303

304

305

241

242

243

244

245

252

393

224

278

241

THOMSON

AMERICAN GENERAL

KELLOGG

GRANADA GROUP

GENERAL RE

Canada

U.S.

U.S.

Britain

U.S.

17.16

17.03

16.90

16.89

16.82

246

247

248

249

250

176

437

289

283

267

REUTERS GROUP

BAYERISCHE HYPOTHEKEN- UND WECHSEL-BANK

ROYAL AND SUN ALLIANCE INSURANCE GROUP

KEYCORP

REPSOL

Britain

Germany

Britain

U.S.

Spain

251

252

253

254

255

287

357

270

223

449

SUNTRUST BANKS

WACHOVIA

ILLINOIS TOOL WORKS

TRAVELERS PROPERTY CASUALTY

PARIBAS

256

257

258

259

260

272

145

233

NR

403

BESTFOODS

NEC

BAXTER INTERNATIONAL

CREDITO ITALIANO

BRITISH AEROSPACE

Britain

Japan

Britain

U.S.

U.S.

14.57

14.56

14.55

14.53

14.52

France

Britain

Hong Kong

Britain

Britain

14.42

14.28

14.26

14.21

14.18

INTERNATIONAL PAPER

VOLVO

CANADIAN IMPERIAL BANK OF COMMERCE

LEGAL & GENERAL GROUP

AMR

U.S.

Sweden

Canada

Britain

U.S.

14.14

14.07

14.06

14.05

14.03

522

225

508

364

273

LOWES

JAPAN TOBACCO

WILLIAMS

IMPERIAL CHEMICAL INDUSTRIES

ELECTRABEL

U.S.

Japan

U.S.

Britain

Belgium

13.90

13.86

13.75

13.73

13.68

306

307

308

309

310

332

162

NR

713

247

BOOTS

TOSHIBA

ERGO VERSICHERUNGSGRUPPE

CVS

CONAGRA

Britain

Japan

Germany

U.S.

U.S.

13.64

13.52

13.51

13.49

13.39

16.76

16.71

16.71

16.70

16.69

311

312

313

314

315

327

392

309

208

355

CHUBB

TORONTO-DOMINION BANK

NINTENDO

NIKE

BANK OF NOVA SCOTIA

U.S.

Canada

Japan

U.S.

Canada

13.37

13.35

13.24

13.24

13.15

U.S.

U.S.

U.S.

U.S.

France

16.68

16.50

16.49

16.37

16.33

316

317

318

319

320

134

306

383

537

331

SEIBU RAILWAY

PHILLIPS PETROLEUM

HARTFORD FINANCIAL SERVICES GROUP

GROUPE SCHNEIDER

PPG INDUSTRIES

Japan

U.S.

U.S.

France

U.S.

13.07

13.02

12.97

12.93

12.93

U.S.

Japan

U.S.

Italy

Britain

16.30

16.26

16.25

16.11

15.92

321

322

323

324

325

710

260

343

391

643

ISTITUTO BANCARIO SAN PAOLO DI TORINO

DEERE

PITNEY BOWES

BAA

COMCAST

Italy

U.S.

U.S.

Britain

U.S.

12.89

12.87

12.86

12.69

12.62

261 300 MBNA

262 NR ELECTRICIDADE DE PORTUGAL (EDP)

263 265 BURLINGTON NORTHERN SANTA FE

264 336 ENRON

265 80 INDUSTRIAL BANK OF JAPAN

U.S.

Portugal

U.S.

U.S.

Japan

15.88

15.79

15.68

15.62

15.58

326

327

328

329

330

482

547

708

388

464

SIEBE

SOCIETE GENERALE DE BELGIQUE

RENAULT

TELLABS

COMMERCIAL UNION ASSURANCE

Britain

Belgium

France

U.S.

Britain

12.59

12.59

12.55

12.52

12.52

Japan

U.S.

Britain

U.S.

Germany

15.57

15.47

15.42

15.37

15.36

331

332

333

334

335

228

360

499

656

384

DAI NIPPON PRINTING

HALLIBURTON

COSTCO

ISTITUTO NAZIONALE DELLE ASSICURAZIONI

SANOFI

Japan

U.S.

U.S.

Italy

France

12.50

12.49

12.48

12.47

12.46

U.S.

Japan

U.S.

Canada

Britain

15.33

15.21

15.18

15.17

14.98

336

337

338

339

340

123

617

338

440

328

CHEUNG KONG HOLDINGS

HBO & CO.

BOSTON SCIENTIFIC

FRANKLIN RESOURCES

UNITED HEALTHCARE

Hong Kong

U.S.

U.S.

U.S.

U.S.

12.42

12.40

12.37

12.36

12.33

U.S.

Netherlands

Spain

Germany

U.S.

14.98

14.92

14.90

14.89

14.88

341

342

343

344

345

330

222

555

363

281

NABISCO HOLDINGS

STANDARD CHARTERED

TELE DANMARK

WESTPAC BANKING

ROHM

U.S.

Britain

Denmark

Australia

Japan

12.33

12.32

12.27

12.24

12.19

U.S.

U.S.

U.S.

Canada

Japan

14.85

14.81

14.75

14.75

14.67

346

347

348

349

350

361

454

544

538

687

TEXTRON

HENKEL

GENERALE DE BANQUE

BANKERS TRUST

BANCO CENTRAL

U.S.

Germany

Belgium

U.S.

Spain

12.14

12.12

12.11

12.10

12.09

266

267

268

269

270

183

321

397

195

311

KANSAI ELECTRIC POWER

BANKBOSTON

CADBURY SCHWEPPES

AMGEN

METRO

271

272

273

274

275

619

139

284

231

329

EQUITABLE

DENSO

SUN MICROSYSTEMS

SEAGRAM

J. SAINSBURY

276

277

278

279

280

290

371

307

277

310

MARSH & McLENNAN

AKZO NOBEL

IBERDROLA

VIAG

MAY DEPARTMENT STORES

281

282

283

284

285

193

235

263

352

187

FIRST DATA

WASTE MANAGEMENT

CIGNA

BANK OF MONTREAL

TOKIO MARINE & FIRE

BUSINESS WEEK / JULY 13, 1998 51

TB

NY: Dowling, Comes, Power, Brady, Warner

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Rank

7/1/98 6:30 PM

CMYK 03

52

Page 52

EDIT PASS

INT-SCOREBD-RANK

BW

BW INTL

INT

PE

DAD

???/!!!

XX

EDIT OK

COLOR OK

THE BUSINESS WEEK GLOBAL 1000

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

351

352

353

354

355

215

418

NR

374

204

BRITISH SKY BROADCASTING GROUP

HEINEKEN

BANCA INTESA

PG&E

UNION PACIFIC

356

357

358

359

360

389

275

455

766

616

RALSTON PURINA GROUP

NORFOLK SOUTHERN

KINGFISHER

CLEAR CHANNEL COMMUNICATIONS

COX COMMUNICATIONS

361

362

363

364

365

446

673

116

285

157

NOVO-NORDISK

LIBERTY MEDIA

MITSUBISHI HEAVY INDUSTRIES

APPLIED MATERIALS

NIPPON STEEL

366

367

368

369

370

266

526

178

86

453

ALUMINUM CO. OF AMERICA

HENNES & MAURITZ

MITSUBISHI TRUST & BANKING

SUN HUNG KAI PROPERTIES

FIFTH THIRD BANCORP

371

372

373

374

375

NR

194

424

227

458

376

377

378

379

380

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

Britain

Netherlands

Italy

U.S.

U.S.

12.09

12.07

12.05

12.00

11.96

416

417

418

419

420

502

430

293

345

587

DEXIA

France/Belgium 10.49

SERVICE CORP. INTERNATIONAL

U.S. 10.46

CSX

U.S. 10.46

TDK

Japan 10.46

ARGENTARIA, CORP. BANCARIA DE ESPANA

Spain 10.45

U.S.

U.S.

Britain

U.S.

U.S.

11.93

11.91

11.90

11.88

11.85

421

422

423

424

425

308

610

597

295

470

LOEWS

ST. PAUL

LAFARGE

NORSK HYDRO

ALLIED DOMECQ

U.S.

U.S.

France

Norway

Britain

10.44

10.41

10.41

10.40

10.35

Denmark

U.S.

Japan

U.S.

Japan

11.82

11.81

11.73

11.72

11.68

426

427

428

429

430

541

722

694

498

NR

COMERICA

USA WASTE SERVICES

ISTITUTO MOBILIARE ITALIANO

GAS NATURAL SDG

CAP GEMINI

U.S.

U.S.

Italy

Spain

France

10.30

10.28

10.26

10.22

10.19

U.S.

Sweden

Japan

Hong Kong

U.S.

11.68

11.62

11.56

11.53

11.48

431

432

433

434

435

380

410

354

520

NR

NTT DATA

USX-MARATHON GROUP

WEYERHAEUSER

CONSOLIDATED EDISON

PORTUGAL TELECOM

Japan

U.S.

U.S.

U.S.

Portugal

10.15

10.12

10.11

10.08

10.00

CABLE & WIRELESS COMMUNICATIONS

MITSUBISHI ESTATE

ALBERTSONS

AETNA

HEALTHSOUTH

Britain

Japan

U.S.

U.S.

U.S.

11.45

11.41

11.38

11.37

11.37

436

437

438

439

440

556

639

650

412

808

SVENSKA HANDELSBANKEN

PROGRESSIVE

PEOPLESOFT

HERSHEY FOODS

ALLEANZA ASSICURAZIONI

Sweden

U.S.

U.S.

U.S.

Italy

9.99

9.98

9.90

9.89

9.89

700

854

385

341

206

ALLIED IRISH BANKS

AGF

GOODYEAR TIRE & RUBBER

NATIONAL POWER

TOKAI BANK

Ireland

France

U.S.

Britain

Japan

11.34

11.33

11.30

11.27

11.23

441

442

443

444

445

565

471

780

671

734

CARDINAL HEALTH

DAMPSKIBSSELSKABET AF 1912

ACCOR

SKANDINAVISKA ENSKILDA BANKEN

PEUGEOT

U.S.

Denmark

France

Sweden

France

9.86

9.86

9.84

9.80

9.79

381

382

383

384

385

420

299

584

516

408

REPUBLIC INDUSTRIES

STMICROELECTRONICS

TRACTEBEL

WM. WRIGLEY JR.

MATTEL

U.S.

France

Belgium

U.S.

U.S.

11.22

11.21

11.20

11.16

11.12

446

447

448

449

450

382

337

695

732

478

CANADIAN PACIFIC

KIRIN BREWERY

RAILTRACK GROUP

TELEPORT COMMUNICATIONS GROUP

DAMPSKIBSSELSKABET SVENBORG

Canada

Japan

Britain

U.S.

Denmark

9.79

9.79

9.79

9.78

9.77

386

387

388

389

390

370

491

155

497

240

INVESTOR

STATE STREET

SAKURA BANK

GENERAL ACCIDENT

SANKYO

Sweden

U.S.

Japan

Britain

Japan

11.12

11.11

11.11

11.07

11.06

451

452

453

454

455

419

628

462

465

436

POLYGRAM

GUIDANT

TEXAS UTILITIES

OCCIDENTAL PETROLEUM

PETROFINA

Netherlands

U.S.

U.S.

U.S.

Belgium

9.75

9.72

9.69

9.64

9.62

391

392

393

394

395

249

542

288

NR

257

CHUBU ELECTRIC POWER

KROGER

BRITISH AIRWAYS

BANCA DI ROMA

BTR

Japan

U.S.

Britain

Italy

Britain

11.05

10.99

10.97

10.96

10.91

456

457

458

459

460

438

861

573

593

NR

WOLTERS KLUWER

BANK AUSTRIA

MASCO

DEUTSCHE LUFTHANSA

CLARIANT

Netherlands

Austria

U.S.

Germany

Switzerland

9.62

9.59

9.56

9.55

9.51

396

397

398

399

400

461

349

344

242

318

FEDERATED DEPARTMENT STORES

COMMONWEALTH BANK OF AUSTRALIA

AUSTRALIA & NEW ZEALAND BANKING GROUP

ROCKWELL INTERNATIONAL

ARCHER DANIELS MIDLAND

U.S.

Australia

Australia

U.S.

U.S.

10.91

10.86

10.82

10.81

10.80

461

462

463

464

465

645

525

521

668

182

SUNAMERICA

KMART

CIBA SPEZIALITAETENCHEMIE HOLDING

BMC SOFTWARE

MITSUBISHI CORP.

U.S.

U.S.

Switzerland

U.S.

Japan

9.50

9.50

9.47

9.47

9.46

401

402

403

404

405

444

433

423

347

485

AON

TENET HEALTHCARE

AVON PRODUCTS

GENERAL MILLS

SCOTTISH POWER

U.S.

U.S.

U.S.

U.S.

Britain

10.80

10.79

10.78

10.76

10.75

466

467

468

469

470

609

821

564

551

414

FDX

BB&T

CNA FINANCIAL

PROMODES GROUP

AIR PRODUCTS & CHEMICALS

U.S.

U.S.

U.S.

France

U.S.

9.43

9.38

9.35

9.32

9.32

406

407

408

409

410

269

586

359

421

381

CLP HOLDINGS

GKN

EDISON INTERNATIONAL

FPL GROUP

HONEYWELL

Hong Kong

Britain

U.S.

U.S.

U.S.

10.66

10.65

10.64

10.60

10.59

471

472

473

474

475

251

441

636

698

402

KYOCERA

KAO

RITE AID

BANK OF IRELAND

RJR NABISCO HOLDINGS

Japan

Japan

U.S.

Ireland

U.S.

9.28

9.26

9.25

9.20

9.15

411

412

413

414

415

978

514

NR

592

530

BANCA COMMERCIALE ITALIANA

FOERENINGSSPARBANKEN

FORT JAMES

KREDIETBANK

PEARSON

Italy

Sweden

U.S.

Belgium

Britain

10.58

10.58

10.58

10.57

10.56

476

477

478

479

480

291

576

640

NR

568

CORNING

HOLDERBANK FINANCIERE GLARUS

NORDBANKEN HOLDING

BAAN

LINCOLN NATIONAL

U.S.

Switzerland

Sweden

Netherlands

U.S.

9.15

9.09

9.07

9.06

9.03

52 BUSINESS WEEK / JULY 13, 1998

TB

NY: Dowling, Comes, Power, Brady, Warner

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Rank

7/1/98 6:30 PM

Page 53

CMYK 03

53

EDIT PASS

INT-SCOREBD-RANK

BW

BW INTL

INT

RANK

1998 1997

COLOR OK

MARKET VALUE

Billions of U.S. dollars

481

482

483

484

485

407

867

NR

566

501

3COM

ORANGE

WOOLWICH

NATIONAL GRID GROUP

THYSSEN

486

487

488

489

490

631

226

487

495

747

491

492

493

494

495

EDIT OK

RANK

1998 1997

PE

DAD

???/!!!

XX

MARKET VALUE

Billions of U.S. dollars

U.S.

Britain

Britain

Britain

Germany

9.02

9.00

8.98

8.97

8.95

546

547

548

549

550

NR

683

489

362

431

ALLIANCE & LEICESTER

NORTHERN TRUST

SANDVIK

KINKI NIPPON RAILWAY

PRAXAIR

Britain

U.S.

Sweden

Japan

U.S.

7.87

7.87

7.84

7.79

7.78

ASDA GROUP

ASAHI BANK

MARRIOTT INTERNATIONAL

CHARLES SCHWAB

SUMMIT BANCORPORATION

Britain

Japan

U.S.

U.S.

U.S.

8.95

8.92

8.88

8.86

8.85

551

552

553

554

555

665

599

561

505

NR

McGRAW-HILL

COOPER INDUSTRIES

DOMINION RESOURCES

HILTON HOTELS

MEDIOBANCA

U.S.

U.S.

U.S.

U.S.

Italy

7.78

7.77

7.76

7.76

7.73

NR

415

604

500

518

STARWOOD HOTELS & RESORTS TRUST

FANUC

BANCO POPULAR ESPANOL

BOMBARDIER

DELTA AIR LINES

U.S.

Japan

Spain

Canada

U.S.

8.83

8.81

8.80

8.74

8.71

556

557

558

559

560

443

792

NR

595

629

BOC GROUP

LEGRAND

HAYS

NEWELL

PUBLIC SERVICE ENTERPRISE GROUP

Britain

France

Britain

U.S.

U.S.

7.70

7.70

7.69

7.69

7.68

496

497

498

499

500

596

480

546

567

506

BECTON, DICKINSON

CONSECO

CLOROX

COGNIZANT

SCOTTISH & NEWCASTLE BREWERIES

U.S.

U.S.

U.S.

U.S.

Britain

8.71

8.71

8.69

8.67

8.66

561

562

563

564

565

657

365

207

719

296

UNUM

TOPPAN PRINTING

NISSAN MOTOR

MEDIASET

SUMITOMO ELECTRIC INDUSTRIES

U.S.

Japan

Japan

Italy

Japan

7.68

7.63

7.62

7.62

7.60

501

502

503

504

505

460

466

493

662

560

SHIZUOKA BANK

AMERICAN ELECTRIC POWER

GENENTECH

SCHRODERS

PENINSULAR & ORIENTAL STEAM NAVIGATION

Japan

U.S.

U.S.

Britain

Britain

8.65

8.64

8.64

8.62

8.59

566

567

568

569

570

991

579

669

451

630

MONTEDISON

ESTEE LAUDER

LIMITED

YAMANOUCHI PHARMACEUTICAL

PIONEER HI-BRED INTERNATIONAL

Italy

U.S.

U.S.

Japan

U.S.

7.58

7.56

7.55

7.53

7.51

506

507

508

509

510

NR

326

510

459

236

RIUNIONE ADRIATICA DI SICURTA (RAS)

UNOCAL

AFLAC

LAND SECURITIES

SHARP

Italy

U.S.

U.S.

Britain

Japan

8.57

8.57

8.55

8.49

8.48

571

572

573

574

575

476

882

686

964

406

WEST JAPAN RAILWAY

KOHLS

COASTAL

SKANDIA FORSAKRING

RICOH

Japan

U.S.

U.S.

Sweden

Japan

7.51

7.50

7.49

7.48

7.47

511

512

513

514

515

512

557

855

632

863

MICHELIN

IMASCO

LEHMAN BROTHERS HOLDINGS

ALUSUISSE-LONZA GROUP

H.F. AHMANSON

France

Canada

U.S.

Switzerland

U.S.

8.47

8.43

8.41

8.40

8.37

576

577

578

579

580

920

625

614

739

NR

TJX

BURLINGTON RESOURCES

INGERSOLL-RAND

UNICOM

SUN LIFE AND PROVINCIAL HOLDINGS

U.S.

U.S.

U.S.

U.S.

Britain

7.47

7.46

7.46

7.46

7.43

516

517

518

519

520

554

395

528

627

634

DOVER

AMP

ASCEND COMMUNICATIONS

AES

PARAMETRIC TECHNOLOGY

U.S.

U.S.

U.S.

U.S.

U.S.

8.36

8.34

8.33

8.31

8.29

581 602 UNITED UTILITIES

582 398 TOYS R US

583 NR LEVEL 3 COMMUNICATIONS

584 NR TCI VENTURES GROUP

585 996 BENEFICIAL

Britain

U.S.

U.S.

U.S.

U.S.

7.41

7.39

7.37

7.35

7.33

521

522

523

524

525

885

427

456

467

NR

COMPUWARE

ASSOCIATED BRITISH FOODS

COMPAGNIE FINANCIERE RICHEMONT

IMPERIAL OIL

CENTRAL JAPAN RAILWAY

U.S.

Britain

Switzerland

Canada

Japan

8.23

8.23

8.23

8.21

8.21

586

587

588

589

590

NR

401

818

774

583

CADENCE DESIGN SYSTEMS

SHIN-ETSU CHEMICAL

ELECTROLUX

MBIA

ALLTEL

U.S.

Japan

Sweden

U.S.

U.S.

7.32

7.32

7.29

7.28

7.27

526

527

528

529

530

638

598

685

NR

749

RECKITT & COLMAN

DRESSER INDUSTRIES

TRIBUNE

PANAMSAT

HOUSTON INDUSTRIES

Britain

U.S.

U.S.

U.S.

U.S.

8.21

8.17

8.16

8.15

8.13

591

592

593

594

595

742

681

375

887

600

NORTHROP GRUMMAN

INTIMATE BRANDS

BARRICK GOLD

ELAN

TRANSAMERICA

U.S.

U.S.

Canada

Ireland

U.S.

7.25

7.25

7.24

7.24

7.24

531

532

533

534

535

663

244

615

740

472

DIGITAL EQUIPMENT

MITSUI & CO.

COMPUTER SCIENCES

INTERPUBLIC GROUP

POWERGEN

U.S.

Japan

U.S.

U.S.

Britain

8.13

8.11

8.10

8.09

8.08

596 NR McKESSON

597 NR HARTFORD LIFE

598 NR ALMANIJ

599 778 CENTRICA

600 315 SINGAPORE AIRLINES

U.S.

U.S.

Belgium

Britain

Singapore

7.23

7.21

7.19

7.13

7.13

536

537

538

539

540

400

582

488

644

755

TELECOM CORP. OF NEW ZEALAND

UPM-KYMMENE

DORDTSCHE PETROLEUM

SYNTHELABO

ADIDAS-SALOMON

New Zealand

Finland

Netherlands

France

Germany

8.07

8.04

8.03

8.01

8.01

601

602

603

604

605

NR

463

972

577

606

US AIRWAYS GROUP

TENNECO

STAPLES

UNITED NEWS & MEDIA

ROLLS-ROYCE

U.S.

U.S.

U.S.

Britain

Britain

7.06

7.06

7.06

7.06

7.05

541

542

543

544

545

515

647

759

563

594

SCHERING

QUAKER OATS

OMNICOM GROUP

WHITBREAD

SYSCO

Germany

U.S.

U.S.

Britain

U.S.

8.00

7.99

7.97

7.95

7.87

606

607

608

609

610

429

711

823

369

373

KYUSHU ELECTRIC POWER

GATEWAY 2000

CINCINNATI FINANCIAL

TORAY INDUSTRIES

MURATA MFG.

Japan

U.S.

U.S.

Japan

Japan

7.02

7.01

7.00

6.98

6.97

BUSINESS WEEK / JULY 13, 1998 53

TB

NY: Dowling, Comes, Power, Brady, Warner

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Rank

7/1/98 6:30 PM

CMYK 03

54

Page 54

EDIT PASS

INT-SCOREBD-RANK

BW

BW INTL

INT

PE

DAD

???/!!!

XX

EDIT OK

COLOR OK

THE BUSINESS WEEK GLOBAL 1000

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

611 888 GROUPE UCB

612 667 REPUBLIC NEW YORK

613 NR EQUITY OFFICE PROPERTIES TRUST

614 974 COMPASS GROUP

615 NR QWEST COMMUNICATIONS INTERNATIONAL

616

617

618

619

620

618

691

545

535

817

PACIFICORP

MGIC INVESTMENT

SLM HOLDING

AMERICAN STORES

MERCANTILE BANCORPORATION

621

622

623

624

625

701

411

621

578

814

TOMKINS

TOHOKU ELECTRIC POWER

UNION CARBIDE

ADECCO

NEW YORK TIMES

626

627

628

629

630

NR

813

503

682

745

MISYS

LADBROKE GROUP

MERCK KGAA

ROHM & HAAS

DIAMOND OFFSHORE DRILLING

631

632

633

634

635

848

422

409

434

558

VALEO

FORTUNE BRANDS

TAISHO PHARMACEUTICAL

EMI GROUP

SAFEWAY PLC

636 NR BRITISH ENERGY

637 NR FIRSTENERGY

638 426 SECOM

639 726 DEN DANSKE BANK

640 NR FRED MEYER

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

Belgium

U.S.

U.S.

Britain

U.S.

6.95

6.95

6.93

6.90

6.87

676

677

678

679

680

909

NR

720

886

847

GOLDEN WEST FINANCIAL

UNISYS

SOLVAY

REGIONS FINANCIAL

THAMES WATER

U.S.

U.S.

U.S.

U.S.

U.S.

6.86

6.84

6.84

6.82

6.81

681

682

683

684

685

994

757

895

753

585

SODEXHO ALLIANCE

BAY NETWORKS

BEAR STEARNS

3I GROUP

ADVANTEST

Britain

Japan

U.S.

Switzerland

U.S.

6.81

6.80

6.80

6.78

6.73

686

687

688

689

690

202

672

591

NR

990

Britain

Britain

Germany

U.S.

U.S.

6.72

6.67

6.67

6.67

6.66

691

692

693

694

695

790

715

601

603

637

France

U.S.

Japan

Britain

Britain

6.65

6.65

6.65

6.64

6.63

696 NR PROVIDIAN FINANCIAL

697 NR INGRAM MICRO

698 781 TORCHMARK

699 824 RANDSTAD HOLDING

700 NR PAINEWEBBER GROUP

Britain

U.S.

Japan

Denmark

U.S.

6.63

6.60

6.60

6.58

6.58

701

702

703

704

705

937

975

NR

483

793

SOUTHWEST AIRLINES

NEXTEL COMMUNICATIONS

CHANCELLOR MEDIA

HONGKONG ELECTRIC HOLDINGS

SYNOVUS FINANCIAL

Japan

U.S.

U.S.

U.S.

Japan

6.57

6.57

6.57

6.55

6.55

706

707

708

709

710

428

445

795

881

540

NIPPON EXPRESS

GEORGIA-PACIFIC GROUP

DEGUSSA

PAYCHEX

CHRISTIAN DIOR

U.S.

Japan

Netherlands

U.S.

Germany

6.53

6.53

6.51

6.51

6.51

711

712

713

714

715

985

494

833

947

802

U.S.

U.S.

Belgium

U.S.

Britain

6.19

6.17

6.17

6.16

6.15

France

U.S.

U.S.

Britain

Japan

6.15

6.14

6.14

6.13

6.12

HENDERSON LAND DEVELOPMENT

BAKER HUGHES

INCENTIVE

EDISON

CASINO, GUICHARD-PERRACHON

Hong Kong

U.S.

Sweden

Italy

France

6.11

6.11

6.11

6.11

6.10

JEFFERSON-PILOT

ARES-SERONO

GENUINE PARTS

ASAHI BREWERIES

WINN-DIXIE STORES

U.S.

Switzerland

U.S.

Japan

U.S.

6.08

6.08

6.07

6.07

6.04

U.S.

U.S.

U.S.

Netherlands

U.S.

6.04

6.03

6.01

6.01

5.99

U.S.

U.S.

U.S.

Hong Kong

U.S.

5.96

5.95

5.94

5.93

5.90

Japan

U.S.

Germany

U.S.

France

5.90

5.89

5.88

5.87

5.83

STAR BANC

TOKYO GAS

S.M.H.

ACE

DUN & BRADSTREET

U.S.

Japan

Switzerland

U.S.

U.S.

5.83

5.82

5.82

5.79

5.79

Belgium

U.S.

U.S.

Hong Kong

Germany

5.78

5.77

5.74

5.74

5.71

Italy

France

France

Germany

U.S.

5.69

5.69

5.69

5.68

5.68

641

642

643

644

645

342

533

661

531

312

MITSUI FUDOSAN

TRW

SAFECO

BROWNING-FERRIS INDUSTRIES

SUMITOMO TRUST & BANKING

646

647

648

649

650

NR

214

830

905

608

CAPITAL ONE FINANCIAL

DDI

VNU

SOUTHTRUST

VEW

651

652

653

654

655

442

552

730

570

475

ALCAN ALUMINIUM

ACOM

VF

ENTERGY

CROWN CORK & SEAL

Canada

Japan

U.S.

U.S.

U.S.

6.50

6.50

6.49

6.48

6.45

716

717

718

719

720

NR

709

907

256

844

COMPAGNIE BENELUX PARIBAS (COBEPA)

SHERWIN-WILLIAMS

DTE ENERGY

SWIRE PACIFIC

MAN

656

657

658

659

660

843

676

581

NR

678

CRESTAR FINANCIAL

HAVAS

EATON

AMVESCAP

R.R. DONNELLEY & SONS

U.S.

France

U.S.

Britain

U.S.

6.43

6.43

6.41

6.39

6.39

721

722

723

724

725

NR

699

958

801

654

BANCA FIDEURAM

CANAL PLUS

ERIDANIA BEGHIN-SAY

AACHENER UND MUENCHENER BETEILIGUNG

TIMES MIRROR

U.S.

Italy

Japan

U.S.

Portugal

6.37

6.35

6.34

6.33

6.32

726

727

728

729

730

571

995

350

517

NR

HONG KONG & CHINA GAS

ASM LITHOGRAPHY HOLDING

SEAGATE TECHNOLOGY

MARUI

STAGECOACH HOLDINGS

Hong Kong

Netherlands

U.S.

Japan

Britain

5.67

5.66

5.65

5.65

5.64

U.S.

Britain

Japan

Japan

Britain

5.64

5.64

5.63

5.63

5.62

U.S.

U.S.

Italy

U.S.

Japan

5.62

5.61

5.59

5.59

5.59

661 927 EXEL

662 NR PIRELLI

663 297 ASAHI GLASS

664 834 OWENS-ILLINOIS

665 NR BANCO COMERCIAL PORTUGUES (BCP)

666

667

668

669

670

871

836

417

796

559

HUNTINGTON BANCSHARES

PECO ENERGY

MATSUSHITA ELECTRIC WORKS

LUCASVARITY

COCA-COLA AMATIL

U.S.

U.S.

Japan

Britain

Australia

6.30

6.29

6.26

6.25

6.24

731 NR ROYAL CARIBBEAN CRUISES

732 773 BRITISH LAND

733 377 SUMITOMO CORP.

734 319 JUSCO

735 NR WILLIAMS

671

672

673

674

675

NR

626

693

783

879

HEIDELBERGER DRUCKMASCHINEN

LINDE

CAROLINA POWER & LIGHT

ROYALE BELGE

SERVICEMASTER

Germany

Germany

U.S.

Belgium

U.S.

6.24

6.22

6.20

6.19

6.19

736

737

738

739

740

768

789

NR

703

435

GENERAL DYNAMICS

CENTRAL & SOUTH WEST

ALITALIA

THERMO ELECTRON

SANYO ELECTRIC

54 BUSINESS WEEK / JULY 13, 1998

TB

NY: Dowling, Comes, Power, Brady, Warner

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Rank

7/1/98 6:30 PM

CMYK 03

55

Page 55

EDIT PASS

INT-SCOREBD-RANK

BW

BW INTL

INT

RANK

1998 1997

COLOR OK

MARKET VALUE

Billions of U.S. dollars

741 NR NATIONWIDE FINANCIAL SERVICES

742 876 PREUSSAG

743 857 GUARDIAN ROYAL EXCHANGE

744 405 DEVELOPMENT BANK OF SINGAPORE

745 NR CREDIT COMMERCIAL DE FRANCE

PE

DAD

???/!!!

XX

EDIT OK

RANK

1998 1997

MARKET VALUE

Billions of U.S. dollars

U.S.

Germany

Britain

Singapore

France

5.58

5.57

5.56

5.56

5.55

806 763 SYDKRAFT

807 NR NEW CENTURY ENERGIES

808 658 CINERGY

809 NR LORAL SPACE & COMMUNICATIONS

810 481 UNION PACIFIC RESOURCES GROUP

Ireland

U.S.

Japan

U.S.

U.S.

5.55

5.55

5.54

5.52

5.48

811

812

813

814

815

276

942

353

988

980

Sweden

U.S.

U.S.

U.S.

U.S.

5.12

5.11

5.10

5.10

5.08

MITSUBISHI ELECTRIC

HASBRO

DAIWA SECURITIES

AUTOZONE

CANADIAN NATIONAL RAILWAY

Japan

U.S.

Japan

U.S.

Canada

5.08

5.08

5.08

5.07

5.04

U.S.

Britain

U.S.

U.S.

Canada

5.03

5.03

5.02

5.01

5.01

746

747

748

749

750

934

NR

432

932

982

CRH

BLACK & DECKER

TOKYO ELECTRON

DANA

MARSHALL & ILSLEY

751

752

753

754

755

856

548

536

810

853

WASHINGTON POST

AJINOMOTO

OSAKA GAS

SEVERN TRENT

SVENSKA CELLULOSA AKTIEBOLAGET

U.S.

Japan

Japan

Britain

Sweden

5.47

5.46

5.46

5.45

5.44

816

817

818

819

820

979

718

NR

399

921

JOHNSON CONTROLS

BRITISH STEEL

COUNTRYWIDE CREDIT INDUSTRIES

MICRON TECHNOLOGY

MAGNA INTERNATIONAL

756

757

758

759

760

NR

799

727

917

744

HARLEY-DAVIDSON

ARCO CHEMICAL

CONSOLIDATED NATURAL GAS

NOVA CORP.

GREEN TREE FINANCIAL

U.S.

U.S.

U.S.

Canada

U.S.

5.44

5.42

5.42

5.40

5.40

821

822

823

824

825

770

590

496

NR

447

SHELL CANADA

TOYODA AUTOMATIC LOOM WORKS

CHEUNG KONG INFRASTRUCTURE HOLDINGS

PROVIDENT

ASAHI CHEMICAL INDUSTRY

Canada

Japan

Hong Kong

U.S.

Japan

5.01

5.00

5.00

4.99

4.99

Sweden

Japan

U.S.

U.S.

U.S.

5.38

5.38

5.37

5.37

5.36

826 524 NEWBRIDGE NETWORKS

827 NR AUTOSTRADE CONCESSIONI E COSTRUZIONI

828 NR HERTZ

829 760 TOSCO

830 655 SCANIA

Canada

Italy

U.S.

U.S.

Sweden

4.97

4.97

4.97

4.96

4.96

Sweden

U.S.

U.S.

Belgium

Canada

5.35

5.35

5.35

5.34

5.34

831

832

833

834

835

697

735

993

NR

976

UST

AMERADA HESS

LEGGETT & PLATT

YAHOO!

TRANSOCEAN OFFSHORE

U.S.

U.S.

U.S.

U.S.

U.S.

4.94

4.94

4.93

4.93

4.93

Germany

Australia

U.S.

Netherlands

U.S.

5.33

5.33

5.32

5.31

5.30

836

837

838

839

840

839

605

NR

911

811

GPU

SHISEIDO

UNION PLANTERS

RMC GROUP

TYSON FOODS

U.S.

Japan

U.S.

Britain

U.S.

4.92

4.92

4.91

4.90

4.89

Japan

Japan

Japan

U.S.

France

5.30

5.30

5.28

5.28

5.27

841 845 RUBBERMAID

842 448 SUMITOMO METAL INDUSTRIES

843 NR HEALTH MANAGEMENT ASSOCIATES

844 NR BALOISE HOLDING

845 731 CARLTON COMMUNICATIONS

U.S.

Japan

U.S.

Switzerland

Britain

4.89

4.88

4.88

4.87

4.86

France

Germany

Germany

Denmark

Finland

5.27

5.25

5.25

5.24

5.24

846

847

848

849

850

Germany

Britain

Britain

France

Singapore

4.86

4.86

4.84

4.84

4.82

Britain

Japan

U.S.

Sweden

Japan

5.23

5.22

5.21

5.21

5.21

851 NR PORSCHE

852 677 HACHIJUNI BANK

853 864 PHARMA VISION 2000

854 NR EQUITY RESIDENTIAL PROPERTIES TRUST

855 NR GEORGE WESTON

Germany

Japan

Switzerland

U.S.

Canada

4.81

4.81

4.79

4.78

4.78

U.S.

Netherlands

Hong Kong

Canada

U.S.

5.20

5.19

5.17

5.17

5.17

856 NR SOLECTRON

857 NR MAYTAG

858 959 WESTERN ATLAS

859 NR TRICON GLOBAL RESTAURANTS

860 NR R&B FALCON

U.S.

U.S.

U.S.

U.S.

U.S.

4.76

4.74

4.74

4.72

4.71

Australia

U.S.

U.S.

U.S.

U.S.

5.17

5.17

5.16

5.16

5.15

861

862

863

864

865

NR

NR

NR

NR

NR

DAILY MAIL & GENERAL TRUST

WPP GROUP

BOUYGUES

POPULAR

OFFICE DEPOT

Britain

Britain

France

U.S.

U.S.

4.71

4.71

4.70

4.70

4.69

U.S.

U.S.

Germany

Belgium

France

5.14

5.14

5.14

5.13

5.13

866

867

868

869

870

NR

973

812

439

944

FAIRFAX FINANCIAL HOLDINGS

COLUMBIA ENERGY GROUP

YAMATO TRANSPORT

JAPAN TELECOM

DOW JONES

Canada

U.S.

Japan

Japan

U.S.

4.69

4.68

4.68

4.68

4.68

761 717 SKANSKA

762 707 SMC

763 NR DOLLAR GENERAL

764 NR AMEREN

765 962 UNIONBANCAL

766

767

768

769

770

741

930

928

935

NR

ATLAS COPCO

NORDSTROM

LINEAR TECHNOLOGY

GROUPE BRUXELLES LAMBERT

LOBLAW

771

772

773

774

775

729

738

826

949

776

BANKGESELLSCHAFT BERLIN

LEND LEASE

FIRSTAR

HEINEKEN HOLDING

EASTMAN CHEMICAL

776

777

778

779

780

372

611

509

899

NR

ALL NIPPON AIRWAYS

MATSUSHITA COMMUNICATION INDUSTRIAL

SEKISUI HOUSE

AVERY DENNISON

LAGARDERE

781 NR DASSAULT SYSTEMES

782 549 FRESENIUS MEDICAL CARE

783 NR BERLINER KRAFT & LICHT

784 NR RATIN

785 NR MERITA-NORDBANKEN

786

787

788

789

790

NR

543

791

756

368

BILLITON

CHUGOKU ELECTRIC POWER

CIENA

STORA KOPPARBERGS BERGSLAGS

KAWASAKI STEEL

791

792

793

794

795

NR

794

274

840

750

FRONTIER

VENDEX INTERNATIONAL

CITIC PACIFIC

TRANSCANADA PIPELINES

INTERNATIONAL FLAVORS & FRAGRANCES

796

797

798

799

800

724

945

943

880

NR

COLES MYER

HUMANA

WHIRLPOOL

W.W. GRAINGER

DONALDSON, LUFKIN & JENRETTE

801 NR CIT GROUP

802 785 EQUIFAX

803 797 BEIERSDORF

804 931 ELECTRAFINA

805 NR CREDIT LYONNAIS

859

714

913

NR

268

HEIDELBERGER ZEMENT

BLUE CIRCLE INDUSTRIES

SMITHS INDUSTRIES

THOMSON-CSF

OCBC OVERSEAS CHINESE BANK

BUSINESS WEEK / JULY 13, 1998 55

TB

NY: Dowling, Comes, Power, Brady, Warner

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Rank

7/1/98 6:30 PM

CMYK 03

58

Page 58

EDIT PASS

EDIT OK

INT-SCOREBD-RANK

BW

BW INTL

INT

COLOR OK

PE

DAD

???/!!!

XX

THE BUSINESS WEEK GLOBAL 1000

RANK

1998 1997

871

872

873

874

875

819

NR

805

764

404

876 NR

877 762

878 NR

879 803

8801000

MARKET VALUE

Billions of U.S. dollars

POTASH CORP. OF SASKATCHEWAN

EL PASO NATURAL GAS

HAGEMEIJER

PETRO-CANADA

NIKKO SECURITIES

4.67

4.66

4.63

4.63

4.62

936 989 PACCAR

937 809 FRESENIUS

938 NR UNIDANMARK

939 NR NETWORK ASSOCIATES

940 NR E.W. SCRIPPS

Canada

U.S.

U.S.

Britain

U.S.

4.62

4.62

4.62

4.61

4.61

Britain

U.S.

U.S.

U.S.

U.S.

U.S.

Germany

Denmark

U.S.

U.S.

4.31

4.31

4.30

4.28

4.26

941 NR NORTHERN STATES POWER

942 866 BIC

943 NR DANAHER

944 951 BURMAH CASTROL

945 NR HILLENBRAND INDUSTRIES

U.S.

France

U.S.

Britain

U.S.

4.26

4.25

4.23

4.23

4.23

4.61

4.59

4.58

4.58

4.57

946 897 ORIX

947 NR ESSILOR INTERNATIONAL

948 NR T. ROWE PRICE ASSOCIATES

949 956 STANLEY WORKS

950 641 MATSUSHITA-KOTOBUKI ELECTRONICS INDUSTRIES

Japan

France

U.S.

U.S.

Japan

4.22

4.21

4.21

4.20

4.20

U.S.

Japan

Britain

Japan

U.S.

4.57

4.57

4.57

4.56

4.55

951 NR BK VISION

952 903 CIRCUIT CITY STORES

953 765 HERCULES

954 NR ALZA

955 NR PERNOD RICARD

Switzerland

U.S.

U.S.

U.S.

France

4.20

4.18

4.18

4.18

4.18

Australia

Japan

U.S.

U.S.

U.S.

4.55

4.55

4.55

4.54

4.53

956 NR PROVIDENT FINANCIAL

957 737 REYNOLDS METALS

958 NR PECHINEY

959 NR STARBUCKS

960 NR CABLEVISION SYSTEMS

Britain

U.S.

France

U.S.

U.S.

4.18

4.18

4.15

4.15

4.15

U.S.

Hong Kong

Britain

U.S.

U.S.

4.53

4.52

4.52

4.50

4.50

961

962

963

964

965

NR

NR

NR

NR

NR

Portugal

Britain

U.S.

U.S.

U.S.

4.14

4.13

4.13

4.12

4.12

Britain

U.S.

U.S.

U.S.

U.S.

4.49

4.48

4.48

4.47

4.46

966

967

968

969

970

653

NR

831

725

952

TOYO TRUST & BANKING

CRESCENT REAL ESTATE EQUITIES

LAIDLAW

NIPPON PAPER INDUSTRIES

MAZDA MOTOR

Japan

U.S.

Canada

Japan

Japan

4.12

4.11

4.10

4.09

4.09

Denmark

Netherlands

Japan

Germany

U.S.

4.45

4.45

4.43

4.43

4.42

971

972

973

974

975

580

748

NR

954

922

DAIWA HOUSE INDUSTRY

NIPPON YUSEN

FIRST TENNESSEE NATIONAL

USINOR

MINEBEA

Japan

Japan

U.S.

France

Japan

4.08

4.08

4.07

4.07

4.07

Norway

U.S.

Netherlands

Britain

Britain

4.42

4.41

4.41

4.40

4.40

976 NR DIXONS GROUP

977 469 KOMATSU

978 NR TOTAL SYSTEM SERVICES

979 NR CENTURY TELEPHONE ENTERPRISES

980 666 PANCANADIAN PETROLEUM

Britain

Japan

U.S.

U.S.

Canada

4.07

4.06

4.05

4.04

4.02

Britain

Germany

France

U.S.

U.S.

4.39

4.39

4.39

4.39

4.39

981 835 ANALOG DEVICES

982 NR SANTA FE INTERNATIONAL

983 NR FIRST SECURITY

984 NR FLORIDA PROGRESS

985 NR AXA COLONIA KONZERN

U.S.

U.S.

U.S.

U.S.

Germany

4.02

4.01

4.00

4.00

3.99

U.S.

U.S.

U.S.

U.S.

Japan

4.38

4.38

4.37

4.37

4.37

986 NR ECOLAB

987 NR TABACALERA

988 NR BRITANNIC ASSURANCE

989 986 BROWN-FORMAN

990 NR IMPERIAL TOBACCO GROUP

U.S.

Spain

Britain

U.S.

Britain

3.97

3.97

3.97

3.97

3.96

Japan

U.S.

U.S.

Japan

U.S.

4.36

4.35

4.35

4.35

4.34

991 NR BENETTON GROUP

992 933 ANADARKO PETROLEUM

993 NR ELECTROCOMPONENTS

994 NR OLIVETTI

995 692 OMRON

Italy

U.S.

Britain

Italy

Japan

3.96

3.96

3.96

3.95

3.95

Canada

Canada

Germany

U.S.

U.S.

4.34

4.33

4.32

4.32

4.31

Sweden

Britain

U.S.

Sweden

U.S.

3.95

3.94

3.94

3.93

3.93

881 670 ENTERPRISE OIL

882 957 SABRE GROUP HOLDINGS

883 NR KANSAS CITY SOUTHERN INDUSTRIES

884 777 UAL

885 NR STEELCASE

786

761

906

473

NR

ALLEGHENY TELEDYNE

PROMISE

LASMO

JAPAN AIRLINES

WELLPOINT HEALTH NETWORKS

891

892

893

894

895

877

675

NR

892

702

BRAMBLES INDUSTRIES

KEYENCE

FOOD LION

PARKER HANNIFIN

NUCOR

896 918 DILLARDS

897 279 NEW WORLD DEVELOPMENT

898 NR SECURICOR

899 904 BALTIMORE GAS & ELECTRIC

900 NR STORAGE TECHNOLOGY

901 NR SEMA GROUP

902 NR TANDY

903 NR CINTAS

904 891 KNIGHT-RIDDER

905 NR SEALED AIR

906

907

908

909

910

926

NR

696

902

874

CARLSBERG

GETRONICS

NICHIEI

FRIED. KRUPP AG HOESCH-KRUPP

NORTHWEST AIRLINES

911 849 ORKLA

912 NR CMS ENERGY

913 929 KONINKLIJKE NUMICO

914 NR EMAP

915 NR NORTHERN ROCK

916 620 RANK GROUP

917 NR KARSTADT

918 NR SOCIETE CENTRALE DU GAN

919 NR CHARTER ONE FINANCIAL

920 NR AMSOUTH BANCORPORATION

921 999 MAXIM INTEGRATED PRODUCTS

922 NR SOUTHERN NEW ENGLAND TELECOMMUNICATIONS

923 743 MOLEX

924 NR ITT INDUSTRIES

925 529 SUMITOMO CHEMICAL

926

927

928

929

930

612

NR

539

712

851

OJI PAPER

VASTAR RESOURCES

NEWMONT GOLD

SONY MUSIC ENTERTAINMENT

CINCINNATI BELL

931

932

933

934

935

NR

688

896

822

733

POWER CORP. OF CANADA

NORANDA

LAHMEYER

CASE

SONAT

MARKET VALUE

Billions of U.S. dollars

Canada

U.S.

Netherlands

Canada

Japan

BC TELECOM

CHAMPION INTERNATIONAL

ROBERT HALF INTERNATIONAL

TI GROUP

H&R BLOCK

886

887

888

889

890

RANK

1998 1997

996

997

998

999

1000

NR

827

NR

NR

969

BANCO ESPIRITO SANTO E COMERCIAL LISBOA

SOUTHERN ELECTRIC

GALILEO INTERNATIONAL

AT HOME

CONSOLIDATED STORES

NETCOM SYSTEMS

WOLSELEY

OLD REPUBLIC INTERNATIONAL

AGA

HOST MARRIOTT

58 BUSINESS WEEK / JULY 13, 1998

TB

NY: Dowling, Comes, Power, Brady, Warner

Large: Morrison, J. Mandel, Rosenberg, Jespersen

5

Int-Scorebd-Country

7/1/98 6:50 PM

CMYK 03

59

Page 59

EDIT PASS

COLOR OK

INT-SCOREBD-COUNTRY

BW

BW INTL

INT

PE

DAD

???/!!!

XX

EDIT OK

THE BUSINESS WEEK GLOBAL 1000

Country by Country

GLOSSARY

MARKET VALUE: Share price on

May 29, 1998, multiplied by

latest available number of

shares outstanding, translated

into U.S. dollars at May monthend exchange rates. Market value may include several classes

of stock; price and yield data

are based on the companys

most widely held issue.

SHARE PRICE AND ANNUAL

CHANGE: Closing per-share

price on May 29, 1998, in

U.S. dollars. Annual percent

change from May 30, 1997, to

May 29, 1998, both in U.S.

dollars and in each companys

local currency.

PRICE/BOOK VALUE RATIO: The

ratio of May closing price to

latest available net worth per

share or common shareholders

equity investment.

PRICE/EARNINGS RATIO: The

ratio of May 29 closing price to

latest 12-months earnings per

share.

YIELD: Latest 12-months dividends per share as a percent of

May closing price.

SALES: Net sales reported by

company, translated at May 29

exchange rates; revenues for

banks and other financial institutions are not included

because they are not comparable to those of industrial

companies.

PROFITS: Latest aftertax earn-

ings available to common

shareholders, translated at May

29 currency exchange rates;

profits are from companies

continuing operations before

extraordinary or special items.

Sales, profits, and assets are for

1997 fiscal year unless noted.

RETURN ON EQUITY: Latest 12months earnings per share as

percent of most recent book

value per share.

INDUSTRY CODE: For key to the

two-digit code, see page 77.

Data for individual companies: Morgan Stanley Capital International, unless otherwise indicated. For further information on MSCI data, contact Morgan Stanley Dean Witter & Co. at

212-761-8141 (New York) or 071-425-6660 (London). Country composites and rankings calculated by BUSINESS WEEK. Additional data by Standard & Poors Compustat, a division

of The McGraw-Hill Companies if footnoted.

GLOBAL

1000

RANK

COUNTRY

RANK

GLOBAL COMPOSITE

MARKET

VALUE

PRICE

% CHANGE

U.S. PER SHARE FROM 1997

$ MIL.

U.S. $ (U.S. $) (LOCAL)

16624529 209

36

PRICE/

BOOK

VALUE

RATIO

P/E

RATIO

YIELD

%

45

4.2

29

2.0 9242313 625959 35335717 18.6

SALES

U.S.

$ MIL.

PROFITS

U.S.

$ MIL.

ASSETS

U.S.

$ MIL.

RETURN

ON

EQUITY INDUSTRY

%

CODE

AUSTRALIA

COUNTRY COMPOSITE

148592

10

20

3.0

22

3.1

57388

8687

430149 15.2

1

2

3

4

TELSTRA

NEWS CORP.

NATIONAL AUSTRALIA BANK

BROKEN HILL PROPRIETARY

128

184

207

236

30278

21802

19828

17500

2

6

14

9

NA

39

3

40

NA

69

18

27

6.7

1.7

2.6

2.2

19

24

15

22

1.6

0.3

4.4

3.7

9668

9013

NA

13120

1608

811

1391

868

16196 34.8

25905

7.0

108803b 17.0d

23009 10.0

5

6

7

8

WESTPAC BANKING

COMMONWEALTH BANK OF AUSTRALIA

AUSTRALIA & NEW ZEALAND BANKING GROUP

COCA-COLA AMATIL

344

397

398

670

12243

10865

10825

6237

7

12

7

7

22

10

4

36

48

33

26

23

2.3

2.6

2.5

1.9

15

15

15

41

3.9

5.5

4.4

1.6

NA

NA

NA

3024

784

755

733

152

LEND LEASE

COLES MYER

BRAMBLES INDUSTRIES

RIO TINTO LTD. (6)

772

796

891

NR

5333

5171

4548

3962

21

5

20

12

8

3

13

26

31

18

37

11

2.9

3.3

5.0

2.8

26

24

28

16

2.9

3.2

2.2

4.0

1066

12041

1671

7784

202

199

152

1031

9588

90

41

47

2.4

57

1.2

NA

112

60449

4.2

9588

90

41

47

2.4

57

1.2

NA

112b

60449b

4.2

9

10

11

12

55

51

61

11

74512

75227

77793

5929

15.0

17.2

16.4

4.5

61

61

61

43

2927

4194

1965

13688b

11.0

13.9

18.1

17.4d

64

54

52

24

AUSTRIA

COUNTRY COMPOSITE

1 BANK AUSTRIA

457

61

BELGIUM

COUNTRY COMPOSITE

130004

572

53

59

3.1

23

2.4

48621

6224

1

2

3

4

ELECTRABEL

SOCIETE GENERALE DE BELGIQUE

GENERALE DE BANQUE

FORTIS AG (4)

305

327

348

NR

13679

12585

12112

11987

250

178

733

286

12

93

85

47

17

102

93

53

2.3

2.6

3.3

3.1

17

24

26

23

5.3

1.8

2.0

1.5

6491

NA

NA

NA

814

525

464

489

12766b

24878

160901

4176

13.8d

10.8

12.4

13.1

12

71

61

63

5

6

7

8

TRACTEBEL

KREDIETBANK

PETROFINA

ALMANIJ

383

414

455

598

11195

10571

9625

7187

133

702

411

82

51

70

17

86

57

78

22

94

3.1

3.6

2.3

3.7

25

27

16

31

2.2

1.5

3.1

1.2

9371b

NA

19786

NA

307b

399

600

234

19740b

113437

10984

3106b

12.6

13.4

14.1

12.0d

12

61

11

62

GROUPE UCB

ROYALE BELGE

SOLVAY

COMPAGNIE BENELUX PARIBAS (COBEPA)

611

674

678

716

6951 4764

6194 387

6168

73

5784

73

75

38

21

71

83

44

27

79

9.8

3.0

2.1

2.3

41

21

16

7

0.7

2.4

3.0

3.2

1648

2863

8463

NA

171

297

373

637

1420b

26011

7705b

1912b

24.0d

14.5

12.6d

25.6d

45

63

22

71

5495

5343

5128

50

38

36

56

44

42

2.3

2.1

1.6

19

30

18

2.4

2.6

2.9

NA

NA

NA

9

10

11

12

13 CREDIT COMMUNAL HOLDING/DEXIA BELGIUM (7) NR

14 GROUPE BRUXELLES LAMBERT

769

15 ELECTRAFINA

804

150

220

138

596

176b

142b

601698 13.8

204878 12.0

5167b 7.2

4618b 8.6

61

71

11

*Based on nonconsolidated results. a) Results are for 9 months. b) Based on 1996 data. c) Based on 1998 data. d) Difference between earnings and book value between 12 and 18 months. Digital

Equipment was acquired by Compaq on June 12, 1998. 1) Global ranking calculated for Royal Dutch/Shell Group by combining market value of the Netherlands Royal Dutch Petroleum and Britains

Shell Transport & Trading. 2) Global ranking calculated for Unilever by combining market value of the Netherlands Unilever NV and Britains Unilever PLC. 3) Global ranking calculated for ABB Asea

Brown Boveri by combining market value of Swedens ABB AB and Switzerlands ABB AG. 4) Global ranking calculated for Fortis by combining market value of Belgiums Fortis AG Group and the