Académique Documents

Professionnel Documents

Culture Documents

Untitled

Transféré par

rezaul karim papel shahin0 évaluation0% ont trouvé ce document utile (0 vote)

9 vues3 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

TXT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme TXT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

9 vues3 pagesUntitled

Transféré par

rezaul karim papel shahinDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme TXT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

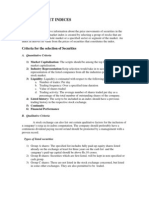

1.085578611 1.056710077 1.156555567 1.

177563661

1.021169647

Cash+ Marketeable securities 0.05 0.05 0.04 0.28

0.02

Cash ratio Current liabilities

0.024149006 0.036169826 0.195940637 0.140095196

1.073736716

0.004468515 0.04 0.009241757 0.04 0.015071286 0.17 0.018293579 0.19

0.022898467 0.30

Leverage ratio 0.003993839 0.004827031 0.171300272

0.229917767 0.052641483

0.099308351 0.10723192 0.442540217 0.27598073

0.326631223

Total debt 0.67 0.64 0.66 0.67 0.73

Debt ratio Total asstet

0.261470704 0.2180677 0.295796968 0.311525593

0.395497148

0.659336533 0.64 0.647587983 0.59 0.646154033 0.49 0.617779524 0.47

0.456257722 0.46

0.612310092 0.775006972 0.325966109 0.271944624

0.16493837

1 0.662831241 0.543495845 0.471060149

0.561623069

Total debt 2.05 1.76 1.95 1.99 2.72

Debt to equity Total equity

0.34099927 0.278883825 0.420045008 0.452493886

0.430052039

1.966183808 1.37 2.173117499 1.43 2.089631359 1.35 2.062483341 1.21

1.631290576 1.34

0.276122412 0.396181997 0.325966109 0.271944624

0.16493837

2.19314266 2.561563079 1.952708058 1.247616086

1.757013118

Coverage ratio

EBIT 2.38 2.60 3.13 4.01 4.82

Interet coverage Interest charges

1.458903544 1.465086416 1.607339566 1.557498151

1.224862925

1.741536444 2.10 1.613341372 2.27 1.761880118 2.57 1.771552129 2.33

1.289887545 2.60

1.841433214 2.024144466 2.396382115 2.277750835

1.795644131

3.105894627 3.650663298 3.943760984 2.027821113

3.883272538

Profitability ratios

Gross profit 0.29 0.29 0.31 0.33 0.34

Gross profit margin Sales 0.310013141 0.347493882 0.350467121

0.361934019 0.37106541

0.364499998 0.42 0.370100475 0.44 0.362188953 0.45 0.350028471 0.46

0.362338359 0.46

0.379187494 0.404590722 0.468436921 0.467568215

0.453017402

0.782771713 0.781847293 0.780055402 0.784284177

0.765935904

Net income 0.04 0.04 0.04 0.05 0.07

ROA Total assets

0.152293367 0.165246826 0.158808655 0.125375439

0.163437139

0.093309526 0.12 0.075481154 0.11 0.089853813 0.10 0.097802214 0.11

0.098550023 0.11

0.099934329 0.119078033 0.044699891 0.039509597

0.029536978

0.190805209 0.175296374 0.177071844 0.215160646

0.171273748

Net income 0.13 0.10 0.12 0.16 0.25

ROE Shareholder's equity

0.198614706 0.211331924 0.225515438 0.182109017

0.177716768

0.215786071 0.28 0.214178954 0.25 0.253881506 0.26 0.255881867 0.24

0.181245164 0.24

0.025850997 0.034379656 0.044699891 0.039509597

0.042791233

0.85155169 0.702655486 0.658733415 0.585766035

0.552952202

Net profit 0.04 0.03 0.04 0.04 0.06

Net profit margin Net sales

0.161718049 0.176947827 0.202584424 0.164541087

0.14960827

0.095391827 0.12 0.075378967 0.12 0.081592391 0.14 0.085339993 0.13

0.09423889 0.13

0.094851882 0.122488374 0.147056941 0.127125404

0.09815553

0.204461319 0.201240869 0.222345337 0.236727664

0.233755943

Net sales 1.10 1.08 1.15 1.21 1.04

Total asset turnover Total assets

0.161718049 0.176947827 0.202584424 0.164541087

0.14960827

0.978171082 0.99 1.001355649 0.60 1.101252353 0.71 1.146030255 0.75

1.045746866 0.65

1.053582983 0.972157841 0.30396315 0.3107923

0.300920166

1.655275355 0.871077406 0.796382087 0.908895237

0.732703287

Activity ratio

Annual credit sales 13.49 9.88 9.45 8.57 5.47

Recievable turnover Account recieveable

33.65491446 24.35238734 23.17193267 24.54023034

26.98045484

13.796112 14.40 12.88356402 11.50 14.41711389 11.65 16.86475535 12.59

13.94723149 11.55

5.278638439 5.820568329 7.17681988 8.605235082

7.198645354

5.771021638 4.561972152 4.050112191 4.368064698

4.133939945

365 27.06 36.93 38.63 42.58 66.72

Average collection period (in days) Recievable turnover

10.84537001 14.98826357 15.75181515 14.87353602

13.52831159

26.45672926 39.35 28.33066995 44.59 25.31713371 44.14 21.64276875 41.01

26.17006825 49.08

69.14661881 62.70865307 50.85818038 42.41604053

50.70398416

63.2470337 80.00925648 90.1209603 83.56103337

88.29349357

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Peyto Exploration & Development Corp. President's Monthly ReportDocument2 pagesPeyto Exploration & Development Corp. President's Monthly ReportCanadianValuePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Stock Market IndicesDocument2 pagesStock Market IndicesbijubodheswarPas encore d'évaluation

- American Bar Association Members, OPERATING NORTHERN TRUSTDocument152 pagesAmerican Bar Association Members, OPERATING NORTHERN TRUSTDUTCH551400Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Black LittermanDocument21 pagesBlack LittermanJoseph TanPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- 08-02-25 Geovic BrochureDocument2 pages08-02-25 Geovic Brochureaeid101Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Marketing Metrics - Examination of Share of Voice (SOV)Document7 pagesMarketing Metrics - Examination of Share of Voice (SOV)JessPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Kedaara CapitalDocument3 pagesKedaara CapitalALLtyPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Bikol Reporter February 25 - March 3, 2018 IssueDocument8 pagesBikol Reporter February 25 - March 3, 2018 IssueBikol ReporterPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Business Valuation: Valuation Methodologies Discounts and PremiumsDocument43 pagesBusiness Valuation: Valuation Methodologies Discounts and PremiumsTubagus Donny SyafardanPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- International Marketing Plan For Tata Swach Water PurifierDocument45 pagesInternational Marketing Plan For Tata Swach Water PurifierHitesh Goyal100% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- BP010 Business and Process StrategyDocument13 pagesBP010 Business and Process StrategyparcanjoPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- OffentliggorelseDocument59 pagesOffentliggorelsenot youPas encore d'évaluation

- Cash DepositsDocument4 pagesCash DepositsAnne Schindler100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Ujjas EnergyDocument5 pagesUjjas Energyamitnpatel1Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- ST Telemedia and Tata Communications Complete The Singapore Data Centre Joint Venture Transaction (Company Update)Document3 pagesST Telemedia and Tata Communications Complete The Singapore Data Centre Joint Venture Transaction (Company Update)Shyam SunderPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Rothschilds Inter Alpha GroupDocument3 pagesRothschilds Inter Alpha Groupradu victor Tapu100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Rich Dad Poor Dad: Book SummaryDocument7 pagesRich Dad Poor Dad: Book SummarySnehal YagnikPas encore d'évaluation

- RD 2018 Societe GeneraleDocument568 pagesRD 2018 Societe GeneraleArcPas encore d'évaluation

- Depreciated Replacement CostDocument7 pagesDepreciated Replacement CostOdetteDormanPas encore d'évaluation

- Global Annual Review 2009 PWCDocument62 pagesGlobal Annual Review 2009 PWCDeepesh SinghPas encore d'évaluation

- Chapter 1 - Introduction To Strategic ManagementDocument39 pagesChapter 1 - Introduction To Strategic Managementsatheeshmba2010Pas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- CFA Program Course of StudyDocument7 pagesCFA Program Course of StudygiridharkumarabPas encore d'évaluation

- SOFP HartaDocument1 pageSOFP Hartaワンピ ースPas encore d'évaluation

- Investor Database MumbaiDocument9 pagesInvestor Database MumbaiVishal JwellPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Sach ESP - IB Moi q3-2Document82 pagesSach ESP - IB Moi q3-2Maito SakuraPas encore d'évaluation

- Comparative Analysis of Bank of BarodaDocument5 pagesComparative Analysis of Bank of BarodaArpita ChristianPas encore d'évaluation

- Britannia FinalDocument39 pagesBritannia FinalNitinAgnihotri100% (1)

- Exercise 3 - 3Document5 pagesExercise 3 - 3Camille PiercePas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Corporate and Social Responsibilty at Citibank Globally: Submitted To Dr. Rajul SinghDocument16 pagesCorporate and Social Responsibilty at Citibank Globally: Submitted To Dr. Rajul SinghShekhar MittalPas encore d'évaluation

- Egypt Innovation EcosystemDocument40 pagesEgypt Innovation EcosystememanPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)