Académique Documents

Professionnel Documents

Culture Documents

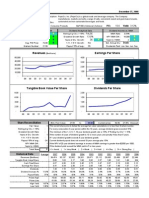

Implied Risk Premium Calculator: Intrinsic Value Estimate

Transféré par

minhthuc2030 évaluation0% ont trouvé ce document utile (0 vote)

21 vues3 pagessp500fcf

Titre original

sp500fcf

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

XLS, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentsp500fcf

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

21 vues3 pagesImplied Risk Premium Calculator: Intrinsic Value Estimate

Transféré par

minhthuc203sp500fcf

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme XLS, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

Sheet1

Implied Risk Premium Calculator

Enter level of the index =

1298

Enter current dividend yield =

4.02%

Enter expected growth rate in earnings for next 5 years

5.50%

for market =

Enter current long term bond rate =

3.95%

Enter risk premium =

4.00%

Enter expected growth rate in the long term =

3.95%

Intrinsic Value Estimate

1

55.05 $

Expected Dividends = $

Expected Terminal Value =

Present Value =

$

51.00

Intrinsic Value of Index $=

1,452.63

2

58.08 $

3

61.27 $

49.84

48.71

4

64.64 $

$

47.60 $

5

68.20

1,772.26

1,255.49

52.1796

Implied Risk Premium

Implied Risk Premium in current level of Index

4.37%

=

(Go under Tools and choose Solver: See below)

1

Expected Dividends =

$55.05

Expected Terminal Value =

Present Value =

$

50.82 $

Intrinsic Value of Index $=

1,330.07

2

$58.08

49.50

3

$61.27

$

48.21

4

$64.64

$

46.96

$

$

5

$68.20

1,623.45

1,134.58

$72.63

This is a picture of the solver option, with the inputs that I used (Do not try to enter numbers in it).

Enter current level of index where you see 759.64.

Page 1

Sheet1

Page 2

Buyback computation

Year

Dividend Yield

Buybacks/Index

2001

1.37%

1.25%

2002

1.81%

1.58%

2003

1.61%

1.23%

2004

1.57%

1.78%

2005

1.79%

3.11%

2006

1.77%

3.38%

2007

1.89%

4.00%

Average yield between 2001-2007 =

Yield

2.62%

3.39%

2.84%

3.35%

4.90%

5.15%

5.89%

4.02%

Page 3

Vous aimerez peut-être aussi

- CH 1 HWKDocument2 pagesCH 1 HWKdwm1855Pas encore d'évaluation

- Two-Stage FCFE Model ValuationDocument14 pagesTwo-Stage FCFE Model ValuationAnkita HandaPas encore d'évaluation

- Common Stock ValuationDocument40 pagesCommon Stock ValuationAhsan IqbalPas encore d'évaluation

- Implied Risk Premium CalculatorDocument3 pagesImplied Risk Premium CalculatorLinh Đỗ MỹPas encore d'évaluation

- Valuation ModelsDocument47 pagesValuation ModelsAshwin Kumar100% (1)

- Assignment 2 Principles of Finance (FIN101: Deadline For Students: (13/11/2022@ 23:59)Document8 pagesAssignment 2 Principles of Finance (FIN101: Deadline For Students: (13/11/2022@ 23:59)Habib NasherPas encore d'évaluation

- Con Ed: Value Versus Growth RateDocument14 pagesCon Ed: Value Versus Growth RateAkash GauravPas encore d'évaluation

- W1 - Implied Equity PremiumDocument7 pagesW1 - Implied Equity PremiumChip choiPas encore d'évaluation

- Cv. Chapter 2Document25 pagesCv. Chapter 2VidhiPas encore d'évaluation

- Glob CrossDocument18 pagesGlob Crossminhthuc203Pas encore d'évaluation

- APV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Document23 pagesAPV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Vineet AgarwalPas encore d'évaluation

- APV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Document23 pagesAPV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Vineet AgarwalPas encore d'évaluation

- Pepsico, Inc.: RecommendationDocument2 pagesPepsico, Inc.: Recommendationsasaki16Pas encore d'évaluation

- Rizal Technological UniversityDocument5 pagesRizal Technological UniversityMerry anne AndusPas encore d'évaluation

- Tutorial 6 FAT SolutionDocument11 pagesTutorial 6 FAT SolutionAhmad FarisPas encore d'évaluation

- Synergy Valuation WorksheetDocument6 pagesSynergy Valuation WorksheetRishav AgarwalPas encore d'évaluation

- Synergy Calculator For Mergers and AcquisitionsDocument6 pagesSynergy Calculator For Mergers and AcquisitionsRoopika PalukurthiPas encore d'évaluation

- Hi GrowthDocument24 pagesHi Growthminhthuc203Pas encore d'évaluation

- Two-Stage FCFF Discount ModelDocument15 pagesTwo-Stage FCFF Discount ModelCarl HsiehPas encore d'évaluation

- Acquirers Anonymous: Seven Steps Back To Sobriety : Aswath Damodaran Stern School of Business, New York UniversityDocument37 pagesAcquirers Anonymous: Seven Steps Back To Sobriety : Aswath Damodaran Stern School of Business, New York UniversityowdkasldPas encore d'évaluation

- ImplpremDocument2 pagesImplpremAnonymous SA40GK6Pas encore d'évaluation

- Two-Stage FCFE Model Revenues by RegionDocument23 pagesTwo-Stage FCFE Model Revenues by Regionminhthuc203Pas encore d'évaluation

- Valuation Models: Aswath DamodaranDocument47 pagesValuation Models: Aswath DamodaranSumit Kumar BundelaPas encore d'évaluation

- The Value of Control: Stern School of BusinessDocument38 pagesThe Value of Control: Stern School of Businessavinashtiwari201745Pas encore d'évaluation

- Chapter 1: Investment Setting and Return FundamentalsDocument23 pagesChapter 1: Investment Setting and Return FundamentalsNishat TasnovaPas encore d'évaluation

- Compre BAV Sol 2019-20 1Document9 pagesCompre BAV Sol 2019-20 1f20211062Pas encore d'évaluation

- Business Analysis and Valuation - IntroductionDocument109 pagesBusiness Analysis and Valuation - IntroductioncapassoaPas encore d'évaluation

- L1R41 - Annotated - LiveDocument52 pagesL1R41 - Annotated - LiveAlex PaulPas encore d'évaluation

- CFA Level 2 Equity Valuation Study ExamplesDocument6 pagesCFA Level 2 Equity Valuation Study ExamplessaurabhPas encore d'évaluation

- Equity Instruments 1Document272 pagesEquity Instruments 1motty123456Pas encore d'évaluation

- Outside Estimate: The Following Will Be Inputs For The Calculation of Fundamental GrowthDocument4 pagesOutside Estimate: The Following Will Be Inputs For The Calculation of Fundamental GrowthSibt Ul HasnainPas encore d'évaluation

- (CF-T22324PWB-1) - (72-Hour Take-Home Exercise No.4) - (Document6 pages(CF-T22324PWB-1) - (72-Hour Take-Home Exercise No.4) - (khanhviforippPas encore d'évaluation

- Reading 1 Rates and Returns - AnswersDocument23 pagesReading 1 Rates and Returns - Answersmenexe9137Pas encore d'évaluation

- Control ValueDocument38 pagesControl ValueskamuddinPas encore d'évaluation

- Cost of CapitalDocument8 pagesCost of CapitalJoanah TayamenPas encore d'évaluation

- Equity Analysis and Evaluation - II Assignment December 23Document14 pagesEquity Analysis and Evaluation - II Assignment December 23sachin.saroa.1Pas encore d'évaluation

- Three-Stage Fcfe Discount ModelDocument24 pagesThree-Stage Fcfe Discount Modelminhthuc203Pas encore d'évaluation

- Diversification, Control & Liquidity: The Discount Trifecta"Document36 pagesDiversification, Control & Liquidity: The Discount Trifecta"Shoutik ChakrabartiPas encore d'évaluation

- IRDA - Chapter 3 Premiums & BonusesDocument40 pagesIRDA - Chapter 3 Premiums & Bonusestdhvikasagarwal100% (1)

- FCFF 2 STDocument15 pagesFCFF 2 STSandeep ChowdhuryPas encore d'évaluation

- Div GinzuDocument42 pagesDiv GinzujenkisanPas encore d'évaluation

- FIN448 Practice Final Exam Fall2020 SolutionDocument14 pagesFIN448 Practice Final Exam Fall2020 SolutionMay ChenPas encore d'évaluation

- CFA Level 1 Quantitative Analysis E Book - Part 1Document26 pagesCFA Level 1 Quantitative Analysis E Book - Part 1Zacharia VincentPas encore d'évaluation

- Chapter 9 FinalizedDocument13 pagesChapter 9 FinalizedSaeed Ahmed (Father Name:Jamal Ud Din)Pas encore d'évaluation

- Finman - Ytm & Stock ValuationDocument5 pagesFinman - Ytm & Stock ValuationnettenolascoPas encore d'évaluation

- Tugas FM Group NikeDocument25 pagesTugas FM Group NikeYudha LampePas encore d'évaluation

- Dividend Discount ModelsDocument77 pagesDividend Discount ModelssalmanPas encore d'évaluation

- Calculating The Effect of Synergy in Mergers and AquisistionDocument4 pagesCalculating The Effect of Synergy in Mergers and AquisistionSagar IndranPas encore d'évaluation

- Valuation Models Summary: Discounted Cash Flow and Relative Valuation ApproachesDocument47 pagesValuation Models Summary: Discounted Cash Flow and Relative Valuation Approachesarmani2coolPas encore d'évaluation

- Synergy Valuation WorksheetDocument4 pagesSynergy Valuation Worksheetabhishekbehal5012Pas encore d'évaluation

- E9 Cost of Capital Gearing and CAPM Part 1Document5 pagesE9 Cost of Capital Gearing and CAPM Part 1TENGKU ANIS TENGKU YUSMAPas encore d'évaluation

- Fundamentals of Valuation: Chapter TWO: Return ConceptsDocument13 pagesFundamentals of Valuation: Chapter TWO: Return ConceptsAhmed RedaPas encore d'évaluation

- Theory and Numericals Types of FactoringDocument7 pagesTheory and Numericals Types of FactoringShweta YadavPas encore d'évaluation

- Nike WACC AnalysisDocument8 pagesNike WACC AnalysisAnurag Sukhija100% (5)

- ITS - Global Cost of Capital Case Study SolutionDocument8 pagesITS - Global Cost of Capital Case Study Solutionalka murarka100% (3)

- Cost of CapitalDocument23 pagesCost of CapitalAsad AliPas encore d'évaluation

- Exercise Sheet 2 With SolutionsDocument8 pagesExercise Sheet 2 With SolutionsFlaminiaPas encore d'évaluation

- Chapter 5 - Part 1: Introduction To Valuation: The Time Value of MoneyDocument23 pagesChapter 5 - Part 1: Introduction To Valuation: The Time Value of MoneyJazzy SinghPas encore d'évaluation

- Accounting and Finance Formulas: A Simple IntroductionD'EverandAccounting and Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- Receiving An Event: Guide For Tandberg Edge 95Document1 pageReceiving An Event: Guide For Tandberg Edge 95minhthuc203Pas encore d'évaluation

- Master Input Sheet: InputsDocument34 pagesMaster Input Sheet: Inputsminhthuc203Pas encore d'évaluation

- FCFF VALUATION MODEL KEYDocument28 pagesFCFF VALUATION MODEL KEYshanPas encore d'évaluation

- FirmmultDocument2 pagesFirmmultapi-3763138Pas encore d'évaluation

- Grossvs NetDocument4 pagesGrossvs Netapi-3763138Pas encore d'évaluation

- Hi GrowthDocument24 pagesHi Growthminhthuc203Pas encore d'évaluation

- Glob CrossDocument18 pagesGlob Crossminhthuc203Pas encore d'évaluation

- FCFFSTDocument10 pagesFCFFSTapi-3701114Pas encore d'évaluation

- Fcfe Stable Growth ModelDocument5 pagesFcfe Stable Growth Modelapi-3763138Pas encore d'évaluation

- Year FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34Document19 pagesYear FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34api-3763138Pas encore d'évaluation

- FcffvsfcfeDocument2 pagesFcffvsfcfePro ResourcesPas encore d'évaluation

- Comparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE CalculationDocument6 pagesComparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE Calculationapi-3763138Pas encore d'évaluation

- Inputs For Valuation Current Inputs (As A Naïve Estimate, You Can Use BV of Debt + BV of Equity)Document6 pagesInputs For Valuation Current Inputs (As A Naïve Estimate, You Can Use BV of Debt + BV of Equity)minhthuc203Pas encore d'évaluation

- FCFF Valuation Model: Before You Start What The Model Does Inputs Master Inputs Page Earnings NormalizerDocument33 pagesFCFF Valuation Model: Before You Start What The Model Does Inputs Master Inputs Page Earnings Normalizerminhthuc203Pas encore d'évaluation

- FCFF 3 STDocument3 pagesFCFF 3 STminhthuc203Pas encore d'évaluation

- OpleaseDocument2 pagesOpleaseapi-3763138Pas encore d'évaluation

- FCFF 2 STDocument15 pagesFCFF 2 STSandeep ChowdhuryPas encore d'évaluation

- SP 500Document2 pagesSP 500minhthuc203Pas encore d'évaluation

- LevbetaDocument2 pagesLevbetaapi-3763138Pas encore d'évaluation

- Sony 00Document1 pageSony 00Abhishek SinghPas encore d'évaluation

- Stock Risk Return Analysis and ForecastingDocument6 pagesStock Risk Return Analysis and Forecastingsumon finPas encore d'évaluation

- Implied Roc RoeDocument2 pagesImplied Roc RoeudelkingkongPas encore d'évaluation

- NatresDocument3 pagesNatresapi-3701114Pas encore d'évaluation

- Prima de Risc de Marime A Firmei - DamodaranDocument5 pagesPrima de Risc de Marime A Firmei - Damodarancataneor2Pas encore d'évaluation

- Nestle NewDocument23 pagesNestle Newminhthuc203Pas encore d'évaluation

- Two-Stage FCFE Model Revenues by RegionDocument23 pagesTwo-Stage FCFE Model Revenues by Regionminhthuc203Pas encore d'évaluation

- Valaution Model - A Model For Any Valuation.Document6 pagesValaution Model - A Model For Any Valuation.kanabaramitPas encore d'évaluation

- FCFF VALUATION MODEL KEYDocument28 pagesFCFF VALUATION MODEL KEYshanPas encore d'évaluation

- Kristin KandyDocument31 pagesKristin Kandyminhthuc203Pas encore d'évaluation