Académique Documents

Professionnel Documents

Culture Documents

Exam MB7-701 Microsoft Dynamics NAV 2013 Core Setup and Finance

Transféré par

kashram2001Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Exam MB7-701 Microsoft Dynamics NAV 2013 Core Setup and Finance

Transféré par

kashram2001Droits d'auteur :

Formats disponibles

Exam MB7-701

Microsoft Dynamics NAV 2013 Core Setup and Finance

Set up the Microsoft Dynamics NAV environment (21%) Perform user personalization Customize the ribbon and navigation pane; choose columns on List pages; add and remove a FactBox from the FactBox pane; add and remove FastTabs on pages; customize charts; customize parts on the Role Center page; change the profile and Role Center Perform basic functions Use keyboard shortcuts; enter and edit information; add OneNote to a record; add notes and links to records; send pages to Word and Excel; send pages as email attachments; print reports and documents; sort and search information; use FactBoxes; post documents Configure master data for sales and purchase processes Add general ledger (G/L) account cards; add chart of accounts pages; add customers and vendors; add item cards Create and process sales and purchase orders Create and process purchase orders; receive multiple purchase orders; create purchase invoices by using the Get Receipt Lines function; create sales quotes; convert quotes to sales orders; process sales orders

Set up an application (21%) Manage user rights and profiles Set up authentication; set up user rights; create permission sets; apply security filters; describe the setup of users and user profiles Set up number series and trail codes Set up and assign number series and number series relationships; assign customer numbers in the Sales & Receivables Setup window; set up source codes and reason codes; navigate the audit trail Set up general journal templates and batches Describe general journal template fields and batch fields; create general journal templates; open general journal batches from a general journal Set up posting groups Set up and assign specific posting groups, including customer, vendor, inventory and bank account posting groups; set up and assign general posting groups; set up and assign value added tax (VAT) posting groups; post and review sales transactions

Set up dimensions Set up and use dimensions and dimension values; describe dimension combinations, default dimensions, account type default dimensions, default dimension priority, and conflicting default dimensions

Set up and manage document approvals Set up document approvals; set up the notification system; set up and use a sales document approval system

Configure fixed assets (14%) Set up fixed asset components Set up fixed asset posting groups; set up depreciation books; set up fixed asset pages; set up main assets and asset components; record open transactions; make duplicate entries; copy fixed assets and fixed asset ledger entries Set up fixed asset transactions Describe journals for fixed assets; describe the purchase of fixed assets; calculate and post depreciation; describe write-down and appreciation of fixed assets, fixed asset disposals, correction of entries, documenting and budgeting fixed asset transactions, fixed asset reports, cost-accounting depreciation, indexation, and minor assets Set up reclassification, maintenance, and insurance of fixed assets Set up asset transfer; set up partial disposal of an asset; combine assets; set up maintenance information; set up maintenance registration and costs; set up maintenance cost reporting; set up insurance information; assign assets to insurance policies; monitor insurance coverage; update insurance information; describe index insurances

Manage finance essentials (24%) Set up business processes Set up the general ledger; set up accounting periods; use the G/L account card ribbon; use the chart of accounts page Set up general journals Create and post journal entries; create standard journals; process recurring journals; process reversals and corrections Set up cash management Set up bank accounts; create customer and vendor accounts; set up cash receipt and payment journals; suggest vendor payments; print and post payables checks; void checks; apply payments; unapply customer and vendor ledger entries; reverse posted journals; describe bank reconciliation Manage receivables and payables Set up and process sales and purchase payment discounts; set up and process payment and payment discount tolerances; review posted payment discount tolerances and payment tolerance entries; review customer and vendor statistics; set up and assign

reminder terms; create and issue reminders; set up and assign finance charge terms; create and issue finance charge memos; calculate interest on reminders; set up Intrastat journals; prepare Intrastat reports Manage VAT Describe VAT calculation types; display VAT amounts in sales and purchase documents; adjust VAT amounts in sales and purchase documents and journals; describe unrealized VAT, VAT statements, and VAT settlement; set up the VAT rate change tool; perform VAT rate conversions Set up prepayments Set up general posting groups; set up unrealized VAT for prepayments; set up number series for prepayment documents; set up prepayment percentages for customers and vendors; set up prepayment verification; set up prepayment processing flows; set up and process prepayment sales and purchase orders; correct prepayments Set up year-end closing processes Close a fiscal year; transfer income statement account balances; post journals

Manage advanced finance (20%) Manage multiple currencies Set up currency pages and currency exchange rates; set up multiple currencies for customers, vendors, and bank accounts; process sales and purchase documents; process cash receipts; process payments; adjust exchange rates for customers, vendors, and bank accounts; set up and use additional reporting currencies; adjust exchange rates for G/L accounts; display the exchange rate adjustment register Manage budgets Set up G/L budgets; set up budget pages; create budgets manually; copy budgets; export and import budgets Manage cost accounting Explain a cost accounting workflow; set up cost accounting; describe cost entries, cost budgets, cost allocation, cost accounting history, and reporting Manage cash flow forecast Set up and create cash flow forecasts; describe cash flow forecast reporting Analyze the chart of accounts; describe account schedules; describe analysis by dimensions; export analysis views to Excel; describe dimension-based reports; combine analysis views with account schedules; describe financial performance charts Manage financial reporting and analysis

Vous aimerez peut-être aussi

- Choosing The Executor or TrusteeDocument22 pagesChoosing The Executor or TrusteeSeasoned_Sol100% (1)

- Business Central PDFDocument3 055 pagesBusiness Central PDFramapandianPas encore d'évaluation

- Project Management Professional (PMP) Training &NEWDocument792 pagesProject Management Professional (PMP) Training &NEWkashram2001100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Dynamics 365 Business Central Capability Guide - En-En - Final - v2Document30 pagesDynamics 365 Business Central Capability Guide - En-En - Final - v2Jesus CastroPas encore d'évaluation

- Financial Accounting II - Course OutlineDocument3 pagesFinancial Accounting II - Course OutlineMuhammad Salman RasheedPas encore d'évaluation

- Manual PDFDocument828 pagesManual PDFIzwan YusofPas encore d'évaluation

- The Controller's Function: The Work of the Managerial AccountantD'EverandThe Controller's Function: The Work of the Managerial AccountantPas encore d'évaluation

- Ashirwad Stone CrusherDocument26 pagesAshirwad Stone Crusherkushal chopdaPas encore d'évaluation

- Dynamics AX Financial Training Detailed TopicsDocument5 pagesDynamics AX Financial Training Detailed TopicsAliPas encore d'évaluation

- Pooja SAP Fico 3Document6 pagesPooja SAP Fico 3zidduPas encore d'évaluation

- NAV CAL Programming GuideDocument59 pagesNAV CAL Programming Guidewennchun100% (2)

- AP Cash Purchases Audit ProgramDocument5 pagesAP Cash Purchases Audit ProgramYvonne Granada0% (1)

- Bank Modelling ValuationDocument4 pagesBank Modelling ValuationQuofi SeliPas encore d'évaluation

- O-Level Principles of AccountsDocument19 pagesO-Level Principles of AccountsOttone Chipara Ndlela80% (5)

- SAP FICO Course ContentsDocument10 pagesSAP FICO Course ContentsSagar Paul'gPas encore d'évaluation

- PharmEasy Research Report (14269)Document21 pagesPharmEasy Research Report (14269)sjit kaur10481Pas encore d'évaluation

- Dynamics365for Financials PDFDocument813 pagesDynamics365for Financials PDFKakumanu Siva100% (1)

- Oracle PeopleSoft Enterprise Financial Management 9.1 ImplementationD'EverandOracle PeopleSoft Enterprise Financial Management 9.1 ImplementationPas encore d'évaluation

- SAP FI AND SAP CO CoursesDocument4 pagesSAP FI AND SAP CO CoursesNaseer SapPas encore d'évaluation

- SAP - FICO Course ContentDocument10 pagesSAP - FICO Course Contentchaitanya vutukuriPas encore d'évaluation

- Resume Sap Reddy1110511251441831Document3 pagesResume Sap Reddy1110511251441831Harsha AdirajuPas encore d'évaluation

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument189 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFRegina Fuertes Padilla100% (2)

- AAFR Notes - IFRS 15Document27 pagesAAFR Notes - IFRS 15Waqas100% (1)

- Exam MB 310 Microsoft Dynamics 365 Finance Skills MeasuredDocument9 pagesExam MB 310 Microsoft Dynamics 365 Finance Skills Measuredvanishri mogerPas encore d'évaluation

- BCDocument2 309 pagesBCcartenaPas encore d'évaluation

- Sap Fico CourseDocument12 pagesSap Fico CourseRajashekar ReddyPas encore d'évaluation

- SAP FICO Course Syllabus: Key Concepts and ConfigurationDocument21 pagesSAP FICO Course Syllabus: Key Concepts and ConfigurationMofedul Haque MahadiPas encore d'évaluation

- microsoft-dynamics-365-business-central-functional-consultant-associate-skills-measuredDocument5 pagesmicrosoft-dynamics-365-business-central-functional-consultant-associate-skills-measuredSIDDHAPas encore d'évaluation

- Certyfikat FIDocument4 pagesCertyfikat FIArekPas encore d'évaluation

- SAP FICO Online Training ContentDocument7 pagesSAP FICO Online Training ContentzidduPas encore d'évaluation

- Introduction To SAP RDocument5 pagesIntroduction To SAP Rmuneendra143Pas encore d'évaluation

- Microsoft Dynamics 365 Business Central Capability GuideDocument28 pagesMicrosoft Dynamics 365 Business Central Capability GuideMatarPas encore d'évaluation

- Hana Fi Course ContentDocument2 pagesHana Fi Course ContentRaju Raj RajPas encore d'évaluation

- FI ModuleDocument3 pagesFI ModuleMuhammad AyazPas encore d'évaluation

- SAP FICO Course Content:-Sap Fi (Finance) : Organizational Structure and Global ParametersDocument6 pagesSAP FICO Course Content:-Sap Fi (Finance) : Organizational Structure and Global ParametersAnonymous 7CVuZbInUPas encore d'évaluation

- Umesh Savant SAP FI/CO ResumeDocument5 pagesUmesh Savant SAP FI/CO ResumeVenkata AraveetiPas encore d'évaluation

- Sap Fico Imp PointsDocument3 pagesSap Fico Imp PointsmrugmanasiPas encore d'évaluation

- SAP FICO Syllabus PDFDocument11 pagesSAP FICO Syllabus PDFÅndraju DineshPas encore d'évaluation

- Fico SyllabusDocument4 pagesFico SyllabusREMYA RAJU SPas encore d'évaluation

- Join Soft SAP FICO SolutionsDocument5 pagesJoin Soft SAP FICO SolutionsSandeep SinghPas encore d'évaluation

- BH FICO TcodesDocument40 pagesBH FICO TcodesBhaskar Rao KapuPas encore d'évaluation

- SAP FICO Contents and Topics GuideDocument6 pagesSAP FICO Contents and Topics Guidemm1979Pas encore d'évaluation

- Accounting Lectures For BegDocument3 pagesAccounting Lectures For Beggazer beamPas encore d'évaluation

- Approve processes, reports and requestsDocument10 pagesApprove processes, reports and requestsJulian CobosPas encore d'évaluation

- 1 (2 Files Merged)Document2 pages1 (2 Files Merged)syed shabbirPas encore d'évaluation

- Job DescriptionsDocument4 pagesJob DescriptionsSaranya Vignesh PerumalPas encore d'évaluation

- Computerized Bookkeeping: Lecture # 1Document57 pagesComputerized Bookkeeping: Lecture # 1mjzadilPas encore d'évaluation

- Sap Fico Online/classroom/fast Track Training at Saraswat Software SolutionsDocument5 pagesSap Fico Online/classroom/fast Track Training at Saraswat Software SolutionsKirankumar KallemPas encore d'évaluation

- Act08 - Lfca133e022 - Lique GiinoDocument4 pagesAct08 - Lfca133e022 - Lique GiinoGino LiquePas encore d'évaluation

- Dynamics AX - Financial Series ModuleDocument3 pagesDynamics AX - Financial Series ModuleBA Training SchoolPas encore d'évaluation

- SAP Business One - Key FunctionalitiesDocument6 pagesSAP Business One - Key FunctionalitiesAkanksha TiwariPas encore d'évaluation

- General Ledger Accounting:: SAP FICO Course ContentDocument10 pagesGeneral Ledger Accounting:: SAP FICO Course ContentsrinivasPas encore d'évaluation

- After The Financial Crisis That Began in 2008Document6 pagesAfter The Financial Crisis That Began in 2008Saurabh ShelarPas encore d'évaluation

- Learning Hub: Course Content For SAP Finance and ControllingDocument3 pagesLearning Hub: Course Content For SAP Finance and ControllingBhushan DhandePas encore d'évaluation

- SAP FICO S4HANA NewDocument24 pagesSAP FICO S4HANA NewAprajita SarafPas encore d'évaluation

- Financial Accounting (FI) : A Appendix ADocument31 pagesFinancial Accounting (FI) : A Appendix AworldPas encore d'évaluation

- SAP FI/CO and Controlling ConfigurationDocument7 pagesSAP FI/CO and Controlling ConfigurationthoopuPas encore d'évaluation

- SAP - ECC 6.0 FICO ContentsDocument8 pagesSAP - ECC 6.0 FICO ContentsBhupesh DebnathPas encore d'évaluation

- SAP FICO Course Contents - Finance, Accounting, ControllingDocument7 pagesSAP FICO Course Contents - Finance, Accounting, ControllingUsa IifcaPas encore d'évaluation

- Integrate Sales Orders with Accounts ReceivableDocument6 pagesIntegrate Sales Orders with Accounts ReceivableYudita Dwi Nur'AininPas encore d'évaluation

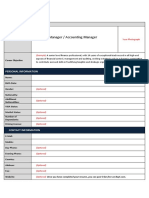

- Finance Manager / Accounting Manager: Personal InformationDocument3 pagesFinance Manager / Accounting Manager: Personal InformationHarshwardhan PathakPas encore d'évaluation

- IGCSE ACCOUNTING NOTESDocument87 pagesIGCSE ACCOUNTING NOTESKimberly ReignsPas encore d'évaluation

- Curriculum Vitae Nabeel FinalDocument6 pagesCurriculum Vitae Nabeel FinalswayamPas encore d'évaluation

- Oracle AR Basic ConecptDocument253 pagesOracle AR Basic Conecpthamzaali227004Pas encore d'évaluation

- Gateway of Tally ScriptDocument5 pagesGateway of Tally Scriptkashram2001Pas encore d'évaluation

- Inventory CostingDocument5 pagesInventory Costingkashram2001Pas encore d'évaluation

- SAP Query IntroductionDocument7 pagesSAP Query Introductionkashram2001Pas encore d'évaluation

- Software License TermsDocument3 pagesSoftware License Termskashram2001Pas encore d'évaluation

- SAP Query IntroductionDocument7 pagesSAP Query Introductionkashram2001Pas encore d'évaluation

- FRSA Question and AnswerDocument4 pagesFRSA Question and AnswerSevitha PandeyPas encore d'évaluation

- PeopleSoft FSCM 92 Release Notes Through Update Image7Document184 pagesPeopleSoft FSCM 92 Release Notes Through Update Image7ram4friendsPas encore d'évaluation

- Working Capital Management.Document3 pagesWorking Capital Management.Christine MalayoPas encore d'évaluation

- Roseland Audit 2020Document49 pagesRoseland Audit 2020carlosballesterosPas encore d'évaluation

- Financial Stament Review-2Document8 pagesFinancial Stament Review-2Shah NidaPas encore d'évaluation

- Exceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionDocument5 pagesExceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionRyan S. AngelesPas encore d'évaluation

- Baglamukhi Masala Fs 2076-77Document44 pagesBaglamukhi Masala Fs 2076-77sudhakar ShakyaPas encore d'évaluation

- Altman PDFDocument6 pagesAltman PDFK MuruganPas encore d'évaluation

- Mamell Sea Food Business PlanDocument22 pagesMamell Sea Food Business PlanFranc TiagoPas encore d'évaluation

- MLM Xii Accountancy 22-23 PDFDocument34 pagesMLM Xii Accountancy 22-23 PDFayush5sharma805Pas encore d'évaluation

- Kotak Mahindra BankDocument23 pagesKotak Mahindra BankSai VasudevanPas encore d'évaluation

- PT Berkah Account Analysis and Balance SheetDocument7 pagesPT Berkah Account Analysis and Balance Sheetputri nobellaPas encore d'évaluation

- Module 2 Conceptual Framework For Financial ReportingDocument9 pagesModule 2 Conceptual Framework For Financial ReportingVivo V27Pas encore d'évaluation

- 2 - (Accounting For Foreign Currency Transaction)Document25 pages2 - (Accounting For Foreign Currency Transaction)Stephiel SumpPas encore d'évaluation

- Balance Sheet A2z AccountingDocument21 pagesBalance Sheet A2z AccountingWilson PrashanthPas encore d'évaluation

- C - TS410 - 1809 SAP Certified Application Associate - Business Process Integration With SAP S/4HANA 1809Document27 pagesC - TS410 - 1809 SAP Certified Application Associate - Business Process Integration With SAP S/4HANA 1809Sahar zidanPas encore d'évaluation

- Chapter 25: Property, Plant & Equipment: Gross MethodDocument17 pagesChapter 25: Property, Plant & Equipment: Gross MethodJohnPaulDMirasolPas encore d'évaluation

- Corporate Finance Chapter 3 Homework SolutionsDocument9 pagesCorporate Finance Chapter 3 Homework Solutionsewacg862100% (1)

- Accounting in Business: © 2019 Mcgraw-Hill EducationDocument81 pagesAccounting in Business: © 2019 Mcgraw-Hill Educationkikad10038Pas encore d'évaluation

- Bead Making UnitDocument20 pagesBead Making Unithamza tariqPas encore d'évaluation

- AFM Q-BankDocument42 pagesAFM Q-Banks BPas encore d'évaluation

- Notes in Acstr14Document3 pagesNotes in Acstr14Gray JavierPas encore d'évaluation

- Answers To The Overall Questions of Chapter SevenDocument3 pagesAnswers To The Overall Questions of Chapter SevenHamza MahmoudPas encore d'évaluation

- Creative AccountingDocument8 pagesCreative Accountingpriteshvadera18791Pas encore d'évaluation

- Chapter 4 PowerpointDocument25 pagesChapter 4 Powerpointapi-248607804Pas encore d'évaluation