Académique Documents

Professionnel Documents

Culture Documents

Company Law 2013

Transféré par

Swati Rohan JadhavDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Company Law 2013

Transféré par

Swati Rohan JadhavDroits d'auteur :

Formats disponibles

Free of Cost

ISBN: 978-93-5034-433-0

Appendix

CS Executive Programme Module-II

(Solution upto June - 2012 & Questions of Dec - 2012 Included)

Paper - 4: Company Law Chapter - 1: Introduction 2012 - June [1] {C} (ii) A company is an artificial person. It is formed and registered under the Companies Act. It has distinct legal entity. Its personality is separate and distinct from its members. In some cases company is treated as a natural person. (a) It can make contract. (b) Open a bank account. (c) Can sue and be sued by others. (d) It can also own property by its own name. The companys money and property belong to the company and not the property of members. Similarly, the members personal property can not be held liable to pay the creditors of the company. LEADING CASE in this point is-Saloman Vs. Saloman company Ltd. has clearly a established the principle that once a company has been validly constituted under the Companies Act, 1956, it becomes a legal person distinct from its members and for this perpose it is immaterial whether any member has a large or small proportion of the share, and whether he holds those shares beneficially or as a mere trustee. Hence, shareholders can not be held liable for the acts of the company. 2012 - June [5] (d) Section 11 provides that no company association or partnership consisting of more than 10 persons in case of banking business or more than 20 persons in case of any other business which has its objects the acquisition of gain can be legally formed unless it is registered under the Companies Act or is formed in pursuance of some other Indian law if they are not so registered they would be considered an illegal association.

1

Vous aimerez peut-être aussi

- Comparison With Other Business Structures by Brian ThuraniraDocument3 pagesComparison With Other Business Structures by Brian ThuraniraRayoh SijiPas encore d'évaluation

- Commercial LawDocument19 pagesCommercial LawTAZWARUL ISLAMPas encore d'évaluation

- Busy Association BeckyDocument11 pagesBusy Association BeckySamuel L EPas encore d'évaluation

- Part - IIDocument15 pagesPart - IIAnkur DixitPas encore d'évaluation

- Companies Act 2013: Meaning of A CompanyDocument7 pagesCompanies Act 2013: Meaning of A CompanyMohit RanaPas encore d'évaluation

- Types of Legal Business Structure in IndiaDocument18 pagesTypes of Legal Business Structure in IndiaROHAN SHELKEPas encore d'évaluation

- Answer 1Document6 pagesAnswer 1akshat brahmchariPas encore d'évaluation

- What Is A CompanyDocument6 pagesWhat Is A CompanyAayushman SharmaPas encore d'évaluation

- Introduction To CompanyDocument15 pagesIntroduction To CompanyShalu ThakurPas encore d'évaluation

- Introduction To Company Law Note 1 of 7 NotesDocument30 pagesIntroduction To Company Law Note 1 of 7 NotesMusbri Mohamed100% (1)

- Company Law NotesDocument67 pagesCompany Law NotesBrian Okuku OwinohPas encore d'évaluation

- Companies Law NotesDocument13 pagesCompanies Law NotesJyotsana GangwarPas encore d'évaluation

- Unit 1Document23 pagesUnit 1Nikhilesh RanaPas encore d'évaluation

- Lecture 3 Legal Personality of A Company.2023Document9 pagesLecture 3 Legal Personality of A Company.2023Faint MokgokongPas encore d'évaluation

- Company Under The Companies Act 2013Document14 pagesCompany Under The Companies Act 2013Shubham saxenaPas encore d'évaluation

- Business Law - Utkarsh BalamwarDocument6 pagesBusiness Law - Utkarsh BalamwarMamta BalamwarPas encore d'évaluation

- Assignment: Corporate Law-I Name: Adnan Yousuf Ba. LL.B 6 Semester (Regular) Roll No. 02Document13 pagesAssignment: Corporate Law-I Name: Adnan Yousuf Ba. LL.B 6 Semester (Regular) Roll No. 02saqib nisarPas encore d'évaluation

- Unit 01 Introduction To Company: New Alliance First Grade College, CrpatnaDocument86 pagesUnit 01 Introduction To Company: New Alliance First Grade College, CrpatnaningegowdaPas encore d'évaluation

- Introduction To Research Regarding Corporate VeilDocument12 pagesIntroduction To Research Regarding Corporate VeilFaisal AshfaqPas encore d'évaluation

- Commercial TransactionsDocument191 pagesCommercial TransactionsDavid MunyuaPas encore d'évaluation

- Company 1Document48 pagesCompany 1mcyhndhiePas encore d'évaluation

- 2022 Chapter 2 Companies Legal Personality Mercantile LawDocument30 pages2022 Chapter 2 Companies Legal Personality Mercantile LawKgotso JacobPas encore d'évaluation

- Law NotesDocument58 pagesLaw NotesSHERIN REGI VARUGHESE 2022040Pas encore d'évaluation

- Limited Liability Partnerships in KenyaDocument5 pagesLimited Liability Partnerships in KenyaStephen Mallowah100% (1)

- Introduction To Company PDFDocument8 pagesIntroduction To Company PDFhasan alPas encore d'évaluation

- BL - 3Document292 pagesBL - 3akashkumarPas encore d'évaluation

- BUS 360 - Lecture 11Document10 pagesBUS 360 - Lecture 11JabirPas encore d'évaluation

- Business Organisation ProjectDocument8 pagesBusiness Organisation ProjectGAME SPOT TAMIZHANPas encore d'évaluation

- BL Unit VDocument13 pagesBL Unit VkhurshidsharifPas encore d'évaluation

- Chapter 3 - Company Act: Industrial Law & Accounting (Hum-2231)Document7 pagesChapter 3 - Company Act: Industrial Law & Accounting (Hum-2231)Asif HossenPas encore d'évaluation

- Term Paper - Company Law - FinalDocument37 pagesTerm Paper - Company Law - Finaltejcd1234Pas encore d'évaluation

- Report On Company LawDocument35 pagesReport On Company LawacidreignPas encore d'évaluation

- Assignment On Company LawDocument15 pagesAssignment On Company Lawতাসমুন ইসলাম প্রান্তPas encore d'évaluation

- What Is A Company?: Instructor: Dr. Manaswee K SamalDocument4 pagesWhat Is A Company?: Instructor: Dr. Manaswee K SamalSahoo SKPas encore d'évaluation

- Difference Between LLP & Partnership and Between Private and Public Company - ERO0240651 - ITT Batch 606Document13 pagesDifference Between LLP & Partnership and Between Private and Public Company - ERO0240651 - ITT Batch 606Siddharth Shankar PaikrayPas encore d'évaluation

- Mercantile LawDocument21 pagesMercantile LawPriyanka BarikPas encore d'évaluation

- Overview On The Companies Act, 1994Document44 pagesOverview On The Companies Act, 1994Tawsif MahbubPas encore d'évaluation

- Basic Features of A CompanyDocument3 pagesBasic Features of A CompanyAyesha HaroonPas encore d'évaluation

- p3 m2 Different Types of BorrowersDocument4 pagesp3 m2 Different Types of BorrowersMadhavKishore100% (1)

- 02 Forms of OrganizationDocument19 pages02 Forms of OrganizationAkhilesh KumarPas encore d'évaluation

- Assignment On CompanyDocument8 pagesAssignment On CompanyHossainmoajjemPas encore d'évaluation

- Assignment: Submitted by Navami K.V Roll No: 54 CLASS 5Document13 pagesAssignment: Submitted by Navami K.V Roll No: 54 CLASS 5sanjanaPas encore d'évaluation

- Notes On Companies Act 1956Document87 pagesNotes On Companies Act 1956Pranay KinraPas encore d'évaluation

- Company Law ProjectDocument28 pagesCompany Law ProjectpushpanjaliPas encore d'évaluation

- Separate Legal Identity: Section 34 (2) of The Companies Act, 2013Document16 pagesSeparate Legal Identity: Section 34 (2) of The Companies Act, 2013Manju SujayPas encore d'évaluation

- Company Law NoteDocument23 pagesCompany Law NotegopikaPas encore d'évaluation

- Business Law Continuous AssessmentDocument11 pagesBusiness Law Continuous AssessmentElly FirahPas encore d'évaluation

- Corporate Veil:: Concept of Limited LiabilityDocument9 pagesCorporate Veil:: Concept of Limited LiabilityRohan PatelPas encore d'évaluation

- 4 TH ChapterDocument15 pages4 TH ChapterKodi NadarPas encore d'évaluation

- Notes of Formation of CompaniesDocument8 pagesNotes of Formation of Companiesjosh mukwendaPas encore d'évaluation

- Company Lawbba 5TH SemDocument29 pagesCompany Lawbba 5TH SemAB ROCKSPas encore d'évaluation

- Corp Acc-2 - Chap1-5-Material Updated-Sep2013Document64 pagesCorp Acc-2 - Chap1-5-Material Updated-Sep2013Pavan Kumar MylavaramPas encore d'évaluation

- All About Principle of Lifting of Corporate Veil Under Companies ActDocument10 pagesAll About Principle of Lifting of Corporate Veil Under Companies ActPria MakandaPas encore d'évaluation

- Company LawDocument42 pagesCompany Lawaboood al7tamyPas encore d'évaluation

- HL Bolton (Engineering) Co LTD V T J Graham & Sons LTD in 1957Document6 pagesHL Bolton (Engineering) Co LTD V T J Graham & Sons LTD in 1957joshuaPas encore d'évaluation

- Corporate Law UNIT I-VDocument231 pagesCorporate Law UNIT I-VMadhav Batra100% (1)

- Advantages and Disadvantages of Incorporation of A CompanyDocument3 pagesAdvantages and Disadvantages of Incorporation of A Companysaqib nisarPas encore d'évaluation

- Theory Notes Modified PDFDocument28 pagesTheory Notes Modified PDFLubna Afseer100% (1)

- Tender DocumentsDocument83 pagesTender DocumentsSwati Rohan JadhavPas encore d'évaluation

- India Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Document4 pagesIndia Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Swati Rohan JadhavPas encore d'évaluation

- Ducon Technical Proposal - Rev00 - 15.01.2018Document24 pagesDucon Technical Proposal - Rev00 - 15.01.2018Swati Rohan Jadhav100% (1)

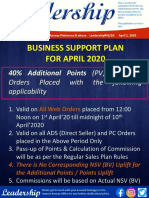

- Business Support Plan For April 2020: LeadershipDocument3 pagesBusiness Support Plan For April 2020: LeadershipSwati Rohan JadhavPas encore d'évaluation

- Rudra SuktaDocument9 pagesRudra SuktaSwati Rohan JadhavPas encore d'évaluation

- ENPS - Contribution ManualDocument31 pagesENPS - Contribution ManualSwati Rohan JadhavPas encore d'évaluation

- Sr. No POP Reg No POP NameDocument8 pagesSr. No POP Reg No POP NameSwati Rohan JadhavPas encore d'évaluation

- Nitya Pooja Complete VidhiDocument152 pagesNitya Pooja Complete Vidhihersh_vardhan87% (23)

- Anual ReportDocument210 pagesAnual ReportSwati Rohan JadhavPas encore d'évaluation

- Nakshatra Table Free-VersionDocument3 pagesNakshatra Table Free-VersionSwati Rohan JadhavPas encore d'évaluation

- Chandra NamaskarDocument8 pagesChandra NamaskarSwati Rohan JadhavPas encore d'évaluation

- Urn ProblemsDocument4 pagesUrn ProblemsSwati Rohan JadhavPas encore d'évaluation