Académique Documents

Professionnel Documents

Culture Documents

Forensic Accounting Case - Tallahassee BeanCounters

Transféré par

slexicCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Forensic Accounting Case - Tallahassee BeanCounters

Transféré par

slexicDroits d'auteur :

Formats disponibles

ISSUES IN ACCOUNTING EDUCATION Vol. 25, No. 2 2010 pp.

279321

American Accounting Association DOI: 10.2308/iace.2010.25.2.279

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

Carol Callaway Dee and Cindy Durtschi

ABSTRACT: Your rm has been engaged to conduct a forensic investigation of the Tallahassee BeanCounters TBC, a privately owned minor league baseball team in Tallahassee, Florida. Team owner Franklin Kennedy has told employees that the audit is related to the mortgage TBC obtained for the recently constructed training facility. However, Mr. Kennedy tells you privately that the investigation is not due to loan requirements; rather, it is due to his concerns arising from an anonymous tip he received in the mail. The assignment requires you and your investigative team to 1 analyze the nancial and background data provided; 2 brainstorm the possible ways in which a fraud could be perpetrated and concealed within the organization; 3 determine the additional information you need to conrm or disprove your suspicions; and 4 request this information from the appropriate party at TBC. When your investigation is complete, you will present your written results to the owner, including 1 who committed the fraud, 2 how it was committed, 3 the economic impact of the fraud to TBC, and 4 the nancial benet your suspects received from committing the crime. Keywords: fraud detection; forensic accounting; auditing; problem-based learning. Data Availability: The authors are willing to share any data as well as Excel versions of all student and teacher handouts. Please contact Professor Durtschi.

PART I: CASE MATERIALS INTRODUCTION our rm has been hired to conduct a forensic investigation of the Tallahassee BeanCounters TBC, a minor league baseball team in Tallahassee, Florida. TBC has never before been audited. Franklin Kennedy, the teams owner, has told employees that the audit is a requirement of the bank, which provided the mortgage loan for the recently completed training facility. However, Mr. Kennedy privately tells your audit team that he received an anony-

Carol Callaway Dee is an Associate Professor at University of Colorado Denver, and Cindy Durtschi is an Associate Professor at DePaul University

We thank Special Agent Joseph Cornwell, FBI now retired, and Anthony Carro, former Chief Investigator of the Manhattan District Attorneys ofce for their input and review of the case. We also thank Robert Dosch University of North Dakota, Thomas Buckhoff Georgia Southern University, William Hillison Florida State University, Kevan L. Jensen University of Oklahoma, Patricia Johnson Canisius College, Chih-Chen Lee Northern Illinois University, David OBrien Pittsburg State University, and Susan Swanger Western Carolina University for helpful comments and assistance in implementing early versions of this case. We also thank participants at the 2007 and 2009 Fraud and Forensic Accounting Education Conferences held in Savannah and Atlanta, Georgia.

Published Online: April 2010

279

280

Dee and Durtschi

mous note below in the mail leading him to suspect that someone within the company is committing fraud. The envelope, addressed to Mr. Kennedy, had a Tallahassee postmark and no return address. Because Mr. Kennedy lives in Boston, he has entrusted the running of this franchise to his long-time associate Phil Ackers. Mr. Kennedy had assumed that things were running efciently until the note arrived. TBC has no formal procedures to accommodate whistleblowers and the employees of TBC are unaware of the true nature of your engagement.

Mr. Kennedy: I think there is something funny going on here at TBC. Numbers that do not add up, lots of whispers in the hallways and closed-door discussions have me suspicious. If I were you I would check it out. A long-time friend.

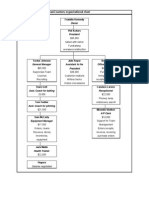

The owner has asked you to focus your investigation on the last ve months May through September. This is the time period during which the training facility was constructed. As you familiarize yourself with the company, you note that in addition to revenue from ticket sales, TBC generates funds from parking, fundraising, and sales of concessions and game programs. Franklin Kennedy also gives TBC some start-up money at the beginning of the season to assist with expenses until the team starts earning revenue from games. He withdraws that money over the course of the season. Operating expenses consist primarily of payroll, equipment bats, balls, etc., team travel, programs, and concession inventory. Any fees due to the baseball league, such as franchise fees, are paid by the Boston Sox Franklin Kennedys major league team on behalf of TBC. Payroll is processed by an outside service company. Other ofce expenses are similar to those of most small businesses. Student Handout SH 1 provides an organizational chart for TBC. Ofce manager Ben Hill oversees daily operations of the organization. Michelle Shelton provides support for management and handles most of the bookkeeping, including accounts payable, cash receipts, and equipment purchase orders. Candace Candie Larson, receptionist, answers phones and compiles time sheets for processing. Julie Roper, assistant to the president, assists with donor relations and is also responsible for concessions ordering and inventory as well as accounts receivable collections. President Phil Ackers oversees fundraising activities and supervised the building of TBCs newly completed training facility. To familiarize yourself with TBC, you attend a night game and chat with some of the employees. The three women who work in the ticket booth seem particularly eager to chat. Myrna Myers, their supervisor, tells you the three women have worked together in the booth for 20 years. Their husbands come to every game, and the six often socialize together as well. Myrna is happy to talk to you about the other TBC employees, especially those in the front ofce. Below is a summary of Myrnas opinions.

Company Overview: Things have changed a lot this last year. Mr. Ackers cut down on excess employees, particularly some of the game-day employees because its expensive to build a new training facility. I dont mind because this new building is great. Its state-of-the-art and I hope it will help us recruit and keep our players in shape. Weve had a great season this year, and all of the ladies here would love to see that continue. A lot of people complained during the building because of the mess and there was some tension because Mr. Ackers was on us to be efcient and cut expenses so we could qualify for a good rate on the mortgage loan, but we qualied and I think it was worth it. Phil brought in food and drinks for all of us the day we got the loan and everything was set. It was a lot of fun. Phil Ackers Company President: Phils a nice guy; he oversees the fundraising, and seems to know everyone everywhere. Thats probably because he was a professional ballplayer years ago. He was pretty tense during the building of the new training facility, but now that its completed, hes getting back to his old self. Hes really close to his family; in fact, he even hired his niece Julie

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting Roper to take the place of Terri Hughes who had been his assistant forever when she left to go take care of her mother. Julie Roper Assistant to the President: Shes a great change from Terri Hughes, Mr. Ackers former assistant. Terri guarded Mr. Ackers ofce to the point it was impossible to get hold of Mr. Ackers to ask even the simplest question. Anyway, Terris mother got sick and Terri left, then Mr. Ackers hired his niece, Julie. Like I said, shes a welcome change. She works very hard, even has taken over some jobs that Terri wouldnt touch, like the ordering for concessions and group ticket sales. She also took over accounts receivable collections from Michelle, who was thrilled to get rid of that job. Tucker Johnson General Manager: The players love Tucker. He has an interesting coaching philosophynever raises his voice to the players or uses foul language. Weve sent many players up to the majors, so he still gets the job done even without the four-letter words. Tucker cant stand paperwork, so he has Sam do most of the ordering as well as taking care of all the equipment. Ben Hill Ofce Manager: Ben still thinks its 1979 and disco is king. He dresses like John Travolta in Saturday Night Fever and is always hitting on the women in the ofce. He has several ex-wives; most of whom he started dating while still married to a previous one. When TBC qualied for its bank loan, Ben got a nice bonus which he blew on a new car. He calls it his chick magnet. He keeps things running smoothly in the ofce though, so Mr. Ackers pretty much lets him run day-to-day operations however he wants. Candace Larson Receptionist: Candie is a sweet young girl. Shes good with the phones, and everyone likes her. Shes the reigning Queen of the Taylor County Crab Festival. We were all real proud when she won. Shes always at the practice eld after worksometimes I think shes more interested in dating players than in doing her job, but overall shes a good worker. Michelle Shelton A/P Clerk: Michelle is really hard working. She handles all the bookkeeping and paperwork, like the purchase orders and stuff. Shes also going to school part time.

281

To begin your audit, your team does a walk-through of each process at TBC. SH 2 describes your observations of those processes and how employees handle their responsibilities. You also collect a copy of the team game schedule SH 3 and copies of the last ve months of nancial information SH 4 through SH 17. ASSIGNMENT Your instructor will divide the class into teams. Working with your team, your assignment is to determine whether fraud has been committed at TBC, and, if so, to gather and present evidence sufcient to prove the guilt of the suspects. This is a competitive exercise. It is essential that you keep the information that your team has gathered private. Leaks provide other teams with cheap information, and will put your team at a disadvantage at the time of grading. Procedure The rst step is to review the background and nancial information provided. Then, working with your team, brainstorm.1 Given the company, its employees, and processes, how could a fraud be committed and concealed? Remember the fraud triangle: to commit fraud, a perpetrator must have pressure, opportunity, and a rationalization for his or her behavior AICPA, para. 33. Are there weaknesses in controls that could be exploited by an unscrupulous employee? Which em-

Statement on Auditing Standards SAS No. 99 requires the audit team to brainstorm about how and where they believe the entitys nancial statements might be susceptible to material misstatement due to fraud, how management could perpetrate and conceal fraudulent nancial reporting, and how assets of the entity could be misappropriated AICPA 2002, para. 14. Generally SAS No. 99 does not apply to forensic investigators unless they are certied public accountants engaged to render an opinion on nancial statements.

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

282

Dee and Durtschi

ployees have the incentive to do so? Review the given nancial data. Do relationships between nancial and non-nancial information seem reasonable? Are there any unusual trends, postings, or transactions about which your group is curious? As in a real audit or forensic investigation, your group is not provided, initially, with all the information needed to solve the case. Once your group has reviewed the materials provided and completed your brainstorming session covering the questions listed above, compile a list of additional information you would like to receive. You will request this information via your instructor. To obtain the additional information you need, send an email to your instructor, but address your request to the appropriate employee of TBC, or the appropriate outside party. For example, Michelle Shelton: Please provide us with copies of the phone invoices for May. As this is a forensic investigative exercise, you have greater latitude than in most audit situations to gather information in any legal manner you see t. For example, you can question TBC employees, their friends, relatives, and business associates. If you have enough evidence to give probable cause, you can obtain a subpoena from a judge enabling you to acquire private information such as credit reports or bank accounts. If requesting evidence from outside of TBC, be clear in your request. For example, If I examine public records, what will I learn about cars owned by Sam McCarty? or If I attend the TBC fundraising event on April 3, what will I see? You can also conduct other information gathering exercisesfor example, surveillance of TBC employees. Interviewing Suspects If time allows, your instructor may provide your team an opportunity to interrogate your suspects near the end of your work on the case. The goal of the interrogation is to obtain a confession from your suspects. You can include any confessions you obtain as additional evidence in your nal fraud report. You will question any suspects as a team, so think of ways you can use your team effectively. The interviews are generally short 10 to 20 minutes, so consider the following: 1. Be prepared. The more information you have gathered toward solving the case, the higher the likelihood you can induce an admission of guilt from your suspect. For example, if you know who did it, how they did it, why they did it, and can show that they beneted from the crime, you can box your suspects into a corner and obtain a confession. Have a plan. Organize your information and decide on a method of presentation that will best demonstrate to the perpetrator that denial of guilt is futile. However, do not treat your pre-planned questions as a script to which you must adhere. You will want to modify your approach as the interview progresses based upon the responses of the suspect. Have a theme for your interview. How will you behave toward the suspect? Will you be empathetic and understanding, allowing the suspect to rationalize his or her behavior? Or will you act as if resistance to questioning is fruitless, as you have all the information you need and are just letting the suspect state his or her side? Will you team up to play good-cop, bad-cop? Make certain that all members of your team are using the same line of reasoning.

2.

3.

Final Fraud Report Your team will be graded based upon your written nal fraud report. Your report should be convincing and include the following for each fraud your group uncovers: 1. 2. 3. The names of the perpetrators of the crime. How the perpetrators committed the fraud. The dollar magnitude of the fraud.

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

283

4. The personal gain received by the perpetrators from the fraud. In your report, you should include evidence to back up your assertions in the four areas above. This evidence might include documentation you have gathered from your emails, information summarized from interviews and other sources such as surveillance, and analysis based on data from the student handouts. Finally, experience has shown that the most successful teams are those that work together. Each team members point of view is valuable. Divide this case and work alone, at your own peril.

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

284

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

285

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

286

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

287

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

288

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

289

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

290

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

291

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

292

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

293

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

294

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

295

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

296

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

297

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

298

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

299

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

300

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

301

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

302

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

303

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

304

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

305

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

306

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

307

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

308

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

309

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

310

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

311

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

312

Dee and Durtschi

Issues in Accounting Education American Accounting Association

Volume 25, No. 2, 2010

Return of the Tallahassee BeanCounters: A Case in Forensic Accounting

313

Issues in Accounting Education

Volume 25, No. 2, 2010 American Accounting Association

Vous aimerez peut-être aussi

- PERDEV - Q1 - Mod1 - Knowing OneselfDocument23 pagesPERDEV - Q1 - Mod1 - Knowing OneselfAienna Lacaya Matabalan89% (131)

- Forensics Sample ReportDocument7 pagesForensics Sample ReportPranjal BagrechaPas encore d'évaluation

- Forensic Audit Report of Laxmi WarehouseDocument6 pagesForensic Audit Report of Laxmi WarehouseMeena BhagatPas encore d'évaluation

- The Fraud ScaleDocument3 pagesThe Fraud ScaleGIlang Wicaksono100% (1)

- Mitchell Heisman - Suicide NoteDocument1 905 pagesMitchell Heisman - Suicide Notejarmenl83% (24)

- Group AssignmentDocument9 pagesGroup AssignmentXiao Han WongPas encore d'évaluation

- Financial Statements Fraud Cases and TheoryDocument25 pagesFinancial Statements Fraud Cases and TheoryCoster Itayi MukushaPas encore d'évaluation

- Shanabrook Forensic AuditDocument63 pagesShanabrook Forensic Auditmike.kellyPas encore d'évaluation

- Forensic Audit Report - 2 Abc ProductionsDocument6 pagesForensic Audit Report - 2 Abc Productionsspeed deamonPas encore d'évaluation

- Pete The Cat Buttons LessonDocument6 pagesPete The Cat Buttons Lessonapi-285851205Pas encore d'évaluation

- PPP - Research Paper - FafdDocument11 pagesPPP - Research Paper - Fafdharshita patniPas encore d'évaluation

- Fraud ReportDocument11 pagesFraud Reportapi-317304401Pas encore d'évaluation

- Forensic Audit Report of BKR Foods Pvt. LTDDocument7 pagesForensic Audit Report of BKR Foods Pvt. LTDA Kumar LegacyPas encore d'évaluation

- Forensic AuditDocument5 pagesForensic AuditAnkita KumariPas encore d'évaluation

- FORENSIC ACC Details 1Document42 pagesFORENSIC ACC Details 1angelPas encore d'évaluation

- Final Fraud ReportDocument27 pagesFinal Fraud Reportpvchandu100% (1)

- Tools and Techniques For Prevention of FraudsDocument12 pagesTools and Techniques For Prevention of Fraudsrahul kumarPas encore d'évaluation

- Chapter 2 Forensic Auditing and Fraud InvestigationDocument92 pagesChapter 2 Forensic Auditing and Fraud Investigationabel habtamuPas encore d'évaluation

- Research Paper Word - Banking Sector FraudDocument13 pagesResearch Paper Word - Banking Sector FraudMeena BhagatPas encore d'évaluation

- Forensic Audit Report of JIPLDocument6 pagesForensic Audit Report of JIPLkhushboo sharmaPas encore d'évaluation

- Research PaperDocument14 pagesResearch PaperSoumya SaranjiPas encore d'évaluation

- 5 6318691500020466224-1Document5 pages5 6318691500020466224-1shuchim guptaPas encore d'évaluation

- Ecological Engineering and Civil Works in NetherlandsDocument369 pagesEcological Engineering and Civil Works in NetherlandsSantiago mosquera guerreroPas encore d'évaluation

- Forensic Report 2 - Gopal Jewellers LimitedDocument24 pagesForensic Report 2 - Gopal Jewellers LimitedMeena BhagatPas encore d'évaluation

- ReportDocument10 pagesReportDhiraj ChordiyaPas encore d'évaluation

- Airport Design GuidelinesDocument408 pagesAirport Design Guidelinesnickolololo67% (9)

- RESEARCH PAPER On Loan and Mortgage FraudsDocument11 pagesRESEARCH PAPER On Loan and Mortgage FraudsAyana GoelPas encore d'évaluation

- Research Paper PPT - Banking Sector FraudDocument16 pagesResearch Paper PPT - Banking Sector FraudMeena BhagatPas encore d'évaluation

- Forensic Report 1Document10 pagesForensic Report 1a2zconsultantsjprPas encore d'évaluation

- Report 11 - Forensic Audit Report - Establishment PhaseDocument28 pagesReport 11 - Forensic Audit Report - Establishment PhaseRush OunzaPas encore d'évaluation

- Pharmaceutical Validation: Presented By: Bharatlal Sain 1 M.Pharm PharmaceuticsDocument32 pagesPharmaceutical Validation: Presented By: Bharatlal Sain 1 M.Pharm PharmaceuticsRaman KumarPas encore d'évaluation

- Roslyn Union Free School District: Anatomy of A ScandalDocument64 pagesRoslyn Union Free School District: Anatomy of A Scandalvchinese0% (1)

- NMC GOLD FINANCE LIMITED - Forensic Report 1Document11 pagesNMC GOLD FINANCE LIMITED - Forensic Report 1Anand KhotPas encore d'évaluation

- Forensic Audit Report of Geetanjali JewellersDocument5 pagesForensic Audit Report of Geetanjali Jewellersanon_2474227Pas encore d'évaluation

- Adv Acct CH 6 HoyleDocument76 pagesAdv Acct CH 6 Hoylewaverider750% (2)

- Bean Counters Teacher Hand-OutsDocument25 pagesBean Counters Teacher Hand-OutsJustin Henderson100% (1)

- Introduction Forensic Audit ReportingDocument16 pagesIntroduction Forensic Audit ReportingChristen CastilloPas encore d'évaluation

- Student Handouts - Fraud CaseDocument30 pagesStudent Handouts - Fraud Casedchristensen5Pas encore d'évaluation

- 1 Simone BewryDocument30 pages1 Simone BewryTan DizzlePas encore d'évaluation

- J Singh & Associates Chartered Accountants: Profile For Concurrent AuditDocument28 pagesJ Singh & Associates Chartered Accountants: Profile For Concurrent AudittusharPas encore d'évaluation

- Introduction, Conceptual Framework of The Study & Research DesignDocument16 pagesIntroduction, Conceptual Framework of The Study & Research DesignSтυριd・ 3尺ㄖ尺Pas encore d'évaluation

- Case StudyDocument5 pagesCase StudyMeghraj RegmiPas encore d'évaluation

- Generic Definition: ": Manufacturing Inventory: Besides Finished Goods, Also Includes Raw Materials Used inDocument12 pagesGeneric Definition: ": Manufacturing Inventory: Besides Finished Goods, Also Includes Raw Materials Used inRosita BarcaloungerPas encore d'évaluation

- Forensic Audit Report of Club RainbowDocument10 pagesForensic Audit Report of Club RainbowA Kumar Legacy100% (1)

- FORENSIC AUDIT REPORT Axis 4Document19 pagesFORENSIC AUDIT REPORT Axis 4ScribdTranslationsPas encore d'évaluation

- Fraud IndicatorsDocument26 pagesFraud IndicatorsIena SharinaPas encore d'évaluation

- Chapter 12Document9 pagesChapter 12EdrickLouise DimayugaPas encore d'évaluation

- Financial Audit: 1. Examination of FS. 2. Add CredibilityDocument4 pagesFinancial Audit: 1. Examination of FS. 2. Add CredibilitySachinPas encore d'évaluation

- Phishing Fraud AnalysisDocument23 pagesPhishing Fraud AnalysisTejas ChokshiPas encore d'évaluation

- ScandalDocument83 pagesScandalForeclosure FraudPas encore d'évaluation

- Internet Fraud 6monthreport 2000 ADocument14 pagesInternet Fraud 6monthreport 2000 AFlaviub23Pas encore d'évaluation

- ETI Microproject 2Document8 pagesETI Microproject 2Varad MadakePas encore d'évaluation

- 2.3: Dr. Steve Albrecht, Keith Howe, and Marshall Romney - The Nine Motivators of FraudDocument7 pages2.3: Dr. Steve Albrecht, Keith Howe, and Marshall Romney - The Nine Motivators of FraudhemaniPas encore d'évaluation

- Fafd Module IcaiDocument225 pagesFafd Module IcaiCAAniketGangwalPas encore d'évaluation

- The Foreign Corrupt Practices Act BY Ca Vijay Kumar GargDocument14 pagesThe Foreign Corrupt Practices Act BY Ca Vijay Kumar GargVijay Garg100% (1)

- Research Paper (Comparative Analysis of Global Financial Laws)Document17 pagesResearch Paper (Comparative Analysis of Global Financial Laws)Soumya SaranjiPas encore d'évaluation

- Aniket Sahu (108849521988689229760 - 21511016 - 1)Document19 pagesAniket Sahu (108849521988689229760 - 21511016 - 1)Technical AniketPas encore d'évaluation

- The Role of Auditors in Fraud Detection and PreventionDocument9 pagesThe Role of Auditors in Fraud Detection and PreventionCharmaine Mapesho CharlottePas encore d'évaluation

- Fraud Examination Exam 1Document12 pagesFraud Examination Exam 1V SalgadoPas encore d'évaluation

- Short Guide To BSC Applied Accounting - FinalDocument8 pagesShort Guide To BSC Applied Accounting - Finalasim riazPas encore d'évaluation

- Out - 28 IT FraudDocument41 pagesOut - 28 IT FraudNur P UtamiPas encore d'évaluation

- Ex-Logitech CFO Accused of Accounting FraudDocument3 pagesEx-Logitech CFO Accused of Accounting FraudAgung KurniawanPas encore d'évaluation

- A New Era in Phishing Research PaperDocument15 pagesA New Era in Phishing Research PaperRuchika RaiPas encore d'évaluation

- Surat Hisotry & His PhotoDocument13 pagesSurat Hisotry & His Photobhaveshlad14100% (1)

- Forensic Audit PDFDocument6 pagesForensic Audit PDFKoolmind33% (3)

- Internship PaperDocument11 pagesInternship Paperapi-348451742Pas encore d'évaluation

- MHC Tax Exemption FormDocument1 pageMHC Tax Exemption FormslexicPas encore d'évaluation

- Southwest Strategic Profit Variance Analysis TemplateDocument1 pageSouthwest Strategic Profit Variance Analysis TemplateslexicPas encore d'évaluation

- Econ7 100 Project ProposalDocument1 pageEcon7 100 Project ProposalslexicPas encore d'évaluation

- The History of AccountingDocument1 pageThe History of AccountingslexicPas encore d'évaluation

- Group2 Case1 4241-6241Document8 pagesGroup2 Case1 4241-6241slexicPas encore d'évaluation

- Hopewell Kaufman 73 AERDocument5 pagesHopewell Kaufman 73 AERslexicPas encore d'évaluation

- Research Design and MethodologyDocument4 pagesResearch Design and MethodologyAnna Graziela De Leon AujeroPas encore d'évaluation

- Theories of Governance and New Public ManagementDocument20 pagesTheories of Governance and New Public ManagementPDRRMO RPDPas encore d'évaluation

- Aligning Compensation Strategy With Business Strategy: A Case Study of A Company Within The Service IndustryDocument62 pagesAligning Compensation Strategy With Business Strategy: A Case Study of A Company Within The Service IndustryJerome Formalejo,Pas encore d'évaluation

- 6 Question: Suggest How Should RSWMDocument3 pages6 Question: Suggest How Should RSWMai_geethuPas encore d'évaluation

- Question Report StatconDocument19 pagesQuestion Report StatconRodel LouronPas encore d'évaluation

- Counter Strike RulesDocument2 pagesCounter Strike Rulesm3evPas encore d'évaluation

- Nama: UTS TANGGL: .. I. Read The Text Carefully, Than Answer The Questions!Document7 pagesNama: UTS TANGGL: .. I. Read The Text Carefully, Than Answer The Questions!moh.faisolPas encore d'évaluation

- 8700 2 QP EnglishLanguage G 4nov20 AM 1Document24 pages8700 2 QP EnglishLanguage G 4nov20 AM 1Finest Aymzino71% (7)

- Nature of Comparative PoliticsDocument2 pagesNature of Comparative PoliticsShaik AfzalPas encore d'évaluation

- Alternative Centres of PowerDocument12 pagesAlternative Centres of PowerSameena SirajPas encore d'évaluation

- Road Map Activity WorksheetDocument3 pagesRoad Map Activity Worksheetapi-361550540Pas encore d'évaluation

- Brockton Police Log March 28, 2019Document17 pagesBrockton Police Log March 28, 2019BBPas encore d'évaluation

- The Roots of Japanese Legal Terminology: Yuki HorieDocument12 pagesThe Roots of Japanese Legal Terminology: Yuki HorieHerryHutapeaPas encore d'évaluation

- Gregory Craig Document Protective Order - 4-12-2019Document5 pagesGregory Craig Document Protective Order - 4-12-2019Beverly TranPas encore d'évaluation

- B1 - Speaking Activities - Worksheet 2Document2 pagesB1 - Speaking Activities - Worksheet 2Mohamed NasirPas encore d'évaluation

- Test 14Document7 pagesTest 14Yến MaiPas encore d'évaluation

- Meaning Making and Resilience Case Studies of A Multifaceted ProcessDocument10 pagesMeaning Making and Resilience Case Studies of A Multifaceted ProcessCarmen NelPas encore d'évaluation

- American History Power Point ProjectDocument3 pagesAmerican History Power Point Projectspotspot1Pas encore d'évaluation

- The Use of Metaphors in Social MediaDocument7 pagesThe Use of Metaphors in Social MediaAnggii Wahabb LanglinglunglinglungPas encore d'évaluation

- Action Research ProposalDocument5 pagesAction Research ProposalJhessa LeePas encore d'évaluation

- Grade 4 Daily Lesson LogDocument4 pagesGrade 4 Daily Lesson LogFlorecita CabañogPas encore d'évaluation

- Mirjan Damaska - Epistemology and Legal Regulation of ProofDocument15 pagesMirjan Damaska - Epistemology and Legal Regulation of Proofinefable007Pas encore d'évaluation

- Philippine Nikkei Jin Kai School of Calinan Durian Village, Calinan, Davao CityDocument2 pagesPhilippine Nikkei Jin Kai School of Calinan Durian Village, Calinan, Davao CityJonathan Oton MasamlocPas encore d'évaluation

- Foreign and Local Related Literature and Studies: ABE International Business CollegeDocument11 pagesForeign and Local Related Literature and Studies: ABE International Business CollegeAnn Kathlyn LabaguisPas encore d'évaluation