Académique Documents

Professionnel Documents

Culture Documents

Insurance Note Taking Guide

Transféré par

api-252386350Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Insurance Note Taking Guide

Transféré par

api-252386350Droits d'auteur :

Formats disponibles

7.10.1.

L1 Note taking guide

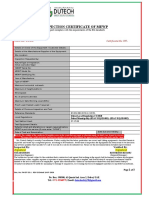

Types of Insurance Essentials Note-Taking Guide

Name__________________ 39 Total Points Earned Total Points Possible Percentage

INSURANCE Policyholder:

Rebecca Channell

4/10/14 Date__________________

4th Class _________________

Risk:

Insurance:

Policy:

a contract between the individual and the insurer specifying the terms of the insurance arrangements

the consumer who purchased the policy

Premium:

the fee paid to the insurer to be covered under the specified terms

an uncertainty about a situation's outcome

an arrangement between an individual and an insurer to protect the individual against risk

Deductible:

the amount paid out of pocket by the policy holder for initial portion of a loss before the insurance coverage begins

AUTOMOBILE INSURANCE Liability Medical payment Uninsured/under insured Physical damage

covers damages caused to the vehicle

Types

covers the insured if injuries or damages are caused to other people or their property

covers injuries sustained by the driver of the insured vehicle or any passenger regardless of fault.

covers injury or damage to the driver, passengers, or the vehicle caused by a driver with insufficient insurance

no

Collision

covers a collision with another object, car, or from a rollover

Comprehensive

covers all physical damage losses except collision and other specified losses

Required by law Who/ what is covered

yes

no

no

the other person or there property

the people

the people and vehicle

the vehicle

Family Economics & Financial Education October 2010 The Essentials to Take Charge of Your Finances Types of Insurance Page 10 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

7.10.1.L1 Note taking guide

HEALTH INSURANCE Why is it important to purchase health insurance? Provides protection against:

provides protection against financial losses resulting from injury, illness, and disability. The purpose is to provide coverage for emergency or routine medical expenses

May cover:

How may health insurance be purchased?

provide coverage for emergency or routine medical expenses

hospital, surgical, dental, vision, long-term care, prescription, and other major expenditures

by an individual or through their employer

Children may stay on their parents health insurance until:

19

LIFE INSURANCE Life insurance:

contract between an insurer and policyholder specifying a sum to be paid to a beneficiary upon the insureds death

Beneficiary:

Dependent:

the recipient of any policy proceeds if the insured person dies

a person who relies on someone else financially

Who should purchase life insurance?

people who have a dependent spouse, dependent children, an aging or disabled dependent relative, or are business owners.

DISABILITY INSURANCE Disability insurance:

replaces a portion of ones income if they become unable to work due to illness or injury

If needed, how much does disability insurance pay an individual?

between 60% 70% of ones full time wage

HOMEOWNERS AND R ENTERS INSURANCE Peril:

an event which can cause a financial loss like fire, falling trees, lightning, and others

Renters insurance:

protects the insured from loss to the contents of the dwelling rather than the dwelling itself

Homeowners insurance:

combines property and liability insurance into one policy to protect a home from damage costs due to perils

Property insurance:

protects the insured from financial losses due to destruction or damage to property or possessions

Why is it important for a renter to purchase renters insurance?

andlords insurance policy on the dwelling does not cover the renters personal possessions

Liability insurance:

protects the insured party from being held liable for others financial losses. The homeowners insurance should cover the replacement cost which will pay to rebuild the home if it is completely destroyed

Covers:

renters personal possessions

Family Economics & Financial Education October 2010 The Essentials to Take Charge of Your Finances Types of Insurance Page 11 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

Vous aimerez peut-être aussi

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!D'EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Évaluation : 5 sur 5 étoiles5/5 (1)

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-2523918430% (1)

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252377919Pas encore d'évaluation

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252460708Pas encore d'évaluation

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252988764Pas encore d'évaluation

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252384953Pas encore d'évaluation

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252384641Pas encore d'évaluation

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252392987Pas encore d'évaluation

- Insurance SheetDocument2 pagesInsurance Sheetapi-252377967Pas encore d'évaluation

- InsuranceDocument2 pagesInsuranceapi-252391740Pas encore d'évaluation

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252387344100% (1)

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252391503Pas encore d'évaluation

- Types of Insurance Lesson PlanDocument8 pagesTypes of Insurance Lesson PlanpcsgdnwuPas encore d'évaluation

- Insurance BasicsDocument24 pagesInsurance BasicsKomal LalwaniPas encore d'évaluation

- 9-6-16 InsuranceDocument52 pages9-6-16 Insuranceapi-327394992Pas encore d'évaluation

- Insuranc 1Document10 pagesInsuranc 1zunaira sarfrazPas encore d'évaluation

- Insurance and Risk ManagementDocument6 pagesInsurance and Risk ManagementSolve AssignmentPas encore d'évaluation

- 5-Insurance Planning (Insurance Planning)Document35 pages5-Insurance Planning (Insurance Planning)Farahliza RosediPas encore d'évaluation

- Unit FourDocument35 pagesUnit FourBI SH ALPas encore d'évaluation

- COMM 229 Notes Chapter 6Document5 pagesCOMM 229 Notes Chapter 6Cody ClinkardPas encore d'évaluation

- Insurance – Definition and Meaning 2Document4 pagesInsurance – Definition and Meaning 2ЕкатеринаPas encore d'évaluation

- Family Risk ManagementDocument12 pagesFamily Risk ManagementAakash ReddyPas encore d'évaluation

- Daniel AyoolaDocument10 pagesDaniel AyoolaSalim SulaimanPas encore d'évaluation

- Introduction of Mediclaim InsuranceDocument17 pagesIntroduction of Mediclaim InsuranceKunal KaduPas encore d'évaluation

- Insurance BasicsDocument23 pagesInsurance BasicsChamandeep SinghPas encore d'évaluation

- Insurance and Pension FundDocument44 pagesInsurance and Pension FundFiaz Ul HassanPas encore d'évaluation

- Finance ReportDocument4 pagesFinance ReportKatrina FregillanaPas encore d'évaluation

- Law of Insurance AnswersheetDocument55 pagesLaw of Insurance Answersheetkhatriparas71Pas encore d'évaluation

- Frauds in Insurance SectorDocument74 pagesFrauds in Insurance Sectoranilmourya5100% (1)

- Lesson 7Document3 pagesLesson 7shadowlord468Pas encore d'évaluation

- InsuranceDocument6 pagesInsuranceHarsh SadavartiaPas encore d'évaluation

- Aid To Trade Insurance: Aditva SharmaDocument20 pagesAid To Trade Insurance: Aditva Sharmaaditva SharmaPas encore d'évaluation

- RMIN 4000 Exam Study Guide Ch 2 & 9Document13 pagesRMIN 4000 Exam Study Guide Ch 2 & 9Brittany Danielle ThompsonPas encore d'évaluation

- Accidental Insurance: Accident Al PoliciesDocument8 pagesAccidental Insurance: Accident Al PoliciesannieangeloPas encore d'évaluation

- NotesDocument6 pagesNotesGoodataka ZackamanPas encore d'évaluation

- Everything You Need to Know About Life InsuranceDocument11 pagesEverything You Need to Know About Life InsurancePooja TripathiPas encore d'évaluation

- Accident Insurance: An Overview of Coverage, Benefits and ConsiderationsDocument9 pagesAccident Insurance: An Overview of Coverage, Benefits and Considerationsbhavika_08_1680844570% (1)

- Insurance Fraud DetectionDocument74 pagesInsurance Fraud DetectionJai GaneshPas encore d'évaluation

- Insurance HandbookDocument28 pagesInsurance HandbookGreat VivekanandaPas encore d'évaluation

- Insurance and Risk ManagementDocument10 pagesInsurance and Risk Managementhitesh gargPas encore d'évaluation

- Insurance MGT NotesDocument36 pagesInsurance MGT NotesHONEY AGRAWALPas encore d'évaluation

- What Is Insurance by VISHALDocument6 pagesWhat Is Insurance by VISHALVishalPas encore d'évaluation

- Insurance Company ProfileDocument12 pagesInsurance Company ProfileKai MK4Pas encore d'évaluation

- Understanding InsuranceDocument64 pagesUnderstanding InsuranceMikant Fernando63% (8)

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentShantam GulatiPas encore d'évaluation

- 5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Document45 pages5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Haliyana HamidPas encore d'évaluation

- Insurance and Risk ManagementDocument6 pagesInsurance and Risk Managementbhupendra mehraPas encore d'évaluation

- Insurance Assignmnt Merits and DemeritsDocument8 pagesInsurance Assignmnt Merits and DemeritsDjay SlyPas encore d'évaluation

- Definition of InsuranceDocument11 pagesDefinition of InsurancePuru SharmaPas encore d'évaluation

- Definition of Insurance Code and TypesDocument2 pagesDefinition of Insurance Code and TypesKoko LainePas encore d'évaluation

- Insurance PDFDocument16 pagesInsurance PDFNANDHINI MPas encore d'évaluation

- Law Economics Risk Management Hedge Risk Uncertain: Types of InsuranceDocument3 pagesLaw Economics Risk Management Hedge Risk Uncertain: Types of InsuranceEdvergMae VergaraPas encore d'évaluation

- Insurance "101" Terminology: Presented For Wisconsin 4-H Youth Development StaffDocument31 pagesInsurance "101" Terminology: Presented For Wisconsin 4-H Youth Development StaffBounna PhoumalavongPas encore d'évaluation

- Classification of InsuranceDocument10 pagesClassification of InsuranceKhalid MehmoodPas encore d'évaluation

- Finance PPT 2Document11 pagesFinance PPT 2sanhithPas encore d'évaluation

- INSURANCE MANAGEMENT GUIDEDocument25 pagesINSURANCE MANAGEMENT GUIDEDeepak ParidaPas encore d'évaluation

- What Is Insurance - Meaning, Types, Importance & BenefitsDocument7 pagesWhat Is Insurance - Meaning, Types, Importance & BenefitsAyush VermaPas encore d'évaluation

- Insurance & Risk Management JUNE 2022Document11 pagesInsurance & Risk Management JUNE 2022Rajni KumariPas encore d'évaluation

- Walmart Cover LetterDocument1 pageWalmart Cover Letterapi-252390333Pas encore d'évaluation

- M&Ms Color Number Brown 5 Red 8 Yellow 10 Green 11 Blue 15 Orange 9Document2 pagesM&Ms Color Number Brown 5 Red 8 Yellow 10 Green 11 Blue 15 Orange 9api-252390333Pas encore d'évaluation

- BudgetDocument2 pagesBudgetapi-252390333Pas encore d'évaluation

- Job ApplicationDocument3 pagesJob Applicationapi-252390333Pas encore d'évaluation

- Dylan Smith: EducationDocument1 pageDylan Smith: Educationapi-252390333Pas encore d'évaluation

- W 2Document1 pageW 2api-252390333Pas encore d'évaluation

- Website Clutch ExedyDocument1 pageWebsite Clutch ExedyEleazar Pavon0% (1)

- Maintain Your DE12TI/DE12TIS EngineDocument23 pagesMaintain Your DE12TI/DE12TIS EngineBùi Xuân Đức100% (1)

- A6000 DME Control UnitDocument8 pagesA6000 DME Control UnittrinhPas encore d'évaluation

- Abac Genesis Leaflet - Airflow-Compressors - Co.ukDocument8 pagesAbac Genesis Leaflet - Airflow-Compressors - Co.ukJosefox69Pas encore d'évaluation

- Data & Specifications: Wärtsilä Low-Speed EnginesDocument13 pagesData & Specifications: Wärtsilä Low-Speed Enginesherysyam1980Pas encore d'évaluation

- Cme Product CatalogDocument280 pagesCme Product CatalogAbimael D. Rodriguez100% (1)

- Datasheet Motor Generador Cummins Onan 30MCGBADocument4 pagesDatasheet Motor Generador Cummins Onan 30MCGBABam BAPas encore d'évaluation

- Holsetpartnumbers 2008Document1 pageHolsetpartnumbers 2008Marielis ContrerasPas encore d'évaluation

- Trek Bikes Manual 7500Document107 pagesTrek Bikes Manual 7500Narcis DobosPas encore d'évaluation

- Parts Manual: SJ519 THDocument226 pagesParts Manual: SJ519 THTatiana VásquezPas encore d'évaluation

- Manual RX 100Document67 pagesManual RX 100Raquel Punkerit100% (5)

- NewFile 1 - OCR - EditDocument2 pagesNewFile 1 - OCR - EditAda SawhneyPas encore d'évaluation

- EEE4016 Electric Vehicles: Understanding HEVs and EVsDocument46 pagesEEE4016 Electric Vehicles: Understanding HEVs and EVsADITYA DAS 17BEE0267Pas encore d'évaluation

- Slip Power Recovery SchemeDocument19 pagesSlip Power Recovery SchemeISL EEE HODPas encore d'évaluation

- Most Reliable: The 100% Battery Electric Refuse Collection Vehicle Affordable, Dependable, & Environmentally FriendlyDocument2 pagesMost Reliable: The 100% Battery Electric Refuse Collection Vehicle Affordable, Dependable, & Environmentally FriendlyGanesan TPas encore d'évaluation

- MGA Prices PDFDocument2 pagesMGA Prices PDFrenger20150303Pas encore d'évaluation

- Application For A Contract Carriage PermitDocument1 pageApplication For A Contract Carriage Permitdev sharmaPas encore d'évaluation

- Unit 2 Safety and Emergency ProceduresDocument10 pagesUnit 2 Safety and Emergency ProceduresmarpelPas encore d'évaluation

- Chain Link Fences and GatesDocument11 pagesChain Link Fences and Gatesمحمد عبد السلام الصوافPas encore d'évaluation

- Ohlins Motorcycle Road Track Catalogue 2021 - 210x210mm - SpreadsDocument39 pagesOhlins Motorcycle Road Track Catalogue 2021 - 210x210mm - SpreadsTiago ZeferinoPas encore d'évaluation

- Chapter 1 MotoresDocument23 pagesChapter 1 MotoresWalter GonzalezPas encore d'évaluation

- Product Bulletin VHP7104GSI S5Document2 pagesProduct Bulletin VHP7104GSI S5Wiliam SeguraPas encore d'évaluation

- U004490 BrochureDocument143 pagesU004490 BrochureKaka BjakaPas encore d'évaluation

- SMC-Mk5 Spareparts 2022.03Document62 pagesSMC-Mk5 Spareparts 2022.03Daniel OliveraPas encore d'évaluation

- PECP9064-10 - Cat Tire Product GuideWEBDocument70 pagesPECP9064-10 - Cat Tire Product GuideWEBKyle McCormackPas encore d'évaluation

- Encore BrochureDocument4 pagesEncore BrochureJagriti KashyapPas encore d'évaluation

- Cooling System Exhaust System: RadiatorDocument2 pagesCooling System Exhaust System: RadiatorMd ShPas encore d'évaluation

- How To Keep Your Volkswagen Alive. Epañol PDFDocument228 pagesHow To Keep Your Volkswagen Alive. Epañol PDFErnesto De La Rosa Flores67% (12)

- 55-1 MewpDocument3 pages55-1 MewpAkhilPas encore d'évaluation

- ValuationDocument6 pagesValuationvisho7Pas encore d'évaluation