Académique Documents

Professionnel Documents

Culture Documents

f1040sc Internship

Transféré par

api-252942620Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

f1040sc Internship

Transféré par

api-252942620Droits d'auteur :

Formats disponibles

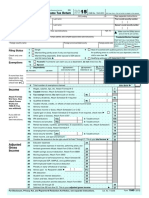

SCHEDULE C (Form 1040)

Department of the Treasury Internal Revenue Service (99) Name of proprietor

For

Profit or Loss From Business

(Sole Proprietorship) information on Schedule C and its instructions, go to www.irs.gov/schedulec. Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065.

OMB No. 1545-0074

Attachment Sequence No. 09

2013

Social security number (SSN)

A C E F G H I J

Principal business or profession, including product or service (see instructions) Business name. If no separate business name, leave blank. Business address (including suite or room no.)

B Enter code from instructions

D Employer ID number (EIN), (see instr.)

City, town or post office, state, and ZIP code Cash (2) Accrual (3) Other (specify) Accounting method: (1) Did you materially participate in the operation of this business during 2013? If No, see instructions for limit on losses If you started or acquired this business during 2013, check here . . . . . . . . . . . . . . . . . Did you make any payments in 2013 that would require you to file Form(s) 1099? (see instructions) . If "Yes," did you or will you file required Forms 1099? . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes Yes Yes

No No No

Part I

1 2 3 4 5 6 7 8 9 10 11 12 13

Income

. .

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the Statutory employee box on that form was checked . . . . . . . . . Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . Cost of goods sold (from line 42) . . . . . . . . . . . . . . . . . . . Gross profit. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . Gross income. Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7

Part II

Expenses

. . . . 8 9 10 11 12

Enter expenses for business use of your home only on line 30.

18 19 20 a b 21 22 23 24 a b 25 Office expense (see instructions) Pension and profit-sharing plans . Rent or lease (see instructions): Vehicles, machinery, and equipment Other business property . . . Repairs and maintenance . . . Supplies (not included in Part III) . Taxes and licenses . . . . . Travel, meals, and entertainment: Travel . . . . . . . . . Deductible meals and entertainment (see instructions) . Utilities . . . . . . . . Wages (less employment credits) . Other expenses (from line 48) . . Reserved for future use . . . . . . . . . . . . .

Advertising .

18 19 20a 20b 21 22 23 24a 24b 25 26 27a 27b 28 29

Car and truck expenses (see instructions) . . . . . Commissions and fees . Contract labor (see instructions) Depletion . . . . . Depreciation and section 179 expense deduction (not included in Part III) (see instructions) . . . . . Employee benefit programs (other than on line 19) . . Insurance (other than health) a b Interest: Mortgage (paid to banks, etc.) Other . . . . . . Legal and professional services

13 14 15 16a 16b 17 . . .

14 15 16

17 28 29 30

26 27a b . .

Total expenses before expenses for business use of home. Add lines 8 through 27a . Tentative profit or (loss). Subtract line 28 from line 7 . . . . . .

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: Method Worksheet in the instructions to figure the amount to enter on line 30 . . . Use the Simplified . . . . . . . 30

31

Net profit or (loss). Subtract line 30 from line 29. If a profit, enter on both Form 1040, line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. If a loss, you must go to line 32.

31

32

If you have a loss, check the box that describes your investment in this activity (see instructions). If you checked 32a, enter the loss on both Form 1040, line 12, (or Form 1040NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited.

32a 32b

All investment is at risk. Some investment is not at risk.

Schedule C (Form 1040) 2013

For Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 11334P

Schedule C (Form 1040) 2013

Page 2

Part III

33 34

Cost of Goods Sold (see instructions)

Method(s) used to value closing inventory:

Cost

Lower of cost or market

Other (attach explanation) . Yes No

Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If Yes, attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . Inventory at beginning of year. If different from last years closing inventory, attach explanation . Purchases less cost of items withdrawn for personal use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 36 37 38 39 40 41 42

35 36 37 38 39 40 41 42

Cost of labor. Do not include any amounts paid to yourself . Materials and supplies Other costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add lines 35 through 39 . Inventory at end of year .

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 .

Part IV

Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562.

43 44 a 45 46 47a b

When did you place your vehicle in service for business purposes? (month, day, year)

Of the total number of miles you drove your vehicle during 2013, enter the number of miles you used your vehicle for: Business b Commuting (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . c Other . . . . . . . . . . . . . . . . . . . . Yes Yes Yes Yes No No No No

Was your vehicle available for personal use during off-duty hours?

Do you (or your spouse) have another vehicle available for personal use?. Do you have evidence to support your deduction? If Yes, is the evidence written? . . . . . . . . . . . . . . . . . . .

Part V

Other Expenses. List below business expenses not included on lines 826 or line 30.

48

Total other expenses. Enter here and on line 27a .

48

Schedule C (Form 1040) 2013

Vous aimerez peut-être aussi

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09fortha loveof100% (5)

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerPas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerPas encore d'évaluation

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- BriteSol Inc IRS 1120 Corporation Tax Return 2012Document5 pagesBriteSol Inc IRS 1120 Corporation Tax Return 2012how3935Pas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Christiana Johnson100% (2)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Thomas LawrencePas encore d'évaluation

- BNI 1120 ReturnDocument5 pagesBNI 1120 ReturndishaakariaPas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Skip LarsonPas encore d'évaluation

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnHamzah B ShakeelPas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09jay wallace100% (4)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Navek SmithsPas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176Pas encore d'évaluation

- Bertrand Russell - Knowledge and WisdomDocument4 pagesBertrand Russell - Knowledge and WisdomDunk7Pas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rose ownes100% (2)

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Frantz Raymond TaxDocument1 pageFrantz Raymond Taxjoseph GRAND-PIERREPas encore d'évaluation

- 1040 Exam Prep Module X: Small Business Income and ExpensesD'Everand1040 Exam Prep Module X: Small Business Income and ExpensesPas encore d'évaluation

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- Tally Ledger Groups List (Ledger Under Which Head or Group in Accounts PDFDocument13 pagesTally Ledger Groups List (Ledger Under Which Head or Group in Accounts PDFravi100% (1)

- Taxes 2016Document1 pageTaxes 2016PhilPas encore d'évaluation

- Inventory Management and Inventory Control Must Be Designed To Meet The Dictates of The Marketplace and Support The CompanyDocument43 pagesInventory Management and Inventory Control Must Be Designed To Meet The Dictates of The Marketplace and Support The CompanyfredkasomiPas encore d'évaluation

- Starting A New Dental Practice Checklist PDFDocument4 pagesStarting A New Dental Practice Checklist PDFAbdelrahman GalalPas encore d'évaluation

- The Craig Proctor Ultimate Real Estate Success Super ConferenceDocument12 pagesThe Craig Proctor Ultimate Real Estate Success Super ConferenceMike Le0% (1)

- f5 Smart NotesDocument98 pagesf5 Smart Notessakhiahmadyar100% (1)

- J.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Mutual FundDocument27 pagesMutual FundDinesh sawPas encore d'évaluation

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyPas encore d'évaluation

- Business Tax Basics - IndexDocument64 pagesBusiness Tax Basics - IndexLuvli PhươngPas encore d'évaluation

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesPas encore d'évaluation

- DHHSCDocument2 pagesDHHSClrowland974Pas encore d'évaluation

- F 1040 SeDocument2 pagesF 1040 SepdizypdizyPas encore d'évaluation

- f1040 Schedule C Expenses PDFDocument2 pagesf1040 Schedule C Expenses PDFVallery FisherPas encore d'évaluation

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13api-253299751Pas encore d'évaluation

- Form 4562Document2 pagesForm 4562Weiming LinPas encore d'évaluation

- F 1040 SaDocument1 pageF 1040 Sahgfed4321Pas encore d'évaluation

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDocument5 pagesU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyPas encore d'évaluation

- Quiz 7-34 1Document2 pagesQuiz 7-34 1lagurrPas encore d'évaluation

- MAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1Document25 pagesMAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1юрий локтионовPas encore d'évaluation

- Randy Thompson SCH C 2020Document2 pagesRandy Thompson SCH C 2020sahilPas encore d'évaluation

- F 1040 SaDocument2 pagesF 1040 Saljens09Pas encore d'évaluation

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620Pas encore d'évaluation

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental ExpensesnusePas encore d'évaluation

- Blackeye0-Loan-2000-Schedule CDocument2 pagesBlackeye0-Loan-2000-Schedule Cpolaoapp3043Pas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Patty Morrarty24Pas encore d'évaluation

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyDocument3 pagesForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandPas encore d'évaluation

- Farm Rental Income and Expenses: Form Department of The Treasury Internal Revenue Service (99) OMB No. 1545-0074Document4 pagesFarm Rental Income and Expenses: Form Department of The Treasury Internal Revenue Service (99) OMB No. 1545-0074AlexPas encore d'évaluation

- Lejean Tax 2019Document1 pageLejean Tax 2019joseph GRAND-PIERREPas encore d'évaluation

- Schedule C DolpheDocument2 pagesSchedule C Dolphejyoti06ranjanPas encore d'évaluation

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental Expensesapi-173610472Pas encore d'évaluation

- Marcelin Farah Tax 2019Document1 pageMarcelin Farah Tax 2019joseph GRAND-PIERREPas encore d'évaluation

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarPas encore d'évaluation

- Foreign Tax Credit: A B C D eDocument2 pagesForeign Tax Credit: A B C D eSamer Mira BazziPas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1Pas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionpittscherylPas encore d'évaluation

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Document2 pagesExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldPas encore d'évaluation

- Massachusettsschedule CDocument2 pagesMassachusettsschedule Cmatthewbraunschweig65100% (1)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354Pas encore d'évaluation

- Form 4A: General Consumption Tax ReturnDocument2 pagesForm 4A: General Consumption Tax ReturnSi KiPas encore d'évaluation

- 2015 Two BrothersDocument43 pages2015 Two BrothersAnonymous Wu0bxv6p7Pas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanPas encore d'évaluation

- BOTEXDocument1 pageBOTEXjoseph GRAND-PIERREPas encore d'évaluation

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineD'EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Jaina Day DescriptionDocument1 pageJaina Day DescriptionDunk7Pas encore d'évaluation

- Instructions For Form 1099-G: Future DevelopmentsDocument2 pagesInstructions For Form 1099-G: Future DevelopmentsDunk7Pas encore d'évaluation

- A 0527 JaDocument2 pagesA 0527 JaDunk7Pas encore d'évaluation

- Assembly Bill No. 130: Legislative Counsel's DigestDocument2 pagesAssembly Bill No. 130: Legislative Counsel's DigestDunk7Pas encore d'évaluation

- Product Lifecyle AssessmentDocument28 pagesProduct Lifecyle AssessmentDunk7Pas encore d'évaluation

- Australia: General InformationDocument1 pageAustralia: General InformationDunk7Pas encore d'évaluation

- Piedmont ShortDocument8 pagesPiedmont ShortDunk7Pas encore d'évaluation

- 2012 Instructions For Schedule C: Profit or Loss From BusinessDocument13 pages2012 Instructions For Schedule C: Profit or Loss From BusinessDunk7Pas encore d'évaluation

- Revised Effective Dates-2010Document4 pagesRevised Effective Dates-2010Dunk7Pas encore d'évaluation

- Quick Start Guide: Welcome To Ebrary ! Below Are A Few Steps To Help You Get StartedDocument2 pagesQuick Start Guide: Welcome To Ebrary ! Below Are A Few Steps To Help You Get StartedDunk7Pas encore d'évaluation

- Demon LoverDocument5 pagesDemon LoverEstherPíscorePas encore d'évaluation

- % Growth: FY14A FY15A FY16A FY17E FY18E FY19E FY20E FY21EDocument2 pages% Growth: FY14A FY15A FY16A FY17E FY18E FY19E FY20E FY21EAtul KoltePas encore d'évaluation

- Korea Shooting Guide-EnglishDocument54 pagesKorea Shooting Guide-EnglishFabiana Fabian100% (1)

- Trends in Inequality: Poverty AlleviationDocument2 pagesTrends in Inequality: Poverty Alleviationlaloo01Pas encore d'évaluation

- Basics of Project FinanceDocument5 pagesBasics of Project Financeogansyl2159Pas encore d'évaluation

- No. Nama Pengajar Alamat E-Mail: Introduction To AccountingDocument4 pagesNo. Nama Pengajar Alamat E-Mail: Introduction To Accountingwuri nugrahaniPas encore d'évaluation

- O Level Economics Question Paper 11Document12 pagesO Level Economics Question Paper 11Ananya KarmakarPas encore d'évaluation

- PGBP Chart 1Document2 pagesPGBP Chart 1Aashish Kumar Singh100% (1)

- AFM Assignment (2019)Document9 pagesAFM Assignment (2019)Videhi BajajPas encore d'évaluation

- Important MCQDocument37 pagesImportant MCQParminder Singh55% (11)

- IBM Oil - Cognos Performance Blueprint Offers Solutions For UpstreamDocument7 pagesIBM Oil - Cognos Performance Blueprint Offers Solutions For UpstreamIBM Chemical and PetroleumPas encore d'évaluation

- Property Digests Consolidated 1-37 For ScribdDocument25 pagesProperty Digests Consolidated 1-37 For ScribdEveBPas encore d'évaluation

- Manuscript FoncardasDocument145 pagesManuscript FoncardasAna EnclonarPas encore d'évaluation

- What Is Break Even AnalysisDocument5 pagesWhat Is Break Even AnalysisElaine MagbuhatPas encore d'évaluation

- 2016 ORION Consolidated Audit ReportDocument112 pages2016 ORION Consolidated Audit ReportJoachim VIALLONPas encore d'évaluation

- 1396 Quarter 1 Fiscal Bulletin-FinalDocument46 pages1396 Quarter 1 Fiscal Bulletin-FinalMacro Fiscal PerformancePas encore d'évaluation

- Marie BrizardDocument205 pagesMarie BrizardAnonymous 31e9Xsy8WPas encore d'évaluation

- Allen Lane Case Write UpDocument2 pagesAllen Lane Case Write UpAndrew Choi100% (1)

- Prob Set 1Document6 pagesProb Set 1Nikki BulantePas encore d'évaluation

- Strides Pharma Science - Elara Securities - 7 February 2021Document7 pagesStrides Pharma Science - Elara Securities - 7 February 2021Ranjan BeheraPas encore d'évaluation

- Yeast Production IndustryDocument71 pagesYeast Production IndustryShabir TrambooPas encore d'évaluation

- SubhashDocument1 pageSubhashsubhash221103Pas encore d'évaluation

- Cash Flow Statement QuestionDocument2 pagesCash Flow Statement QuestionFarai KandaPas encore d'évaluation

- Accounting Activity 4Document2 pagesAccounting Activity 4Ar JayPas encore d'évaluation