Académique Documents

Professionnel Documents

Culture Documents

Aspal Buton Project 2013

Transféré par

Ignatius WirawanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Aspal Buton Project 2013

Transféré par

Ignatius WirawanDroits d'auteur :

Formats disponibles

BUTON ASPHALT

EXTRACTION PROJECT

[Superpave Mix Design]

Highest ROI I Green Technology I The First In The World

Presentation By

Ignatius A. Wirawan

Agung Kristianto

Foreword

In order to support the Government of Indonesia in:

Developing infrastructure facilities,

Saving the Foreign Exchange Reserves,

Opening job opportunities and modernizing local communities,

Increasing local Governments income,

Reducing urbanization and developing technology by a concept of one

village one movement product based on natural resource basis,

herewith we would like to introduce THE BUTON ASPHALT EXTRACTION

PROJECT

This project is to produce a bitumen product called modifier from a purification

process of naturally occurring asphalt of Buton using full-extraction technique

an Eco Friendly Technology found by Ir. Sayono that has a Patent Certificate and

get recognition from world institution such as International Federation of

Investors Association (IFA), Texas A&M University, the Asphalt Institute.

This is a pioneering project, however, it is very unique, because it might be the

only one in the world and the result of the project will make the investor a world

class company.

Investment Presentation

Asphalt World

Petroleum Asphalt, Natural Asphalt, Modifier Asphalt

Investment Presentation 3

About Asphalt

Asphalt is a dark brown to black cementitious material in which

the predominating constituents are bitumens that occur in nature

or are obtained in petroleum processing. [ASTM, American

Society for Testing and Materials]

Petroleum Asphalt: Modern asphalt is a natural constituent of

petroleum. Practically all asphalt used in the world nowadays is

produced by modern oil refineries and is called petroleum asphalt.

In civil engineering and construction it is also called AC or asphalt

cement.

Naturally Occurring Asphalt: These asphalts occurred naturally.

The soft asphalt material is typified in the Trinidad Lake

depository called Trinidad Lake Asphalt (TLA), on the Island of

Trinidad, in Bermudez Lake in Venezuela.

The solid rock formation (asphaltite) can be found in Uintah Basin

in eastern part of the State of Utah, North America called

American Gilsonite Company (AGC).

Buton Asphalt in the Buton Island, south coast of Sulawesi. One of

the largest natural asphalt deposit in the world.

Investment Presentation

Conventional to Superpave

Ninety-eight percent of the worlds asphalt is a product of petroleum refining.

Modification techniques are used to meet highway needs.

The asphalt industry is responding to the increase in traffic and heavier loads on

highways, which have resulted in unwelcome pavement distresses and calls for

smoother and longer lasting roads.

In 1987, the Federal Highway Administration (FHWA), the highway industry and the

American Association of State Highway and Transportation Officials (AASHTO) in

USA, working through the National Academy of Science, initiated the Strategic

Highway Research Program (SHRP). From this program came the development of

the Superpave (Superior Performing Asphalt Pavement) mix design system

where modified asphalt plays a significant role.

The Superpave system addresses the performance properties of both asphalt

binders and mineral aggregates. In addition, asphalt binders are characterized by

their engineering properties so their performance can be predicted for the specific

climate and loading conditions where they are applied. The binders can be

improved with modifiers, when warranted, to offer an even greater level of

performancemaking roads last longer while maintaining smooth riding

surfaces.

Investment Presentation

Modifier Asphalt

Modified asphalt simply performs better than conventional asphalt cement.

Natural Modifier: natural asphalt is a perfect modifier for producing

Superpave. Trinidad Lake Asphalt (TLA) and Gilsonite Asphalt (AGC) are the

examples of natural modifier produced commercially and accepted by

international market as modifier for petroleum asphalt.

Synthetic Modifier: A wide variety of synthetic modifiers, which target

specific performance deficiencies of commodity asphalt, have been developed.

However, the success of synthetic modifiers has been inconsistent and the

opinions of engineers have been mixed. While synthetic modifier can offer

superior performance in many facets, a modifier that makes an asphalt

pavement more resilient to extreme heat or deformation may not allow for

greater strength or resistance to low temperature.

Investment Presentation

or

Buton Asphalt as Modifier

Buton natural asphalt mine deposit is one of the largest in the world which is

estimated around 700 million tons.

However, not as lucky as TLA and AGC, Buton natural asphalt has not yet

been categorized as international standard modifier because of its

inherent weaknesses.

Full-extraction process is the only solution to repair any weakness inherited in

Asbuton these days. A pilot test run toward this process has been successfully

tested by inventor named Sayono. By this process, all Asbuton weaknesses

are certainly able to be repaired today. Furthermore, this process also gives

possibility for Asbuton to be specified as an international standard natural

modifier product competing others.

Bitumen produced by full-extraction process from Asbuton is ready to match

its physical properties referred to as TLA and AGC. This approach is also

chosen as a marketing strategy consideration. Market is expected to absorb the

presence of Asbuton modifier because its specification is recognizable and

consistent among other well-known international natural modifiers.

It just need 20% addition of Asbuton modifier to petroleum asphalts to

match with Superpave Performance standard.

Investment Presentation

A Dutch geological expert, Hetzel, in 1936 has discovered that the

occurrence of Asbuton deposits in Buton Island spans about 70 km from

north to south.

According to a report released by the office of energy and mineral

resources in Province of Southeast Sulawesi, the estimated Asbuton deposit

is very enormous with asphalt (bitumen) content that varies from 10 to

50%.

The deposit locations expand from Lawele bay in the north to Sampolawa

bay in the south for about 70 km long and 10 to 15 km wide, plus Enreko

area in the Regency of North Buton (previously was the Regency of Muna).

Investment Presentation

South Buton Asphalt Deposit

No Location Asphalt Content (%) Deposit (Million Ton)

1 Kabungka 10 - 20 60

2 Winto 10 - 20 3.2

3 Winil 10 - 20 0.6

4 Siantopina 10 - 20 181.25

5 Olala 10 - 20 47.049

6 Enreko 10 - 20 174.725

7 Lawele 20 - 40 210

Source : Report on Asbuton Geo-Electric Sounding & Core Drilling In Lawele Village, South Sulawesi, 1997.

Boring-Log Data Example

Investment Presentation

Source: Alberta Research Council, Canada, 1989.

(TOR untuk Penetrasi pada 25 C ditentukan = 2)

The Invention

Technology, Patent, Award, Recognition

Investment Presentation 10

Ir. Sayono Technology

This project is prepared by using a technology that has been developed

since the early 1990s by Sayono, beginning with a number of researches,

followed by inventions and a certified patent on Buton natural asphalt

purification process.

Such process has undergone several stages of pilot run scale testing

procedures in Texas A&M University, one of the well-known research

institutions in the United States.

By these achievements, quality of Buton asphalt is now possible to be

repaired make it uniquely to compete with any existing similar

qualified products. The product resulted from this project is an

international standard pure bitumen required by infrastructure world,

especially by construction agencies which are involved in asphalt mixture

road pavement.

Therefore we would like to implement such achievements become a

commercial-scale production process.

Investment Presentation

Extraction Process

Investment Presentation

Pilot Run at Texas A&M University

Investment Presentation

The Test Result

Investment Presentation

Modified Asphalt

(PG Standard)

Petroleum-base

Asphalt

Modifier

Polymer SBS (styrene-butadiene-styrene)

Synthetic

Shell

Chemical

(Elastomer

)

BASF

Chemical

Du-Pont

Good Year

(Ultracote)

Naturally Occurring Asphalt

Trinidad Lake

Asphalt

(TLA)

American

Gilsonite Co.

(AGC)

Asbuton

Need to be specified for it

to be accepted by the

global market.

Mix Design SUPERPAVE

Investment Presentation

Source: www.asphaltinstitute.org

Pertamina Asphalt

Without modifier =

PG 46-10

Shell = PG 52-16

Pertamina Asphalt

with Modifier Asphalt

Button = PG 64-16

Patent

Property by the Patent Certificate No. ID 0 004 877: Extraction Process

for Refining the Buton Islands Asphalt Using Organic Solvents. From

the point of legal aspect, the process of Buton Asphalt Extraction is

protected legally from an attempt of duplication or plagiarism by others.

Six years were needed for the Patent Certificate to be issued as

verification process on other comparing documents (if any) was exercised

by the World Intellectual Property Organization (WIPO) in Geneva,

Switzerland, through a program called Patent Cooperation Treaty (PCT).

The invention was registered in the International Federation of

Inventors Associations (IFA) in Geneva, Switzerland, with reg no 191C in

2003. Indonesia is still represented by only one inventor.

This product has also already passed a number of international

standard certifications released by the Asphalt Institute, a reputable

asphalt standard-setting institution in United States.

Investment Presentation

Patent Document

Investment Presentation

World Intellectual Property Organization

Investment Presentation

Recognition

Pilot Test Run in Texas A&M University on November 7-14, 1997.

A number of Performance Graded (PG) certifications for the product by the

Asphalt Institute in 1998-2000.

Engineering, Procurement and Construction (EPC) Design Report by

China Machinery & Equipment Co., Beijing, China, on May 20, 2005.

Complete Test Result on quality of Asbuton-modified Aphalt by R&D

Centre for Roads and Bridges, the Ministry of Public Works, on March

4, 2008, and

Asbuton Modifier Technical Specification by Laboratory of Petroleum

Technology, Department of Chemical Engineering, UGM, on April 14,

2008.

Investment Presentation

Prelimenary Investment Presentation

Mr. Sayono

Recognition by Asphalt Institute

Product Certification

Investment Presentation

Result that

Asphalt Buton is Qualified

as the

Modifier for Superpave

(Superior Performing Asphalt Pavement)

Accredited in USA through The Asphalt

Institute, Lexington, Kentucky, USA.

Investment Presentation

Product Extensions:

The By Products:

Roofing Materials

Body Coating

Pipe Coating

Sealant

Technology Value

Business Projection

Market Demand, Estimate Price, Potential Revenue

Investment Presentation 23

Potential Revenue

From the perspective of material substance, this product is unique as

there are only two kind of similar products in the world which

comply with international specification, i.e. Trinidad Lake Asphalt

(TLA) and America Gilsonite Company (AGC).

Product margin generated by this project is relatively high caused by the

involvement of invention technology. Once the projects risk are

anticipated carefully, high-profit margins are typical for such invention-

based projects.

The end product is price at USD 1000/tons, this is lower than the

competition price of USD 1500 2000/ton and also lower than SHELL/

BP/ EXXON products, which is USD 2000 4000/ton. Adjustment of

selling price will have a positive impact to the profitability of the profit.

[Note: Price for Modifier Asbuton when price for crude oil US$ 60/Barrels is around USD

1000 to USD 1500 with competitor price is around USD 1500/Ton (AGC Modifier) and

USD 1250/Ton (TLA Modifier).]

Investment Presentation

Local Market Needs

Investment Presentation

According to Directorate General of Highway, the Ministry of Public Works,

domestic asphalt consumption in year 2012 is around 1,5 million tons and

grows 5% per year. Meanwhile, Pertamina can only provide asphalt below half

a million ton/year. The shortage is unfortunately compensated by importing.

International Market Needs

Investment Presentation

According to a New Report by Global Industry Analysts (GIA); the global market

for Asphalt is forecast to reach 118.4 million metric tons by the year 2015.

Prediction estimate, 20% of the global market(118.4 Million Metric Tons), needs to have

a SUPERPAVE Asphalt Modifier, to have a cost saving & build better road.

US & Canada Market

AC or Asphalt Cement is a solid or semisolid

asphalt that has not been modified by the

addition. Modified AC is defined as an asphalt

cement to which a performance- improving

additive has been combined.

Asbuton specified such as TLA or AGC is potential

to fill in the global market for modifier.

It is shown in Table 5.5 that AC consumption in

the US is around 25 million tons whereas

Modified AC consumption is 2.5 million tons.

Meanwhile Table 5.6 shows that AC and Modified

AC consumptions in Canada are respectively

around 2.7 million and 190 thousand tons.

Using conservative assumption that proportion of

modifier ranges from 10 to 15% of its total

consumption (both AC and Modified AC),

therefore, market potentials for asphalt modifier

in the United States and Canada can be calculated.

Investment Presentation

European Market

In Europe EAPA or European Asphalt

Pavement Association released a report saying

that asphalt consumption in EU country

members in 2008 is listed in Table 5.7.

Total Bitumen (EAPA uses this term instead of

AC) consumption in Europe plus Australia,

Japan, New Zealand, Mexico and Venezuela in

2008 is around 26.27 million tonnes whereas

total Modified Bitumen (EAPAs term for

Modified AC) consumption, after multiplying

with each percentage respectively, is 3 million

tonnes.

One tonne equals to 1 metric ton or 1,000 kg.

Hence, using as same conservative assumption

as in the United States and in Canada, market

potentials for asphalt modifier in Europe and

some countries in Asia Pacific and Central

America can be calculated.

Investment Presentation

Letter of Intent

Product purchase warranty from both domestic and foreign:

The Ministry of Public Works of the Republic of Indonesia;

Letter of Intent from PT. Sapta Tunggal Perkasa (TLA and AGC

supplier based in Denpasar, Bali)

Letter of Intent from C&G Law (a legal association representing

asphalt producersin Adelaide, Australia)

Letter of Intent from Bellsouth Co. Ltd (a company running in

modified asphalt business from Owensboro, Kentucky, USA)

Letter of Intent from the Asphalt Associates Ltd (TLA and AGC

supplier based in Survey, United Kingdom)

Off Take agreement from Antech Co. Ltd (a trading company in

Daejeon, South Kore)

Investment Presentation

Letter of Intent Document

Investment Presentation

Investment Presentation

Letter of Intent Document

Bellsouth Co. Ltd, Owensboro, KY USA

Off take Agreement

Investment Presentation

Competition

No local competitor. There are numerous asphalt mining projects in the

island, but none will ever have the qualities and profitability of this project.

Head to head against high-capital multinational industries such as Shell

Elastomer (one of the biggest synthetic modifier producers), TLA, AGC,

Alberta Canada (tar sand refinery in Canada), etc.

Presently to make the asphalt, synthetic products, which are petroleum

based are manufactured by oil companies (SHELL, EXXON, etc).

However, these products are expensive, extremely dependent in oil price

which require highest maintenance.

Investment Presentation

Business Notes

This project is indeed a new technology. However, since a pilot test run

has been successful, hence engineering and financial aspects for the

projects equipment procurement are identified and calculated.

Condition of asphalt mine in Buton Island which is still not equipped with

sufficient infrastructures, such as lack of road access from mine location

to sea harbor, electrical and clean water supply, etc.

Invention-based project potentially disturb and destabilize the

continuation of similar existing products.

Immature preparation and management could result in failure of the

projects production and operational failure.

The most possible risk which often occurs is driven by these two

following major causes:

Lack of after-sales service (which causes distrust on buyers side

when, for instance), product delivery is not in time.

Unhealthy competition made by similar producers, if any.

Investment Presentation

Plant

Note of the Project

Investment Presentation 35

Extraction Schematic

Investment Presentation

CHILLER

< 0 oC

LIGHT VACCUM

PUMP > 100 MM Hg CONDENSER

40 oC

WORKING

TANK

DECANTER

HYDRO

CYCLONE

CENTRYFUGE

EXTRACTOR

25 - 90 oC

E

v

a

p

o

r

a

t

o

r

1

E

v

a

p

o

r

a

t

o

r

2

H

F

O

T

A

N

K

D

E

C

A

N

T

E

R

280 oC

250 oC

STEAM

300 oC

CONDENSER

CRUSHER

2.5 MM

DRYING

BIN

3 HARI

DRYING

BIN

3 HARI

CONVEYOR

STEEL CONVEYOR

DESOLVENTIZER

CONVEYOR WASTE KE LAUT

TURBINE

GENERATOR > 2 MW

BOILER

WATER

TREATMENT

KOLAM AIR

UNTUK PROSES

DAN PENDINGINAN

PELLETIZATION

BAGGING UNIT

SCHEMATIC

DIAGRAM

KE BOILER

DARI KOLAM

DARI KOLAM

DARI TANKI

SUPLESI SOLVENT

FLUDIZED

BED

BOILER

C

L

E

A

N

B

I

T

U

M

E

N

HOT MODIFIER

H

O

T

M

O

D

I

F

I

E

R

A

i

r

6

%

s

/

d

1

6

%

d

a

r

i

R

O

M

CONDENSER

40 oC

DARI KOLAM

POMPA

AIR

KE KOLAM

250 oC

M

a

x

.

3

.

0

0

0

.

0

0

0

K

c

a

l

/

j

a

m

1

2

.

0

0

0

.

0

0

0

K

c

a

l

/

j

a

m

4

0

0

.

0

0

0

K

c

a

l

/

j

a

m

Larutan

Bitumen Kotor

Larutan

Bitumen Bersih

S

O

L

I

D

-

L

I

Q

U

I

D

H

o

t

V

a

p

o

r

H

o

t

V

a

p

o

r

p

l

u

s

s

t

e

a

m

H

o

t

V

a

p

o

r

p

l

u

s

s

t

e

a

m

SPRAY

COOLING WATER

RAW OF

MATERIAL

K

E

K

O

L

A

M

S

o

l

v

e

n

t

V

a

p

o

r

S

o

l

v

e

n

t

V

a

p

o

r

Solvent

Solvent

S

o

l

v

e

n

t

Engine Design Full Extraction

Investment Presentation

Machine & Equipment

Investment Presentation

No. Mesin dan Peralatan Jumlah Tailor Made Vendor Catatan

1 Conveyor 1 Transport dari Mining Pit

2 Hammer Mill 1 Khusus untuk Rock Asphalt

3 Stock Yard (Conveyor) 2 Menurunkan kadar air

4 Side Conveyor 2 Transfer RoM (Raw of Material)

5 Feed Conveyor to Sludge 1 Transfer RoM (Raw of Material)

6 Sludge Mixer or Bladder (+ Vent Condenser) 1 Pembuatan lumpur RoM

7 Chain Conveyor or Sludge Pump 1 Transfer lumpur

8 Extractor 1 Counter-Current Process

9 Sentrifuge Separator 1 Pemurnian Miscella (Solvent+Bitumen) > 99%

10 Screw Conveyor 1 Transfer Solid-Liquid

11 Desolventizer 1 Solvent Recovery

12 Economizer 1 Heat Recovery

13 Blower 1 Support untuk Dust Separation

14 Dust Separator 1 Separator debu halus, sedang, kasar.

15 Cyclone 3 Pengambilan Filler

16 Screw Conveyor 1 Transfer ampas

17 Conveyor to Dump 1 Sisa ampas dibuang untuk fill-in

18 Evaporator I 1 Memisah bitumen dari solvent

19 Dome & Condensor 1 Pendinginan

20 Solvent Work Tank 1 Menampung Make-Up Solvent (recycle)

21 Water-Solvent Separator 1 Mengambil Solvent dari air

22 Vacuum Jet 1 Menjaga kondisi Light Vacuum

23 Stripper Condenser 1 Mengambil Solvent

24 Fresh Solvent Tank 1 Mensupply kehilangan solvent dalam proses

25 Evaporator II 1 Menspesifikasi Modifier

26 Dome & Condensor 1 Pendinginan Oil

27 Oil Work Tank 1 Pemisahan Oil

28 Chain Cooler Conveyor + Bagging 1 Tangki Modifier dan Pengepakan

29 Bag Filler 1 Pengepakan Filler

30 Oil-Heated Boiler (10 MKCal) 1 Sumber pemanasan

31 1 MW Fluidized Power Plant 1 Supply listrik untuk penggerak

Infrastructure Notes

Electricity facilities are mostly in adequate, therefore, at the initial

stage, a diesel generator will be needed. However, the by product

is a coal like product which would be used to fire up the electricity.

This will need additional equipment, but is included in the

investment.

Skilled labor is not available, thus, key labor will have to be

imported. It is important to consider to move up the local

population as unemployment is quite high.

By Working with the local authorities, safety should not be a

problem.

Investment Presentation

Harbour & Plant Locations

Investment Presentation

Harbour & Plant

location

Investment Presentation

Infrastructure Value

Time Schedule

Investment Presentation

I LEGAL ASPECTS & COMPANY ESTABLISHMENT

- Set the Core Team (Head Office)

- Establishment of the Company

- Management of the Company Permits

- Preparation Head Office

- Licensing Branch Office (P. Buton)

- Handling Plant Location Permit

- EIA

II PRE-DEVELOPMENT PROJECT

- Plant Design & Lab. for Sample Modifier

- Conception Design

- Basic Design

- Detail Design

- Prequalification / Tender

- Product Licensing Abroad (Brand, MOU, JV, etc.)

- Making Sample in Lab. UGM

- Sample shipment to overseas

- Build Lab. for Modifier

III DEVELOPMENT PROJECT

Implemented in BUTON

- Soil Preparation Plant in Buton (+/- 2 Ha)

- Road Construction

- Construction of Plant

- Making Machines

- Delivery to the Plant Machinery

- Installation of Machinery

- Testing & Commissioning

- Procurement of Infrastructure (Tanks, Genset)

- Procurement of Vehicles Factory

- Procurement of Office Equipment Factory

- Employee Recruitment Factory

IV PRODUCTION

- Trial Production

- Commercial Production

V MARKETING

- Arrangements for Export Permit

- Member Renewal in the Asphalt Institute USA

- Membership in the Association of Asphalt (others)

Bln-20 Bln-13 Bln-14 Bln-15 Bln-16 Bln-03 Bln-04 Bln-17 Bln-18 Bln-19 Bln-05 Bln-06

No. ITEMS

Pre-Development Project Development Project

Bln-21 Bln-22 Bln-23 Bln-24 Bln-07 Bln-08 Bln-09 Bln-10 Bln-11 Bln-12 Bln-01 Bln-02

Financial Aspect

Size of the Project, Breakdown of Investment

Investment Presentation 43

Size of the project

This project will build 1 plant with 50.000 metric ton/amount

capacity.

With a total investment of US$ 34,831,267 Million, the project

feasibility analysis (10 years) result is: Payback Period is 4

Years, 8 Months with ROI 38,98% and ROA 16,61%.

The investment breakdown is as follows:

Plant & Equipment : 85,66%

and

Working Capital : 14,34%

Investment Presentation

Project Notes

The operational stages for the project are scheduled accordingly covering

technical design, detail engineering drawing design, plant construction,

production plan, pre-operational management scheme, project fund

sources scheme, operational and marketing timeframe schedule. All of

these would become a stage of activities that goes simultaneously.

From the Investors approval and due diligence is approx 20-24 months.

The commercial production can start after 20 months. Pre-marketing

should be conducted 9-12 months before commercial production. At the

present stage there are expressions of interest from Australia, China,

South Korea & UK.

Headed by Ir. Sayono as patent holders and inventor of Buton asphalt

extraction technology, the project will be executed by a group of selected

experts in their fields as well as management and marketing team with

international standards.

Investment Presentation

Financial Summary

Investment Presentation

`

GENERAL INFORMATION

NAME OF PROJECT Asphalt Buton Extraction

LOCATION Kabungka, P. Buton, Sulawesi Tenggara

TOTAL INVESTMENT USD 29.835.060

TOTAL WORKING CAPITAL USD 4.996.207

PROJECT PERIOD 15 years (included 2 years Pre Operation)

PRODUCTION MACHINE Indonesia

PROSES Use Patent owned by Ir. SAYONO (Inventor)

No. Patent: ID 0004877, Extraction Process for Refining

The Buton Island's Asphalt Using Organic Solvents

PRODUCTION CAPACITY 50.000 Nominal Ton / Year

with work days 300 days per years, 24 hours per day

EXPORT MARKET Korea ( FOB Selling price ), Australia, England, USA

LABOUR On Plant Site, P. Buton 149 person

On Head Office, Jakarta 26 person

INVESTMENT SCHEDULE Preparation (pra construction) during 6 months USD 1.589.500

Construction during 18 months USD 28.245.560

WORKING CAPITAL SCHEDULE During 4 months Operasional on Year 3 4.996.207

34.831.267

10 Tahun 12 Tahun 15 Tahun

PROJECT FEASIBILITY ANALYSIS 1. Payback Period 4 Years 8 Months 4 Years 8 Months 4 Years 8 Months

2. NPV USD 54.693.887 USD 70.335.469 USD 100.792.043

3. IRR 39,28% 40,89% 42,27%

FINANCIAL ANALYSIS 1. Gross Profit Margin 69,60% 68,63% 68,12%

2. Operating Income Ratio 37,02% 35,31% 39,10%

3. Net Profit Margin 27,77% 26,48% 29,33%

4. R O I 38,98% 38,89% 45,57%

5. R O A 16,61% 14,09% 13,01%

FINANCIAL POSITION 1. Total Asset USD 147.829.844 USD 174.805.180 USD 249.113.818

2. Retain Earnings USD 108.611.860 USD 135.471.321 USD 206.352.255

3. Cash Balance USD 131.395.196 USD 163.208.975 USD 236.263.740

T O T A L

Profit & Loss

Investment Presentation

Year 1 Year 2 Year Year Year Year Year Year Year Year Year Year Year Year Year

USD % (6 months) (18 months) 3 4 5 6 7 8 9 10 11 12 13 14 15

1 TOTAL REVENUE Prod. & Sales 703.634.228 100,00% 0 0 29.166.667 39.950.000 45.951.000 52.176.060 54.121.608 55.204.040 56.584.141 57.998.745 59.448.713 60.934.931 62.458.304 64.019.762 65.620.256

2 COST OF GOOD SOLD COGS 224.289.295 31,88% 0 0 8.661.028 11.610.515 13.271.234 15.134.374 16.157.451 17.037.225 18.006.498 19.049.850 20.166.129 21.360.438 20.203.806 21.084.034 22.546.715

3 GROSS PROFIT 479.344.933 68,12% 0 0 20.505.639 28.339.485 32.679.766 37.041.686 37.964.157 38.166.815 38.577.643 38.948.895 39.282.584 39.574.493 42.254.499 42.935.728 43.073.541

4 OPERATING EXPENSES

- Head Office Overhead Fixed Cost 0 0 785.567 834.333 886.514 942.347 1.002.088 977.111 1.045.509 1.118.694 1.197.003 1.280.793 1.370.449 1.466.380 1.569.027

- Transport Cost (Factory - Banabungi) 4 Ton 33,33 0 0 243.056 326.389 368.056 409.722 416.667 416.667 416.667 416.667 416.667 416.667 416.667 416.667 416.667

- Transport Cost (Banabungi - Makasar) 1 Ton 15,00 0 0 437.500 587.500 662.500 737.500 750.000 750.000 750.000 750.000 750.000 750.000 750.000 750.000 750.000

- Transport Cost (Makasar - Overseas) 30 Ton 4.990 0 0 4.851.389 6.514.722 7.346.389 8.178.056 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667

- Retribution Local Government Ton Production1,20 0 0 210.000 240.000 270.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000

Total Operating Expenses 134.208.592 19,07% 0 0 6.527.511 8.502.944 9.533.458 10.567.624 10.785.421 10.760.444 10.828.842 10.902.028 10.980.336 11.064.127 11.153.782 11.249.714 11.352.360

5 MORTGAGE DEBT 10% / annum 10% 35.000.000 0 0 3.500.000 3.500.000 3.500.000 3.500.000 3.500.000 10.500.000 10.500.000 10.500.000 10.500.000 10.500.000 0 0 0

6 EARNINGS BEFORE TAX 275.136.340 39,10% 0 0 10.478.128 16.336.540 19.646.308 22.974.062 23.678.736 16.906.371 17.248.801 17.546.867 17.802.248 18.010.367 31.100.717 31.686.015 31.721.181

7 Income Tax 25% 0 0 2.619.532 4.084.135 4.911.577 5.743.515 5.919.684 4.226.593 4.312.200 4.386.717 4.450.562 4.502.592 7.775.179 7.921.504 7.930.295

8 NET EARNINGS 206.352.255 29,33% 0 0 7.858.596 12.252.405 14.734.731 17.230.546 17.759.052 12.679.778 12.936.601 13.160.150 13.351.686 13.507.775 23.325.537 23.764.511 23.790.886

Note :

1 Retribution Local Government = 6 % x USD 20 /Ton Raw Material

2 Transport Cost to Overseas, size 40 Feet (30 Ton) = USD 4.990

3 Transport Cost Factory - Banabungi IDR 300.000 /4 Ton = USD 33,33 / 4 Ton

4 Transport Cost Banabungi - Makasar USD 15 / Ton

T O T A L (15 Years)

NO. ITEMS Ref. Standar

Cash Flow

Investment Presentation

Year 1 Year 2 Year Year Year Year Year Year Year Year Year Year Year Year Year

(6 months) (18 months) 3 4 5 6 7 8 9 10 11 12 13 14 15

I INCOME

- Sales Prod. & Sales 0 0 26.736.111 39.051.389 45.450.917 51.657.305 53.959.479 55.113.837 56.469.133 57.880.861 59.327.883 60.811.080 62.331.357 63.889.641 65.486.882

II EXPENSES

- Purchase Raw Material Raw Material 0 0 4.083.333 4.369.167 5.247.458 6.227.302 6.553.980 7.012.759 7.503.652 8.028.907 8.590.931 9.192.296 9.835.757 10.524.260 11.260.958

- Purchase Solvent BP (Solvent) 0 0 2.654.167 2.839.958 3.410.848 4.047.746 4.260.087 4.558.293 4.877.374 5.218.790 5.584.105 5.974.992 6.393.242 6.840.769 7.319.623

- Purchase Diesel Fuel BP (Diesel Fuel) 0 0 1.057.583 1.131.614 1.359.092 1.612.871 1.697.481 1.816.304 1.943.446 2.079.487 2.225.051 2.380.805 2.547.461 2.725.783 2.916.588

- Water Cooling Cost BP (Others) 0 0 47.775 57.330 67.721 79.008 82.958 87.106 91.462 96.035 100.836 105.878 111.172 116.731 122.567

- Water Cleaner Cost BP (Others) 0 0 8.400 10.080 11.907 13.892 14.586 15.315 16.081 16.885 17.729 18.616 19.547 20.524 21.550

- Direct Labor Cost COGS 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

- Repair & Maintenance COGS 0 0 449.064 480.498 514.133 550.123 588.631 629.835 673.924 721.099 771.576 825.586 883.377 945.213 1.011.378

- Plant Overhead COGS 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

- Insurance Cost COGS 0 0 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688

- Laboratory Cost (Quality Test) COGS 0 0 100.000 107.000 114.490 122.504 131.080 140.255 150.073 160.578 171.819 183.846 196.715 210.485 225.219

- Head Office Overhead P-L 0 0 696.667 745.433 797.614 853.447 913.188 977.111 1.045.509 1.118.694 1.197.003 1.280.793 1.370.449 1.466.380 1.569.027

- Transport Cost (Factory - Banabungi) P-L 0 0 243.056 326.389 368.056 409.722 416.667 416.667 416.667 416.667 416.667 416.667 416.667 416.667 416.667

- Transport Cost (Banabungi - Makasar) P-L 0 0 437.500 587.500 662.500 737.500 750.000 750.000 750.000 750.000 750.000 750.000 750.000 750.000 750.000

- Transport Cost (Makasar - Overseas) P-L 0 0 4.851.389 6.514.722 7.346.389 8.178.056 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667 8.316.667

- Retribution Local Government P-L 0 0 210.000 240.000 270.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000 300.000

- Mortgage Debt P-L 0 0 3.500.000 3.500.000 3.500.000 3.500.000 3.500.000 10.500.000 10.500.000 10.500.000 10.500.000 10.500.000 0 0 0

- Taxes 0 0 0 2.619.532 4.084.135 4.911.577 5.743.515 5.919.684 4.226.593 4.312.200 4.386.717 4.450.562 4.502.592 7.775.179 7.921.504

Total Operating Expenses 0 0 18.488.621 23.678.912 27.904.031 31.693.435 33.418.528 41.589.685 40.961.134 42.185.697 43.478.788 44.846.396 35.793.332 40.558.346 42.301.435

III OPERATIONAL INCOME 0 0 8.247.490 15.372.477 17.546.886 19.963.870 20.540.951 13.524.153 15.507.999 15.695.164 15.849.094 15.964.684 26.538.024 23.331.295 23.185.446

IV INVESTMENT EXPENSES

- Pre Development Period (6 Months) Pre-Dev (1.589.500) 0

- Development Period (18 Months) Pre-Dev

* Plant & Office (Buton) Pre-Dev 0 (27.213.060)

* Head Office Overhead 0 (1.032.500)

Total Investment Expenses (1.589.500) (28.245.560) 0 0 0 0 0 0 0 0 0 0 0 0 0

V CAPITAL INJECTION

- For Investment Expenses 29.835.060 1.589.500 28.245.560 0 0 0 0 0 0 0 0 0 0 0 0 0

- For Working Capital *) 4.996.207 0 0 4.996.207 0 0 0 0 0 0 0 0 0 0 0 0

Total Capital Injection 34.831.267 1.589.500 28.245.560 4.996.207 0 0 0 0 0 0 0 0 0 0 0 0

VI NET SURPLUS 0 0 13.243.697 15.372.477 17.546.886 19.963.870 20.540.951 13.524.153 15.507.999 15.695.164 15.849.094 15.964.684 26.538.024 23.331.295 23.185.446

VII BALANCE BROUGH FORWARD 0 0 0 13.243.697 28.616.174 46.163.060 66.126.929 86.667.881 100.192.033 115.700.032 131.395.196 147.244.291 163.208.975 189.746.999 213.078.294

VIII BALANCE CARRIER FORWARD 0 0 13.243.697 28.616.174 46.163.060 66.126.929 86.667.881 100.192.033 115.700.032 131.395.196 147.244.291 163.208.975 189.746.999 213.078.294 236.263.740

Note :

*) Working Capital = 4 Months x Operational Expenses on Year 3

NO. ITEMS Ref.

Financial Analysis

Investment Presentation

Year 1 Year 2 Year Year Year Year Year Year Year Year Year Year Year Year Year

(6 months) (18 months) 3 4 5 6 7 8 9 10 11 12 13 14 15

1 Operational Income 0 0 26.736.111 39.051.389 45.450.917 51.657.305 53.959.479 55.113.837 56.469.133 57.880.861 59.327.883 60.811.080 62.331.357 63.889.641 65.486.882

2 Operational Expenses 0 0 18.488.621 23.678.912 27.904.031 31.693.435 33.418.528 41.589.685 40.961.134 42.185.697 43.478.788 44.846.396 35.793.332 40.558.346 42.301.435

NET PROCEED 0 0 8.247.490 15.372.477 17.546.886 19.963.870 20.540.951 13.524.153 15.507.999 15.695.164 15.849.094 15.964.684 26.538.024 23.331.295 23.185.446

3 Initial Cash Flows

- Investment (1.589.500) (28.245.560)

- Working Capital (4.996.207)

4 Net Cash Flow (1.589.500) (28.245.560) 3.251.283 15.372.477 17.546.886 19.963.870 20.540.951 13.524.153 15.507.999 15.695.164 15.849.094 15.964.684 26.538.024 23.331.295 23.185.446

5 Acc. Net Cash Flow (1.589.500) (29.835.060) (26.583.777) (11.211.301) 6.335.585 26.299.455 46.840.406 60.364.559 75.872.558 91.567.722 107.416.817 123.381.501 149.919.525 173.250.820 196.436.266

6 PROJECT ANALYSIS

- PAYBACK PERIOD 4 Years 8 Months 4 Years 8 Months 4 Years 8 Months

- Discount Factor 7% 7% 7%

- Net Present Value (NPV) USD 100.792.043 USD 70.335.469 USD 54.693.887

- IRR 42,27% 40,89% 39,28%

15 Years (include 2 Years Pre-Operation) 12 Years (include 2 Years Pre-Operation) 10 Years (include 2 Years Pre-Operation)

NO. ITEMS

Product & Sales Projection

Investment Presentation

Year 1 Year 2 Year Year Year Year Year Year Year Year Year Year Year Year Year

(6 months) (18 months) 3 4 5 6 7 8 9 10 11 12 13 14 15

1 PRODUCTION VOLUME

- Production Capabilities % 70% 80% 90% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

- Total Production (Modifier) 50.000 Ton 0 0 35.000 40.000 45.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000

- Beginning Inventory Ton 0 0 0 5.833 6.667 7.500 8.333 8.333 8.333 8.333 8.333 8.333 8.333 8.333 8.333

- Ending Inventory Ton 0 0 5.833 6.667 7.500 8.333 8.333 8.333 8.333 8.333 8.333 8.333 8.333 8.333 8.333

2 SALES Ton 0 0 29.167 39.167 44.167 49.167 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000

3 PRICE 1.000 USD/Ton 0 0 1.000 1.020 1.040 1.061 1.082 1.104 1.132 1.160 1.189 1.219 1.249 1.280 1.312

4 TOTAL SALES USD 0 0 29.166.667 39.950.000 45.951.000 52.176.060 54.121.608 55.204.040 56.584.141 57.998.745 59.448.713 60.934.931 62.458.304 64.019.762 65.620.256

5 RECEIVABLE USD 0 0 2.430.556 3.329.167 3.829.250 4.348.005 4.510.134 4.600.337 4.715.345 4.833.229 4.954.059 5.077.911 5.204.859 5.334.980 5.468.355

6 CASH RECEIPT USD 0 0 26.736.111 39.051.389 45.450.917 51.657.305 53.959.479 55.113.837 56.469.133 57.880.861 59.327.883 60.811.080 62.331.357 63.889.641 65.486.882

Note:

1 Inventory of Finish Goods = 2 months production

2 Price goods increase 2 % to 2,5% / year

3 Receivable Life in 1 month

NO. ITEMS Standar Unit

Cost of Good Sold

Investment Presentation

Year 1 Year 2 Year Year Year Year Year Year Year Year Year Year Year Year Year

(6 months) (18 months) 3 4 5 6 7 8 9 10 11 12 13 14 15

1 COST OF PRODUCTION

VARIABLE COST:

- Raw Material Cost Raw Material 0 0 3.500.000 4.239.167 5.102.117 6.065.108 6.482.519 6.936.296 7.421.836 7.941.365 8.497.260 9.092.069 9.728.513 10.409.509 11.138.175

- Cost of Solvent BP(Solvent) 0 0 2.275.000 2.755.458 3.316.376 3.942.320 4.213.637 4.508.592 4.824.194 5.161.887 5.523.219 5.909.845 6.323.534 6.766.181 7.239.814

- Cost of Diesel Fuel BP(Diesel Fuel) 0 0 906.500 1.097.944 1.321.448 1.570.863 1.678.972 1.796.501 1.922.256 2.056.813 2.200.790 2.354.846 2.519.685 2.696.063 2.884.787

- Other Cost:

- Water Cooling BP(Others) 0 0 47.775 57.330 67.721 79.008 82.958 87.106 91.462 96.035 100.836 105.878 111.172 116.731 122.567

- Water Cleaner (Processing) BP(Others) 0 0 8.400 10.080 11.907 13.892 14.586 15.315 16.081 16.885 17.729 18.616 19.547 20.524 21.550

- Labor Cost 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total Variable Cost 0 0 6.737.675 8.159.979 9.819.569 11.671.190 12.472.674 13.343.810 14.275.828 15.272.985 16.339.836 17.481.253 18.702.451 20.009.008 21.406.893

FIXED COST:

- Repair & Maintenance Fixed Cost 0 0 449.064 480.498 514.133 550.123 588.631 629.835 673.924 721.099 771.576 825.586 883.377 945.213 1.011.378

- Plant Overhead Fixed Cost 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

- Insurance Cost Fixed Cost 0 0 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688

- Laboratory Cost (Quality Test) Fixed Cost 0 0 100.000 107.000 114.490 122.504 131.080 140.255 150.073 160.578 171.819 183.846 196.715 210.485 225.219

- Depreciation Fixed Assets Fixed Cost 0 0 2.739.056 2.739.056 2.739.056 2.739.056 2.739.056 2.703.556 2.703.556 2.703.556 2.703.556 2.703.556 0 0 0

- Amortization (Cost Put Off) Fixed Cost 0 0 217.750 217.750 217.750 217.750 217.750 217.750 217.750 217.750 217.750 217.752 0 0 0

Total Fixed Cost 0 0 3.655.558 3.693.992 3.735.117 3.779.121 3.826.205 3.841.085 3.894.991 3.952.671 4.014.388 4.080.428 1.229.780 1.305.386 1.386.285

TOTAL COST OF PRODUCTION 0 0 10.393.233 11.853.972 13.554.686 15.450.311 16.298.878 17.184.894 18.170.819 19.225.656 20.354.224 21.561.681 19.932.231 21.314.394 22.793.179

2 BEGINNING FINISH GOODS 0 0 0 1.732.206 1.975.662 2.259.114 2.575.052 2.716.480 2.864.149 3.028.470 3.204.276 3.392.371 3.593.613 3.322.038 3.552.399

3 ENDING FINISH GOODS 0 0 1.732.206 1.975.662 2.259.114 2.575.052 2.716.480 2.864.149 3.028.470 3.204.276 3.392.371 3.593.613 3.322.038 3.552.399 3.798.863

4 COST OF GOOD SOLD 0 0 8.661.028 11.610.515 13.271.234 15.134.374 16.157.451 17.037.225 18.006.498 19.049.850 20.166.129 21.360.438 20.203.806 21.084.034 22.546.715

Note :

1 Labor cost increase 7 % / Tahun

2 Ending Inventory of Finished Goods = 2 months production

NO. ITEMS Ref.

Cost Overhead (Factory & Head Office)

Investment Presentation

Year 1 Year 2 Year Year Year Year Year Year Year Year Year Year Year Year Year

(6 months) (18 months) 3 4 5 6 7 8 9 10 11 12 13 14 15

1 FACTORY OVERHEAD (Buton Island)

- Repair & Maintenance Maintenance/yr 3,0% 449.064 480.498 514.133 550.123 588.631 629.835 673.924 721.099 771.576 825.586 883.377 945.213 1.011.378

- Cost of Factory Overhead Labor Cost 30,0% 0 0 0 0 0 0 0 0 0 0 0 0 0

- Insurance Maintenance/yr 1,0% 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688 149.688

- Laboratory Cost (Quality Test) per year 100.000 100.000 107.000 114.490 122.504 131.080 140.255 150.073 160.578 171.819 183.846 196.715 210.485 225.219

- Depreciation Fixed Assets Assets 0 0 2.739.056 2.739.056 2.739.056 2.739.056 2.739.056 2.703.556 2.703.556 2.703.556 2.703.556 2.703.556 0 0 0

- Amortization (Cost Put Off) Assets 0 0 217.750 217.750 217.750 217.750 217.750 217.750 217.750 217.750 217.750 217.752 0 0 0

Total Factory Fixed Cost 0 0 3.655.558 3.693.992 3.735.117 3.779.121 3.826.205 3.841.085 3.894.991 3.952.671 4.014.388 4.080.428 1.229.780 1.305.386 1.386.285

2 OVERHEAD KANTOR PUSAT (JKT)

- Bod, BoC & Staff Salary (Head Office) Pre-Dev 12 0 0 522.000 558.540 597.638 639.472 684.236 732.132 783.381 838.218 896.893 959.676 1.026.853 1.098.733 1.175.644

- Head Office Rent Pre-Dev 0 0 81.000 86.670 92.737 99.228 106.174 113.607 121.559 130.068 139.173 148.915 159.339 170.493 182.428

- Official Travel Abroad Pre-Dev 12.500 2 0 0 25.000 26.750 28.623 30.626 32.770 35.064 37.518 40.145 42.955 45.961 49.179 52.621 56.305

- Domestic Official Travel Pre-Dev 1.000 12 0 0 12.000 12.840 13.739 14.701 15.730 16.831 18.009 19.269 20.618 22.062 23.606 25.258 27.026

- Head Office Overhead Pre-Dev 2.500 12 0 0 30.000 32.100 34.347 36.751 39.324 42.077 45.022 48.173 51.546 55.154 59.015 63.146 67.566

- Other Cost Pre-Dev 2.222 12 0 0 26.667 28.533 30.531 32.668 34.955 37.401 40.019 42.821 45.818 49.026 52.457 56.129 60.058

- Depreciation Fixed Assets Assets 0 0 88.900 88.900 88.900 88.900 88.900 0 0 0 0 0 0 0 0

Total Head Office Fixed Cost 0 0 785.567 834.333 886.514 942.347 1.002.088 977.111 1.045.509 1.118.694 1.197.003 1.280.793 1.370.449 1.466.380 1.569.027

Note :

1 All cost (except Depreciation & Amortization) increase 7 % / year

NO. ITEMS Ref. USD Unit

Raw Material Cost

Investment Presentation

Year 1 Year 2 Year Year Year Year Year Year Year Year Year Year Year Year Year

(6 months) (18 months) 3 4 5 6 7 8 9 10 11 12 13 14 15

1 PRODUCTION

- Production Capabilities % 70% 80% 90% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

- Total Production (Modifier) 50.000 Ton 0 0 35.000 40.000 45.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000 50.000

2 RAW MATERIAL

- Standard of Raw Material Required 1 Ton Modifier = Kali 0 0 5 5 5 5 5 5 5 5 5 5 5 5 5

5 Ton Raw Material

- Standar Price Raw Material 1 Ton = 20,00 USD 0 0 20,00 21,40 22,90 24,50 26,22 28,05 30,01 32,12 34,36 36,77 39,34 42,10 45,04

- Beginning Inventory Ton 0 0 0 29.167 33.333 37.500 41.667 41.667 41.667 41.667 41.667 41.667 41.667 41.667 41.667

USD 0 0 0 583.333 713.333 858.675 1.020.869 1.092.330 1.168.793 1.250.609 1.338.151 1.431.822 1.532.049 1.639.293 1.754.043

- Purchase Raw Material Ton 0 0 204.167 204.167 229.167 254.167 250.000 250.000 250.000 250.000 250.000 250.000 250.000 250.000 250.000

USD 0 0 4.083.333 4.369.167 5.247.458 6.227.302 6.553.980 7.012.759 7.503.652 8.028.907 8.590.931 9.192.296 9.835.757 10.524.260 11.260.958

- Ending Inventory Ton 0 0 29.167 33.333 37.500 41.667 41.667 41.667 41.667 41.667 41.667 41.667 41.667 41.667 41.667

USD 0 0 583.333 713.333 858.675 1.020.869 1.092.330 1.168.793 1.250.609 1.338.151 1.431.822 1.532.049 1.639.293 1.754.043 1.876.826

- Raw Material Consumption Ton 0 0 175.000 200.000 225.000 250.000 250.000 250.000 250.000 250.000 250.000 250.000 250.000 250.000 250.000

USD 0 0 3.500.000 4.239.167 5.102.117 6.065.108 6.482.519 6.936.296 7.421.836 7.941.365 8.497.260 9.092.069 9.728.513 10.409.509 11.138.175

Note :

1 Price of Raw Material increase 7 % / year

2 Raw Material stock for using 2 month production

3 FIFO method

NO. ITEMS Standar Satuan

Thank You

For further information please contact:

Ignatius Wirawan N. I 0817 0090 263 I @ ignatiuslegioner@yahoo.com

Agung Kristianto I 0811 142 260 I @ agungkrist.amdg@gmail.com

Vous aimerez peut-être aussi

- Coastal Ocean Observing SystemsD'EverandCoastal Ocean Observing SystemsYonggang LiuPas encore d'évaluation

- New Presentation Jakarta Whell 2017-2Document33 pagesNew Presentation Jakarta Whell 2017-2Wan Zainal Wan Zain0% (1)

- Lampiran ND. 177 DRPPLN Green Book 2021 Final V2Document179 pagesLampiran ND. 177 DRPPLN Green Book 2021 Final V2tmaulanaPas encore d'évaluation

- Brosur MMJDocument80 pagesBrosur MMJBAMBANG IRAWANPas encore d'évaluation

- Polytama Propindo Q1 2021Document108 pagesPolytama Propindo Q1 2021Hendrawan SusiloPas encore d'évaluation

- Project Summary ReklamasiDocument10 pagesProject Summary ReklamasiBagus TriwantoroPas encore d'évaluation

- Analisis Kelayak Investasi PT. Pertamina Patra Niaga Dalam Kerjasama Pembangunan Pengoperasian Terminal Aspal Curah DumaiDocument142 pagesAnalisis Kelayak Investasi PT. Pertamina Patra Niaga Dalam Kerjasama Pembangunan Pengoperasian Terminal Aspal Curah DumaibustamilPas encore d'évaluation

- Kalimantan Coal Railway Project PDFDocument23 pagesKalimantan Coal Railway Project PDFpuput utomoPas encore d'évaluation

- Petrochemical IndonesiaDocument43 pagesPetrochemical IndonesiaElfara PuspitaPas encore d'évaluation

- 10 Beach Well Intakes For Small Seawater Reverse Osmosis PlantsDocument239 pages10 Beach Well Intakes For Small Seawater Reverse Osmosis PlantsAnonymous tqG0TJSAapPas encore d'évaluation

- 2012 PGN Annual ReportDocument538 pages2012 PGN Annual Reporterwin hpPas encore d'évaluation

- Beier Machinery EnglishDocument30 pagesBeier Machinery EnglishSundar MoorthiPas encore d'évaluation

- Day 2 - Andi Rachman (Provincial City of Palembang & PT CNG Hilir Raya)Document17 pagesDay 2 - Andi Rachman (Provincial City of Palembang & PT CNG Hilir Raya)HûsniTheaPas encore d'évaluation

- Pertamina Financial Statement 2020 AuditedDocument388 pagesPertamina Financial Statement 2020 Auditedyasir channelPas encore d'évaluation

- Murum Site Visit ReportDocument12 pagesMurum Site Visit ReportAnonymous UUw70xirblPas encore d'évaluation

- Grand Batang City Plabuhan PDFDocument24 pagesGrand Batang City Plabuhan PDFIkhwan FauziPas encore d'évaluation

- BSSR Annual Reports 2012Document218 pagesBSSR Annual Reports 2012DadanPas encore d'évaluation

- Coal Investment Thailand enDocument12 pagesCoal Investment Thailand enKhan Ahmed MuradPas encore d'évaluation

- Our Mission: Background ObjectiveDocument12 pagesOur Mission: Background ObjectiveShariel C ArielPas encore d'évaluation

- Oil & Gas Industry in IndonesiaDocument17 pagesOil & Gas Industry in IndonesiaSuleiman BaruniPas encore d'évaluation

- Adnan Ruziq Ihsan 2019 PDFDocument12 pagesAdnan Ruziq Ihsan 2019 PDFhudaPas encore d'évaluation

- Delong Holdings Annual Report 2008Document92 pagesDelong Holdings Annual Report 2008WeR1 Consultants Pte LtdPas encore d'évaluation

- Vale Indonesia - For CSA Institute Visit Emiten 2023Document17 pagesVale Indonesia - For CSA Institute Visit Emiten 2023hartono 288Pas encore d'évaluation

- Permintaan Bukti Potong PPH 23Document6 pagesPermintaan Bukti Potong PPH 23septi yuliyantiPas encore d'évaluation

- Sentralisasi It Untuk Mendukung Transformasi Bisnis Holding PT PertaminaDocument16 pagesSentralisasi It Untuk Mendukung Transformasi Bisnis Holding PT PertaminabrhamayudhaPas encore d'évaluation

- Railway StudyDocument2 pagesRailway StudyAnonymous UUw70xirblPas encore d'évaluation

- Dissertation - International Trade of CoalDocument15 pagesDissertation - International Trade of CoalRano Joy100% (1)

- Indonesia Cable Market by Agustina DataconsultDocument9 pagesIndonesia Cable Market by Agustina DataconsultAgustina EffendyPas encore d'évaluation

- Utilities? Solutions: Did Someone Say We Have All TheDocument6 pagesUtilities? Solutions: Did Someone Say We Have All TheSewatama Analytics 1Pas encore d'évaluation

- Indonesia Usa Petroleum Report 2005-2006Document121 pagesIndonesia Usa Petroleum Report 2005-2006Muhammad FaisalPas encore d'évaluation

- BP Migas AnnualReport2010Document38 pagesBP Migas AnnualReport2010sapcrest100% (1)

- GAIKINDO-Ditjen ILMATE Workshop Bio Fuel - 23 Feb 2023Document13 pagesGAIKINDO-Ditjen ILMATE Workshop Bio Fuel - 23 Feb 2023Mohamad BachtiarPas encore d'évaluation

- Effect of Silica Fume On Steel Slag-TesisDocument61 pagesEffect of Silica Fume On Steel Slag-TesisemonetoPas encore d'évaluation

- KI Modern CikandeDocument15 pagesKI Modern CikandeDedy Setyo OetomoPas encore d'évaluation

- Summary Pengajuan IPKKH Pit C J & KDocument3 pagesSummary Pengajuan IPKKH Pit C J & KAfriani FRPas encore d'évaluation

- Vallar ProspectusDocument720 pagesVallar ProspectusdeanmaitPas encore d'évaluation

- Kajian Ekonomi Penambangan BatubaraDocument10 pagesKajian Ekonomi Penambangan BatubaraAzis RachmanPas encore d'évaluation

- One Page Info KalrezDocument2 pagesOne Page Info KalrezDaryoko RispurwantoPas encore d'évaluation

- Peta TL Sulawesi 2017-2026Document8 pagesPeta TL Sulawesi 2017-2026Hadi SofyanPas encore d'évaluation

- Valuation Report Ryanair ShortDocument20 pagesValuation Report Ryanair ShortJohn Sebastian Gil (CO)Pas encore d'évaluation

- Dredging Management Practices For The EnvironmentDocument4 pagesDredging Management Practices For The EnvironmentSeaworks CompanyPas encore d'évaluation

- SP LCT Niaga Samudra 18Document1 pageSP LCT Niaga Samudra 18cem jakartaPas encore d'évaluation

- INDONESIA INDUSTRIAL ESTATES DIRECTORY 2018-2019 (Westpoint) PDFDocument1 pageINDONESIA INDUSTRIAL ESTATES DIRECTORY 2018-2019 (Westpoint) PDFGinnyPas encore d'évaluation

- Pre Feasibility PDFDocument90 pagesPre Feasibility PDFSulaksha WimalasenaPas encore d'évaluation

- National Shipping Policy and Inter-Island Shipping in IndonesiaDocument38 pagesNational Shipping Policy and Inter-Island Shipping in Indonesiadepzz27Pas encore d'évaluation

- Dong-Kyu Choi PDFDocument33 pagesDong-Kyu Choi PDFParthiban NagarajanPas encore d'évaluation

- LOTTE E&C - IntroduceDocument14 pagesLOTTE E&C - Introducemyusuf123Pas encore d'évaluation

- PMBOK Integration - Stake Holder - CommunicationDocument51 pagesPMBOK Integration - Stake Holder - CommunicationGibran WijayaPas encore d'évaluation

- Data Analysis: What Will We Do With Our Data ?Document38 pagesData Analysis: What Will We Do With Our Data ?Linggar Kumara MurtiPas encore d'évaluation

- 278 1271 2 PBDocument12 pages278 1271 2 PBjoko ajiPas encore d'évaluation

- APAC ProspectusDocument84 pagesAPAC Prospectusshare818Pas encore d'évaluation

- Env ScopDocument48 pagesEnv ScopErnest V SPas encore d'évaluation

- SPE28749 Arun PDFDocument8 pagesSPE28749 Arun PDFMuhammad Raynaldo PratamaPas encore d'évaluation

- Chinese Investment in The Indonesian Mining Industry China Mining 2019 SSEK Legal ConsultantsDocument15 pagesChinese Investment in The Indonesian Mining Industry China Mining 2019 SSEK Legal ConsultantsnrarfPas encore d'évaluation

- Peranan - Perkembangan Dan Permasalahan LogistikDocument32 pagesPeranan - Perkembangan Dan Permasalahan LogistikIrfanHardiansyahPas encore d'évaluation

- Case75 Asphalt enDocument3 pagesCase75 Asphalt ening_eduPas encore d'évaluation

- SR206 EnviromentalImpact PDFDocument4 pagesSR206 EnviromentalImpact PDFLeonardo KumarPas encore d'évaluation

- International Journal of Technical Innovation in Modern Engineering & Science (IJTIMES)Document13 pagesInternational Journal of Technical Innovation in Modern Engineering & Science (IJTIMES)AnuoluwapoPas encore d'évaluation

- Fly Ash For Bricks, Cement and Concrete - The Indian PerspectiveDocument12 pagesFly Ash For Bricks, Cement and Concrete - The Indian PerspectiveJoy Prokash RoyPas encore d'évaluation

- Tyre Flows Recycling AnalysisDocument27 pagesTyre Flows Recycling AnalysisMohammed AlnahhalPas encore d'évaluation

- QUALICOAT Specifications 16th Edition Updated VersionDocument86 pagesQUALICOAT Specifications 16th Edition Updated VersionСтанислав ПодольскийPas encore d'évaluation

- Gl300a 20180718Document2 pagesGl300a 20180718Essam AhmedPas encore d'évaluation

- Norton Scan 12212Document4 pagesNorton Scan 12212Saurabh KumarPas encore d'évaluation

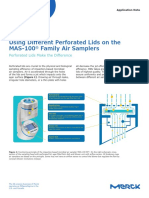

- Using Different Perforated Lids On The MAS-100 Family Air SamplersDocument6 pagesUsing Different Perforated Lids On The MAS-100 Family Air SamplersJuan Salvador MaestrePas encore d'évaluation

- Chapter 11Document38 pagesChapter 11Ismail HussainPas encore d'évaluation

- NJ Res Chapter10Document10 pagesNJ Res Chapter10Anonymous bVFHovPas encore d'évaluation

- Presentation On Usb 3.0Document21 pagesPresentation On Usb 3.0Anuj KumarPas encore d'évaluation

- S419Document2 pagesS419Syed IhyaPas encore d'évaluation

- Charpy Impact Test - STP 1072Document219 pagesCharpy Impact Test - STP 1072biancogallazzi100% (3)

- Digital Image Correlation - Tracking With MatlabDocument20 pagesDigital Image Correlation - Tracking With MatlabrajibmePas encore d'évaluation

- Stainless Steel Wire Mesh and Wire ClothDocument3 pagesStainless Steel Wire Mesh and Wire ClothStela LjevarPas encore d'évaluation

- Load TablesDocument3 pagesLoad Tablesidinjan.ashtariPas encore d'évaluation

- Risk Assesment-Rebar Loading & UnloadingDocument1 pageRisk Assesment-Rebar Loading & Unloadingmainraj rajPas encore d'évaluation

- ZımparaDocument8 pagesZımparalinaPas encore d'évaluation

- 1998 Turkish Earthquake CodeDocument84 pages1998 Turkish Earthquake CodeFatih Koçak100% (2)

- Understanding The Harmony Information in The Preset DisplayDocument2 pagesUnderstanding The Harmony Information in The Preset DisplaymileroPas encore d'évaluation

- LCD and TV Repair GuideDocument195 pagesLCD and TV Repair GuideUlisesMartin79% (14)

- S. No. Unit: (Ch. 23 Item 7)Document4 pagesS. No. Unit: (Ch. 23 Item 7)Muhammad Abdul Wajid RaiPas encore d'évaluation

- Grundfosliterature 5439530Document244 pagesGrundfosliterature 5439530Dien HuynhPas encore d'évaluation

- Ductwork Myth BusterDocument3 pagesDuctwork Myth BustermbowmanjaxPas encore d'évaluation

- Lotus Evora 400 Official BrochureDocument4 pagesLotus Evora 400 Official Brochurenumber 20% (1)

- Supersonic AerodynamicsDocument54 pagesSupersonic AerodynamicsLuis Daniel Guzman GuillenPas encore d'évaluation

- Equipment Damage Curves TransformersDocument8 pagesEquipment Damage Curves TransformersrobertoseniorPas encore d'évaluation

- Kick Off MPPTCL-TR-108Document15 pagesKick Off MPPTCL-TR-108Akd DeshmukhPas encore d'évaluation

- MS301L11 Navigational Methods and Route Planning LADocument3 pagesMS301L11 Navigational Methods and Route Planning LASam HollidayPas encore d'évaluation

- InFocus Thunder Speakerphone DatasheetDocument2 pagesInFocus Thunder Speakerphone Datasheetpinke01Pas encore d'évaluation

- PM 2.5 Sampler Model Aas-127: Advantages: FeaturesDocument1 pagePM 2.5 Sampler Model Aas-127: Advantages: FeaturesRajesh MishraPas encore d'évaluation

- Itw Catalog PDFDocument180 pagesItw Catalog PDFGilbertoPas encore d'évaluation

- A TCP TutorialDocument11 pagesA TCP Tutorialpfck4589Pas encore d'évaluation