Académique Documents

Professionnel Documents

Culture Documents

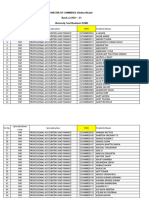

Parameter No: of Investors Percentage: Gender

Transféré par

Nitesh ChauhanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Parameter No: of Investors Percentage: Gender

Transféré par

Nitesh ChauhanDroits d'auteur :

Formats disponibles

PARAMETER NO: OF INVESTORS PERCENTAGE

GENDER

MALE 58 58%

FEMALE 42 42%

TOTAL

100 100%

AGE GROUP

BELOW 20 0 0%

BETWEEN 20 30 35 35%

BETWEEN 30 40 35 35%

ABOVE 40 30 30%

TOTAL 100 100%

QUALIFICATION

UNDER GRADUATES 7 7%

GRADUATES 46 46%

POST GRADUATES 39 39%

OTHERS 8 8%

TOTAL 100 100%

OCCUPATION

SALARIED 52 52%

BUSINESS 22 22%

PROFESSIONAL 14 14%

HOUSE WIFE 11 11%

RETIRED 1 1%

TOTAL 100 100%

ANNUAL INCOME

BELOW Rest. 2, 00,000 37 37%

Rest. 2, 00,000 - 4, 00,000 31 31%

Rest. 4, 00,000 - 6, 00,000 18 18%

ABOVE Rest, 6, 00,000 14 14%

TOTAL 100 100%

Salary

Bussiness

Professional

Housewife

BELOW 20

BETWEEN 20 - 30

BETWEEN 30 - 40

ABOVE 40

TOTAL

QUALIFICATION

UNDER GRADUATES

GRADUATES

POST GRADUATES

OTHERS

TOTAL

ANNUAL INCOME

BELOW Rest. 2, 00,000

Rest. 2, 00,000 - 4, 00,000

Rest. 4, 00,000 - 6, 00,000

ABOVE Rest, 6, 00,000

TOTAL

INVESTMENT

AVENUES

LIFE INSURANCE

GOLD

BANK FIXED DEPOSITS

MUTUAL FUNDS

REAL ESTATE

POST OFFICE SAVINGS

PPF

NSC

EQUITY SHARES

SAVINGS ACCOUNT

TOTAL

INVESTMENT

AVENUES

BANK FIXED DEPOSITS

LIFE INSURANCE

REAL ESTATE

MUTUAL FUNDS

GOLD

EQUITY SHARES

CHIT FUNDS

POST OFFICE SAVINGS

SAVINGS ACCOUNT

NSC

TOTAL

INVESTMENT

AVENUES

BANK FIXED DEPOSITS

LIFE INSURANCE

GOLD

REAL ESTATE

POST OFFICE SAVINGS

SAVINGS ACCOUNT

MUTUAL FUNDS

PPF

BONDS

GOVT SECURITIES

TOTAL

INVESTMENT

AVENUES

GOLD

INSURANCE

BANK FIXED DEPOSITS

REAL ESTATE

POST OFFICE SAVINGS

CHIT FUNDS

EQUITY

SAVINGS ACCOUNT

NSC

MUTUAL FUNDS

TOTAL

INVESTMENT

AVENUES

LIFE INSURANCE

BANK FIXED DEPOSITS

GOLD

REAL ESTATE

MUTUAL FUNDS

POST OFFICE SAVINGS

EQUITY SHARES

SAVINGS ACCOUNT

NSC

PPF

TOTAL

PARAMETER

LEVEL OF RISK

LOW RISK

MEDIUM RISK

HIGH RISK

TOTAL

PARAMETER

LEVEL OF RISK

LOW RISK

MEDIUM RISK

HIGH RISK

TOTAL

PARAMETER

LEVEL OF RISK

LOW RISK

MEDIUM RISK

HIGH RISK

TOTAL

SUGGESTED PORFOLIO CONSTRUCTION

BASED ON AGE GROUP AND LEVEL OF RISK

PARAMETER

AGE GROUP

BETWEEN 20 - 30

BETWEEN 30 - 40

ABOVE 40

1 PARAMETER NO OF INVESTORS

SHORT TERM 10

MEDIUM 60

LONG TERM 30

TOTAL 100

2 PARAMETER NO OF INVESTORS

DAILY 17

MONTHLY 35

OCCATIONALLY 41

OTHER 7

TOTAL 100

3 PARAMETER NO OF INVESTORS

YES 30

NO 70

TOTAL 100

4 Table 2.5 FAMILY BUDGET

PARAMETER NO OF INVESTORS

YES 73

NO 27

TOTAL 100

5 PARAMETER NO OF INVESTORS

YES 48

NO 52

TOTAL 100

6 PARAMETER NO OF INVESTORS

YES 77

NO 23

TOTAL 100

7 PARAMETER VOTES

CHILDREN'S EDUCATION 71

RETIREMENT 47

HOME PURCHASE 38

Table 2.3 FREQUENCY OF MONITORING THE INVESTMENT

Table 2.4 INVESTMENT IN EQUITY MARKET

Table 2.6 INVESTMENT TARGET

Table 2.7 FINANCIAL ADVISOR

Table 3.1 SAVINGS OBJECTIVE

CHILDREN'S MARRIAGE 30

HEALTHCARE 57

OTHERS 5

TOTAL 248

8

PARAMETER VOTES

WEALTH CREATION 37

TAX SAVING 43

EARN RETURNS 45

FUTURE EXPENDITURE 44

TOTAL 169

9

PARAMETER VOTES

SAFETY OF PRINCIPAL 60

LOW RISK 35

HIGH RETURNS 27

MATURITY PERIOD 16

TOTAL 138

10

PARAMETER NO: OF - SALARIED

AGE GROUP

BELOW 20 0

BETWEEN 20 - 30 22

BETWEEN 30 - 40 18

ABOVE 40

12

TOTAL 52

QUALIFICATION

UNDER GRADUATES 0

GRADUATES 21

POST GRADUATES 25

OTHERS 6

TOTAL 52

ANNUAL INCOME

BELOW Rest. 2, 00,000 15

Rest. 2, 00,000 - 4, 00,000 15

Rest. 4, 00,000 - 6, 00,000 17

ABOVE Rest, 6, 00,000 5

TOTAL 52

PARAMETER NO: OF - BUSINESS

Table 3.2 PURPOSE BEHIND INVESTMENT

Table 3.3 FACTORS CONSIDERING BEFORE INVESTING

TABLE 4: DEMOGRAPHICS BASED ON OCCUPATION

AGE GROUP

BELOW 20 0

BETWEEN 20 - 30 2

BETWEEN 30 - 40 10

ABOVE 40 10

TOTAL 22

QUALIFICATION

UNDER GRADUATES 5

GRADUATES 11

POST GRADUATES 6

OTHERS 0

TOTAL 22

ANNUAL INCOME

BELOW Rest. 2, 00,000 11

Rest. 2, 00,000 - 4, 00,000 5

Rest. 4, 00,000 - 6, 00,000 1

ABOVE Rest, 6, 00,000 5

TOTAL 22

PARAMETER NO: OF - PROFESSIONAL

Professional AGE GROUP

BELOW 20 0

BETWEEN 20 - 30 8

BETWEEN 30 - 40 2

ABOVE 40 4

TOTAL 14

QUALIFICATION

UNDER GRADUATES 0

GRADUATES 6

POST GRADUATES 6

OTHERS 2

TOTAL 14

ANNUAL INCOME

BELOW Rest. 2, 00,000 2

Rest. 2, 00,000 - 4, 00,000 8

Rest. 4, 00,000 - 6, 00,000 1

ABOVE Rest, 6, 00,000 3

TOTAL 14

PARAMETER NO: OF - HOUSEWIFE

Housewife AGE GROUP

BELOW 20 0

BETWEEN 20 - 30 4

BETWEEN 30 - 40 3

ABOVE 40 4

TOTAL 11

QUALIFICATION

UNDER GRADUATES 1

GRADUATES 6

POST GRADUATES 2

OTHERS 2

TOTAL 11

ANNUAL INCOME

BELOW Rest. 2, 00,000 9

Rest. 2, 00,000 - 4, 00,000 1

Rest. 4, 00,000 - 6, 00,000 0

ABOVE Rest, 6, 00,000 1

TOTAL 11

INVESTMENT

AVENUES VOTES

LIFE INSURANCE 35

GOLD 25

BANK FIXED DEPOSITS 24

MUTUAL FUNDS 23

REAL ESTATE 23

POST OFFICE SAVINGS 20

PPF 18

NSC 17

EQUITY SHARES 16

SAVINGS ACCOUNT 14

TOTAL 215

INVESTMENT

AVENUES VOTES

BANK FIXED DEPOSITS 13

LIFE INSURANCE 13

REAL ESTATE 11

MUTUAL FUNDS 10

GOLD 8

EQUITY SHARES 7

CHIT FUNDS 6

POST OFFICE SAVINGS 5

SAVINGS ACCOUNT 4

NSC 4

TOTAL 81

Table 5.1 Preferred investment avenues for salaried

Table 5.2 Preferred investment avenues for business people

INVESTMENT

AVENUES VOTES

BANK FIXED DEPOSITS 10

LIFE INSURANCE 10

GOLD 6

REAL ESTATE 6

POST OFFICE SAVINGS 5

SAVINGS ACCOUNT 4

MUTUAL FUNDS 4

PPF 3

BONDS 3

GOVT SECURITIES 3

TOTAL 54

INVESTMENT

AVENUES VOTES

GOLD 9

INSURANCE 9

BANK FIXED DEPOSITS 8

REAL ESTATE 5

POST OFFICE SAVINGS 5

CHIT FUNDS 4

EQUITY 4

SAVINGS ACCOUNT 3

NSC 2

MUTUAL FUNDS 1

TOTAL 50

INVESTMENT

AVENUES VOTES

LIFE INSURANCE 67

BANK FIXED DEPOSITS 55

GOLD 50

REAL ESTATE 45

MUTUAL FUNDS 38

POST OFFICE SAVINGS 35

EQUITY SHARES 29

SAVINGS ACCOUNT 25

NSC 25

PPF 22

TOTAL 391

Table 5.3 Preferred investment avenues for professionals

Table 5.4 Preferred investment avenues for housewives

Table 5.5 Preferred investment avenues overall

PARAMETER

LEVEL OF RISK NO OF INVESTORS

LOW RISK 13

MEDIUM RISK 17

HIGH RISK 5

TOTAL 35

PARAMETER

LEVEL OF RISK NO OF INVESTORS

LOW RISK 20

MEDIUM RISK 11

HIGH RISK 4

TOTAL 35

PARAMETER

LEVEL OF RISK NO OF INVESTORS

LOW RISK 21

MEDIUM RISK 6

HIGH RISK 3

TOTAL 30

SUGGESTED PORFOLIO CONSTRUCTION

BASED ON AGE GROUP AND LEVEL OF RISK

PARAMETER

AGE GROUP LOW RISK

BETWEEN 20 - 30 30%

BETWEEN 30 - 40 50%

ABOVE 40 70%

ABOVE 40 AGE GROUP

LEVEL OF RISK - PERCENTAGE OF INCOME TO BE APPORTIONED

Table 6.1 risk tolerance of age group 20 30

20 - 30 AGE GROUP

Table 6.2 risk tolerance of age group 30 - 40

30 - 40 AGE GROUP

Table 6.3 risk tolerance of age group above 40

PERCENTAGE Table 2.2 TIME PERIOD PREFERED TO INVEST

10

60

30

100

PERCENTAGE

17

35

41

7

100

PERCENTAGE

30

70

100

PERCENTAGE

73

27

100

PERCENTAGE

48

52

100

PERCENTAGE

77

23

100

WEIGHTS RANKING

29 1

19 3

15 4

Table 2.3 FREQUENCY OF MONITORING THE INVESTMENT

Table 2.4 INVESTMENT IN EQUITY MARKET

Table 2.6 INVESTMENT TARGET

Table 2.7 FINANCIAL ADVISOR

Table 3.1 SAVINGS OBJECTIVE

100

12 5

23 2

2 6

100

WEIGHTS RANK

22 4

25 3

27 1

26 2

100

WEIGHTS RANKING

43 1

25 2

19 3

13 4

100

PERCENTAGE

0

42

35

23

100

0

40

48

12

100

29

29

33

10

100

PERCENTAGE

Table 3.2 PURPOSE BEHIND INVESTMENT

Table 3.3 FACTORS CONSIDERING BEFORE INVESTING

TABLE 4: DEMOGRAPHICS BASED ON OCCUPATION

0

50

100

150

200

0

9

45

45

100

23

50

27

0

100

50

23

5

23

100

PERCENTAGE

0

9

45

45

100

0

43

43

14

100

14

57

7

21

100

PERCENTAGE

0

36

27

36

100

9

55

18

18

100

82

9

0

9

100

WEIGHTS RANK

16 1

12 2

11 3

11 4

11 5

9 6

8 7

8 8

7 9

7 10

100

WEIGHTS RANK

16 1

16 2

14 3

12 4

10 5

9 6

7 7

6 8

5 9

5 10

100

Table 5.1 Preferred investment avenues for salaried

Table 5.2 Preferred investment avenues for business people

WEIGHTS RANK

19 1

18 2

11 3

11 4

9 5

7 6

7 7

6 8

6 9

6 10

100

WEIGHTS RANK

18 1

18 2

16 3

10 4

10 5

8 6

8 7

6 8

4 9

2 10

100

WEIGHTS RANK

17 1

14 2

13 3

12 4

10 5

9 6

8 7

6 8

6 9

5 10

100

Table 5.3 Preferred investment avenues for professionals

Table 5.4 Preferred investment avenues for housewives

Table 5.5 Preferred investment avenues overall

PERCENTAGE

37

49

14

100

PERCENTAGE

57

32

11

100

PERCENTAGE

70

20

10

100

SUGGESTED PORFOLIO CONSTRUCTION

BASED ON AGE GROUP AND LEVEL OF RISK

MEDIUM RISK HIGH RISK TOTAL

50% 20% 100%

35% 15% 100%

20% 10% 100%

ABOVE 40 AGE GROUP

LEVEL OF RISK - PERCENTAGE OF INCOME TO BE APPORTIONED

Table 6.1 risk tolerance of age group 20 30

20 - 30 AGE GROUP

Table 6.2 risk tolerance of age group 30 - 40

30 - 40 AGE GROUP

Table 6.3 risk tolerance of age group above 40

10%

60%

30%

NO OF INVESTORS

SHORT TERM MEDIUM LONG TERM

17%

35%

41%

7%

NO OF INVESTORS

DAILY MONTHLY OCCATIONALLY OTHER

73%

27%

NO OF INVESTORS

YES NO

77

23

0

50

100

YES NO

NO OF INVESTORS

47

38

30

57

5

RETIREMENT

HOME PURCHASE

CHILDREN'S MARRIAGE

HEALTHCARE

OTHERS

VOTES

71

47

38

0 10 20 30 40 50 60 70 80

CHILDREN'S EDUCATION

RETIREMENT

HOME PURCHASE

37

43 45 44

169

0

50

100

150

200

WEALTH

CREATION

TAX SAVING EARN RETURNS FUTURE

EXPENDITURE

TOTAL

VOTES

60

35

27

16

0

100

VOTES

Chart Title

SAFETY OF PRINCIPAL LOW RISK HIGH RETURNS MATURITY PERIOD

LEVEL OF RISK - PERCENTAGE OF INCOME TO BE APPORTIONED

Vous aimerez peut-être aussi

- Internal Audit Checklist IMSDocument3 pagesInternal Audit Checklist IMSVineet Pandey VlogsPas encore d'évaluation

- 101 Ways to Save Money on Your Tax - Legally! 2023-2024D'Everand101 Ways to Save Money on Your Tax - Legally! 2023-2024Pas encore d'évaluation

- Corporate FinanceDocument398 pagesCorporate FinanceLongeni Hendjala100% (1)

- RA 002 - HFO Line Pressure TestDocument4 pagesRA 002 - HFO Line Pressure Testdassi99100% (1)

- SWMS-HYD-VAYUCON-03 - Unloading and Shifting Material Through ForkliftDocument7 pagesSWMS-HYD-VAYUCON-03 - Unloading and Shifting Material Through ForkliftBodakunta Ajay VarmaPas encore d'évaluation

- Amc Concourse Bridge Project: Activity: Flushing of Chilled Water PipelineDocument8 pagesAmc Concourse Bridge Project: Activity: Flushing of Chilled Water PipelineEm Niax100% (1)

- Marketing DictionaryDocument14 pagesMarketing DictionaryNitesh ChauhanPas encore d'évaluation

- Caltrans Project Risk Management HandbookDocument65 pagesCaltrans Project Risk Management HandbookNookiez Chaiyadit100% (3)

- 101 Ways to Save Money on Your Tax - Legally! 2022-2023D'Everand101 Ways to Save Money on Your Tax - Legally! 2022-2023Pas encore d'évaluation

- ChartSpots NQ Daytrading Statistics 2022 SampleDocument10 pagesChartSpots NQ Daytrading Statistics 2022 SampleJoão TrocaPas encore d'évaluation

- ChartSpots ES Daytrading Statistics 2022 SampleDocument10 pagesChartSpots ES Daytrading Statistics 2022 SampleJoão TrocaPas encore d'évaluation

- Logical Thinking: The Categories of Legitimate ReservationDocument4 pagesLogical Thinking: The Categories of Legitimate ReservationEduardJoHoPas encore d'évaluation

- Reliability and Quality Management PDFDocument174 pagesReliability and Quality Management PDFFathirGangguanJiwa33% (3)

- TO-HQ-02-071 Rev 00 Philosophy For HSE Management - OnshoreDocument39 pagesTO-HQ-02-071 Rev 00 Philosophy For HSE Management - OnshoreAHMED AMIRAPas encore d'évaluation

- Readymade Garment Manufacturing.Document23 pagesReadymade Garment Manufacturing.Yasir Sheikh83% (6)

- BoholPDRRMPlan v4Document97 pagesBoholPDRRMPlan v4marvinPas encore d'évaluation

- Chapter04 TestbankDocument42 pagesChapter04 TestbankDuy ThứcPas encore d'évaluation

- Reliability Assessment of Crane Operations: TitleDocument63 pagesReliability Assessment of Crane Operations: TitleClaudio RodriguesPas encore d'évaluation

- Fire Risk Analysis of The Airport TerminalsDocument5 pagesFire Risk Analysis of The Airport TerminalsKristaps Puļķis0% (1)

- 2013 Technical GuidanceDocument18 pages2013 Technical Guidanceamman khannaPas encore d'évaluation

- Back To Back ContractsDocument4 pagesBack To Back ContractshumaidjafriPas encore d'évaluation

- AGE 30 Years 30-50 Years 51 & ABOVE Years 54 38 8Document10 pagesAGE 30 Years 30-50 Years 51 & ABOVE Years 54 38 8Ranjit SuperanjitPas encore d'évaluation

- Accounts SumsDocument58 pagesAccounts SumsSanjose MbaPas encore d'évaluation

- Chapter - 4: Data Analysis & InterpretationDocument39 pagesChapter - 4: Data Analysis & InterpretationnagpalanishPas encore d'évaluation

- HDFC Final My DocumentDocument34 pagesHDFC Final My DocumentPraneeth Kumar V RPas encore d'évaluation

- No of Respondents Percentage: Age GroupDocument14 pagesNo of Respondents Percentage: Age GroupShihab PvrPas encore d'évaluation

- Gender: Table & Graph 1 The Table & Graph Showing Gender of InvestorsDocument20 pagesGender: Table & Graph 1 The Table & Graph Showing Gender of InvestorsSuraj MohandasPas encore d'évaluation

- Final DisertationDocument27 pagesFinal DisertationSumana DuttaPas encore d'évaluation

- Awareness of Mutual FundsDocument12 pagesAwareness of Mutual FundsObaid AhmedPas encore d'évaluation

- Data AnalysisDocument25 pagesData Analysischinmay ajgaonkarPas encore d'évaluation

- Data Analysis Q1. Have You Invested /are You Interested To Invest in Mutual Funds?Document10 pagesData Analysis Q1. Have You Invested /are You Interested To Invest in Mutual Funds?Ranjeet RajputPas encore d'évaluation

- 3.2 Data Analysis and Interpertion 3.2.1 Table Showing The Age of The RespondentDocument37 pages3.2 Data Analysis and Interpertion 3.2.1 Table Showing The Age of The RespondentRajesh KsPas encore d'évaluation

- New Naveed Data Analysis Microsoft Excel WorksheetDocument42 pagesNew Naveed Data Analysis Microsoft Excel WorksheetMuhammad IbrahimPas encore d'évaluation

- Personal Financial PlannerDocument18 pagesPersonal Financial PlannerBeastPlaysPas encore d'évaluation

- Responses Number of Responses % of Responses Single 19 38 Married 31 68 Total 50 100Document19 pagesResponses Number of Responses % of Responses Single 19 38 Married 31 68 Total 50 100Anuj ChoudharyPas encore d'évaluation

- Data Analysis and Interpretation To The Customers Table - 1Document49 pagesData Analysis and Interpretation To The Customers Table - 1T S Kumar KumarPas encore d'évaluation

- A Study of Women EnterpreneurshipDocument21 pagesA Study of Women EnterpreneurshipbalakumarPas encore d'évaluation

- QuestionnaireDocument16 pagesQuestionnairepooja36Pas encore d'évaluation

- Data RoughDocument4 pagesData RoughVaibhav SampatPas encore d'évaluation

- Whole AssignmentDocument51 pagesWhole AssignmentRtr Sandeep ShekharPas encore d'évaluation

- MBA MANAGEMENT SYNOPSIS Suraj Rameshrao RaskarDocument11 pagesMBA MANAGEMENT SYNOPSIS Suraj Rameshrao RaskarAbhay DeshpandePas encore d'évaluation

- Number of Respondents: Table 1Document7 pagesNumber of Respondents: Table 1Dileep PinkuPas encore d'évaluation

- Tax Saving Investment Instrument W.R.T To Sole Trader: Preapared by Keval Bhanushali Roll No. 126Document22 pagesTax Saving Investment Instrument W.R.T To Sole Trader: Preapared by Keval Bhanushali Roll No. 126Paras BhanushaliPas encore d'évaluation

- Document (3) Gugan SRM EditedDocument25 pagesDocument (3) Gugan SRM EditedgunPas encore d'évaluation

- Analisis Las SMT Genap 2011Document9 pagesAnalisis Las SMT Genap 2011firmanrusydiPas encore d'évaluation

- Male 108 54 2. Female 92 46Document57 pagesMale 108 54 2. Female 92 46aryaa_statPas encore d'évaluation

- Illiquid Assets Secondaries - Buy ListDocument83 pagesIlliquid Assets Secondaries - Buy ListandresheftiPas encore d'évaluation

- Aditya Pratap SinghDocument22 pagesAditya Pratap SinghAditya SinghPas encore d'évaluation

- Data Analysis 3. Gender: SEX No - of Respondents PercentageDocument35 pagesData Analysis 3. Gender: SEX No - of Respondents PercentageVinod NairPas encore d'évaluation

- Onkar ResearchDocument21 pagesOnkar ResearchOMKARPas encore d'évaluation

- Mutual Fund PPT 123Document53 pagesMutual Fund PPT 123Sneha SinghPas encore d'évaluation

- USN Online MComDocument11 pagesUSN Online MComSiva Kumar Raju ChamarthiPas encore d'évaluation

- Analysis and InteerpretationDocument43 pagesAnalysis and Inteerpretationmsvishnu7Pas encore d'évaluation

- Tabulation FinalDocument20 pagesTabulation FinalcoolchethanPas encore d'évaluation

- Data AnalysisDocument18 pagesData Analysisritvik sharmaPas encore d'évaluation

- Denim Charts: Reasons For Manufacturing This ProductDocument43 pagesDenim Charts: Reasons For Manufacturing This ProductHarshit ShahPas encore d'évaluation

- RaghaveDocument43 pagesRaghaveMubeenPas encore d'évaluation

- Report For Founders NewDocument5 pagesReport For Founders NewizzaPas encore d'évaluation

- Financial Plan: Case Analysis: Financial Point of ViewDocument13 pagesFinancial Plan: Case Analysis: Financial Point of ViewSaket AmbekarPas encore d'évaluation

- Age Group (Years) Frequency PercentageDocument31 pagesAge Group (Years) Frequency PercentageAjay VishwanathPas encore d'évaluation

- A Study of Contingency Tables & Marginal and Conditional Probabilities Group - 10Document9 pagesA Study of Contingency Tables & Marginal and Conditional Probabilities Group - 10Nishant PhilipPas encore d'évaluation

- Table ChartsDocument33 pagesTable ChartsKarthick NaikPas encore d'évaluation

- O Population: Barangay Baoyan, BolineyDocument7 pagesO Population: Barangay Baoyan, BolineyErnest AtonPas encore d'évaluation

- Simulasi GuruDocument23 pagesSimulasi GuruIZAZURAINIPas encore d'évaluation

- Employment in The West MidlandsDocument3 pagesEmployment in The West MidlandsNadia OmairPas encore d'évaluation

- Analysis & Interpretation: Classification of Respondent On The Basis of AgeDocument17 pagesAnalysis & Interpretation: Classification of Respondent On The Basis of AgeAfghan PashaPas encore d'évaluation

- Data AnalysisDocument29 pagesData AnalysisRocks KiranPas encore d'évaluation

- Data AnalysisDocument19 pagesData AnalysisYogesh DevmorePas encore d'évaluation

- TabulationDocument19 pagesTabulationcoolchethanPas encore d'évaluation

- ANHD 2016 Economic Opportunity PosterDocument1 pageANHD 2016 Economic Opportunity PosterNorman OderPas encore d'évaluation

- Quantitive Methods of Business: Narsee Monjee College of Commerce and EconomicsDocument38 pagesQuantitive Methods of Business: Narsee Monjee College of Commerce and EconomicsNiraliSPas encore d'évaluation

- Supershop Fianal For Balance SheetDocument21 pagesSupershop Fianal For Balance SheetMohammad Osman GoniPas encore d'évaluation

- Sample Data Is Given: Year Total Invested During This Year Est. Investment Value at EoyDocument10 pagesSample Data Is Given: Year Total Invested During This Year Est. Investment Value at EoyJay Michael EugenioPas encore d'évaluation

- Leanmari Excel Activities July 25 2016Document6 pagesLeanmari Excel Activities July 25 2016api-329739910Pas encore d'évaluation

- Demographic Statistics: PopulationDocument7 pagesDemographic Statistics: PopulationmvcsmsPas encore d'évaluation

- British America Tobacco: Group Balance Sheet at 31 DecemberDocument6 pagesBritish America Tobacco: Group Balance Sheet at 31 DecemberMd. Abdul Momen JibonPas encore d'évaluation

- PGDFM Project Final 1Document61 pagesPGDFM Project Final 1Nitesh ChauhanPas encore d'évaluation

- Parameter No of Investors Percentage: GenderDocument1 pageParameter No of Investors Percentage: GenderNitesh ChauhanPas encore d'évaluation

- PngstatDocument177 pagesPngstatNitesh ChauhanPas encore d'évaluation

- Finance DictionaryDocument126 pagesFinance DictionaryNitesh Chauhan100% (1)

- Symc (2011 2Q) PDFDocument59 pagesSymc (2011 2Q) PDFNitesh ChauhanPas encore d'évaluation

- The Magic of Jeevan Saral: An Insight Into This Unique Plan of L.I.C. Golden Peacock Award Winner in 2004Document31 pagesThe Magic of Jeevan Saral: An Insight Into This Unique Plan of L.I.C. Golden Peacock Award Winner in 2004Nitesh ChauhanPas encore d'évaluation

- Scope StatementDocument1 pageScope StatementSriPas encore d'évaluation

- Ch-11 Helping Investor With Financial PlanningDocument17 pagesCh-11 Helping Investor With Financial PlanningrishabhPas encore d'évaluation

- SSRN-Id1753788 - The Prayer - Ten-Step Checklist For Advanced Risk and Portfolio ManagementDocument29 pagesSSRN-Id1753788 - The Prayer - Ten-Step Checklist For Advanced Risk and Portfolio ManagementarielsbgPas encore d'évaluation

- Sapm Unit1Document24 pagesSapm Unit1Shobha ThallapalliPas encore d'évaluation

- Integrated-Case-Plan-Template DTCDocument5 pagesIntegrated-Case-Plan-Template DTClatoyakelly162Pas encore d'évaluation

- Code of Corporate Governance For Publicly-Listed CompaniesDocument41 pagesCode of Corporate Governance For Publicly-Listed CompaniesTherese Janine HetutuaPas encore d'évaluation

- Methodology For Calculation The Traffic Accidents Costs: September 2015Document7 pagesMethodology For Calculation The Traffic Accidents Costs: September 2015Sandy SandeepPas encore d'évaluation

- Advanced Safety ManagementDocument2 pagesAdvanced Safety ManagementziyadeliPas encore d'évaluation

- CommRev CasesDocument30 pagesCommRev CasesanjisyPas encore d'évaluation

- Agroentrepreneurship NC IIDocument6 pagesAgroentrepreneurship NC IIRaquel GervacioPas encore d'évaluation

- Kotak Mahindra General Insurance Limited FY20Document80 pagesKotak Mahindra General Insurance Limited FY20Shreya AmbolePas encore d'évaluation

- DENTISTASSUICIDASDocument8 pagesDENTISTASSUICIDASJESUS FRANCISCO SANCHEZ PATRICIOPas encore d'évaluation

- Hedge Fund ResumeDocument6 pagesHedge Fund Resumec2s1s8mr100% (1)

- 2021 Victoria Fallon Psychosocial Experiences of Postnatal Women During Covid 19 PandemicDocument10 pages2021 Victoria Fallon Psychosocial Experiences of Postnatal Women During Covid 19 Pandemicadni halianiePas encore d'évaluation

- Presentation LEGAL BASIS OF DRRMDocument22 pagesPresentation LEGAL BASIS OF DRRMJoel Delos SantosPas encore d'évaluation