Académique Documents

Professionnel Documents

Culture Documents

Tugas SPM 6-1

Transféré par

Reza AfrisalTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tugas SPM 6-1

Transféré par

Reza AfrisalDroits d'auteur :

Formats disponibles

TUGAS SISTEM PENGENDALIAN MANAJEMEN

TRANSFER PRICING

DISUSUN OLEH :

REZA AFRISAL CB / 115020301111038

FAKULTAS EKONOMI DAN BISNIS - AKUNTANSI

UNIVERSITAS BRAWIJAYA

MALANG

2013

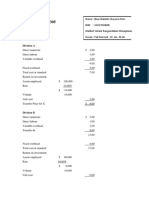

KASUS 6-1

Nomor. 1

Perhitungan

Division A

Direct materials

$ 2.00

Direct labour

1.00

Variable overhead

1.00

4.00

Fixed overhead

3.00

Total cost at standard

7.00

Return on investment:

Assets employed $ 100,000

Rate 10.00%

$ 10,000

Volume 10,000

Unit cost

1.00

Transfer Price for X

$ 8.00

Division B

Direct materials

$ 3.00

Direct labour

1.00

Variable overhead

1.00

Transfer-In

8.00

13.00

Fixed overhead

4.00

Total cost at standard

17.00

Return on investment:

Assets employed $ 60,000

Rate 10.00%

$ 6,000

Volume 10,000

Unit cost

0.60

Transfer Price for Y

$ 17.60

Division C

Direct materials

$ 1.00

Direct labour

2.00

Variable overhead

2.00

Transfer-In

17.60

22.60

Fixed overhead

1.00

Total cost at standard

$ 23.60

Nomor. 2

Perhitungan

X Division

Direct materials

$ 2.00

Direct labour

1.00

Variable overhead

1.00

4.00

Monthly charge:

Assets employed $ 100,000

Rate 10.00%

$ 10,000

Fixed costs 30,000

Annual cost 40,000

Volume 10,000

Unit cost

4.00

Transfer Price for X

$ 8.00

Y Division

Direct materials

$ 3.00

Direct labour

1.00

Variable overhead

1.00

Transfer-in

8.00

13.00

Monthly charge:

Assets employed $ 60,000

Rate 10.00%

$ 6,000

Fixed costs 40,000

46,000

Volume 10,000

Unit cost

4.60

Transfer Price for Y

$17.60

Z Division

Direct materials

$ 1.00

Direct labour

2.00

Variable overhead

2.00

Transfer-In

17.60

22.60

Fixed overhead

1.00

Total cost at standard

$23.60

Nomor. 3

Perhitungan

If we follow competitor

price:

Potential Selling Price $ 28.00 $ 27.00 $ 26.00 $ 25.00 $ 23.00 $ 22.00

Standard Cost-variable 22.60 22.60 22.60 22.60 22.60 22.60

Unit Profit $ 5.40 $ 4.40 $ 3.40 $ 2.40 $ 0.40 $ (0.60)

Volume 10,000 10,000 10,000 10,000 10,000 10,000

Total profit $ 54,000 $ 44,000 $ 34,000 $ 24,000 $ 4,000 $ (6,000)

If we stay at $28.00:

Potential Selling Price $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00

Standard Cost-variable 22.60 22.60 22.60 22.60 22.60 22.60

Unit Profit $ 5.40 $ 5.40 $ 5.40 $ 5.40 $ 5.40 $ 5.40

Volume 10,000 9,000 7,000 5,000 2,000 -

Total profit $ 54,000 $ 48,600 $ 37,800 $ 27,000 $ 10,800 $ -

Difference $ - $ (4,600) $ (3,800) $ (3,000) $ (6,800) $ (6,000)

For the Company:

Unit Selling Price $ 28.00 $ 27.00 $ 26.00 $ 25.00 $ 23.00 $ 22.00

Variable costs:

Direct materials-A 2.00 2.00 2.00 2.00 2.00 2.00

Direct materials-B 3.00 3.00 3.00 3.00 3.00 3.00

Direct materials-C 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-A 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-B 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-C 2.00 2.00 2.00 2.00 2.00 2.00

Variable overhead-A 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-B 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-C 2.00 2.00 2.00 2.00 2.00 2.00

14.00 14.00 14.00 14.00 14.00 14.00

Unit contribution 14.00 13.00 12.00 11.00 9.00 8.00

Volume 10,000 10,000 10,000 10,000 10,000 10,000

Total contribution $ 140,000 $ 130,000 $ 120,000 $ 110,000 $ 90,000 $ 80,000

Unit Selling Price $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00

Variable costs:

Direct materials-A 2.00 2.00 2.00 2.00 2.00 2.00

Direct materials-B 3.00 3.00 3.00 3.00 3.00 3.00

Direct materials-C 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-A 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-B 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-C 2.00 2.00 2.00 2.00 2.00 2.00

Variable overhead-A 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-B 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-C 2.00 2.00 2.00 2.00 2.00 2.00

14.00 14.00 14.00 14.00 14.00 14.00

Unit contribution 14.00 14.00 14.00 14.00 14.00 14.00

Volume 10,000 9,000 7,000 5,000 2,000 -

Total contribution $ 140,000 $ 126,000 $ 98,000 $ 70,000 $ 28,000 $ -

Difference $ - $ 4,000 $ 22,000 $ 40,000 $ 62,000 $ 80,000

Nomor. 3 Bagian B

Perhitungan

If we follow competitor

price:

Potential Selling Price $ 28.00 $ 27.00 $ 26.00 $ 25.00 $ 23.00 $ 22.00

Standard Cost 23.60 23.60 23.60 23.60 23.60 23.60

Unit Profit $ 4.40 $ 3.40 $ 2.40 $ 1.40 $ (0.60) $ (1.60)

Volume 10,000 10,000 10,000 10,000 10,000 10,000

Total profit $ 44,000 $ 34,000 $ 24,000 $ 14,000 $ (6,000) $ (16,000)

If we stay at $28.00:

Potential Selling Price $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00

Standard Cost 23.60 23.60 23.60 23.60 23.60 23.60

Unit Profit $ 4.40 $ 4.40 $ 4.40 $ 4.40 $ 4.40 $ 4.40

Volume 10,000 9,000 7,000 5,000 2,000 -

Total profit $ 44,000 $ 39,600 $ 30,800 $ 22,000 $ 8,800 $ -

Difference $ - $ (5,600) $ (6,800) $ (8,000) $ (14,800) $ (16,000)

For the Company:

Unit Selling Price $ 28.00 $ 27.00 $ 26.00 $ 25.00 $ 23.00 $ 22.00

Variable costs:

Direct materials-A 2.00 2.00 2.00 2.00 2.00 2.00

Direct materials-B 3.00 3.00 3.00 3.00 3.00 3.00

Direct materials-C 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-A 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-B 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-C 2.00 2.00 2.00 2.00 2.00 2.00

Variable overhead-A 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-B 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-C 2.00 2.00 2.00 2.00 2.00 2.00

14.00 14.00 14.00 14.00 14.00 14.00

Unit contribution 14.00 13.00 12.00 11.00 9.00 8.00

Volume 10,000 10,000 10,000 10,000 10,000 10,000

Total contribution $ 140,000 $ 130,000 $ 120,000 $ 110,000 $ 90,000 $ 80,000

Unit Selling Price $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00

Variable costs:

Direct materials-A 2.00 2.00 2.00 2.00 2.00 2.00

Direct materials-B 3.00 3.00 3.00 3.00 3.00 3.00

Direct materials-C 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-A 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-B 1.00 1.00 1.00 1.00 1.00 1.00

Direct labour-C 2.00 2.00 2.00 2.00 2.00 2.00

Variable overhead-A 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-B 1.00 1.00 1.00 1.00 1.00 1.00

Variable overhead-C 2.00 2.00 2.00 2.00 2.00 2.00

14.00 14.00 14.00 14.00 14.00 14.00

Unit contribution 14.00 14.00 14.00 14.00 14.00 14.00

Volume 10,000 9,000 7,000 5,000 2,000 -

Total contribution $ 140,000 $ 126,000 $ 98,000 $ 70,000 $ 28,000 $ -

Difference $ - $ 4,000 $ 22,000 $ 40,000 $ 62,000 $ 80,000

Jawaban :

a. Dengan harga transfer yang telah diperhitungkan di Soal Nomor 1, sebaiknya Divisi C

jangan mempertahankan harga sebesar 28, karena harga transfer dari Divisi A ke B,

serta Divisi B ke C ternyata jauh lebih rendah sehingga Divisi C perlu menurunkan

harga transfer supaya tidak kalah bersaing.

Nomor. 4

Perhitungan

Division C Perspective Status

Incremental

Advertising

Quo $ 100,000 $ 200,000 $ 300,000 $ 400,000 $ 500,000

Unit selling price

$ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00

Standard cost ( Part

1)

22.60 22.60 22.60 22.60 22.60 22.60

Unit contribution

5.40 5.40 5.40 5.40 5.40 5.40

Volume

10,000 20,000 29,000 37,000 44,000 50,000

54,000 108,000 156,600 199,800 237,600 270,000

Fixed costs

10,000 10,000 10,000 10,000 10,000 10,000

Incremental

advertising

- 100,000 200,000 300,000 400,000 500,000

Total fixed costs

10,000 110,000 210,000 310,000 410,000 510,000

$ 44,000 $ (2,000) $ (53,400) $ (110,200) $ (172,400)

$

(240,000)

Status

Incremental

Advertising

Quo $ 100,000 $ 200,000 $ 300,000 $ 400,000 $ 500,000

Unit selling price

$ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00

Standard cost ( Part

2)

22.60 22.60 22.60 22.60 22.60 22.60

Unit contribution

5.40 5.40 5.40 5.40 5.40 5.40

Volume

10,000 20,000 29,000 37,000 44,000 50,000

54,000 108,000 156,600 199,800 237,600 270,000

Fixed costs

30,000 30,000 30,000 30,000 30,000 30,000

Incremental

advertising

- 100,000 200,000 300,000 400,000 500,000

Total fixed costs

30,000 130,000 230,000 330,000 430,000 530,000

$ 24,000 $ (22,000) $ (73,400) $ (130,200) $ (192,400)

$

(260,000)

Incremental

Difference

$ (46,000) $ (97,400) $ (154,200) $ (216,400)

$

(284,000)

For the Company:

Incremental

Advertising

Quo $ 100,000 $ 200,000 $ 300,000 $ 400,000 $ 500,000

Unit selling price

$ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00 $ 28.00

Actual variable

costs

14.00 14.00 14.00 14.00 14.00 14.00

Unit contribution

14.00 14.00 14.00 14.00 14.00 14.00

Volume

10,000 20,000 29,000 37,000 44,000 50,000

140,000 280,000 406,000 518,000 616,000 700,000

Fixed costs

80,000 80,000 80,000 80,000 80,000 80,000

Incremental

advertising

- 100,000 200,000 300,000 400,000 500,000

Total fixed costs

80,000 180,000 280,000 380,000 480,000 580,000

$ 60,000 $ 100,000 $ 126,000 $ 138,000 $ 136,000 $ 120,000

Incremental

Difference

$ 40,000 $ 66,000 $ 78,000 $ 76,000 $ 60,000

Nomor. 5

Perhitungan

a. Intermediate division

Kapasitas per bulan 50.000 unit dimana 10.000 ribu unit per produk dan 20.000 unit

kombinasi dari ketiganya, maka :

Produk A Produk B Produk C

Unit

Kapasitas minimal 10.000 10.000 10.000

Kapasitas kombinasi 6.667 6.667 6.667

Total kapasitas (unit) 16.667 16.667 16.667

Harga transfer 166.670 166.670 250.005

Biaya manufaktur variabel (50.001) (100.002) (83.335)

Laba kontribusi 116.669 66.668 166.670

Biaya tetap (total) (50.000) (100.000) (75.000)

Laba (rugi) bersih 66.669 (33.332) 91.670

Dapat dilihat dari table di atas bahwa produk A dan produk C memiliki laba masing-

masing sebesar 66.669 dan 91.670, sementara produk B menghasilkan kerugian sebesar

33.332. Jika menjadi manajer intermediate division, yang dipilih adalah produk C.

b. Final division

Final division memproduksi 40% lebih banyak daripada yang sekarang karena

terbatasnya produk A, B, C yang diproduksi. Maka besarnya produksi Final division

yaitu : 50.000 unit + (40% x 50.000 unit) = 70.000 unit

Tiap produk : 70.000 unit : 3 macam produk = 23.333

Produk X Produk Y Produk Z

Unit 23.333 23.333 23.333

Pendapatan penjualan 653.324 699.990 699.990

Biaya variabel :

Pembelian dari dalam 233.330 233.330 349.995

Biaya variabel lainnya 116.665 116.665 186.664

Total biaya variabel 349.995 349.995 536.659

Laba kontribusi 303.329 349.995 163.331

Biaya tetap (total) 100.000 100.000 200.000

Laba (rugi bersih) 203.329 249.995 (36.669)

Keputusan yang diambil adalah memilih produk Y dengan laba besar dan biaya tetap

tidak berubah jumlahnya atau tetap meski ada biaya variabel pada Final division.

c. Dalam merencanakan pola produksi seperti faktor-faktor berikut :

- Pola penjualan

Perusahaan dalam berproduksi atau untuk memenuhi kebutuhan penjualan. Apabila

suatu pola penjualan bergelombang dipenuhi dengan pola produksi yang konstan

maka akan terjadi penyimpangan

- Pola biaya

Biaya perputaran tenaga kerja, biaya simpan, biaya lembur, dan biaya sub-kontrak

- Kapasitas maksimum fasilitas produksi

Vous aimerez peut-être aussi

- Case 6-1 (ANDI DIAN AULIA-46117022)Document5 pagesCase 6-1 (ANDI DIAN AULIA-46117022)dianPas encore d'évaluation

- Reta Sharfina Tahar 1111002006 Case 10-1 Variance Analysis ProblemsDocument2 pagesReta Sharfina Tahar 1111002006 Case 10-1 Variance Analysis ProblemsTiffany SmithPas encore d'évaluation

- Analyzing Financial Performance ReportsDocument22 pagesAnalyzing Financial Performance ReportsTia Permata SariPas encore d'évaluation

- AKL PartnershipDocument3 pagesAKL PartnershipNanda Latifa PutriPas encore d'évaluation

- Chapter 1Document4 pagesChapter 1Micaela BakerPas encore d'évaluation

- MCS-Nurul Sari-Case 7.1 7.2 7.7Document4 pagesMCS-Nurul Sari-Case 7.1 7.2 7.7Nurul Sari0% (3)

- Bab 14. Jawaban Contoh SoalDocument2 pagesBab 14. Jawaban Contoh SoalVanaPas encore d'évaluation

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsan100% (1)

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesDocument28 pagesConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesRiska Azahra NPas encore d'évaluation

- Jawaban Kieso Intermediate Accounting p19-4Document3 pagesJawaban Kieso Intermediate Accounting p19-4nadiaulyPas encore d'évaluation

- Analisis Biaya Volume LabaDocument7 pagesAnalisis Biaya Volume LabaVeronica Yuniarti100% (1)

- Tugas AKL1Document4 pagesTugas AKL1Yandra Febriyanti0% (1)

- Anthony & Govindarajan - CH 11Document3 pagesAnthony & Govindarajan - CH 11Astha Agarwal100% (1)

- Advanced Accounting Chapter 5 AnswerDocument12 pagesAdvanced Accounting Chapter 5 Answeryacapinburgos40% (5)

- Slide AKT 405 Teori Akuntansi 12 GodfreyDocument33 pagesSlide AKT 405 Teori Akuntansi 12 Godfreyadinugroho0% (1)

- SMCH 14 BeamsDocument21 pagesSMCH 14 BeamsAtika Darety100% (1)

- Chapter 11 Atkinson Kaplan 2012Document28 pagesChapter 11 Atkinson Kaplan 2012EmmelinaErnestine100% (2)

- Siapm Uts - Maksi Js - 17 Apr 2021Document14 pagesSiapm Uts - Maksi Js - 17 Apr 2021Ilham FajarPas encore d'évaluation

- RESUME SAP Financial Unit 3Document5 pagesRESUME SAP Financial Unit 3Novita WardaniPas encore d'évaluation

- CH 07Document56 pagesCH 07Skarlz ZyPas encore d'évaluation

- Lathian Soal CH 5 Kelompok 7 P5-3Document2 pagesLathian Soal CH 5 Kelompok 7 P5-3AshdhPas encore d'évaluation

- Case Study Leigh Ann Walker, Case 6.1Document4 pagesCase Study Leigh Ann Walker, Case 6.1asa100% (3)

- CHP 8Document32 pagesCHP 8sugenghidayatPas encore d'évaluation

- Jawaban Audit 16-25Document4 pagesJawaban Audit 16-25Lisca Nabilah50% (4)

- Paper Chapter 11Document6 pagesPaper Chapter 11Hans Jonni100% (1)

- Advance Accounting P14-3Document2 pagesAdvance Accounting P14-3Jeremy BastantaPas encore d'évaluation

- Wahyudi-Syaputra Assignment-2 Akl-IiDocument4 pagesWahyudi-Syaputra Assignment-2 Akl-IiWahyudi SyaputraPas encore d'évaluation

- CH 22Document3 pagesCH 22dedPas encore d'évaluation

- Boynton SM Ch.08Document10 pagesBoynton SM Ch.08Eza RPas encore d'évaluation

- Ekuitas: Akuntansi PerpajakanDocument17 pagesEkuitas: Akuntansi PerpajakanChoi MinriPas encore d'évaluation

- Kunci Jawaban Auditing Chapter 14 Arens 15th EditionDocument8 pagesKunci Jawaban Auditing Chapter 14 Arens 15th EditionArfini Lestari100% (2)

- A Critique of Conceptual Framework ProjectsDocument12 pagesA Critique of Conceptual Framework ProjectsJhoPas encore d'évaluation

- Beams AdvAcc11 Chapter17Document22 pagesBeams AdvAcc11 Chapter17husnaini dwi wanriPas encore d'évaluation

- SOAL CASE 14 - 33 Dan CASE 16-35Document4 pagesSOAL CASE 14 - 33 Dan CASE 16-35Rictu SempakPas encore d'évaluation

- AM5AMalam - Kelompok 8 - Case Study 2 SPMDocument5 pagesAM5AMalam - Kelompok 8 - Case Study 2 SPMDita EnsPas encore d'évaluation

- Advanced Financial Accounting Chapter 11 Problem SolutionsDocument6 pagesAdvanced Financial Accounting Chapter 11 Problem SolutionsEmily PiperPas encore d'évaluation

- Cisco Case Study AnalysisDocument2 pagesCisco Case Study AnalysisVega AgnityaPas encore d'évaluation

- Slide AKT 405 Teori Akuntansi 4 GodfreyDocument29 pagesSlide AKT 405 Teori Akuntansi 4 GodfreyadinugrohoPas encore d'évaluation

- E 14-6 Acquisition-Excess Allocation and Amortization EffectDocument13 pagesE 14-6 Acquisition-Excess Allocation and Amortization EffectRizkina MoelPas encore d'évaluation

- Essence Company Blends and Sells Designer FragrancesDocument2 pagesEssence Company Blends and Sells Designer FragrancesElliot Richard100% (1)

- Chapter 5 Advanced AccountingDocument19 pagesChapter 5 Advanced AccountingMarife De Leon VillalonPas encore d'évaluation

- TR-1 (Hanifah Nabilah Ginting)Document3 pagesTR-1 (Hanifah Nabilah Ginting)Hanifah Nabilah100% (1)

- CH 13Document24 pagesCH 13antonio-dublines-372150% (2)

- AEB15 SM C18 v3Document33 pagesAEB15 SM C18 v3Aaqib Hossain100% (1)

- Soal Latihan 2 Akuntansi Keuangan LanjutanDocument2 pagesSoal Latihan 2 Akuntansi Keuangan LanjutanRizkiPas encore d'évaluation

- Chapter 16 Solution ManualDocument54 pagesChapter 16 Solution ManualJose Matalo67% (3)

- (TA) Soal Jawab Problems 8.1Document3 pages(TA) Soal Jawab Problems 8.1Aida Fitria67% (3)

- Chp9 BeamsDocument27 pagesChp9 BeamsGustina Sirait100% (3)

- Chapter 12 Solutions ManualDocument30 pagesChapter 12 Solutions ManualAndry Onix33% (3)

- Exercise 12-21 Margin, Turnover, Return On Investment, Average Operating AssetsDocument3 pagesExercise 12-21 Margin, Turnover, Return On Investment, Average Operating AssetsDhiva Rianitha ManurungPas encore d'évaluation

- Chapter 23 Solutions Manual ExamDocument15 pagesChapter 23 Solutions Manual ExamMariance Romaulina Malau67% (3)

- Monitoring Tindak Lanjut Laporan AuditDocument3 pagesMonitoring Tindak Lanjut Laporan AuditSiti Istikomah100% (1)

- E12 2Document2 pagesE12 2Sandra SholehahPas encore d'évaluation

- Pertanyaan Materi Joint VentureDocument4 pagesPertanyaan Materi Joint VentureNadyaNovita100% (1)

- Tugas 4Document2 pagesTugas 4Nisrina Nur Rachmayani100% (1)

- Ethical Behavior-Philosophers' ContributionsDocument36 pagesEthical Behavior-Philosophers' ContributionsMa'ruv RulBe Hazcah100% (1)

- KASUS 6-1 Hal 305: Nomor. 1 PerhitunganDocument21 pagesKASUS 6-1 Hal 305: Nomor. 1 PerhitunganjnPas encore d'évaluation

- Tugas Sistem Pengendalian Manajemen Transfer Pricing: Disusun Oleh: Reza Afrisal CB / 115020301111038Document13 pagesTugas Sistem Pengendalian Manajemen Transfer Pricing: Disusun Oleh: Reza Afrisal CB / 115020301111038Maulida insPas encore d'évaluation

- Kasus 6-1 - Jihan NabilahDocument21 pagesKasus 6-1 - Jihan Nabilahalesha nindyaPas encore d'évaluation

- KASUS 6-1: Nomor. 1 PerhitunganDocument21 pagesKASUS 6-1: Nomor. 1 PerhitunganMeita PutriPas encore d'évaluation

- Agregrate Supply and DemandDocument25 pagesAgregrate Supply and DemandReza AfrisalPas encore d'évaluation

- Expenditure Multipliers: The Keynesian Model: Lecture: Al Muizzuddin F., Se., MeDocument16 pagesExpenditure Multipliers: The Keynesian Model: Lecture: Al Muizzuddin F., Se., MeReza AfrisalPas encore d'évaluation

- Uang Harga InflasiDocument14 pagesUang Harga InflasiReza AfrisalPas encore d'évaluation

- Finance Saving InvestmenDocument16 pagesFinance Saving InvestmenReza AfrisalPas encore d'évaluation

- Nilai Tukar Dan Neraca Pembayaran: Lecture: Al Muizzuddin F., Se., MeDocument18 pagesNilai Tukar Dan Neraca Pembayaran: Lecture: Al Muizzuddin F., Se., MeReza AfrisalPas encore d'évaluation

- Pertumbuhan Ekonomi: Lecture: Al Muizzuddin F., Se., MeDocument12 pagesPertumbuhan Ekonomi: Lecture: Al Muizzuddin F., Se., MeReza AfrisalPas encore d'évaluation

- Inflasi, Pengangguran, Dan Siklus BisnisDocument16 pagesInflasi, Pengangguran, Dan Siklus BisnisReza AfrisalPas encore d'évaluation