Académique Documents

Professionnel Documents

Culture Documents

Income Tax Caculator For Salaried Person For Fy 2013 14

Transféré par

saraedu0 évaluation0% ont trouvé ce document utile (0 vote)

25 vues11 pagesTax Calculator

Titre original

Income Tax Caculator for Salaried Person for Fy 2013 14

Copyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentTax Calculator

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

25 vues11 pagesIncome Tax Caculator For Salaried Person For Fy 2013 14

Transféré par

saraeduTax Calculator

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 11

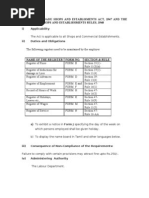

NOTE : PLEASE DO NOT CHANGE ANY FIGURE OF COLOURED COLUMN

FILL ONLY BLANK COLUMN

NAME : DESIGNATION

SEX : MALE DEPTT.

PREVIOUS

EMPLOYER

SALARY 0 0 0 0

APRIL'2013 16217 8109 8000 4865 800 11346 40537 1946 38591 0

MAY 16217 8109 8000 4865 800 11346 40537 1946 38591 0

JUNE 16217 8109 8000 4865 800 11346 40537 1946 38591 0

JULY 16217 8109 8000 4865 800 11346 40537 1946 38591 0

AUGUST 16217 8109 8000 4865 800 11346 40537 1946 38591 0

ARREAR 8000

SEPT. 16217 8109 8000 4865 800 11346 40537 1946 38591 0

OCT. 16217 8109 8000 4865 800 11346 30000 70537 1946 68591 0

NOV. 16217 8109 8000 4865 800 11346 40537 1946 38591 0

DEC. 16217 8109 8000 4865 800 11346 40537 1946 38591 0

JAN.2014 16217 8109 8000 4865 800 11346 40537 1946 38591 0

FEB. 16217 8109 8000 4865 800 11346 40537 1946 38591 0

Mar-14 16217 8109 8000 4865 800 11346 40537 1946 38591 0

TOTAL 194604 97308 104000 58380 9600 136152 0 30000 516444 23352 0 493092 0 0

ANNUAL TOT 194604 97308 104000 58380 9600 136152 0 30000 516444 23352 0 493092 0 0

0

WORKING:- AMOUNT COMPUTATION FOR FY 2013-2014 AMOUNT

CONVEYANCE RECEIVED. 58380 1. BASIC SALARY 194604

LESS : DED.(800/- PM ) 9600 2. HRA TAXABLE 19466

48780 3. CONVEYANCE TAXABLE 48780

97308 4. SPL ALLOWANCE 136152

50% OF SAL(NOIDA 40%) 77842 5. BONUS & EXGRATIA & INCENTIVE 30000

RENT PAID 104000 6. ARREAR OF SALARY/ LEAVE SALARY (IF ANY) 0

7. OTHER INCOME RECD.

8. MEDICAL EXP REMIBURSE > 15000

BASIC TOT 194604 TOTAL 429002

BAS SAL%10 19460 84540 9.INCOME FROM HOUSE PROPERTY

HRA EXEMPT 77842 Interest on Home Loan 102000

327002

TAXABLE HOUSE RENT 19466

Deduction allowed U/S 80 C 100000

PROVIDENT FUND 23352

LIC PAID 25000 Deduction allowed U/S 80 d 5300

NSC PURCHASED

TUTION FEES 36000 105300

PPF DEPOSIT 221702

OTHERS TAX DUE ON RS. R/ OFF 221702

REPAYMENT OF HLA 23604 2170

TOTAL 107956 2000

MAXI.LIMIT Deduction U/S 80 C 100000 170

DEDUCTION U/S 80 D - MEDICLAIM INSURANCE ADD: EDUCATIONAL CESS 3% 5

175

MEDICLAIM INSURANCE PAID 5300 TDS DEDUCTED / ADVANCE TAX 0

BALANCE TAX PAYABLE 175

DEDUCTION U/S 80 G *** AVERAGE MONTLY TDS 14 Any person or

assessee who I.E. NO

DEDUCTION

WILL BE

MADE IN

IN CASE OF

CLAIMING

OF HRA

EXEMPTION,

SIGNATURE OF EMPLOYEE

INCOME TAX CALCULATOR FOR MALE / FEMALE AGE LESS THAN 60 YEARS

N

E

T

S

A

L

A

R

Y

P

A

I

D

M

E

D

I

C

A

L

E

X

P

R

E

M

I

B

U

S

E

M

E

N

T

GROSS TOTAL INCOME

COMPANY NAME : M/S

CALCULATION OF INCOME TAX(TDS) FOR THE YEAR -2013-14 (01/04/13 TO 31/03/14)

M

E

D

I

C

A

L

E

X

P

T

A

X

A

B

L

E

T

O

T

A

L

G

R

O

S

S

S

A

L

A

R

Y

E

P

F

1

2

%

O

F

B

A

S

I

C

S

A

L

A

R

Y

C

O

N

V

E

Y

A

N

C

E

A

L

L

O

W

A

N

C

E

E

X

E

M

P

T

E

D

B

O

N

U

S

/

G

I

F

T

/

I

N

C

E

N

T

I

V

E

E

T

C

.

DEDUCTION U/S 80 G**

HRA RECEIVED

P

E

R

Q

U

I

S

T

I

E

S

&

O

T

H

E

R

I

N

C

O

M

E

A

R

R

E

A

R

O

F

S

A

L

A

R

Y

/

L

E

A

V

E

S

A

L

A

R

Y

(

I

F

DEDUCTION U/S 80 C

Deduction allowed U/S 80 C for

Infrastructue bond limit Rs.20000/-

DEDUCTION U/S 80 D

DEDUCTION U/S 80 C

HRA

C

O

N

V

E

Y

A

N

C

E

A

L

L

O

W

A

N

C

E

P

A

I

D

M

O

N

T

H

B

A

S

I

C

S

A

L

A

R

Y

H

R

A

R

E

C

D

F

R

O

M

C

O

M

P

A

N

Y

R

E

N

T

P

A

I

D

T

D

S

D

E

D

U

C

T

E

D

/

A

D

V

A

N

C

E

T

A

X

P

A

I

D

NET TAX PAYBLE

TOTAL DEDUCTIONS

TAX PAYBLE

ADDITIOANL TAX REBATE

TOTAL TAX PAYBLE

NET TOTAL INCOME

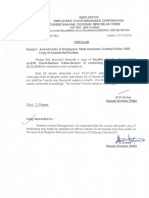

NOTE : PLEASE DO NOT CHANGE ANY FIGURE OF COLOURED COLUMN

FILL ONLY BLANK COLUMN

NAME : DESIGNATION

SEX : MALE ew-- DEPTT.

PREVIOUS

EMPLOYER

SALARY 0 0

APRIL'2013 0 0

MAY 0 0

JUNE 0 0

JULY 0 0

AUGUST 0 0

SEPT. 0 0

OCT. 0 0

NOV. 0 0

DEC. 0 0

JAN.2014 0 0

FEB. 0 0

Mar-14 0 0

TOTAL 0 0 0 0 0 0 0 0 0

ANNUAL TOT 0 0 0 0 0 0 0 0 0

WORKING:- AMOUNT COMPUTATION FOR FY 2012-2013

CONVEYANCE RECEIVED. 0 1. BASIC SALARY

LESS : DED.(800/- PM ) 0 2. HRA TAXABLE

0 3. CONVEYANCE TAXABLE

0 4. SPL ALLOWANCE

50% OF SAL(NOIDA 40%) 0 5. BONUS & EXGRATIA & INCENTIVE

RENT PAID 0 6. ARREAR OF SALARY/ LEAVE SALARY (IF ANY)

7. OTHER INCOME RECD.

8. MEDICAL EXP REMIBURSE > 15000

BASIC TOT 0

BAS SAL%10 0 0 9.INCOME FROM HOUSE PROPERTY

HRA EXEMPT 0

TAXABLE HOUSE RENT 0

INCOME TAX CALCULATOR FOR MALE / FEMALE AGE EQUAL TO OR MORE THAN 60 BUT LESS THAN 80 YEARS

COMPANY NAME : M/S

M

O

N

T

H

B

A

S

I

C

S

A

L

A

R

Y

HRA

C

O

N

V

E

Y

A

N

C

E

A

L

L

O

W

A

N

C

E

P

A

I

D

C

O

N

V

E

Y

A

N

C

E

A

L

L

O

W

A

N

C

E

E

X

E

M

P

T

E

D

P

E

R

Q

U

I

S

T

I

E

S

&

O

T

H

E

R

I

N

C

O

M

E

A

R

R

E

A

R

O

F

S

A

L

A

R

Y

/

L

E

A

V

E

S

A

L

A

R

Y

(

I

F

H

R

A

R

E

C

D

F

R

O

M

C

O

M

P

A

N

Y

R

E

N

T

P

A

I

D

CALCULATION OF INCOME TAX(TDS) FOR THE YEAR -2013-14 (01/04/13 TO 31/03/14)

HRA RECEIVED

B

O

N

U

S

/

G

I

F

T

/

I

N

C

E

N

T

I

V

E

E

T

C

.

T

O

T

A

L

G

R

O

S

S

S

A

L

A

R

Y

DEDUCTION U/S 80 C

GROSS TOTAL INCOME

Deduction allowed U/S 80 C

PROVIDENT FUND 0

LIC PAID 75655 Deduction allowed U/S 80 d

NSC PURCHASED 10000

TUTION FEES

PPF DEPOSIT

OTHERS 20000 TAX DUE ON RS. R/ OFF

REPAYMENT OF HLA

TOTAL 105655

MAXI.LIMIT Deduction U/S 80 C 100000

ADD: EDUCATIONAL CESS 3%

DEDUCTION U/S 80 D - MEDICLAIM INSURANCE TDS DEDUCTED / ADVANCE TAX

MEDICLAIM INSURANCE PAID 5500 BALANCE TAX PAYABLE

AVERAGE MONTLY TDS

DEDUCTION U/S 80 G ***

Any person or

assessee who

makes an

I.E. NO

DEDUCTION

WILL BE

MADE IN

For detailed Analysis you can refer CBDT CIRCULAR 01/2010 DATED 11 JAN 2010 IN RESPECT OF TDS ON SALARY

SIGNATURE OF EMPLOYEE

ADDITIOANL TAX REBATE

DEDUCTION U/S 80 C

TOTAL TAX PAYBLE

NET TOTAL INCOME

TOTAL DEDUCTIONS

DEDUCTION U/S 80 D

DEDUCTION U/S 80 G**

TAX PAYBLE

NET TAX PAYBLE

Deduction allowed U/S 80 C for

Infrastructue bond limit Rs.20000/-

0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0 0 0

0 0 0 0 0

0

COMPUTATION FOR FY 2012-2013 AMOUNT

1. BASIC SALARY 0

0

3. CONVEYANCE TAXABLE 0

4. SPL ALLOWANCE 0

5. BONUS & EXGRATIA & INCENTIVE 0

6. ARREAR OF SALARY/ LEAVE SALARY (IF ANY) 0

7. OTHER INCOME RECD. 5000

8. MEDICAL EXP REMIBURSE > 15000 370000

TOTAL 375000

9.INCOME FROM HOUSE PROPERTY

Interest on Home Loan 0 0

375000

INCOME TAX CALCULATOR FOR MALE / FEMALE AGE EQUAL TO OR MORE THAN 60 BUT LESS THAN 80 YEARS

COMPANY NAME : M/S

N

E

T

S

A

L

A

R

Y

P

A

I

D

M

E

D

I

C

A

L

E

X

P

R

E

M

I

B

U

S

E

M

E

N

T

M

E

D

I

C

A

L

E

X

P

T

A

X

A

B

L

E

CALCULATION OF INCOME TAX(TDS) FOR THE YEAR -2013-14 (01/04/13 TO 31/03/14)

DEDUCTION U/S 80 C

E

P

F

1

2

%

O

F

B

A

S

I

C

S

A

L

A

R

Y

T

D

S

D

E

D

U

C

T

E

D

/

A

D

V

A

N

C

E

T

A

X

P

A

I

D

GROSS TOTAL INCOME

Deduction allowed U/S 80 C 100000

10000

Deduction allowed U/S 80 d 5500

115500

259500

TAX DUE ON RS. R/ OFF 259500

950

950

0

ADD: EDUCATIONAL CESS 3% 0

0

TDS DEDUCTED / ADVANCE TAX 0

BALANCE TAX PAYABLE 0

AVERAGE MONTLY TDS 0

For detailed Analysis you can refer CBDT CIRCULAR 01/2010 DATED 11 JAN 2010 IN RESPECT OF TDS ON SALARY

SIGNATURE OF EMPLOYEE

ADDITIOANL TAX REBATE

TOTAL TAX PAYBLE

NET TOTAL INCOME

TOTAL DEDUCTIONS

DEDUCTION U/S 80 D

DEDUCTION U/S 80 G**

TAX PAYBLE

NET TAX PAYBLE

Deduction allowed U/S 80 C for

Infrastructue bond limit Rs.20000/-

NOTE : PLEASE DO NOT CHANGE ANY FIGURE OF COLOURED COLUMN

FILL ONLY BLANK COLUMN

NAME : DESIGNATION

SEX : MALE DEPTT.

PREVIOUS

EMPLOYER

SALARY 0 0

APRIL'2013 10000 6000 7500 4500 800 18950 39450

MAY 10000 6000 7500 4500 800 18950 39450

JUNE 10000 6000 7500 4500 800 18950 39450

JULY 10000 6000 7500 5000 800 13000 34000

AUGUST 10000 6000 7500 5000 800 13000 34000

ARREAR 0

SEPT. 10000 6000 7500 5000 800 13000 33000 67000

OCT. 10000 6000 7500 5000 800 13000 34000

NOV. 10000 6000 7500 5000 800 13000 34000

DEC. 10000 6000 7500 5000 800 13000 34000

JAN.2014 10000 6000 7500 5000 800 13000 34000

FEB. 10000 6000 7500 5000 800 13000 34000

Mar-14 10000 9000 7500 5000 800 13000 37000

TOTAL 120000 75000 90000 58500 9600 173850 0 33000 460350

ANNUAL TOT 120000 75000 90000 58500 9600 173850 0 33000 460350

WORKING:- AMOUNT COMPUTATION FOR FY 2012-2013

CONVEYANCE RECEIVED. 58500 1. BASIC SALARY

LESS : DED.(800/- PM ) 9600 2. HRA TAXABLE

48900 3. CONVEYANCE TAXABLE

75000 4. SPL ALLOWANCE

50% OF SAL(NOIDA 40%) 60000 5. BONUS & EXGRATIA & INCENTIVE

RENT PAID 90000 6. ARREAR OF SALARY/ LEAVE SALARY (IF ANY)

7. OTHER INCOME RECD.

8. MEDICAL EXP REMIBURSE > 15000

BASIC TOT 120000

BAS SAL%10 12000 78000 9.INCOME FROM HOUSE PROPERTY

HRA EXEMPT 60000

TAXABLE HOUSE RENT 15000

COMPANY NAME : M/S

M

O

N

T

H

B

A

S

I

C

S

A

L

A

R

Y

HRA

C

O

N

V

E

Y

A

N

C

E

A

L

L

O

W

A

N

C

E

P

A

I

D

C

O

N

V

E

Y

A

N

C

E

A

L

L

O

W

A

N

C

E

E

X

E

M

P

T

E

D

P

E

R

Q

U

I

S

T

I

E

S

&

O

T

H

E

R

I

N

C

O

M

E

H

R

A

R

E

C

D

F

R

O

M

C

O

M

P

A

N

Y

R

E

N

T

P

A

I

D

A

R

R

E

A

R

O

F

S

A

L

A

R

Y

/

L

E

A

V

E

S

A

L

A

R

Y

(

I

F

B

O

N

U

S

/

G

I

F

T

/

I

N

C

E

N

T

I

V

E

E

T

C

.

T

O

T

A

L

G

R

O

S

S

S

A

L

A

R

Y

CALCULATION OF INCOME TAX(TDS) FOR THE YEAR -2013-14 (01/04/13 TO 31/03/14)

INCOME TAX CALCULATOR FOR MALE / FEMALE AGE EQUAL TO OR MORE THAN 80 YEARS

DEDUCTION U/S 80 C

HRA RECEIVED

GROSS TOTAL INCOME

Deduction allowed U/S 80 C

PROVIDENT FUND 14400

LIC PAID 75655 Deduction allowed U/S 80 d

NSC PURCHASED 10000

TUTION FEES

PPF DEPOSIT

OTHERS 20000 TAX DUE ON RS. R/ OFF

REPAYMENT OF HLA

TOTAL 120055

MAXI.LIMIT Deduction U/S 80 C 100000

ADD: EDUCATIONAL CESS 3%

DEDUCTION U/S 80 D - MEDICLAIM INSURANCE TDS DEDUCTED / ADVANCE TAX

MEDICLAIM INSURANCE PAID 5500 BALANCE TAX PAYABLE

AVERAGE MONTLY TDS

DEDUCTION U/S 80 G ***

Any person or

assessee who

makes an

I.E. NO

DEDUCTION

WILL BE

MADE IN

For detailed Analysis you can refer CBDT CIRCULAR 01/2010 DATED 11 JAN 2010 IN RESPECT OF TDS ON SALARY

SIGNATURE OF EMPLOYEE

ADDITIOANL TAX REBATE

TOTAL TAX PAYBLE

TOTAL DEDUCTIONS

NET TOTAL INCOME

DEDUCTION U/S 80 C

Deduction allowed U/S 80 C for

Infrastructue bond limit Rs.20000/-

DEDUCTION U/S 80 D

DEDUCTION U/S 80 G**

NET TAX PAYBLE

TAX PAYBLE

0 0

1200 500 37750 0

1200 38250 0

1200 38250 0

1200 32800 0 45000 180000

1200 32800 0 13000 2

0 0

1200 65800 0

1200 32800 0

1200 32800 0

1200 32800 0

1200 32800 0

1200 32800 0

1200 35800 0

14400 500 445450 0 0

14400 500 445450 0 0

0

COMPUTATION FOR FY 2012-2013 AMOUNT

1. BASIC SALARY 120000

15000

3. CONVEYANCE TAXABLE 48900

4. SPL ALLOWANCE 173850

5. BONUS & EXGRATIA & INCENTIVE 33000

6. ARREAR OF SALARY/ LEAVE SALARY (IF ANY) 0

7. OTHER INCOME RECD. 5000

8. MEDICAL EXP REMIBURSE > 15000 900000

TOTAL 1295750

9.INCOME FROM HOUSE PROPERTY

Interest on Home Loan 0 0

1295750

COMPANY NAME : M/S

M

E

D

I

C

A

L

E

X

P

R

E

M

I

B

U

S

E

M

E

N

T

M

E

D

I

C

A

L

E

X

P

T

A

X

A

B

L

E

E

P

F

1

2

%

O

F

B

A

S

I

C

S

A

L

A

R

Y

CALCULATION OF INCOME TAX(TDS) FOR THE YEAR -2013-14 (01/04/13 TO 31/03/14)

INCOME TAX CALCULATOR FOR MALE / FEMALE AGE EQUAL TO OR MORE THAN 80 YEARS

DEDUCTION U/S 80 C

T

D

S

D

E

D

U

C

T

E

D

/

A

D

V

A

N

C

E

T

A

X

P

A

I

D

N

E

T

S

A

L

A

R

Y

P

A

I

D

GROSS TOTAL INCOME

Deduction allowed U/S 80 C 100000

10000

Deduction allowed U/S 80 d 5500

115500

1180250 930250

TAX DUE ON RS. R/ OFF 1180250 UPTO 500000 10%

154075 FROM 5 LAC TO 10 LAC 20%

0 ABOVE 10 LAC 30%

154075

ADD: EDUCATIONAL CESS 3% 4622

158697

TDS DEDUCTED / ADVANCE TAX 500

BALANCE TAX PAYABLE 158197

AVERAGE MONTLY TDS 12840

For detailed Analysis you can refer CBDT CIRCULAR 01/2010 DATED 11 JAN 2010 IN RESPECT OF TDS ON SALARY

SIGNATURE OF EMPLOYEE

ADDITIOANL TAX REBATE

TOTAL TAX PAYBLE

TOTAL DEDUCTIONS

NET TOTAL INCOME

Deduction allowed U/S 80 C for

Infrastructue bond limit Rs.20000/-

DEDUCTION U/S 80 D

DEDUCTION U/S 80 G**

NET TAX PAYBLE

TAX PAYBLE

A. Individual, Hindu undivided family, association of persons, body of individuals, artificial

juridical person

Paragraph A of Part-III of First Schedule to the Bill provides following rates of income-tax:-

(i) The rates of income-tax in the case of every individual (other than those mentioned in (ii), (iii) and

(iv) below) or Hindu undivided family or every association of persons or body of individuals,

whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of

clause (31) of section 2 of the Income-tax Act (not being a case to which any other Paragraph of Part

III applies) are as under :

Upto Rs. 2,00,000 Nil.

Rs. 2,00,001 to Rs. 5,00,000 10 per cent.

Rs. 5,00,001 to Rs. 10,00,000 20 per cent.

Above Rs. 10,00,000 30 per cent.

(ii) In the case of every individual, being a woman resident in India, and below the age of sixty years

at any time during the previous year,

Upto Rs. 2,00,000 Nil.

Rs. 2,00,001 to Rs. 5,00,000 10 per cent.

Rs. 5,00,001 to Rs. 10,00,000 20 per cent.

Above Rs. 10,00,000 30 per cent.

(iii) In the case of every individual, being a resident in India, who is of the age of sixty years or more

but less than eighty years at any time during the previous year,

Upto Rs. 2,50,000 Nil.

Rs. 2,50,001 to Rs. 5,00,000 10 per cent.

Rs. 5,00,001 to Rs. 10,00,000 20 per cent.

Above Rs. 10,00,000 30 per cent.

(iv) in the case of every individual, being a resident in India, who is of the age of eighty years or more

at anytime during the previous year, -

Upto Rs. 5,00,000 Nil.

Rs. 50,00,001 to Rs. 10,00,000 20 per cent.

Above Rs.10,00,000 30 per cent.

No surcharge will be levied in the cases of persons covered under paragraph-A of part-III of the First

Schedule.

(i) The rates of income-tax in the case of every individual (other than those mentioned in (ii), (iii) and

clause (31) of section 2 of the Income-tax Act (not being a case to which any other Paragraph of Part

(ii) In the case of every individual, being a woman resident in India, and below the age of sixty years

(iii) In the case of every individual, being a resident in India, who is of the age of sixty years or more

(iv) in the case of every individual, being a resident in India, who is of the age of eighty years or more

No surcharge will be levied in the cases of persons covered under paragraph-A of part-III of the First

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Test Bank For Fundamentals of Nursing Care Concepts Connections and Skills BurtonDocument24 pagesTest Bank For Fundamentals of Nursing Care Concepts Connections and Skills BurtonLisaFloresMDdbnx100% (47)

- 2022 Blue Notes Labor LawDocument229 pages2022 Blue Notes Labor LawGrace Ann Tamboon100% (1)

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikPas encore d'évaluation

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikPas encore d'évaluation

- Business Plan - Herbal Hair OilDocument7 pagesBusiness Plan - Herbal Hair Oilsaraedu100% (1)

- Comparatives Superlatives Worksheet PDFDocument1 pageComparatives Superlatives Worksheet PDFÁngela MarcelaPas encore d'évaluation

- LegalEthicsDigest - Ali Vs Atty. Bubong, AC 4018 (March 8, 2005)Document3 pagesLegalEthicsDigest - Ali Vs Atty. Bubong, AC 4018 (March 8, 2005)Lu CasPas encore d'évaluation

- Vivo v. Montesa DigestDocument2 pagesVivo v. Montesa DigestkathrynmaydevezaPas encore d'évaluation

- 246 Corp v. DawayDocument2 pages246 Corp v. DawaySylvia SecuyaPas encore d'évaluation

- Contoh Proposal Bisnis PlanDocument31 pagesContoh Proposal Bisnis PlanHadianto Nugroho100% (4)

- Statutory Compliance of All ActsDocument16 pagesStatutory Compliance of All ActsezhilarasanmpPas encore d'évaluation

- Engleza Fisa RezolvataDocument4 pagesEngleza Fisa RezolvataOana Maria BasPas encore d'évaluation

- Wage Ceiling 21000 - Gazette NotificationDocument3 pagesWage Ceiling 21000 - Gazette NotificationsaraeduPas encore d'évaluation

- 30 Most Important HR Interview Questions With Suggested AnswersDocument2 pages30 Most Important HR Interview Questions With Suggested AnswerssaraeduPas encore d'évaluation

- SWOT Analysis Worksheet: Outline Goals and StrategiesDocument2 pagesSWOT Analysis Worksheet: Outline Goals and StrategiesTu NguyenPas encore d'évaluation

- Final EDI BookDocument56 pagesFinal EDI BooksaraeduPas encore d'évaluation

- Registration With Coir Board As Exporter of Coir and Coir ProductsDocument4 pagesRegistration With Coir Board As Exporter of Coir and Coir ProductssaraeduPas encore d'évaluation

- Practice Tamil WritingDocument27 pagesPractice Tamil WritingJayakanthan AyyanathanPas encore d'évaluation

- Practice Tamil WritingDocument27 pagesPractice Tamil WritingJayakanthan AyyanathanPas encore d'évaluation

- Employer Master DataDocument36 pagesEmployer Master DatasaraeduPas encore d'évaluation

- Labour Welfare Fund - 2015Document2 pagesLabour Welfare Fund - 2015saraeduPas encore d'évaluation

- 6 Communication Skill II PDFDocument6 pages6 Communication Skill II PDFMichael SmithPas encore d'évaluation

- Oultry EED: Assistant Director (Metallurgy)Document6 pagesOultry EED: Assistant Director (Metallurgy)saraeduPas encore d'évaluation

- PMEGP DPR Software User ManualDocument7 pagesPMEGP DPR Software User Manualsuryanath0% (3)

- Holiday List - 2015 - All India - Proposed - 1.0Document2 pagesHoliday List - 2015 - All India - Proposed - 1.0saraeduPas encore d'évaluation

- Training and DevelopmentDocument12 pagesTraining and DevelopmentsaraeduPas encore d'évaluation

- Holiday List - 2015 - All India - Proposed - 1.0Document2 pagesHoliday List - 2015 - All India - Proposed - 1.0saraeduPas encore d'évaluation

- HR KpoDocument1 pageHR KposaraeduPas encore d'évaluation

- Dips For MangersDocument1 pageDips For MangerssaraeduPas encore d'évaluation

- Xyz LTD: Final Recommendations: Selected/Wait-List/Not SuitableDocument2 pagesXyz LTD: Final Recommendations: Selected/Wait-List/Not SuitablesaraeduPas encore d'évaluation

- 14 HabitsDocument16 pages14 HabitssaraeduPas encore d'évaluation

- Epf 105Document2 pagesEpf 105anandthennarasuPas encore d'évaluation

- Roles & Responsibilities of HRDocument7 pagesRoles & Responsibilities of HRsaraeduPas encore d'évaluation

- Direct Walk InsDocument2 pagesDirect Walk InssaraeduPas encore d'évaluation

- Dips For MangersDocument1 pageDips For MangerssaraeduPas encore d'évaluation

- Induction Vs OrientationDocument2 pagesInduction Vs OrientationsaraeduPas encore d'évaluation

- Answer Formula Edited XDocument176 pagesAnswer Formula Edited Xmostafa motailqPas encore d'évaluation

- McDade Virtual FCS Course Syllabus 20-21 Middle School Math Grade 6 On-LevelDocument3 pagesMcDade Virtual FCS Course Syllabus 20-21 Middle School Math Grade 6 On-LevelHiyaPas encore d'évaluation

- Ghenesis Lit Analysis Brownies FinalDocument6 pagesGhenesis Lit Analysis Brownies Finalapi-242939687Pas encore d'évaluation

- Pashto Love Poetry - Lover ChoiceDocument1 pagePashto Love Poetry - Lover ChoiceSanan KhanPas encore d'évaluation

- RPH Taxation ReportDocument38 pagesRPH Taxation ReportLois SabadoPas encore d'évaluation

- Name List Form 5 2023Document10 pagesName List Form 5 2023Muhamad IpeayPas encore d'évaluation

- GA-14-751 Pre-Qual Questionnaire9Document14 pagesGA-14-751 Pre-Qual Questionnaire9Shahid IqbalPas encore d'évaluation

- Annual Report: IEA Technology Collaboration Programme On Energy Efficient End-Use Equipment (4E)Document26 pagesAnnual Report: IEA Technology Collaboration Programme On Energy Efficient End-Use Equipment (4E)prasanta_bbsrPas encore d'évaluation

- Agreement For BGVB Mortgage LoanDocument6 pagesAgreement For BGVB Mortgage LoanBiswajit DasPas encore d'évaluation

- Tax - First Preboard QuestionnaireDocument14 pagesTax - First Preboard QuestionnairewithyouidkPas encore d'évaluation

- Heirs of Juan de Dios E. Carlos v. Linsangan, A.C. No. 11494, July 24, 2017Document6 pagesHeirs of Juan de Dios E. Carlos v. Linsangan, A.C. No. 11494, July 24, 2017Xennia Keizia FernandezPas encore d'évaluation

- FIRST-SEM UCSP1112HBSIf13 Neo Sir-FerdDocument26 pagesFIRST-SEM UCSP1112HBSIf13 Neo Sir-FerdJanice Dano OnaPas encore d'évaluation

- Kenstar v. GeraldezDocument10 pagesKenstar v. GeraldezJenniferPas encore d'évaluation

- Living With Art 11th Edition Mark Getlein Solutions ManualDocument35 pagesLiving With Art 11th Edition Mark Getlein Solutions Manualbombyciddispelidok100% (18)

- Act 3 The CrucibleDocument2 pagesAct 3 The CrucibleDieu AnhPas encore d'évaluation

- Ferietillst enDocument4 pagesFerietillst enCarl MillerPas encore d'évaluation

- Accreditation Process PresentationDocument14 pagesAccreditation Process PresentationEdward Dean CarataoPas encore d'évaluation

- Global Migration ReferenceDocument28 pagesGlobal Migration ReferenceBabee HanePas encore d'évaluation

- Interpretation of Statutes 2023 Question PaperDocument4 pagesInterpretation of Statutes 2023 Question PaperNisha BhartiPas encore d'évaluation

- Jose Montero y Vidal and Pardo de Tavera accounts of the Cavite MutinyDocument1 pageJose Montero y Vidal and Pardo de Tavera accounts of the Cavite MutinyaminoacidPas encore d'évaluation

- FOMB - Letter - PREPA - FY2021 Budget Reprogramming Letter - FET Fee - December 7, 2021Document3 pagesFOMB - Letter - PREPA - FY2021 Budget Reprogramming Letter - FET Fee - December 7, 2021Metro Puerto RicoPas encore d'évaluation

- General Knowledge - Awareness Quiz - Multiple Choice Question (MCQ) Answers Solution 2013 Online Mock TestDocument8 pagesGeneral Knowledge - Awareness Quiz - Multiple Choice Question (MCQ) Answers Solution 2013 Online Mock TestSanjay Thapa100% (1)

- Client Care LetterDocument7 pagesClient Care Letteremanuel775Pas encore d'évaluation