Académique Documents

Professionnel Documents

Culture Documents

Daily Market Sheet 12-7-09

Transféré par

chainbridgeinvestingCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Daily Market Sheet 12-7-09

Transféré par

chainbridgeinvestingDroits d'auteur :

Formats disponibles

DAILY MARKET SHEET

WWW.CHAINBRIDGEINVESTING.COM

CHAIN BRIDGE INVESTING

DECEMBER 7, 2009

Pricing Data on the Major Indices for 12/7/09

Daily % Day % of 52-Wk Close 1 Yr

Index Daily High Daily Low Daily Range Daily Open Daily Close Prev. Close Chng. Chng. High 52-Wk High 52-Wk Low 52-Wk Range Ago % Yr. Change

DJIA 10,443.16 10,360.18 82.98 10,386.86 10,390.11 10,388.90 1.21 0.01% 98.80% 10,516.70 6,469.95 4,046.75 8,635.42 20.32%

S&P500 1,110.72 1,100.83 9.89 1,105.52 1,103.25 1,105.98 -2.73 -0.25% 98.58% 1,119.13 666.79 452.34 876.07 25.93%

NASDAQ 2,201.42 2,183.13 18.29 2,191.35 2,189.61 2,194.35 -4.74 -0.22% 98.88% 2,214.39 1,265.52 948.87 1,509.31 45.07%

Indicators on the Major Indices 12/7/09

% Diff. from % Diff. from 200D - % Diff. from 12D - EMA % Diff. from 26D - EMA % Diff. from 200D - EMA % Diff. from 1 10D - RSI 60D - RSI

Index 12D - EMA Close 26D - EMA Close EMA Close 10D - RSI 60D - RSI Yr. Ago 1 Yr. Close Yr. Ago 1 Yr. Close Yr. Ago Yr. Close Yr. Ago Yr. Ago

DJIA 10,373.62 0.16% 10,266.66 1.20% 9,441.37 10.05% 56.9 58.9 8,479.82 1.83% 8,631.64 0.04% 10,815.05 -20.15% 50.8 46.9

S&P500 1,101.42 0.17% 1,093.23 0.92% 1,012.59 8.95% 54.7 56.0 859.21 1.96% 883.55 -0.85% 1,170.38 -25.15% 49.9 45.6

NASDAQ 2,175.29 0.66% 2,160.03 1.37% 1,974.59 10.89% 57.6 56.6 1,479.96 1.98% 1,537.63 -1.84% 2,086.11 -27.65% 49.0 44.2

Volume on the Major Indices 12/7/09

% Diff. Yr. Ago 200D - EMA

Volume 12D - EMA % Diff. from 26D - EMA % Diff. 200D - EMA from Volume 12D - EMA % Diff. from 26D - EMA % Diff. from Yr. Ago % Diff. from 1

Index (000s) (000s) Close (000s) from Close (000s) Close (000s) Yr. Ago (000s) 1 Yr. Close Yr. Ago (000s) 1 Yr. Close (000s) Yr. Close

DJIA 196,578 225,740 -12.92% 214,724 -8.5% 249,614 -21.2% 346,373 326,283 6.16% 331,649 4.44% 284,852 21.60%

S&P500 N/A 30,513 N/A 33,678 N/A 42,800 N/A 49,808 48,946 1.76% 49,931 -0.25% 42,995 15.85%

NASDAQ 1,819,910 776,591 134.35% 695,745 161.6% 701,036 159.6% 877,800 841,931 4.26% 875,877 0.22% 911,396 -3.69%

Top Common Stock Gainers for 12/7/09 Top Common Stock Losers for 12/7/09

Market % Volume Avg. Vol Market % Volume Avg. Vol

Ticker Name Cap Change (000s) (000s) Exchange Ticker Name Cap Change (000s) (000s) Exchange

ROY International Royalty Corporat $637.3M 51.2% 6,248 314 AMEX ZLC Zale Corporation $119.9M -24.4% 4,304 654 NYSE

IHO Invitel Holdings A/S 84.5M 50.7% 167 9 AMEX BTH Blyth, Inc. 266.6M -14.2% 199 53 NYSE

ASIA AsiaInfo Holdings, Inc. 1.430B 22.4% 8,500 1,115 NGM ALTH Allos Therapeutics, Inc. 611.2M -11.2% 12,874 2,740 NGM

ZILG ZiLOG, Inc. 60.9M 18.9% 3,782 87 NGM SGMO Sangamo Biosciences, Inc. 240.3M -10.1% 321 356 NGM

SONA Southern National Banc. of Vir 83.4M 18.0% 105 10 NGM ISYS Integral Systems, Inc. 146.1M -9.4% 258 148 NasdaqNM

CFSG China Fire & Security Group, I 414.2M 17.4% 1,329 413 NCM KBX Kimber Resources, Inc. 80.7M -8.5% 574 184 AMEX

PKOH Park-Ohio Holdings Corp. 62.2M 16.5% 102 42 NasdaqNM TCL Tata Communications Limited (A 4.426B -7.3% 152 94 NYSE

BIOF BioFuel Energy Corp. 87.7M 16.5% 1,392 341 NGM KGN Keegan Resources Inc. 237.4M -7.3% 359 222 AMEX

DYP Duoyuan Printing, Inc. 248.0M 16.5% 99 375 NYSE AXU Alexco Resource Corp. (USA) 137.7M -7.0% 625 218 AMEX

CFI Culp, Inc. 112.6M 15.8% 140 16 NYSE ICO International Coal Group, Inc. 616.6M -6.5% 2,286 2,023 NYSE

STLY Stanley Furniture Company, Inc 104.4M 14.5% 16 26 NasdaqNM KKD Krispy Kreme Doughnuts 213.2M -6.5% 2,132 552 NYSE

CPD Caraco Pharmaceutical Laborato 204.8M 14.4% 194 60 AMEX MIM MI Developments Inc. (USA) 581.5M -6.5% 64 54 NYSE

SNTA Synta Pharmaceuticals Corp. 172.3M 13.9% 122 63 NGM PIP PharmAthene, Inc. 92.7M -6.3% 67 55 AMEX

S Sprint Nextel Corporation 12.026B 13.3% 147,373 63,043 NYSE SRZ Sunrise Senior Living, Inc. 160.9M -6.0% 1,165 2,712 NYSE

SOL ReneSola Ltd. (ADR) 651.5M 12.2% 2,970 2,005 NYSE BVN Compania de Minas Buenaventura 9.519B -5.8% 2,359 1,642 NYSE

Unusual Volume for 12/7/09 Most Active Common Stock for 12/7/09

Market % Price Volume Avg. Vol Market % Volume Avg. Vol

Ticker Name Cap Change (000s) (000s) Exchange Ticker Name Cap Change (000s) (000s) Exchange

ASIA AsiaInfo Holdings, Inc. 1.430B 22.4% 8,500 1,115 NGM BAC Bank of America Corporation $137.5B -2.4% 291,029 203,533 NYSE

CAGC China Agritech Inc. 247.3M 9.9% 914 191 NGM C Citigroup Inc. 92.142B -0.7% 232,009 479,730 NYSE

SIRO Sirona Dental Systems, Inc. 1.919B 2.8% 779 236 NasdaqNM S Sprint Nextel Corporation 12.026B 13.3% 147,373 63,043 NYSE

ECPG Encore Capital Group, Inc. 438.1M 3.6% 290 131 NasdaqNM CMCSA Comcast Corporation 49.300B 7.1% 77,580 27,520 NasdaqNM

PRSC Providence Service Corporation 206.9M 6.0% 230 106 NasdaqNM PFE Pfizer Inc. 145.7B -2.3% 76,051 54,755 NYSE

MJN Mead Johnson Nutrition CO 8.640B -3.8% 3,234 1,235 NYSE NVDA NVIDIA Corporation 8.928B 12.8% 68,305 17,010 NasdaqNM

HIT Hitachi, Ltd. (ADR) 8.703B -5.6% 222 78 NYSE GE General Electric Company 171.2B -0.7% 64,417 100,327 NYSE

CSL Carlisle Companies, Inc. 2.014B -2.0% 965 400 NYSE BMY Bristol Myers Squibb Co. 50.079B 0.6% 56,461 15,202 NYSE

FGXI FGX International Holdings Lim 359.1M -4.9% 290 103 NGM INTC Intel Corporation 112.5B -0.4% 47,083 62,642 NasdaqNM

CAAS China Automotive Systems, Inc. 525.1M -7.3% 1,505 442 NCM Q Qwest Communications Internati 7.096B 5.1% 46,419 26,491 NYSE

AMD Advanced Micro Devices, Inc. 5.711B 8.4% 45,635 35,209 NYSE

F Ford Motor Company 29.466B -0.3% 41,476 81,455 NYSE

Market Statistics for 12/7/09

New 52- New 52- Volume

MSFT Microsoft Corporation 264.5B -0.6% 38,083 56,630 NasdaqNM

Exchange Advancing Declining Unchanged Total Wk High Wk Low (millions) SNV Synovus Financial Corp. 1.129B 9.3% 36,968 22,215 NYSE

CSCO Cisco Systems, Inc. 139.3B 0.2% 33,099 44,972 NasdaqNM

NYSE 2,002 (52%) 1,774 (46%) 108 (3%) 3,884 244 32 4,821

Nasdaq 1,378 (48%) 1,329 (47%) 140 (5%) 2,847 108 17 1,898

Amex 315 (41%) 406 (53%) 42 (6%) 763 20 8 837

DAILY MARKET SHEET

© 2009 Chain Bridge Investing

MARKET

WWW.CHAINBRIDGEINVESTING.COM

SHEET

DAILY

CHAIN BRIDGE INVESTING

DECEMBER 7, 2009 PAGE 2

High Volume Options for 12/7/09 Unusally High Volume Options for 12/7/09

Close Change Close Change

Ticker Name Date Option Price Price Volume Ticker Name Date Option Price Price Volume

BMY Bristol-Myers Squ 9-Dec 30 Call 0.02 0.01 102,544 RAI Reynolds American 10-Jan 40 Call 14.30 1.10 30,500

RAI Reynolds American 10-Jan 50 Call 3.95 0.90 81,158 BAX Baxter Intl Inc 9-Dec 52.5 Call 3.60 (0.60) 19,250

BAC Bk Of America Cp 9-Dec 16 Call 0.37 (0.20) 65,529 SLV Ishares Silver Tr 11-Jan 17 Call 3.45 (0.15) 27,189

XLF Financial Sel Spd 9-Dec 14 Put 0.17 0.03 62,474 PNC P N C Fin Svcs Gr 10-Jan 46 Put 0.95 0.15 30,046

SPY S&P Dep Receipts 9-Dec 111 Put 1.78 0.11 59,294 XME Spdr S&P Metals & 9-Dec 51 Call 0.40 (0.20) 3,671

TRV The Travelers Co 10-Jan 40 Call 10.65 (0.45) 51,900 WHR Whirlpool Cp 10-Mar 65 Put 2.70 - 15,031

UUP Ps Db Usd Idx Bl 10-Jan 23 Call 0.18 (0.05) 43,621 YHOO Yahoo! Inc. 10-Apr 17 Put 2.11 (0.24) 4,409

AAPL Apple Inc. 9-Dec 200 Call 1.01 (1.17) 31,369 QCOM Qualcomm Incorpor 10-Apr 55 Call 0.32 (0.04) 10,135

QQQQ Powershares Excha 9-Dec 43 Put 0.34 0.02 30,201 TRA Terra Inds Inc 9-Dec 36 Call 5.60 1.80 3,210

PNC P N C Fin Svcs Gr 10-Jan 46 Put 0.90 0.15 30,046 ERTS Electronic Arts I 10-Jan 16 Call 1.05 0.05 12,627

RIMM Research In Motio 10-Jan 80 Call 0.44 0.12 27,406 SPY S&P Dep Receipts 10-Feb 119 Call 0.97 (0.12) 6,100

SLV Ishares Silver Tr 11-Jan 17 Call 3.43 (0.10) 27,189 CF Cf Ind Hldgs Inc 10-Jan 100 Call 1.60 0.30 8,835

IWM Ishare Rus 2000 I 9-Dec 60 Put 0.92 (0.10) 27,173 SO Southern Co 11-Jan 35 Call 1.40 0.05 3,030

EEM Ishares Msci E.M. 10-Jan 43 Call 0.95 (0.20) 26,596 MO Altria Group Inc 11-Jan 20 Call 0.95 0.02 8,266

BAX Baxter Intl Inc 9-Dec 52.5 Call 3.50 (0.65) 19,250 VNO Vornado Realty Tr 10-Jan 70 Call 3.20 (0.80) 3,150

Top and Worst Industries for 12/7/09

Top Yahoo % Worst Yahoo %

Industries Change Industries Change

Tobacco Products 5.70% REIT-Office -2.88%

Semicndtr-Special 3.10% REIT-Hotel/Motel -2.65%

CATV Systems 3.07% Resorts&Casinos -2.29%

Pub-Newspapers 2.48% Health Info Serv -2.17%

Health Care Plans 2.26% Catalog&Mail Ordr -2.15%

Nonmet Min Mining 2.22% REIT-Retail -2.15%

Toy&Hobby Stores 2.11% REIT-Residential -2.12%

Broadcasting-TV 1.77% PersonalComputers -2.12%

Hospitals 1.74% REIT-Industrial -2.03%

Agricultural Chem 1.72% Confectioners -1.99%

HeavyConstruction 1.72% Silver -1.91%

Home Health Care 1.67% Gold -1.87%

Manuf Housing 1.57% Invstmt Brok-Reg' -1.74%

Dairy Products 1.46% Copper -1.72%

Aero/Def-Major 1.45% Div Investments -1.64%

DAILY MARKET SHEET

© 2009 Chain Bridge Investing

Vous aimerez peut-être aussi

- Bagpipe LV 1-5Document228 pagesBagpipe LV 1-5Sathia Kdms100% (2)

- DuffphelpsDocument1 pageDuffphelpsG ChaddiPas encore d'évaluation

- CulvertsDocument18 pagesCulvertsAmmar A. Ali100% (1)

- Duffphelps RF Erp CRSP 5-21-2019Document1 pageDuffphelps RF Erp CRSP 5-21-2019G ChaddiPas encore d'évaluation

- Matters Signified by The Sublord of 11th Cusp in KP SystemDocument2 pagesMatters Signified by The Sublord of 11th Cusp in KP SystemHarry HartPas encore d'évaluation

- Betas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Document21 pagesBetas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Elias del CampoPas encore d'évaluation

- Fortune 500 2022 CompleteDocument35 pagesFortune 500 2022 CompleteGabriele CiampiniPas encore d'évaluation

- PT Adhi Karya (Persero) Tbk. 2004-2007: Aktiva LancarDocument11 pagesPT Adhi Karya (Persero) Tbk. 2004-2007: Aktiva LancarFatharani SolihaPas encore d'évaluation

- Quartile1 PDFDocument2 pagesQuartile1 PDFHanifah Edres DalumaPas encore d'évaluation

- Maritime Management SystemsDocument105 pagesMaritime Management SystemsAndika AntakaPas encore d'évaluation

- Iodide and Bromide Ions in Brackish Water, Seawater, and Brines D 3869 - 04Document12 pagesIodide and Bromide Ions in Brackish Water, Seawater, and Brines D 3869 - 04stevgonPas encore d'évaluation

- Power Markets and Economics: Energy Costs, Trading, EmissionsD'EverandPower Markets and Economics: Energy Costs, Trading, EmissionsPas encore d'évaluation

- Daily Market Sheet 12-11-09Document2 pagesDaily Market Sheet 12-11-09chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-14-09Document2 pagesDaily Market Sheet 12-14-09chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-18-09Document2 pagesDaily Market Sheet 12-18-09chainbridgeinvestingPas encore d'évaluation

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganPas encore d'évaluation

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganPas encore d'évaluation

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganPas encore d'évaluation

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganPas encore d'évaluation

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganPas encore d'évaluation

- Polaroid 1996 CalculationDocument8 pagesPolaroid 1996 CalculationDev AnandPas encore d'évaluation

- GridExport December 8 2022 19 20 38Document4 pagesGridExport December 8 2022 19 20 38FBusinessPas encore d'évaluation

- Week 12 Outlook - March 21 To 25, 2011Document3 pagesWeek 12 Outlook - March 21 To 25, 2011JC CalaycayPas encore d'évaluation

- Data Nilai Perusahaan TercatatDocument4 pagesData Nilai Perusahaan TercatatSee YuhuuPas encore d'évaluation

- ValuEngine Weekly Newsletter March 30, 2010Document15 pagesValuEngine Weekly Newsletter March 30, 2010ValuEngine.comPas encore d'évaluation

- Initial investment Time horizon (years) Return µ σ Stock marketDocument17 pagesInitial investment Time horizon (years) Return µ σ Stock marketvaskorePas encore d'évaluation

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaPas encore d'évaluation

- Distribution MarketUpdate Q3 20181031-2Document5 pagesDistribution MarketUpdate Q3 20181031-2buckybad2Pas encore d'évaluation

- Listed Companies Highlights: Bcel: Banque Pour Le Commerce Exterieur Lao PublicDocument1 pageListed Companies Highlights: Bcel: Banque Pour Le Commerce Exterieur Lao PubliclaomedPas encore d'évaluation

- Introduction To Meeting PresentationDocument20 pagesIntroduction To Meeting PresentationNazmul HasanPas encore d'évaluation

- Analyse Bus 31-12-2018Document198 pagesAnalyse Bus 31-12-2018n.02thierryPas encore d'évaluation

- Flowsniper Daily ReportDocument1 pageFlowsniper Daily ReportMatt EbrahimiPas encore d'évaluation

- 26.08.2021 ZSE Price SheetDocument1 page26.08.2021 ZSE Price Sheetdenford dangayisoPas encore d'évaluation

- 05 2023 Sales Out Report MTDDocument2 pages05 2023 Sales Out Report MTDNOCINPLUSPas encore d'évaluation

- Adani PortsDocument24 pagesAdani PortsManisha JhunjhunwalaPas encore d'évaluation

- Daily Market Update 4Document1 pageDaily Market Update 4Towfick KamalPas encore d'évaluation

- Monthly Performance Report: MonthDocument16 pagesMonthly Performance Report: Monthkumarprasoon99Pas encore d'évaluation

- Uv0052 Xls EngDocument12 pagesUv0052 Xls Engpriyanshu14Pas encore d'évaluation

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0David Syah putraPas encore d'évaluation

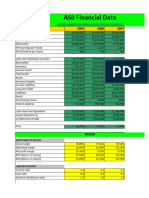

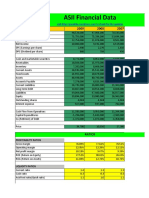

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007AdrianPas encore d'évaluation

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Akhi DanuPas encore d'évaluation

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007yrperdanaPas encore d'évaluation

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Gilang AnggoroPas encore d'évaluation

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Arif SupriyadiPas encore d'évaluation

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaPas encore d'évaluation

- The State of South Carolina: Investment Analysis and Portfolio ManagementDocument46 pagesThe State of South Carolina: Investment Analysis and Portfolio ManagementhellolauraPas encore d'évaluation

- Ethics of Business Turnaround Mangement: Global Trade War (Us - China)Document12 pagesEthics of Business Turnaround Mangement: Global Trade War (Us - China)Ashlesh MangrulkarPas encore d'évaluation

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comPas encore d'évaluation

- Stock Analysis of Power Finance CorporationDocument5 pagesStock Analysis of Power Finance CorporationDeepak YadavPas encore d'évaluation

- 6 Polaroid Corporation 1996Document64 pages6 Polaroid Corporation 1996jk kumarPas encore d'évaluation

- Analyse Bus 28-02-2018Document75 pagesAnalyse Bus 28-02-2018n.02thierryPas encore d'évaluation

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comPas encore d'évaluation

- Stock Screener203025Document5 pagesStock Screener203025Sde BdrPas encore d'évaluation

- Sustainable Growth Analysis of Under Armour Inc. 2009 - 2013Document9 pagesSustainable Growth Analysis of Under Armour Inc. 2009 - 2013Maria Camila CadavidPas encore d'évaluation

- Beta Portofolio Saham PCA Kel 4 - 121022Document63 pagesBeta Portofolio Saham PCA Kel 4 - 121022Muhibbuddin NoorPas encore d'évaluation

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalPas encore d'évaluation

- Equty Analysis by Rameez Fazal Tayyeba JayanthDocument17 pagesEquty Analysis by Rameez Fazal Tayyeba JayanthtayyebaPas encore d'évaluation

- Dev ClassDocument25 pagesDev Classhrithik choudharyPas encore d'évaluation

- Bcel 2019Document1 pageBcel 2019Dương NguyễnPas encore d'évaluation

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005Pas encore d'évaluation

- Nike Inc - HMDocument8 pagesNike Inc - HMHumphrey OsaigbePas encore d'évaluation

- Development Sales Lacking: Wheelock Properties (S)Document7 pagesDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerPas encore d'évaluation

- Trustee Investment Strategy for Endowments and FoundationsD'EverandTrustee Investment Strategy for Endowments and FoundationsPas encore d'évaluation

- Daily Market Sheet 1-12-10Document2 pagesDaily Market Sheet 1-12-10chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 1-15-10Document2 pagesDaily Market Sheet 1-15-10chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 1-13-10Document2 pagesDaily Market Sheet 1-13-10chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 1-14-10Document2 pagesDaily Market Sheet 1-14-10chainbridgeinvestingPas encore d'évaluation

- Insider Purchases 1-10-10Document2 pagesInsider Purchases 1-10-10chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 1-11-10Document2 pagesDaily Market Sheet 1-11-10chainbridgeinvestingPas encore d'évaluation

- Insider Purchases December 18, 2009Document2 pagesInsider Purchases December 18, 2009chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 1-7-10Document2 pagesDaily Market Sheet 1-7-10chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 1-8-10Document2 pagesDaily Market Sheet 1-8-10chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-21-09Document2 pagesDaily Market Sheet 12-21-09chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-8-09Document2 pagesDaily Market Sheet 12-8-09chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-15-09Document2 pagesDaily Market Sheet 12-15-09chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-10-09Document2 pagesDaily Market Sheet 12-10-09chainbridgeinvestingPas encore d'évaluation

- S&P 500 Removed 12-15-09Document1 pageS&P 500 Removed 12-15-09chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-10-09Document2 pagesDaily Market Sheet 12-10-09chainbridgeinvestingPas encore d'évaluation

- Daily Market Sheet 12-9-09Document2 pagesDaily Market Sheet 12-9-09chainbridgeinvestingPas encore d'évaluation

- Karl MarxDocument4 pagesKarl Marxeirvine noah isidroPas encore d'évaluation

- Conceptual Artist in Nigeria UNILAGDocument13 pagesConceptual Artist in Nigeria UNILAGAdelekan FortunePas encore d'évaluation

- Coding Decoding Sheet - 01 1678021709186Document9 pagesCoding Decoding Sheet - 01 1678021709186Sumit VermaPas encore d'évaluation

- Wcdma Idle Mode (Ericsson)Document29 pagesWcdma Idle Mode (Ericsson)Hosein ShahbaziPas encore d'évaluation

- Carrefour-SA Shopping Center TurkeyDocument2 pagesCarrefour-SA Shopping Center TurkeyVineet JogalekarPas encore d'évaluation

- Minimalist KWL Graphic OrganizerDocument2 pagesMinimalist KWL Graphic OrganizerIrish Nicole AlanoPas encore d'évaluation

- Project ReportDocument14 pagesProject ReportNoah100% (7)

- Technical Data Sheet: LPI HVSC PlusDocument2 pagesTechnical Data Sheet: LPI HVSC PlusNguyễn TấnPas encore d'évaluation

- Hashimoto's Thyroiditis: Veena RedkarDocument10 pagesHashimoto's Thyroiditis: Veena RedkarSan RedkarPas encore d'évaluation

- 1 s2.0 S1110016815000563 Main PDFDocument13 pages1 s2.0 S1110016815000563 Main PDFvale1299Pas encore d'évaluation

- English Class Vii PDFDocument101 pagesEnglish Class Vii PDFpannapurohitPas encore d'évaluation

- Model Detailed Project Report: Animal Feed Making UnitDocument19 pagesModel Detailed Project Report: Animal Feed Making UnitShashi ShekharPas encore d'évaluation

- YoungMan EN131 GUIDEDocument16 pagesYoungMan EN131 GUIDErcpawar100% (1)

- Statics: Vector Mechanics For EngineersDocument39 pagesStatics: Vector Mechanics For EngineersVijay KumarPas encore d'évaluation

- CS402 Mcqs MidTerm by Vu Topper RMDocument50 pagesCS402 Mcqs MidTerm by Vu Topper RMM. KhizarPas encore d'évaluation

- Islam and Civilization (Analysis Study On The History of Civilization in Islam) Muhammad Hifdil IslamDocument18 pagesIslam and Civilization (Analysis Study On The History of Civilization in Islam) Muhammad Hifdil IslamLoveth KonniaPas encore d'évaluation

- Bulk Material/Part Ppap Process Checklist / Approval: Required?Document32 pagesBulk Material/Part Ppap Process Checklist / Approval: Required?krds chidPas encore d'évaluation

- Asme Code Sec Ix Ma Appe 2004Document3 pagesAsme Code Sec Ix Ma Appe 2004Guillermo CamachoPas encore d'évaluation

- RepaHeel Beeswax-Based Gel For Treating Heel Spurs Has Been Produced in EUDocument2 pagesRepaHeel Beeswax-Based Gel For Treating Heel Spurs Has Been Produced in EUPR.comPas encore d'évaluation

- Ecall Vs NG EcallDocument6 pagesEcall Vs NG EcallTrần Văn DũngPas encore d'évaluation

- MMW ReviewerDocument3 pagesMMW ReviewerMarcSaloj NeryPas encore d'évaluation

- 1F-Korean-Nami Mun - Miles From NowhereDocument4 pages1F-Korean-Nami Mun - Miles From NowhereNeil PatelPas encore d'évaluation

- Las Tech Drafting 3Q WKDocument13 pagesLas Tech Drafting 3Q WKClemenda TuscanoPas encore d'évaluation

- Crma Unit 1 Crma RolesDocument34 pagesCrma Unit 1 Crma Rolesumop3plsdn0% (1)