Académique Documents

Professionnel Documents

Culture Documents

Renault Duster-The Way Forward: Group 12

Transféré par

ravi007kantDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Renault Duster-The Way Forward: Group 12

Transféré par

ravi007kantDroits d'auteur :

Formats disponibles

RENAULT DUSTER- THE WAY

FORWARD

Group 12

Sriram Bharadwaj (1411318)

Ranjan Choudhary (1411321)

Ravi Kant (1411323)

Vidhyadhar S (1411342)

Mihir Malve (1411350)

Group 12 Marketing Management Renault Duster IIM Bangalore

Group 12 Marketing Management Renault Duster IIM Bangalore

Dusters presence in market

Market STP at time of Launch

Renault Duster

Challenges Faced by duster

Problem Statement

5 C

STP

4P

Marketing Plan

Conclusion

Group 12 Marketing Management Renault Duster IIM Bangalore

0

50

100

150

200

250

300

2008 2009 2010 2011

SUV Sales in India by year (in '000)

Launch of compact SUV

RENAULT DUSTER

0

10

20

30

40

50

60

Market Share of Indian

Auto Market by Body Style

Group 12 Marketing Management Renault Duster IIM Bangalore

Threat of New

Entrants

Segment Rivalry

Substitute

Products

Bargaining power

of Suppliers

Bargaining power

of buyers

Porters Five Forces Model- Compact SUV Segment

Group 12 Marketing Management Renault Duster IIM Bangalore

Threat of New

Entrants

Segment Rivalry

Substitute

Products

Bargaining power

of Suppliers

Bargaining power

of buyers

Porters Five Forces Model- Compact SUV Segment

Group 12 Marketing Management Renault Duster IIM Bangalore

For the Unstoppable Indian

Ruggedness of SUV with comfort of Sedan

Group 12 Marketing Management Renault Duster IIM Bangalore

CHALLENGES FACED BY DUSTER

Group 12 Marketing Management Renault Duster IIM Bangalore

CHALLENGES FACED BY DUSTER

Group 12 Marketing Management Renault Duster IIM Bangalore

PROBLEM STATEMENT

With very few players

such as Bolero, Scorpio

in the rural market and

with the income levels of

rural India rising, can

the Duster position and

market its product in the

rural market?

What should the Duster

do to sustain itself and

maintain its market

share in the urban

Compact SUV market?

Group 12 Marketing Management Renault Duster IIM Bangalore

SEGMENTATION

GEOGRAPHIC SEGMENTATION

Group 12 Marketing Management Renault Duster IIM Bangalore

SEGMENTING RURAL MARKETS

Rural India

68% of Indias Population

19.2% increase in per-capita expenditure

57000+ Utility Vehicles sold in Oct 2013 (7% rise)

Steady rise in rural car sales despite overall reduction

0 10 20 30 40 50

R1

R2

R3

R4

Rural SEC Classification (% of Total Population)

Rural SEC

Classification (% of

Total Population)

Group 12 Marketing Management Renault Duster IIM Bangalore

Threat of New

Entrants

Segment Rivalry

Substitute

Products

Bargaining power

of Suppliers

Bargaining power

of buyers

Porters Five Forces Model Segments Attractiveness

Group 12 Marketing Management Renault Duster IIM Bangalore

THANK YOU

Vous aimerez peut-être aussi

- 07 Patriout Parts Manual PDFDocument455 pages07 Patriout Parts Manual PDFAgustin GuzmanPas encore d'évaluation

- Toyota 2006 VIN DecoderDocument1 pageToyota 2006 VIN DecoderKevin J. Thomson IIPas encore d'évaluation

- Subaru Transmissions SpecsDocument4 pagesSubaru Transmissions SpecsJose Antonio Solis100% (1)

- Range Rover Evoque 2011 Ubicacion de ConectoresDocument2 pagesRange Rover Evoque 2011 Ubicacion de ConectoresZyrus Hedphelym Kaothic100% (4)

- Land Rover NA-CaseDocument4 pagesLand Rover NA-CaseWeiPas encore d'évaluation

- For Information On Using These Wiring Diagrams, See USING MITCHELL1'S SYSTEM WIRINGDocument159 pagesFor Information On Using These Wiring Diagrams, See USING MITCHELL1'S SYSTEM WIRINGNilson BarbosaPas encore d'évaluation

- Dusting Off The Competition - Dealing With CompetitionDocument5 pagesDusting Off The Competition - Dealing With CompetitionSoumyajeet GhoshPas encore d'évaluation

- Land Rover 65 Year Anniversary Tcm296 97844Document31 pagesLand Rover 65 Year Anniversary Tcm296 97844Guido KühnPas encore d'évaluation

- VACUUM (Diagrams)Document33 pagesVACUUM (Diagrams)vinerd100% (2)

- PCMtuner Module Connections.Document22 pagesPCMtuner Module Connections.Mohammed ZaferPas encore d'évaluation

- GOLF V AdaptionsDocument4 pagesGOLF V AdaptionsCristian SindiePas encore d'évaluation

- 02 Varun Nagar - Case HandoutDocument2 pages02 Varun Nagar - Case Handoutravi007kant100% (1)

- Mercedes India Competitive StrategiesDocument20 pagesMercedes India Competitive StrategiesAjit Kumar KPas encore d'évaluation

- Marketing Strategy of Maruti SuzukiDocument88 pagesMarketing Strategy of Maruti SuzukiApoorva KohliPas encore d'évaluation

- Final Report Maruti SuzukiDocument70 pagesFinal Report Maruti SuzukiVarun Abrol88% (8)

- Suspension y Direccion 1Document114 pagesSuspension y Direccion 1Ricardo CondoriPas encore d'évaluation

- Plan Mantenimiento Despliegue 2017Document198 pagesPlan Mantenimiento Despliegue 2017Camilo OclesPas encore d'évaluation

- Renault Duster Report 9 April 2020 2Document11 pagesRenault Duster Report 9 April 2020 2Zawad SaadPas encore d'évaluation

- Over All ReportDocument19 pagesOver All Reportravi007kantPas encore d'évaluation

- BRANDING Thesis VineetmalaniDocument77 pagesBRANDING Thesis Vineetmalanibonker508100% (3)

- SDM, Org Structure-Fk1973Document2 pagesSDM, Org Structure-Fk1973kakoli123Pas encore d'évaluation

- Marketing Management Assignment: Topic: Marketing Plan of Gel-Enabled Cricket Pads Produced by Sansperills GreenlandsDocument11 pagesMarketing Management Assignment: Topic: Marketing Plan of Gel-Enabled Cricket Pads Produced by Sansperills GreenlandsAthulya santhosh50% (2)

- Fiat India: Perspective ManagementDocument20 pagesFiat India: Perspective Managementshreyas1111Pas encore d'évaluation

- Final Project Berger PDFDocument148 pagesFinal Project Berger PDFAmna FarooquiPas encore d'évaluation

- Circumstances Faced by Management: Event Situation DecisionDocument2 pagesCircumstances Faced by Management: Event Situation DecisionZawad SaadPas encore d'évaluation

- Circumstances Faced by Management: Event Situation DecisionDocument5 pagesCircumstances Faced by Management: Event Situation DecisionZawad SaadPas encore d'évaluation

- Assesment FinalDocument6 pagesAssesment FinalManjunath UPas encore d'évaluation

- Jaguar PDFDocument5 pagesJaguar PDFLokesh VarunPas encore d'évaluation

- STP of Tata MotorsDocument3 pagesSTP of Tata Motorslekha pmPas encore d'évaluation

- RenaultDocument3 pagesRenaultVINAYAK SHARMAPas encore d'évaluation

- Mahindra Renault Logan: Brand FailureDocument16 pagesMahindra Renault Logan: Brand FailureSiddharth Mertia50% (2)

- Tata Motors: Presented by - 1) 2) 3) 4) 5) 6)Document20 pagesTata Motors: Presented by - 1) 2) 3) 4) 5) 6)humtum733Pas encore d'évaluation

- Rural Marketing - Group 3Document17 pagesRural Marketing - Group 3janhavi salviPas encore d'évaluation

- SIMULATION (Mind Mapping)Document4 pagesSIMULATION (Mind Mapping)Syed Muhd AmriPas encore d'évaluation

- Indian AutomobileDocument37 pagesIndian Automobilevaibhavchopra1Pas encore d'évaluation

- Tata Nano : ONE LakhDocument29 pagesTata Nano : ONE LakhManish KalraPas encore d'évaluation

- Case Study-Renault DusterDocument7 pagesCase Study-Renault DusterSurabhi SinhaPas encore d'évaluation

- Marktng Proj Group 9Document22 pagesMarktng Proj Group 9Ashutosh K TripathyPas encore d'évaluation

- Jaguar PDFDocument5 pagesJaguar PDFLokesh VarunPas encore d'évaluation

- NASREEN RAHAT - 39516 - Assignsubmission - File - SecC - Group6 - ProjectDocument18 pagesNASREEN RAHAT - 39516 - Assignsubmission - File - SecC - Group6 - ProjectHEM BANSALPas encore d'évaluation

- RENAULTDocument19 pagesRENAULTprasad patilPas encore d'évaluation

- Swot Analysis of Tanker Truck Segment in Mumbai and Suggesting Marketing Strategy FOR Mahindra Trucks and Buses DivisionDocument4 pagesSwot Analysis of Tanker Truck Segment in Mumbai and Suggesting Marketing Strategy FOR Mahindra Trucks and Buses DivisionAnand AgarwalPas encore d'évaluation

- SssssDocument3 pagesSssssMohammad SyafiiPas encore d'évaluation

- TATA Motors My AssignmentDocument12 pagesTATA Motors My AssignmentGhazzali HaniffaPas encore d'évaluation

- Sample ReportDocument16 pagesSample ReportSRIRAMA CHANDRAPas encore d'évaluation

- 1 Product Management Project Report On Renault DusterDocument3 pages1 Product Management Project Report On Renault DustersinhavisPas encore d'évaluation

- Marketing Strategy of Maruti SuzukiDocument88 pagesMarketing Strategy of Maruti SuzukiApoorva KohliPas encore d'évaluation

- Facts Figures March 2018 EditionDocument43 pagesFacts Figures March 2018 EditionIancu_Emanuel_89Pas encore d'évaluation

- MM CS5 Pes1202202920 PDFDocument3 pagesMM CS5 Pes1202202920 PDFmohammed yaseenPas encore d'évaluation

- Strategic Management Project On Tata Motors: Under The Guidance of Prof. SubramaniamDocument33 pagesStrategic Management Project On Tata Motors: Under The Guidance of Prof. SubramaniamMainali GautamPas encore d'évaluation

- SectionB - Group7 - Tata NanoDocument13 pagesSectionB - Group7 - Tata NanoJayPas encore d'évaluation

- The Changing Makrketing Strategies (A Case Study On Renault Duster)Document13 pagesThe Changing Makrketing Strategies (A Case Study On Renault Duster)Mehdi RostamiPas encore d'évaluation

- Mahindra RenaultDocument4 pagesMahindra RenaultOmkar MulekarPas encore d'évaluation

- Annual Report 2021 22Document192 pagesAnnual Report 2021 22Tushar PathelaPas encore d'évaluation

- THE RENAULT KWID Indian Market StrategyDocument9 pagesTHE RENAULT KWID Indian Market StrategyAkshat BansalPas encore d'évaluation

- Renault: What Changed Their FortuneDocument3 pagesRenault: What Changed Their FortuneABHILASHA MUKHERJEEPas encore d'évaluation

- MFCW PresentationDocument21 pagesMFCW PresentationDevesh MalooPas encore d'évaluation

- London-SAM Mba-112 International Marketing StrategyDocument18 pagesLondon-SAM Mba-112 International Marketing StrategyBhaveshkumar BhanderiPas encore d'évaluation

- Marketing StrategyDocument6 pagesMarketing Strategygayathri rajanPas encore d'évaluation

- Renault's Ride Into India: Discussion QuestionsDocument1 pageRenault's Ride Into India: Discussion QuestionsAdhiraj MukherjeePas encore d'évaluation

- Jamkash Vehicleades: Sales Promotion in MarutiDocument69 pagesJamkash Vehicleades: Sales Promotion in MarutiRishabh GangwarPas encore d'évaluation

- Toyota QualisDocument12 pagesToyota Qualisvatsal ghediaPas encore d'évaluation

- SDM Assignment 1Document13 pagesSDM Assignment 1Mukesh BholPas encore d'évaluation

- Group A4 - Renault Duster Dusting Away Competition or Facing A Dust StormDocument14 pagesGroup A4 - Renault Duster Dusting Away Competition or Facing A Dust StormPrabhash PareekPas encore d'évaluation

- Why Tata Motors Succeeded in Global Market and General Motors FailedDocument5 pagesWhy Tata Motors Succeeded in Global Market and General Motors FailedroshaniPas encore d'évaluation

- Project RenaultDocument16 pagesProject Renaultswathika swathikaPas encore d'évaluation

- Renualt Duster - Case StudyDocument8 pagesRenualt Duster - Case StudyAniruddh NaikPas encore d'évaluation

- Media 30may21 FiDocument7 pagesMedia 30may21 FianupamPas encore d'évaluation

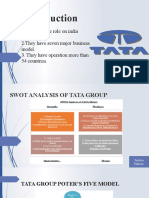

- Plays A Huge Role On India Economy 2.they Have Seven Major Business Model. 3. They Have Operation More Than 54 CountriesDocument12 pagesPlays A Huge Role On India Economy 2.they Have Seven Major Business Model. 3. They Have Operation More Than 54 CountriesBooty WorldPas encore d'évaluation

- Datsun India - A Journey Uncovered.Document2 pagesDatsun India - A Journey Uncovered.wetgrhbtjnyjrt6jrPas encore d'évaluation

- Maruti Sales ProcessDocument33 pagesMaruti Sales ProcessakbarPas encore d'évaluation

- Mba Iisem ProjectDocument13 pagesMba Iisem ProjectAnkit jainPas encore d'évaluation

- Swot Analysis of Mini CooperDocument9 pagesSwot Analysis of Mini CoopersangeethaPas encore d'évaluation

- VNACS Case: Mr. Agarwal's Predicament: ObjectiveDocument5 pagesVNACS Case: Mr. Agarwal's Predicament: Objectiveravi007kantPas encore d'évaluation

- VNACS Case: Mr. Agarwal's Predicament: Presented byDocument5 pagesVNACS Case: Mr. Agarwal's Predicament: Presented byravi007kantPas encore d'évaluation

- MM Project Proposal - Section C - Group 5Document1 pageMM Project Proposal - Section C - Group 5ravi007kantPas encore d'évaluation

- Australian Market: An Island of OpportunitiesDocument5 pagesAustralian Market: An Island of Opportunitiesravi007kantPas encore d'évaluation

- 1, Audi: Car ListDocument9 pages1, Audi: Car Listcarlosjuniors888Pas encore d'évaluation

- ZFAudiProgram PDFDocument2 pagesZFAudiProgram PDFwilderPas encore d'évaluation

- Axxess Vehicle Application GuideDocument363 pagesAxxess Vehicle Application GuideGaudencio Alberco vilcayauriPas encore d'évaluation

- Denso 5Document1 pageDenso 5Safety WaxyPas encore d'évaluation

- Catalogo de BujiasDocument4 pagesCatalogo de BujiasDaniel Tapia HenríquezPas encore d'évaluation

- Lista de ProductosDocument53 pagesLista de ProductosTommy CamposPas encore d'évaluation

- Rabbit Jetta Scirocco 1983 CricosDocument9 pagesRabbit Jetta Scirocco 1983 CricosJuan Carlos GomezPas encore d'évaluation

- New Toyota Rush - The Trusted 7-Seater SUV CarDocument1 pageNew Toyota Rush - The Trusted 7-Seater SUV CarAtika AzmanPas encore d'évaluation

- Lista de Precio Mazda Marzo 2021Document1 pageLista de Precio Mazda Marzo 2021Magaly LozanoPas encore d'évaluation

- Lista Atlantic 09-03-23 PDFDocument32 pagesLista Atlantic 09-03-23 PDFcorsetti33Pas encore d'évaluation

- Monthly Report Subcont (Januari 2022)Document29 pagesMonthly Report Subcont (Januari 2022)ARPas encore d'évaluation

- 2022 Toyota Hiace Panel 28l Diesel 2wd MTDocument2 pages2022 Toyota Hiace Panel 28l Diesel 2wd MTJames Lucas MoorePas encore d'évaluation

- Bentley BrochureDocument8 pagesBentley BrochurealdoPas encore d'évaluation

- Job No. 1200: InventoryDocument2 pagesJob No. 1200: InventoryHugh O'Brien GwazePas encore d'évaluation

- Motro 22Document33 pagesMotro 22Jose cuelloPas encore d'évaluation

- DicarDocument154 pagesDicarGallo0% (1)

- TJM CatalogueDocument140 pagesTJM CatalogueStevePas encore d'évaluation

- DM GeneralDocument174 pagesDM Generallarry gonzalezPas encore d'évaluation