Académique Documents

Professionnel Documents

Culture Documents

Accounting For Government Assistance

Transféré par

mahendrabpatel0 évaluation0% ont trouvé ce document utile (0 vote)

289 vues7 pagesIAS 20 Accounting For Government Assistance aims to prescribe the Accounting Treatment for Government Assistance. An appropriate methods of transfer of resources Indication of beneficiary Scope and Application Apply to all Grants BUT NOT TO grants in form of Benefits (Tax Holidays) government participation grant Under IAS 41 (agriculture)

Description originale:

Titre original

Accounting for Government Assistance

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PPT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentIAS 20 Accounting For Government Assistance aims to prescribe the Accounting Treatment for Government Assistance. An appropriate methods of transfer of resources Indication of beneficiary Scope and Application Apply to all Grants BUT NOT TO grants in form of Benefits (Tax Holidays) government participation grant Under IAS 41 (agriculture)

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

289 vues7 pagesAccounting For Government Assistance

Transféré par

mahendrabpatelIAS 20 Accounting For Government Assistance aims to prescribe the Accounting Treatment for Government Assistance. An appropriate methods of transfer of resources Indication of beneficiary Scope and Application Apply to all Grants BUT NOT TO grants in form of Benefits (Tax Holidays) government participation grant Under IAS 41 (agriculture)

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 7

IAS 20

Accounting For Government

Assistance

Objective

۩To prescribe the accounting

treatment for government assistance

۩An appropriate methods of transfer of

resources

۩Indication of beneficiary

Scope and Application

۩Apply to all Grants BUT

NOT TO

۩Grants in form of Benefits (Tax

Holidays)

۩Government participation

۩Grant Under IAS 41 (Agriculture)

Definitions

۩Grant (Subsidies, Premium)

۩Fair Value

۩Forgivable loan

۩Government

Accounting Treatment

۩ Capital Approach

Under which grant Cr. to shareholder’s

Interest

۩ Income Approach

Grant taken as income over the period of

time

“As Income and other taxes charged if

Grant relates to Depreciable assets”

Grant Of Land = Non depreciable

Presentation Of Grant

۩ Grants relates to Assets

Non Monetary grants at fair value set off

set up grant as differed income

deduct grant from carrying cost/amount of assets

۩ Grant relates to income

As a differed income under head of “Other Income” Or

Deduct from relative expenses

۩ Repayment of Govt grants

Repayment recognized as expense

Reducing the differed income balance

۩ Forgivable loan

If the entity meet terms for forgiveness

۩ Non monetary grants

Record both grant and assets

۩ Government Assistance

Free Technical, Marketing, and other support

Disclosures

Accounting policy for method

presantation

Forms of Govt assistance

Conditions and contingencies

Vous aimerez peut-être aussi

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelPas encore d'évaluation

- Assignenment 1 DT Unit 1Document9 pagesAssignenment 1 DT Unit 1mahendrabpatelPas encore d'évaluation

- Material Variance: Unit 2 Standard Costing (MA-06101355)Document12 pagesMaterial Variance: Unit 2 Standard Costing (MA-06101355)mahendrabpatelPas encore d'évaluation

- MotivationDocument6 pagesMotivationmahendrabpatelPas encore d'évaluation

- Question BankDocument31 pagesQuestion BankmahendrabpatelPas encore d'évaluation

- Get Started Right AwayDocument2 pagesGet Started Right AwaymahendrabpatelPas encore d'évaluation

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelPas encore d'évaluation

- Financial Accounting IntroductionDocument15 pagesFinancial Accounting IntroductionmahendrabpatelPas encore d'évaluation

- Historia Del Mondonguito A La ItalianaDocument7 pagesHistoria Del Mondonguito A La ItalianaJuan OrocoPas encore d'évaluation

- Unit V Cost of CapitalDocument24 pagesUnit V Cost of CapitalmahendrabpatelPas encore d'évaluation

- 1 CostsheetDocument8 pages1 CostsheetNash ShahPas encore d'évaluation

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelPas encore d'évaluation

- Cost and Management Accounting exam questions and ratiosDocument3 pagesCost and Management Accounting exam questions and ratiosmahendrabpatelPas encore d'évaluation

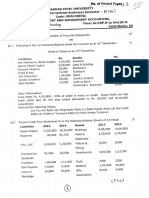

- SP Uni CA 2016 MayDocument4 pagesSP Uni CA 2016 MaymahendrabpatelPas encore d'évaluation

- Ch1 6Document109 pagesCh1 6Tia MejiaPas encore d'évaluation

- What Is Cost Reconciliation Statement?Document2 pagesWhat Is Cost Reconciliation Statement?mahendrabpatelPas encore d'évaluation

- Amit ResumeDocument3 pagesAmit ResumemahendrabpatelPas encore d'évaluation

- SP Uni CA 2016Document2 pagesSP Uni CA 2016mahendrabpatelPas encore d'évaluation

- TestDocument2 pagesTestmahendrabpatelPas encore d'évaluation

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelPas encore d'évaluation

- SP Uni CA 1Document4 pagesSP Uni CA 1mahendrabpatelPas encore d'évaluation

- SP Uni CA 2015Document3 pagesSP Uni CA 2015mahendrabpatelPas encore d'évaluation

- API Format 2017Document4 pagesAPI Format 2017mahendrabpatelPas encore d'évaluation

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelPas encore d'évaluation

- Capital BudgetingDocument24 pagesCapital BudgetingmahendrabpatelPas encore d'évaluation

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelPas encore d'évaluation

- TestDocument2 pagesTestmahendrabpatelPas encore d'évaluation

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelPas encore d'évaluation

- Capital StructureDocument37 pagesCapital StructuremahendrabpatelPas encore d'évaluation

- Instructor Effectiveness Form (IEF) Cronbach ReliabilitiesDocument3 pagesInstructor Effectiveness Form (IEF) Cronbach ReliabilitiesmahendrabpatelPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)