Académique Documents

Professionnel Documents

Culture Documents

Export Import Documentation

Transféré par

Nimesh Shah0 évaluation0% ont trouvé ce document utile (0 vote)

569 vues24 pagesAll complex Export Import Documentation Explained in the best way! A complete project on all information you need for Import and Export Documentation!

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAll complex Export Import Documentation Explained in the best way! A complete project on all information you need for Import and Export Documentation!

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

569 vues24 pagesExport Import Documentation

Transféré par

Nimesh ShahAll complex Export Import Documentation Explained in the best way! A complete project on all information you need for Import and Export Documentation!

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 24

Page | 1

EXPORT IMPORT PROCEDURES AND

DOCUMENTATION

PROJECT ON:

EXPORT - IMPORT

DOCUMENTATION

Page | 2

INDEX

SR. NO PARTICULARS PAGE NO.

1. SIGNIFICANCE 1

2. CATEGORIES 2

3. COMMERCIAL DOCUMENTS 3

4. EXPORT DOCUMENTATION 4

5. IMPORT DOCUMENTATION 7

6. UNDERSTANDING DOCUMENTS 8

7. REFERENCES 22

Page | 3

EXPORT

&

IMPORT

DOCUMENTATION

SIGNIFICANCE OF DOCUMENTATION:

Documents are important for the following reasons:

(a) As an evidence of shipment and title of goods;

(b) For obtaining payment;

(c) To provide a specific and complete description of the goods;

(d) For assessment of correct Duty for clearance purpose;

(e) For obtaining Export Licenses;

(f) For obtaining export finance;

(g) For completing Pre-shipment Inspection;

(h) For claiming export benefits like Duty Drawback, etc.

Documents are categorized into two categories, namely Commercial Documents

and Regulatory Documents.

Page | 4

Commercial set of documents are mainly used for Commerce. In other

words these are documents normally exchanged between buyer and

seller.

Regulatory documents are required in dealing with various regulatory

authorities such as customs, RBI, Excise, Licencing authorities Inspection

and other Export Promotion bodies for availing incentives etc.

Commercial Regulatory

Commercial Invoice Shipping Bill

Inspection Certificate ARE1 from (Excise)

Insurance Certificate RBI Declaration Forms (GR/PP)

Bill of Lading / AWB

Application for remittance of

currency

Certificate of Origin Various Licenses

Bill of Exchange Bill of Entry

Shipment Advice

Packing List

Page | 5

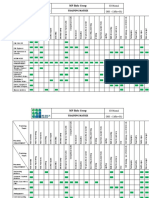

Commercial Documents

8. Letter to Bank for negotiation

of documents

8. Bill of Exchange

7. Shipping Instructions 7. Packing List

6. Shipping order 6. Shipment Advice

5. Mate Receipt 5. Bill of Lading

4. Application for Certificate of

Origin

4. Certificate of Origin

3. Declaration for Insurance 3. Insurance Certificate

2. Intimation for Inspection 2. Inspection Certificate

1. Proforma Invoice 1. Commercial Invoice

Auxiliary Principal

Page | 6

EXPORT DOCUMENTATION:

1. Export Sales Contract

2. Pre-shipment Documents

3. Post-shipment Documents

1. EXPORT SALES CONTRACT

Agreement between buyer and seller, stipulating each and every details of

the transaction.

Legally binding document.

It reduces the probabilities of disputes & differences as it fixes the role and

responsibilities of each party.

Terms and Conditions:

While drafting the sales contract one must ensure the following:-

1. Coverage is complete.

2. Maximum clarity.

3. Future probability to be provided.

4. Trade practices.

5. Law of both countries

6. Need of both parties.

There should not be any ambiguity regarding the exact specifications of

goods and terms of sale including export price, mode of payment, storage

and distribution methods, type of packaging, port of shipment, delivery

schedule etc.

Page | 7

Following standard terms and conditions are covered in an Export Sales

contract: -

Name & address of both the parties.

Contract Number & Date, place

Description of goods, quantity and quantity

Product Standards and Technical Specifications of goods.

Inspection/certification

Total Value of Contract

Terms of delivery (F.O.B./C.F.R./C.I.F. etc.),

Period of Delivery/Shipment, part shipment, Trans-shipment.

Terms of payment:- L/C, D/A, D/P, advance payment, Amount/Mode

& Currency

Taxes, Duties and charges

Packing, Labeling, Marking, etc.

Brokerage/commissions and discounts

Licenses and Permits

Insurance Requirements, Certificates of Insurance

Documentary Requirements

Performance guarantee

Signature by all parties to the contract.

Force Majeure of Excuse for Non-performance of contract

Remedies

Arbitration.

Page | 8

2. PRE-SHIPMENT DOCUMENTS

Documents at pre-shipment stage are those documents, which are

required to be made, till the consignment is presented to the customs

department for clearance.

The following documents can, therefore, be treated as pre-shipment

documents:

Proforma Invoice

Confirmed order or contract

Letter of Credit

Pre-shipment Inspection Certificate

Packing list

Shipping Bill

Export Declaration Forms (GR/SDF)

ARE

3. POST-SHIPMENT DOCUMENTS

Documents at Post-shipment stage are naturally those which are prepared

after the shipment.

These documents include the following:-

Mate Receipt

Bill of Lading

Airway Bill

Roadway/Railway Bill

Post Parcel/ Courier Receipt

Invoices (including consular invoice)

Certificate of Origin

Insurance Certificate or Policy

Bill of Exchange

Page | 9

IMPORT DOCUMENTATION:

Invoice

Packing list

Bill of Lading or Delivery Order/Airway Bill

GATT declaration form duly filled in

Importers/CHAs declaration

Licence/Authorizations in original wherever necessary

Letter of Credit/Bank Draft/wherever necessary

Insurance document

Import license

Industrial License, if required

Test report in case of chemicals

Catalogue, Technical write up, Literature in case of machineries, spares or

chemicals as may be applicable

Separately split up value of spares, components, machineries

Certificate of Origin, if preferential rate of duty is claimed under PTAs/FTAs

etc.

No Commission declaration

Page | 10

UNDERSTANDING THE DOCUMENTS:

1. Proforma Invoice

The starting point of the export contract is in the form of offer made by the

exporter to the foreign customer. The offer made by the exporter is in the form

of a proforma invoice. It is a quotation given as a reply to an inquiry. It normally

forms the basis of all trade transactions.

SAMPLE:

Page | 11

2. Commercial Invoice:

Commercial invoice is an important and basic export document. It is also known

as a 'Document of Contents' as it contains all the information required for the

preparation of other documents. It is actually a seller's bill of merchandise. It is

prepared by the exporter after the execution of export order giving details about

the goods shipped. It is essential that the invoice is prepared in the name of the

buyer or the consignee mentioned in the letter of credit. It is a prima facie

evidence of the contract of sale or purchase and therefore, must be prepared

strictly in accordance with the contract of sale.

Page | 12

3. Packing List:

It is a consolidated statement in a prescribed format detailing how goods are

packed, marked and numbered including weight and dimensions of each

package. It is useful for customs at the time of examination and warehouse

keeper of buyer to maintain inventory record and to effect delivery.

Page | 13

4. Certificate of Origin:

The importers in several countries require a certificate of origin without which

clearance to import is refused. The certificate of origin states that the goods

exported are originally manufactured in the country whose name is mentioned in

the certificate. Certificate of origin is required when:-

The goods produced in a particular country are subject to preferential tariff

rates in the foreign market at the time importation.

The goods produced in a particular country are banned for import in the

foreign market.

5. Shipping Bill:

Shipping Bill is the principal document required by the customs authorities. It

contains description of export goods and other particulars like number and

description of package(s), marks and number, quantity and value as defined in

the Sea Customs Act, Indian or foreign merchandise, name of the vessel in which

goods are to be shipped, country of destination, etc. It is only after the Shipping

Bill, is stamped by the customs that cargo is allowed to be carted to Port sheds

and Docks. It is used for export by sea or air or even for transportation from one

port to another within the country.

There are separate forms of shipping bill for free goods (Free Shipping Bill),

goods on which export duty is payable (Dutiable Shipping Bill), goods for which

there is a claim for drawback of duty (Drawback Shipping Bill) and in case of

imported goods for re-export which are kept in custom bonded warehouses

(Shipping Bill for Shipment ex-bond).

Page | 14

Types of Shipping Bill

Based on the incentives offered by the government, customs authorities have

introduced three types of shipping bills:-

Drawback Shipping Bill: - Drawback shipping bill is useful for claiming the

customs drawback against goods exported.

Dutiable Shipping Bill: - Dutiable shipping bill is required for goods which

are subject to export duty.

Duty-free Shipping Bill: - Duty-free shipping bill is useful for exporting

goods on which there is no export duty.

Page | 15

6. Mates Receipt

When the cargo is loaded on the ship, the Commanding Officer of the ship will

issue a receipt called the

`

Mate Receipt'. This includes information about the

name of the vessel, berth, date of shipment, description of packages, marks and

numbers, condition of the cargo at the time of receipt on board the ship etc. The

mate receipt is first handed over to the port authorities for payment of port dues

and then to the shipping company for obtaining the Bill of Lading.

7. Airway Bill

An airway bill, also called an air consignment note, is a receipt issued by an

airline for the carriage of goods. As each shipping company has its own bill of

lading, so each airline has its own airway bill. Airway Bill or Air Consignment Note

is not treated as a document of title and is not issued in negotiable form.

8. Form GR

It is an exchange control document which is to be submitted to the Reserve Bank

of India after clearance from the Customs Authorities. It is designed mainly to

furnish guarantee to the Reserve Bank of India to remit the foreign exchange

earned from the export shipment within 180 days from the date of exports.

9. PP Form

It is also an exchange control document. It is used in place of form GR when

goods are exported by post parcel.

Page | 16

10. Bill of exchange

The instrument is used in receiving payment from the importer. The importer

may prefer bill of exchange to LC as it does not involve blocking of funds. A bill

of exchange is drawn by the exporter on the importer, to make payment on

demand at sight or after a certain period of time.

B/E is a means to collect payment.

B/E is a means to demand payment.

B/E is a means to extent the credit.

B/E is a means to promise the payment.

B/E is an official acknowledgement of receipt of payment.

Financial documents perform the function of obtaining the finance

collection of payment etc.

2 sets. Each one bearing the exclusion clause making the other part of the

draft invalid.

Sight B/E.

It is known as draft.

Immediate payment Sight draft.

There are two copies of draft. Each one bears reference to the other part

A&B. when any one of the draft is paid, the second draft becomes null and

void.

Parties to bill of exchange:

1. The drawer: The exporter / person who draws the bill.

2. The drawee: The importer / person on whom the bill is drawn for

payment.

3. The payee: The person to whom payment is made, generally, the exporter

/ supplier of the goods.

Page | 17

11. Marine Insurance Policy

Goods in transit are subject to risks of loss of goods arising due to fire on the

ship, perils of sea, thefts etc. Marine insurance protects losses incidental to

voyages and in land transportation.

Marine Insurance Policy is one of the most important document used as

collateral security because it protects the interest of all those who have insurable

interest at the time of loss. The exporter is bound to insure the goods in case of

CIF quotation, but he can also insure the goods in case of FOB contract, at the

request of the importer, but the premium payment will be made by the exporter.

12. Insurance Certificate

On receipt of these documents the Export Department makes an application to

the Insurance Company for marine insurance cover and requests them to issue

an insurance policy/certificate in duplicate with appropriate risk coverage.

13. Health Certificate

It is required for export of food products, seeds, animal meat products etc. This

certificate is issued by the health Department of the exporting country certifying

that these items are free from infection and contamination.

14. Bill of Lading

The bill of lading is a document issued by the shipping company or its agent

acknowledging the receipt of goods on board the vessel, and undertaking to

deliver the goods in the like order and condition as received, to the consignee or

his order, provided the freight and other charges as specified in the bill have

been duly paid. It is also a document of title to the goods and as such, is freely

transferable by endorsement and delivery.

Page | 18

Bill of Lading serves three main purposes:

As a document of title to the goods;

As a receipt from the shipping company; and

As a contract for the transportation of goods.

Types of Bill of Lading

Clean Bill of Lading: - A bill of lading acknowledging receipt of the goods

apparently in good order and condition and without any qualification is

termed as a clean bill of lading.

Claused Bill of Lading: - A bill of lading qualified with certain adversere

marks such as, "goods insufficiently packed in accordance with the

Carriage of Goods by Sea Act," is termed as a claused bill of lading.

Transshipment or Through Bill of Lading: - When the carrier uses other

transport facilities, such as rail, road, or another steamship company in

addition to his own, the carrier issues a through or transshipment bill of

lading.

Stale Bill of Lading: - A bill of lading that has been held too long before it

is passed on to a bank for negotiation or to the consignee is called a stale

bill of lading.

Freight Paid Bill of Lading: - When freight is paid at the time of shipment

or in advance, the bill of landing is marked, freight paid. Such bill of lading

is known as freight bill of lading.

Freight Collect Bill of lading :- When the freight is not paid and is to be

collected from the consignee on the arrival of the goods, the bill of lading

is marked, freight collect and is known as freight collect bill of lading

Page | 19

Page | 20

15. Certificate of Inspection

This certificate certifies that goods being exported are export worthy. It is issued

by inspection authorities in the country of the exporter. The certificate states

that the goods have been inspected under the recognized quality control

standards and satisfies the specifications provided under quality control and

inspection.

If need arises, the importer can demand a Certificate of Inspection from his own

designated inspection agency located in exporter's country. Certificate of

Inspection is a negotiable document sent to importer by the exporter through his

bank.

16. Certificate of Measurement

There are two ways how freight can be charged i.e. on the basis of weight or

measurement. When freight is charged on the basis of weight, the weight

declared by the exporter is accepted. However, the exporter can obtain

certificate of measurement either from the Indian Chamber of Commerce or any

other approved organisation and submit it to the shipping company for

calculation of applicable freight.

The certificate contains details like name of the vessel, port of destination,

description of goods, length, breadth, quantity, depth, etc. of the packages.

Page | 21

Page | 22

17. Freight Declaration

When the importer agrees to the freight or the overseas supplier pays the

freight; in both the cases freight declaration is needed from the overseas

supplier.

18. Fumigation Certificate

In order to ensure safety against spread of harmful virus importers insist on

fumigation certificate where the cargo includes plants and weeds. Unless this

certificate is provided the cargo will not be allowed to enter into their countries.

The exporter is responsible to carry out fumigation and also obtain a certificate

from the prescribed agency. Serious complications will arise in the absence of

this certificate. Importers insist on getting this certificate from the exporters.

This certificate will enable importers easy clearance of goods.

Page | 23

Page | 24

REFERENCES

1. http://kalyan-city.blogspot.com/2011/03/documents-in-foreign-trade-

transactions.html

2.http://www.google.co.in/url?sa=t&rct=j&q=import%20export%20documentati

on&source=web&cd=2&cad=rja&sqi=2&ved=0CDQQFjAB&url=http%3A%2F%2F

www.egyankosh.ac.in%2Fbitstream%2F123456789%2F35466%2F1%2FUnit-

8.pdf&ei=V1g9UY6AEsL9rAfQ84DgCA&usg=AFQjCNGoHPMn1VERRPRdTnORD8T

a-llSKg

3. http://www.nfpl.net/pdf/procedure%20for%20import%20and%20export.pdf

4. http://www.managementstudyguide.com/imports-documentation-in-

customs-clearance.htm

Vous aimerez peut-être aussi

- Export-Import DocumentationDocument34 pagesExport-Import DocumentationSiddharth OjahPas encore d'évaluation

- Export Import DoccumentationDocument25 pagesExport Import DoccumentationErik Treasuryvala0% (1)

- Exim DocumentsDocument24 pagesExim DocumentsPraveen KumarPas encore d'évaluation

- ADS & Export DocumentsDocument102 pagesADS & Export Documentsamit1002001Pas encore d'évaluation

- Documentation in Export Import BusinessDocument25 pagesDocumentation in Export Import BusinessBhupesh Roy100% (1)

- Export DocumentationDocument21 pagesExport DocumentationIndrani ThotaPas encore d'évaluation

- Export-Import Documentation Aditya Kapoor PDFDocument8 pagesExport-Import Documentation Aditya Kapoor PDFPradeepPas encore d'évaluation

- Letter of Credit (Fob)Document40 pagesLetter of Credit (Fob)Priya ShahPas encore d'évaluation

- Documents Used in Foreign Trade TransactionsDocument7 pagesDocuments Used in Foreign Trade TransactionskshobanaPas encore d'évaluation

- Exim DocumentationDocument25 pagesExim DocumentationKARCHISANJANAPas encore d'évaluation

- Export Import DocumentationDocument159 pagesExport Import DocumentationMohak NihalaniPas encore d'évaluation

- Aligned documentation system presentation transcriptDocument6 pagesAligned documentation system presentation transcriptAvinash ShuklaPas encore d'évaluation

- Import Export DocumentsDocument32 pagesImport Export DocumentsPriya Shah100% (1)

- Sale and Purchase AgreementDocument9 pagesSale and Purchase AgreementDipendu SarkarPas encore d'évaluation

- Air Export CustomsDocument7 pagesAir Export CustomsDivyabhan SinghPas encore d'évaluation

- Customs Clearance Process Guide - Sea CollectorateDocument16 pagesCustoms Clearance Process Guide - Sea CollectorateZariq ShahPas encore d'évaluation

- DRAFT CONTRACT - SugarIC45Document15 pagesDRAFT CONTRACT - SugarIC45Ricardo Flores CampolloPas encore d'évaluation

- Soft Corporate Offer Rev 1 - PDF - Barrel (Unit) - SalesDocument7 pagesSoft Corporate Offer Rev 1 - PDF - Barrel (Unit) - SalesTHREE EARTH COMPANYPas encore d'évaluation

- White Sugar ICUMSA 45: Commercial Services SarlDocument6 pagesWhite Sugar ICUMSA 45: Commercial Services SarlChandan Jst100% (1)

- Import Documentation Requirement For Customs ClearanceDocument3 pagesImport Documentation Requirement For Customs ClearanceanuboraPas encore d'évaluation

- Spa Cif DubaiDocument7 pagesSpa Cif DubaiJacob UnionPas encore d'évaluation

- Matt Advance Sales Purchase ContractDocument6 pagesMatt Advance Sales Purchase ContractAnil Kumar SinghPas encore d'évaluation

- International Trade ContractDocument4 pagesInternational Trade ContractLharmie AmodiaPas encore d'évaluation

- Irrevocable Corporate Purchase Order (Icpo/Loi) For: Contract 12 MonthsDocument4 pagesIrrevocable Corporate Purchase Order (Icpo/Loi) For: Contract 12 MonthsjungPas encore d'évaluation

- Icpo TDLDocument2 pagesIcpo TDLMustolih MusPas encore d'évaluation

- FCODocument3 pagesFCObuoncaPas encore d'évaluation

- Terms of Business: For Market Maker Types of Accounts (Standard, Micro, Pamm Standard)Document8 pagesTerms of Business: For Market Maker Types of Accounts (Standard, Micro, Pamm Standard)Badril AminPas encore d'évaluation

- Buyer-Seller Bank Guarantee ContractDocument21 pagesBuyer-Seller Bank Guarantee ContractCharles Deneen100% (1)

- 100KG FcoDocument1 page100KG FcopraneethreddyPas encore d'évaluation

- Procedure For Clearance of Export GoodsDocument11 pagesProcedure For Clearance of Export GoodssahuanPas encore d'évaluation

- Dubai Draft SPA Amended 1 Feb 2023Document10 pagesDubai Draft SPA Amended 1 Feb 2023kenga Gildas BahinezaPas encore d'évaluation

- Sale and Purchase Agreement SanitizedDocument16 pagesSale and Purchase Agreement SanitizedChantal Sue Paler100% (1)

- Non-Circumvention, Non-Disclosure & Working Agreement (Ncnda) Irrevocable Master Fee Protection Agreement (Imfpa)Document8 pagesNon-Circumvention, Non-Disclosure & Working Agreement (Ncnda) Irrevocable Master Fee Protection Agreement (Imfpa)A.GOKHAN KEBAPCIOGLUPas encore d'évaluation

- Our Gold FcoDocument3 pagesOur Gold FcoFarhan Ashraf100% (1)

- Sample of Export ContractDocument8 pagesSample of Export ContractGabriel GintaganPas encore d'évaluation

- Draft Ncnda & ImfpaDocument9 pagesDraft Ncnda & ImfpaSELO ADIPas encore d'évaluation

- Sales Contract October 2008Document4 pagesSales Contract October 2008api-19504618100% (1)

- 6 Spa GoldDocument9 pages6 Spa Golddeenlove9Pas encore d'évaluation

- 100 Kilograms Spot - 011814Document7 pages100 Kilograms Spot - 011814Jojo Aboyme CorcillesPas encore d'évaluation

- A # 1561 # - Kar - Gold Bullion Bars Sco - BG or SBLC (3) .Doc - .DoDocument6 pagesA # 1561 # - Kar - Gold Bullion Bars Sco - BG or SBLC (3) .Doc - .DoJOHN PATRICK BERNARDINOPas encore d'évaluation

- Export Contract - FinalDocument4 pagesExport Contract - FinalAnonymous GAulxiI100% (1)

- Soft Offer Oil Soja y Girasol-Jun10Document4 pagesSoft Offer Oil Soja y Girasol-Jun10davidarcosfuentesPas encore d'évaluation

- Sales Contract BangladeshDocument6 pagesSales Contract Bangladeshnatasha catteryPas encore d'évaluation

- Paranjothi Trading Offers Bulk Sugar DealsDocument7 pagesParanjothi Trading Offers Bulk Sugar Dealslee kok onnPas encore d'évaluation

- SPA Dip and PayDocument10 pagesSPA Dip and PayKhristine B.Pas encore d'évaluation

- Sale Contract For PaperDocument2 pagesSale Contract For PaperAlex Akvino100% (1)

- Wa0016Document6 pagesWa0016trustcompanyPas encore d'évaluation

- SALE CHICKEN - BK - JMSL-FCL 'Document9 pagesSALE CHICKEN - BK - JMSL-FCL 'Bhagoo HatheyPas encore d'évaluation

- Full Corporate Offer: PrincipalDocument3 pagesFull Corporate Offer: PrincipalGrigory Vladimirovich TishkinPas encore d'évaluation

- New Fco Sept - Dec 2019Document38 pagesNew Fco Sept - Dec 2019nurashenergy100% (2)

- International Chamber of Commerce Agreement for Metal Ore TradeDocument21 pagesInternational Chamber of Commerce Agreement for Metal Ore TradeRonald Rene Ruiz RodriguezPas encore d'évaluation

- Eren LTD.,: Sales ContractDocument6 pagesEren LTD.,: Sales Contractatahan şenakarPas encore d'évaluation

- Full Corporate Offer I-2-1Document4 pagesFull Corporate Offer I-2-1Cesar Barreto100% (1)

- IMPORT and EXPORT Business Process OrgDocument10 pagesIMPORT and EXPORT Business Process OrgmuralimohanPas encore d'évaluation

- New مستند Microsoft WordDocument4 pagesNew مستند Microsoft WordMohammed Abuhyder100% (1)

- Soft Offer Soybean Oil-May10Document3 pagesSoft Offer Soybean Oil-May10davidarcosfuentesPas encore d'évaluation

- Sample of International Sale ContractDocument7 pagesSample of International Sale ContractAngelnolas100% (1)

- Screenshot 2023-08-22 at 2.51.48 PMDocument3 pagesScreenshot 2023-08-22 at 2.51.48 PMWebster FrancoisePas encore d'évaluation

- Potential Exports and Nontariff Barriers to Trade: Nepal National StudyD'EverandPotential Exports and Nontariff Barriers to Trade: Nepal National StudyPas encore d'évaluation

- Export Documentation GuideDocument10 pagesExport Documentation GuideNick NikhilPas encore d'évaluation

- Six Sigma Explained!Document33 pagesSix Sigma Explained!Nimesh ShahPas encore d'évaluation

- Role of Cooperative On Rural MarketsDocument25 pagesRole of Cooperative On Rural MarketsNimesh ShahPas encore d'évaluation

- Right To Information (RTI)Document25 pagesRight To Information (RTI)Nimesh Shah100% (1)

- Import Procedure Explained!Document35 pagesImport Procedure Explained!Nimesh ShahPas encore d'évaluation

- Criminal Liability On Dud Cheques & Dishonor of ChequesDocument12 pagesCriminal Liability On Dud Cheques & Dishonor of ChequesNimesh ShahPas encore d'évaluation

- QualityDocument18 pagesQualityNimesh ShahPas encore d'évaluation

- Impact of Poor Maintenance!Document16 pagesImpact of Poor Maintenance!Nimesh Shah100% (1)

- Introduction, Example, Types, Provisions, Causes, Impact, Current Situation & ConclusionDocument14 pagesIntroduction, Example, Types, Provisions, Causes, Impact, Current Situation & ConclusionNimesh ShahPas encore d'évaluation

- Non Banking Financial InstitutionsDocument18 pagesNon Banking Financial InstitutionsNimesh Shah100% (1)

- Online Shopping TrendsDocument88 pagesOnline Shopping TrendsNimesh ShahPas encore d'évaluation

- College of Nursing: Assignment ON Nursing ClinicDocument5 pagesCollege of Nursing: Assignment ON Nursing ClinicPriyaPas encore d'évaluation

- WozairDocument4 pagesWozairRajakumar Bajji SubburamanPas encore d'évaluation

- Reservoir Engineering Handbook Tarek Ahmed Solution ManualDocument36 pagesReservoir Engineering Handbook Tarek Ahmed Solution ManualMohamad Hasen japerPas encore d'évaluation

- Casa Cook ArvindDocument65 pagesCasa Cook ArvindLEAN MauritiusPas encore d'évaluation

- Case CX210B Mine Crawler Excavator Tier 3 Parts Manual PDFDocument701 pagesCase CX210B Mine Crawler Excavator Tier 3 Parts Manual PDFJorge Martinez100% (3)

- FM200 Clean Agent System Installation GuideDocument6 pagesFM200 Clean Agent System Installation Guidehazro lizwan halimPas encore d'évaluation

- Feasibility Analysis of ORC Systems for Flexible DesignDocument227 pagesFeasibility Analysis of ORC Systems for Flexible DesignAwais SalmanPas encore d'évaluation

- Design and Analysis of Interleaved Boost Converter for Increased Renewable Energy OutputDocument18 pagesDesign and Analysis of Interleaved Boost Converter for Increased Renewable Energy OutputHarshitPas encore d'évaluation

- Porphyria's Lover - Robert BrowningDocument9 pagesPorphyria's Lover - Robert Browningdearkatie6688Pas encore d'évaluation

- AREADocument10 pagesAREAhaipm1979Pas encore d'évaluation

- Alfa Laval Energy Balance Casestory enDocument2 pagesAlfa Laval Energy Balance Casestory enHélder FernandoPas encore d'évaluation

- Interaction of Radiation With Matter: Dhruba GuptaDocument36 pagesInteraction of Radiation With Matter: Dhruba GuptaHala SweetPas encore d'évaluation

- DLP Science Week 6 Day 5Document3 pagesDLP Science Week 6 Day 5John Carlo DinglasanPas encore d'évaluation

- Heidegger On Destruction - Chung ChinDocument16 pagesHeidegger On Destruction - Chung ChinAprilo DielovaPas encore d'évaluation

- Operation Manual: Impedance Audiometer AT235hDocument102 pagesOperation Manual: Impedance Audiometer AT235hmendezoswaldoPas encore d'évaluation

- MSE Admission and Degree RequirementsDocument6 pagesMSE Admission and Degree Requirementsdeathbuddy_87Pas encore d'évaluation

- Week 2 - Risk AssessmentDocument35 pagesWeek 2 - Risk AssessmentTahir BashirPas encore d'évaluation

- Turbofarmer P 34.7: AustraliaDocument2 pagesTurbofarmer P 34.7: AustraliaDenis OhmakPas encore d'évaluation

- Co2 OrderDocument2 pagesCo2 OrderRamakant PatelPas encore d'évaluation

- IRELAND - Rivers, Lakes and Mountains: Look at The Maps and Answer These QuestionsDocument2 pagesIRELAND - Rivers, Lakes and Mountains: Look at The Maps and Answer These QuestionsHannaPas encore d'évaluation

- Naval Noise Psycho-Acoustic Backpropagation NNDocument12 pagesNaval Noise Psycho-Acoustic Backpropagation NNSilvia FlorentinaPas encore d'évaluation

- W2AEW Videos (Apr 29, 2017) Topics Listed NumericallyDocument12 pagesW2AEW Videos (Apr 29, 2017) Topics Listed Numericallyamol1agarwalPas encore d'évaluation

- Barrett Firearms - REC10 - Operators Manual 8.5x5.5 ALL REVB 17278Document22 pagesBarrett Firearms - REC10 - Operators Manual 8.5x5.5 ALL REVB 17278Ricardo C TorresPas encore d'évaluation

- Crusher Type Part Number Description Weight (KG)Document3 pagesCrusher Type Part Number Description Weight (KG)Juvenal CorreiaPas encore d'évaluation

- LRV Reference TableDocument6 pagesLRV Reference TableVaishnavi JayakumarPas encore d'évaluation

- Sea Cucumber PDFDocument171 pagesSea Cucumber PDFRebeccaSulivanPas encore d'évaluation

- Technical Manual: Package Air Conditioner Rooftop - Cooling Only (50Hz)Document56 pagesTechnical Manual: Package Air Conditioner Rooftop - Cooling Only (50Hz)Im Chinith100% (1)

- MP Birla Group: Training MatrixDocument3 pagesMP Birla Group: Training MatrixAprilia kusumaPas encore d'évaluation

- Countable UncountableDocument4 pagesCountable UncountablePaoLo Mena la TorrePas encore d'évaluation

- Modul Cemerlang Matematik JPN Kedah 2016 PDFDocument102 pagesModul Cemerlang Matematik JPN Kedah 2016 PDFAnna ZubirPas encore d'évaluation