Académique Documents

Professionnel Documents

Culture Documents

RCBC Vs Arro

Transféré par

Fritz Jared P. Afable0 évaluation0% ont trouvé ce document utile (0 vote)

103 vues1 pageResidoro Chua and Enrique Go executed a comprehensive surety agreement guaranteeing any existing or future debts of Davao Agricultural Industries Corporation (Daicor) up to Php100,000 to Rizal Commercial Banking Corporation (RCBC). Daicor issued a promissory note for Php100,000 to RCBC signed by Go on behalf of Daicor. When the note was unpaid, RCBC sued Daicor, Go, and Chua. Chua claimed no liability as he did not sign the note. The court dismissed the case against Chua. RCBC appealed arguing the surety agreement covered this debt. The Supreme Court ruled Chua could be held liable under the surety

Description originale:

digest

Titre original

RCBC vs Arro

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentResidoro Chua and Enrique Go executed a comprehensive surety agreement guaranteeing any existing or future debts of Davao Agricultural Industries Corporation (Daicor) up to Php100,000 to Rizal Commercial Banking Corporation (RCBC). Daicor issued a promissory note for Php100,000 to RCBC signed by Go on behalf of Daicor. When the note was unpaid, RCBC sued Daicor, Go, and Chua. Chua claimed no liability as he did not sign the note. The court dismissed the case against Chua. RCBC appealed arguing the surety agreement covered this debt. The Supreme Court ruled Chua could be held liable under the surety

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

103 vues1 pageRCBC Vs Arro

Transféré par

Fritz Jared P. AfableResidoro Chua and Enrique Go executed a comprehensive surety agreement guaranteeing any existing or future debts of Davao Agricultural Industries Corporation (Daicor) up to Php100,000 to Rizal Commercial Banking Corporation (RCBC). Daicor issued a promissory note for Php100,000 to RCBC signed by Go on behalf of Daicor. When the note was unpaid, RCBC sued Daicor, Go, and Chua. Chua claimed no liability as he did not sign the note. The court dismissed the case against Chua. RCBC appealed arguing the surety agreement covered this debt. The Supreme Court ruled Chua could be held liable under the surety

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

B2013

Credit Transactions| Atty. Vasquez

1

Rizal Commercial Banking Corp. vs. Arro

Rizal Commercial Banking Corporation, petitioner, vs. Hon. Jose P. Arro, Judge of the Court of First Instance of

Davao, and Residoro Chua, respondents.

Date: 31 July 1982

Ponente: De Castro, J.

Facts:

Private respondent Residoro Chua, with Enrique Go, Sr., executed a comprehensive surety agreement to

guaranty, above all, any existing or future indebtedness of Davao Agricultural Industries Corporation

(Daicor), and/or induce the bank at any time or from time to time to make loans or advances or to extend

credit to said Daicor, provided that the liability shall not exceed ay any time Php100,000.00.

A promissory note for Php100,000.00 (for additional capital to the charcoal buy and sell and the activated

carbon importation business) was issued in favor of petitioner RCBC payable a month after execution. This

was signed by Go in his personal capacity and in behalf of Daicor. Respondent Chua did not sign in said

promissory note.

As the note was not paid despite demands, RCBC filed a complaint for a sum of money against Daicor, Go

and Chua.

The complaint against Chua was dismissed upon his motion, alleging that the complaint states no cause of

action against him as he was not a signatory to the note and hence he cannot be held liable. This was so

despite RCBCs opposition, invoking the comprehensive surety agreement which it holds to cover not just

the note in question but also every other indebtedness that Daicor may incur from petitioner bank.

RCBC moved for reconsideration of the dismissal but to no avail. Hence, this petition.

Issue: WON respondent Chua may be held liable with Go and Daicor under the promissory note, even if he was not

a signatory to it, in light of the provisions of the comprehensive surety agreement wherein he bound himself

with Go and Daicor, as solidary debtors, to pay existing and future debts of said corporation.

Held: Yes, he may be held liable. Order dismissing the complaint against respondent Chua reversed and set aside.

Case remanded to court of origin with instruction to set aside motion to dismiss and to require defendant

Chua to answer the complaint.

Ratio:

The comprehensive surety agreement executed by Chua and Go, as president and general manager,

respectively, of Daicor, was to cover existing as well as future obligations which Daicor may incur with

RCBC. This was only subject to the proviso that their liability shall not exceed at any one time the

aggregate principal amount of Php100,000.00. (Par.1 of said agreement).

The agreement was executed to induce petitioner Bank to grant any application for a loan Daicor would

request for. According to said agreement, the guaranty is continuing and shall remain in full force or effect

until the bank is notified of its termination.

During the time the loan under the promissory note was incurred, the agreement was still in full force and

effect and is thus covered by the latter agreement. Thus, even if Chua did not sign the promissory note,

he is still liable by virtue of the surety agreement. The only condition necessary for him to be liable under

the agreement was that Daicor is or may become liable as maker, endorser, acceptor or otherwise.

The comprehensive surety agreement signed by Go and Chua was as an accessory obligation dependent

upon the principal obligation, i.e., the loan obtained by Daicor as evidenced by the promissory note.

The surety agreement unequivocally shows that it was executed to guarantee future debts that may be

incurred by Daicor with petitioner, as allowed under NCC Art.2053: A guaranty may also be given as

security for future debts, the amount of which is not yet known; there can be no claim against the

guarantor until the debt is liquidated. A conditional obligation may also be secured.

Vous aimerez peut-être aussi

- RCBC VS ArroDocument1 pageRCBC VS ArroLorelie Sakiwat VargasPas encore d'évaluation

- Central Bank v. MorfeDocument8 pagesCentral Bank v. MorfeKristineSherikaChyPas encore d'évaluation

- HSBC V PB TrustDocument3 pagesHSBC V PB Trustrgtan3Pas encore d'évaluation

- Col Francisco Dela Merced Vs Gsis and Spouses ManlongatDocument2 pagesCol Francisco Dela Merced Vs Gsis and Spouses ManlongatFrancis Coronel Jr.100% (1)

- People V PadlanDocument11 pagesPeople V PadlanCamella AgatepPas encore d'évaluation

- Corazon Nevada Vs Atty Rodolfo Casuga Case DigestDocument1 pageCorazon Nevada Vs Atty Rodolfo Casuga Case DigestDhin CaragPas encore d'évaluation

- PICOP Resources Inc Vs TanecaDocument2 pagesPICOP Resources Inc Vs TanecaKathlyn DacudaoPas encore d'évaluation

- Oscar VillamariaDocument12 pagesOscar VillamariaJess SerranoPas encore d'évaluation

- RUBY v. CADocument4 pagesRUBY v. CAchappy_leigh118Pas encore d'évaluation

- Cristobal vs. Court of AppealsDocument1 pageCristobal vs. Court of AppealsDeniel Salvador B. MorilloPas encore d'évaluation

- 1957-Umbao - v. - Yap (GR L-8933)Document4 pages1957-Umbao - v. - Yap (GR L-8933)Bogart CalderonPas encore d'évaluation

- Machetti Vs HospicioDocument1 pageMachetti Vs HospicioWally CalaganPas encore d'évaluation

- (CD) 01. Tanglao Vs ParungaoDocument2 pages(CD) 01. Tanglao Vs ParungaoNicole ClianoPas encore d'évaluation

- SEC v. Merchant Capital, LLC, 11th Cir. (2009)Document5 pagesSEC v. Merchant Capital, LLC, 11th Cir. (2009)Scribd Government DocsPas encore d'évaluation

- Pantaleon Vs American Express InternationalDocument3 pagesPantaleon Vs American Express InternationalJia VillarinPas encore d'évaluation

- Consolidated Cases in LaborDocument68 pagesConsolidated Cases in LaborATTYSMDGPas encore d'évaluation

- Yu Bun Guan V OngDocument1 pageYu Bun Guan V OngDan LocsinPas encore d'évaluation

- Digest 5 Universal International Investment V Ray Burton DevDocument2 pagesDigest 5 Universal International Investment V Ray Burton DevMarjorie ThunderPas encore d'évaluation

- CredTrans - Southern Motors V Barbosa - VilloncoDocument2 pagesCredTrans - Southern Motors V Barbosa - VilloncoCHEENSPas encore d'évaluation

- Sales 101Document8 pagesSales 101Ma. Goretti Jica GulaPas encore d'évaluation

- PNB v. Heirs of Militar - Buyer in Good Faith Prove Ocular Inspect If Lot Is in Possession of Someone Other Than The VendorDocument11 pagesPNB v. Heirs of Militar - Buyer in Good Faith Prove Ocular Inspect If Lot Is in Possession of Someone Other Than The VendorSarah Jane-Shae O. SemblantePas encore d'évaluation

- Padilla vs. CA PDFDocument10 pagesPadilla vs. CA PDFD MonioPas encore d'évaluation

- 16mam Vs NLRCDocument2 pages16mam Vs NLRCjohn ryan anatanPas encore d'évaluation

- Saldana vs. Phil. GuarantyDocument1 pageSaldana vs. Phil. GuarantyKeilah ArguellesPas encore d'évaluation

- SONEDCO Workers Free Labor Union v. URCDocument2 pagesSONEDCO Workers Free Labor Union v. URCEm-em CantosPas encore d'évaluation

- 2.1 Ermita-Malate Hotel and Motel Operators Association, Inc. vs. City Mayor of ManilaDocument1 page2.1 Ermita-Malate Hotel and Motel Operators Association, Inc. vs. City Mayor of ManilaBelen Aliten Sta MariaPas encore d'évaluation

- De La Paz Vs L & J DevelopmentDocument3 pagesDe La Paz Vs L & J DevelopmentMary Louisse RulonaPas encore d'évaluation

- Ilano vs. Español 2Document3 pagesIlano vs. Español 2Emmelie DemafilesPas encore d'évaluation

- Labor Relations Reviewer Elah V. Definitions: Duty To Bargain CollectivelyDocument12 pagesLabor Relations Reviewer Elah V. Definitions: Duty To Bargain CollectivelyKris GaoatPas encore d'évaluation

- Producers Bank of The Philippines V CA Digest 2Document2 pagesProducers Bank of The Philippines V CA Digest 2Angel UrbanoPas encore d'évaluation

- Manuel Vs NC Construction SupplyDocument5 pagesManuel Vs NC Construction SupplyRowela DescallarPas encore d'évaluation

- 01 Lim V SabanDocument2 pages01 Lim V SabannayowmeePas encore d'évaluation

- Firestone v. CADocument2 pagesFirestone v. CAKaren Ryl Lozada BritoPas encore d'évaluation

- Insular Investment & Trust Corp. V Capital One Equities Corp & PlantersDocument27 pagesInsular Investment & Trust Corp. V Capital One Equities Corp & PlantersMicah Clark-MalinaoPas encore d'évaluation

- Case # 4 and # 5 DoctrinesDocument5 pagesCase # 4 and # 5 DoctrinesMike HamedPas encore d'évaluation

- Colegio de San Juan de Letran V Association of Employees and Faculty of LetranDocument8 pagesColegio de San Juan de Letran V Association of Employees and Faculty of LetranNneka VillacortaPas encore d'évaluation

- Labor Cases SCRADocument240 pagesLabor Cases SCRAKrizPas encore d'évaluation

- Tomas Ang vs. Associated BankDocument2 pagesTomas Ang vs. Associated BankRoche DalePas encore d'évaluation

- People vs. Marcelo GR No. 181541Document7 pagesPeople vs. Marcelo GR No. 181541Suri LeePas encore d'évaluation

- Que Vs People 154 SCRA 160Document1 pageQue Vs People 154 SCRA 160Kat JolejolePas encore d'évaluation

- CHAN WAN, Plaintiff-Appellant, vs. TAN KIM and CHEN SO, Defendants-AppelleesDocument3 pagesCHAN WAN, Plaintiff-Appellant, vs. TAN KIM and CHEN SO, Defendants-AppelleesJerry CanePas encore d'évaluation

- RCBC Vs BernardinoDocument13 pagesRCBC Vs BernardinoJasielle Leigh UlangkayaPas encore d'évaluation

- 16 BPI V RoyecaDocument3 pages16 BPI V RoyecarPas encore d'évaluation

- Republic vs. Court of Appeals - Docx GR No. L-61647Document10 pagesRepublic vs. Court of Appeals - Docx GR No. L-61647Friendship GoalPas encore d'évaluation

- Labor CaseDocument20 pagesLabor CaseAnonymous SBT3XU6IPas encore d'évaluation

- Home Bankers Savings Trust Co. v. CADocument12 pagesHome Bankers Savings Trust Co. v. CADessa ReyesPas encore d'évaluation

- The People of The Philippines vs. Claudio Bulaong and Fonso LAURECIO, G.R. No. L-37836: July 31, 1981, EN BANC (Aquino, J.)Document5 pagesThe People of The Philippines vs. Claudio Bulaong and Fonso LAURECIO, G.R. No. L-37836: July 31, 1981, EN BANC (Aquino, J.)Marshan GualbertoPas encore d'évaluation

- NAMARCO v. MarquezDocument2 pagesNAMARCO v. MarquezMikaela PamatmatPas encore d'évaluation

- Dean Virgilio Jara: Manotoc vs. Court of AppealsDocument3 pagesDean Virgilio Jara: Manotoc vs. Court of AppealsBenedict Jonathan BermudezPas encore d'évaluation

- Accomodation Party Case Digest MidtermDocument3 pagesAccomodation Party Case Digest Midtermmares100% (1)

- Vdocuments - MX - Cabo Vs Sandiganbayan Digestpdf PDFDocument4 pagesVdocuments - MX - Cabo Vs Sandiganbayan Digestpdf PDFAliPas encore d'évaluation

- Labor CasesDocument21 pagesLabor CasesAira AlyssaPas encore d'évaluation

- 9 DigestDocument2 pages9 DigestNaomi InotPas encore d'évaluation

- Laher v. LopezDocument7 pagesLaher v. LopezHayden Richard AllauiganPas encore d'évaluation

- REPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKDocument5 pagesREPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKZaira Gem GonzalesPas encore d'évaluation

- CD - 1. Dreamland vs. JohnsonDocument1 pageCD - 1. Dreamland vs. JohnsonAnonymous 3y1PFJsEthPas encore d'évaluation

- Floreindo v. MetrobankDocument1 pageFloreindo v. MetrobankSarah Jane UsopPas encore d'évaluation

- Heirs of Sofia Quirong Vs Development Bank of The Philippines - G.R. No 173441Document6 pagesHeirs of Sofia Quirong Vs Development Bank of The Philippines - G.R. No 173441Ivy VillalobosPas encore d'évaluation

- RCBC vs. ArroDocument1 pageRCBC vs. ArroAices SalvadorPas encore d'évaluation

- RCBC V ArroDocument2 pagesRCBC V Arronicole coPas encore d'évaluation

- Sayson vs. CADocument2 pagesSayson vs. CAFritz Jared P. AfablePas encore d'évaluation

- Legal Justice Reform Philippines 2017Document2 pagesLegal Justice Reform Philippines 2017Fritz Jared P. AfablePas encore d'évaluation

- 023 PCR enDocument40 pages023 PCR enFritz Jared P. AfablePas encore d'évaluation

- CBK POWER COMPANY LIMITED vs. COMMISSIONER OF INTERNAL REVENUEDocument3 pagesCBK POWER COMPANY LIMITED vs. COMMISSIONER OF INTERNAL REVENUEFritz Jared P. AfablePas encore d'évaluation

- Nicaragua V US ReservationsDocument9 pagesNicaragua V US ReservationsFritz Jared P. AfablePas encore d'évaluation

- Case DigestDocument15 pagesCase DigestFritz Jared P. AfablePas encore d'évaluation

- Wing On Company vs. Syyap CoDocument1 pageWing On Company vs. Syyap CoFritz Jared P. AfablePas encore d'évaluation

- Legal FormsDocument11 pagesLegal FormsFritz Jared P. Afable100% (1)

- Release Waiver and QuitclaimDocument3 pagesRelease Waiver and QuitclaimFritz Jared P. AfablePas encore d'évaluation

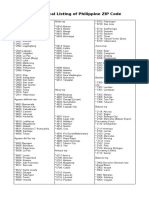

- Listing of Phil Zip CodesDocument9 pagesListing of Phil Zip CodesFritz Jared P. AfablePas encore d'évaluation

- Office of The Solicitor General For Petitioner. Pio Joven For RespondentDocument3 pagesOffice of The Solicitor General For Petitioner. Pio Joven For RespondentFritz Jared P. AfablePas encore d'évaluation

- Rule 58 - 59 Preliminary Injunction and Receivership Case DigestDocument10 pagesRule 58 - 59 Preliminary Injunction and Receivership Case DigestFritz Jared P. AfablePas encore d'évaluation

- GR No. L-61549Document3 pagesGR No. L-61549Fritz Jared P. AfablePas encore d'évaluation

- Consolidated Broadcasting System, Inc. Vs OberioDocument4 pagesConsolidated Broadcasting System, Inc. Vs OberioFritz Jared P. AfablePas encore d'évaluation

- Singer Sewing Machine Company Vs DrilonDocument4 pagesSinger Sewing Machine Company Vs DrilonFritz Jared P. AfablePas encore d'évaluation

- Supreme Court: The CaseDocument4 pagesSupreme Court: The CaseFritz Jared P. AfablePas encore d'évaluation