Académique Documents

Professionnel Documents

Culture Documents

Copyofleg 04

Transféré par

api-223035554Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Copyofleg 04

Transféré par

api-223035554Droits d'auteur :

Formats disponibles

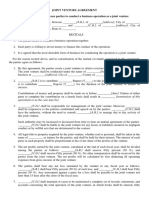

Partnership Agreement

THIS PARTNERSHIP AGREEMENT is made this __October____ day of __13_____, 2014, by and between

the following individuals:

Josh Roof

___________________________

Address: __________________________

City/State/ZIP:______________________

Tanner Murray

___________________________

Address: __________________________

City/State/ZIP:______________________

1. Nature of Business. The partners listed above hereby agree that they shall be considered partners in business

for the following purpose:

___________ To Create and Produce the best Gaming software__________________________

______________________________________________________________________________

2. Name. The partnership shall be conducted under the name of ___Star Gamerz Inc.______ and shall maintain

offices at Fort Worth Texas

3. Day-To-Day Operation. The partners shall provide their full-time services and best efforts on behalf of the

partnership. No partner shall receive a salary for services rendered to the partnership. Each partner shall have

equal rights to manage and control the partnership and its business. Should there be differences between the

partners concerning ordinary business matters, a decision shall be made by unanimous vote. It is understood that

the partners may elect one of the partners to conduct the day-to-day business of the partnership; however, no

partner shall be able to bind the partnership by act or contract to any liability exceeding $_10,000____ without the

prior written consent of each partner.

4. Capital Contribution. The capital contribution of each partner to the partnership shall consist of the following

property, services, or cash which each partner agrees to contribute:

Name Of Partner Capital

Contribution

Agreed-Upon Cash % Share

Josh Roof 10,000 5,000 50%

Tanner Murray 10,000 5,000 50%

The partnership shall maintain a capital account record for each partner; should any partners capital account fall

below the agreed to amount, then that partner shall (1) have his share of partnership profits then due and payable

applied instead to his capital account; and (2) pay any deficiency to the partnership if his share of partnership

profits is not yet due and payable or, if it is, his share is insufficient to cancel the deficiency.

5. Profits and Losses. The profits and losses of the partnership shall be divided by the partners according to a

mutually agreeable schedule and at the end of each calendar year according to the proportions listed above.

6. Term/Termination. The term of this Agreement shall be for a period of __5_ years, unless the partners

mutually agree in writing to a shorter period. Should the partnership be terminated by unanimous vote, the assets

and cash of the partnership shall be used to pay all creditors, with the remaining amounts to be distributed to the

partners according to their proportionate share.

7. Disputes. This Partnership Agreement shall be governed by the laws of the State of Texas. Any disputes

arising between the partners as a result of this Agreement shall be settled by arbitration in accordance with the

rules of the American Arbitration Association and judgment upon the award rendered may be entered in any court

having jurisdiction thereof.

8. Withdrawal/Death of Partner. In the event a partner withdraws or retires from the partnership for any reason,

including death, the remaining partners may continue to operate the partnership using the same name. A

withdrawing partner shall be obligated to give sixty (60) days prior written notice of his/her intention to

withdraw or retire and shall be obligated to sell his/her interest in the partnership. No partner shall transfer interest

in the partnership to any other party without the written consent of the remaining partner(s). The remaining

partner(s) shall pay the withdrawing or retiring partner, or to the legal representative of the deceased or disabled

partner, the value of his interest in the partnership, or (a) the sum of his capital account, (b) any unpaid loans due

him, (c) his proportionate share of accrued net profits remaining undistributed in his capital account, and (d) his

interest in any prior agreed appreciation in the value of the partnership property over its book value. No value for

good will shall be included in determining the value of the partners interest.

9. Non-Compete Agreement. A partner who retires or withdraws from the partnership shall not directly or

indirectly engage in a business which is or which would be competitive with the existing or then anticipated

business of the partnership for a period of __5 years____, in those _5 years___ of this State where the partnership

is currently doing or planning to do business.

IN WITNESS WHEREOF, the partners have duly executed this Agreement on the day and year set forth

hereinabove.

______Joshua

Roof__________ Partner

_______Tanner

Murray___________ Partner

Vous aimerez peut-être aussi

- General Partnership AgreementDocument5 pagesGeneral Partnership AgreementJay Smith100% (1)

- Draft Partnership AgreementDocument3 pagesDraft Partnership AgreementDuke SucgangPas encore d'évaluation

- Form No. 1 - Articles of Partnership General Partnership Philippines Legal FormDocument3 pagesForm No. 1 - Articles of Partnership General Partnership Philippines Legal Formgodbwdye3100% (1)

- Sample Partnership AgreementDocument11 pagesSample Partnership AgreementkahderbPas encore d'évaluation

- General Partnership Agreement: Page - ofDocument4 pagesGeneral Partnership Agreement: Page - ofPrinceston PuentaPas encore d'évaluation

- Template For Joint Venture AgreementDocument3 pagesTemplate For Joint Venture AgreementMohamed Shibley0% (1)

- Partnership Agreement PDFDocument4 pagesPartnership Agreement PDFNeon TasmanPas encore d'évaluation

- Sample Partnership AgreementDocument38 pagesSample Partnership AgreementAlex VolkovPas encore d'évaluation

- Loan Cancellation AgreementDocument1 pageLoan Cancellation AgreementMa. Angelica de GuzmanPas encore d'évaluation

- Memorandum of Agreement PFCCDocument2 pagesMemorandum of Agreement PFCCHoward UntalanPas encore d'évaluation

- Consultancy AgreementDocument5 pagesConsultancy Agreementhellojdey0% (1)

- Authorization Letter To Conduct Bank and Trade ChecksDocument1 pageAuthorization Letter To Conduct Bank and Trade ChecksTin-tin Reyes Jr.100% (1)

- Standard Contract Addendum FormDocument6 pagesStandard Contract Addendum FormNihmathullah Kalanther LebbePas encore d'évaluation

- Advertising AgreementDocument4 pagesAdvertising AgreementRamakant SinghPas encore d'évaluation

- Know All Men by These Presents:: Irrevocable ProxyDocument2 pagesKnow All Men by These Presents:: Irrevocable Proxypaomillan0423Pas encore d'évaluation

- Letter To Lower Interest Rates - SampleDocument1 pageLetter To Lower Interest Rates - SamplePatbau100% (1)

- Afffidavit of Non-Filing of Double Claim and Agreeement To Testify in CourtDocument1 pageAfffidavit of Non-Filing of Double Claim and Agreeement To Testify in CourtBryan VeneracionPas encore d'évaluation

- Release Waiver and Quitclaim AgreementDocument1 pageRelease Waiver and Quitclaim AgreementSummerRainPas encore d'évaluation

- Memorandum of Agreement Loan TermsDocument3 pagesMemorandum of Agreement Loan TermsBonnie BalaguerPas encore d'évaluation

- Escrow AgreementDocument2 pagesEscrow Agreementlexman88Pas encore d'évaluation

- Joint Venture AgreementDocument2 pagesJoint Venture Agreementpan RegisterPas encore d'évaluation

- Special Power of Attorney claim Provident FundDocument1 pageSpecial Power of Attorney claim Provident FundCj MaravillaPas encore d'évaluation

- Sales Commission Contract Agreement Template SampleDocument6 pagesSales Commission Contract Agreement Template SampleKUANPas encore d'évaluation

- Specimen of Resignation Letter of DirectorDocument1 pageSpecimen of Resignation Letter of Directorswat2kk5Pas encore d'évaluation

- Contract of Lease - EquipmentDocument4 pagesContract of Lease - EquipmentCharlotte Marie GalineaPas encore d'évaluation

- Incorporation Engagement LetterDocument3 pagesIncorporation Engagement LetterRyan Dave Alutaya100% (1)

- Loan Agreement TemplateDocument3 pagesLoan Agreement TemplateErwinJaysonIslaPas encore d'évaluation

- Contract Addendum ChangesDocument1 pageContract Addendum ChangesPearly Grace Resano100% (1)

- 7-3 Waiver of Notice - Shareholders Special MeetingDocument1 page7-3 Waiver of Notice - Shareholders Special MeetingDaniel100% (1)

- Toll Manufacturing ContractDocument4 pagesToll Manufacturing ContractHoward Untalan100% (1)

- Panoril PN Set-2Document2 pagesPanoril PN Set-2Aileen PuerinPas encore d'évaluation

- Supply AgreementDocument9 pagesSupply AgreementAjithPas encore d'évaluation

- Mikko John C. Cablao of Brgy. 08, Guiuan E. Samar Yvanne Rey M. Balatay of Brgy. 08, Housing Project, Guiuan E. Samar Mary Grace June B. Gagatiga ofDocument3 pagesMikko John C. Cablao of Brgy. 08, Guiuan E. Samar Yvanne Rey M. Balatay of Brgy. 08, Housing Project, Guiuan E. Samar Mary Grace June B. Gagatiga ofJel MCPas encore d'évaluation

- Special Power of Attorney for Corporation FormationDocument2 pagesSpecial Power of Attorney for Corporation FormationALEXANDRIA RABANESPas encore d'évaluation

- Demand For Loan Restructure - BTBDocument5 pagesDemand For Loan Restructure - BTBwrmarleyPas encore d'évaluation

- Influencers Contract - Benjamin Alvarez-SignedDocument3 pagesInfluencers Contract - Benjamin Alvarez-SignedAngelo Harvey TipaneroPas encore d'évaluation

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyAljim Totex Montallana ArcuenoPas encore d'évaluation

- Supply AgreementDocument3 pagesSupply AgreementVinceOnikaa PerryGermanottaPas encore d'évaluation

- AGREEMENT - Investment - Valcorza v2Document3 pagesAGREEMENT - Investment - Valcorza v2JEPH Manliguez EnteriaPas encore d'évaluation

- Sample Partnership AgreementDocument4 pagesSample Partnership Agreementtmir_1100% (3)

- Employment AgreementDocument10 pagesEmployment AgreementAnirban SahaPas encore d'évaluation

- Contract of Loan: Penaranda, Brennin Mark O. Sample Only/ Do NotDocument2 pagesContract of Loan: Penaranda, Brennin Mark O. Sample Only/ Do NotBrenPeñarandaPas encore d'évaluation

- Father consent use surnameDocument1 pageFather consent use surnameAC LuPas encore d'évaluation

- Broker's Accreditation Form (KD)Document2 pagesBroker's Accreditation Form (KD)KD DE AsasPas encore d'évaluation

- Release Waiver and QuitclaimDocument2 pagesRelease Waiver and QuitclaimKatherine Jane UnayPas encore d'évaluation

- Draft Demand LetterDocument3 pagesDraft Demand Letterlaw tharioPas encore d'évaluation

- Deduction AuthorizationDocument3 pagesDeduction Authorizationjennylyn soco100% (1)

- Service AgreementDocument2 pagesService AgreementChristina QuiachonPas encore d'évaluation

- III. Trucking Services AgreementDocument6 pagesIII. Trucking Services AgreementDyords TiglaoPas encore d'évaluation

- InvestmentDocument71 pagesInvestmentJon CarlPas encore d'évaluation

- Waiver Quitclaim - Sample DraftDocument2 pagesWaiver Quitclaim - Sample DraftRemar G. Tagara100% (1)

- Partnership Agreement: - , of Legal Age, Married, Filipino, and A Resident of - , ZamboangaDocument3 pagesPartnership Agreement: - , of Legal Age, Married, Filipino, and A Resident of - , ZamboangaMariana Jessa SerranoPas encore d'évaluation

- Joint Venture Publishing AgreementDocument3 pagesJoint Venture Publishing AgreementClive MakumbePas encore d'évaluation

- Deed of PartnershipDocument3 pagesDeed of PartnershipAbhishek SinghPas encore d'évaluation

- General Partnership AgreementDocument6 pagesGeneral Partnership AgreementRawlings IndiyaPas encore d'évaluation

- General Partnership AgreementDocument6 pagesGeneral Partnership AgreementJayhan PalmonesPas encore d'évaluation

- Business Partnership AgreementDocument5 pagesBusiness Partnership AgreementParveen Kumar100% (3)

- Admission Cum Retirement DeedDocument8 pagesAdmission Cum Retirement DeedRohit Yadav50% (2)

- Partnership AgreementDocument1 pagePartnership AgreementCAMILLE CRIS B. MONASTERIALPas encore d'évaluation

- P104 PDFDocument4 pagesP104 PDFkismadayaPas encore d'évaluation

- Xi AccountancyDocument198 pagesXi AccountancyRajesh Gupta100% (1)

- ZAA424631821 - Indesore Sweater LTD - Periodic - SMETA 4 Pillars - 26 Jul 23 - CAPRDocument14 pagesZAA424631821 - Indesore Sweater LTD - Periodic - SMETA 4 Pillars - 26 Jul 23 - CAPRmd.kajalbdPas encore d'évaluation

- Farrukh Mushtaq ResumeDocument2 pagesFarrukh Mushtaq ResumeFarrukh M. MirzaPas encore d'évaluation

- Chapter 8/competitive Firms and MarketsDocument19 pagesChapter 8/competitive Firms and Marketsi.abdellah100% (1)

- Rural TourismDocument30 pagesRural TourismWaleed Abdalla El SayedPas encore d'évaluation

- 2-2mys 2002 Dec ADocument17 pages2-2mys 2002 Dec Aqeylazatiey93_598514Pas encore d'évaluation

- Introduction To "Services Export From India Scheme" (SEIS)Document6 pagesIntroduction To "Services Export From India Scheme" (SEIS)Prathaamesh Chorge100% (1)

- 05 - GI-23.010-2 - QualityDocument18 pages05 - GI-23.010-2 - QualityHernanPas encore d'évaluation

- Oil CompaniesDocument20 pagesOil CompaniesJulio CesarPas encore d'évaluation

- Basma Rice Mills PVTDocument3 pagesBasma Rice Mills PVTAmna SaadatPas encore d'évaluation

- Oe/Ee/Hps:: Instructions To Bidder FORDocument46 pagesOe/Ee/Hps:: Instructions To Bidder FORRabana KaryaPas encore d'évaluation

- Fin Model Class2 Excel NPV Irr, Mirr SlidesDocument5 pagesFin Model Class2 Excel NPV Irr, Mirr SlidesGel viraPas encore d'évaluation

- CreditMangerEurope Number 4 - 2013Document40 pagesCreditMangerEurope Number 4 - 2013Anonymous bDCiOqPas encore d'évaluation

- Withholding Tax in MalaysiaDocument4 pagesWithholding Tax in MalaysiaYana Zakaria100% (1)

- MBA Notes AdvertisingDocument4 pagesMBA Notes AdvertisingBashir MureiPas encore d'évaluation

- Chapter 5 Solutions Chap 5 SolutionDocument9 pagesChapter 5 Solutions Chap 5 Solutiontuanminh2048Pas encore d'évaluation

- QA System KMC AS7Document76 pagesQA System KMC AS7Rayudu VVSPas encore d'évaluation

- PAL Pilots Seek Reinstatement After Illegal Strike RulingDocument835 pagesPAL Pilots Seek Reinstatement After Illegal Strike RulingJohn Robert BautistaPas encore d'évaluation

- Cola CaseDocument40 pagesCola Case01dynamic100% (1)

- Cost Accounting Importance and Advantages of Cost Accounting PapaDocument14 pagesCost Accounting Importance and Advantages of Cost Accounting PapaCruz MataPas encore d'évaluation

- Auditing Theory Cabrera ReviewerDocument49 pagesAuditing Theory Cabrera ReviewerCazia Mei Jover81% (16)

- Bill Ackman's Letter On General GrowthDocument8 pagesBill Ackman's Letter On General GrowthZoe GallandPas encore d'évaluation

- 21 CFR Part 111Document36 pages21 CFR Part 111Bhavana AlapatiPas encore d'évaluation

- Financial Ratio Analysis of Dabur India LimitedDocument44 pagesFinancial Ratio Analysis of Dabur India LimitedRajesh Kumar roulPas encore d'évaluation

- SupermarketsDocument20 pagesSupermarketsVikram Sean RosePas encore d'évaluation

- Computational Multiple Choice Questions on Cash and ReceivablesDocument18 pagesComputational Multiple Choice Questions on Cash and ReceivablesAndrin LlemosPas encore d'évaluation

- SALUDO Vs CADocument2 pagesSALUDO Vs CALaika CorralPas encore d'évaluation

- Form No 15GDocument4 pagesForm No 15Graghu_kiranPas encore d'évaluation

- Deed of Undertaking - AbelidasDocument2 pagesDeed of Undertaking - AbelidasatazanjearickPas encore d'évaluation

- Kap 09 - Bill of Quantities and Cost Estimates-2009-03-09 PDFDocument43 pagesKap 09 - Bill of Quantities and Cost Estimates-2009-03-09 PDFLateera AbdiinkoPas encore d'évaluation