Académique Documents

Professionnel Documents

Culture Documents

Cost Analysis For Alternative Lending

Transféré par

MrscourtTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cost Analysis For Alternative Lending

Transféré par

MrscourtDroits d'auteur :

Formats disponibles

Business Loan Operation Analysis v.1.

03 (GP)

Break Down of Revenue Model Dollars Percentage

Interest Revenue (See below assumption) 279,035.18 $ 100%

Variable Expense:

Brokerage Fee* (25,000) $ -9%

Account Management Fee+ (25,000) $ -9%

Unrecoverable default** (37,500) $ -13%

Contribution Margin 191,535 $ 69%

Fixed Expense:

Employees (159,000) $ -57%

Initial Software Cost - $ 0%

Legal-Fee - $ 0%

Net operating income 32,535 $ 12%

Profit by investing in banks at 2% return 50,000 $

*Assumes 12 compounding interest rate, for average of 12 months loans, amortized.

Profit from the

Operation

Bank Investment

Return

$- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000

1

2

Profit Level

The Investor's Options:

Avg. Annual

Interest Rate

Avg. Loan

Amount

Number of

Clients

Total

Investment (DO

NOT CHANGE) Brokerage Fee*

20% $ 25,000 100 $ 2,500,000 1.0%

Unrecoverable

Default**

Account

Management

Fee

Initial Software

Cost

Legal-Fee

(yearly)

1.5% 1.0% $ - $ -

Employee Cost Base pay Benefits + Taxes Total Cost

Employee #1 40,000 $ 13,000 $ 53,000 $

Employee #2 40,000 $ 13,000 $ 53,000 $

Employee #3 40,000 $ 13,000 $ 53,000 $

Employee #4 - $

Emp #5 (PT) - $

Emp #6 (PT) - $

Total 159,000 $

KEY STATISTICS

1 Total Interest Revenue

279,035.18 $

2 Total Employeement Compensation

159,000.00 $

3 Interest Revenue - Employees Payment

120,035.18 $ << Employee Payment too high

1 Interest revenue needed in order to break-even

231,636.79 $

2 Net Operating Income

32,535.18 $

1 Competitor (Bank) Return

50,000.00 $

2 Net Operating Income - Competitor Return

($17,464.82)

<< Needs to be a positive

number to beat the market

Statistical Analysis (Don't Change the Number Here)

-10%

-

-65%

0% 0%

WHAT MAKES UP THE TOTAL EXPENSES?

(SHOWN IN NEGATIVES)

Brokerage Fee*

Unrecoverable default**

Initial Software Cost

Statistical Analysis (Don't Change the Number Here)

10%

-10%

-15%

WHAT MAKES UP THE TOTAL EXPENSES?

(SHOWN IN NEGATIVES)

Account Management Fee+

Employees

Legal-Fee

Enter values

Loan amount 2,500,000.00 $

Annual interest rate 20.000%

Loan period in years 1

Start date of loan 1/1/2014

Monthly payment 231,586.26 $

Number of payments 12

Total interest profit 279,035.18 $

Total cost of loan 2,779,035.18 $

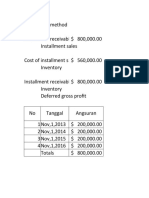

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

1 2/1/2014 2,500,000.00 $ 231,586.26 $ 189,919.60 $ 41,666.67 $ 2,310,080.40 $

2 3/1/2014 2,310,080.40 $ 231,586.26 $ 193,084.92 $ 38,501.34 $ 2,116,995.48 $

3 4/1/2014 2,116,995.48 $ 231,586.26 $ 196,303.01 $ 35,283.26 $ 1,920,692.47 $

4 5/1/2014 1,920,692.47 $ 231,586.26 $ 199,574.72 $ 32,011.54 $ 1,721,117.75 $

5 6/1/2014 1,721,117.75 $ 231,586.26 $ 202,900.97 $ 28,685.30 $ 1,518,216.78 $

6 7/1/2014 1,518,216.78 $ 231,586.26 $ 206,282.65 $ 25,303.61 $ 1,311,934.13 $

7 8/1/2014 1,311,934.13 $ 231,586.26 $ 209,720.70 $ 21,865.57 $ 1,102,213.43 $

8 9/1/2014 1,102,213.43 $ 231,586.26 $ 213,216.04 $ 18,370.22 $ 888,997.39 $

9 10/1/2014 888,997.39 $ 231,586.26 $ 216,769.64 $ 14,816.62 $ 672,227.75 $

10 11/1/2014 672,227.75 $ 231,586.26 $ 220,382.47 $ 11,203.80 $ 451,845.28 $

11 12/1/2014 451,845.28 $ 231,586.26 $ 224,055.51 $ 7,530.75 $ 227,789.77 $

12 1/1/2015 227,789.77 $ 231,586.26 $ 227,789.77 $ 3,796.50 $ 0.00 $

Interest Revenue from Loan

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

No.

Payment

Date

Beginning

Balance Payment Principal Interest

Ending

Balance

Vous aimerez peut-être aussi

- Effective Interest RateDocument8 pagesEffective Interest RateDoha anaPas encore d'évaluation

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasPas encore d'évaluation

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzPas encore d'évaluation

- Supply Chain Finance at Procter & Gamble - 6713-XLS-ENGDocument37 pagesSupply Chain Finance at Procter & Gamble - 6713-XLS-ENGKunal Mehta100% (2)

- Task 7Document14 pagesTask 7Damaris MoralesPas encore d'évaluation

- Cash Flow Forecasting TemplateDocument41 pagesCash Flow Forecasting TemplateAdil Javed CHPas encore d'évaluation

- Forex Compounding CalculatorDocument8 pagesForex Compounding CalculatorMye RakPas encore d'évaluation

- Instruksi: Baca Cara Penggunaan Software Secara SeksamaDocument24 pagesInstruksi: Baca Cara Penggunaan Software Secara SeksamaditaPas encore d'évaluation

- Cash Flow Forecasting TemplateDocument41 pagesCash Flow Forecasting Templatejose miguel baezPas encore d'évaluation

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiPas encore d'évaluation

- Ejercicio Proyecto FinalDocument3 pagesEjercicio Proyecto FinalCortez Rodríguez Karen YanethPas encore d'évaluation

- Financial PlanDocument12 pagesFinancial PlanNico BoialterPas encore d'évaluation

- Case 40 Primus Automation Division 2002 Leasing Opsi 4Document39 pagesCase 40 Primus Automation Division 2002 Leasing Opsi 4rizkal rizaldiPas encore d'évaluation

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoPas encore d'évaluation

- Case 2 - Lady M-2Document11 pagesCase 2 - Lady M-2Joanne LinPas encore d'évaluation

- Netflix Financial StatementsDocument2 pagesNetflix Financial StatementsGoutham RaoPas encore d'évaluation

- 5 Year Financial Plan ManufacturingDocument30 pages5 Year Financial Plan ManufacturingLiza GeorgePas encore d'évaluation

- Annual Income Statemen1 Mcdonalds KFCDocument6 pagesAnnual Income Statemen1 Mcdonalds KFCAnwar Ul HaqPas encore d'évaluation

- 1st Practice AccountingDocument7 pages1st Practice AccountingJose AmayaPas encore d'évaluation

- Statement of Income Expected 2016 2015 2014Document29 pagesStatement of Income Expected 2016 2015 2014Rendy Setiadi MangunsongPas encore d'évaluation

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaPas encore d'évaluation

- Project 6Document10 pagesProject 6api-489150270Pas encore d'évaluation

- ანრი მაჭავარიანი ფინალურიDocument40 pagesანრი მაჭავარიანი ფინალურიAnri MachavarianiPas encore d'évaluation

- Nim - Nama - Group L - Planning 6-9Document12 pagesNim - Nama - Group L - Planning 6-9willyPas encore d'évaluation

- Financial PlanDocument28 pagesFinancial PlannabeelaraoPas encore d'évaluation

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazPas encore d'évaluation

- Steve Wynn, Matthew Maddox Compensation, 2007-2016Document2 pagesSteve Wynn, Matthew Maddox Compensation, 2007-2016Las Vegas Review-JournalPas encore d'évaluation

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufPas encore d'évaluation

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbePas encore d'évaluation

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiPas encore d'évaluation

- Sample Business Plan Excel TemplateDocument27 pagesSample Business Plan Excel TemplateAndriyadi MardinPas encore d'évaluation

- RV Park Business Plan ExampleDocument27 pagesRV Park Business Plan Examplejackson jimPas encore d'évaluation

- FINC 721 Project 2Document2 pagesFINC 721 Project 2Sameer BhattaraiPas encore d'évaluation

- Financial Planning Business Plan: 7.1 Important AssumptionsDocument32 pagesFinancial Planning Business Plan: 7.1 Important AssumptionstemesgenPas encore d'évaluation

- Project 6 - Future and Present ValueDocument5 pagesProject 6 - Future and Present Valueapi-666269710Pas encore d'évaluation

- Projections of BusinessDocument4 pagesProjections of BusinessJawwad JabbarPas encore d'évaluation

- Impact of Proposed 2009 Tax IncreaseDocument1 pageImpact of Proposed 2009 Tax IncreaseNathan Benefield100% (1)

- Sample Financial PlanDocument12 pagesSample Financial PlanSneha KhuranaPas encore d'évaluation

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinPas encore d'évaluation

- Loans ListingDocument58 pagesLoans ListingsockeymmPas encore d'évaluation

- Project Management - Fixer UpperDocument12 pagesProject Management - Fixer UpperKedara Gouri AvulaPas encore d'évaluation

- Sample Financial ModelDocument69 pagesSample Financial ModelfoosaaPas encore d'évaluation

- Eib Finances - Sheet1Document1 pageEib Finances - Sheet1api-359849819Pas encore d'évaluation

- Micro Shots 2010Document158 pagesMicro Shots 2010Arifin MasruriPas encore d'évaluation

- TVM Problems SolutionsDocument3 pagesTVM Problems SolutionsEmirī PhoonPas encore d'évaluation

- BL SheetDocument3 pagesBL Sheetroselle oronganPas encore d'évaluation

- Trabajo Final de Ingeniería EconomicaDocument30 pagesTrabajo Final de Ingeniería EconomicaSergio HernandezPas encore d'évaluation

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraPas encore d'évaluation

- Expense Report AnnelieDocument9 pagesExpense Report Annelieapi-255370969Pas encore d'évaluation

- Tutoring Business Plan ExampleDocument23 pagesTutoring Business Plan Example24 Alvarez, Daniela Joy G.Pas encore d'évaluation

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanPas encore d'évaluation

- Proyecto Final EpDocument21 pagesProyecto Final EpFernanda LozanoPas encore d'évaluation

- Akm 233Document6 pagesAkm 233wahdah ulin nafisahPas encore d'évaluation

- Fuwang LTD.Document16 pagesFuwang LTD.MAHTAB KhandakerPas encore d'évaluation

- Tarea Final Principles of AccountingDocument8 pagesTarea Final Principles of AccountingCarlos RiveraPas encore d'évaluation

- Loan Amortization Calculator: No. Payment Date Payment Due Interest PrincipalDocument4 pagesLoan Amortization Calculator: No. Payment Date Payment Due Interest PrincipalAhmad Zia KhurramPas encore d'évaluation

- Session 7 - Financial Statements and RatiosDocument23 pagesSession 7 - Financial Statements and Ratiosalanablues1Pas encore d'évaluation

- Interes 1Document9 pagesInteres 1Milo GuevaraPas encore d'évaluation

- Cash Breakeven Analysis: Awus $10,000 100%Document13 pagesCash Breakeven Analysis: Awus $10,000 100%iPakistanPas encore d'évaluation

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Aptitude ExamDocument146 pagesAptitude ExamshePas encore d'évaluation

- Finance - Questions and Answers 220Document40 pagesFinance - Questions and Answers 220Anwaar AlQuraishi100% (2)

- C3 ValuationDocument26 pagesC3 ValuationMinh Lưu NhậtPas encore d'évaluation

- Sss Disclosure AggreementDocument3 pagesSss Disclosure AggreementLin RuixiPas encore d'évaluation

- Bellway INFULLREPORTDocument13 pagesBellway INFULLREPORTAnup BajajPas encore d'évaluation

- SFM Question Bank 2019Document32 pagesSFM Question Bank 2019Oyeleye Tofunmi100% (1)

- Ar 2020 BTPN Eng 14 AprilDocument612 pagesAr 2020 BTPN Eng 14 AprilklieindwrPas encore d'évaluation

- Accounts Theory Chapterwise - 27069624 - 2023 - 12 - 27 - 19 - 231227 - 193022Document80 pagesAccounts Theory Chapterwise - 27069624 - 2023 - 12 - 27 - 19 - 231227 - 193022Vibhu VashishthPas encore d'évaluation

- F FADSFDSFDocument18 pagesF FADSFDSFJohn Carlo Peru100% (2)

- Statement Date Y D. Y. D.: PaymentDocument2 pagesStatement Date Y D. Y. D.: PaymentSkander NoualiPas encore d'évaluation

- Sarmiento and Villaseñor V JavellanaDocument2 pagesSarmiento and Villaseñor V Javellanacmv mendozaPas encore d'évaluation

- 08 Theoretical Aspects of Public DebtDocument35 pages08 Theoretical Aspects of Public DebtAnkit Singh100% (2)

- 32 Etcherla Auction NoteDocument15 pages32 Etcherla Auction Notepandu123456Pas encore d'évaluation

- Introduction To Financial Services MarketingDocument14 pagesIntroduction To Financial Services MarketingJitender Kaushal100% (1)

- 111年會考 中會題庫Document99 pages111年會考 中會題庫KirosTeklehaimanotPas encore d'évaluation

- HMF in Tanzania Final ReportDocument193 pagesHMF in Tanzania Final ReportAnonymous FnM14a0100% (1)

- Financial Markets Chapter 2 - NotesDocument3 pagesFinancial Markets Chapter 2 - Notesgojo satoruPas encore d'évaluation

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86Pas encore d'évaluation

- USD Vs INRDocument27 pagesUSD Vs INRSunny KhandelwalPas encore d'évaluation

- $2,750,000,000 Fixed-to-Floating Rate Notes Due 2028: Issue Price: 100.000%Document63 pages$2,750,000,000 Fixed-to-Floating Rate Notes Due 2028: Issue Price: 100.000%Helpin HandPas encore d'évaluation

- Euro Bond MarketDocument14 pagesEuro Bond MarketManjesh Kumar100% (1)

- Bloomberg Cheat Sheets PDFDocument45 pagesBloomberg Cheat Sheets PDFRakesh SuriPas encore d'évaluation

- Test Partnership Numerical Reasoning Test 3: AssessmentdayDocument20 pagesTest Partnership Numerical Reasoning Test 3: AssessmentdayThanh Phu TranPas encore d'évaluation

- OR Post: AZA Group. Investment in A HotelDocument8 pagesOR Post: AZA Group. Investment in A HotelShedrine WamukekhePas encore d'évaluation

- Chapter 19 - Financial Asset at Amortized Cost Bond InvestmentDocument8 pagesChapter 19 - Financial Asset at Amortized Cost Bond InvestmentmercyvienhoPas encore d'évaluation

- Lehman Brothers - The Short-End of The CurveDocument20 pagesLehman Brothers - The Short-End of The CurveunicycnPas encore d'évaluation

- Treasury and Fund Management in BanksDocument40 pagesTreasury and Fund Management in Bankseknath2000100% (2)

- 03 0450 12 MS Prov Rma 08022023110937Document24 pages03 0450 12 MS Prov Rma 08022023110937abin alexanderPas encore d'évaluation

- SwapsDocument17 pagesSwapsBruno André NunesPas encore d'évaluation

- Promissory Note With Installment PaymentsDocument8 pagesPromissory Note With Installment PaymentsRocketLawyerPas encore d'évaluation