Académique Documents

Professionnel Documents

Culture Documents

AK Adak (Aug14)

Transféré par

Aditya JagtapTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AK Adak (Aug14)

Transféré par

Aditya JagtapDroits d'auteur :

Formats disponibles

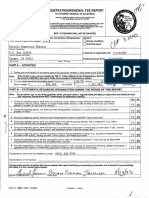

CITY OF ADAK, ALASKA

P.O. BOX 2011 - ADAK, ALASKA 99546-2011

Phone: (907) 592-4500 - Fax: (907) 592-4262

http://www.adak-ak.us

SALES TAX RETURN

NOTICE: The Adak Municipal Code 4.06 details the application, exemptions, collections and remittance of sales tax. This report is invalid unless completed in detail. The

report must be filed even if no receipts for the month. Information provided on this form is confidential subject to AMC 4.06.90.

End of

Period

:

10/31/2014

Monthly Filer

ALL RETURNS MUST BE FILED - INCLUDING NO SALES

No sales for the month

Final Tax Return ---------------> Date Closed/Sold:

For Calendar Month/Year:

10/31/2014

City Tax ID #:

Business Name:

Address:

1. DETERMINATION OF GROSS RECEIPTS/REVENUE:

A. Sales

B. Rentals

C. Services

TOTAL GROSS RECEIPTS/REVENUE (Add lines A thru C):

A.

B.

C.

2. DETERMINATION OF EXEMPT SALES

A. Government Agencies

B. Sales Occuring Outside City Limits

C. Other

TOTAL EXEMPT SALES (Add lines A thru C):

A.

B.

C.

1.

0.00

2.

0.00

3. SALES SUBJECT TO SALES TAX (Subtract line 2 from line 1):

3.

0.00

4. SALES TAX AT 4% (Multiply line 3 by .04):

4.

0.00

5. PENALTY FOR LATE/NON-PAYMENT OF TAX (if applicable): 5%

5.

6. INTEREST FOR LATE/NON-PAYMENT OF TAX (if applicable): 10.5%

0.00

0.00

0.00

Months: 0

7. TOTAL DUE (Add lines 4 through 6):

6.

7.

0.00

MONTHLY SALES TAX RETURNS MUST BE FILED BY THE LAST BUSINESS DAY OF THE MONTH FOLLOWING THE

CALENDAR MONTH IN WHICH TAXES WERE COLLECTED.

FAILURE TO FILE A REPORT AS REQUIRED WILL RESULT IN A DELINQUENT PENALTY OF 5% PER MONTH OR FRACTION

THEREOF AND 10% PER MONTH FOR THE FOLLOWING MONTH. ADDITIONALLY A DELINQUENT INTEREST OF 10.5% PER

ANNUM OF THE DELINQUENT TAX WILL BE ASSESSED AND DUE.

IF PENALTY AND/OR INTEREST ARE INCORRECTLY CALCULATED THE DIFFERENCE WILL BE INVOICED WHICH WILL BE

IMMEDIATELY DUE AND PAYABLE.

I CERTIFY UNDER PENALTY OF PERJURY THAT THIS RETURN (INCLUDING ANY ACCOMPANYING STATEMENTS HAS BEEN

EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGNATURE & TITLE

11/04/2014

Date

(Rev.07/2014)

Check this box to enter updated rates:

Click the Clear button to clear return: Clear

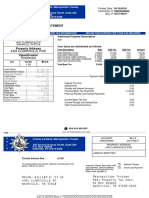

CITY OF ADAK, ALASKA

P.O. BOX 2011 - ADAK, ALASKA 99546-2011

Phone: (907) 592-4500 - Fax: (907) 592-4262

http://www.adak-ak.us

SALES TAX RETURN

SCHEDULE A - EXEMPTIONS

City Tax ID #:

Business Name:

For Calendar Month/Year:

10/31/2014

A. GOVERNMENT/EXEMPT AGENCIES

Date

Government Agency Name

Agency Type

Amount

Total Government Agency Sales:

B. SALES OCCURING OUTSIDE CITY LIMITS

Date

Name

Description of Sale

0.00

Amount

Total Sales Occuring Outside City Limits:

0.00

C. ALL OTHER SALES CLAIMED EXEMPT (MUST HAVE CITY ISSUED CERTIFICATE - NO EXCEPTIONS)

Date

Name

Certificate No.

Amount

Total Other Sales Claimed Exempt:

0.00

(Rev.07/2014)

Vous aimerez peut-être aussi

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterTony MillerPas encore d'évaluation

- Payroll Accounting 2014 Form1040 Ch4Document4 pagesPayroll Accounting 2014 Form1040 Ch4DanCoppePas encore d'évaluation

- F 9465Document3 pagesF 9465Pat PlantePas encore d'évaluation

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonPas encore d'évaluation

- F 941 SsDocument4 pagesF 941 SsBilboDBagginsPas encore d'évaluation

- PRINT in BLACK INK. Ovals Must Be Filled in Completely.Document2 pagesPRINT in BLACK INK. Ovals Must Be Filled in Completely.mik2bgPas encore d'évaluation

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterpdizypdizyPas encore d'évaluation

- November 07, 2016 PDFDocument8 pagesNovember 07, 2016 PDFChristine HoguePas encore d'évaluation

- Cigna Claim FormDocument2 pagesCigna Claim FormLoganBohannonPas encore d'évaluation

- Attention:: Not File Copy A Downloaded From This Website. You Can Only FileDocument8 pagesAttention:: Not File Copy A Downloaded From This Website. You Can Only FilepdizypdizyPas encore d'évaluation

- Offer in Compromise ApplicationDocument4 pagesOffer in Compromise ApplicationRoy CraytonPas encore d'évaluation

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonPas encore d'évaluation

- FederalDocument24 pagesFederalNeil NitinPas encore d'évaluation

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 pagesACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyPas encore d'évaluation

- Balibago WaterDocument9 pagesBalibago WaterJeffrey MacalinoPas encore d'évaluation

- County of Riverside Treasurer-Tax Collector Application and Agreement To Enter Into An Installment Payment PlanDocument1 pageCounty of Riverside Treasurer-Tax Collector Application and Agreement To Enter Into An Installment Payment PlandeePas encore d'évaluation

- F6 Self Assessment NotesDocument7 pagesF6 Self Assessment NotesVivy Mwix SeinPas encore d'évaluation

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonPas encore d'évaluation

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsPas encore d'évaluation

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonPas encore d'évaluation

- 656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateDocument4 pages656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateRonell D. MoorePas encore d'évaluation

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonPas encore d'évaluation

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationMd HumayunPas encore d'évaluation

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonPas encore d'évaluation

- 700 E San Antonio Ave C-101 El Paso, TX 79901Document4 pages700 E San Antonio Ave C-101 El Paso, TX 79901Sofia100% (3)

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonPas encore d'évaluation

- CA Charity Annual Report FormDocument1 pageCA Charity Annual Report FormagbufzbfPas encore d'évaluation

- FYI 406 Your Rights Under The Tax LawDocument2 pagesFYI 406 Your Rights Under The Tax LawFuji guruPas encore d'évaluation

- 1601 C CompensationDocument2 pages1601 C Compensationjon_cpaPas encore d'évaluation

- IRS Fines Ron Paul's Campaign For LibertyDocument4 pagesIRS Fines Ron Paul's Campaign For Libertytshoes100% (1)

- Instructions For Form 941: (Rev. January 2011)Document9 pagesInstructions For Form 941: (Rev. January 2011)Ten TendulkarPas encore d'évaluation

- Installment Agreement RequestDocument1 pageInstallment Agreement Requestkyiwayphy03681Pas encore d'évaluation

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonPas encore d'évaluation

- Caa RRF 2004Document2 pagesCaa RRF 2004L. A. PatersonPas encore d'évaluation

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonPas encore d'évaluation

- Form 9465 (Installment Agreement Request)Document2 pagesForm 9465 (Installment Agreement Request)Benne JamesPas encore d'évaluation

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonPas encore d'évaluation

- Guide For Receiving UI Benefits: Privacy Act StatementDocument13 pagesGuide For Receiving UI Benefits: Privacy Act StatementPackdaddyPas encore d'évaluation

- Instructions For Completing This Form 13.1 Financial StatementDocument33 pagesInstructions For Completing This Form 13.1 Financial StatementMy Support CalculatorPas encore d'évaluation

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Ver ArocenaPas encore d'évaluation

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonPas encore d'évaluation

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonPas encore d'évaluation

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonPas encore d'évaluation

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonPas encore d'évaluation

- PF Midterm ReviewerDocument5 pagesPF Midterm ReviewerHannah Nicole CamaraPas encore d'évaluation

- Property Tax BillDocument2 pagesProperty Tax BillAnonymous GF8PPILW5Pas encore d'évaluation

- IRS e-file Acknowledgement for Tax Year 2016Document2 pagesIRS e-file Acknowledgement for Tax Year 2016anandrapakaPas encore d'évaluation

- FTG RRF 2012Document1 pageFTG RRF 2012L. A. PatersonPas encore d'évaluation

- Tax Return Engagement LetterDocument2 pagesTax Return Engagement LetterAshru AshrafPas encore d'évaluation

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakePas encore d'évaluation

- Form P50 Income Tax PDFDocument2 pagesForm P50 Income Tax PDFemesjotPas encore d'évaluation

- Consumer Assistance Program Application: Receive Up To $1,500 To Retire Your VehicleDocument0 pageConsumer Assistance Program Application: Receive Up To $1,500 To Retire Your VehicleNestor LopezPas encore d'évaluation

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonPas encore d'évaluation

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDocument4 pages941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanPas encore d'évaluation

- IRS EIN NoticeDocument2 pagesIRS EIN Noticejessica messica100% (1)

- 2014 Form 1 ES Instructions - Estimated Income Tax For Individuals, Estates, and TrustsDocument2 pages2014 Form 1 ES Instructions - Estimated Income Tax For Individuals, Estates, and TrustsSyed Abbas Ali Shah BukhariPas encore d'évaluation

- File 2018 Tax Return ElectronicallyDocument3 pagesFile 2018 Tax Return Electronicallymuhammad afiqPas encore d'évaluation

- 1040 Exam Prep: Module II - Basic Tax ConceptsD'Everand1040 Exam Prep: Module II - Basic Tax ConceptsÉvaluation : 1.5 sur 5 étoiles1.5/5 (2)

- Boisdale Cocktail List 2010 3rdDocument56 pagesBoisdale Cocktail List 2010 3rdAditya JagtapPas encore d'évaluation

- Puerto Rico English VersionDocument6 pagesPuerto Rico English VersionAditya JagtapPas encore d'évaluation

- Study of Home Loan Appraisal ProcessDocument4 pagesStudy of Home Loan Appraisal ProcessAditya JagtapPas encore d'évaluation

- There Are Two Types of Teaching PrinciplesDocument4 pagesThere Are Two Types of Teaching PrinciplesAditya Jagtap33% (3)