Académique Documents

Professionnel Documents

Culture Documents

Sambhram Institute of Technolog3

Transféré par

ravi_nyseCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sambhram Institute of Technolog3

Transféré par

ravi_nyseDroits d'auteur :

Formats disponibles

Department of Management Studies and Research

MBA IV Sem -III Internal Exams, April 2014

Subject: International Financial Management

Subject Code : 12MBAFM426

Time : 1:15 mns

Marks: 30

Answer any one of following questions. Question number 3 is compulsory

1. (a) What is SWIFT?

3 Marks

(b) Havells Indian Ltd has 50,000 worth debts outstanding at Spain. The amount is

likely to be received in 3 months. It is given that spot 1= Rs 61.1826 and 3 months

forward rate 1= Rs 61.5225 expected euro rate in 3 month is Rs 60.2512.

a) What is the rate applicable if Havells India wishes to hedge?

b) What is the receipt to Havells India if they go for forward hedge?

c) If Havells go for forward hedge and the Spain party fails to make payment

what is the net gain or loss to Havells Ltd.

7 Marks

(c) A foreign exchange dealer has assumed the following information for a particular

bank. the quoted price is given below.

Value of Canadian dollar in USD $ 0.90; Value of New Zealand dollar USD $ 0.30;

Value of Canadian dollar in New Zealand dollars $ 3.02

i) On the basis of the above information. Is triangular arbitrage possible? If yes, explain

the steps and calculate the profit from this strategy, if you had $ 1,50,000.

ii) What market forces would occur to eliminate the further possibilities if triangular

Arbitrage?

10 Marks

2. (a) Define transaction Exposure?

3 Marks

(b) In Australia cricket bats sell for AUD 40 while in India they sell for only Rs 1,000.

i) According to the theory of PPP, what should be the RS/$ rate?

ii) If the price of cricket bats in the Australia goes up to AUD 44 each in one year and

the price of cricket bats in India goes up to Rs 1,074 each, what is the one year forward

Rs/AUD rate?

7Marks

(c) Suppose a French Importer is to pay $10,000 in 3 months time. The exchange rates are

being quoted as follows.

Spot FFr 5.6/$

3 Month forward FFr 5.8/$

From the given data show that forward cover profitable or not.

10 Marks

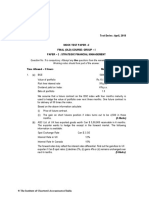

3. Given the spot exchange rate $1=FFr 7.05

Particulars

$ Interest rate (Annual)

French franc Interest rate (annual)

Forward FFr/$

Forward $ premium

3Months

11.5%

19.5%

A

B

6Months

12.25%

C

D

6.5%

10 Marks

1Year

20%

7.5%

7.5

F

Vous aimerez peut-être aussi

- The Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsD'EverandThe Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsPas encore d'évaluation

- MF Tutorial - Q - June2020Document19 pagesMF Tutorial - Q - June2020Marcia PattersonPas encore d'évaluation

- Brazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsD'EverandBrazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsPas encore d'évaluation

- Solved, MF0015 AssignmentDocument3 pagesSolved, MF0015 AssignmentArvind KPas encore d'évaluation

- Millionaire Expat: How To Build Wealth Living OverseasD'EverandMillionaire Expat: How To Build Wealth Living OverseasÉvaluation : 3 sur 5 étoiles3/5 (10)

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarPas encore d'évaluation

- The Big Long: Using Stops to Profit More and Reduce Risk in the Long-Term UptrendD'EverandThe Big Long: Using Stops to Profit More and Reduce Risk in the Long-Term UptrendPas encore d'évaluation

- Key Mcqs - 2 - ProblemsDocument8 pagesKey Mcqs - 2 - ProblemsPadyala SriramPas encore d'évaluation

- 9 Ferm HW 29 - 38Document10 pages9 Ferm HW 29 - 38Sudheer100% (1)

- Assignment No. 1 - If Extra Practice ProblemDocument4 pagesAssignment No. 1 - If Extra Practice ProblemTejas Joshi100% (1)

- International FinanceDocument14 pagesInternational Financecpsandeepgowda6828100% (1)

- MCQS 1 - Problems On Foreign Exchange ManagementDocument4 pagesMCQS 1 - Problems On Foreign Exchange ManagementPadyala SriramPas encore d'évaluation

- International Finance & Trade (Ift) : Shanti Business School PGDM Trimester-Iii End Term Examination JULY - 2015Document7 pagesInternational Finance & Trade (Ift) : Shanti Business School PGDM Trimester-Iii End Term Examination JULY - 2015SharmaPas encore d'évaluation

- Lecture 1 Question RiskDocument2 pagesLecture 1 Question RiskJody BuiPas encore d'évaluation

- Final Correction International Finance 2022 - CopieDocument7 pagesFinal Correction International Finance 2022 - Copieschall.chloePas encore d'évaluation

- International Finance 2018-19 ReDocument2 pagesInternational Finance 2018-19 ReNAITIK SHAHPas encore d'évaluation

- Question and Problem-Sinh VienDocument4 pagesQuestion and Problem-Sinh Vienapi-3755121Pas encore d'évaluation

- Practice Question of International ArbitrageDocument5 pagesPractice Question of International ArbitrageHania DollPas encore d'évaluation

- 1-Activities EcoDocument6 pages1-Activities EcombondoPas encore d'évaluation

- Term Final Friday Spring 2020 Inffin OnlineDocument2 pagesTerm Final Friday Spring 2020 Inffin OnlineMd. Abdul HaiPas encore d'évaluation

- ECB3IFMIB Regular Tutorials ExercisesDocument13 pagesECB3IFMIB Regular Tutorials ExercisesjuanpablooriolPas encore d'évaluation

- Investment ManagementDocument19 pagesInvestment ManagementMichael VuhaPas encore d'évaluation

- Forex Pages 42 90Document49 pagesForex Pages 42 90RITZ BROWN100% (1)

- Ps 2Document8 pagesPs 2Amy BeansPas encore d'évaluation

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerYash GoklaniPas encore d'évaluation

- L7 8 9 EssDocument6 pagesL7 8 9 EssPhuong NguyenPas encore d'évaluation

- Activities FXDocument5 pagesActivities FXWaqar KhalidPas encore d'évaluation

- AFF2341 Exam 2013 S1Document11 pagesAFF2341 Exam 2013 S1asteria0409Pas encore d'évaluation

- TutoialDocument5 pagesTutoialVaibhav Anand RastogiPas encore d'évaluation

- FIN 444 Mid Term Summer 2021Document5 pagesFIN 444 Mid Term Summer 2021Abdulla HussainPas encore d'évaluation

- 4.2 Forex PDFDocument4 pages4.2 Forex PDFGuru RaghuPas encore d'évaluation

- International Finance 2021-22Document3 pagesInternational Finance 2021-22NAITIK SHAHPas encore d'évaluation

- FOREXHandoutpdfDocument1 pageFOREXHandoutpdfmuhamad asrul bin ahmadPas encore d'évaluation

- Mock Exam - Section ADocument4 pagesMock Exam - Section AHAHAHAPas encore d'évaluation

- ECON3007 Tutorial 2 2017Document3 pagesECON3007 Tutorial 2 2017Sta KerPas encore d'évaluation

- International Finance PDFDocument5 pagesInternational Finance PDFDivakara ReddyPas encore d'évaluation

- Assignment 5 2020Document5 pagesAssignment 5 2020林昀妤Pas encore d'évaluation

- 3Document1 page3Nhanh LêPas encore d'évaluation

- Financial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsDocument15 pagesFinancial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsNg Chunye100% (1)

- CA - IPCC - Leverage Test Q 1) Answer The Following: (Any 4) 10Document1 pageCA - IPCC - Leverage Test Q 1) Answer The Following: (Any 4) 10Nitesh MattaPas encore d'évaluation

- Finance Systems Information Analysis QuestionsDocument15 pagesFinance Systems Information Analysis QuestionsNivneth PeirisPas encore d'évaluation

- Foreign Exch. Market QuestionsDocument4 pagesForeign Exch. Market QuestionsBarakaPas encore d'évaluation

- Problem Set #3Document2 pagesProblem Set #3Oxky Setiawan WibisonoPas encore d'évaluation

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaPas encore d'évaluation

- Derivatives Practice Exam Q&ADocument15 pagesDerivatives Practice Exam Q&AgjmitchellPas encore d'évaluation

- Forex Problems1Document4 pagesForex Problems1skalidasPas encore d'évaluation

- Ps1 AnswerDocument6 pagesPs1 AnswerChan Kong Yan AnniePas encore d'évaluation

- Final Assignment Sept 2023 BBF30803Document4 pagesFinal Assignment Sept 2023 BBF30803karthiyainni gunasegarPas encore d'évaluation

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidPas encore d'évaluation

- Derivatives Practice Exam QDocument12 pagesDerivatives Practice Exam QgjmitchellPas encore d'évaluation

- International Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80Document3 pagesInternational Financial Management (Regular) Paper: 3.2: Time: 3 Hours Maximum Marks: 80SANAULLAH SULTANPURPas encore d'évaluation

- Futures and Options Final Exam.1. 2020 EJndU7vIaaDocument3 pagesFutures and Options Final Exam.1. 2020 EJndU7vIaaAbhishek DeswalPas encore d'évaluation

- 01 - Forex - Question For Cma Final LectureDocument42 pages01 - Forex - Question For Cma Final Lecturerehaliya15Pas encore d'évaluation

- Illustrations For PracticeDocument3 pagesIllustrations For PracticeDhruvi AgarwalPas encore d'évaluation

- Volume 5 SFMDocument16 pagesVolume 5 SFMrajat sharmaPas encore d'évaluation

- Chance) /imp.) Examination, April 2021 (2014 Admission Onwards) Elective-A: FINANCE COM 4 E02: International Financial ManagementDocument2 pagesChance) /imp.) Examination, April 2021 (2014 Admission Onwards) Elective-A: FINANCE COM 4 E02: International Financial Managementbhupesh tkPas encore d'évaluation

- Candidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDocument3 pagesCandidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksGyan PokhrelPas encore d'évaluation

- Balance of Payment 20 PDFDocument79 pagesBalance of Payment 20 PDFRiyaPas encore d'évaluation

- Chance) /imp.) Examination, April 2021 (2014 Admission Onwards) Elective-A: FINANCE COM 4 E02: International Financial ManagementDocument2 pagesChance) /imp.) Examination, April 2021 (2014 Admission Onwards) Elective-A: FINANCE COM 4 E02: International Financial Managementbhupesh tkPas encore d'évaluation

- DDDocument9 pagesDDravi_nysePas encore d'évaluation

- QuestionsDocument3 pagesQuestionsravi_nyse100% (1)

- 9-Fundamentals of DesignsfDocument44 pages9-Fundamentals of DesignsfSivi Almanaf Ali ShahabPas encore d'évaluation

- NotesDocument2 pagesNotesravi_nysePas encore d'évaluation

- QDocument9 pagesQravi_nysePas encore d'évaluation

- ∆ U Α +Β ∆ Logy ∆ Ε Change∈Employment Rate At Period T .: A) Okun'S LawDocument1 page∆ U Α +Β ∆ Logy ∆ Ε Change∈Employment Rate At Period T .: A) Okun'S Lawravi_nysePas encore d'évaluation

- The Problem: 2. The Research 3. The Solution 4. The Impact 5. Experience It 6. Try It 7. QuestionsDocument11 pagesThe Problem: 2. The Research 3. The Solution 4. The Impact 5. Experience It 6. Try It 7. Questionsravi_nysePas encore d'évaluation

- CLDocument1 pageCLravi_nysePas encore d'évaluation

- Chancery PavilionDocument19 pagesChancery Pavilionravi_nyse0% (1)

- Faculty Details Department of Management StudiesDocument1 pageFaculty Details Department of Management Studiesravi_nysePas encore d'évaluation

- Educational Park For Transformation of Rural India in Emerging EconomyDocument1 pageEducational Park For Transformation of Rural India in Emerging Economyravi_nysePas encore d'évaluation

- Sambhram Institute of Technolog6Document1 pageSambhram Institute of Technolog6ravi_nysePas encore d'évaluation

- Sambhram Institute of Technology, Bangalore Department of Management Studies and Research MBA I Sem - III Internal Exams, December, 2014Document2 pagesSambhram Institute of Technology, Bangalore Department of Management Studies and Research MBA I Sem - III Internal Exams, December, 2014ravi_nysePas encore d'évaluation

- Sambhram Institute of Technlogy Department of Management Studies and Research Bangalore PG Regular SemesterDocument9 pagesSambhram Institute of Technlogy Department of Management Studies and Research Bangalore PG Regular Semesterravi_nysePas encore d'évaluation

- ToDocument1 pageToravi_nysePas encore d'évaluation

- Educational Park For Transformation of Rural India in Emerging EconomyDocument1 pageEducational Park For Transformation of Rural India in Emerging Economyravi_nysePas encore d'évaluation

- Economics 1st Module Notes AllDocument11 pagesEconomics 1st Module Notes Allravi_nysePas encore d'évaluation

- Effective Referral Building and A 9 Steps Process To Get The Best JobsDocument1 pageEffective Referral Building and A 9 Steps Process To Get The Best Jobsravi_nysePas encore d'évaluation

- Sambhram Institute of Technology House Keeping Labour AttendanceDocument2 pagesSambhram Institute of Technology House Keeping Labour Attendanceravi_nysePas encore d'évaluation

- Sambhram Institute of Technology: Department of Management Studies and Research Centre Tax ManagementDocument2 pagesSambhram Institute of Technology: Department of Management Studies and Research Centre Tax Managementravi_nysePas encore d'évaluation

- Sambhram Institute of Technolog6Document1 pageSambhram Institute of Technolog6ravi_nysePas encore d'évaluation

- Northwestern Polytechnic University: Catalog 2 0 1 4Document137 pagesNorthwestern Polytechnic University: Catalog 2 0 1 4ravi_nysePas encore d'évaluation

- TripDocument2 pagesTripravi_nysePas encore d'évaluation

- CircularsDocument5 pagesCircularsravi_nysePas encore d'évaluation

- Sambhram Institute of Technolog5Document1 pageSambhram Institute of Technolog5ravi_nysePas encore d'évaluation

- Sambhram Institute of Technolog4Document2 pagesSambhram Institute of Technolog4ravi_nysePas encore d'évaluation

- Sambhram Institute of Technolog1Document2 pagesSambhram Institute of Technolog1ravi_nysePas encore d'évaluation

- Answer Any One Set of Questions From The Following:: RD THDocument2 pagesAnswer Any One Set of Questions From The Following:: RD THravi_nysePas encore d'évaluation

- ToDocument1 pageToravi_nysePas encore d'évaluation