Académique Documents

Professionnel Documents

Culture Documents

Annuities Part 4 Answers q44-46 Mortgages and Personal Finance Ns

Transféré par

api-268810190Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Annuities Part 4 Answers q44-46 Mortgages and Personal Finance Ns

Transféré par

api-268810190Droits d'auteur :

Formats disponibles

MAP4C. Annuities and Mortgages Assignment.

Name_____________ Date________

Answers PART 4 : Questions 44-46. Problem Solving Questions Involving

Personal Finance. (Continued from last class.)

Answer all questions. Use additional paper as required and attach them to this report.

You may have to complete some of this work on your own time, using computers,

and/or the internet.

[Curriculum: Generate an amortization table for a mortgage, using a variety of tools and strategies (e.g., input data into an

online mortgage calculator; determine the payments using the TVM Solver on a graphing calculator and generate the

amortization table using a spreadsheet), calculate the total interest paid over the life of a mortgage, and compare the total

interest with the original principal of the mortgage.]

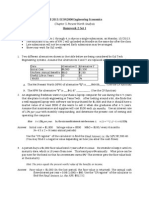

44. Task: Use the Government of Canada online mortgage calculator available at

www.fcac.gc.ca to create a mortgage payment schedule for a Canadian mortgage

amount between $150 000 and $350 000 at 5%/a, amortized for 25 years. Use a 5-year

term. Show the results of the Calculation Summary and the results of the Mortgage

Summary. [10 marks]

1. Follow link to FCAC mortgage tool and enter an amount. For example,

2. Select Calculate to create the mortgage payment schedule; and to show the

amortization summary table. For example,

MAP4C. Annuities and Mortgages Assignment. Name_____________ Date________

[Curriculum: Making comparisons between mortgage options. Determine, through investigation using technology (e.g.,

TVM Solver, online tools, or financial software), the effects of varying payment periods, regular payments, and interest

rates on the length of time needed to pay off a mortgage and on the total interest paid.]

45. Task: Create mortgage schedules using the mortgage tools available at

www.fcac.gc.ca , then use these reports to calculate the interest saved on a $100 000

Canadian (compounded semi-annually) mortgage with monthly payments, at 6% per

annum, when it is amortized over 20 years instead of 25 years. Clearly state your

findings for each. Use a 5-year term.

[10 marks]

20 year Amortization

25 year Amortization

Interest Paid: $70925.23

Interest Paid: $91941.99

Difference: $91941.99 $70925.23 = $21016.76

Therefore, $21016.76 will be saved on a $100000CAN mortgage at 6% per year, if amortized

over 20 years rather than 25 years.

20 year Amortization

MAP4C. Annuities and Mortgages Assignment. Name_____________ Date________

25 year Amortization of $100000 at 6%

MAP4C. Annuities and Mortgages Assignment. Name_____________ Date________

46. RESEARCH: Research a town-home, or single detached hope, for sale in Durham

Region. Can a couple afford the home on a family income of $50 000 per year? $90 000

per year? Report on your Investigation. Explain your reasoning. Provide mathematical

evidence to support your reasoning. ANSWERS will vary. See Rubric below.

Online, find a home for sale in the range of $200000 to $400000;

Start a Word document file to write a report;

Determine the down payment amount at 10% of the home

price:_______________;

Determine the amount of the mortgage required:_____________________;

Determine the monthly payment required: _________________;

Write a monthly budget showing income, expenses, and balance remaining.

Include $1200 for food; monthly mortgage payment amount; utilities at

$400/mo.; phone at $80/mo; clothing at $100/mo.; entertainment at $100/mo.;

maintenance at $100/mo.; transportation at $200/mo.; plus any other items that

you care to include;

Submit a report summarizing your findings. Can this couple financial afford such

a home on their income? JUSTIFY your conclusions.

Q46. Marking Rubric

Level 1

(50-59) 5

Level 2

(60-69)

Thinking and Inquiry. Ability to

comprehend the situation and find

information.

Little

evidence

provided.

Substantiall

y below

standard

expected.

Little, or

incorrect,

mathemati

cal

reasoning

is evident.

Some

evidence

provide, but

lacks detail.

Application of mathematical

reasoning.

(Down payment issues

addressed.)

(Payment schedule showing

monthly principal, interest, and

balance owing is included).

(Other monthly financial issues

addressed food, etc.)

Communication:

(Report is clearly written and

effectively communicated with

proper spelling

, punctuation, and grammar;

Report includes: a photo of the

home for sale ad; an fcac.gc.ca

mortgage payment schedule; a

viable 12-month budget; and a

written explanation and summary.

Total (out of 30)

Little or no

written

statements

or evidence

to support

the

financial

argument.

Some

mathematical

reasoning is

evident;

Reasoning

may contain

some small or

non-significant

errors.

Some written

statements to

support or

evidence to

support the

financial

argument.

Level 3

(70-79)

7

[Meets Prov.

Standard]

Sufficient

inquiry

evidence

provided.

Level 4

(80 100)

10

Good

mathematical

reasoning

clearly evident.

Thorough mathematical

reasoning is evident and

referenced in the report.

Substantial

written

statements or

evidence to

support the

financial

argument.

Thorough written

statements and evidence

clearly support the

financial argument.

Thoroughly researched

and documented. Student

clearly understands the

scope of the assignment.

Vous aimerez peut-être aussi

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)D'EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Annuities Part 4 q44-46 Mortgages and Personal Finance NsDocument3 pagesAnnuities Part 4 q44-46 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- Annuities Part 3 Answers q40-43 Mortgages and Personal Finance NsDocument5 pagesAnnuities Part 3 Answers q40-43 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- CXC It Sba 2015Document6 pagesCXC It Sba 2015Wayne WrightPas encore d'évaluation

- 2024 ItsbaDocument7 pages2024 ItsbaNyesha GrahamPas encore d'évaluation

- Chapter 3 Lab - College Finances - Fall 2021Document6 pagesChapter 3 Lab - College Finances - Fall 2021api-581381535Pas encore d'évaluation

- Information Technology (Grade 10) May 2020Document8 pagesInformation Technology (Grade 10) May 2020Daniel GRAYPas encore d'évaluation

- Annuities and Mortgages and Personal Finance NsDocument20 pagesAnnuities and Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- Annuities Part 2 q28-39 Mortgages and Personal Finance NsDocument5 pagesAnnuities Part 2 q28-39 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- 2015 HW2Document4 pages2015 HW2trollingandstalkingPas encore d'évaluation

- Module 2 - Time Value of MoneyDocument61 pagesModule 2 - Time Value of MoneyNarayanan Subramanian100% (1)

- Itech Tutoring Comm 308 BookletDocument117 pagesItech Tutoring Comm 308 BookletAytekin AkolPas encore d'évaluation

- Chapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual67% (3)

- Chapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END OF CHAPTER QUESTIONSMariem JabberiPas encore d'évaluation

- Assignment 2,3Document8 pagesAssignment 2,3HASSAN AHMADPas encore d'évaluation

- Future Budget ProjectDocument2 pagesFuture Budget ProjectkelseythemathteacherPas encore d'évaluation

- Summer 2020 1Document1 pageSummer 2020 1Hossain AhmedPas encore d'évaluation

- Project Work For Class Ix - (2020 - 2021) : Cost Discount (In Percentage)Document5 pagesProject Work For Class Ix - (2020 - 2021) : Cost Discount (In Percentage)Mr NoobPas encore d'évaluation

- Living My Best Life FinancesDocument8 pagesLiving My Best Life Financesapi-665406277Pas encore d'évaluation

- Acc 421Document3 pagesAcc 421Anonymous dLIq7U3DKzPas encore d'évaluation

- Math 100 ProjectDocument10 pagesMath 100 Projectapi-566489640Pas encore d'évaluation

- Comprehensive ProblemDocument11 pagesComprehensive Problemapi-295660192Pas encore d'évaluation

- Future Value of 1 Sample Problem: SolutionDocument9 pagesFuture Value of 1 Sample Problem: Solutioncris_magno08Pas encore d'évaluation

- Present ValueDocument8 pagesPresent ValueFarrukhsgPas encore d'évaluation

- Loans Notes and ExamplesDocument7 pagesLoans Notes and ExamplesJennifer PitterlePas encore d'évaluation

- Annuities Part 2 Answers q28-39 Mortgages and Personal Finance NsDocument7 pagesAnnuities Part 2 Answers q28-39 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- CH 04 EOC Solutions 4e StudentDocument15 pagesCH 04 EOC Solutions 4e StudentMary Shannon DeeringPas encore d'évaluation

- Contemporary Financial Management 13th Edition Moyer Solutions Manual 1Document36 pagesContemporary Financial Management 13th Edition Moyer Solutions Manual 1thomasbuckley11072002asg100% (25)

- Canadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument7 pagesCanadian Tax Principles 2014 2015 Edition Volume I and Volume II 1st Edition Byrd Test Bankdrkevinlee03071984jki100% (22)

- HSC Mathematics Advanced - Financial AdviserDocument6 pagesHSC Mathematics Advanced - Financial AdviserKelvin LimPas encore d'évaluation

- PPTXDocument16 pagesPPTXJenifer KlintonPas encore d'évaluation

- Nominal & EffectiveDocument20 pagesNominal & EffectivesandhurstalabPas encore d'évaluation

- Wednesday WK 2Document35 pagesWednesday WK 2Smriti LalPas encore d'évaluation

- Fin 300 Exam PracticeDocument6 pagesFin 300 Exam PracticePhillip Lee0% (1)

- AU FINC 501 MidTerm Winter 2013hhh SsDocument16 pagesAU FINC 501 MidTerm Winter 2013hhh SsSomera Abdul QadirPas encore d'évaluation

- Senior Economics ProjectDocument7 pagesSenior Economics ProjectkelleyjhalePas encore d'évaluation

- 2102 Midterm 2 Study GuideDocument13 pages2102 Midterm 2 Study GuideMoses SuhPas encore d'évaluation

- Introduction To Corporate FinanceDocument4 pagesIntroduction To Corporate FinanceDarshitPas encore d'évaluation

- Finance Project Math 1030Document5 pagesFinance Project Math 1030api-241289407Pas encore d'évaluation

- Case Study Before UTS LD21-20221028051637Document5 pagesCase Study Before UTS LD21-20221028051637Abbas MayhessaPas encore d'évaluation

- Personal Budget Checkpoint 2-1Document9 pagesPersonal Budget Checkpoint 2-1api-627693474Pas encore d'évaluation

- IE 360 Engineering Economic Analysis: Name: Read The Following Instructions CarefullyDocument11 pagesIE 360 Engineering Economic Analysis: Name: Read The Following Instructions CarefullyjohnhenryyambaoPas encore d'évaluation

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDocument17 pagesCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_Pas encore d'évaluation

- IEECONO Q1 T1 2022 Set B With Answer Key 1Document9 pagesIEECONO Q1 T1 2022 Set B With Answer Key 1Janry ArezaPas encore d'évaluation

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadPas encore d'évaluation

- 3 Phase CPN Credit Repair and Funding ProgramDocument7 pages3 Phase CPN Credit Repair and Funding ProgramAsberry Financial and 3G Technical Services73% (15)

- (Instructions) CXC CSEC INFORMATION TECHNOLOGY - SBA - 2023Document16 pages(Instructions) CXC CSEC INFORMATION TECHNOLOGY - SBA - 2023Marc CreatesPas encore d'évaluation

- 2023 Summer Capital AssignmentDocument2 pages2023 Summer Capital AssignmentPoetic YatchyPas encore d'évaluation

- Man Acc 1Document4 pagesMan Acc 1KathleneGabrielAzasHaoPas encore d'évaluation

- Collier 1ce Solutions Ch04Document10 pagesCollier 1ce Solutions Ch04Oluwasola OluwafemiPas encore d'évaluation

- RE 01 09 Hotel Acquisition Renovation SolutionsDocument7 pagesRE 01 09 Hotel Acquisition Renovation SolutionsAnonymous bf1cFDuepPPas encore d'évaluation

- AgBio3-Budget ProjectDocument11 pagesAgBio3-Budget ProjectCarriePas encore d'évaluation

- Presentation 3-Time Value of Money - 29908Document39 pagesPresentation 3-Time Value of Money - 29908Chin Keanna BuizonPas encore d'évaluation

- EC09Document18 pagesEC09Junaid YPas encore d'évaluation

- Berkeleyfirst: Financing Initiative For Renewable and Solar TechnologyDocument6 pagesBerkeleyfirst: Financing Initiative For Renewable and Solar TechnologySriphani VissamrajuPas encore d'évaluation

- Fin 455 SP 2017 CumulativeDocument10 pagesFin 455 SP 2017 CumulativedasfPas encore d'évaluation

- HW 2 Set 1 KeysDocument7 pagesHW 2 Set 1 KeysIan SdfuhPas encore d'évaluation

- Performance Task QuizDocument3 pagesPerformance Task QuizRhobie CuaresmaPas encore d'évaluation

- Tax Year 2013 DeskReferenceGuideDocument8 pagesTax Year 2013 DeskReferenceGuideMia JacksonPas encore d'évaluation

- 3m 4 4 The Sine LawDocument5 pages3m 4 4 The Sine Lawapi-268810190Pas encore d'évaluation

- Exam Map4c1 Formulas and Conversions Reference SheetDocument5 pagesExam Map4c1 Formulas and Conversions Reference Sheetapi-268810190Pas encore d'évaluation

- Lesson Status Quadratic ExpectationsDocument2 pagesLesson Status Quadratic Expectationsapi-268810190Pas encore d'évaluation

- 4 2 Trig Finding AnglesDocument5 pages4 2 Trig Finding Anglesapi-268810190Pas encore d'évaluation

- 3m Ch2solutions pck1Document18 pages3m Ch2solutions pck1api-268810190Pas encore d'évaluation

- Skills 4 SolutionsDocument8 pagesSkills 4 Solutionsapi-268810190Pas encore d'évaluation

- Class 8 Composite Volume and Optimal Area - Chapter 2 GeometryDocument7 pagesClass 8 Composite Volume and Optimal Area - Chapter 2 Geometryapi-268810190Pas encore d'évaluation

- Pyth TheoremDocument4 pagesPyth Theoremapi-268810190Pas encore d'évaluation

- Skills2 SolutionsDocument6 pagesSkills2 Solutionsapi-268810190Pas encore d'évaluation

- Diagnostic GeometryDocument4 pagesDiagnostic Geometryapi-268810190Pas encore d'évaluation

- Imperial Length ConversionsDocument2 pagesImperial Length Conversionsapi-268810190Pas encore d'évaluation

- Cross MultiplicationDocument2 pagesCross Multiplicationapi-268810190Pas encore d'évaluation

- Skills1 Solutions0001Document6 pagesSkills1 Solutions0001api-268810190Pas encore d'évaluation

- Skills 1Document7 pagesSkills 1api-268810190Pas encore d'évaluation

- Trig Questions NsDocument3 pagesTrig Questions Nsapi-268810190Pas encore d'évaluation

- Annuities Part 2 Answers q28-39 Mortgages and Personal Finance NsDocument7 pagesAnnuities Part 2 Answers q28-39 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- C3asmt Geometry Canadian FlagDocument3 pagesC3asmt Geometry Canadian Flagapi-268810190Pas encore d'évaluation

- Annuities Part 1 Answers q1-27 Mortgages and Personal Finance NsDocument6 pagesAnnuities Part 1 Answers q1-27 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- TrigonometryDocument12 pagesTrigonometryapi-268810190Pas encore d'évaluation

- About This Course Map4c Assessment Emotional Strategies and Prior KnowledgeDocument5 pagesAbout This Course Map4c Assessment Emotional Strategies and Prior Knowledgeapi-268810190Pas encore d'évaluation

- Essential Concepts in GeometryDocument3 pagesEssential Concepts in Geometryapi-268810190Pas encore d'évaluation

- Exam Preparation Map4cDocument2 pagesExam Preparation Map4capi-268810190Pas encore d'évaluation

- Annuities Part 2 Answers q28-39 Mortgages and Personal Finance NsDocument7 pagesAnnuities Part 2 Answers q28-39 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- Annuities Part 2 q28-39 Mortgages and Personal Finance NsDocument5 pagesAnnuities Part 2 q28-39 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- Annuities and Mortgages and Personal Finance NsDocument20 pagesAnnuities and Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- Annuities Part 3 q40-43 Mortgages and Personal Finance NsDocument3 pagesAnnuities Part 3 q40-43 Mortgages and Personal Finance Nsapi-268810190Pas encore d'évaluation

- Map4c Skills 7Document4 pagesMap4c Skills 7api-268810190Pas encore d'évaluation

- Common Securitization Platform Testing: Case StudyDocument2 pagesCommon Securitization Platform Testing: Case Studyabhikalp bhaskarPas encore d'évaluation

- Ics Exams 2013 Questions SFDocument2 pagesIcs Exams 2013 Questions SFDeepak Shori100% (1)

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovPas encore d'évaluation

- Upp-Int Progress Test Unit 02 B. Norvydas TuoDocument4 pagesUpp-Int Progress Test Unit 02 B. Norvydas TuoNorvydas TuomėnasPas encore d'évaluation

- Chapter 5 - Teacher's Manual - Afar Part 1Document15 pagesChapter 5 - Teacher's Manual - Afar Part 1Mayeth BotinPas encore d'évaluation

- Real Estate Analyst ResumeDocument8 pagesReal Estate Analyst Resumeujsqjljbf100% (2)

- PNB v. Ong Acero, 148 SCRA 166Document8 pagesPNB v. Ong Acero, 148 SCRA 166Jass ElardoPas encore d'évaluation

- Signing NotificationDocument2 pagesSigning Notificationjrholtz73Pas encore d'évaluation

- Credit DigestDocument1 pageCredit Digestfdbarateta6Pas encore d'évaluation

- cREDIT tRANSACTIONS1Document6 pagescREDIT tRANSACTIONS1Janil Jay EquizaPas encore d'évaluation

- The Ultimate Asset Protection GuideDocument41 pagesThe Ultimate Asset Protection GuideOneNation100% (1)

- Functions of Financial Institutions: Cribe, UmaliDocument7 pagesFunctions of Financial Institutions: Cribe, Umalijullian UmaliPas encore d'évaluation

- Home Hunting Comparison WorksheetDocument2 pagesHome Hunting Comparison WorksheetImran F SyedPas encore d'évaluation

- Customer Satisfaction On Housing Loan in SBI BankDocument23 pagesCustomer Satisfaction On Housing Loan in SBI BankDebjyoti Rakshit100% (2)

- Discharging Debt Via HJR 192 - Understand Contract Law and You Win!Document13 pagesDischarging Debt Via HJR 192 - Understand Contract Law and You Win!W. A. Bey Emperor Asher100% (14)

- Gardaí Never Investigated State Official's Destruction of Documents, Trial HearsDocument444 pagesGardaí Never Investigated State Official's Destruction of Documents, Trial HearsRita Cahill100% (1)

- Week 5 Tutorial ProblemsDocument6 pagesWeek 5 Tutorial ProblemsWOP INVESTPas encore d'évaluation

- Tax 06 Capital Gains Taxation Part 4Document7 pagesTax 06 Capital Gains Taxation Part 4Panda CocoPas encore d'évaluation

- PSI Topic Exam QuestionsDocument10 pagesPSI Topic Exam QuestionsEPSONPas encore d'évaluation

- IJTRD7784 (1) Customer Perception IntroductionDocument3 pagesIJTRD7784 (1) Customer Perception IntroductionVivek ThakurPas encore d'évaluation

- Jutic v. CaDocument8 pagesJutic v. CaYang AlcoranPas encore d'évaluation

- Aec 005 Week 7 ModuleDocument32 pagesAec 005 Week 7 ModuleJohn Andrei ValenzuelaPas encore d'évaluation

- Money and BankingDocument11 pagesMoney and Bankingamna hafeezPas encore d'évaluation

- Credit Analysis Partener Prompt 1 - Linie CreditDocument15 pagesCredit Analysis Partener Prompt 1 - Linie CredityayaPas encore d'évaluation

- P Segment LoansDocument192 pagesP Segment Loansgee emm100% (1)

- EIOPA's Revised Solvency II Calibration Still Risks Turning European Insurers Away From SecuritizationsDocument9 pagesEIOPA's Revised Solvency II Calibration Still Risks Turning European Insurers Away From Securitizationsapi-228714775Pas encore d'évaluation

- Non - Bank Financial Institutions and Economic Growth in NigeriaDocument57 pagesNon - Bank Financial Institutions and Economic Growth in Nigeriajayeoba oluwaseyi100% (1)

- Chapter 3 - Classification of BanksDocument8 pagesChapter 3 - Classification of BanksShasharu Fei-fei LimPas encore d'évaluation

- Atom Bank Mortgage Broker ListDocument42 pagesAtom Bank Mortgage Broker ListSpartacus UkinPas encore d'évaluation

- OFO Codes Version2013 Data Tables BankingSectorCustomisedMasterList BANKSETA v1.0Document973 pagesOFO Codes Version2013 Data Tables BankingSectorCustomisedMasterList BANKSETA v1.0VincsPas encore d'évaluation