Académique Documents

Professionnel Documents

Culture Documents

Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart Levels

Transféré par

Miir ViirTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart Levels

Transféré par

Miir ViirDroits d'auteur :

Formats disponibles

Mizuho Corporate Bank

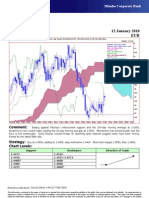

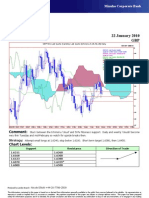

Technical Analysis 14 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

28Sep09 - 19Feb10

Pr

EUR=EBS , Last Quote, Candle 1.515

14Jan10 1.4510 1.4556 1.4495 1.4540

EUR= , Bid, Tenkan Sen 9 1.51

14Jan10 1.4419

EUR= , Bid, Kijun Sen 26

14Jan10 1.4496 1.505

EUR= , Bid, Senkou Span(a) 52

18Feb10 1.4457 1.5

EUR= , Bid, Senkou Span(b) 52

18Feb10 1.4680 1.495

EUR= , Bid, Chikou Span 26

10Dec09 1.4537

1.49

1.485

1.48

1.475

1.47

1.465

1.46

1.455

1.45

1.445

1.44

1.435

1.43

1.425

05Oct09 12Oct 19Oct 26Oct 02Nov 09Nov 16Nov 23Nov 30Nov 07Dec 14Dec 21Dec 28Dec 04Jan 11Jan 18Jan 25Jan 01Feb 08Feb 15Feb

Comment: Still struggling to close above the 26-day moving average at 1.4496. Momentum is bullish and

might increase, pushed by a rising 9-day average. Other major currencies confirm, looking for a weaker USD.

Strategy: Buy at 1.4540, adding to 1.4485; stop well below 1.4400. Short term target 1.4575, then 1.4800.

Chart Levels:

Support Resistance Direction of Trade

1.4495 1.4557

1.4453 1.4580*

1.4400* 1.4600

1.4300 1.4680

1.4255 1.4800*

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

Vous aimerez peut-être aussi

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

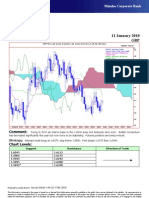

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirPas encore d'évaluation

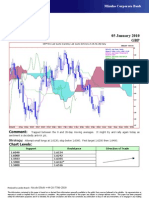

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirPas encore d'évaluation

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

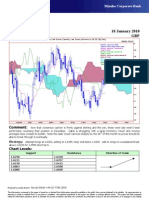

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirPas encore d'évaluation

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Eur-Usd-04 January 2010 DailyDocument1 pageEur-Usd-04 January 2010 DailyMiir ViirPas encore d'évaluation

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirPas encore d'évaluation

- GBP Usd 01 19 2010Document1 pageGBP Usd 01 19 2010Miir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Gbp-Usd-05 January 2010 DailyDocument1 pageGbp-Usd-05 January 2010 DailyMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- AUG-05 Mizuho Technical Analysis EUR USDDocument1 pageAUG-05 Mizuho Technical Analysis EUR USDMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- Gbp-Usd-04 January 2010 DailyDocument1 pageGbp-Usd-04 January 2010 DailyMiir ViirPas encore d'évaluation

- Mizuho Corporate BankDocument1 pageMizuho Corporate BankMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- MyFXForecastsforTHURSDAY July29thDocument2 pagesMyFXForecastsforTHURSDAY July29thapi-26441337Pas encore d'évaluation

- Esquema Prueba Viga Vpt-1aDocument1 pageEsquema Prueba Viga Vpt-1aVictor HerreraPas encore d'évaluation

- MyFXForecastsforMONDAY August2ndDocument2 pagesMyFXForecastsforMONDAY August2ndapi-26441337Pas encore d'évaluation

- AUG-04 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-04 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Document7 pagesBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraPas encore d'évaluation

- Bupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"Document1 pageBupropion - Louis 3 1 "C:/Users/Nmr/Dropbox (Lims) /NMR 500Mhz/2019 Medical Capstone"lorenzoPas encore d'évaluation

- My Latest FXForecastsfor JULY5Document2 pagesMy Latest FXForecastsfor JULY5api-26441337Pas encore d'évaluation

- MyFXForecastsforWEDNESDAY August18thDocument2 pagesMyFXForecastsforWEDNESDAY August18thapi-26441337Pas encore d'évaluation

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocument1 pageBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuPas encore d'évaluation

- EUR USDUPDATEApril23Document2 pagesEUR USDUPDATEApril23api-26441337Pas encore d'évaluation

- My LATESTFXForecastsfor MAY13Document2 pagesMy LATESTFXForecastsfor MAY13api-26441337Pas encore d'évaluation

- Area-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10Document1 pageArea-250 SQ.M Kitchen Area - 510 SQ.M Restaurant: SLOPE - 1:10mathivananPas encore d'évaluation

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewDocument3 pagesMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337Pas encore d'évaluation

- AUG-02 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-02 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsDocument1 pageTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirPas encore d'évaluation

- Tugas Akhir Steel Pipe Rack MSIBDocument3 pagesTugas Akhir Steel Pipe Rack MSIBf a chaidirPas encore d'évaluation

- MyFXForecastsforTHURSDAY August12thDocument2 pagesMyFXForecastsforTHURSDAY August12thapi-26441337Pas encore d'évaluation

- Technical Analysis 15 September 2010 JPY: CommentDocument1 pageTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsPas encore d'évaluation

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocument1 pageAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraPas encore d'évaluation

- Presentation Schedule2010BWFLYER FinalDocument1 pagePresentation Schedule2010BWFLYER FinalRamon Salsas EscatPas encore d'évaluation

- MyFXForecastsforMONDAY August23rdDocument2 pagesMyFXForecastsforMONDAY August23rdapi-26441337Pas encore d'évaluation

- Balcon B equipment layout and dimensionsDocument1 pageBalcon B equipment layout and dimensionsOana RusuPas encore d'évaluation

- Arquitectonico PBDocument1 pageArquitectonico PBPedro MárquezPas encore d'évaluation

- ANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieDocument1 pageANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieSandu Denis-SorinPas encore d'évaluation

- ScienceDocument9 pagesScience심린Pas encore d'évaluation

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEEPas encore d'évaluation

- ATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewDocument1 pageATGB3052: Kolej Universiti Tunku Abdul Rahman Station 6 Section ViewKAR WEI LEEPas encore d'évaluation

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- Arkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Document1 pageArkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Wahyu UPas encore d'évaluation

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirPas encore d'évaluation

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirPas encore d'évaluation

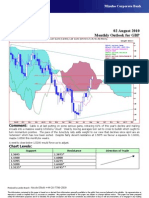

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirPas encore d'évaluation

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirPas encore d'évaluation

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirPas encore d'évaluation

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirPas encore d'évaluation

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirPas encore d'évaluation

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirPas encore d'évaluation

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirPas encore d'évaluation

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirPas encore d'évaluation

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirPas encore d'évaluation

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirPas encore d'évaluation

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirPas encore d'évaluation

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirPas encore d'évaluation

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirPas encore d'évaluation

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirPas encore d'évaluation

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirPas encore d'évaluation

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirPas encore d'évaluation

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirPas encore d'évaluation

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirPas encore d'évaluation

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirPas encore d'évaluation

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirPas encore d'évaluation

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirPas encore d'évaluation

- Strategic Choice-Bowmans Strategic ClockDocument7 pagesStrategic Choice-Bowmans Strategic ClockDeepakPas encore d'évaluation

- 1.1 Electronic Commerce:: Definition of E-CommerceDocument8 pages1.1 Electronic Commerce:: Definition of E-Commercesyed hussainPas encore d'évaluation

- Econ 202 Interview Consumption Paper 1Document3 pagesEcon 202 Interview Consumption Paper 1api-479844980Pas encore d'évaluation

- 4G Auction in TurkeyDocument17 pages4G Auction in TurkeymotaazizPas encore d'évaluation

- NISM Chap 2Document14 pagesNISM Chap 2Amarjeet SinghPas encore d'évaluation

- Mastering The Covered Call FinalDocument65 pagesMastering The Covered Call Finaljenna100% (1)

- Mergers & Acquisitions and Financial RestructuringDocument30 pagesMergers & Acquisitions and Financial Restructuringloving_girl165712Pas encore d'évaluation

- Retail MethodDocument9 pagesRetail MethodToan Nguyen100% (1)

- Outlet Centres Europe - 2022 12Document81 pagesOutlet Centres Europe - 2022 12Đồng ĐàoPas encore d'évaluation

- Assignments 24 March - March 31 2015Document2 pagesAssignments 24 March - March 31 2015Alex HuesingPas encore d'évaluation

- Consumer Attitudes Towards Online Grocery Shopping in Kathmandu ValleyDocument7 pagesConsumer Attitudes Towards Online Grocery Shopping in Kathmandu ValleyRajan JaswalPas encore d'évaluation

- Assessment 4 Mark 1Document29 pagesAssessment 4 Mark 1Devaky_Dealish_182Pas encore d'évaluation

- Chapter 11Document1 pageChapter 11Allen EspeletaPas encore d'évaluation

- Lectura Semana 02Document28 pagesLectura Semana 02Manuel Smelling Barriga PeraltaPas encore d'évaluation

- Chapter 05 1Document31 pagesChapter 05 1Alex BayogPas encore d'évaluation

- Breakaway GapsDocument4 pagesBreakaway GapsNikos PasparakisPas encore d'évaluation

- The Anthropology of Development and Globalization From Classical Political Economy To Contemporary Neoliberalism Blackwell Anthologies in Social andDocument416 pagesThe Anthropology of Development and Globalization From Classical Political Economy To Contemporary Neoliberalism Blackwell Anthologies in Social andAndré Dumans GuedesPas encore d'évaluation

- Social Media ManagementDocument4 pagesSocial Media Managementmaybell panlaquiPas encore d'évaluation

- No. #1 Shopify Development Service Provider MumbaiDocument6 pagesNo. #1 Shopify Development Service Provider MumbaiShopify web developers in MumbaiPas encore d'évaluation

- 3 Financial AccountingDocument17 pages3 Financial Accountingooagentx440% (1)

- Summative ICT 10Document2 pagesSummative ICT 10Angela Rulete100% (1)

- LinearEquationsInOneVariable InvestmentDocument3 pagesLinearEquationsInOneVariable InvestmentKurt Byron AngPas encore d'évaluation

- Thesis 3rd SemDocument56 pagesThesis 3rd Semsumi akterPas encore d'évaluation

- Analysis of Global Lithium Ion Battery MarketDocument11 pagesAnalysis of Global Lithium Ion Battery MarketDwarkanath BhattacharyyaPas encore d'évaluation

- Calculate WACC and Cost of EquityDocument1 pageCalculate WACC and Cost of EquitysauravPas encore d'évaluation

- Bond Yields and Yield Calculations ExplainedDocument17 pagesBond Yields and Yield Calculations ExplainedJESSICA ONGPas encore d'évaluation

- Target Costing and Cost Analysis For Pricing Decisions: Answers To Review QuestionsDocument48 pagesTarget Costing and Cost Analysis For Pricing Decisions: Answers To Review QuestionsMJ Yacon0% (1)

- Marketing 3.0 From Products To Customers To The Human Spirit PDFDocument3 pagesMarketing 3.0 From Products To Customers To The Human Spirit PDFArif KruytPas encore d'évaluation

- Intermediate Accounting II Chapter 15Document3 pagesIntermediate Accounting II Chapter 15izza zahratunnisa100% (1)

- Canadian dollar's forward rate should exhibit a premiumDocument3 pagesCanadian dollar's forward rate should exhibit a premiumPhước NguyễnPas encore d'évaluation