Académique Documents

Professionnel Documents

Culture Documents

Adelson Family Foundation 2013 990

Transféré par

eliclifton0 évaluation0% ont trouvé ce document utile (0 vote)

685 vues33 pagesAdelson Family Foundation 2013 990

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAdelson Family Foundation 2013 990

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

685 vues33 pagesAdelson Family Foundation 2013 990

Transféré par

elicliftonAdelson Family Foundation 2013 990

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 33

Merare! TO+Y 01 $0 0001 Yery MMe

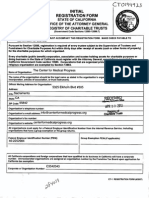

Return of Private Foundation

oF Section 4847(a)() Trust Treated as Private Foundation

Do not entar Social Security numbers on this form as it may bo made public.

i

2

s

i

2

a

For calendar year 2019 or fx year beginning and ending

Tine of en 1 Spr Tea

Adelson Family Foundation

‘Nonber and eet (0.0 ox robe Fa no eben RTE) Roa 7024330

300 Fist Ave. "Teo roe aden

hy own Sam ae

Needham Ma 2494 (781) 972-5950

Pea ema Teng oman rae fons [© vemnpti epatin penarg. cxartos >]

S Check aiat apply; [] tial etum [tial alum ofa former public charly | © 1. Faceneqarasns, echo -o

GF inatretn EE] Amend return 2. Fenestra ecg 8,

TAddress change _C) Name Seateemeaeacmpae +E]

H Check ype oforgantation: [x] Section 507(6\) exempt private foundation © apna astern

G Section 4947(8)(1) nonexempt charitable trust_[] Other taxable private foundation _— e

T Foirmarket value of ell assets at | J Accounting method: C] Cosh L) Accrual

end of year (rom Pat co. (2), BH omer (epecity) Mi ' vacneroceeet ee +L

ine 16)» $ 25,943] (Part, column () mutt been cach basis)

TIN Analyois of Revenue and Expenses (The w/o! | 1) nevnand i Danaea

amounts in columns (8). (c), end (@) may not necessanly | “‘bipeneaper | (©) Netlvaatrent | (0) Aduednet | tr chaabe

equal the amounts in column (a) (see instructions).) poke foash basis ony)

1 Contributions, gifs, grants, etc, received (attach schedule) 53,250,124] ~

2 Check >] he foundations nat required atch Sh. 8 z

3 Interest on savings and temporary cash investments Ti] Ties]

44 Dividends and interest fom secures,

Ba Gross rents

b_ Not rental income or (loss)

6a_Net gain or (loss) from sale of assals not on ine 10

1b Gross sales price forall asses on ine 62 2

Capital gain net income (from Part V.Tine 2).

8 Net short-term capital gain. - i

9

oa

b

Revenue

Income modifications : i

Gross sales less rtums and slowances

Less: Cost of goods sold

Gross proft or (loss) (attach schedule) E

Other income (attach schedule) : a

Total. Add ines 1 through 11. [33251367 1.188 of

‘Compensation officers, directors, rstees, ele = = 157214 serait

Omer employee saianes anawages [==

Pension plans, employee benefits. : 2435 738

Legaltees (tach schedule) ss. 751,840 751.000

Accounting fee (attach schedule)

Other professional fees (attach schedule) 2268 2286

Interest cece

Taxes (attach schoduie) (see instructors) 7007 ao

Depreciation (atach schedule) and denietion 756 a

E} 20 oceupaney 2... oe

Z| 21 Travel, conferences, and meetings 1642 16482

| 22 Printing ne pubtcations

5] 23 omer expenses (atach schedule) ae 134540 as

B) 24 Total operating and administrative expenses.

B| Add ines +3 trough 23, 488,240 ol _ 487,404

§| 25 Contrbutons, gts, grants paid... s2Bi2216| wzs12216

[28 _Totlerpenses and disbursements Addins 2and25| 59,000 456 A 53,200,700

2 Subiract ine 26 from line 12: ae 1 .

2 Excess of revenue over expenses and disbursements... 49.068) i

Net investment income (f negetve, enter -0-) RC

<_ Adjusted net income (t negatve, enter 0) a

For Paperwork Reduction Act Notice, see Instructions. om S50-PF cnt)

a

1

a

/

3

7

2

Fem o00-PF (2019) Adelson Family Foundation

04-7024350 page 2

eu ‘Machel sees end avast escigin can |_Boginning f year En of year

MEIETE Balance Sheet dba txendotyeaunantscy.(Sevsiusins) |" (yesoevxe | yBontvoue |) FarNare vw

1 Cash—norinterest bearing 73,334 25,000] 25,000,

2 Savings and temporary cash investments

3 Accounts receivable

Less: allowance for doubtful accounts

4 Pledges receivable D

Less: allowance for doubtful accounis

6 Grants receivable... 0...

6 Receivables due fom officers, directors, trustees, and other

disqualified persons (attach schedule) (see instructions)

7 Other notes and inns reosivable(atiach schedule)

Less allowance fo doubts accounts

8 Inventories for sale or use

9 Prepaid expenses and deferred charges

40a _Ivestnents-—U.S. end stat goremmenobigaons (tach schedule)

Investments —corporate stock (attach schedule)

€ Investments—corporate bonds (aiach schedule). .

11 ivestnens—land bugs, and equpment bass 7 aa J

Less: acme deprecation aac shade)

42 Investments—mortgage loans

13 Investments—other attach schedule)

44 Land, ulin, end equipment bass nn ;

Less: acute depreciabon (atac schedie) oat

16 Otveraccote (doccribo m y

16 Total assets (io be competed by all fiere—see the

instructions. Also, see page 1 er : 75,030] 25,941 25,941

17 Accounis payable and accrued expenses 1

18 Grants payable i

49 Deford revenue

20 Loans tom oftcers, crete, rstes, and oer equate percens |

21 Morigages and other notes payable (attach schedule) |

‘22 Other liabilities (descnbe > ) |

23 Total labiltes (add ines 17 though 28) : a] nH |

Foundations that fotlow SFAS 117, check here > |

8] and completa tines 24 through 26 and tines 30 and 31. |

El 26 Unestited ee 75,030] 2seai] « ;

| 2% Temporary restricted i

S| 26 Permanent restricted |

S| Foundations that do not follow SFAS 117, check here ® |

©} and complete lines 27 through 31. :

5) 27 Capital stock, trust principal, or current funds

3 28 Paid-in or capital surplus, or land, bidg., and equipment fund |

29° Retained earings, accumuintd income, endowment, or oes funds

<} 30 Total not assets or fund balances (see instuctons). . . =) 25,941

$|s1teultemtenatmoriemenes |

instructions) ee 75,930] oat |

‘Analysis of Changes in Net Assets or Fund Balances

Total sal or nd ances at begorig of yeat—Part cohen (ae 3 (ust apo wih

end-of-year figure reported on prior year return) : 4 75,030

2. Enter amount from Part, tne 272 2 49,088

3. Other increases not included in line 2(temize) > 3

4 Addines 4,2, ond 3 4 259m

5 Decreases not included in line 2 itemize) > 6

6 Total net assets or fund balances at end of year (ie 4 ins ine Sf “PUA colin ie 25a

Ferm 980-PF (2013)

a

1

‘ Fem200- 2013) __ Adelson Family Foundation 04-7024330 pape 3

3 ‘Capital Gains and Losses for Tax on Investment Income

7 Fox sonnet

7 (0) son ese ebro oper so (6.9, ret eae ‘€)oate cures | (6) Dew sos

: ary bck wane, earner Sat MOR MUS CO Sees | taeccorey | tm.)

a ie

a b

d

e

(beget awe (o) Cato ce ens (pha a tou

(0) res aes rca ca Shs oxpoe tan copa mo

b

€

:

‘Comptes on fo assets showing gain lh courn (i aed wared by the Foundation on T2769 erect nenee

FAny ance 209K ed peat. 0 a etree hoe

b

€

d

e !

Tf gain, sso entarn Part, ino 7

2 Capita gainnatincome or(netcaptaltossy { 20m agaeniern Pont tee? yl -

3 Net short-term capita gain or (loss) a8 defined in sections 1222(5) and (6)

i gehen entra 6, column sso takuctoneh. oma, are- +n}

Parti, tne 8 3 o

‘Qualification Under Section 4940je) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject tothe section 4940(a) tax on net investment income.)

1 section 4940(6)(2) apes, leave this part blank

\Was the foundation able forthe section 4942 tax on the distibutable amount of any year in the base period? 1 Yes J No

117Yees, the foundation does not qualfy under section 4940). Do nat complete this part

Enter the appropriate |mount in each column for each year, see the instructions before making eny enties.

o @

‘ase pai years o 2 Distation ato

ee y_|__Mteduaihing devtiors | nett trondataboves ones | a, DEERE

2012 5 267,772 786,488] 242.845502

2011 21,914,855] 115,347] 168, 990706

Zow 1773629 Z0.982] 17.8796/7

2008 31,539 495| 47,244) 667.587313,

2008. 55,178,667] 210,192] 262.515543

2 Totalof ne 1, column (6) 2 2,100.816741

3 Average distribution ratio forthe S-year base period—divde the total online 2 by , or bythe

number of years the foundation has been in existence iless than 5 years 3 436.183748

4 Enter the net velue of noncharitable-se assets for 2013 from Part X, tine 5 4 646,525

5 Multi tine 4 by tne 3 : ‘ -. [8 2,903,534

6 Enter 1% of net investment income (1% of Part, line 276) 6 42

7 Addlines Sané6 .. . . aoa z 281,903,546

8 Enter qualifying cistibutions from Part XI, Ene 4 8 53,209,700

{tine 8 is equal oor greater than Kine 7, check the box in Pat VI ine 1b, and complete that part using a 1% lax ale. Soe he

Part i instructions.

Farm 980-PF ois)

Fomeesr ors) ___Aeton Family Foundation 04-7024330 paged

EEN excise Tax Gased on investment income (Section 404(a), cOs0b) AAU), or AS49 eno structions)

1 Erenp open buain descibedin secon SHGK2, cece > L] and enfer"NA" online 4. —]

Cate of ruling or determination fetter: (attach copy of letter if necessary—see instructions)

Domestic foundatons tat mee he sean aB40(e) requirements in Pat V, check

here > C) ard enter 1% of Pat, ne 70 i

Aller domestic foundations entar 2% of tin 270. Exempt oeign organizations enter 4% of

Part ne 12, 3. (0)

1

7

a

7

2

°

‘

2 Taxunder secon 511 (domestic section 4047(o)(1) tris and taxable foundations ony. Others enter.) |2 | |

3 Add lines t and 2 3 24]

4 Sail A (income tax (domestic section 4947) trust a taxable foundations ony. Others enter) 4

6 Tax based on investment income. Subtract line 4 from fine 3. zero or less, enter -0- 5 24]

6 Credits/Payments: 1

4 21Detinated tex yen and 2012 oepaymentcreteaio 2019 | a 29] | y.

1b Exempt foreign organizations —tax withheld at source sb |

Tax pald wth application fo extension of tne to fle (Form 8868) 6c. 200)

d_ Backup withholding erroneously withheld 64 !

7 Total ceclis and payments. Addines 6athough Gd... Fe

8 Enter any penalty for underpayment of estimated tax, Check here] if Form 2220/is attached

5) Tax du. ifthe ltl of nes 3 and more than ne 7, eter amount owed > dl

{9 Overpayment tne 7 er han tie and etre aout ove > Zs

Enior he amount fine 10 tobe: Credited to 2014 estimatod tax 215| Refunded » [11 a

Statements Regarding Activities

‘During the tx year, i he foundation attempt oinflvance any natnal wae, or ocal legion or idk = [ves no

Participate or intervene in any political campaign? . . . . . . ta x

1b Did it spend mere than $100 during the y

Instructions forthe definition)? . .

110 answor is “Yes"t0 1 oF 1b, ettech @ dotalod description ofthe actives and copies of any materials

published or distributed by the foundation in connection with the activites,

© Did the foundation file Form 1420-POL fortis year? . . .

4 Enter the amount (i any) of tax on politcal expenditures (section 4965) imposed during the year:

(1) On the foundation. > $ (2) On foundation managers. >S

‘© Enter the reimbursement (any) paid By ihe foundation during the year for poltical expenditure tax imposed

fon foundation managers.

2 Hes the foundation engaged in any actviies that have not previously been reported to the IRS?

11 Yes," attach a detailed description ofthe actives.

3. Hes the foundation made any changes, not previously reported tothe IRS, ints governing instrument, articles

oficarprain,o bon, les sranans? "Yas tach a coomod cop fe changes

Did the foundation have unrelated business gross income of $1,000 or more during the year?

17¥es,"has it fled a tax return on Form 990-T for this year? . :

Was there 9 Byuidaion, termination, vnsoliin, or subslanial conbolion ding the year? |.

I "Yes,"altach the statement required by Genre! Instruction T-

5 Are the requirements of section 608(e) (relating to sections 4941 through 4945) saisfied ether:

‘By language inthe governing instrument, oF

‘© By stato legisiaton that effectively amends the governing instrument so that no mandatory directions that

confict withthe state law remain in the governing instrument? at

7 Didteunaten have test $5.00 ssa nye ig ha yea? Yes, complete Pa i, ek (9 and Pat XV

8a Enter the states to which the foundation reporss or with which itis registered (see instructions)

(ether dvecty o indiecty) for pica purposes (see

cot

Ifthe answer is "Yes" ished a copy’

(0: designate) of each state as requited by Genera! Instruction G? If No," attach explanation

9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942()(3)

428) aed yea 2013 tral yer Dein 2013 (senso fr Pan XN?

ney

Yes," comptote Part XIV 8 x

0 oes any arvons become substan contibuor ding the oe “yea? tes" tech 2 sched filing oir

names and adcrossos 0 x

Fam 990-PF (e013)

FomssoPF 2013) Adelson Family Foundation 04-7024330 page 5

[EERIE Statements Regarding Activities (continued)

41 Atany ime during the year, did the foundation, directly or inirecly, own a controled entity witin the

meaning of section 512(6\13)? If"Yes." attach schedule (see instructions)

12 Did the foundation make @ distribution to a donor advised fund over which the foundation ora disqualified

person had advisory privileges? "Yes," attach statement (see instuctons)

13.0 tne foundation comply wth the pubic inspection requirements forts annual eluns and exemption appeation?

Website address _waw.adelsonfoundationorg

1“

felephone no.

ZiP4

18 Section 4947(a)(1) nonexempt charitable truss fling Form 960-PF in lieu of Form 1041—Check here

‘and enter the amount of tax-exempt interest received or accrued during the year ae > Ls

a x

I>

16 Atany time during calendar year 2013, did the foundation have en interest in or a signature or other authority

over 2 bank, securities, or other financial account in a foreign country? .

Sethe instructions for exceptions and fling requirements for Form TD F 80-22.1. "Yes enter the name of

the foreign country

En ‘Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item Is checked in the "Yes" column, unless an exception applies.

ta__Duting the year i the foundation (ether directly or indirecty)

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? Oves no

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept from) a

Gisquaiified person? : Cres No

(3) Furnish goods, services, of facies to (or accept them from) a disqualified person? ves Lo

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? Byes Ono

(8) Transfer any income or assets to a disqualified person (or make any of either available for

the benef or use ofa cisqualfed pereon)? . Five Biv |

(6) Agree to pay money or propery toa government oficial? (Exception. Check "Noi the

foundation agreed to make a grant to or to employ the official for a period after

termination of goverment serve, terminating win 80 days) Oves no

b Ifany answer is "Yes" to 12(1)-{6), did any of the acts fall to qualify under the exceptions described in

Regulations section §3,4941()-3 orn 2 current notice regarding disaster assistance (see instructions)?

Organizatone ring on curennotce egardng deter asstance check here ‘oO

€ Did he foundation engage ina pir yearin any ofthe acts describe in 1a, otter than excepted acs, that

‘were not corrected before the first day of the tax year beginning in 2013?

2 Taxes on failure to cistrbute income (section 4942) (does not aply for years the foundation was a private

‘operating foundation defined in section 4942()(3) or 4942()(5))

a Atthe end of tax year 2013, cid the foundation have any undistributed income (ines 6¢ and

6e, Part Xi) for tax year(s) beginning before 20137 Oves (No

ltrYes."listtheyeers 20.20.20, 20.

b Ave there any years liste in 2a for which the foundation is not aoplving the provisions of section 4942(a\(2)

{relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) to

all years listed, answer "No" and attach statement—see instructions.)

¢ Ifthe provisions of section 4942(a)(2) are being applied to any ofthe year listed in 2a, ist the years here,

‘arm 990-PF (2013)

Form 99097 (2019) ‘Adelson Family Foundation

04-7024330__ page 7

GENEVE Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

3 Five highest-paid independent contractors for professional services (sea instructions). if none, entor “NONE”

ba ane een den pect pt ne Su Ooi cents ‘cee

‘bo Stte St, boston, Wa 8 Leger 151940

“Total ocers receiving ove $50,000 To prcessonal sanices efesereseccecece

‘Summary of Direct Charitable Activities

‘ss aia singed crane ech fo Pcs et a an er

“ayers en ober bene tevez cferences Cowen, seme pages POS,

1

Farm 990-PF (013)

1

7

a

7

2

°

‘

Fameso7r (2013) Adelson Family Foundation

‘Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

see instructions.)

04-7024320 page 8

7

Fair market value of assets not used (or held for use) directly in carving out charitable, e.,

purposes:

‘Average monthly far market value of securities

‘Average of monthly cash balances

Fair market value ofall other assets (see instructions)

Total (add tines 12, b, and c)

Reduction claimed for blockage or ther factors reported on lines 1 and

‘1c (attach detailed explanation)

Acquisition indebtedness applicable to line 1 assets

‘Subtract line 2 fom line 1d.

Cash deemed held for charitable activites. Entor 1 % % of fine 3 (for greater amount, soe

instructions)

Net value of nonchartable-vse assets. Subtract ne 4 from ine 3, Enter here and on PartV, tine 4

Minimum investment return. Enter 5% of ine 5

[| id

655,168

9,843

345,325

32316

Distributable Amount (see instructions) (Section 4942{)(3) and ()(8) private operating

foundations end certain foreign organizations check here __ [_) and do not compete this part)

Minimum investment retum from PartX,line6..

Tax on investment income for 2013 from Part VI tine 5 2a 2a

32516

Income tax for 2013. (This does not include the tax from Part VL)... 2

Addlines 2aand2 0... ee ee

Distreutable amount before adjustments, Subtract ie 2c from fine 1

Recoveries of amounts treated as qualifying distributions

‘Add linee 3 ond 4

Deduction rom disbibutable amount (see insinctons)

Distributable amount os austed. Suva ine fom Ine 5, Ener here and on Pari,

line 1

24

32,292

33282

Jor ]on]a [eo]

32.202

Qualifying Distributions (see instructions)

7

>

2

"Amounts paid (including administrative expenses) to accormpish charitable, et, purposes:

Expenses, contributions, gis, etc.—total from Pat |, column (d), ine 28

Programelated investirents—total from Part X-B

‘Amounts paid 1o acquire assets used (or held for use) deci in carrying out chartable, ete,

purposes :

‘Amounts set aside for specific charitable projects that satisfy the:

‘Suitability test (prior IRS approval required) :

Cash distribution test (attach the required schedule)...

Qualtying distributions, Addins 1a tough 2b, Enter here and on Par V, fine 8, and Pert il ne 4

FFoungavions tnat quay under section 4940(0) for ie reduced rate of tax on net Investment income.

Enter 1% of Part |, ine 27b (see instructions)

Adjusted qualifying distributions, Subtract line 5 from line 4

$3,290,700

33,206,700,

53,298,700,

Note. The amount on fine 6 willbe used in Part V, column (b) in subsequent years when calculating whether the foundation

qualifies for he section 4940(6) reduction of tax in those years.

Fam 990-PF (ory)

2

f Fom9s0-PF (2013) Adelson Family Foundation 04-7024330 page 9

3 Undistributed Income (see instructions)

i o 5 & a

: 4. Disubutable amount for 2013 trom Part, com Yew prio 012 a =n

i foe 7 ] 32,282

‘ 2 Undistibuted income if any, 25 ofthe end of 2013: eee

8 Enter amount for 2012 only... : a

Total for prioryears: 20 20__,20, |

3 Eset dan cmos ary. 1028 1 |

8 From 2008 : $4,059,671 ys

» From2000 22... . [sissza77 |

© From2010 17.135,194

4 From2011

© Fiom2012 2. 45,278,465]

f Totatoflines 3a trough € 169,528,510

4 Quaiiying disibutons for 2013 fom Part Xl,

fines: ® $53,290,700

2 Applied to 2012, butnot more than ine 23 -

Applied to undistributed income of prior years

(Elec required 200 instructions)

Treated as distributions out of corpus (Election

reauired—eee instructions) oe

d Applied to 2073 distributable amount . . . | 4 32,292

© Remaining amount dstibuied out of corpus 3527 aa a 1

5 Excess distributions caryover applied to 2013,

(fon emount eppeerin column (4) tho samo 1 1

‘emount mist be shown in column (@},) |

6 Enter the net total ofeach column as

indicated below:

Corpus. Add nes 3, dc, and 4e, Subtract Ere 5 723,187,038 :

Prior years undistibuted income, Subtract |

tne 4 rom ine 2 : |

¢_Enter the amount of prior years’ undistributed | + |

1

|

1

21200 108 |

|

j

}

|

|

inoare for ich anos of clonoy hes |

boon sued of on which he eecion 40020) | | Ie

‘tax has been previously assessed 4

4. Sublet ne erm ine 6, Taxable

ameunt_ceetrevucions =

Uncle ince for 2012 Soiac ine

{arfom ine 2a Toxble omount_see

acu : ce | | A

1 Uncistned income or 20%, bt ines tT 1

‘end tom ine Tis amount mus be |

dotibed 2004

17 -ameunia tested os dnons ou of conus

to satisfy requirements imposed by section

170{b\{ IMF) or 4942(g)(3) (see instructions)

8 Excess dtrbutons caryover fom 2008 nt 1

sppied on ine Sone 7 (ee insbuctons) ssossen| : | !

9 Excess distributions carryover to 2014. |

Subtact nes 7 and 8 fom ine Sa 169,327,347 i

10 Anatesoftre 9

2 exces fom 2008 aiso7a7

Excess from 2010 17,125,191 |

© Excess from 2081 21,509,106 |

@ Excess from 2012. |». | 48276455 : | | i

excess from 2019 | | | | 53267409

Fam 980-PF Gora)

Form 990-PF (2013) Adelson Family Foundation 04-7024330 10

FREI _ Private Operating Foundations (cee insirucions and Pan VIFA, question) N/A

‘1a the foundation has received a ruling or determination letter that isa private operating

foundation, and the ruling is effective for 2013, enter the date ofthe ruling

>

‘Check box to indicate whether the foundation is @ private operating foundation described in section |] aadagryor [] a3da5)

>

2a Enter the lesser ofthe adjusted net Texyeat

Poe 3 years

income from Part tor the minimum

investment um fom Pe tor CED

EM

a

1a 10

(o) Tou

each year listed

b 85% of ine 2a

€Quallying distibuions fom Part Xl,

line 4 for each yesr listed

Around in ine 2 nosed ety

foc active conduct of exempt actos

© Qualifying distibutions made directly

for active conduc of exempt activities.

‘Subtractline 2d from line 2c...

3 Complete 32, b, or ¢for the

atemative test relied upon:

2 “Assets” alternative test—enter

(1) Value of al assets

(2) Value of assats qualiyng uncer

section 49425(3)(8)(!)

'b “Endowment siemative test—enter 23

cofrminimur investment returs chown in

PartX, ine 6 foreach year Isles.

“Support alternative test—enter

(1) Totel suppor ether then gross

investment income (interest,

30] 51,245,853

Fem 990-PF (2013)

1

a

/

3

7

2

Fem S807 (2013) ‘Adelson Famity Foundation 04-7024330_ page 12

‘Analysis of income-Producing Activities

Enter ross amounts unless otherwise indicated. Unekiedianessinane | Eebiethyoxin sz siase [

Oy © Cc) (| Stabe name

1. Program service revenue:

Jevsiness cooe| amount excision cace} Amount | (See neivcors)

2 Contributions received "900089, 53,250,124

(9. Fees and contracts from goverment agencies

‘Membership dues and assessments

Interest on savings and temporary cash Investments ‘900089

Dividends and intorest from securities

Net rental income or (loss) from real estat: i

‘2 Debt-inanced property

b Not debtfinanced property 0...

Net cental income or (loss) from personal property

(ter investment income =

‘Gain o (oss from sales of assets other nn inventory

Net income or (loss) from special events

Gross profit or (oss) from sales of inventory

‘Other revenue: @ IRS refund 2009 return "900089,

a

a

12 Subjotal Add columns (B), (@), and e) Q | o| 83,251,367

13 Total. Add line 12, columns (b), (2),

nd (e) See cry 53,251,367

(See worksheet in line 13 instructions to verity calciations.)

GEMEAUEY _ Relationship of Activities to the Accomplishment of Exempt Purposes:

{Une No. | Explain below bow each acy for which income i report in column (6) of Part XVI-A contributed important tothe

v accomplishment ofthe foundabon's exempt purposes (ther than by proving funds for such purposes) (See instruckons )

1 [Contributions recelved suppor the Foundation’s grant making.

3 Interest eared directly supported the funding efforts for grants end donations given during the year,

“11__[Other income received directly supports the Foundation’s funding efforts for grants and donations given during the year

“11 income was from an IRS refund fora prior yea

“11 [Funds were then used for curent year contributions,

Farm 980-PF (2013)

7 __ Did the organization direciy or indreclly engage in any of the folowing with any other organization described Tres] No,

in section 501(c} ofthe Code (other than section 501()(3) organizations) or in section 627, relating topotteal | i

coxganizations? ]

1 Taser tom he etn foudaton oa oncharal exempt epanzaon | 4 J

(1) Cash see oe ait x

(2) Other assets fail [x

Other transactions: (eee ee

(1) Sales of assets to a noncharitable exemot organization eee Heel

(@) Purchases of assets ftom a nonchartable exempt organization + free Tox

(3) Renta of facilis, equipment or other assets. fee eee ears : tao] [x

(4) Reimbursement arrangements... : ee away] | x

(6) Loans of loan guarantees ee laogeyf fc

(6) Pecformance of services or membership or fundraising solicitations foie [x

‘¢ Sharing of aces, equipment, malng lists, other assets, or palé employees... te, x.

4 the ansne to any ofthe above is "Yes, complete the folowing schedule. Clurn(b) should aways show the at market

‘ae ote gods oer sr snes gen byte earn onan. foundston recedes than ret

vale in any transaction or sharing arrangement, show in column (d) the value ofthe goods, other asses, or services received,

Teitnene. | W)Anontiwohed | (e! Nae cancers enol operation (Gl Oeergten owners, wesecis and sare erengenerts

2a_ Is the foundation directly or direct affliated with, or related fo, one or more tax-exempt organizations

described in section 501(c) ofthe Code (other than section 501(c)(3)) or in section 5277 Cl Yes 0 No

b_tf"Yes." complete the following schedule.

(a) Hae ot erpenzten [Wipe expen {EI Deseotan ot este

Thi ey, gal a TGS NOT Te BDL iS DEL ET

sian] cons Doe en re bad art wh pepe oe asa

jo~34¥ Ye lem aa

Here | mea ana mabe & inroamre

Pag [oie peers ae are oa Or P™

Preparer Sesto O'Connor isco. potza7s14

Fiuissane + Stephen J O'Connor Finis GIN ® 27-3942383

Use ONIY| rns geese » 300 First Avenue, Needham, Mh 02604 781-707-2540

Fam 980-PF cars)

Adeison Family Foundation

Recipients) paid during the year

Name

Binai Brith Youth Organization

‘Street

2020 K St. NW, 7th Floor

04.7024330_Page 1 _of 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

City

‘Washington

[zip Code

{20006

Foreign Country

Relationship

Foundation Status

PC

Purpose of graniicontribution

General chartable purposes.

Name

nai Zion Foundation,

‘Street

136 Esat 30th St

[Amount

509,000

City

New York

[Zip Code

10018

[Foreign Country

Relationship

Foundation Status

PC.

Purpose of granticontribution

General charitable purposes

Name

Braille Institute of America

‘Street

70.251 Ramon Rd.

[Amount

35,000

ity

Rancho Mirage

[Zip Code

192270

Foreign Country

Relationship

Foundation Status

PC.

Purpose of granticontribution

General charitable purposes.

Name

Brandeis University

‘Street

415 South St. MS O14

[Amount

ity

Waltham

Stato

MA

[zip Code

jonas

Foreign Country

Relationship

[Foundation Status

Pc.

Purpose of granticontribution

General charitable purposes

Name

‘Center for Jewish Community Studies

‘Street

7 Church Lane Suite 9

[Amount

1.000

‘city

Baltimore

[zip Code

121208

[Foreign Country

Relationship

[Foundation Status

PC.

Purpose of granticontribution

General chartable purposes.

Name

Chabad of Summertin

‘Street

2640 Regatta Or.

[Amount

4,900,000,

City

Las Vegas

[zip Code"

189128

[Foreign Country

Relationship

[Foundation Status

Pc.

Purpose of granticontribution

General charitable puposes

[Amount

6.500

Adelson Family Foundation. 047024330 Pago 2 of 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

Recipient(s) pald during the year

Name

Chelsea Jewish Nursing Home Foundation

‘Steet

17 Lafayette Ave,

city State [Zip Code Foreign Country

Chelsea MA_|o2150

Relationship [Foundation Status

Purpose of grantcontibation amount

‘General cnartable puposes. 200,000

Name

Christians United for sraet

‘Street

£3520 North Buffalo Dr

ciy Suave [Zip Code Foreign County

Las Vegos nv_lesi29

Relationship [Foundation Status

Ipc

Purpose of granticontribution [Amount

General charitable purposes 425,000

Name

Gity Ans

‘Street

525 Broadway, Suite 602

city ‘State [Zip Code Foreign Country

New York Ny [10012

Relationship [Foundation Status

lec.

Purpose of granticontribution [Amount

‘General charitable purposes 40,000

Name

‘Combined Jewish Phitanthropies

‘Street

126 High St

city ‘State [Zip Code [Foreign Country

Boston MA_|o2110

Relationship Foundation Status

PC.

Purpose of granticontribution [Amount

General chantable purposes. 3,400,000

Name

x Miriam and Sheldon G. Adelson Educational Insttule

‘Street

‘9700 West Hillpointe Rd.

ity State [Zip code [Foreign Country

Las Vegas ny_}e9134

Relationship [Foundation Status

Pc.

Purpose of grantcontribution [Amount

General charitable purposes. 32,000

Name

Drug Free America Foundation

‘Street

5999 Central Ave., Suite 301,

city State [Zip Code Forelgn Country

St Petersburg FL_ [33710

Relationship. [Foundation Status

PC.

Purpose of granticontribution [Amount

General charitable purposes. 100,000,

Adelson Family Foundation

Recipient(s) paid during the year

Name

Endowment for Middle East Truth

‘Stroot

1050 Connecticut Ave, NW_ 10th Floor

04-7024330 Page 3_of 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

city

Washington

‘State

[Zip Code

[20036

Foreign Country

Relationship

[Foundation Status

PC.

Purpose of granticontribution

‘General chantable purposes

Name

Fideity Charitable Gift Fund

‘Street

200 Seaport Bd.

[Amount

‘city

Boston

‘State

[Zip Code

lo2210

[Foreign Country

Rolationship

Foundation Status

Purpose of granticontribution

General charitable purposes

Name

Ford's Theater Society

‘Street

514 10th St_ NW

City

‘Washington,

State

oC.

IZip Code

Amount

2,000,000

[Foreign Country

Relationship

[Foundation Status

Purpose of granticontribution

General charitable purposes

Name

Friends of Israel Defense Forces

‘Street

1430 Broadway Suite 1901

[Amount

250,000

city

New York

Stato

[zip Code

10018

[Foreign County

Relationship

Purpose of granticontribution

General chantable purposes

Name

Friends of Israel initiative

‘Street

2950 SW 27th Ave. Suite 300

[Foundation Status

lpc.

[Amount

210,800

‘city

Mami

State

FL.

[Zip Code

33133

[Foreign Country

Relationship

Foundation Status

PC.

Purpose of granticontribution

General charitable purposes

Name

Friends of Israel Scouts

‘Steet

575 ath Ave., 11th Floor

[Amount

+,900,000,

city

New York

[Zip Code

10018

Foreign Country

Relationship

[Foundation Status

PC

Purpose of granticontribution

General chantable purposes.

lAmount

300,000

‘Adelson Family Foundation

Recipient(s) paid during the year

Name

Gann Academy

‘Street

333 Forest St

047024330 Page 4 ot 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

City

Waltham

[Zip Code

lozase

[Foreign Country

Relationship

[Foundation Status

Purpose of granticoniribution

General chantable purposes

Name

Gateways Aocess to Jewish Education

‘Street

333 Nahanton St

[Amount

100,900

ity

Newton

[Zip Code

Jozass

[Foreign Country

Relationship

[Foundation Status

Po.

Purpose of granticontribution

General charitable purposes

Name

Gideon Hausner Jewish Day Schoo!

‘Street

450 San Antonio Ro.

City

Palo Ato

[Zip Code

[Foreign Country

[Amount

10,000

Relationship

[Foundation Status

pc.

Purpose of granticoniribution

General charitable purposes

Name

Gif of Lite Bone Marrow Foundation

‘Street

£200 Yamato Rd.

[Amount

city

Boca Raton

State

[zip Code

33434

Foreign Country

Relationship

Foundation Status

PC

Purpose of granticontribution

General charitable purposes

Name

Gis TowrvOr Chadash

‘Street

1417 Coney Isiand Ave.

[Amount

‘city

Brooklyn,

Sate

NY.

Zip Code

11230

[Foreign County

Relationship

Foundation Status

pc.

Purpose of granticontribution

General charitable purposes

Name

Hebrew Senior Lite

‘Street

1200 Centre St.

ity

Boston

[Amount

00,004

State

MA

[Zip Code

102134

Foreign County

Relationship

Foundation Status

PC

Purpose of granticontribution

General charitable purposes.

fAmount

600,000

‘Adelson Family Foundation 047024330 Page 5 of 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

Recipient(s) paid during the year

Name

International Association of Jewish Genealogical Societies

‘Street

‘55 Mandalay R¢.

City ‘State [Zip Code [Foreign Country

Newton Centre Ma_|o2459

Relationship [Foundation Status

Purpose of grantcontribution [Amount

General charitable purposes 40,000

Name

Israel American Council

Street

$5900 Canoga Ave, Suite 390

City State [Zip Code [Foreign Country

‘Woodland Hils ca_|91367

Relationship [Foundation Status

pc

Purpose of granticontribation [amount

General chartable purposes. 5,000,000,

Name

Israel Leadership Chub

Street

5200 Canoga Ave., Sue 399

ity State [eip Code [Foreign County

Woodland His cé_|ot367,

Relationship [Foundation Status

Pc

Purpose of grandcontrbution [Amount

General charitable purposes 250,000

Name

Israfest Foundation

‘Street

£8404 Wilshire Bivd, Sute 1030

city ‘State [Zip Code Foreign Country

‘Los Angeles, cA |90048

Relationship [Foundation Status

PC

Purpose of granticontribution rAmount

‘General charitable purposes 20,000

‘Name

Jewish Community Centers of Greater Boston

‘Street

[333 Nahanton St

city ‘Stato [Zip Code [Foreign County

Newton a _loz459

Relationship Foundation Status

PC.

Purpose of granticontribution rAmount

General charitable purposes 0,000

Name

Jewish Community Center of Southern Nevada

‘Street

+1400 N, Rampart Bivd,, Suite 105,

ity ‘State [Zip Code Foreign Country

Las Vegas Nv_]9123,

Relationship Foundation Status

Purpose of granticontribution [Amount

General charitable purposes, 95,700

Adelson Family Foundation.

Recipient(s) paid during the year

Name

Jewish Agency for Israel

‘Street

633 Third Ave., 32nd Floor, Suite C

04-7024330_Page 6 of 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

ty,

New York

State

NY

[Zip Code

10017

Foreign Country

Relationship

Foundation Status

Purpose of granticontribution

General chantable purposes

Name

Jewish Federation of Las Vegas

‘Street

2317 Renaissance Or

[Amount

2,000,000

ity

Las Vegas

[Zip Code

lest19

Foreign Country

Relationship

Foundation Status

Purpose of granticontribution

General charitable purposes

Name

Jewish News Service

‘Street

214 Lincotn St

‘city

Boston

[Zip Code

Jozi

[Amount

[Foreign Country

919,045

Relationship

[Foundation Status

PC.

Purpose of granticontribution

General charitable purposes

Name

Lubavitch Foundation of Lexington

‘Street

$ Burlington St.

[Amount

300,000

City

Lexington

‘State

[Zip Code

102420

Relationship

[Foundation Status

Ipc.

Purpose of granticontribution

General charitable purposes

Name

Machne Israel

‘Street

770 Eastern Parkway

[Amount

36,000

‘city

Brooklyn,

State

[Zip Code

31213

[Foreign County

Relationship

Foundation Status

PC.

Purpose of granticontribution

General charitable purposes

Name

McGill University

‘Street

817 Sherbrooke St. West

city

Montreal, OC.

Zip Code

HBA 26,

Foreign Country

(Canada

Relationship

Foundation Status

Po

Purpose of granticontribution

General charitable purposes.

[Amount

27,000

‘Adelson Family Foundation 04-7024330_Page 7 _of_9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

Recipient(s) pald during the year

Name

Middle East Media and Research Insitute

‘Street

1819. Street, NW, Sth Floor

ity State ]zip Code Foreign Country

Washington oc _|20036

Relationship Foundation Status

PC

Purpose of grantlcontribution [Amount

{General chamtable purposes. 390,000

Name

Nevada Partners in Education, Clark County Public Education Foundation

‘Street

4151 Philip stand St

ity ‘State [Zip Code Foreign Country

Relationship Foundation Status

PC.

Purpose of granticontribution [Amount

General charitable purposes 50,000

Name

Partnership for Excellence in Jewish Education

‘Street

‘88 Broad St, 6th Floor _ -

City State |Zip Code [Foreign Country

Boston MA_lo2110

Relationship [Foundation Status

Pc.

Purpose of granticontribution [Amount

General charitable purposes 0,000

Name

PE. F Israel Endowment Funds

‘Steet

317 Madison Ave., Suite 607

ity State [Zip Code Foreign Country

New York Ny_|10017,

Relationship [Foundation Status

pc.

Purpose of granticontribution ‘Amount

General charitable purposes. 300,000

Name

Rashi School

‘Steet

[8000 Great Meadow Ro.

City ‘State [zip Code [Foreign Country

Dedham Ma _|o2026

Relationship Foundation Status

Purpose of granticontribution [Amount

General charitable purposes 4,900,000

Name

Rethink israe initiative

‘Street

633 3rd Ave, Floor 21

city ‘State [Zip Code Foreign Country

New York ny_|10017

Relationship [Foundation Status

PC

Purpose of grantcontribution fAmount

General charitable purposes 937,500

‘Adelson Family Foundation

Recipient(s) pald during the year

Name

Rodman Ride.

‘Street

40 Lincoln Re

04-7024330 Page 8 of 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

city

Foxborough.

[Zip Code

Foreign Country

Relationship

[Foundation Status

Purpose of granticontribution

General charitable purposes

Name

Silicon Valley Jewish Film Festival

‘Stroet

PO Box 2190,

[Amount

40,000

city

Cupertino

[Zip Code

195015

Foreign Country

Relationship

Foundation Status

Pc

Purpose of granticontribution

General charitable purposes

Name

Striar Hebcaw Academ

‘Stroct

A00Ames Si.

[Amount

6,000

city

‘Sharon

[Zip Code

102067

Foreign Country

Relationship

Foundation Status

pc.

Purpose of granticontribution

General charitable purposes

Name

Temple Emanuel

‘Street

385 Ward St

[Amount

25,000

city

Newton Centre

State

[Zip Code

lozase

[Foreign Country

Relationship

[Foundation Status

Pc.

Purpose of granticontribution

General charitable purposes

Name

“This World - The Jewish Values Network

‘Street

394 Palisade Ave.

[Amount

25,000

‘city

Englewood

‘State

[Zip Code

loves

Foreign Country

Relationship

[Foundation Status

lec.

Purpose of granticontribution

General charitable purposes.

Name

“Tough Mudder New England

‘Street

45 MetroTech Center, 7th Floor

[Amount

639,000

city

Brooklyn,

‘Stato

Zip Code

11201

Foreign Country

Relationship

[Foundation Status

PC.

Purpose of granticontribution

General charitable purposes

2,500

Adelson Family Foundation

04-7024330 Page 9 of 9

Continuation of Part XV, Line 3a (990-PF) - Grants and Contributions Paid During the Year

Recipient(s} paid during tho year

Name

“Touro Synagogue

Strect

£85 Touro St

‘city

Newport

[Zip Code

Foreign Country

Relationship

Purpose of granticontribution

‘General chantable purposes

Name

Foundation Status

PC

Volunteers in Medicine of Southern Nevada

‘Street

44770 Hartson Dr, Suite 200

[Amount

10,000

ity

Las Vegas

[Zip Code

jeo121

[Foreign Country

Relationship

Foundation Status

PC.

Purpose of granticontribution

General chantable purposes

Name

Zionist Organization of America

‘Street

4 East 34th St.

ity

New York

State

iZip Code

10016

[Amount

209,000

[Foreign Country

Relationship

[Foundation Status

Po.

Purpose of granticontribution

General charitable purposes

Name

[Amount

2,000,000

‘Strost

city

State

[Zip Code

[Foreign Country

Relationship

[Foundation Status

Purpose of granticontribution

[Amount

Name

‘Sreet

hy

State

[Zip Code

[Foreign Country

Relationship

[Foundation Status

Purpose of grandcontribution

[Amount

‘Street

city

State

Foreign Country

Relationship

[Foundation Status

Purpose of grantcontibution

Amount

‘Adelson Family Foundation

04-7024330_Page 1 of 1

Continuation of Part XV, Line 3b (980-PF) - Grants and Contributions Approved for Future Payment

Recipients) approved for future payments.

Name

American Society of Yad Vashem

‘Street

500 Sth Ave 42 Floor

City

New York

State [Zip Code

Ny_|10180

[Foreign Country

Relationship

Foundation Status

PC.

Purpose of graniicentribution

General charitable purposes.

Name

[Amount

21,333,333,

‘Street

iy

State [Zip Code

[Foreign Country

Relationship

[Foundation Status

Purpose of granticontribution

[Amount

Name

‘Steet

iy

‘State [Zip Code

Foreign Country

Relationship

[Foundation Status

Purpose of granticontribution

[Armount

Sweet

City

State |Zip Code

[Foreign Country

Relationship

[Foundation Status

Purpose of graniicontribution

[Amount

Name

‘Street

City

‘State [Zip Code

Foreign County

Relationship

[Foundation Status

Purpose of granticontribution

[Amount

Name

‘Sweet

cy

State Zip Code

[Foreign Country

Rolationship

Foundation Status

Purpose of granticontribution

lAmount

[

i

I

Part l, Line 44 (980-PF) - Other Income

7 7 7

Revenue

and Expenses | Netinvestment | Adjusted

Description per Books Income Not Income,

TiRS reftind 2009 return: L 7 D

Part |, Line 16a (980-PF) - Legal Fees

EB 3 2 eo

ments

Revenue and for Chattable

Expenses per | Netinvestment | Adjusted Not | Purposes

Description Books Income Income | (Cash Basis Oni)

7 [toute & Cater 151620 } 151,840]

2

Part |, Line 16c (990-PF) - Other Professional Fees

2268 7 9 228

Dabureneris

Revenue and for Chortable

Expenses per | Netlavestment | AdustodNet | Purposes

Descrtion Books income income __| (Cash Basis Ont

Teper 20 2-200)

2 Abert Risk Management 89 a

Part I, Line 18 (990-PF) - Taxes

Toi a a Tor

Revenue Dabumements

and Expenses | Netinvesiment | Adjusted | for Chertable

Description per Books Income Net income Purposes

[7 ita Form PC lax expense "000 "boa

("3 JiR ae torpor year 77 7

os. 7020830,

non FeniyFounation

art, Line 19 (990-PF) - Depreciation and Depletion

Bigaeg

ate Motos ot Coster | Acamulted

Dustin ewes _| __compuiaion Ascot ie tre sasis_| _Dewrecation

7 otis eget aise01t |S 3 152] 3]

zy

(©7013 CCH Sr Frm Seren, A nt reserves.

i

|

i

2

{ Part |, Line 23 (980-PF) - Other Expenses

3 Base 3 a So

7 ‘Revenue and Disbursements

8 Erpersee | Netinvestment | Adjusted Net | for Chattable

: Deserioion per Books inom tnoome Purposes

i 7 [eank ees a im]

2 Boks, eiSSCIGIGns, Ieee 33 a

3 [Data stooge a3 a3

auras 7318 7318

6 Menbership dues 75000 75.009

[ower expense = 3

7" [Postage shenia and dove TI a

‘8 |Office and computer suppli 405 405)

9 |Telsconmurcatione ma Ta

70 | Urcapiniced rire a SS Tie 7

1 [Shared serves TE 770104

ke Fenty Foundeton 04.7024330

Part Il, Line 14 (990-PF) - Land, Buildings, and Eq)

Ta at 3a

Book Value Book Value Fwy

Asset Description Bes. of Year End of Year End of Year

"T[eemputer equipment 2017 1,558 oa oa

2 | 0)

(©7019 CoH Sra Fem Sarieas, A lt revered

|

Part VI, Line 6a (990-PF) - Estimated Tax Payments

Credit from prior year return

First quarter estimated tax payment...

‘Second quarter estimated tax payment

‘Third quarter estimated tax payment

Fourth quarter estimated tax payment

Other payments:

Total

Dae

‘Aout

i

i

i

§

4.702433

Part Vill, Line 3 (990-PF) - Highest-Paid Independent Contractors for Professional Services

Name and address of each person paid more than $50,000 10) Type of service ()Sompensaton

Name Lourie & Cutler Tegal Bi

4, Sueet 60 State St

"cy ‘Boston ‘ST MA__7P 02108 Explanation

crwek i basess] X | Foreign County,

Name

2, Sect

* ory oF a Explanation

cower Beans] —[ Foreign Gouniy

Name

3 Set

ty oF a. Explanation

comer ousens] | Foreign County

Name

Street

cay a ZP. Explanation

comer auarens] | Foreign Country

Narva

5 Beet

* Giy 7 Zz Explanation

comes fine] | Forign Country

Be

vass20

“ Department of Treasury Notice CA,

Internal Revenue Service Taxperiod ____decenber 31,2013

IRS Ogden UT 84201 7 Notice date August 25,2018

Employer 10 mummber 047024330

To contact us Phone 1-877-829-5500

FAX 801-620-5555

045920,477403.177583.10666 1 aT 0.

AMET fanned

‘ADELSON FAMILY FOUNDATION

‘SHELDON G ADELSON ET AL TTEE

300 FIRST AVE

NEEDHAM MA 02494-2736

Page Tort

Important information about your December 31, 2013 Form 990PF

We approved your Form 8868, Application for Extension of Time To

File an Exempt Organization Return

‘We approved the Form 8868 for your What you need to do

December 31. 2013 Form 990PF.

Your new due dates Novenber 15,2014 File your December 31, 2013 Form 990PF by November 15, 2014.

Visit wows govchaies to leam about aproved File provides, what types of

fetuins canbe filed electronical, and whether you are required to le electronical

Additional information Visit worms. govicp2 Ta,

+ For tax forms, instructions, and publications, visit wavs. gov or cll

1-800-TAX-FORM (1-800-829-3676),

+ Keep this notice for your records.

Ifyou need assistance, please don’t hesitate to contact us.

1

/

3

7

2

°

a

2 pet elely

“Fomenn ta 205) 2

«yout ng fron Additonal (Not Aulomatle)3 Month Evenson, compete only Part and check tis box >i

‘Note Ory eompet Por if you have aead been ranean automate Smerih extension one previously led For G86,

Ityou are fling for an Automatic 3-Month Extension, complete only Part | (on page 1).

FEMTMII Additional (Not Automatic) 3-Month Extension of Time. Only fe the orginal (no copies needed)

Enter filers identifying number, seo instructions

Type or | Name of exempt organization or other fer, see instructions. Employer ereton nama (EIN) ot

print [Adelson Family Foundation Jo4-7024330.

"Number, Steet, ad room or sule no, Wa PO. box, see nsiuctons. ‘Social security number (SSN)

flame |300 First Ave.

‘irgyor” | City, town or post office, stale, and ZIP code. For foreign address, see instructions.

Sees [Neeunam, mA 02498

Enter the Return code for the return that this application is for (fle @ separate application for each return). 4

‘Application Return [Application

Is For Code_| is For

Form 990 or Form 990-EZ or = ENE taasded 6

Form 990-8 02 __| Form 1047-4.

Form 4720 (ingividval) (03 __| Fox 4720 (other than individual) 09

Form 690-PF (04 __[ Form 6227, 10

Form 960-T (see. 401{a) or 408(@) trust (05 | Form 6069 11

Form 960-1 (trust other than above) (06 [Fox 8870 2

‘STOP! Do not complote Part If you wore not already granted an automatic 3-month extension on a previously filed Form 8868.

The books are in the care of > David Bloo

a Fax No. © (762) 72 i

«ithe orgarizaton doe ceo iacsof business in he United Sats, check his bor . -O

¢ rss fora Group Return ener he organization's four digt Group Exempton Number (GEN) ints

forthe whole group, check tis box > LA. tits or part ofthe group, check tis box TD and atacn a

fist with the names and EINs of all members the extension is fot.

4 request en additional 3:month extension of time until

5 Forcalendar year | 2013. or other tax year beginning

6 Ifthe tax year entered inline 5 is for less than 12 months, check reason:

(Change in accounting period

7 State in detail why you need the extension Additional ti

an accurate return.

‘Ba __Irthis application is for Forms 960-BL, YBU-PF, YO, 4720, OF 6069, enter the tentative tax, less eny

nonrefundable credits. See instructions.

'b ifthis application is for Forms $80-PF, 990-T, 4720, or 6068, enter any refundabie credits and

‘estimated tax payments made. include any prior year overpayment allowed as a credit and any

_amount paid previously with Form 8868. ab Is 239

8.

24

© “Balance due, Subtract line &b from line 8a. Include your payment wth this form, i required, by using

EFTPS (Electronic Federal Tax Payment System). See instructions.

Signature and Verification must be completed for Part Il only.

Under penalties of pejury, | dectare that have examined ths form, including sccompanying schedules and statements, and to the best of my

knowledge and beet, tis te, corect, and complete, and that | em authorized to prepare this form.

Sionance Tito_ Duly Authorized Agent pee

For 8868 (Rev 1.2014)

1

a

/

3

7

2

£ ast

s

a 8868 Application for Extension of Time To File an

(Rev. sanvery 2014), Exempt Organization Return OMB No, 1545-1709

patel Teny > Flea separateapplcation foreach retun

wranaiRewre eves” | infomation about Form S868 an is Instructions st wo gowomnd8

*itycu.are ing for an Automate 3-Month Extension, complete only Part ard check hs box >O

‘+ Ifyou are fing for an Additional (Not Automatic) 3-Month Extension, complete only Part Il (on page 2 of this form).

Do not complete Part il untess you have alieady been granted an automatic 3-month extension on a previously fled Form 8868.

Electronic filing (e-file). You can electronically fle Form 8868 if you need a 3-month automatic extension of time to fe (6 months for

8 corporation required to fle Form 980-7), or an additional (not automatic) 3-month extension of time. You can electronically file Form

{8868 to request an extension af ime to file any of the forms listed in Part | or Part Il wth the exception of Farm 8870, Information

Return for Transfers Associated With Certain Personal Benefit Contracts, which must be sent to the IRS in paper format (see

instructions). For more details on the electronic fling ofthis form, visit warwirs.govfefile and click on e-file for Charities & Nonprofits.

HERTIEL__Automatic 3. Month Extension of Time. Only submit original (no copies needed)

‘A corporation required to file Form 880-T and requesting an automatic 6-month extension—check this box and compile

Part | oniy >

‘All other corporations (including 1120-C filers), partnerships, REMICs, end trusts must use Form 7004 fo request an extension of

time to file income tex returns,

Enter filers Identtying number, see instructions

Type or | Name of exempt ganization or ake Wr, see hsvaclons oly Were Donte (ER

print [Acelson Family Foundation o4-7024350

Fie ye [ Number, eet, and room or site no, Wa PO, bor, se eile Social secuy number (SSN)

sedate |300 First Ave

‘wun See | Cy, town or post ofc, sat, and ZIP code, Fo a foreign adaress, fee FTucTOns

sservctont._|Needham, MA 02494

Enter the Return code for the retum that this application is for (fle a separate application for each return) 8

“Application Return [Application Rotum

Is For Gode_| Is For Code

Form $80 or Form 990-2, (1 _| Form 960-7 (corporation) o

Form $90-BL ‘02 [ Form 1044-A. 08

Form 4720 (indiadual (03 | Form 4720 (other than Individual) 09

Fort 990.PF (04 | Form 5227 40,

Form 990-T (sec. 401(a) or 408(@) ust) 05__| Form 6063 a4

Form $90-T (trust other than above) (06 [ Form 8870 2

‘© The books are in the care of David Bt

Teleghone No. 702-791-9400 a Fax No. > (702) 791-7819

Ifthe organization does not have an ofice or piace of Business in the United Statoe, chock thie bax

+ this fra Group Retum, eter the organization's fou digt Group Exemption Number (GEN) iri

forthe whole group, check tis box... .. «itis or part ofthe group, check this box PE and atach a

lis with the names and EINs ofall members ihe exnsion is for.

‘11 Trequest an automatic 3-month (6 months for a corporation required to fle Form 980-7) extension of time

uni!

to file the exempt organization return for the organization named above. The extension

he organization's return for

‘calendar yesr 2013. or

>] taxyear beginning and ending

2 tthe tax year entered in ina tis for lose than 12 monthe, check eason: [CJ niin” [-] Fina reurn

[] Change in accounting period

32 this eopication is for Forms 990-BL, G80-PF, 6907, 4720, oF 6069, enter the lentalve tax, lose ony

‘nonrefundable cresis. See instructions. za|s 29

'b tris application is for Forms 990-PF, 880-7, 4720, or 6068, enter any refundable credis and

eesimated tax payments made, Include any prior year overpayment alowed 28 a credit sols 39

€ “Balance due. Subvact ine 20 from ine 33. Include your payment wth tis form, i required, by using

EFTPS (Electronic Federal Tax Payment System). See instructions. acls 200,

‘Caution. you are going to make an elecronic nds withrewal (dee debi) wih bis Ferm GB56, S02 Farm 6459-60 and For 8873E0 for

payer instructions

For Privacy Act and Paperwork Reduction Act Notice, see Instructions, Fam 6868 (Rev 201)

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Brookings 2009 Schedule ADocument1 pageBrookings 2009 Schedule AelicliftonPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Citizens For Nuclear Free Iran 2015 990Document22 pagesCitizens For Nuclear Free Iran 2015 990eliclifton100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Project Veritas 2013 Schedule BDocument6 pagesProject Veritas 2013 Schedule BelicliftonPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Ivari InternationalDocument21 pagesIvari InternationalelicliftonPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- United Against Nuclear Iran 2013 Schedule BDocument3 pagesUnited Against Nuclear Iran 2013 Schedule BelicliftonPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Civil Society Joint Letter To President Obama On Drone Strikes - May 13, 2015Document4 pagesCivil Society Joint Letter To President Obama On Drone Strikes - May 13, 2015elicliftonPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Foundation For Defense of Democracies 2011 Schedule ADocument1 pageFoundation For Defense of Democracies 2011 Schedule Aeliclifton100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Center For Security Policy 2013 Schedule BDocument10 pagesCenter For Security Policy 2013 Schedule BelicliftonPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- FDD 1023Document23 pagesFDD 1023eliclifton100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- National Christian Charitable Foundation 2009 Schedule BDocument2 pagesNational Christian Charitable Foundation 2009 Schedule BelicliftonPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)