Académique Documents

Professionnel Documents

Culture Documents

Was Senior Management at Barings Aware That There Was A Problem at BFS? Explain

Transféré par

etravo0 évaluation0% ont trouvé ce document utile (0 vote)

9 vues4 pagesl

Titre original

Question 10 Afin806

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentl

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

9 vues4 pagesWas Senior Management at Barings Aware That There Was A Problem at BFS? Explain

Transféré par

etravol

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

Question 10: Was Senior

management at Barings aware that

there was a problem at BFS?

Explain

The management wasnt aware of

the problem until the megamargins calls in January and

February 1995.

It is only at this time, that

management suspected Leesons

trading was not arbitrage but naked

positions and sent a team of

auditors, but at this time it was too

late, losses exceeded the value of

the firm.

Why we can doubt about the management

ignorance?

Process of loans to clients should request

someone in the bank to check

creditworthiness and level of exposure.

Difference between margin deposited by

Barings customers and the amount of

funding requested by Leeson. This

difference was GBP100m by the second half

of 1994.

Conclusion : As if it appears that the

management was not officially aware

of the problem, it seems really

surprising. This case recall the more

recent one with Jerome Kerviel and

Societe Generale and its loss of

EU4.9Bn in 2008, where the

management was officially not aware,

but in reality let him act because of

the bonus exposure for his superiors.

Vous aimerez peut-être aussi

- Baring Brothers Short Version April 2009Document4 pagesBaring Brothers Short Version April 2009Daniel IsacPas encore d'évaluation

- Institute of Business and Management: Assignment Corporate GovernanceDocument5 pagesInstitute of Business and Management: Assignment Corporate GovernanceShoaib SharifPas encore d'évaluation

- Corp Finance HBS Case Study: Williams 2002Document6 pagesCorp Finance HBS Case Study: Williams 2002Tang Lei100% (1)

- Lehman Brothers: Case StudyDocument2 pagesLehman Brothers: Case StudyFFJ OPMPas encore d'évaluation

- Baring BankDocument4 pagesBaring Bankfarhanhaseeb7Pas encore d'évaluation

- Barings Bank: Corporate Governance and Ethics: Case Analysis - Barings BankDocument12 pagesBarings Bank: Corporate Governance and Ethics: Case Analysis - Barings BankMansi ParmarPas encore d'évaluation

- Fraud ReportDocument5 pagesFraud ReportGiang DuongPas encore d'évaluation

- Derivatives EditedDocument10 pagesDerivatives EditedEdwin KimosopPas encore d'évaluation

- Lehman Brother Ethical DilemmaDocument3 pagesLehman Brother Ethical DilemmaVenkatesh KamathPas encore d'évaluation

- JPMorgan London WhaleDocument10 pagesJPMorgan London Whalejanedpe25000Pas encore d'évaluation

- What Is Repo 105?: Process For Lehman's Repo 105 TransactionsDocument3 pagesWhat Is Repo 105?: Process For Lehman's Repo 105 TransactionsAnindya BasuPas encore d'évaluation

- Lehman Brothers and Bear Stearns Unethical CultureDocument26 pagesLehman Brothers and Bear Stearns Unethical CultureShubham GoenkaPas encore d'évaluation

- Enunciado Auditoria OperativaDocument3 pagesEnunciado Auditoria OperativaGustavo AlfonsoPas encore d'évaluation

- Assignment On BaringsDocument10 pagesAssignment On Baringsimtehan_chowdhuryPas encore d'évaluation

- WORLDCOM ACCOUNTING FRAUD EXPOSEDDocument8 pagesWORLDCOM ACCOUNTING FRAUD EXPOSEDKuldip50% (2)

- Barings CaseDocument3 pagesBarings CaseAnonymous LC5kFdtcPas encore d'évaluation

- WilliamsDocument20 pagesWilliamsUmesh GuptaPas encore d'évaluation

- Chapter 7Document11 pagesChapter 7Minh TúPas encore d'évaluation

- Chapter 1 (Exercises)Document3 pagesChapter 1 (Exercises)claudiazdeandresPas encore d'évaluation

- 601A 22125059 Group7 As14Document3 pages601A 22125059 Group7 As14Nikhil DubeyPas encore d'évaluation

- Misa BSA 33P Chapter 2 AssignmentDocument6 pagesMisa BSA 33P Chapter 2 AssignmentJulmar MisaPas encore d'évaluation

- Lehman Brothers:: Too Big To Fail?Document13 pagesLehman Brothers:: Too Big To Fail?abbiecdefgPas encore d'évaluation

- The Four Factors that Heightened the Financial Crisis CollapseDocument5 pagesThe Four Factors that Heightened the Financial Crisis CollapseDivyen PatelPas encore d'évaluation

- FMA - Ethical Case A, RevisedDocument12 pagesFMA - Ethical Case A, RevisedYezena Tegegne75% (4)

- Baring Bank Case Analysis - Group 8 - Ver3Document10 pagesBaring Bank Case Analysis - Group 8 - Ver3Puneet Agarwal100% (1)

- BolDocument1 pageBolAnindya BasuPas encore d'évaluation

- Lehman Brothers Corporate GovernanceDocument15 pagesLehman Brothers Corporate GovernanceAhmed AdelPas encore d'évaluation

- Chapter 07 Financial Distress - FinalDocument22 pagesChapter 07 Financial Distress - FinalMohammad Salim HossainPas encore d'évaluation

- Lecture 2.3 Case Study STUDENTDocument6 pagesLecture 2.3 Case Study STUDENTKim DuyênPas encore d'évaluation

- Mfa700 ExamDocument5 pagesMfa700 ExamThomas T.R HokoPas encore d'évaluation

- At The: The Carillion Failure: Misunderstood Risks and Constrained AuditorsDocument4 pagesAt The: The Carillion Failure: Misunderstood Risks and Constrained AuditorsAnonymous RuB6o4Pas encore d'évaluation

- CF Chap 3Document38 pagesCF Chap 3elianamacedo1720Pas encore d'évaluation

- Accounting 202 Chapter 9 TestDocument2 pagesAccounting 202 Chapter 9 TestLương Thế CườngPas encore d'évaluation

- THE LEHMAN BROTHERS CASE A Corporate Governance Failure, Not A Failure of Financial Markets - Finance - BankingDocument4 pagesTHE LEHMAN BROTHERS CASE A Corporate Governance Failure, Not A Failure of Financial Markets - Finance - BankingKumar AnandPas encore d'évaluation

- Review of Lehman Brothers' Accounting Ethics BreachesDocument8 pagesReview of Lehman Brothers' Accounting Ethics BreachespaternePas encore d'évaluation

- Corporate Failure (Assignment)Document9 pagesCorporate Failure (Assignment)Talha MunirPas encore d'évaluation

- Case Study On Lehman Brothers by Nadine SebaiDocument5 pagesCase Study On Lehman Brothers by Nadine Sebainadine448867% (3)

- Collapse of Lehman BrothersDocument8 pagesCollapse of Lehman BrothersDerick John PalapagPas encore d'évaluation

- Creative AccountingDocument5 pagesCreative Accountingvikas_nair_2Pas encore d'évaluation

- Marriot CorporationDocument3 pagesMarriot CorporationEddie KrulePas encore d'évaluation

- Bank Management and Electronic Banking (FIN-441) Assignment 1Document6 pagesBank Management and Electronic Banking (FIN-441) Assignment 1MD. WASIB ISLAMPas encore d'évaluation

- Williams Seeks $900M Financing to Address Liquidity CrisisDocument4 pagesWilliams Seeks $900M Financing to Address Liquidity CrisisAnirudh SurendranPas encore d'évaluation

- Lucent's $24.7B market cap plunge due to revenue manipulationDocument3 pagesLucent's $24.7B market cap plunge due to revenue manipulationDoreen WangPas encore d'évaluation

- Barings Bank: Model Answer: Q1. A. Credit RiskDocument5 pagesBarings Bank: Model Answer: Q1. A. Credit RiskRizwan Ahmed KhanPas encore d'évaluation

- MarriottDocument3 pagesMarriottluizPas encore d'évaluation

- Marriott Case AnalysisDocument3 pagesMarriott Case Analysissplinterion0% (1)

- Window DressingDocument5 pagesWindow DressingNichherla JyotiPas encore d'évaluation

- GuloDocument2 pagesGulohakdogPas encore d'évaluation

- Summary JobDocument2 pagesSummary JobHendry Piqué SPas encore d'évaluation

- BA 297 Final Exam The Bankruptcy of Lehman BrothersDocument3 pagesBA 297 Final Exam The Bankruptcy of Lehman BrothersChristian Paul BonguezPas encore d'évaluation

- AML Tab 7 Student Version Case StudiesDocument7 pagesAML Tab 7 Student Version Case StudiesSandhya SnehasreePas encore d'évaluation

- Lehman Brothers Case Examines Repo 105 TransactionsDocument7 pagesLehman Brothers Case Examines Repo 105 Transactionslumiradut70100% (1)

- Ch07 Kieso Ifrs4Document92 pagesCh07 Kieso Ifrs4Owen Kurnia100% (2)

- Ch07 Kieso Ifrs4 PPT HNDocument62 pagesCh07 Kieso Ifrs4 PPT HNEsra GuzelelPas encore d'évaluation

- Collapse of The Lehman Brothers - CASE STUDYDocument20 pagesCollapse of The Lehman Brothers - CASE STUDYXavier Francis S. LutaloPas encore d'évaluation

- Lehman Brothers' Corporate Governance Failures and Repo 105 DeceptionDocument12 pagesLehman Brothers' Corporate Governance Failures and Repo 105 DeceptionNurul Artikah SariPas encore d'évaluation

- JohnsonDocument3 pagesJohnson志祥Pas encore d'évaluation

- CRS Report For Congress: Accounting Problems at Fannie MaeDocument6 pagesCRS Report For Congress: Accounting Problems at Fannie MaestiftritePas encore d'évaluation

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionD'EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionPas encore d'évaluation

- Resisting Corporate Corruption: Cases in Practical Ethics From Enron Through The Financial CrisisD'EverandResisting Corporate Corruption: Cases in Practical Ethics From Enron Through The Financial CrisisPas encore d'évaluation

- Consent Form for Background and Financial ChecksDocument1 pageConsent Form for Background and Financial ChecksetravoPas encore d'évaluation

- Ntro To-Options 2012Document53 pagesNtro To-Options 2012etravoPas encore d'évaluation

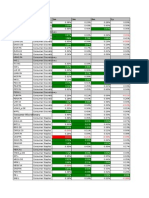

- Consumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceDocument13 pagesConsumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceetravoPas encore d'évaluation

- Tudor Capital Europe Pillar 3 Policy SummaryDocument7 pagesTudor Capital Europe Pillar 3 Policy SummaryetravoPas encore d'évaluation

- Equity Index Fair Value MonitorDocument2 pagesEquity Index Fair Value MonitoretravoPas encore d'évaluation

- Credit Default Swap Valuation IDocument35 pagesCredit Default Swap Valuation ISharad Dutta0% (1)

- Option NoteDocument2 pagesOption NoteetravoPas encore d'évaluation

- L 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumDocument5 pagesL 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumetravoPas encore d'évaluation

- Ratings CriteriaDocument1 pageRatings CriteriaAakash KhandelwalPas encore d'évaluation

- Consumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceDocument13 pagesConsumer Discretionary, Staples, Energy, Financials, Healthcare, Industrials Sector PerformanceetravoPas encore d'évaluation

- Chart Implied Volatility Data in Real-TimeDocument2 pagesChart Implied Volatility Data in Real-TimeetravoPas encore d'évaluation

- Autocallable Feature Explained: How This Structured Product Trait WorksDocument4 pagesAutocallable Feature Explained: How This Structured Product Trait WorksetravoPas encore d'évaluation

- Finacial TimesDocument2 pagesFinacial TimesetravoPas encore d'évaluation

- Assignement DerivativesDocument4 pagesAssignement DerivativesetravoPas encore d'évaluation

- XRTrading Cover LetterDocument1 pageXRTrading Cover LetteretravoPas encore d'évaluation

- Business ValuationDocument7 pagesBusiness ValuationetravoPas encore d'évaluation

- 42728711ACST828ASS1Document17 pages42728711ACST828ASS1etravoPas encore d'évaluation

- Dispersion Trading Reference For StartingDocument1 pageDispersion Trading Reference For StartingetravoPas encore d'évaluation

- Group Assignment Strategic ManagementDocument2 pagesGroup Assignment Strategic ManagementetravoPas encore d'évaluation

- Finacial TimesDocument2 pagesFinacial TimesetravoPas encore d'évaluation

- Finacial TimesDocument2 pagesFinacial TimesetravoPas encore d'évaluation

- FT WordDocument1 pageFT WordetravoPas encore d'évaluation

- Bain and Company Global Private Equity Report 2012 PDFDocument72 pagesBain and Company Global Private Equity Report 2012 PDFLinus Vallman JohanssonPas encore d'évaluation

- Gem Global Report 2010revDocument85 pagesGem Global Report 2010revRafael Martins VieiraPas encore d'évaluation