Académique Documents

Professionnel Documents

Culture Documents

ch04 Prob

Transféré par

api-281193111Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ch04 Prob

Transféré par

api-281193111Droits d'auteur :

Formats disponibles

2255T_c04_025-034.

qxd 1/17/07 11:11 AM Page 25 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Exercises: Set B

EXERCISES: SET B

E4-1B The trial balance columns of the worksheet for Green Company at June 30, 2008, are as

follows.

Complete the worksheet.

(SO 1)

GREEN COMPANY

Worksheet

for the Month Ended June 30, 2008

Trial Balance

Dr.

Cr.

Account Titles

Cash

Accounts Receivable

Supplies

Accounts Payable

Unearned Revenue

Lenny Briscoe, Capital

Service Revenue

Salaries Expense

Miscellaneous Expense

$1,760

2,100

1,320

$1,080

360

2,280

2,100

500

140

$5,820

$5,820

Other data:

1. A physical count reveals $250 of supplies on hand.

2. $120 of the unearned revenue is still unearned at month-end.

3. Accrued salaries are $250.

Instructions

Enter the trial balance on a worksheet and complete the worksheet.

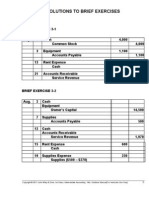

E4-2B The adjusted trial balance columns of the worksheet for Bad Company are as follows.

Complete the worksheet.

(SO 1)

BAD COMPANY

Worksheet (partial)

for the Month Ended April 30, 2008

Adjusted Trial

Balance

Account Titles

Dr.

Cash

Accounts Receivable

Prepaid Rent

Equipment

Accumulated Depreciation

Notes Payable

Accounts Payable

J. Bad, Capital

J. Bad, Drawing

Service Revenue

Salaries Expense

Rent Expense

Depreciation Expense

Interest Expense

Interest Payable

11,400

7,000

2,000

20,000

Totals

54,500

Cr.

4,200

5,000

4,950

25,800

3,500

14,500

9,430

500

600

50

50

54,500

Income

Statement

Dr.

Cr.

Balance Sheet

Dr.

Cr.

25

2255T_c04_025-034.qxd 1/17/07 11:11 AM Page 26 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

26

Chapter 4 Completing the Accounting Cycle

Instructions

Complete the worksheet.

Prepare financial statements

from worksheet.

(SO 1, 6)

Journalize and post closing

entries and prepare a postclosing trial balance.

(SO 2, 3)

Prepare adjusting entries from

a worksheet, and extend balances

to worksheet columns.

E4-3B Worksheet data for Bad Company are presented in E4-2B. The owner did not make any

additional investments in the business in April.

Instructions

Prepare an income statement, an owners equity statement, and a classified balance sheet.

E4-4B Worksheet data for Bad Company are presented in E4-2B.

Instructions

(a) Journalize the closing entries at April 30.

(b) Post the closing entries to Income Summary and J. Bad, Capital. Use T accounts.

(c) Prepare a post-closing trial balance at April 30.

E4-5B The adjustments columns of the worksheet for Myers Company are shown below.

(SO 1)

Adjustments

Account Titles

Debit

Accounts Receivable

Prepaid Insurance

Accumulated Depreciation

Salaries Payable

Service Revenue

Salaries Expense

Insurance Expense

Depreciation Expense

1,100

Credit

500

1,250

650

1,100

650

500

1,250

3,500

3,500

Instructions

(a) Prepare the adjusting entries.

(b) Assuming the adjusted trial balance amount for each account is normal, indicate the financial statement column to which each balance should be extended.

Derive adjusting entries from

worksheet data.

E4-6B Selected worksheet data for Nicklaus Company are presented below.

(SO 1)

Account Titles

Trial Balance

Dr.

Accounts Receivable

Prepaid Insurance

Supplies

Accumulated Depreciation

Salaries Payable

Service Revenue

Insurance Expense

Depreciation Expense

Supplies Expense

Salaries Expense

Cr.

?

28,000

8,000

Adjusted

Trial Balance

Dr.

35,000

24,000

?

24,000

?

80,000

Instructions

(a) Fill in the missing amounts.

(b) Prepare the adjusting entries that were made.

Cr.

?

6,000

92,000

?

12,000

6,500

52,000

2255T_c04_025-034.qxd 1/17/07 11:11 AM Page 27 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Exercises: Set B

E4-7B Kimmie Meissner Company had the following adjusted trial balance.

KIMMIE MEISSNER COMPANY

Prepare closing entries, and

prepare a post-closing trial

balance.

(SO 2, 3)

Adjusted Trial Balance

for the Month Ended June 30, 2008

Adjusted Trial Balance

Account Titles

Cash

Accounts Receivable

Supplies

Accounts Payable

Unearned Revenue

Kimmie Meissner, Capital

Kimmie Meissner, Drawing

Service Revenue

Salaries Expense

Miscellaneous Expense

Supplies Expense

Salaries Payable

Debits

Credits

$4,650

5,200

640

$2,500

200

7,280

400

5,360

1,650

350

3,050

600

$15,940

$15,940

Instructions

(a) Prepare closing entries at June 30, 2008.

(b) Prepare a post-closing trial balance.

E4-8B Commanche Company ended its fiscal year on July 31, 2008. The companys adjusted

trial balance as of the end of its fiscal year is as shown below.

(SO 2, 3)

COMMANCHE COMPANY

Adjusted Trial Balance

July 31, 2008

No.

Account Titles

Debits

101

112

157

167

201

208

301

306

404

429

711

720

732

Cash

Accounts Receivable

Equipment

Accumulated Depreciation

Accounts Payable

Unearned Rent Revenue

K. Commanche, Capital

K. Commanche, Drawing

Commission Revenue

Rent Revenue

Depreciation Expense

Salaries Expense

Utilities Expense

$ 9,900

6,200

10,600

Credits

$ 5,400

2,800

1,200

30,700

11,000

42,400

5,100

2,700

37,100

10,100

$87,600

Journalize and post closing

entries, and prepare a postclosing trial balance.

$87,600

Instructions

(a) Prepare the closing entries using page J15.

(b) Post to K. Commanche, Capital and No. 350 Income Summary accounts. (Use the three-column

form.)

(c) Prepare a post-closing trial balance at July 31.

27

2255T_c04_025-034.qxd 1/17/07 11:11 AM Page 28 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

28

Chapter 4 Completing the Accounting Cycle

Prepare financial statements.

E4-9B The adjusted trial balance for Commanche Company is presented in E4-8B.

(SO 6)

Instructions

(a) Prepare an income statement and an owners equity statement for the year. Commanche did

not make any capital investments during the year.

(b) Prepare a classified balance sheet at July 31.

Answer questions related to the

accounting cycle.

E4-10B Angela Borke has prepared the following list of statements about the accounting cycle.

(SO 4)

1.

2.

3.

4.

5.

6.

7.

8.

Analyze business transactions is the first step in the accounting cycle.

Adjusting entries are a required step in the accounting cycle.

Correcting entries are a required step in the accounting cycle.

If a worksheet is prepared, all the steps of the accounting cycle are incorporated into the

worksheet.

The accounting cycle begins with the analysis of business transactions and ends with the

preparation of a post-closing trial balance.

All steps of the accounting cycle occur daily during the accounting period.

The step of post to the ledger accounts occurs after the step of journalize the transactions.

Closing entries must be prepared before financial statements can be prepared.

Instructions

Identify each statement as true of false. If false, indicate how to correct the statement.

Prepare closing entries.

(SO 2)

E4-11B Selected accounts for Lauras Salon are presented below. All June 30 postings are from

closing entries.

Salaries Expense

6/10

6/28

2,100

3,800

6/30

Service Revenue

5,900

6/30

Supplies Expense

6/12

6/24

400

450

6/30

10,100

6/15

6/24

Laura Francis, Capital

4,500

5,600

Rent Expense

850

6/1

2,000

6/30

6/30

1,700

6/1

6/30

10,000

1,350

Bal.

9,650

Laura Francis, Drawing

2,000

6/13

6/25

700

1,000

6/30

1,700

Instructions

(a) Prepare the closing entries that were made.

(b) Post the closing entries to Income Summary.

Prepare correcting entries.

E4-12B Pender Company discovered the following errors made in January 2008.

(SO 5)

1. A payment of Salaries Expense of $700 was debited to Supplies and credited to Cash,

both for $700.

2. A collection of $2,000 from a client on account was debited to Cash $200 and credited to

Service Revenue $200.

3. The purchase of supplies on account for $860 was debited to Supplies $680 and credited to

Accounts Payable $680.

Instructions

(a) Correct the errors by reversing the incorrect entry and preparing the correct entry.

(b) Correct the errors without reversing the incorrect entry.

Prepare correcting entries.

(SO 5)

E4-13B Jenny Company has an inexperienced accountant. During the first 2 weeks on the job, the

accountant made the following errors in journalizing transactions.All entries were posted as made.

1. A payment on account of $720 to a creditor was debited to Accounts Payable $270 and credited to Cash $270.

2. The purchase of supplies for $650 cash was debited to Inventory $65 and credited to

Cash $65.

3. A $500 withdrawal of cash for D. Jennys personal use was debited to Salaries Expense $500

and credited to Cash $500.

Instructions

Prepare the correcting entries.

2255T_c04_025-034.qxd 1/17/07 11:11 AM Page 29 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Exercises: Set B

E4-14B The adjusted trial balance for Anthony Bowling Alley at December 31, 2008, contains

the following accounts.

29

Prepare a classified balance

sheet.

(SO 6)

Debits

Building

Accounts Receivable

Prepaid Insurance

Cash

Equipment

Land

Insurance Expense

Depreciation Expense

Interest Expense

Credits

$ 77,000

9,000

2,700

10,840

37,500

38,000

540

4,400

1,600

Jess Anthony, Capital

Accumulated DepreciationBuilding

Accounts Payable

Note Payable

Accumulated DepreciationEquipment

Interest Payable

Bowling Revenues

$ 67,000

26,000

7,400

60,000

11,000

1,600

8,580

$181,580

$181,580

Instructions

(a) Prepare a classified balance sheet; assume that $15,000 of the note payable will be paid in 2009.

(b)

Comment on the liquidity of the company.

E4-15B The following are the major balance sheet classifications.

Current assets (CA)

Long-term investments (LTI)

Property, plant, and equipment (PPE)

Intangible assets (IA)

Classify accounts on balance

sheet.

Current liabilities (CL)

Long-term liabilities (LTL)

Owners equity (OE)

(SO 6)

Instructions

Classify each of the following accounts taken from Donn Companys balance sheet.

______ Accounts payable

______ Accounts receivable

______ Cash

______ Donn, Capital

______ Utilities payable

______ Trademarks

______ Investments

______ Inventories

______ Accumulated depreciation

______ Buildings.

______ Land

______ Long-term debt

______ Supplies

______ Prepaid insurance

______ Equipment

E4-16B The following items were taken from the financial statements of Cat Company.

(All dollars are in thousands.)

Long-term debt

Prepaid expenses

Property, plant, and equipment

Long-term investments

Short-term investments

Notes payable in 2009

Cash

$ 660

620

8,100

185

2,500

340

$ 1,800

Accumulated depreciation

Accounts payable

Notes payable after 2009

Steven Cat, Capital

Accounts receivable

Inventories

4,000

1,010

250

8,925

1,100

880

Prepare a classified balance

sheet.

(SO 6)

Instructions

Prepare a classified balance sheet in good form as of December 31, 2008.

E4-17B These financial statement items are for Luol Deng Company at year-end, July 31, 2008.

Salaries payable

Salaries expense

Utilities expense

Equipment

Accounts payable

Commission revenue

Rent revenue

$ 1,800

39,000

3,600

26,500

3,600

63,000

7,600

Note payable (long-term)

Cash

Accounts receivable

Accumulated depreciation

L. Deng, Drawing

Depreciation expense

L. Deng, Capital (beginning

of the year)

$ 2,000

18,300

21,200

5,400

3,600

16,200

45,000

Prepare financial statements.

(SO 1, 6)

2255T_c04_025-034.qxd 1/17/07 11:11 AM Page 30 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

30

Chapter 4 Completing the Accounting Cycle

Instructions

(a) Prepare an income statement and an owners equity statement for the year. The owner did

not make any new investments during the year.

(b) Prepare a classified balance sheet at July 31.

Use reversing entries.

(SO 7)

*E4-18B Hosie Company pays salaries of $20,000 every Monday for the preceding 5-day week

(Monday through Friday).Assume December 31 falls on a Wednesday, so Hosies employees have

worked 3 days without being paid.

Instructions

(a) Assume the company does not use reversing entries. Prepare the December 31 adjusting entry and the entry on Monday, January 5, when Hosie pays the payroll.

(b) Assume the company does use reversing entries. Prepare the December 31 adjusting entry, the

January 1 reversing entry, and the entry on Monday, January 5, when Hosie pays the payroll.

Prepare closing and reversing

entries.

(SO 2, 4, 7)

*E4-19B On December 31, the adjusted trial balance of Norway Employment Agency shows the

following selected data.

Accounts Receivable

Interest Expense

$35,000

11,000

Commission Revenue

Interest Payable

$100,000

2,500

Analysis shows that adjusting entries were made to (1) accrue $6,000 of commission revenue and

(2) accrue $2,500 interest expense.

Instructions

(a) Prepare the closing entries for the temporary accounts at December 31.

(b) Prepare the reversing entries on January 1.

(c) Post the entries in (a) and (b). Rule and balance the accounts. (Use T accounts.)

(d) Prepare the entries to record (1) the collection of the accrued commissions on January 10

and (2) the payment of all interest due ($3,000) on January 15.

(e) Post the entries in (d) to the temporary accounts.

PROBLEMS: SET C

Prepare a worksheet, financial

statements, and adjusting and

closing entries.

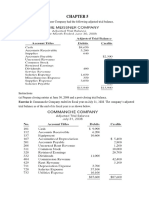

P4-1C The trial balance columns of the worksheet for Sasse Roofing at March 31, 2008, are as

follows.

(SO 1, 2, 3, 6)

SASSE ROOFING

Worksheet

For the Month Ended March 31, 2008

Account Titles

Cash

Accounts Receivable

Roofing Supplies

Equipment

Accumulated DepreciationEquipment

Accounts Payable

Unearned Revenue

J. Sasse, Capital

J. Sasse, Drawing

Service Revenue

Salaries Expense

Miscellaneous Expense

Trial Balance

Dr.

Cr.

4,500

3,200

2,000

11,000

1,250

2,500

550

12,900

1,100

6,300

1,300

400

23,500

23,500

2255T_c04_025-034.qxd 1/17/07 11:11 AM Page 31 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Problems: Set C

31

Other data:

1.

2.

3.

4.

A physical count reveals only $650 of roofing supplies on hand.

Depreciation for March is $250.

Unearned revenue amounted to $170 at March 31.

Accrued salaries are $600.

Instructions

(a) Enter the trial balance on a worksheet and complete the worksheet.

(b) Prepare an income statement and owners equity statement for the month of March and a

classified balance sheet at March 31. J. Sasse did not make any additional investments in the

business in March.

(c) Journalize the adjusting entries from the adjustments columns of the worksheet.

(d) Journalize the closing entries from the financial statement columns of the worksheet.

P4-2C The adjusted trial balance columns of the worksheet for Rachel Company, owned by

Toni Rachel, are as follows.

(a) Adjusted trial balance

$24,350

(b) Net income $2,780

Total assets $17,850

Complete worksheet; prepare

financial statements, closing

entries, and post-closing trial

balance.

(SO 1, 2, 3, 6)

RACHEL COMPANY

Worksheet

For the Year Ended December 31, 2008

Account

No.

Account Titles

101

112

126

130

151

152

200

201

212

230

301

306

400

610

631

711

722

726

905

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Office Equipment

Accumulated DepreciationOffice Equipment

Notes Payable

Accounts Payable

Salaries Payable

Interest Payable

T. Rachel, Capital

T. Rachel, Drawing

Service Revenue

Advertising Expense

Supplies Expense

Depreciation Expense

Insurance Expense

Salaries Expense

Interest Expense

Totals

Adjusted

Trial Balance

Dr.

Cr.

8,100

10,800

1,500

2,000

24,000

5,600

15,000

6,100

2,400

600

15,800

7,000

61,000

8,400

4,000

5,600

3,500

31,000

600

106,500

106,500

Instructions

(a) Complete the worksheet by extending the balances to the financial statement columns.

(b) Prepare an income statement, owners equity statement, and a classified balance sheet.

(Note: $9,000 of the notes payable become due in 2009.) Toni Rachel did not make any

additional investments in the business during the year.

(c) Prepare the closing entries. Use J14 for the journal page.

(d) Post the closing entries. Use the three-column form of account. Income Summary is No. 350.

(e) Prepare a post-closing trial balance.

P4-3C The completed financial statement columns of the worksheet for Muddy Company are

shown on the next page.

(a) Net income $7,900

(b) Current assets $22,400;

Current liabilities $18,100

(e) Post-closing trial balance

$46,400

Prepare financial statements,

closing entries, and post-closing

trial balance.

(SO 1, 2, 3, 6)

2255T_c04_025-034.qxd 2/22/07 7:19 PM Page 32 TEAM-B 108:JWQY034:ch04:

32

Chapter 4 Completing the Accounting Cycle

MUDDY COMPANY

Worksheet

For the Year Ended December 31, 2008

(a) Ending capital $36,600;

Total current assets

$31,500

(d) Post-closing trial balance

$52,500

Complete worksheet; prepare

classified balance sheet, entries,

and post-closing trial balance.

(SO 1, 2, 3, 6)

Income Statement

Dr.

Cr.

Balance Sheet

Dr.

Cr.

Account

No.

Account Titles

101

112

130

157

167

201

212

301

306

400

622

711

722

726

732

Cash

Accounts Receivable

Prepaid Insurance

Equipment

Accumulated Depreciation

Accounts Payable

Salaries Payable

Melissa Muddy, Capital

Melissa Muddy, Drawing

Service Revenue

Repair Expense

Depreciation Expense

Insurance Expense

Salaries Expense

Utilities Expense

1,600

2,100

1,800

30,000

1,400

Totals

Net Income

36,900

19,100

56,000

63,500

44,400

19,100

56,000

56,000

63,500

63,500

17,900

10,800

2,800

21,000

4,500

9,000

2,400

28,500

11,000

56,000

Instructions

(a) Prepare an income statement, owners equity statement, and a classified balance sheet.

(b) Prepare the closing entries. Melissa did not make any additional investments during the year.

(c) Post the closing entries and rule and balance the accounts. Use T accounts. Income Summary

is account No. 350.

(d) Prepare a post-closing trial balance.

P4-4C Rockford Management Services began business on January 1, 2008, with a capital investment of $120,000. The company manages condominiums for owners (Service Revenue) and

rents space in its own office building (Rent Revenue). The trial balance and adjusted trial balance columns of the worksheet at the end of the first year are as follows.

ROCKFORD MANAGEMENT SERVICES

Worksheet

For the Year Ended December 31, 2008

Account Titles

Cash

Accounts Receivable

Prepaid Insurance

Land

Building

Equipment

Accounts Payable

Unearned Rent Revenue

Mortgage Note Payable

R. Neillsen, Capital

R. Neillsen, Drawing

Service Revenue

Rent Revenue

Trial Balance

Dr.

Cr.

13,800

28,300

3,600

67,000

127,000

59,000

Adjusted

Trial Balance

Dr.

Cr.

13,800

28,300

2,400

67,000

127,000

59,000

12,500

6,000

120,000

144,000

22,000

12,500

2,000

120,000

144,000

22,000

90,700

29,000

90,700

33,000

2255T_c04_025-034.qxd 1/17/07 11:11 AM Page 33 Team B TeamB_04:Desktop Folder:17/01/07:WEYGOND WEB:

Problems: Set C

Account Titles

Salaries Expense

Advertising Expense

Utilities Expense

Totals

Insurance Expense

Depreciation ExpenseBuilding

Accumulated DepreciationBuilding

Depreciation ExpenseEquipment

Accumulated DepreciationEquipment

Interest Expense

Interest Payable

Totals

Trial Balance

Dr.

Cr.

42,000

20,500

19,000

402,200

33

Adjusted

Trial Balance

Dr.

Cr.

42,000

20,500

19,000

402,200

1,200

3,000

3,000

4,700

4,700

11,000

11,000

420,900

420,900

Instructions

(a) Prepare a complete worksheet.

(b) Prepare a classified balance sheet. (Note: $20,000 of the mortgage note payable is due for

payment next year.)

(c) Journalize the adjusting entries.

(d) Journalize the closing entries.

(e) Prepare a post-closing trial balance.

(a) Net income $22,300

(b) Total current assets

$44,500

(e) Post-closing trial balance

$297,500

P4-5C Lee Chang opened Changs Cleaning Service on July 1, 2008. During July the following

transactions were completed.

Complete all steps in accounting cycle.

July 1

1

3

5

12

18

20

21

25

31

31

Chang invested $20,000 cash in the business.

Purchased used truck for $9,000, paying $4,000 cash and the balance on account.

Purchased cleaning supplies for $2,100 on account.

Paid $1,800 cash on one-year insurance policy effective July 1.

Billed customers $4,500 for cleaning services.

Paid $1,500 cash on amount owed on truck and $1,400 on amount owed on cleaning

supplies.

Paid $2,000 cash for employee salaries.

Collected $3,400 cash from customers billed on July 12.

Billed customers $9,000 for cleaning services.

Paid gas and oil for month on truck $350.

Withdrew $1,600 cash for personal use.

(SO 1, 2, 3, 4, 6)

The chart of accounts for Changs Cleaning Service contains the following accounts: No. 101 Cash,

No. 112 Accounts Receivable, No. 128 Cleaning Supplies, No. 130 Prepaid Insurance, No. 157

Equipment, No. 158 Accumulated DepreciationEquipment, No. 201 Accounts Payable, No. 212

Salaries Payable, No. 301 Lee Chang, Capital, No. 306 Lee Chang, Drawing, No. 350 Income

Summary, No. 400 Service Revenue, No. 633 Gas & Oil Expense, No. 634 Cleaning Supplies

Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries Expense.

Instructions

(a) Journalize and post the July transactions. Use page J1 for the journal and the three-column

form of account.

(b) Prepare a trial balance at July 31 on a worksheet.

(c) Enter the following adjustments on the worksheet and complete the worksheet.

(1) Services provided but unbilled and uncollected at July 31 were $2,700.

(2) Depreciation on equipment for the month was $500.

(3) One-twelfth of the insurance expired.

(4) An inventory count shows $700 of cleaning supplies on hand at July 31.

(5) Accrued but unpaid employee salaries were $1,000.

(d) Prepare the income statement and owners equity statement for July and a classified balance

sheet at July 31.

(b) Trial balance $37,700

(c) Adjusted trial balance

$41,900

(d) Net income $10,800;

Total assets $34,400

2255T_c04_025-034.qxd 2/22/07 7:19 PM Page 34 TEAM-B 108:JWQY034:ch04:

34

Chapter 4 Completing the Accounting Cycle

(g) Post-closing trial balance

$34,900

(e) Journalize and post adjusting entries. Use page J2 for the journal.

(f) Journalize and post closing entries and complete the closing process. Use page J3 for the journal.

(g) Prepare a post-closing trial balance at July 31.

CONTINUING COOKIE CHRONICLE

(Note: This is a continuation of the Cookie Chronicle from Chapter 1 through 3.)

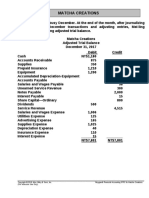

CCC4 Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted

trial balance.

COOKIE CREATIONS

Adjusted Trial Balance

December 31, 2007

Debit

Cash

Accounts Receivable

Baking Supplies

Prepaid Insurance

Baking Equipment

Accumulated DepreciationBaking Equipment

Accounts Payable

Salaries Payable

Interest Payable

Unearned Revenue

Note Payable

N. Koebel, Capital

N. Koebel, Drawings

Teaching Revenue

Salaries Expense

Telephone Expense

Advertising Supplies Expense

Baking Supplies Expense

Depreciation Expense

Insurance Expense

Interest Expense

Credit

$1,130

875

350

1,210

1,300

$

43

75

56

15

300

2,000

900

500

4,315

856

125

165

1,025

43

110

15

$7,704

$7,704

Instructions

Using the information in the adjusted trial balance, do the following.

(a) Prepare an income statement and a statement of owners equity for the 2 months ended

December 31, 2007, and a classified balance sheet at December 31, 2007. The note payable

has a stated interest rate of 6%, and the principal and interest are due on November 16, 2009.

(b) Natalie has decided that her year-end will be December 31, 2007. Prepare and post closing

entries as of December 31, 2007.

(c) Prepare a post-closing trial balance.

Vous aimerez peut-être aussi

- CH 04Document4 pagesCH 04vivien33% (3)

- حل الكتابDocument12 pagesحل الكتابايهاب غزالةPas encore d'évaluation

- Assignment 2Document4 pagesAssignment 2Sultan LimitPas encore d'évaluation

- On January 1 2010 Kloppenberg Company Had Accounts Receivable PDFDocument1 pageOn January 1 2010 Kloppenberg Company Had Accounts Receivable PDFAnbu jaromiaPas encore d'évaluation

- Transaction Analysis-Ch-1 Session 2, 3 4Document17 pagesTransaction Analysis-Ch-1 Session 2, 3 4rj OpuPas encore d'évaluation

- Chapter 6 Motivation - NotesDocument6 pagesChapter 6 Motivation - NotesAli NehanPas encore d'évaluation

- Accounting Problem 5 5ADocument8 pagesAccounting Problem 5 5AParbon Acharjee100% (1)

- Fitzgeraldhyne Rappan - A031221038Document2 pagesFitzgeraldhyne Rappan - A031221038Fitzgeraldhyne RappanPas encore d'évaluation

- CH 6 - HomeworkDocument6 pagesCH 6 - HomeworkAxel OngPas encore d'évaluation

- Account Titiles Trial Balance Adjustment Adjusted Trial BalanceDocument2 pagesAccount Titiles Trial Balance Adjustment Adjusted Trial BalanceBambang HasmaraningtyasPas encore d'évaluation

- 2009-10-28 225356 SouthcoastDocument17 pages2009-10-28 225356 Southcoastjas02h1100% (1)

- Brief Exercise 3-2 AdjustmentsDocument3 pagesBrief Exercise 3-2 AdjustmentsMori NavaPas encore d'évaluation

- Completing the Accounting Cycle WorksheetDocument54 pagesCompleting the Accounting Cycle WorksheetYasin Arafat ShuvoPas encore d'évaluation

- Tugas Pengantar Akuntansi-1Document23 pagesTugas Pengantar Akuntansi-1Wiedya fitrianaPas encore d'évaluation

- PR 16-4aDocument2 pagesPR 16-4aAhmed AwaisPas encore d'évaluation

- Analyze Transactions and Prepare Income Statement, Retained Earnings Statement, and Statement of Financial PositionDocument1 pageAnalyze Transactions and Prepare Income Statement, Retained Earnings Statement, and Statement of Financial PositionAlfonsus William BudiPas encore d'évaluation

- Adjusting Allowance for Doubtful AccountsDocument2 pagesAdjusting Allowance for Doubtful AccountsWisanggeni RatuPas encore d'évaluation

- Accounting 1Document11 pagesAccounting 1Audie yanthiPas encore d'évaluation

- Ey Terms: 3 3 4 Chapter 8 - ReceivablesDocument11 pagesEy Terms: 3 3 4 Chapter 8 - ReceivablesRaffay Maqbool100% (1)

- Tugas Individu Akuntansi TM3Document1 pageTugas Individu Akuntansi TM3Yuni ArtaPas encore d'évaluation

- Soal-Soal LatihanDocument5 pagesSoal-Soal LatihanAldoPas encore d'évaluation

- Unbilled revenue, depreciation, insurance adjustmentsDocument15 pagesUnbilled revenue, depreciation, insurance adjustmentsAngel JPas encore d'évaluation

- Tugas Statistik Hal 109 No 11 - 14Document26 pagesTugas Statistik Hal 109 No 11 - 14Reva FachrizaPas encore d'évaluation

- Mid TestDocument10 pagesMid TestAfriza FadriansyahPas encore d'évaluation

- Modul Lab AD I 2019 - 2020 - 1337415165 PDFDocument52 pagesModul Lab AD I 2019 - 2020 - 1337415165 PDFClarissa Aurella ChecyalettaPas encore d'évaluation

- MC4 Matcha Creations: (For Instructor Use Only)Document2 pagesMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraPas encore d'évaluation

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahPas encore d'évaluation

- Self Study Solutions Chapter 3Document27 pagesSelf Study Solutions Chapter 3flowerkmPas encore d'évaluation

- Listening English - Rescheduling a MeetingDocument6 pagesListening English - Rescheduling a MeetingIis Merly NoviantyPas encore d'évaluation

- WEEK 1 Discussion ProblemsDocument9 pagesWEEK 1 Discussion ProblemsJemPas encore d'évaluation

- HW 4Document4 pagesHW 4Mishalm96Pas encore d'évaluation

- Unit 11Document26 pagesUnit 11naufal fahriPas encore d'évaluation

- CH 04Document7 pagesCH 04Tien Thanh Dang50% (2)

- Hercules Poirot WorksheetDocument6 pagesHercules Poirot WorksheetvaldaPas encore d'évaluation

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaPas encore d'évaluation

- CH 05Document77 pagesCH 05Phan Quynh HaPas encore d'évaluation

- Accounting AssmntDocument11 pagesAccounting AssmntasadPas encore d'évaluation

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoPas encore d'évaluation

- P3 2aDocument10 pagesP3 2adzaky2303Pas encore d'évaluation

- 4281554Document6 pages4281554mohitgaba19Pas encore d'évaluation

- CH 5Document2 pagesCH 5tigger5191Pas encore d'évaluation

- 10 Exercises BE Solutions-1Document40 pages10 Exercises BE Solutions-1loveliangel0% (2)

- CH08SOLSDocument23 pagesCH08SOLSMiki TiendaPas encore d'évaluation

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionPas encore d'évaluation

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionPas encore d'évaluation

- Exercises 2-1 TransactionsDocument8 pagesExercises 2-1 TransactionsMạnh HàPas encore d'évaluation

- Hyzer Disc Golf Course Financial RecordsDocument9 pagesHyzer Disc Golf Course Financial RecordsTegar Babarunggul100% (1)

- Chapter 7 Practice QuestionsDocument12 pagesChapter 7 Practice QuestionsZethu JoePas encore d'évaluation

- Chapter 10Document44 pagesChapter 10Rifai RifaiPas encore d'évaluation

- Soal UTS GANJIL 2018-2019 B'Rita FathiahDocument5 pagesSoal UTS GANJIL 2018-2019 B'Rita FathiahDaeng Buana SaputraPas encore d'évaluation

- Homework Chapter 8Document10 pagesHomework Chapter 8Trung Kiên Nguyễn0% (1)

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaquePas encore d'évaluation

- Jawaban PR Pertemuan 4Document30 pagesJawaban PR Pertemuan 4ninarizkitaPas encore d'évaluation

- Jawaban Answer Question Buku Akuntansi KiesoDocument3 pagesJawaban Answer Question Buku Akuntansi Kiesodutaardian100% (1)

- (Anhngumshoa) .Very Easy TOEIC PDFDocument258 pages(Anhngumshoa) .Very Easy TOEIC PDFLinh LinhPas encore d'évaluation

- Chapter 5Document3 pagesChapter 5hnin scarletPas encore d'évaluation

- CH 02Document7 pagesCH 02Arian MorinaPas encore d'évaluation

- Chapter 5Document3 pagesChapter 5Kei HanzuPas encore d'évaluation

- CH 03Document10 pagesCH 03api-2741206220% (1)

- Taller Cuatro Acco 112Document35 pagesTaller Cuatro Acco 112api-274120622Pas encore d'évaluation

- Taller Tres Acco 112Document41 pagesTaller Tres Acco 112api-274120622Pas encore d'évaluation

- Taller Dos Acco 112Document51 pagesTaller Dos Acco 112api-274120622Pas encore d'évaluation

- 7 1aDocument1 page7 1aapi-274120622Pas encore d'évaluation

- Caleb BorkeDocument1 pageCaleb Borkeapi-274120622Pas encore d'évaluation

- Taller Uno Acco 112Document44 pagesTaller Uno Acco 112api-274120622Pas encore d'évaluation

- Taller Ocho Acco 111Document29 pagesTaller Ocho Acco 111api-274120622Pas encore d'évaluation

- 7 4aDocument2 pages7 4aapi-274120622Pas encore d'évaluation

- CCC 8Document2 pagesCCC 8api-274120622Pas encore d'évaluation

- 8 4aDocument2 pages8 4aapi-274120622Pas encore d'évaluation

- 8 2aDocument2 pages8 2aapi-274120622Pas encore d'évaluation

- CCC 6Document2 pagesCCC 6api-274120622Pas encore d'évaluation

- ccc3 3Document1 pageccc3 3api-274120622Pas encore d'évaluation

- ccc4 2Document1 pageccc4 2api-274120622Pas encore d'évaluation

- CCC 5Document10 pagesCCC 5api-274120622Pas encore d'évaluation

- CH 08Document8 pagesCH 08api-274120622Pas encore d'évaluation

- ccc4 3Document1 pageccc4 3api-274120622Pas encore d'évaluation

- ccc4 1Document1 pageccc4 1api-274120622Pas encore d'évaluation

- Self 2Document1 pageSelf 2api-274120622Pas encore d'évaluation

- ccc3 4Document1 pageccc3 4api-274120622Pas encore d'évaluation

- ccc3 2Document1 pageccc3 2api-274120622Pas encore d'évaluation

- ccc3 5Document1 pageccc3 5api-274120622Pas encore d'évaluation

- ccc3 1Document1 pageccc3 1api-274120622Pas encore d'évaluation

- Self Test DaisyDocument1 pageSelf Test Daisyapi-274120622Pas encore d'évaluation

- ccc2 4Document1 pageccc2 4api-274120622Pas encore d'évaluation

- ch06 CookieDocument4 pagesch06 Cookieapi-2741206220% (1)

- ccc2 1Document1 pageccc2 1api-274120622Pas encore d'évaluation

- Taller Seis Acco 111Document44 pagesTaller Seis Acco 111api-274120622Pas encore d'évaluation

- ch08 ProblemDocument9 pagesch08 Problemapi-281193111Pas encore d'évaluation

- Taller Cinco Caleb BorkeDocument1 pageTaller Cinco Caleb Borkeapi-274120622Pas encore d'évaluation

- Management Accounting Notes at Mba BKDocument134 pagesManagement Accounting Notes at Mba BKBabasab Patil (Karrisatte)Pas encore d'évaluation

- Acctg 16a Final Exam AnswerDocument4 pagesAcctg 16a Final Exam AnswerLy JaimePas encore d'évaluation

- IFRS 15 SolutionsDocument12 pagesIFRS 15 SolutionsshakilPas encore d'évaluation

- Everelite Technology Financial AnalysisDocument15 pagesEverelite Technology Financial AnalysisNelly Yulinda50% (2)

- Activity Ratios: By: Rabindra GouriDocument9 pagesActivity Ratios: By: Rabindra GouriRabindra DasPas encore d'évaluation

- Final Exam All Problem Solving Revision 2 1Document28 pagesFinal Exam All Problem Solving Revision 2 131231023949Pas encore d'évaluation

- CH 14 Alt ProbDocument14 pagesCH 14 Alt ProbJu RaizahPas encore d'évaluation

- Audit of ReceivableDocument26 pagesAudit of ReceivableHannah AngPas encore d'évaluation

- Mary'SPoolCase (Fall 2015)Document17 pagesMary'SPoolCase (Fall 2015)Ashish Bhalla0% (5)

- p2 With TheoryDocument40 pagesp2 With TheoryGrace Corpo0% (1)

- Working Capital On BEMLDocument103 pagesWorking Capital On BEMLAjay Karthik100% (2)

- Subcontracting ProcessDocument9 pagesSubcontracting ProcesslourdumyallaPas encore d'évaluation

- Understanding Working Capital and its Key ComponentsDocument9 pagesUnderstanding Working Capital and its Key ComponentsRohit Patel100% (3)

- Managerial Accounting Major Assignment For Mid Term S21Document4 pagesManagerial Accounting Major Assignment For Mid Term S21Inayat Ur RehmanPas encore d'évaluation

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Calculating Financial Ratios and FiguresDocument27 pagesCalculating Financial Ratios and Figuresanks0909100% (2)

- Interpretation and Analysis of Financial Statement: CA N Maheswara RaoDocument62 pagesInterpretation and Analysis of Financial Statement: CA N Maheswara RaoRavikiran Bapatla100% (1)

- AmardeepDocument56 pagesAmardeepMandhir NarangPas encore d'évaluation

- JACKSON COMPANY General Ledger Trial Balance and Cost of Goods Sold StatementDocument5 pagesJACKSON COMPANY General Ledger Trial Balance and Cost of Goods Sold StatementElizabethPas encore d'évaluation

- 0452 m17 Ms 22Document13 pages0452 m17 Ms 22Mohammed MaGdyPas encore d'évaluation

- Ratio Analysis Guide for Financial AssessmentDocument45 pagesRatio Analysis Guide for Financial AssessmentwubePas encore d'évaluation

- Inventory ManagementDocument74 pagesInventory ManagementSonia LawsonPas encore d'évaluation

- ch18, IFRS 15Document107 pagesch18, IFRS 15Bayan KttbPas encore d'évaluation

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriesRoger FedererPas encore d'évaluation

- Millat Tractors Ltd.Document21 pagesMillat Tractors Ltd.Isma IshtiaqPas encore d'évaluation

- GrowthForce - CEO's Guide To Improving Cash Flow 072417Document40 pagesGrowthForce - CEO's Guide To Improving Cash Flow 072417VinothAyyasamyPas encore d'évaluation

- Government of Bermuda FDS Account Receivable FinalDocument32 pagesGovernment of Bermuda FDS Account Receivable FinalMitchPas encore d'évaluation

- The Statement of Cash Flows: HapterDocument48 pagesThe Statement of Cash Flows: HapterLouisePas encore d'évaluation

- Ch06 Proactive Approach To Detecting FraudDocument26 pagesCh06 Proactive Approach To Detecting Fraud230191Pas encore d'évaluation

- INVESTMENTSDocument27 pagesINVESTMENTSJao FloresPas encore d'évaluation