Académique Documents

Professionnel Documents

Culture Documents

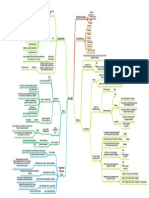

Adjusting Entries

Transféré par

Clarisse AnnCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Adjusting Entries

Transféré par

Clarisse AnnDroits d'auteur :

Formats disponibles

(1) Accrued Expense a liability account; expenses incurred but not yet paid; can match with earnings

debit= expense;

credit= liability(payable)

(2) Accrued Revenue an asset account; revenue earned but not yet received/collected; can match with expense

debit= receivable

credit= revenue

(3) Prepaid/Deferred Expense- asset account; expenses paid in advance; opposite of accrued expense

Asset Method

upon payment:

debit= asset (ex. supplies);

credit= cash;

upon adjustment

debit= expense (ex. supplies expense);

credit= asset (supplies)

Expense Method

upon payment:

debit= expense (ex. supplies expense);

credit= cash;

upon adjustment

debit= asset (ex. supplies);

credit= expense (supplies expense)

(4) Deferred Revenue- liability; revenues collected/received in advance

Liability Method

upon payment:

debit= Cash

credit= liability account (ex. Unearned rent revenue);

upon adjustment

debit=liability account (ex. unearned rent revenue) ;

credit= revenue (ex. rent revenue)

Revenue Method

upon payment:

debit=Cash

credit= revenue (ex. rent revenue)

upon adjustment

debit= revenue (ex rent revenue),

credit= liability account (ex Unearned rent revenue)

(5) Depreciation Expense-depreciation of cost of fixed/plant assets (except land); contra-asset account

Depreciation Rate:

Asset Cost Estimated Residual Value=

Depreciable Cost

=Annual Depreciation

Estimated Useful Life

Debit=Depreciation Expense (name of asset)

Credit=Accumulated Depreciation (name of asset)

(6) Uncollectible Accounts or Bad Debts Expense- companys receivables which might not be collected; recognizes the

anticipated loss that the business might incur; contra-asset account

Debit=Uncollectible accounts expense or Bad debts expense

Credit=Allowance for uncollectible account

Vous aimerez peut-être aussi

- Chapter 9Document1 pageChapter 9Clarisse AnnPas encore d'évaluation

- Chapter 26Document2 pagesChapter 26Clarisse AnnPas encore d'évaluation

- SALESDocument1 pageSALESClarisse AnnPas encore d'évaluation

- OM strategies and concepts for operations managersDocument9 pagesOM strategies and concepts for operations managersClarisse AnnPas encore d'évaluation

- Chapter 23Document2 pagesChapter 23Clarisse AnnPas encore d'évaluation

- Chapter 1Document7 pagesChapter 1Clarisse AnnPas encore d'évaluation

- External and Internal Audit OrganizationsDocument6 pagesExternal and Internal Audit OrganizationsClarisse AnnPas encore d'évaluation

- Pom CH 1-2Document3 pagesPom CH 1-2Clarisse AnnPas encore d'évaluation

- Philippine Accounting SummaryDocument4 pagesPhilippine Accounting SummaryClarisse AnnPas encore d'évaluation

- Implementing Rules of Philippine Mining ActDocument144 pagesImplementing Rules of Philippine Mining Actcecilemarisgozalo98100% (2)

- Calculating Present Value of Restructured NoteDocument5 pagesCalculating Present Value of Restructured NoteClarisse AnnPas encore d'évaluation

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsClarisse AnnPas encore d'évaluation

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnPas encore d'évaluation

- Average Propensity To Consume SurveyDocument1 pageAverage Propensity To Consume SurveyClarisse AnnPas encore d'évaluation

- Law - IntroductionDocument3 pagesLaw - IntroductionClarisse AnnPas encore d'évaluation

- Donors Tax Theory ExplainedDocument5 pagesDonors Tax Theory ExplainedJoey Acierda BumagatPas encore d'évaluation

- Basketball DiagramDocument1 pageBasketball DiagramClarisse AnnPas encore d'évaluation

- Law - IntroductionDocument3 pagesLaw - IntroductionClarisse AnnPas encore d'évaluation

- Audit of ReceivablesDocument4 pagesAudit of ReceivablesClarisse AnnPas encore d'évaluation

- Supply, Demand & EquilibriumDocument4 pagesSupply, Demand & EquilibriumClarisse AnnPas encore d'évaluation

- Ratio Analysis FormulasDocument1 pageRatio Analysis FormulasClarisse AnnPas encore d'évaluation

- Philippine DepartmentsDocument1 pagePhilippine DepartmentsClarisse AnnPas encore d'évaluation

- Financial Formulas - Ratios (Sheet)Document3 pagesFinancial Formulas - Ratios (Sheet)carmo-netoPas encore d'évaluation

- BOA Syllabus MASDocument3 pagesBOA Syllabus MASElizabeth YgotPas encore d'évaluation

- Audtheo CH 1Document3 pagesAudtheo CH 1Clarisse AnnPas encore d'évaluation

- Principle No. 6 - Cooperation Among Cooperatives (Pre-Final)Document42 pagesPrinciple No. 6 - Cooperation Among Cooperatives (Pre-Final)Clarisse AnnPas encore d'évaluation

- Good News (The Last Supper) ActivityDocument4 pagesGood News (The Last Supper) ActivityClarisse AnnPas encore d'évaluation

- Obligations and ContractsDocument1 pageObligations and ContractsClarisse AnnPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)