Académique Documents

Professionnel Documents

Culture Documents

Prepare A Bank Reconciliation Statement of Ahmed-18

Transféré par

Mrinal Kanti Das0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues1 pagePrepare a Bank Reconciliation Statement of Ahmed-18

Titre original

Prepare a Bank Reconciliation Statement of Ahmed-18

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentPrepare a Bank Reconciliation Statement of Ahmed-18

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues1 pagePrepare A Bank Reconciliation Statement of Ahmed-18

Transféré par

Mrinal Kanti DasPrepare a Bank Reconciliation Statement of Ahmed-18

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Mrinal Kanti Das BAPPY

BBA AIS-6th Batch, JNU

mrinalbappy@gmail.com

01683694149

Prepare a bank reconciliation statement of Ahmed

& sons as 30th June 2013, from the following

particulars:

(a) Cash book showed as debit balance of tk. 12242

on 30th june 2013.

(b) Bank honoured bills payable of tk. 3700 of the

firm, but no record was made in the cash book.

(c) A Cheque deposited in the bank amounting to tk.

115 and duly credited in the bank statement, but

entered in cash book as 151.

(d) Insurance claim is received by the bank amounting

to tk. 300.

(e) Miscellaneous expense is been credited in the cash

book tk. 200. But no entry on this regard has not

been pass in pass book.

(f) 1000 tk. Of khan brothers A/c has been wrongly

credited to Ahmeds A/c.

(g) Dividend amounting to tk. 320 paid direct into

bank had not been entered in cash book.

(h) Cheque deposited on 28th June, but credited by the

bank on 1st july, 2013 tk 1700.

(i) Cheque issued but not presented for payment tk.

1500.

(j)

Bank interest and commission of tk. 15 and tk. 45

respectively was not entered in the cash book.

Vous aimerez peut-être aussi

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasPas encore d'évaluation

- Why Does Conflict OccurDocument2 pagesWhy Does Conflict OccurMrinal Kanti DasPas encore d'évaluation

- List of Current LiabilityDocument2 pagesList of Current LiabilityMrinal Kanti DasPas encore d'évaluation

- Sources of FinanceDocument8 pagesSources of FinanceMrinal Kanti DasPas encore d'évaluation

- WALLMART Latest Financial StatementDocument3 pagesWALLMART Latest Financial StatementMrinal Kanti DasPas encore d'évaluation

- List of Current AssetsDocument2 pagesList of Current AssetsMrinal Kanti Das100% (1)

- ClauseDocument1 pageClauseMrinal Kanti DasPas encore d'évaluation

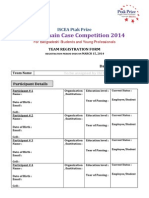

- Supply Chain Case Competition 2014Document2 pagesSupply Chain Case Competition 2014Shamsul Alam SajibPas encore d'évaluation

- ShakilDocument1 pageShakilMrinal Kanti DasPas encore d'évaluation

- Quesstionnaire On BD Labor ACT 2006Document25 pagesQuesstionnaire On BD Labor ACT 2006Mrinal Kanti DasPas encore d'évaluation

- What Is The Role of Management Information SystemDocument5 pagesWhat Is The Role of Management Information SystemMrinal Kanti DasPas encore d'évaluation

- Interest and AnnuityDocument10 pagesInterest and AnnuityMrinal Kanti DasPas encore d'évaluation

- Insurance ACt 2010 Section 2Document3 pagesInsurance ACt 2010 Section 2Mrinal Kanti DasPas encore d'évaluation

- Agency ProblemDocument1 pageAgency ProblemMrinal Kanti Das100% (1)

- Assignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Document24 pagesAssignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Mrinal Kanti DasPas encore d'évaluation

- Welcome To Our PresentationDocument23 pagesWelcome To Our PresentationMrinal Kanti DasPas encore d'évaluation

- Models of The Communication ProcessDocument13 pagesModels of The Communication ProcessMrinal Kanti DasPas encore d'évaluation

- CommunicationDocument7 pagesCommunicationMrinal Kanti DasPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)