Académique Documents

Professionnel Documents

Culture Documents

Retirement and Insurance Planning

Transféré par

api-285618946Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Retirement and Insurance Planning

Transféré par

api-285618946Droits d'auteur :

Formats disponibles

FundsAtWork

South Africa is a nation of diversity with over 50 million people and a wide variety of

cultures, languages and religious beliefs. Research reveals that on the whole South

Africans are grossly under insured and their retirement savings are appallingly low.

This results in a retirement savings and insurance gap.

Employee retirement and insurance planning

The FundsAtWork umbrella funds are built on the philosophy of transparency, flexibility, value for money and ease of use to provide appropriate

retirement, insurance, lifestyle and business benefits.

FundsAtWork recognises that individuals have different needs. Therefore we have designed four product options offering retirement savings and

insurance benefits with different levels of flexibility.

From a cost effective entry level option, Founder, with no flexibility, to the option for the most financially sophisticated individual requiring more

choice, Entrepreneur, FundsAtWork is committed to helping close the retirement savings and insurance gaps. (Refer to the product options

summary on the back.)

FundsAtWork longevity into preservation benefits

Umbrella fund lifestyle benefits

Multiply

Preservation fund retirement benefits

This is Momentums wellness programme which encourages

members to improve their state of wellbeing. As they participate in

healthy activities, they earn Multiply points. Members pay a monthly

fee and gain access to the information and tools needed to reach

their physical and financial goals.

When a member leaves the FundsAtWork umbrella fund they can

move their benefits to the FundsAtWork preservation fund while

staying in the same product option and investment portfolios.

Preservation fund insurance benefits

Home loans

Any member under the age of 55 that transfers from the

FundsAtWork umbrella fund to the FundsAtWork preservation

fund, can take up an individual policy for the same amount of cover

as that applying to the insurane benefit that they had under the

FundsAtWork umbrella fund. This must be done within 90 days. A

Myriad policy will then be issued with minimum hassle and at a

competitive price. The insurance products offered are life, disability

and dread disease insurance.

Members can apply for home loans with Standard Bank and First

National Bank against their retirement savings. The retirement

savings will be secured in the Momentum Secure Bonus portfolio for

the duration of the loan.

FNB Smart Accounts

Momentum provides a solution for members without bank accounts

by opening a FNB Smart Account on their behalf, on withdrawal from

the fund.

Members will receive the funeral benefit BASE under Family

Protector for free if they move from the FundsAtWork umbrella

fund. Members who take out individual insurance policies will be

entitled to the education benefit BASE and health premium waiver

BASE under the Family Protector for free if they move from the

FundsAtWork umbrella fund.

Internet transacting and cellphone or email notification

Members can register on www.momentum.co.za/fundsatwork

to enjoy online transacting. Cellphone or email notification of

the members retirement savings balance and other relevant

information is available on subscription.

Preservation fund lifestyle benefits

Members may continue with Momentum Multiply in the

FundsAtWork preservation fund. Internet transacting and cellphone

notifications remain available for members in the preservation fund.

Umbrella fund business benefits

Employer portal

It allows for real-time transacting. The employer controls the

monthly reconciliation process and informs FundsAtWork of claims

via the portal, which means members will receive their cash

withdrawal benefits quicker.

For more information on the FundsAtWork products

and options visit our website on www.momentum.

co.za/fundsatwork or phone our client contact centre

on 0860 65 75 85.

Momentums external educators provide training to employers and

members.

Family Protector

Provides basic

payouts to cover

funeral expenses,

educational needs

and continuation of

health cover in the

case of a members

death or disability.

Have

RETIREMENT benefits, get the left block at no additional cost, or upgrade right...

PLUS

Funeral benefit BASE 1

Have

RETIREMENT benefits +

DISABILITY, get...

Health premium waiver BASE (on disability) 2

PLUS

+ funeral benefit BASE 1

Have

RETIREMENT benefits +

Education benefit BASE 3

+ health premium waiver BASE (on death) 2

+ funeral benefit BASE 1

Funeral benefit PLUS 1 (FlexiCovers)

Health premium waiver PLUS (on disability) 2 (FlexiCovers)

+ funeral benefit PLUS 1 (FlexiCovers)

GROUP LIFE, get...

PLUS

Education benefit PLUS 3 (FlexiCovers)

+ health premium waiver PLUS (on death) 2 (FlexiCovers)

+ funeral benefit PLUS 1 (FlexiCovers)

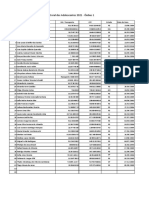

FundsAtWork product options summary

Founder

Narrator

Provider

Entrepreneur

Dynamic Lifestages

Guaranteed portfolios

Boutique / Specialist

Momentum Lifestages

Metropolitan MultiManager

All Provider portfolios

Smooth Growth (Global)

Momentum Money Market

Momentum InflationGro

Momentum MultiManager Money Market

Momentum Secure Bonus

Momentum Balanced

Dynamic Lifestages

Momentum MultiManager Balanced

Momentum Lifestages

Momentum Shariah

Inflation targeted

Momentum Super Nation

Momentum Enhanced

Momentum MultiManager Aggressive

Factor 7 (CPI+7%)

Momentum Passive Lifestages

Factor 6 (CPI+6%)

Momentum Bond

Factor 5 (CPI+5%)

Momentum Inflation Guaranteed

Factor 4 (CPI+4%)

Momentum Capital Plus

Factor 3 (CPI+3%)

Momentum Gold Bullion

Guaranteed

Metropolitan MultiManager

Smooth Growth (Global) trustee default portfolio

volatility of portfolio returns

Retirement benefits

>7

years to retirement

5-7

years

3-5

years

CPI

+7%

0-3

years

CPI

CPI

CPI

+6%

+5%

+3%

years to retirement

Over 300 unit trusts

Insurance benefits

Group life cover (GLA)

Compulsory benefits

Permanent health insurance

(PHI)

Life Eventing (GLA)

Lump sum disability (PTD)

Permanent health insurance

(PHI)

Group life cover (GLA), lump sum disability (PTD)

and capital income provider (CIP)

8

high

17.5%

7

6

Dread disease

medium

15%

5

4

GLA

low

10%

3

PTD

PHI

Life Eventing

2

1

35

Dread disease

45

Accidental death cover, dread disease,

spouses life cover, temporary income disability (TTD)

FlexiCovers

Group life cover (GLA), spouses and childrens annuity (SAC), permanent

health Insurance (PHI), lump sum disability (PTD),

capital income provider (CIP)

10 x

annual

salary

6x

annual

salary

R ## ###,##

1x

annual

salary

4x

annual

salary

2x

annual

salary

Employers choice

(default cover)

Free cover limit is

a rand amount

Lifestyle benefits Housing loans, Smart Accounts, online transacting, sms and cellphone notification

Business benefits Employer portal real time online transacting, external educators, email notifications and asset consulting

Family Protector PLUS

Family Protector BASE

less

flexibility

more

flexibility

An authorised financial services and credit provider

Momentum Group Limited is a wholly owned subsidiary of MMI Holdings Limited

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Lightworker's HandbookDocument58 pagesThe Lightworker's HandbookEvgeniq Marcenkova100% (9)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- A Midsummer's Night Dream Script (FULL)Document74 pagesA Midsummer's Night Dream Script (FULL)prahuljosePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- City of Cleveland Shaker Square Housing ComplaintDocument99 pagesCity of Cleveland Shaker Square Housing ComplaintWKYC.comPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- He Hard Truth - If You Do Not Become A BRAND Then: Examples Oprah WinfreyDocument11 pagesHe Hard Truth - If You Do Not Become A BRAND Then: Examples Oprah WinfreyAbd.Khaliq RahimPas encore d'évaluation

- CRPC MCQ StartDocument24 pagesCRPC MCQ StartkashishPas encore d'évaluation

- E Commerce AssignmentDocument40 pagesE Commerce AssignmentHaseeb Khan100% (3)

- Battletech BattleValueTables3.0 PDFDocument25 pagesBattletech BattleValueTables3.0 PDFdeitti333Pas encore d'évaluation

- The Renaissance PeriodDocument8 pagesThe Renaissance PeriodAmik Ramirez TagsPas encore d'évaluation

- Completed Jen and Larry's Mini Case Study Working Papers Fall 2014Document10 pagesCompleted Jen and Larry's Mini Case Study Working Papers Fall 2014ZachLoving100% (1)

- 1 Introduction Strategic Project Management (Compatibility Mode)Document39 pages1 Introduction Strategic Project Management (Compatibility Mode)Pratik TagwalePas encore d'évaluation

- Wallem Philippines Shipping vs. SR Farms (2010)Document1 pageWallem Philippines Shipping vs. SR Farms (2010)Teff QuibodPas encore d'évaluation

- Cosmic Education Montessori Bauhaus andDocument10 pagesCosmic Education Montessori Bauhaus andEmma RicciPas encore d'évaluation

- Nurlilis (Tgs. Bhs - Inggris. Chapter 4)Document5 pagesNurlilis (Tgs. Bhs - Inggris. Chapter 4)Latifa Hanafi100% (1)

- Implications - CSR Practices in Food and Beverage Companies During PandemicDocument9 pagesImplications - CSR Practices in Food and Beverage Companies During PandemicMy TranPas encore d'évaluation

- Employee Shift ScheduleDocument32 pagesEmployee Shift ScheduleRishane RajapaksePas encore d'évaluation

- Christmas Pop-Up Card PDFDocument6 pagesChristmas Pop-Up Card PDFcarlosvazPas encore d'évaluation

- Albert EinsteinDocument3 pagesAlbert EinsteinAgus GLPas encore d'évaluation

- BiratchowkDocument2 pagesBiratchowkdarshanPas encore d'évaluation

- Case Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFDocument7 pagesCase Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFFaizan SiddiquePas encore d'évaluation

- Sharmila Ghuge V StateDocument20 pagesSharmila Ghuge V StateBar & BenchPas encore d'évaluation

- Enrollment DatesDocument28 pagesEnrollment DatesEdsel Ray VallinasPas encore d'évaluation

- OD2e L4 Reading Comprehension WS Unit 3Document2 pagesOD2e L4 Reading Comprehension WS Unit 3Nadeen NabilPas encore d'évaluation

- Pankaj YadavSEPT - 2022Document1 pagePankaj YadavSEPT - 2022dhirajutekar990Pas encore d'évaluation

- MOP Annual Report Eng 2021-22Document240 pagesMOP Annual Report Eng 2021-22Vishal RastogiPas encore d'évaluation

- Grammar For Ielts - Worksheet: Module 1 - Lesson 9: Past Simple & Past ContinuousDocument11 pagesGrammar For Ielts - Worksheet: Module 1 - Lesson 9: Past Simple & Past ContinuousNguyễn Như QuỳnhPas encore d'évaluation

- Final Test 1 Grade 10Document4 pagesFinal Test 1 Grade 10Hường NgôPas encore d'évaluation

- Upsc 1 Year Study Plan 12Document3 pagesUpsc 1 Year Study Plan 12siboPas encore d'évaluation

- Information Security NotesDocument15 pagesInformation Security NotesSulaimanPas encore d'évaluation

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDocument1 pageCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaPas encore d'évaluation

- Cw3 - Excel - 30Document4 pagesCw3 - Excel - 30VineePas encore d'évaluation