Académique Documents

Professionnel Documents

Culture Documents

Assets Test Parameters - Non Homeowners Pension Impact

Transféré par

Stephanie AndersonCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assets Test Parameters - Non Homeowners Pension Impact

Transféré par

Stephanie AndersonDroits d'auteur :

Formats disponibles

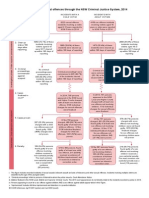

Rebalance the Assets Test Parameters Pensioner Impacts

Non-homeowner couples

The table below:

compares the amount of Age Pension received by a non-home owner couple under the measure

to Rebalance the Assets Test Parameters with the amount they would receive under the

present assets test arrangements;

shows the percentage of their assets that they would need to draw down to replace the

reduction in their pension as a result of the Rebalance the Assets Test Parameters measure; and

shows the number of pensioners with assessable assets in the ranges that are affected by

Rebalance the Assets Parameter measure.

Number of

Assessable

Reduction

% of

Assessable

pensioners

Age

Age

Assets

(increase)

assets

asset range

with

Pension

Pension

in pension

required

assessable

received at under

income

to

assets in

current

rebalanced

received

replace

specified

$1.50 taper asset test

Age

range

rate*

measure *

Pension

a year

$100,000

$34,923

$34,923

$0

N/A

$200,000

$34,923

$34,923

$0

N/A

$300,000

$34,923

$34,923

$0

N/A

$400,000

$34,923

$34,923

$0

N/A

$500,000

$33,012

$34,923

($1,911)

N/A

$600,000

$29,112

$32,973

($3,861)

N/A

$699,000

$25,251

$25,251

$0

N/A

$700,000

$25,212

$25,173

$39

0.01%

$800,000

$21,312

$17,373

$3,939

0.49%

$900,000

$17,412

$9,573

$7,839

0.87%

$1,000,000

$13,512

$1,773

$11,739

1.17%

$1,023,000

$12,615

$0

$12,615

1.23%

$1,100,000

$9,612

$0

$9,612

0.87%

$1,200,000

$5,712

$0

$5,712

0.48%

$1,300,000

$0

$0

$0

*based on projected pension rates at 1 January 2017.

N/A

$0 - $99,999

$100,000 $199,999

$200,000 $299,999

$300,000 $399,999

$400,000 $499,999

271,935

30,453

13,909

7,378

3,865

$500,000 $599,999

2,271

$600,000 $699,999

1,307

$700,000 $799,999

$800,000 $899,999

$900,000 $999,999

$1,000,000 $1,099,999

$1,100,000 $1,199,999

$1,200,000

AND GREATER

961

699

531

302

224

102

Single Non-home owners

The table below:

compares the amount of Age Pension received by a single non-home owner under the measure

to Rebalance the Assets Test Parameters with the amount they would receive under the

present assets test arrangements;

shows the percentage of their assets that they would need to draw down to replace the

reduction in their pension as a result of the Rebalance the Assets Test Parameters measure; and

shows the number of pensioners with assessable assets in the ranges that are affected by

Rebalance the Assets Parameter measure.

Assessable

Assets

Reduction

(increase)

in pension

income

received

% of assets

required to

replace Age

Pension a

year

Age

Pension

received at

current

$1.50 taper

rate*

Age

Pension

under

rebalanced

asset test

measure *

$100,000

$23,166

$23,166

$0

N/A

$200,000

$23,166

$23,166

$0

N/A

$300,000

$23,166

$23,166

$0

N/A

$400,000

$21,723

$23,166

($1,443)

N/A

$500,000

$17,823

$19,266

($1,443)

N/A

$537,000

$16,380

$16,380

$0

N/A

$600,000

$13,923

$11,466

$2,457

0.41%

$700,000

$10,023

$3,666

$6,357

0.91%

$747,000

$8,190

$0

$8,190

1.1%

$800,000

$6,123

$0

$6,123

0.77%

$900,000

$2,223

$0

$2,223

0.25%

$1,000,000

$0

$0

$0

N/A

* based on projected pension rates at 1 January 2017.

Assessable

asset range

$0 $99,999

$100,000 $199,999

$200,000 $299,999

$300,000 $399,999

$400,000 $499,999

Number of

pensioners

with

assessable

assets in

specified

range

900,730

57,964

24,615

12,668

6,383

$500,000 $599,999

3,731

$600,000 $699,999

2,174

$700,000 $799,999

1,292

$800,000 $899,999

$900,000 $999,999

666

67

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Reasons For Ruling On Disqualification Application Dated 31 August 2015Document67 pagesReasons For Ruling On Disqualification Application Dated 31 August 2015David Marin-GuzmanPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Speech On Marriage Amendment (Marriage Equality) Bill 2015Document6 pagesSpeech On Marriage Amendment (Marriage Equality) Bill 2015Stephanie AndersonPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- PNG Supreme Court Decision On Manus IslandDocument34 pagesPNG Supreme Court Decision On Manus IslandStephanie AndersonPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Select Committee On The Recent Allegations Relating To Conditions and Circumstances at The Regional Processing Centre in NauruDocument219 pagesSelect Committee On The Recent Allegations Relating To Conditions and Circumstances at The Regional Processing Centre in NauruStephanie AndersonPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Shorten To Move Private Member's Bill On Marriage EqualityDocument1 pageShorten To Move Private Member's Bill On Marriage EqualitySBS_NewsPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Agricultural Competitiveness White PaperDocument152 pagesAgricultural Competitiveness White PaperStephanie AndersonPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Penny Wong On Marriage EqualityDocument5 pagesPenny Wong On Marriage EqualityStephanie AndersonPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Abbott's Address To Federal Women's Committee Luncheon AdelaideDocument5 pagesAbbott's Address To Federal Women's Committee Luncheon AdelaideStephanie AndersonPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Sexual Attribution DiagramsDocument9 pagesSexual Attribution DiagramsStephanie AndersonPas encore d'évaluation

- Australian Citizenship Amdt (Allegiance To Australia) Bill 2015-A4Document14 pagesAustralian Citizenship Amdt (Allegiance To Australia) Bill 2015-A4Adam ToddPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Shorten's Opening Address To ALP ConferenceDocument13 pagesShorten's Opening Address To ALP ConferenceStephanie AndersonPas encore d'évaluation

- Interim Analysis of The 2015 16 Federal BudgetDocument13 pagesInterim Analysis of The 2015 16 Federal BudgetStephanie AndersonPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Storyboard AfghanistanDocument18 pagesStoryboard AfghanistanOuest-France.frPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Superannuation Policy For Post-RetirementDocument110 pagesSuperannuation Policy For Post-RetirementStephanie AndersonPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Terror Suspects To Lose CitizenshipDocument2 pagesTerror Suspects To Lose CitizenshipStephanie AndersonPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Ricky Muir On Marriage EqualityDocument2 pagesRicky Muir On Marriage EqualityStephanie AndersonPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- ANU Polling On Australian AttitudesDocument24 pagesANU Polling On Australian AttitudesStephanie AndersonPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Chris Bowen - NPC SpeechDocument13 pagesChris Bowen - NPC SpeechPolitical AlertPas encore d'évaluation

- Assets Test - Homeowner Pension ImpactDocument2 pagesAssets Test - Homeowner Pension ImpactStephanie Anderson100% (1)

- Fact Sheet - Labors Plan For Fair Sustainable SuperDocument5 pagesFact Sheet - Labors Plan For Fair Sustainable SuperPolitical AlertPas encore d'évaluation

- Report On Foreign Investment in Residential Real EstateDocument148 pagesReport On Foreign Investment in Residential Real EstateStephanie AndersonPas encore d'évaluation

- Bill Shorten's 2015 Budget ReplyDocument21 pagesBill Shorten's 2015 Budget ReplyStephanie AndersonPas encore d'évaluation

- Antisemitism Worldwide 2014Document94 pagesAntisemitism Worldwide 2014Stephanie AndersonPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- GST ReviewDocument146 pagesGST ReviewStephanie AndersonPas encore d'évaluation

- Review of Mental Health Programmes and ServicesDocument25 pagesReview of Mental Health Programmes and ServicesStephanie AndersonPas encore d'évaluation

- Address To Australian Chamber of Commerce and Industry LuncheonDocument7 pagesAddress To Australian Chamber of Commerce and Industry LuncheonStephanie AndersonPas encore d'évaluation

- Tax Final Discussion PaperDocument202 pagesTax Final Discussion PaperStephanie AndersonPas encore d'évaluation

- Indigenous Issues ANU Poll 2015Document16 pagesIndigenous Issues ANU Poll 2015Stephanie AndersonPas encore d'évaluation

- Tax Final Discussion PaperDocument202 pagesTax Final Discussion PaperStephanie AndersonPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)