Académique Documents

Professionnel Documents

Culture Documents

Assignment 1 Whole Sheet of Paper

Transféré par

Ralph Christer Maderazo0 évaluation0% ont trouvé ce document utile (0 vote)

6 vues1 pageq

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentq

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

6 vues1 pageAssignment 1 Whole Sheet of Paper

Transféré par

Ralph Christer Maderazoq

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Assignment 1 whole sheet of Paper

Reference: Accounting for Foreign Currency Transactions+

1. Iskubidu Company, a Philippine Corporation, bought inventory from a supplier in Japan on

November 2, 2009 for 50,000 yen, when the spot rate was P 0.4295. On December 31,

2010, the spot rate was P 0.4295. On January 15, 2011, Iskubidu bought 50,000 yen at a

spot rate of P 0.4250 and paid the invoice. How much should Iskubidu report in its income

statements for 2010 and 2011 as foreign exchange gain or (loss). Prepare all necessary

journal entries.

2. On October 1, 2010, Iskrapidu Cmpany, a Philippine Corporation acquired goods from USA

company for $ 10,000 payable in US Dollars on April 1, 2011. Spot rates on various dates

follow:

a. Transaction Date=

P 1= $0.018

b. Balance Sheet Date, 12/31/10= P 1= $ 0.017

c. Settlement Date=

P 1= $ 0.020

As a result of this transaction, Iskrapidu has a foreign exchange gain or (loss) in 2010 and

2011 of?

Prepare all necessary journal entries.

3. On July 1. 2010, Luzon Corporation borrowed 1, 680, 000 yen from a Japanese Lender

evidenced by an interest bearing note due on July 1, 2011. The Philippine Peso equivalent

of the note principal was as follows:

a. July 1, 2010

- Date Borrowed

P 210,000

b. December 31, 2010- Luzons Year end

240,000

c. July 1, 2011- Date repaid

280,000

In its income statement for 2011, what amount should Luzon include as a foreign

exchange gain or (loss)?

Prepare all necessary journal entries.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Lateral Transfer LetterDocument1 pageLateral Transfer LetterRalph Christer MaderazoPas encore d'évaluation

- Exercise 4-2:, Thus Understating The Related ExpensesDocument2 pagesExercise 4-2:, Thus Understating The Related ExpensesRalph Christer MaderazoPas encore d'évaluation

- Lateral Transfer LetterDocument1 pageLateral Transfer LetterRalph Christer MaderazoPas encore d'évaluation

- Opening Remarks - CFC AnniversaryDocument1 pageOpening Remarks - CFC AnniversaryRalph Christer MaderazoPas encore d'évaluation

- Amendment To Paragraph 3 of The Request For Expression of InterestDocument1 pageAmendment To Paragraph 3 of The Request For Expression of InterestRalph Christer MaderazoPas encore d'évaluation

- Pabuhat Ni RichardDocument1 pagePabuhat Ni RichardRalph Christer MaderazoPas encore d'évaluation

- Rrlgroup 5Document12 pagesRrlgroup 5Ralph Christer MaderazoPas encore d'évaluation

- As Long As The Contract of Marriage Still Binds The Husband and Wife, The Husband's Remains Automatically Go To The WifeDocument3 pagesAs Long As The Contract of Marriage Still Binds The Husband and Wife, The Husband's Remains Automatically Go To The WifeRalph Christer MaderazoPas encore d'évaluation

- Crim MidtermsDocument2 pagesCrim MidtermsRalph Christer MaderazoPas encore d'évaluation

- 00 - Case Study and InstructionsDocument2 pages00 - Case Study and InstructionsRalph Christer MaderazoPas encore d'évaluation

- Maderazo - Crim Law MidtermsDocument3 pagesMaderazo - Crim Law MidtermsRalph Christer MaderazoPas encore d'évaluation

- Case Digests Bill of RightsDocument50 pagesCase Digests Bill of RightsRalph Christer MaderazoPas encore d'évaluation

- General ProvsionsDocument21 pagesGeneral ProvsionsRalph Christer MaderazoPas encore d'évaluation

- 04 - WORKING PAPER 2 - Results of Test of DetailsDocument3 pages04 - WORKING PAPER 2 - Results of Test of DetailsRalph Christer MaderazoPas encore d'évaluation

- Syllabus in Statutory Construction (2nd)Document8 pagesSyllabus in Statutory Construction (2nd)Ralph Christer MaderazoPas encore d'évaluation

- Case Study: Seminar On Audit Sampling Session 4Document3 pagesCase Study: Seminar On Audit Sampling Session 4Ralph Christer MaderazoPas encore d'évaluation

- 03 - WORKING PAPER 1 - Audit Sampling For Test of DetailsDocument2 pages03 - WORKING PAPER 1 - Audit Sampling For Test of DetailsRalph Christer MaderazoPas encore d'évaluation

- Midterms PhiloDocument2 pagesMidterms PhiloRalph Christer MaderazoPas encore d'évaluation

- Midterms Stat ConDocument11 pagesMidterms Stat ConRalph Christer MaderazoPas encore d'évaluation

- 01 - ANNEX 1 - List of PopulationDocument15 pages01 - ANNEX 1 - List of PopulationRalph Christer MaderazoPas encore d'évaluation

- A Married Filipino Remains Married Even If A Divorce Is Obtained Abroad Because Divorce Is Generally Not Recognized in The PhilippinesDocument2 pagesA Married Filipino Remains Married Even If A Divorce Is Obtained Abroad Because Divorce Is Generally Not Recognized in The PhilippinesRalph Christer MaderazoPas encore d'évaluation

- 2nd ASSIGNMENT PHILOSOPHY OF LAWDocument1 page2nd ASSIGNMENT PHILOSOPHY OF LAWRalph Christer MaderazoPas encore d'évaluation

- Philosophy of LawDocument1 pagePhilosophy of LawRalph Christer MaderazoPas encore d'évaluation

- Report Philosophy of Law - Legal TruthDocument3 pagesReport Philosophy of Law - Legal TruthRalph Christer MaderazoPas encore d'évaluation

- Differentiate National Budgeting From Local BudgetingDocument2 pagesDifferentiate National Budgeting From Local BudgetingRalph Christer MaderazoPas encore d'évaluation

- Letter To Construction Regarding Status of Infra 2020Document3 pagesLetter To Construction Regarding Status of Infra 2020Ralph Christer MaderazoPas encore d'évaluation

- ExamDocument1 pageExamRalph Christer MaderazoPas encore d'évaluation

- Rights and Obligations Between Husband and WifeDocument60 pagesRights and Obligations Between Husband and WifeRalph Christer MaderazoPas encore d'évaluation

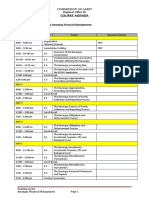

- Course Agenda: Course Title: Training On The Barangay Financial Management Date: July 1-5, 2019Document1 pageCourse Agenda: Course Title: Training On The Barangay Financial Management Date: July 1-5, 2019Ralph Christer MaderazoPas encore d'évaluation

- Letter of Submission of DTRDocument2 pagesLetter of Submission of DTRRalph Christer MaderazoPas encore d'évaluation